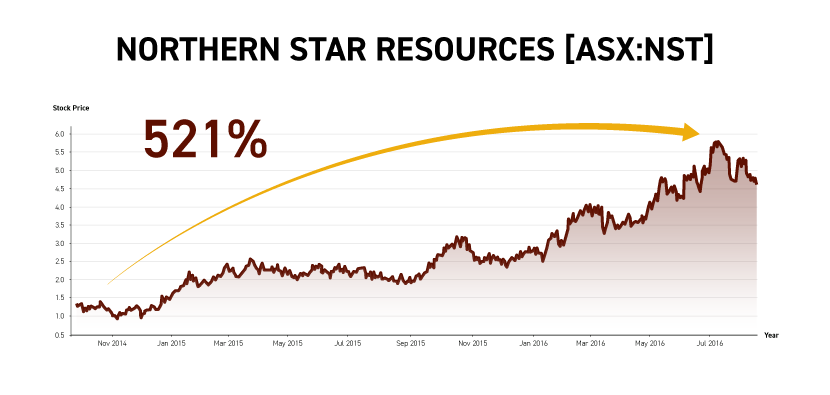

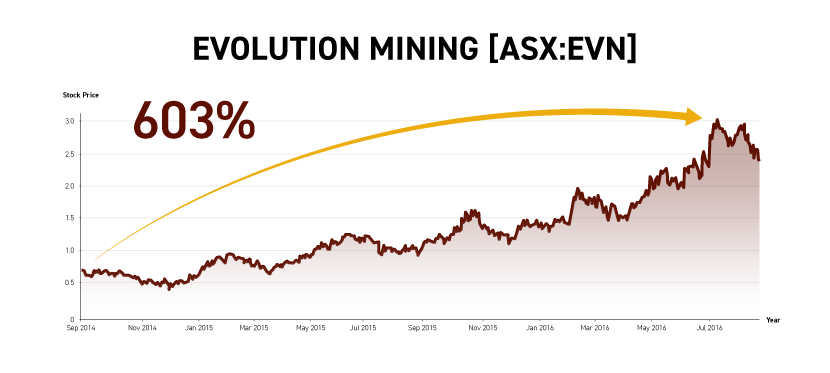

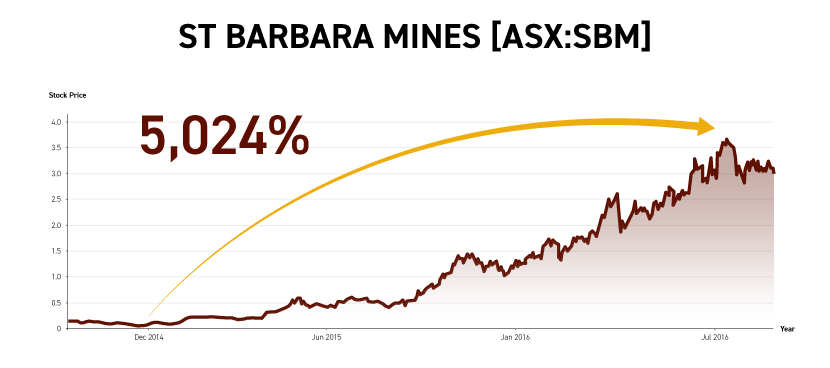

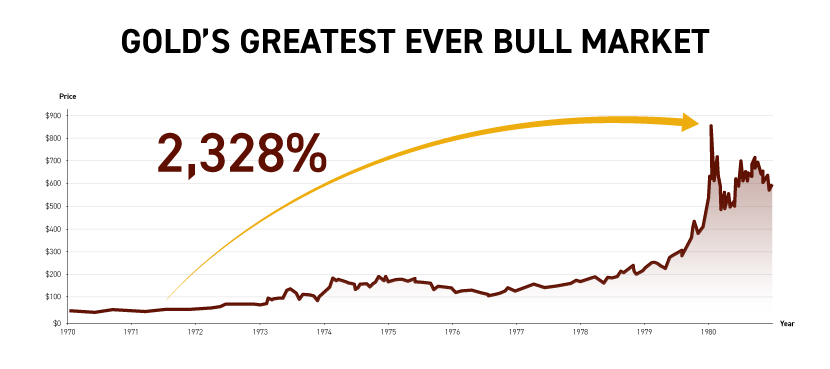

As gold hits yet another all-time high, the expert who predicted this move back in mid-2022 now says:

‘It’s NOW OR NEVER for

Australian investors’

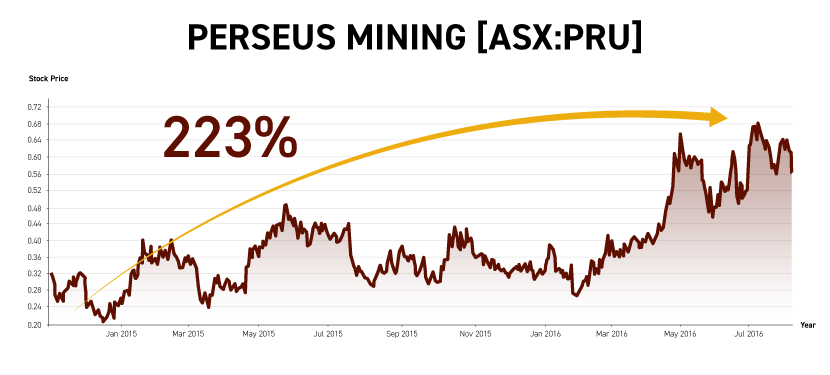

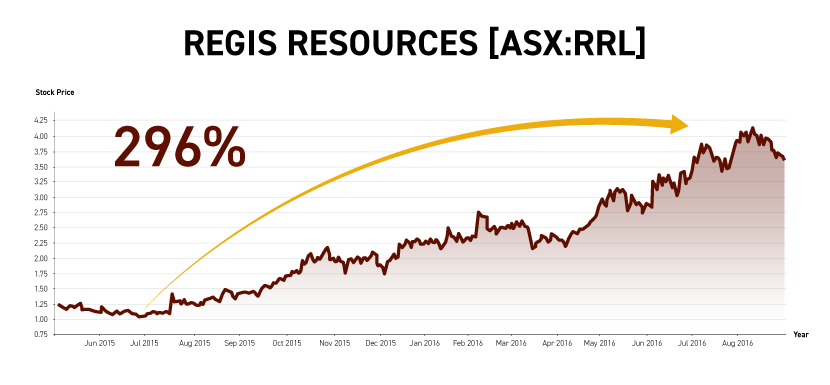

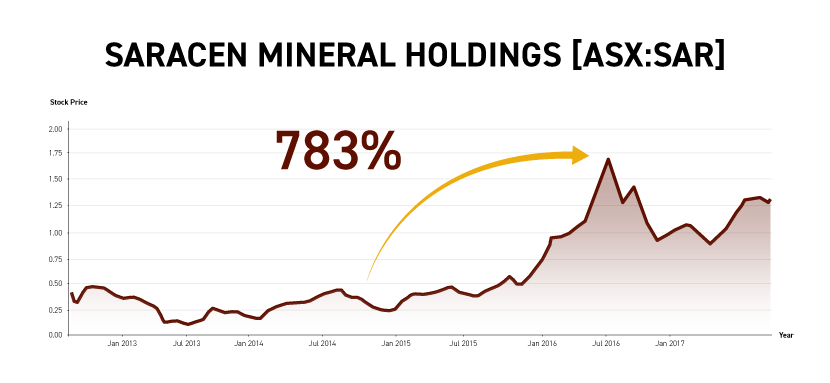

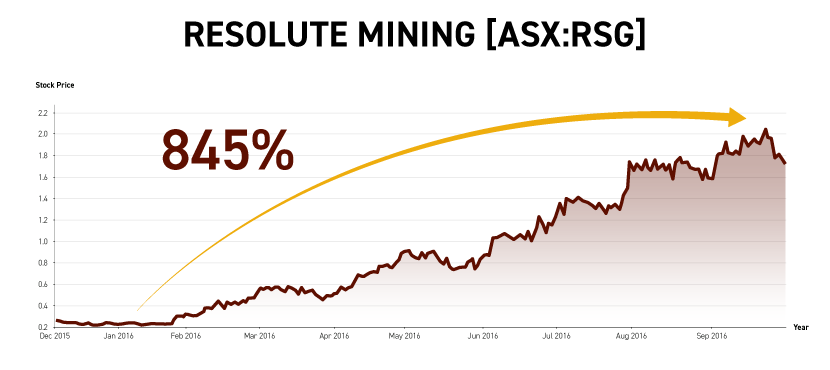

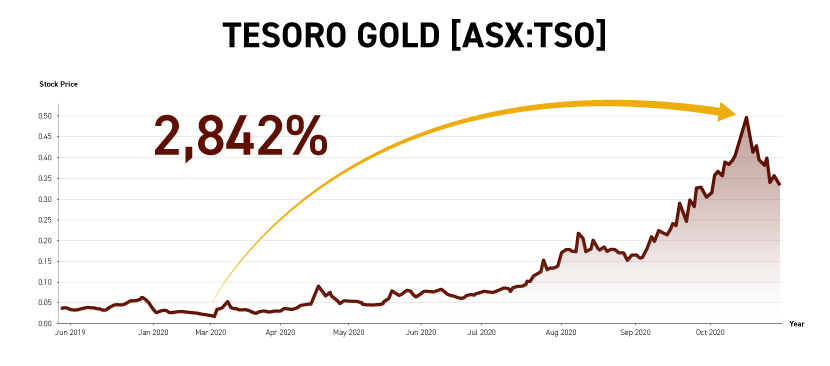

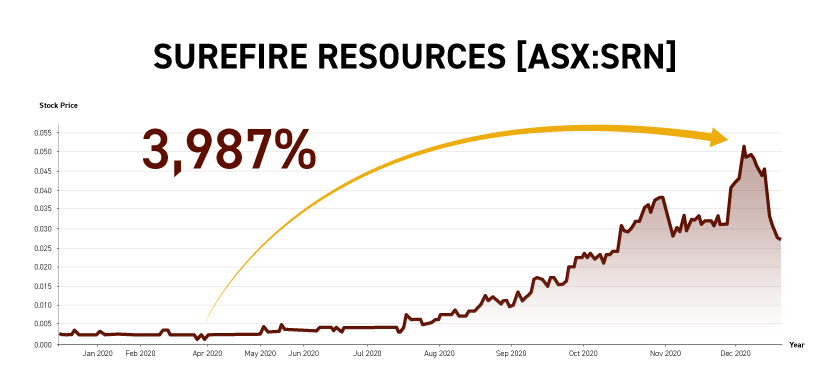

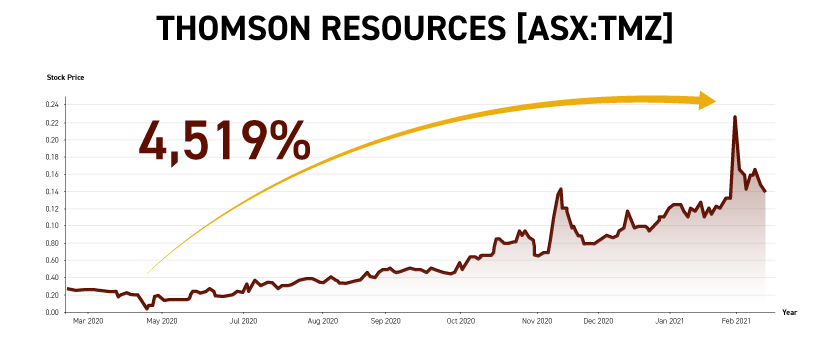

Discover three primed-to-run stocks as this historic

gold bull run continues in 2024.

Plus: Circle Thursday 2 May – It’s a key

date for the next phase (see below!)