Demand for one specific metal reaches record highs as governments in Australia, the UK, the US, and 137 other countries march towards…

Goldman Sachs: This Metal is the ‘New Oil’ of the Electrified Economy

Demand for one specific metal reaches record highs as governments in Australia, the UK, the US, and 137 other countries march towards…

Dear Reader,

‘Electrify everything.’

That’s the latest catchphrase that’s going to save the planet.

Here in Australia, Albo says we’re ‘eager and ready to do our part’.

Politicians from the UK, the US, and 137 other countries are also joining in.

That’s because academics and think tanks are now saying everything must run on the grid.

James Cooper

But as a geologist, I know we can’t expand the world’s energy grids without one specific metal.

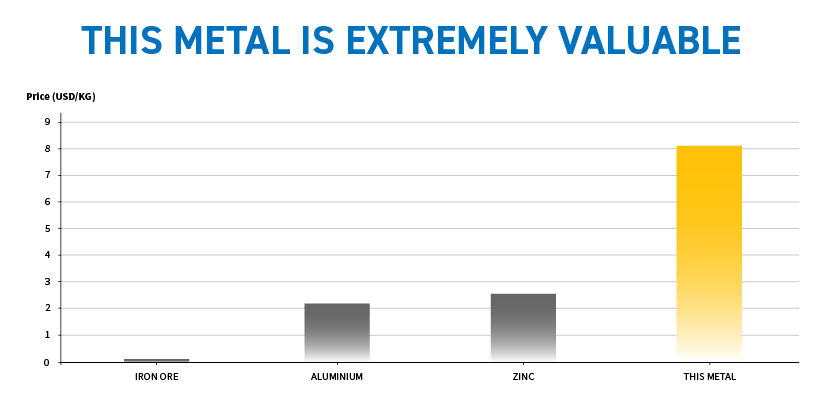

This metal is so valuable, Goldman Sachs dubs it the ‘new oil’ of the electrified economy.

This unprecedented demand to electrify everything is already creating a dangerous supply shortage.

And if history is any guide, I know exactly what’s coming next.

In recent years, this simple pattern has led investors to some of the biggest stock market wins.

Because when resource prices spike, certain Aussie mining shares often take off with them.

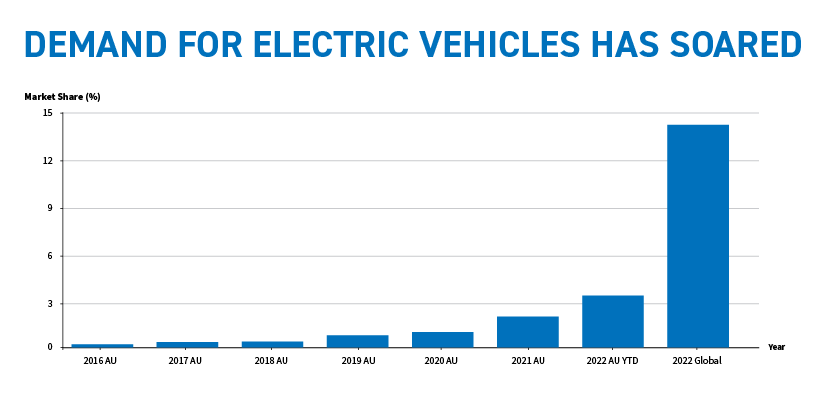

It’s no secret that lithium-ion-powered electric vehicles are taking the world by storm.

Here in Australia, in just the last two years, EV purchases have quadrupled.

Globally, demand is four times that amount.

A large chunk of lithium — about the size of a bowling ball — is required for every electric battery in every car.

However, the more popular cars, like the Model S, need almost eight times as much lithium.

So, it’s no wonder the world has been running short on supply.

In 2022, these shortages hit electric vehicle producers, like Tesla and Volkswagen, hard.

Media outlets were quick to fuel the hysteria, predicting the worst was yet to come.

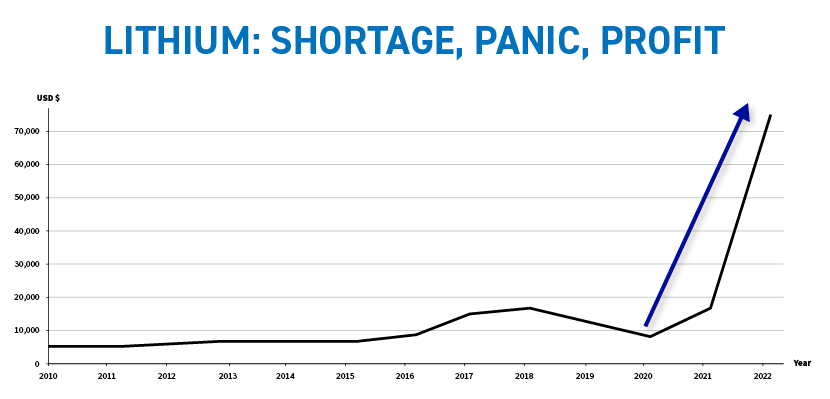

Then, desperate buyers lit the fuse.

Markets panicked, sending prices skyrocketing.

Lithium reached record highs, almost overnight.

And when the price of lithium went vertical, several ASX-listed mining stocks went with it.

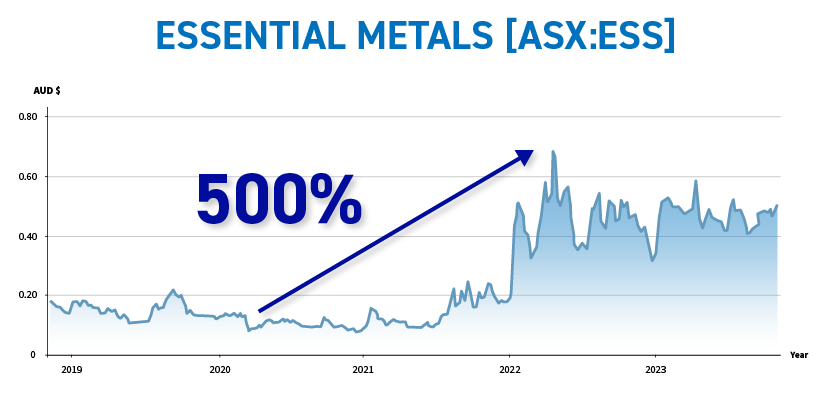

Stocks like Essential Metals [ASX:ESS] — an explorer based out of Western Australia.

130 kilometres south of Kalgoorlie, its Pioneer Dome project sits right at the heart of WA’s ‘lithium corridor’.

Press releases suggest Essential is sitting on a lithium oxide discovery to the tune of at least 11.2 million tonnes.

Therefore, it’s no surprise when the price of lithium spiked, Essential’s share price went with it — going up 500%.

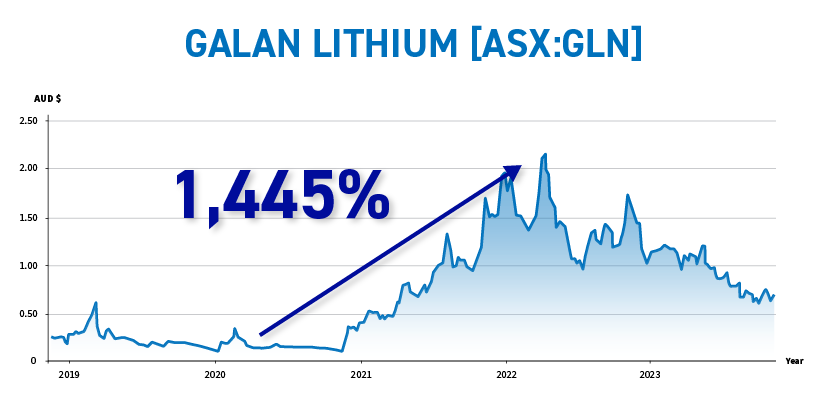

And then there’s ASX-listed Galan Lithium [ASX:GLN]…

Galan is a mining company with projects in Argentina and Australia.

Its Australian project is 250 kilometres south of Perth, and its Argentinean projects are in the famous ‘lithium triangle’ in South America.

Come 2022, investors who held Galan shares at the start of 2020 saw their value increase 10-fold.

Pilbara Minerals [ASX:PLS] was another big winner from this pattern.

The Financial Review reported Pilbara’s accountant’s calculator literally short-circuited from their record 2022 profits.

Investors in Pilbara saw their shares rise in value by more than 20-fold.

When it came to lithium, the same story played out over and over throughout the sector…

The pattern was clear: shortage, panic, profit.

Liontown Resources [ASX:LTR] rose 40-fold…

Arizona Lithium [ASX:AZL] shot up 50-fold…

And shares in Lake Resources [ASX:LKE] skyrocketed an astonishing 80-fold in value.

Here, check this out.

The Finniss Project is an open-pit mine and processing plant near Darwin.

It’s one of the highest-grade lithium resources in Australia, and it’s the only fully permitted lithium project outside of WA.

The owner and developer of the project is Core Lithium [ASX:CXO].

In 2022, when lithium prices soared, shares of CXO went into the stratosphere, shooting up 9,284%.

A 90-fold up move.

Can you imagine what a move like that would’ve done to even a small investment in CXO?

Of course, these are exceptional stock moves.

Not all lithium plays reacted this way. And some didn’t move at all.

But my point is, this pattern repeatedly plays out in the resources sector.

And when it does, it creates a ripe environment for companies like these who are in the right place, at the right time.

In just a moment, I’ll tell you about the ASX-listed mining stocks I’m targeting to take advantage of this historic opportunity.

The best part is, the action could really accelerate from here.

Let me show you another recent example…

A couple years back, a longer-than-average winter saw European countries run down their natural gas reserves by 25%.

Simultaneously, rising demand from Asia’s post-pandemic recovery strained LNG supplies even further.

There’s your shortage.

Now, half of Europe’s natural gas supply comes from Russia and Norway.

Norway has been busy rebuilding its energy infrastructure, taking most of its supply off the table unexpectedly.

At the same time, in Russia, a Siberian processing plant caught fire.

There’s your panic.

This created perfect conditions for Aussie LNG stocks like Karoon Energy [ASX:KAR].

Karoon’s stock value eventually reached peak gains of 589%.

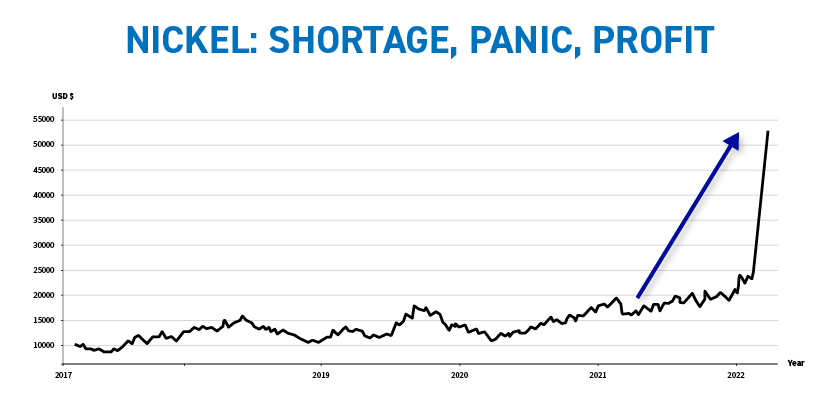

Rising demand for EVs has led to another shortage — this time in nickel.

Russia is the world’s largest exporter of refined nickel.

Immediately following Russia’s invasion of Ukraine, nickel prices moved sharply higher.

To quell the panic, the London Metal Exchange was forced to halt trading.

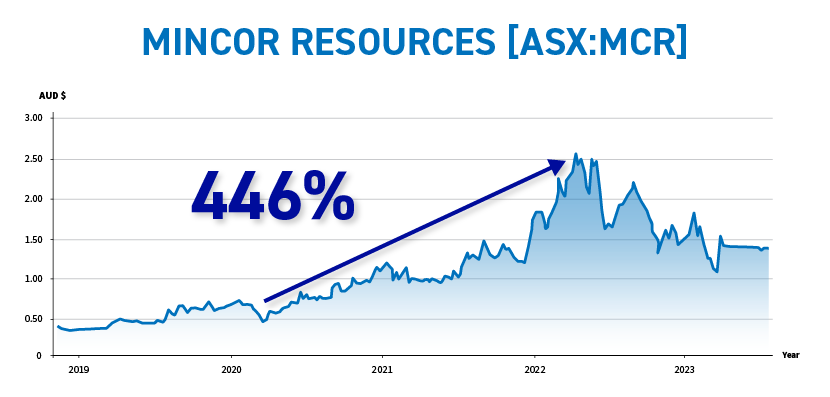

Once again, when prices spiked, Aussie miners profited handsomely.

Some ASX-listed nickel stocks more than doubled.

From its lows in 2020, IGO [ASX:IGO] eventually went up as much as 350%.

While investors in Mincor Resources [ASX:MCR] enjoyed a peak return of 446%.

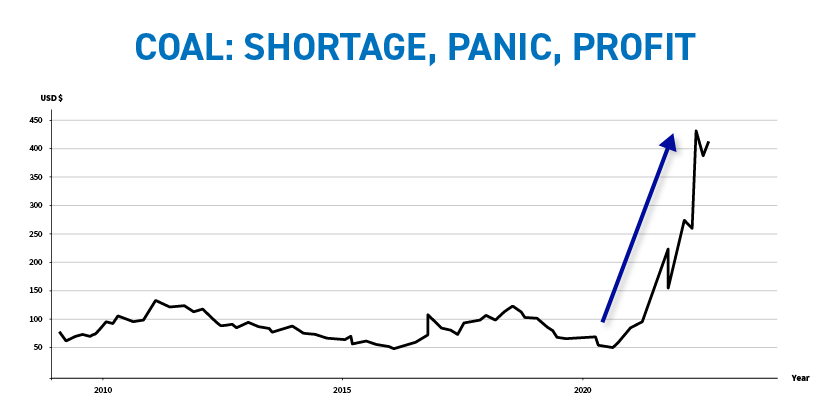

It’s mainstream news that we’re in a worldwide coal shortage.

Stockpiles were already at record lows when the panic set in.

More European sanctions against Russia, one of the world’s largest exporters of coal, sent global markets into a tailspin.

And ASX-listed coal plays multiplied in value as a result.

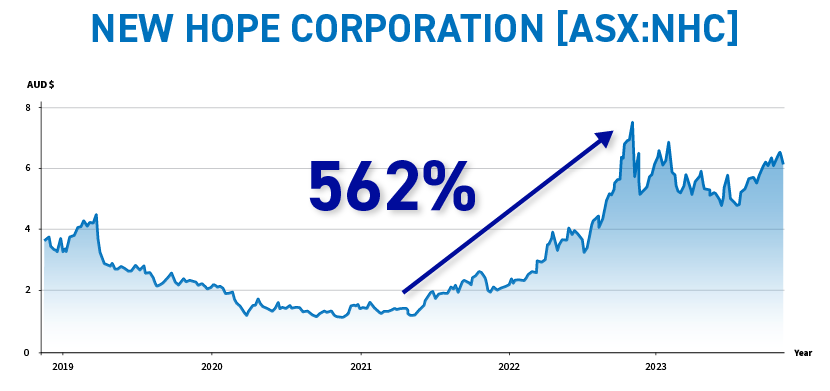

From trough to peak, New Hope’s [ASX:NHC] share price rose 562%.

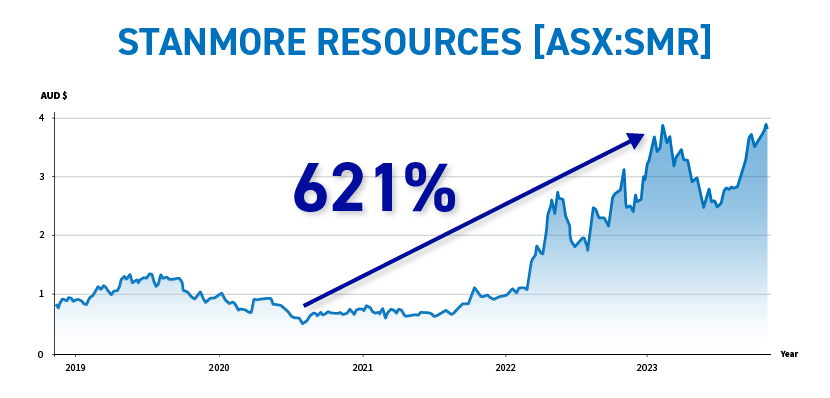

Stanmore Resources’ [ASX:SMR] stock value shot up 621%.

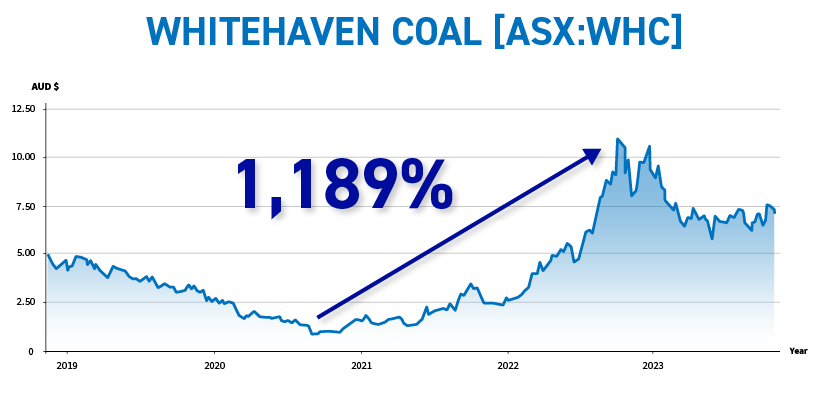

And shares in small Aussie miner Whitehaven Coal [ASX:WHC] soared 1,189%.

Major institutions like Goldman Sachs, Wood Mackenzie, and Bank of America are already warning about a new worldwide shortage in one critical metal.

The fuse is lit.

And based on my independent research and analysis, I’m certain panic is around the corner.

That’s why I already have two ASX-listed mining plays locked and loaded.

These are the Aussie miners I believe are best positioned to ride the coming price spike.

I’ll share all those details with you in a moment.

I’m James Cooper.

James Cooper,

Geologist/Financial Analyst

I’ve lived and worked on mine sites all over the world.

I believe THAT kind of boots-on-the-ground experience will be critical for what’s coming next.

I’ve been on site in Zambia’s famous Lumwana mine, so I’ve seen these events unfolding firsthand.

What’s driving this historic shortage isn’t the fact that this metal is used in every 5G device on Earth…

Or the fact that it’s the most abundant metal in every smartphone — all 7.1 billion of them, including yours.

If you run this metal under a powerful microscope, you will find an abundance of delocalised electrons.

In general, the more electrons, the higher the conductivity.

It turns out this metal has the highest conductivity rating of all commercial metals.

To date, we’ve mined more than 700 million metric tons of this critical metal — a haul worth over $4 trillion.

That sounds like a lot, but according to S&P Global, demand for this metal is about to eclipse that amount many times over.

But before I can tell you what’s going on, there’s one other piece of the puzzle you need to understand.

To reshape this metal, we’re looking at two steps.

First, it’s pulled through a die, which reduces its width and increases its length.

This process, called drawing, leaves us with brittle, string-like pieces.

Then, a process called annealing applies heat, softens the metal, and brings back its natural flexibility.

When this metal is fully shaped into long, thin wires, they measure less than one one-thousandth of a centimetre in diameter.

The world is about to electrify everything.

According to academics and thinktanks, everything is going to run on the grid — from your stovetop burner to your car to your computer.

In fact, we could soon electrify all of our kitchens, laundries, basements, attics, garages — as well as our small businesses, commercial buildings, and industrial processes.

This is called Full Electrification.

And it’s going to affect everybody.

The movement to electrify everything has quickly spread to every corner of the globe.

From China to the US, Europe to India, and everywhere in between, in total, 140 countries have publicly committed to taking steps down this path, including Australia.

Experts say Full Electrification could become Australia’s preferred energy solution because we don’t need to invent anything new.

We take our existing energy technologies and simply build more of them, expanding our electrical grid at the same time.

It sounds good in theory.

So without crucial upgrades, regular blackouts will become a reality for millions.

This summer, according to the Australian Energy Market Operator, blackouts are likely in Victoria, Queensland, New South Wales, and South Australia without urgent investment in our power grid.

The UK Government has just ‘war gamed’ emergency plans for coping with rolling outages.

And the US is already suffering under the weight of its early attempts to ‘electrify everything’.

Anthony Albanese has said Australia is ‘eager and ready to do our part’.

UK Prime Minister Rishi Sunak has said these goals will be met in ‘a proportionate and pragmatic way’.

And US President Joe Biden has said ‘we can do this now, we don’t have to wait’.

It’s a similar story in 140 countries worldwide.

That’s why the Australian State and Federal governments have just pledged a combined $7.8 billion towards a massive electrical upgrade.

A £54 billion overhaul could be in the cards for the UK’s power grid.

And the US Government has just made its largest ever investment in its energy network — clocking in at US$73 billion.

The reason for this historic surge in demand can be boiled down to two words: ‘energy density’.

Power stations running on energy-dense fuels like coal and gas can be relatively small — and therefore be located close to where people live.

This makes it easy to move electrical power a short distance to reach people’s homes and offices.

But as you know, governments are phasing out fossil fuels and mandating renewables.

Renewables are not energy-dense.

First, wind and solar farms have to be big — way bigger than traditional power stations to generate the same output.

That’s also why they’re typically found way out in the country, because you need a lot of empty land.

Even then, you can’t just put them anywhere.

Wind farms have to be where the wind blows, typically at altitude.

Solar farms need to be where the sun shines.

That’s why there are currently 18 solar farms in rural Queensland, the ‘Sunshine State’, but only seven in Victoria.

Basically, to make renewables work, you need a lot of wind, a lot of unobstructed sun, and a lot of uninhabited land.

By definition, those are places where nobody lives.

That’s more than the entire width of Australia, coast to coast, twice over.

But the story doesn’t stop there.

Governments in Asia, North America, and Europe require even larger projects.

For example, Sweden just decided to replace 16,000 kilometres of cabling to enhance their national electrical grid.

In India, this number goes up to 27,000 kilometres.

Meanwhile, in the US, they’re constructing more than 75,000 kilometres of new cables to meet the demands of Full Electrification.

That’s precisely why copper is the ‘oil’ of the new electrified economy.

The Democratic Republic of the Congo controls a significant amount of the world’s copper supply — about 8% to be exact.

We cannot do without this stockpile.

But dictatorships, bribery, and corruption are making it difficult for serious miners to invest in the Congo.

Recently, Congolese authorities have been fighting over one major mine in particular…

A dispute that has gridlocked $1.5 billion worth of vital resources.

Things are even worse in Peru.

Glencore recently suspended operations after environmentalists set fire to one of its mines.

Three other copper mines are also in danger of major protestor interference.

Disruption to Peru’s miners puts another 10% of global production at risk.

If that wasn’t bad enough, Chile just shot itself in the foot as well.

27% of global supply comes from Chile, making it the world’s biggest copper producer by far.

Chile’s left-wing government just nationalised their lithium industry — all lithium mines now fall under state control.

Even if they don’t nationalise the copper mines, Chile’s Government has already hiked taxes on miners operating within its borders.

So, what’s the result of all this?

Chile’s copper output has fallen by 5% this year.

And the political unrest in Peru has caused a staggering 20% drop in copper exports.

And I’m betting panic — and price spikes — are around the corner.

Because we’re not likely to pull off another miracle find.

Globally, discoveries of copper have fallen off a cliff.

Out of the 224 deposits discovered in the past 30 years, only 16 were found in the last decade.

And between 2017 and 2021, just two new significant mines began operations.

To meet current demand, we’d have to find a new mine as big as Chile’s La Escondida — the world’s largest ever mine…

What’s more, we’d need to get it up, running, and producing right away.

And we’d need to do that once a year, every year, for the next eight years.

Not going to happen.

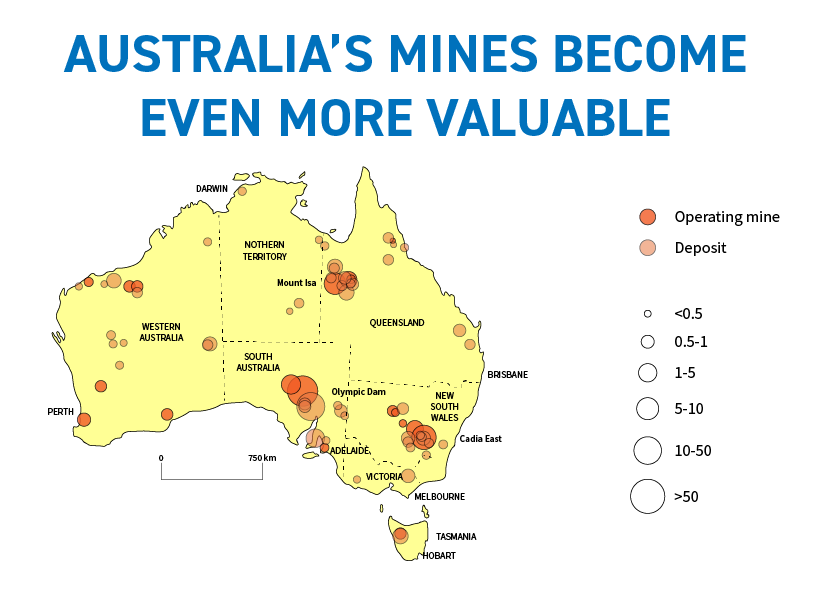

As global supply dries up, I expect Australian companies will fast-track projects across the country.

Miners in Queensland, New South Wales, and South Australia could be the biggest winners.

Operations in Tasmania, Victoria, and Western Australia could also stand to benefit.

And Australian investors who back the right companies could be handsomely rewarded…

Just like we’ve already seen from the boom in coal, nickel, LNG, and lithium miner shares in recent years.

Global governments are already forging ahead with Full Electrification.

It’s unlikely additional supply will come quickly enough from the world’s major players like Congo, Peru, or Chile.

Holding the world’s second-largest reserve of copper… Australia is a key player in future supply.

And that’s great news for you.

Right now, all my research and analysis is flashing green buy signals on Aussie miners — who I believe are best positioned to ride the coming price spike.

I dig into the dirt, and the balance sheets.

I’ve gotten my hands dirty with everything from diatomaceous clays to iron ore…

A project that fed the raw materials for Toyota to build their famous Prados and Outlanders.

Most recently, I was headhunted to be Dacian’s Senior Exploration Geologist — specifically, I was in charge of the company’s gold, nickel, and rare earth exploration projects.

I’ve spent years on ‘geologist walkabout’ in the Australian Outback and in Africa.

In fact, it was Zambia’s Lumwana mine where I first worked with copper directly.

That was in 2010.

Even back then, I could see this story unfolding with my own eyes.

The global supply of copper is already dangerously low.

The world’s biggest producing countries are embroiled in political and economic strife.

And we’re unlikely to find any new copper mines any time soon.

That puts Australia in the box seat.

Meanwhile, demand is set to double, if not more, as new copper-intensive projects are mandated by governments worldwide.

This is the perfect setup for a massive price spike.

Today, we’re ahead of the curve — but you only have a short window of opportunity to act.

If you want a simple way in, there are worse places to park your money than the Global X Copper Miners ETF — ASX ticker WIRE.

It’s an exchange-traded fund you can buy like any stock on the ASX.

It tracks an index of global copper miners.

It’s a great way to gain broad exposure to copper, but it’s unlikely to set the world alight.

It’s a ‘plain vanilla’ way of playing this story.

And if that’s all you want, great.

But I think we can be a lot more ambitious.

Inside this report, you’ll find everything you need to know to buy these two ASX-listed stocks.

Inside this report, you’ll find everything you need to know to buy these two ASX-listed stocks.

You’ll get their names and ticker symbols, of course.

You’ll also get my entire ‘buying rationale’ — my analysis on the management team, the geology of key projects, the financials, the risks, and the potential rewards.

If you’re open to more speculative plays, ones with more risk but with much higher potential upside, then you should consider checking out this special report.

To illustrate the potential upside of certain stocks when a supply squeeze takes hold, you may recall what happened to Poseidon [ASX:POS].

It was all thanks to the kind of price spike that I’ve been talking about today.

You won’t be surprised to hear how the story played out…

Shortage, panic, profit.

In this case, nickel was Poseidon’s resource of choice.

In the late 1960s, over half a million troops descended on Vietnam.

With them came tanks, helicopters, rifles, and other supplies for the war effort…

Nickel was a vital component in all of them.

This stop-work action choked production, sending commodity traders and institutional firms into a frenzy.

The price of nickel skyrocketed.

By Friday, 26 September 1969, Poseidon’s shares had already more than doubled, hitting $1.85.

The following Monday, the company confirmed they’d hit ‘paydirt’ — discovering a gigantic nickel deposit in the deserts of Western Australia.

Shares raced to $6.60… then $12.30… and they kept going up — all the way to $75 and beyond.

That’s the kind of move that turns a $5,000 stake into more than $1.5 million.

Can you imagine that kind of gain?

It’s an extreme example.

But it’s the power of shortage, panic, profit…

Now, I’m not predicting we’ll see another situation like Poseidon.

And you should know after the bubble burst, its shares fell as fast as they rose.

I’m simply sharing this story to illustrate the potential reactions of certain stocks when a supply squeeze takes hold in high-demand resources.

And that’s why I want to tell you about the two ASX-listed stocks I’m recommending right now.

Positive drill results have a significant impact on an exploration company’s stock price.

That’s exactly what happened with my first copper play.

A couple of years back, they hit paydirt at one of their properties up in North West Queensland.

Shares jumped 700%.

Personally, I’d be happy with making eight times my money…

But it’s what happened next that really got me excited.

It’s like an X-Ray that fires electrical impulses, allowing geologists to ‘see’ what’s going on underground.

The technical term for this is ‘induced polarisation’.

Of course, I’m simplifying it.

But as investors, what really matters are the results this technology is yielding.

For instance, last year, the company tested three different copper targets on its tenements…

And they found wide zones of high-grade copper on all three of them.

That is huge.

Now, this is a speculative play, for sure — all exploration stocks are.

A few bad drill results could quickly send shares moving in the wrong direction.

But the macro picture of shrinking supply and growing demand for copper is undeniable.

And the micro outlook for this stock on the ground in Queensland just keeps getting better and better.

Plus, this copper explorer’s shares are well down from their peak in 2021.

Which means you have the opportunity to get into a prime company, with a great team, plenty of recent successes, and a ‘secret weapon’ that promises plenty more to come…

…for a big discount on 2021’s peak share price.

I’ll show you how to get your hands on its ticker symbol in a moment...

But first, there’s one more stock I want to share with you today…

In the circles I run in, he’s a legend…

The man who convinced Barrick to sell him 300,000 ounces of gold for just $100 million — roughly $30 per ounce.

Today, an ounce of gold changes hands for almost US$2,000.

In other words, Bill Beament got the deal of the century.

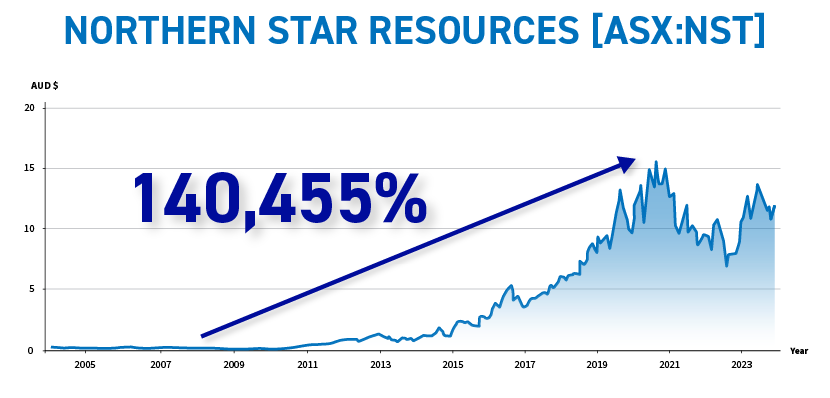

After successfully turning his firm, Northern Star Resources [ASX:NST], from a 1-cent shell to a $15 billion gold producer, Beament decided to go out on top.

But this is not a bloke content to sit on the beach sipping martinis.

This is a mining insider who is constantly hungry for the next challenge.

And this time around, he’s not eyeing up gold.

Instead, he’s set his sights on critical minerals like silver, zinc, and, of course, copper.

All it takes is a small investment in his late-stage Pilbara exploration outfit.

Right now, this explorer has two flagship projects.

Specifically, one project I’m looking at that could turn into a major copper reserve — with zinc and silver thrown in for good measure.

This is a great way of playing the coming copper price spike, by investing with one of Australia’s shrewdest resource insiders.

If he pulls off even a fraction of what he did with Northern Star, I’m certain he’ll make his investors very happy.

But these two copper miners won’t sit around forever.

This report is the best way to get my full analysis on both ASX-listed companies I’ve just told you about.

This report is the best way to get my full analysis on both ASX-listed companies I’ve just told you about.

I’ll send it to you, right now, as a gift for joining my investment research service, Diggers and Drillers.

China and other Asian countries’ desire for steel drove Australia’s last mining boom.

But based on my analysis, the next boom is likely to be even bigger.

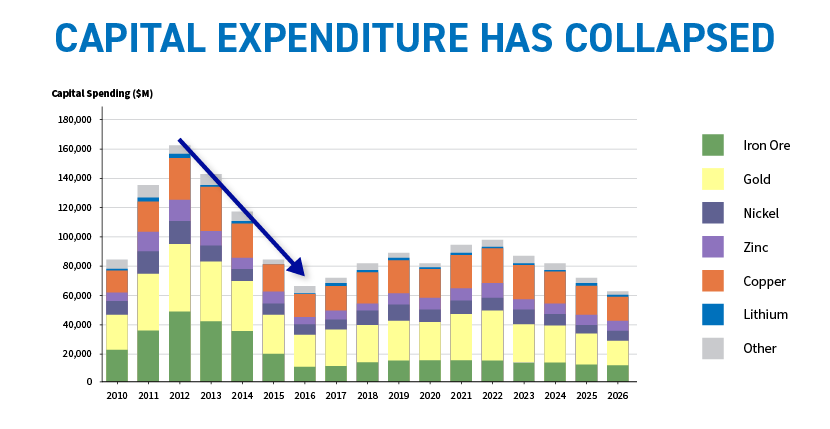

Years of underinvestment has set the stage for rising prices across the board.

Not just in copper — as I’ve shown you today — but for everything.

We could now be looking at the biggest commodity supply squeeze in history.

Shortage, panic, profit…

We’ve already seen this pattern play out at least once in lithium, coal, LNG, and nickel…

And each time it led to big moves in related stocks.

I predict copper will be the next resource to go through this pattern…

But I doubt it will be the last.

Hydro power also needs large amounts of aluminium to operate…

Wind turbines require neodymium, terbium, and other rare earths…

Solar panels rely heavily on silicon, silver, cadmium, gallium, and tellurium…

Electric vehicles require all the resources I’ve just mentioned — plus manganese, graphite, cobalt, and lithium.

Any number of price spikes are just around the corner — because the shortages are already here.

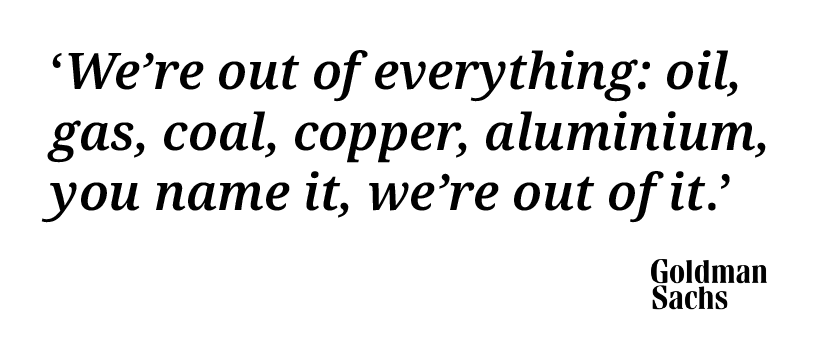

Jeff Currie, head of commodities at Goldman Sachs, likens these shortages to the Great Recession.

He says if 2008 was a financial crisis, then this is a molecule crisis — and we’re out of everything.

That’s exactly why I believe the years ahead could present the greatest opportunity we’ve ever seen for resource investors and mining companies.

And more specifically…Australian mining companies.

The Sydney Morning Herald calls what’s coming ‘The Mining Boom on Steroids’.

There are no guarantees, of course.

Take it from me, even the best mining stocks are high-risk, high-speculation plays.

They can shoot up quickly and fall just as fast.

Now, I don’t have a crystal ball — because I don’t believe I need one.

The push for Full Electrification is happening right now in 140 countries all around the world.

And as supply from the Congo, Peru, and Chile dries up…

Australia’s copper mines will become infinitely more valuable.

I expect capital to flood into new and existing mining projects — with well-positioned Aussie miners likely to benefit.

This presents a genuine opportunity for switched-on Aussie investors.

That’s what my investment advisory service, Diggers and Drillers, aims to do:

To get you into the right mining stocks… at discounted prices… before everybody else.

As a Diggers and Drillers member, you’ll get access to a steady stream of new resource stock recommendations.

Up market or down market, I’m going to give you regular opportunities to grow your wealth.

Up market or down market, I’m going to give you regular opportunities to grow your wealth.

Right now, I believe there are great mining stocks on sale for serious discounts.

I understand if some people want to wait it out on the sidelines for a while…

But I’m cautiously optimistic about where we’re headed, which means we can still make smart moves in the current environment.

I’ll also be sending you email updates to help you stay on top of the stocks I’ve recommended.

That way, you don’t need to be chained to your computer reading corporate financial statements all day.

You’ll get specific buy, sell, and hold signals, so you’re always completely clear about what to do next.

I’ll tell you when to buy… what price to pay… and when to sell, whether that’s for cutting losses or taking profits.

Plus, you’ll get my regular reports and in-depth analysis, so you’re always up to date with what’s going on in the resource market.

Today, I’ve been telling you about the Full Electrification revolution that’s set to drive the price of copper sky-high.

But next month, it could easily be cobalt, aluminium, tin, graphite, or rare earths that are in the spotlight.

Since launching Diggers and Drillers last November, I’ve been humbled by the responses I’ve received.

‘As a former senior exec of one of the largest energy companies listed on the NYSE, I can’t overemphasize how impressed I’ve been with James Cooper’s Diggers and Drillers subscription.

‘Having been a senior exec myself, surrounded by global technical experts at the highest level, it is obvious to me that James knows how resources companies work, how to value their assets and assess their risks.

‘That is exactly what I’m looking for in a resources company adviser.’

Martin Breen from Coorparoo, QLD

‘For me, James Cooper generates trust based on his broad knowledge of this sector.

‘I am enjoying and learning. Great combination.’

Jean-Michel from Caloundra, QLD

‘Absolutely love his clear and well-argued reasoning, have followed ALL recommendations and am well ahead already.

‘So glad I am a subscriber.’

Peter S from Mosman, NSW

‘I think that this service has been introduced at exactly the right time in the cycle.

‘I am looking forward to good results!’

RGL from Sydney, NSW

‘Very excited about this service and what’s ahead.’

AM from Baldivis, WA

‘There’s a wealth of opportunity in the years to come.

‘Knowing who to back and who some of the rare earths and precious metals players are likely to be is invaluable.’

Josh G from Adelaide, SA

‘I have been thoroughly impressed with the new Diggers and Drillers’ service and the value for money it offers.

‘James has produced some very well researched long-term ASX listed recommendations so far while clearly outlining the upside and downside risks for each recommendation.’

James from Dianella, WA

‘Excellent service that gives you the confidence to invest in this sector.’

Graham from Miranda, NSW

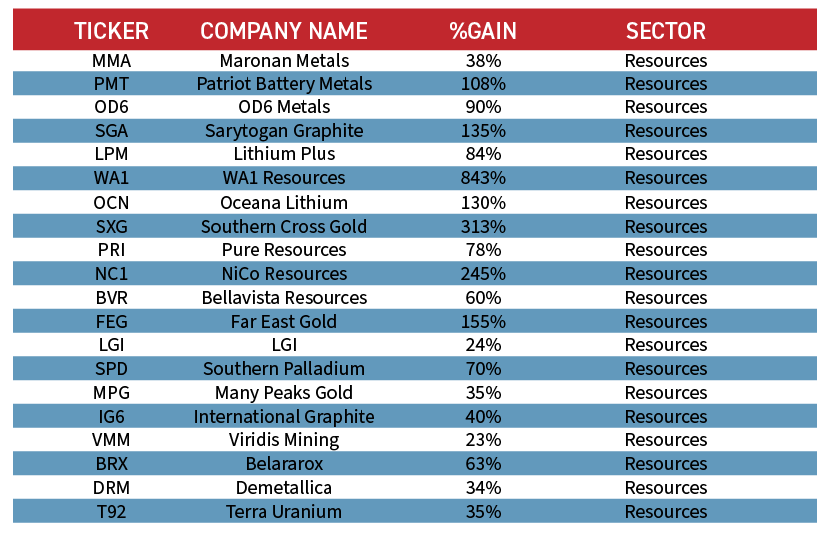

In 2022, 19 of the 20 most successful ASX IPOs were all mining companies.

The top performer, WA1 Resources [ASX:WA1], rose 843% last year.

That tells me one thing:

Aussie resource stocks are back.

But given the current market conditions, you can’t just go throwing darts and hoping for the best.

Risk is part and parcel of investing in the resource sector — and you should never risk more than you can afford to lose.

That’s just common sense.

It’s also why you need a true insider in your corner.

I thoroughly vet each stock before recommending it.

That kind of in-depth analysis is exactly what you’ll receive inside my report, ‘Two Aussie Stocks for the Coming Copper Price Spike’.

You’ll receive this report as a welcome gift for joining Diggers and Drillers today.

That’s why it’s not inexpensive to join.

But I’ve arranged it so you won’t be paying the full retail price for your membership today.

I’ll tell you about your special discount in just a moment.

First, you should know you’re also getting my stock selection strategy guide as part of your welcome package.

This is a succinct but vital report, full of hard-earned intel I learnt on the ground as a working geo for the last 15 years.

It’s called: ‘Six Tactics for Spotting Winning Mining Stocks in Australia’s Next Resources Boom’.

This report is for you if you want to see ‘behind the curtain’ of my stock-picking strategy.

This report is for you if you want to see ‘behind the curtain’ of my stock-picking strategy.

You’ll see exactly how I find well-run resource stocks with great long-term potential.

You can even use this strategy to find quality miners before I recommend them — getting into great plays well ahead of the pack.

The potential benefits of this one report alone are enormous — and it’s all yours with my compliments when you become a member of Diggers and Drillers today.

Your 12-month membership to Diggers and Drillers…

And your two special reports…

‘Two Aussie Stocks for the Coming Copper Price Spike’, and…

‘Six Tactics for Spotting Winning Mining Stocks in Australia’s Next Resources Boom’.

The retail value of everything I’m giving you is a substantial sum of money…

But I know most Aussies are doing it tough right now.

It’s hard enough to pay for petrol, groceries, and a roof over your head — let alone grow your net worth with smart investments.

You won’t find this discount advertised on our website — or anywhere else for that matter.

It’s only for viewers who decide to try out my Diggers and Drillers advisory service today.

Click the button below for all the details.

You’ll be taken to a short order form where you can secure your membership to Diggers and Drillers at a fantastic price.

Take us for a test drive in that time.

For the next 30 days, browse all the advisory updates inside Diggers and Drillers.

For the next 30 days, browse all the advisory updates inside Diggers and Drillers.

Read through all the special reports you’re getting today.

Learn about the two copper plays set to soar with the coming copper price spike…

If you don’t absolutely love what you see — and you don’t believe this service will benefit your investment goals…

Please don’t hesitate to contact our Melbourne-based customer service team and ask for a full refund of your subscription fee.

We’ll give it to you, no questions asked.

That’s how much conviction I have in what we’re doing here at Diggers and Drillers.

And once you discover the stocks I’m recommending today, plus our game plan moving forward, I think you’ll be as excited as I am for what’s coming next.

Copper is at the heart of the action right now.

But this story is so much bigger.

I believe the resource sector could be home to almost all of the hottest investments in the coming weeks, months, and years.

My Diggers and Drillers advisory service is one of the best ways I know of, to keep you up-to-date on everything I’m hearing around the industry and out in the field.

I can’t wait to share it all with you.

Click the button below to secure your membership at today’s special discounted rate.

I’m James Cooper.

Have a great day.

Regards,

James Cooper,

Editor, Diggers and Drillers

(You can review your order on the next page)