As gold hits yet another all-time high, the expert who predicted this move back in mid-2022 now says:

As gold hits yet another all-time high, the expert who predicted this move back in mid-2022 now says:

GREG CANAVAN:

Hello, I’m Greg Canavan.

As we speak, money is moving into the gold sector at a record-breaking pace.

Investors are positioning themselves for what could be a historic year for gold in 2024.

But where will the biggest opportunities be found in the coming months?

Not from holding bullion or coins, according to my guest today.

He says the biggest beneficiaries of this wave of capital will be the companies who dig gold out of the ground…

And, more importantly, those who own these companies’ shares.

That’s why we’re here today.

In a moment, I’ll be speaking with Brian Chu — founder of The Australian Gold Fund.

To my knowledge, his private family office fund is one of the only funds in the country dedicated solely to investing in gold stocks.

We know from previous bull markets that investing in gold stocks — at the right time — has the potential to multiply your returns compared to holding physical gold.

With that in mind, we’re going to take a look at three ASX-listed stocks that could do incredibly well under the perfect storm of conditions we’re watching unfold today.

We’ll also discuss why now could be the right time to position yourself in these companies and others like them.

Brian, great to have you here.

BRIAN CHU:

Thanks Greg.

You made a very good point there.

This is exactly the right time to take a closer look at gold mining stocks…

If you believe — as I do — that the spot price is set to skyrocket in 2024.

In fact, I believe Australia’s gold sector is already in a bull market.

The conditions we’re seeing today remind me a lot of the bull market of 2015 and 2016.

GREG CANAVAN:

I’m glad you mentioned the 2015–16 bull market.

It was certainly a great time for many Aussie gold mining companies.

The Australian gold sector has performed spectacularly in 2015, far in excess of the gold price...

— Financial Review

Even the Financial Review was saying the sector had outperformed spectacularly — far in excess of just investing in physical gold.

I remember I had a few handy performers myself.

You too saw that action firsthand.

Tell us what happened from your perspective…

BRIAN CHU:

Well, I have to take you back even further, to mid-2013.

I actually started investing in gold stocks in the depths of a bear market.

Now, we know that these stocks can be volatile, and that you often have to wear on-paper losses before the big gains come around…

Well that’s exactly what happened to me.

But I knew the conditions were right…

I knew these were good companies…

So I used any dips in price to buy more shares — and I’m glad I did.

When the bull market finally rolled around in 2015, my portfolio was rising by as much as 15–20% per month.

In fact, some of my gold producer holdings were doubling within weeks.

By late September 2016, my gold stock portfolio had rallied 600% from its lows.

Now, I did make some mistakes along the way, so I didn’t capture that entire 600% run-up…

But the short version is, the returns from my portfolio were significant.

GREG CANAVAN:

So to be clear, you could have bought and held physical gold as the price went up.

But instead, you chose to invest in the companies that find and produce this gold…

And as a result, you were able to magnify the gains made by the spot price many times over.

BRIAN CHU:

Exactly, Greg.

And let’s be clear, buying physical gold — especially in times of recession, inflation, or economic uncertainty — can be a great way to protect your wealth.

But if you want to seriously grow your portfolio, I believe investing in gold stocks — under the right circumstances — is a much better way to do that.

Want some evidence?

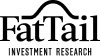

Take Northern Star Resources [ASX:NST], it’s a perfect example from the 2016 bull market…

This company quickly became Australia’s second-largest gold producer after a series of strategic acquisitions right before the start of the bull run.

First, they snapped up Barrick’s Plutonic, Kanowna Belle, and Kundana mines for US$100 million.

Then, they purchased Newmont’s Jundee mine for more than US$80 million.

When you add these perfectly timed, high-producing mine acquisitions to the spot price of gold surging 18%…

You can see why their stock value rose from 93 cents per share…

To $5.78 per share.

Investors who backed Northern Star were rewarded with gains of over 500%.

500% or 18%, Greg, which would you rather have?

I think we both know the answer!

Now, Northern Star may have handed investors an exceptional result — but it certainly wasn’t an exceptional story during the 2016 run up.

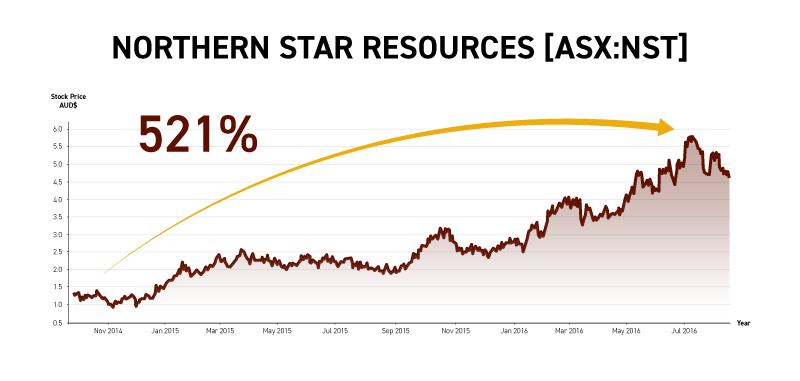

Take Evolution Mining [ASX:EVN].

Like Northern Star, Evolution joined the top five Aussie gold producers through two big acquisitions — Cowal, and Ernest Henry.

When you combine these smart purchases with the rising price of gold, their stock price hit the accelerator…

Handing investors in Evolution gains of more than 600%.

GREG CANAVAN:

Wow, some good stories there Brian…

Although we should point out that not every gold miner is going to do this…

Like you say, the conditions have to be right.

Also, there are no guarantees in this sector. This is speculative territory, after all…

So we wouldn’t recommend allocating a huge portion of your capital to gold mining stocks…

But as you’ve just shown us Brian, even a small slice of your portfolio can help you take advantage of rare but lucrative opportunities like these.

BRIAN CHU:

One more quick story, if I may….

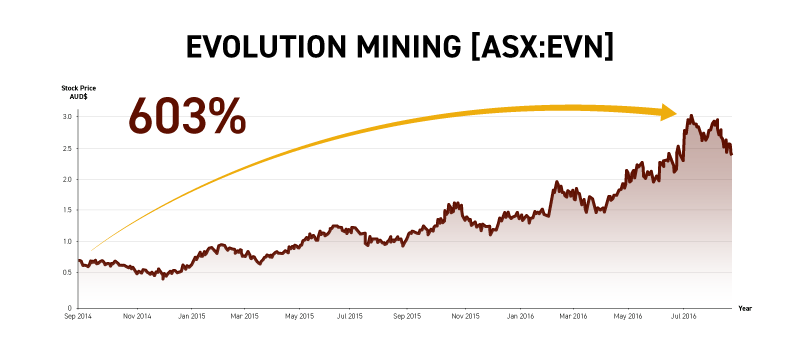

In mid-2013, I invested in St Barbara Mines [ASX:SBM].

They’re a Western Australian-based mining outfit.

At the time I bought in, it was a highly leveraged company with more than $400 million in debt.

They were also encountering difficulties with their operations in Papua New Guinea and the Solomon Islands.

So during the bear market in 2014, its value fell some 95%.

To put that another way…

Despite having a market cap of more than $1 billion two years earlier — at their lowest point, St Barbara was worth less than $50 million.

Their shares were priced as low as seven cents.

One of the reasons I hung on was that I knew they owned high-quality assets.

Their flagship mine, Gwalia, is the deepest underground gold mine in the country.

In 2013, it was already producing a significant amount of gold — around 183,000 ounces.

Over the following years, growth in production at Gwalia bought the company time to pay down its debts and turn around its operations in the Pacific.

Then in 2016, Gwalia’s output expanded to more than 267,000 ounces…

The most in the company’s history up to that point.

The result surprised the market, and their share price went ballistic.

From trough to peak, it shot up over 5,000%.

Unfortunately, I’d got in a couple years earlier, so I didn’t quite capture a 5,000% return…

But nonetheless, St Barbara turned out to be one of my best investments during that bull market.

GREG CANAVAN:

Wow. It just goes to show, doesn’t it Brian…

If a company is in great shape, hitting results, year after year — and then a bull market comes along…

That can be a great opportunity for investors in those businesses.

OK, now you mentioned earlier that you believe the Aussie gold sector is in a bull market right now.

Why do you say this?

BRIAN CHU:

Greg, there are three key signals that give me great cause for optimism right now…

And this is why I think viewers need to pay close attention to the specific stocks I’m going to talk about in a moment.

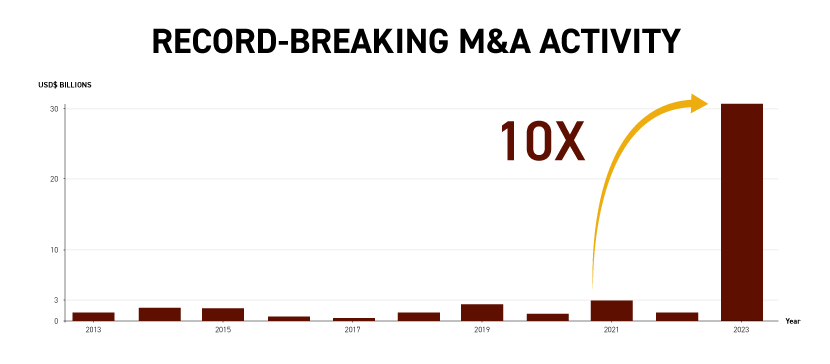

The first signal is increased M&A activity — mergers and acquisitions.

Not many people realise how significant a signal this is, so let me put it in plain English for you.

The Australian mining industry never sees its M&A spend go higher than about US$3 billion per year.

But in 2023, that number shot up to more than US$30 billion.

That’s 10 times higher.

Gold mining companies are getting bought up everywhere you look.

Let me give you some recent examples.

Genesis Minerals [ASX:GMD] just completed its acquisition of Dacian Gold [ASX:DCN].

That deal was worth over AU$380 million.

Ramelius Resources [ASX:RMS] acquired three major competitors — Breaker Resources [ASX:BRB], Apollo Consolidated [ASX:AOP], and Musgrave Minerals [ASX:MGV].

Those deals totalled AU$459 million.

But the biggest headline-grabber has been Newmont [NYSE:NEM] merging with Newcrest [ASX:NCM].

Newmont Acquisition of Newcrest Would Be Largest Gold Merger In History

— S&P Global

It’s been hailed as the largest gold merger in history, worth over AU$26 billion.

Now, this sounds like a lot of money, but the guys who own these companies aren’t just throwing it around.

They know exactly what they’re doing.

They’re buying up confirmed assets on the cheap — to position themselves for a higher gold price in 2024.

GREG CANAVAN:

This sounds very similar to what you just described from the 2016 bull run, where you had the likes of Evolution and Northern Star snapping up assets from distressed companies.

Then, when the bull market rolled around, those assets multiplied in value — and Evolution and Northern Star’s share prices went right up with them.

And I guess with record M&A activity happening right now, it’s not much of a stretch to see something similar happening this year.

OK Brian, that’s your first bullish signal. So what’s your second?

BRIAN CHU:

Well, this one is a little more obvious. It’s the rising price of gold.

Gold closed out 2023 within a whisker of its new all-time high, which it set in early December.

But I think it’s going higher still in 2024.

Why? Well let’s look at it…

As a general rule, global uncertainty drives demand for gold.

And right now, the world is a more uncertain place than ever.

Untamed inflation, rising interest rates…

International conflicts, geopolitical tensions…

All of this means demand for gold — an asset considered a safe haven of value for over 6,000 years — is higher than ever before.

That’s why the financial system’s most powerful players — the world’s central banks — are now purchasing gold at the fastest pace on record.

Central Banks Are Buying Gold at The Fastest Pace In 55 Years

— OILPRICE.COM

In 2022, they bought more than 1,100 tonnes of bullion.

In the first nine months of 2023, they snapped up another 800 tonnes.

And this record-breaking pace looks set to continue.

Central Banks Could Keep Gold Demand Hot in 2024

— CNBC

Nearly two-thirds of all central banks expect to keep increasing their holdings into the foreseeable future, according to the World Gold Council.

In fact, they’re calling this a ‘diversification moment’.

In some cases, it looks like a concerted effort by countries to choose gold over the US dollar.

De-Dollarization: The End of Dollar Dominance

— J.P.Morgan

This is what’s known as ‘de-dollarisation’.

And it’s being led by Russia and China.

Both have a strategic aim to remove the US dollar as the world’s primary currency for international transactions.

They believe the US is abusing its position as the world’s reserve currency.

GREG CANAVAN:

Just on that note…

The US is currently running a fiscal deficit of US$1.7 trillion.

Now, that’s an astonishing number in itself.

But what’s more, that figure effectively doubled in 2023 alone.

U.S. Deficit, Pegged at $1.7 Trillion, Effectively Doubled in 2023

— The New York Times

So it’s clear the US is racking up debt at an absolutely unsustainable rate.

The problem is, they can’t default, because they can literally print the money they need to pay for it.

Of course, that would devalue the dollar…but it also means they’ll never go broke.

In fact, just like going on a shopping spree with a credit card you never have to pay off — it means they can purchase whatever they want, when they want it…

Defence spending, infrastructure projects, you name it.

Only the US can get away with this because they’re the world’s reserve currency.

So you can see why some world leaders think the US holds an unfair political advantage…

And why the idea of de-dollarisation is quickly becoming more mainstream…

BRIAN CHU:

That’s a great point, Greg.

Deficit spending also puts massive inflationary pressure on the economy, which is another factor that can push up the price of gold.

So there’s plenty happening in the US.

But there’s even more action happening abroad.

For instance, soon after tanks rolled across the border into Ukraine, the US flexed its financial muscle to freeze Russia’s dollar holdings.

Russia Suspended from Bank for International Settlements

— The Wall Street Journal

This pushed them out of the international banking system.

Billionaire Ray Dalio has been warning other governments their assets could be frozen just as easily.

Elon Musk agreed, saying, ‘If you weaponize [a] currency enough times, other countries will stop using it.’

And that’s exactly what’s happening.

China’s de-dollarisation plans are rapidly gaining momentum.

The yuan has now surpassed the dollar to become the most-traded foreign currency on the Moscow exchange.

Russia Embraces China's [Yuan] in Face of Western Sanctions

— Financial Times

Russian President Vladimir Putin has pledged to adopt the Chinese yuan for ‘payments between Russia and [the] countries of Asia, Africa, and Latin America.’

Putin himself has said de-dollarisation is an ‘irreversible process’.

Now, Putin isn’t the leader of some small country like, say, Iraq or Libya…

Russia is a force to be reckoned with.

This is why I believe we’ll likely see other countries jump on board this trend in the near future.

So de-dollarisation is a key reason why I believe gold could hit new all-time highs this year.

And that could seriously benefit investors in the right gold mining stocks, provided they use this opportunity to take a position now.

We know from previous bull markets that when gold stocks move as a response to the rising spot price, they can move fast.

GREG CANAVAN:

Just on the de-dollarisation point, I’m hearing that Saudi Arabia is considering moving away from the dollar, too.

BRIAN CHU:

You could be right, Greg.

After a recent visit from Chinese President Xi Jinping, reports emerged that the Saudis could soon be using yuan for sales of oil to China.

Saudis Consider Using Yuan For China Oil Sales

— Bloomberg

Their neighbouring states — including Qatar, Kuwait, Iraq, and the United Arab Emirates — could also be planning similar yuan-for-oil deals.

These moves, if they go ahead, would disrupt the worldwide petrodollar regime.

And it’s not just the Middle East…

South America has been in China’s sights ever since Argentina agreed to pay for Chinese imports in yuan instead of dollars.

Argentina to Settle Chinese Imports in Yuan

— South China Morning Post

And French company Engie just completed one of the first-ever yuan-settled LNG trades.

French Energy Firm Engie Complete Yuan-settled LNG Trade

— Reuters

So Europe is getting involved, too.

All told, the yuan has now become the most-used currency for cross-border transactions in China — overtaking the dollar for the first time in 2023.

And this movement is gathering steam…

A Global Shift Away from The Almighty Dollar

— Financial Times

India has just convinced 22 countries trade in the rupee.

And these are not just small fish located in nearby Africa or Asia.

We’re talking economic powerhouses like Germany, New Zealand, and the United Kingdom.

So even Western nations are beginning to dump the dollar.

And what’s more, Greg, many of these countries are already replacing their US dollar foreign exchange reserves with gold.

China is Leading a 'Voracious' Gold-Buying Spree as Central Banks Try To Shrink Dollar Reserves

— Business Insider

China’s central bank just scooped up the most bullion of any country in 2023 — putting their gold stockpiles at more than 2,100 tonnes.

India, Brazil, and South Africa now hold about 1,000 tonnes combined.

Meanwhile, Russia’s stockpiles exceed 2,300 tonnes — the fifth-largest gold holdings of any country in the world.

To put those numbers in perspective, Western nations like Canada hold zero gold reserves.

And Australia holds just 80 tonnes.

So you can see how the US dollar’s dominance is being challenged…

Some have even speculated that several nation states will create their own currency to rival the dollar.

In 2023, one Russian minister announced that…

We are currently working with a number of countries to create bilateral platforms in order not to use dollars and euros.

— Alexey Moiseyev, Russian Deputy Finance Minister

Early talk amongst insiders is this could be a cryptocurrency backed by…

You guessed it…

Gold.

GREG CANAVAN:

So to bring things back to the purpose of our event today…

You predict that this move away from the dollar is going to continue driving the gold price even higher this year – is that right?

BRIAN CHU:

Well, the good news is, we don’t have to predict anything.

All we need to do is turn to history.

We’ve seen this story play out before.

Today, most people look back on the 1960s as the decade of peace and love.

But in reality, the 60s was a period of intense economic upheaval.

In 1961, under a Democrat administration, you had the US stock market suffering a 28% crash — one of the worst bear markets of all-time.

Then, in 1965, President Lyndon B Johnson kicked off the Great Society, causing inflation to eventually reach near-record highs of over 14%.

You also had youth movements pushing for political action on the environment…

As well as the assassination of Dr. Martin Luther King leading to riots in the streets.

GREG CANAVAN:

Sounds eerily like what’s happening right now with market volatility, high inflation, and social chaos, especially in the West.

BRIAN CHU:

Precisely.

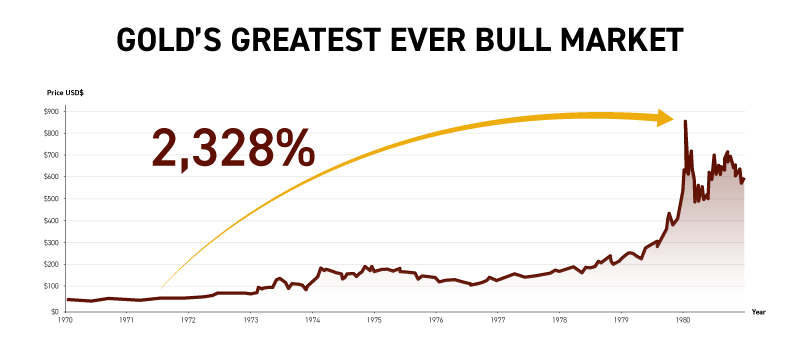

And back in the 60s, this economic uncertainty is what paved the way for the greatest ever bull run in gold.

As you probably know, the Bretton Woods agreement crowned the US dollar as the world’s reserve currency.

This was thanks in part to the US holding the world’s largest stockpiles of gold.

These stockpiles gave foreign central banks the confidence to hold US$ because the banks knew they could convert them to gold at US$35 dollars per ounce.

But here’s what you may not know…

Bretton Woods did not regulate the price of gold.

If the market value of gold crept higher than US$35 dollars an ounce, central banks had financial incentive to redeem their US$ for gold.

By the late 1950s, central bank demand for gold was soaring — just like we’re seeing today.

Then, the economic uncertainty of the 1960s kicked this action into high gear.

Countries including France and the Netherlands began redeeming tonnes of gold from the US.

Soon, other countries started joining in, accelerating this run on supply.

Then on 15 August, 1971 — to save what was left of its stockpiles — US President Richard Nixon was forced to dismantle the Bretton Woods agreement.

He ended the gold standard.

This launched the greatest bull market in gold’s history.

With central banks now rapidly swapping their US$ for gold…

The spot price took off from US$35 dollars an ounce, and reached a high of US$850 dollars an ounce.

Ultimately, gold skyrocketed more than 2,300%.

GREG CANAVAN:

As you can see, gold’s greatest ever bull market has a lot in common with what’s going on today…

Including the economic uncertainty sweeping across the globe, helping drive the gold price to new all-time highs.

That’s why Brian has put together a special report for viewers of today’s presentation.

It’s called ‘The Ultimate Australian Gold Game Plan’.

It’s designed to give you everything you need to know to capitalise on what could be an historic opportunity in the Australian gold sector in 2024…

Even if you’ve never invested in gold stocks in your life.

Brian, you’ve outlined the story behind the rising price of gold, and the frantic M&A spending in the sector — two signals that the next bull market is already here.

What’s the third bullish signal?

BRIAN CHU:

Well Greg, when it comes to extracting and refining gold, the biggest cost is energy.

Specifically, the price of oil.

This is because diesel is a major cost factor for running mining vehicles and equipment.

Let me take you back to 2008.

When the Global Financial Crisis struck, demand for oil dropped like a rock.

As the world’s major economies ground to a halt, the price of oil plummeted to about US$40 per barrel — a sharp decline of 70%.

But this turned out to be a massive tailwind for gold mining companies, because it lowered their costs dramatically.

So when you combine this cheap oil with the price of gold surging 163% over the following three years…

Profits — and certain share prices — went through the roof.

Investors in Kingsgate Consolidated [ASX:KCN] would’ve made over 450% on their money in less than 24 months.

OceanaGold Corporation [ASX:OGC], 2,500% in less than 22 months, and…

Silver Lake Resources [ASX:SLR] delivered returns of over 2,800% — more than 20 times your money — in less than three years.

GREG CANAVAN:

Now, we should say again that not all gold stocks rose like these.

And, of course, there are risks and volatility involved with investing in this sector, which we’ll talk about more in a moment.

But returns like these are what can happen if you catch the right gold stocks at the right time, like when the price of oil drops dramatically.

BRIAN CHU:

Absolutely.

And the same story played out again during another economic crisis: the global lockdowns of 2020.

With international travel at a standstill and nearly everyone stuck at home, global demand for oil fell off a cliff.

In fact, for a few hours in April 2020, the price of oil futures actually went negative.

Traders were actually willing to pay to sell their oil because there was nowhere to store the excess supply.

That’s how extreme this oil crash was.

Within a few short months, oil finished down almost 70% again — this time settling at a low of US$19 per barrel.

And at the same time, the global uncertainty during this period was a big reason the price of gold spiked up 29%.

GREG CANAVAN:

I imagine this combination of cheap oil and higher priced gold was rocket fuel for Aussie mining companies.

BRIAN CHU:

It was unbelievable, Greg.

Alacer Gold [ASX:AQG] rose over 220% in less than 18 months…

Dacian Gold [ASX:DCN] shot up over 350% in less than seven months, and…

West African Resources [ASX:WAF] soared over 440% in less than three years.

Simply put, when the oil price drops, costs go down.

When the gold price rises, profits go up.

If you get a window where these two market forces align — that’s when we see historic bull runs in the Aussie gold stock sector.

So it’s no surprise that since September last year, with gold trending up and oil trending down, most established producers have bounced considerably off their recent lows.

About a dozen producers are already up double-digit percentages…

Companies like Aeris Resources [ASX:AIS], Alkane Resources [ASX:ALK], Aurelia Metals [ASX:AMI], and Capricorn Metals [ASX:CMM]…

And several are up triple-digit percentages… Including Tietto Minerals [ASX:TIE], Red 5 [ASX:RED], and Emerald Resources [ASX:EMR]…

This is a good sign, but we know from past bull markets that these early gains were just the beginning.

There could be fireworks on the way Greg, and I’d love to help our viewers get involved…

GREG CANAVAN:

OK, so right now, there are 221 gold stocks listed on the ASX.

But not all of them will react like the examples Brian has been showing you today.

These are high-risk, high-volatility plays.

And as we know, gold stocks have just experienced a rough couple of years…

BRIAN CHU:

I’m fully transparent about the risks in this sector.

Anyone who wants to take a position in some of these mining stocks needs to know that it’s not always smooth sailing.

The share prices of these companies are highly sensitive to a bunch of market factors.

Any company that can double in a month can halve over the same amount of time.

To give you an example…

From August 2020 through to May 2022, the price of gold dropped 6% while oil spiked 169%…

The exact opposite of the bullish conditions I just described.

Profit margins for gold miners went down while costs went way up.

The GDX Gold Miners ETF fell as much as 45%…

And plenty of individual gold stocks went into freefall.

So please don’t go throwing darts, hoping to pick a winner.

But, as things stand right now, with oil down 37% from its peak in 2022, and continuing to trend down…

And gold up 11% and already making new all-time highs…

Plus the rapid M&A activity by insiders in our gold mining sector…

The conditions are certainly in favour of a major run up in some of the stocks I cover.

GREG CANAVAN:

OK Brian, well in a moment we’re going to turn our attention to three of the gold companies you’re excited about in 2024.

But in case anyone watching doesn’t know, Brian runs a couple of premium advisories here at Fat Tail Investment Research.

The Australian Gold Report is one of our most popular services — and Brian’s among our most revered experts.

Brian, we receive loads of positive emails from your subscribers, mate…

Mike H M says:

‘His insights and recommendations into the gold market are in my opinion absolutely spot on, especially seeing that the gold prices have seen so much volatility in the past two-plus years.’

RKD says:

‘Thought provoking and enlightening. Brian shows immense passion in his work and advice, but does so with caution and commitment to his clients.’

J R Daniel says:

‘I like Brian’s honest and informative ‘no BS’ way of communicating. He gets to the point and doesn’t build flash hopes.’

Neil G says:

‘I enjoy Brian’s optimism and his truthfulness in his writings.’

And Alan W says:

‘I am most impressed with the quantity of knowledge that Brian carries in his head. This makes listening to him a privilege.’

Your subscribers certainly seem to love what you do.

But let’s not forget that underpinning it all is a proven ability to identify high-performing gold stocks.

Like you said earlier, the 2016 bull run was a particular high point…

BRIAN CHU:

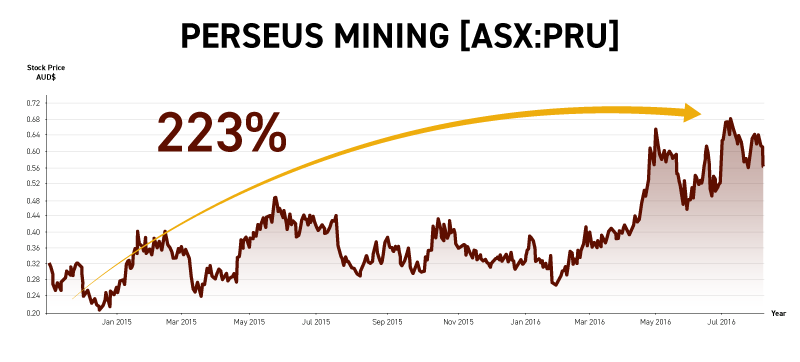

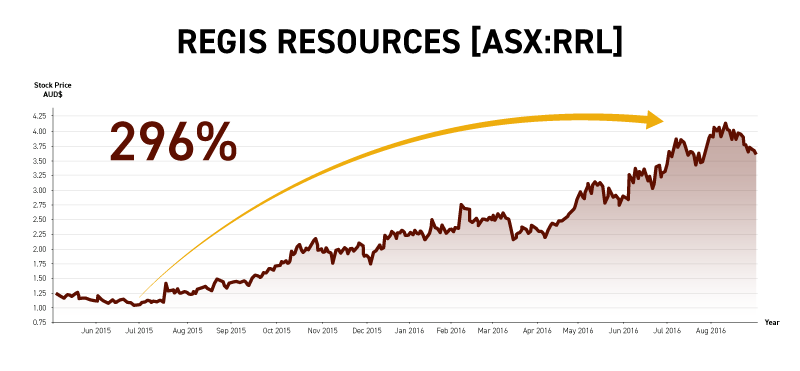

Absolutely, Greg, the bull market of 2015 and 2016 was a great time for gold stock investors.

It kicked off when oil cratered 54% near the tail end of 2014, with gold then rising by about 15%…

That led to outsized performance of certain gold producers like ASX-listed Perseus Mining [ASX:PRU]…

Whose value increased over 200% in about 18 months…

Or Perth-based Regis Resources [ASX:RRL]…

Whose share price rose almost 300% in just over one year…

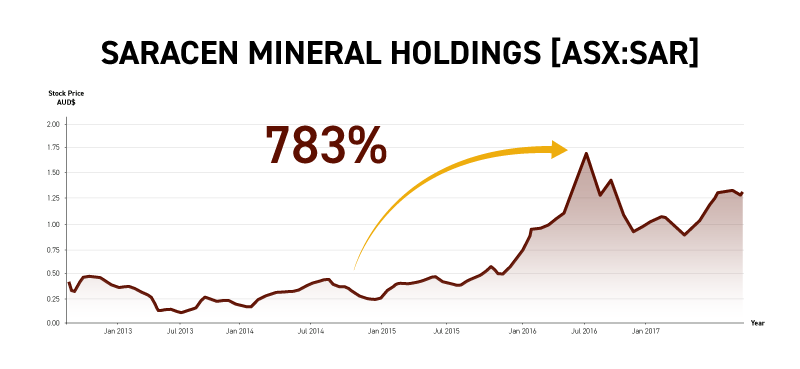

Or Saracen Mineral Holdings [ASX:SAR].

In just under two years, Saracen’s shareholders watched as the company climbed over 780% in value.

These are exceptional examples, of course.

And past performance is no guarantee of future returns.

But in a bull market, moves like these are very possible.

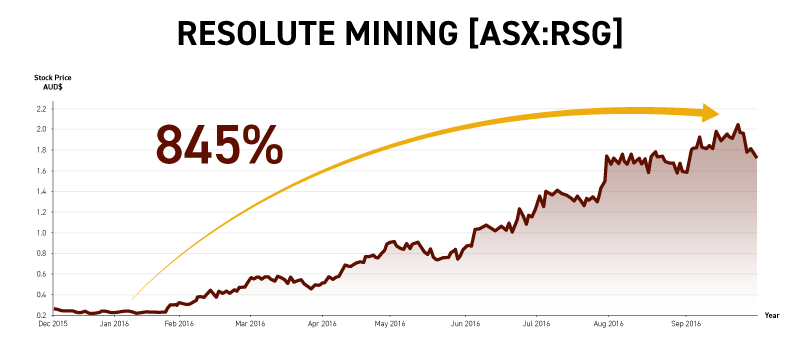

Like one of my best buys of that bull market, Resolute Mining [ASX:RSG].

In less than 10 months, Resolute’s share price shot up 845%.

Given everything I’ve outlined today, I believe the sector is ripe for opportunities just like these in 2024.

GREG CANAVAN:

Personally, I don’t know of anyone better to listen to if you want to become a successful gold stock investor.

And, as I say, it seems your readers would agree with that.

BJV says:

‘I appreciate an analyst who is committed, and backs his or her findings with their own monies.’

Spiro says:

‘Brian Chu’s expert and micro knowledge of gold stocks is exactly what I need to help improve my active gold sector investing.’

Anne says:

‘Your investments are in sound, experienced hands with Brian Chu’s deep knowledge of the gold markets.’

And Johno says, quite simply, ‘In a word: brilliant.’

That must make you feel pretty good!

BRIAN CHU:

Having benefited from several multi-year bull runs firsthand, and now being able to bring my readers along for this ride…

I’ve been humbled by the responses I’ve received.

Because when it comes to the markets, in my opinion, there’s nothing more exciting than investing in gold stocks.

GREG CANAVAN:

Well then, let’s get to the first of your three recommendations for 2024…

BRIAN CHU:

Sure thing.

My first play is on the cusp of becoming a major gold producer.

This puts them in a unique position.

Here’s a quick snapshot of how I classify mining companies.

Large producers: They produce over half a million ounces of gold annually.

Major producers: Over one million ounces.

So going from large to major, that’s quite a big leap.

And that’s what this company is attempting to do.

To achieve this, they’ve been aggressively selling off their smaller projects.

They’ve also acquired several larger projects — and those have been doing so well, the company is now expanding internationally.

It recently paid AU$500 million to purchase a legendary mine site over in Canada.

Their plan is to use modern technology to revive that site to its former glory.

And Greg, this company is cash rich, which is unusual in this sector.

Get this, since 2013, they’ve paid out dividends worth over AU$1 billion.

Which tells you management is confident about their ongoing profitability.

Now, obviously this company isn’t immune to market sentiment.

During the 2022 bear market, its share price got cut in half.

And earlier this year, it took another hit due to delays in development.

But I believe that these short-term setbacks do not detract from its long-term investment case.

In fact, the recent selloff gives you the opportunity to pay a lower price for a quality company.

And with major producer status just over the horizon…

I believe this presents an enormous opportunity right now.

GREG CANAVAN:

Well Brian, they sound perfectly positioned to potentially capitalise on the coming gold bull market.

And we’ll let everyone know in a moment how they can get all the details.

But what about your second play?

BRIAN CHU:

My second play is a mid-tier producer that has just overcome its longstanding underdog mentality.

‘Mid-tier’ means they produce between 150,000 and half a million ounces of gold annually.

These guys are currently sitting on short-term projections of 250,000 ounces with medium-term guidance pointing towards 350,000 ounces.

So they’ve got plenty of upside potential left in the tank.

But they had to scrape and claw to get to this point.

Their two main competitors are Ramelius Resources and Silver Lake Resources.

Between the three of them, the company I’m recommending has raised the least amount of outside capital.

Instead, they’ve chosen to self-fund by bootstrapping cash from their current operations.

This is an uncommon approach.

But it’s turned out well for them.

They’ve out-produced both of their competitors from 2017 to 2020.

If that wasn’t enough, here’s what makes this opportunity really compelling.

Despite outperforming in terms of production, this company’s market cap has been chronically undervalued.

I believe this is due in large part to being plagued, historically, by basic operational problems.

Deteriorating infrastructure, outdated equipment, water management systems that don’t work, the list goes on and on…

Since 2016, they’ve spent over AU$350 million fixing these problems.

And all this effort has finally paid off.

Output at the company’s flagship mine has recently gained massive traction.

They’re now actively planning to bring other dormant deposits back online as well.

Plus, they’ve just announced a series of positive drill results, including one new deposit holding over half a million ounces of resources, ready to be tapped.

These are all extremely bullish signs.

And even though their previous problems are behind them, I believe their valuation is still more favourable than that of Ramelius Resources or Silver Lake Resources.

In fact, their recent returns since the bear market lows of 2022 are now outpacing both competitors.

That’s a hard-fought win for this company.

So I wouldn’t wait much longer to consider getting into this ‘former underdog’ play.

GREG CANAVAN:

OK Brian, what’s the third gold stock you’ve got for us today?

BRIAN CHU:

With my third play, you’re getting in at the perfect time.

Their current mine site is estimated to hold 4.9 million ounces of gold resources.

Their new site — 6.7 million ounces.

So they’re on track to more than double their annual production.

And they’re going to do it by 2025.

Their neighbours include international giants like Russia’s Nordgold and Canada’s Endeavour Mining [TSE:EDV].

Those company’s market caps — they’re all in the multibillion-dollar territory.

The company I’m recommending today, has a market cap of around one billion dollars.

So there’s massive opportunity for growth here.

And these guys are already proven performers.

During Australia’s last gold bull market, this company’s share price surged 443%…

Turning every one thousand dollars invested into more than five thousand dollars.

But during the recent bear market, it’s no surprise their stock also took a beating.

I believe that only makes their prospects even brighter this time around.

Because construction is already underway at their new mine, funding is fully secured…

And they expect to pour their first bar of new gold by early 2025.

So if you want to get into this potential quick-turn value play, there’s not much time to waste.

GREG CANAVAN:

The ticker symbols for all three of Brian’s recommendations can be found in his special report, ‘The Ultimate Australian Gold Game Plan’.

It’s included as a complimentary gift when you join his Australian Gold Report service today.

This is Brian’s newsletter dedicated to gold and gold mining stocks.

I’ll explain how you can become a subscriber at a special discounted rate in just a moment.

Inside the Australian Gold Report, you’re getting everything you need to capitalise on what could be a historic opportunity for gold stock investors in 2024.

As you’ve just heard, Brian believes there are great stocks on sale for serious discounts right now.

So there’s still time to position your portfolio before the bull market gets into full swing.

He’ll also be sending you email updates to help you stay on top of the stocks he’s recommended.

You’ll get specific buy, sell, and hold signals, so you’re always completely clear about what to do next.

He’ll tell you when to buy, what price to pay, and when to sell — whether that’s for cutting losses or taking profits.

Then, every quarter, Brian will send you his ‘State of the Gold Industry’ report, with his big-picture commentary and risk analysis on the gold market.

Plus, you’ll get immediate access to his full model portfolio of gold stock plays.

And he wants you to hit the ground running.

That’s why as soon as you become a subscriber, he’ll send you his special report, ‘The Ultimate Australian Gold Game Plan’.

Inside, you’ll discover the ticker symbols of the three gold stock recommendations we’ve been discussing today.

He’ll also show you how to set up your own gold portfolio step-by-step — whether you choose physical bullion, precious metals ETFs, gold mining stocks, or all of the above.

So, whether you’re brand new to the gold market or a seasoned precious metals investor, Brian’s got you covered…

BRIAN CHU:

Greg, sorry to interrupt, but I want to let our viewers know that when they join the Australian Gold Report today, they’re also getting two bonus reports.

The first bonus report is called, ‘Three Advanced Indicators for Gold Market Success’.

This is for you if you want to learn more about my stock-picking strategy.

In it, I reveal some of the newest indicators I’ve developed that help me find high-quality producers at heavily discounted prices.

You won’t find these indicators anywhere else.

I do it all in-house, and they’re exclusively for my subscribers.

You can use these indicators to find excellent value companies before I recommend them — getting into great plays well ahead of the pack.

The second bonus report is called, ‘Your Journey into Speculative Gold Stocks.’

Now, I’ve designed the Australian Gold Report to focus more on established gold producers with an emphasis on stability and predictability when it comes to future results.

But there’s a whole world of more speculative exploration plays out there that I want to introduce you to, as well.

This report is going to help you navigate that riskier, but potentially much more lucrative, territory.

For example, during the recent gold bull run from September 2018 to August 2020, the ASX Gold Index rallied 107%…

But a bunch of tiny exploration stocks took off like rockets.

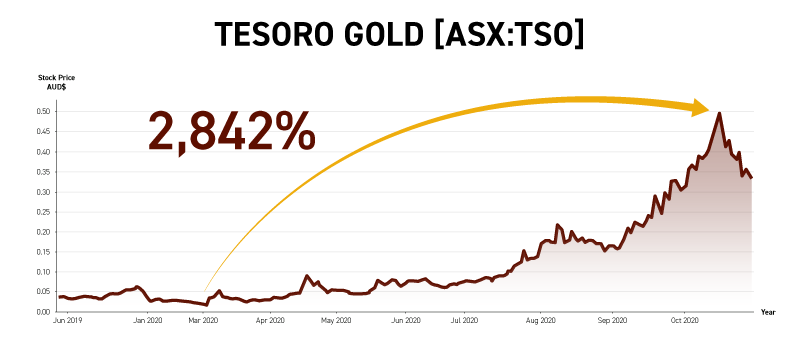

Consider the 2,800% gains on Tesoro Gold [ASX:TSO] in just over seven months…

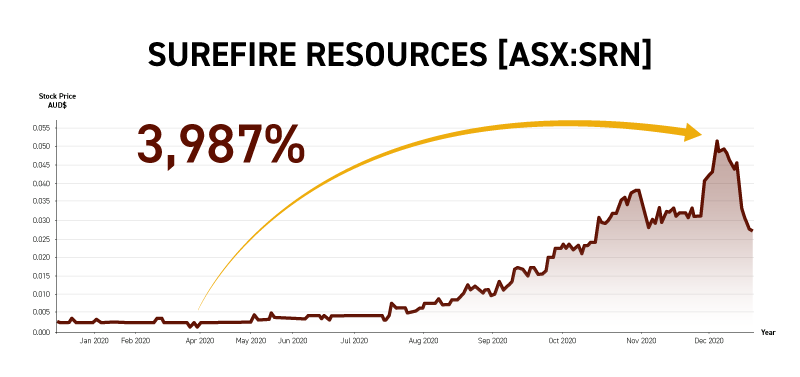

The 3,900% gains on Surefire Resources [ASX:SRN] in less than eight months…

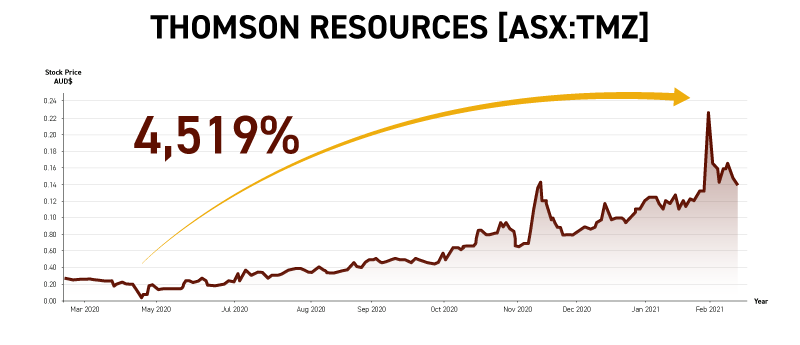

Or the 4,500% gains on Thomson Resources [ASX:TMZ] in less than nine months.

These are all exceptional examples, of course.

And for every speculative gold play that skyrocketed in value, many didn’t move at all.

But these moves can happen for the right companies at the right part of the gold cycle.

That’s why you need to know how to assess the risks and potential rewards of any exploration company you invest in.

This report shows you how to do exactly that.

I’ve even included two speculative recommendations you can use to start building your portfolio immediately.

Both of these reports are yours to keep for giving the Australian Gold Report a go today.

GREG CANAVAN:

Now, research reports like these — written by gold industry insiders — typically retail for hundreds, even thousands of dollars.

So if we were to offer everything Brian is giving you today at market rates, the cost would be a substantial sum of money.

But here at Fat Tail Investment Research, we know most Aussies are doing it tough right now.

It’s hard enough to pay for petrol, groceries, and a roof over your head, let alone grow your net worth with smart investments.

That’s why we’ve decided to offer you a special discount.

You won’t find this discount advertised on our website — or anywhere else for that matter.

It’s only for viewers who decide to try out Brian’s Australian Gold Report advisory service today.

Click the button below for all the details.

You’ll be taken to a short order form where you can secure your membership at an incredible price.

Your membership is also covered by our ironclad 30-day, no-obligation money-back guarantee.

Your membership is also covered by our ironclad 30-day, no-obligation money-back guarantee.

Take us for a test drive in that time.

For the next 30 days, browse all the updates inside the Australian Gold Report…

Read through all the special reports you’re getting today…

Discover the three gold producers that Brian believes will lead the pack in Australia’s next gold stock bull market…

Plus, you’re getting two more speculative plays inside the bonus report that Brian just mentioned…

And if you don’t love what you see and you don’t believe this service will benefit your investment goals…

Please don’t hesitate to contact our Melbourne-based customer service team and ask for a full refund of your subscription fee.

We’ll give it to you, no questions asked.

Any reports and back-issues you download are yours to keep, whether you decide to continue with us or not.

It’s our way of saying thank you for giving us a go.

So Brian, any closing comments?

BRIAN CHU:

Due to the unprecedented uncertainty in the global markets, plus the modern-day gold rush kicking off here at home…

I believe Australia is the best place in the world to become a gold stock investor right now.

And the Australian Gold Report is the best way I know to be by your side, every step of the way, keeping you up to date with everything I’m hearing around the industry.

I can’t wait to share it all with you.

Thank you and God bless.

GREG CANAVAN:

Once again, click the button below to secure your subscription at today’s special discounted rate.

On behalf of Brian Chu and Fat Tail Investment Research, I want to thank you for joining us.

I’m Greg Canavan.

Have a great day.

(You can review your order on the next page)