I’m Greg Canavan from Fat Tail Investment Research, one of Australia’s largest independent financial firms.

I’m Greg Canavan from Fat Tail Investment Research, one of Australia’s largest independent financial firms.

And behind me is the Department of the Prime Minister and Cabinet.

What do they do in there?

Well frankly, WHO KNOWS?

On their website, they say their role is to ‘provide fresh thinking and sound advice to government’.

They can’t be all that busy then, on current evidence.

But the reason I'm talking to you from here is that a new 'sub-office' was set up in the building behind me on 1 July this year.

It’s called the NET ZERO AUTHORITY.

And its job is to, quote: ‘rewire Australia’ and make us a ‘renewable energy superpower’.

They're in there right now. Bedding in. Setting up shop. And making big plans to completely transform this country.

But I think those plans are about

to be dealt a cold dose of reality

All across Australia, people are starting to realise what impact net zero policies will have on their way of life over the coming years.

And they’re coming to the conclusion — as are many others around the world — that despite all the big words and the lofty goals, the end result simply won’t be worth all the hassle.

The market — as ever — is two steps ahead of all of this...and that’s why I want to talk to you today.

Right now, one of the most obvious investment opportunities I’ve ever seen is starting to emerge.

The markets can see that net zero is wobbling...

Investors sense a major energy U-turn coming...

If I’m right about that, anti-fossil fuel policies could soon be scrapped...and the department being set up behind me could quickly be disbanded.

In that scenario — becoming more likely by the day — investment in mining exploration would skyrocket. Commodity prices would soar. And oil and gas stock prices could go vertical....

Several big market movers have been

quietly preparing for this U-turn

- As recently as June, Warren Buffett dropped US$123 million on Occidental Petroleum shares. Occidental’s stock price has doubled since the beginning of 2022.

- The New York Times reports that despite ‘catastrophic climate change’ Private Equity Firms — those secretive, deep-pocketed investment groups — have sunk US$1.1 trillion into the energy market since 2011, with almost 90% of it going into fossil fuel companies.

- The Guardian revealed in May that the world’s biggest asset managers, BlackRock and State Street Corporation have been quietly loading up on fossil fuel investments — to the tune of US$1 billion...even in their ‘ESG’ funds...the vehicles they market to investors as ‘socially responsible’.

- Jamie Dimon, CEO of JPMorgan, said in December that 80% of the world’s energy currently comes from oil and gas...'and that number’s going to be very high for 10–20 years'...Dimon also recommitted his firm to investing in fossil fuels because not to do so would be ‘the road to hell...’

These guys are no fools. They may not say it publicly. But their actions tell me they believe net zero is a pipe dream. They know the economic reality is going to bite soon. So they’re buying stocks they believe will lead the energy ‘rebound’ — while they’re hated and cheap.

If they’re proven right about this course change, they'll win BIG.

You could too — if you follow the simple steps I’ll share with you.

Just understand that hardly anyone in the investment business will advise you to do what I’m going to recommend today for fear of being labelled a heretic.

I believe that will change soon, but for the moment, we’re ahead of the curve.

And we’ll stay there until more people accept that...

‘Net zero’ is unlikely to happen

and chasing it threatens our way of life...

...in ways that are beyond acceptable to most of us.

Since the Age of Enlightenment, the idea of progress has been about increasing prosperity and human happiness.

This has been possible until now because of continual innovation in energy.

Back in the 16th century, people used to burn wood to cook food and stay warm. But as countries industrialised, they realised that wood wasn’t practical or efficient. Nor was it readily available, leading to price spikes.

In the 1700s, developing nations turned to coal. The first major energy transition led to the Industrial Revolution, the steam engine, and the birth of electricity.

All these new applications for coal led to greater production and innovation in the mining sector. This in turn led to economies of scale which drove the cost of coal down.

Energy is THE most important input in any economy. The lower your energy costs, the more opportunity there is to increase wealth and living standards.

Transitioning to coal — a more efficient form of energy — was a huge leap forward for humanity…

It helped pull us out of serfdom where all our efforts went into feeding ourselves. And it freed up time and resources, allowing us to increase productivity and wealth creation. As a result...

People became

more prosperous

The same thing happened in the late 1800s when the world transitioned from coal to another more efficient energy source: oil.

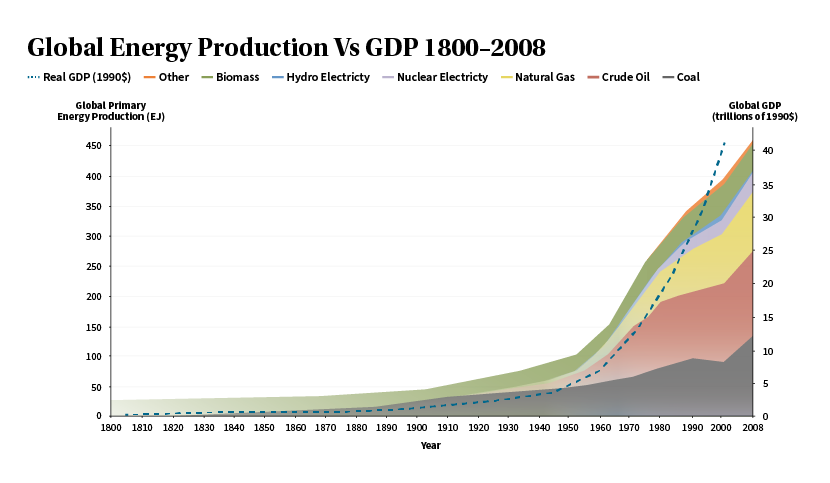

Source: energyskeptic.com

New deep drilling techniques led to big oil discoveries. This helped grow the automobile industry. Mass transport grew exponentially. Now goods could be transported via land, sea and air.

Increased demand for oil drove more exploration, which in turn drove production...and that brought the oil price down.

Cheaper energy costs drove even greater economic output.

Economic growth boomed. Cheap, reliable electricity — generated by coal and, later, natural gas, drove an explosion in computer technology…giving rise to electronic commerce and the Internet.

My point is…

Since the 1800s, energy production and economic growth in major industrialised nations have been in perfect lockstep.

The more we grew, the more prosperous we became. The more prosperous we are, the better our standard of living. And the happier we tend to be.

That journey ends if we

go through with net zero

We’re on a new path now. The path to carbon neutrality by 2050…seemingly at any cost.

This energy transition from fossil fuels to renewables — if it goes ahead — will make people poorer, not richer. That’s because, for the first time in history, we are moving to a LESS efficient form of energy.

That means the price of energy will go up, not down.

If we don’t pull back from the trajectory that we’re on, the cost of living for most people will be through the roof — sooner than you think. Even the basics will become unaffordable. It’s already headed that way.

Continue down this path and thousands of businesses will be forced to close… blackouts will become commonplace in most metro areas and suburbs this decade...overseas travel could well be a thing of the past for all but the wealthiest Australians...even travelling interstate will be too expensive for most of us.

Petrol will be a high-end luxury, not a necessity — as will meat, dairy and much of the fresh produce we take for granted now.

Just paying the bills could wipe out your savings over a few months.

If good sense doesn’t prevail, the course we’re on now could set Australia back 150 years or more. I’m not even kidding. Many people will struggle badly in this scenario and most won’t know what to do.

No sane person

would want this

The Spectator says net zero is ’a formula for sustained economic immiseration'.

The British Daily Telegraph calls the initiative ‘lunacy'.

Even the co-founder of Greenpeace says net zero is a ‘suicide pact'.

Perhaps you agree. If you do...and you’re prepared to make a few ‘unpopular’ investments now...at the very least, you'll protect yourself and your family from the fallout…but my guess is you’ll also profit handsomely as this U-turn plays out.

As I say, the market is already betting on net zero being called off or walked back significantly.

The blue line on this chart shows the US index of oil, gas and fuel stocks is up almost 50% since the start of 2022...While the broader S&P 500 is down by 7%.

Source: Yahoo! Finance

Meaning fossil fuel stocks are currently outperforming the regular US index by a factor of eight to one.

And it’s not just the index. Several individual companies are flying too. Since the beginning of last year, Exxon Mobil stock is up by 73%, ConocoPhillips is up 52%...and BP is up by 38%.

Here in Australia, Woodside Energy is up by 57%...Beach Energy is up by 14%…and Strike Energy is up by 112% since the start of 2022.

The ASX 200, the broad stock market index, is DOWN by 3% over the same period.

Fossil fuels are now a major

investment trend by any metric

Still…

You won't see this leading evening news.

But money IS moving back into the oil and gas sector. And I believe it’s just the beginning.

If, and when, more countries reject net zero, as some already have...this thing could snowball quickly, flooding the market with billions of dollars. Traditional energy stocks could be the big winners.

Today I want to tell you about three investment plays tied to this trend — before it really takes off.

They’re not the obvious, ‘big oil’ stocks that most people will buy instinctively, which is why I feel they have more upside potential at this point.

It’s an exciting opportunity and our timing could hardly be better. You can get your hands on all the details in my new report called: ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

It’s an exciting opportunity and our timing could hardly be better. You can get your hands on all the details in my new report called: ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

Like I say, it’s obvious to me, my readers and a few others. But most regular investors have been so brainwashed by the ‘climate-crisis’ narrative they won’t go anywhere near these kinds of stocks.

That means — if you’re the kind of person who likes to make their own mind up about things — you have a window you can exploit.

I’ll give you all the details in just a moment.

First, let me

introduce myself…

As I said, my name is Greg Canavan.

As I said, my name is Greg Canavan.

I’m the Chief Strategist at Fat Tail Investment Research, one of Australia’s leading independent investment firms.

Each week more than 75,000 readers receive our market insights and recommendations.

And even though I’ve appeared as an investment expert on major outlets such as CNBC and Sky News...

...And my writing has been featured in The Sydney Morning Herald and The Australian, among others...

The chances are you’ve never heard of me...or the business I work for.

That’s because we rarely advertise ourselves.

Fat Tail Investment Research is different from most other financial firms in Australia. For starters, we’re not owned by a big institution or media organisation. And we aren’t an offshoot of some non-governmental think-tank or lobby group.

We’re independent. The only investment services we promote are our own. And we never sell 'advertising space'.

Which means...

No one gets to tell us what

we can and can’t write about

This is important when you stand — as we do — for free markets, independent thinking and personal liberty.

Our business has been part of the financial landscape in Australia since 2005...but our roots stretch all the way back to 1978.

We exist to give you investment ideas and advice — in the same way other licensed advisers do...

But with one fundamental difference.

We believe you should choose how you build and preserve wealth for your family — not someone else.

The unique position Fat Tail Investment Research occupies in Australia means we can say things other firms can’t. And we can make the kinds of investment calls mainstream advisors won’t.

For two decades now, we’ve been way ahead of them when it comes to calling booms in commodities, tech, gold, crypto and more.

These are the kinds of assets most Australian fund managers and brokers typically don’t tell you about, because it doesn’t fit their business model or compensation structure.

But we think the point of investing is to

line YOUR pockets, not someone else’s

This energy U-turn — 'NOT Zero’, as we call it — is the perfect case in point.

No one — aside from a few independent outlets and individuals — is talking about this. Few dare to go against the approved narrative.

But that’s exactly where we find value and opportunity — like the one in front of you right now.

Our subscribers have had the full exposé on climate alarmism since the beginning of 2021.

I’ve shown them — with data — how the economics of renewables simply don’t stack up...

...And I predicted that traditional energy stocks would rise again — because the doomed United Nations ‘ESG’ initiative, was causing value gaps in some of Australia’s world-class oil and gas companies.

ESG — ‘Environmental, Social and Governance’ — is like a corporate social credit system. In effect, it’s state-sponsored market intervention.

Any kind of central planning is a bad idea in markets. It typically leads to price distortion. And it has made many of these stocks cheaper than they’d otherwise be...

I’ve recommended several of them to readers of my newsletter — Fat Tail Investment Advisory — these past two years — and we’ve had a lot of success...

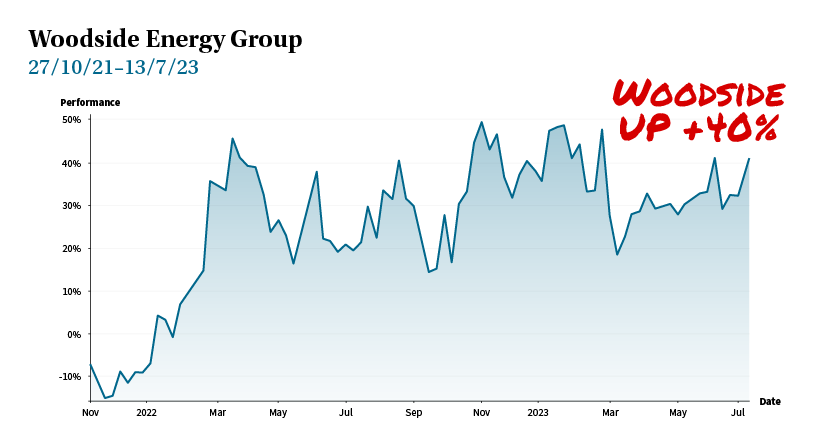

In October 2021, I recommended Woodside Energy Group, Australia’s largest oil and gas company. That’s now up by 40%...

Source: Yahoo! Finance

Origin Energy — which operates our country’s largest coal-fired power station — is up by 80% since I tipped it in April 2021...

Source: Yahoo! Finance

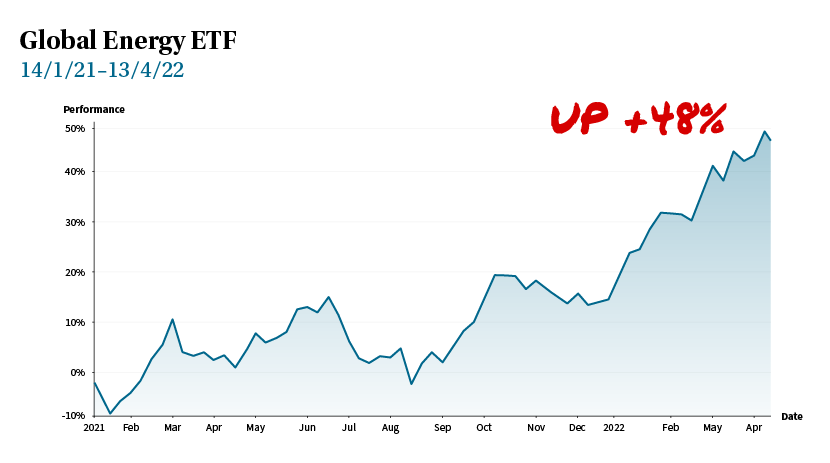

Then there’s the Global Energy ETF — a basket of some of the world’s major oil and gas companies — that went up by 46% from when I tipped it in January 2021 until I sent out the sell alert in April 2022...

Source: Yahoo! Finance

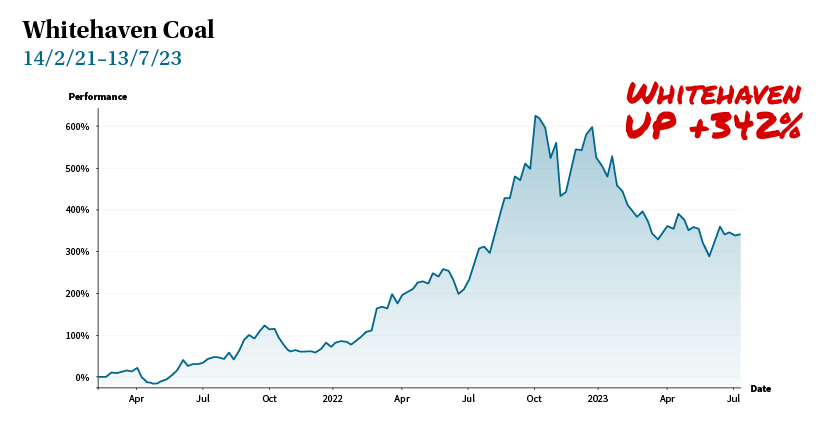

And Whitehaven Coal, the dominant player in our domestic coal industry, is up by 342% since I recommended it to subscribers in February 2021...

Source: Yahoo! Finance

A five grand investment in Whitehaven when I told our subscribers about it would be worth $22,100 today.

This is why it pays to look beyond

the mainstream narrative

And that’s what we do for our subscribers here at Fat Tail Investment Research. By and large, they appreciate it.

- ‘I find Greg’s advice fantastic...' writes M McMahon from West Pymble, NSW.

- 'Fantastic ideas and investment advice — and you do it before all the others,' says Martin from Perth...

- While KW writes: 'I have found Greg’s advice very accurate, and I have made good returns on Whitehaven Coal, Woodside Petroleum and Beach Energy.'

Of course, that’s not to say every stock I recommend goes up like these four.

But I think a lot more will before this ‘de-transition’ trend has played out.

And I’ve picked out three candidates with even greater potential at this point than the ones I just showed you.

In a moment, I’ll explain how you can get hold of my new research report, ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

If anything I’ve said so far has struck a chord with you, I would urge you to get your hands on my report before this net zero initiative falls flat on its face…and more investors flood back into the traditional energy sector.

If anything I’ve said so far has struck a chord with you, I would urge you to get your hands on my report before this net zero initiative falls flat on its face…and more investors flood back into the traditional energy sector.

And yes, I know it might go against the grain. But when investments are hated or shunned by the majority — despite demand for their products skyrocketing — that’s typically a good time to buy them.

This is the opportunity you have with traditional energy stocks now.

You’ve seen it yourself. The media demonises oil and gas companies daily. World leaders denounce them from the lectern at climate summits.

Everyone from the Church of England to local super fund managers is falling over themselves to 'divest' from fossil fuel stocks.

But at the same time, the International Energy Agency is predicting record oil demand in 2023.

We are forecast to use an astonishing 102.1 MILLION barrels a DAY by the end of this year.

So while the corporate media is busy whipping up fear about climate change...

Demand for oil has

never been higher

This is how big oil companies were able to double their profits in 2022. And it’s why, right now, all those major investors are piling into oil and gas stocks.

Their PR releases may say one thing, but you and I both know it’s what they do with their money that really counts. They are betting that there’s a big profit to be made by taking the opposite side of this net zero trade. That’s all they really care about.

You should pay attention to what these big players are doing. And give serious thought to copying their strategy.

And you need to move quickly. This story is developing rapidly. Events that I predicted two years ago are now unfolding on an almost daily basis.

- In June, Sweden announced it was backpedalling out of its ‘net zero’ commitments and scrapping its goal of a 100% renewable energy supply.

Finance Minister, Elisabeth Svantesson, told the Swedish Parliament that solar and wind power are ‘too unstable’to meet the country’s energy requirements.

So Sweden is making a U-turn. It’s reversing its policy to phase out nuclear power in the country. Instead, it’s building more reactors to cope with an expected doubling of electricity consumption by 2040.

- Then you’ve got Germany admitting in June that they’d been completely hooked on cheap Russian oil and gas for decades...until Putin cut off their supply.

They couldn’t switch to nuclear because they’d sacrificed all their 36 power plants on the altar of net zero — despite nuclear being emissions-free.

Their ‘plan C’ was wind power — but they don’t have anywhere near enough to cope with the harsh winters they have up there. In fact, wind installations in Germany have been in steep decline since 2019.

So what did the Germans do?

They made a U-turn

They brought 20 coal-fired power stations out of mothballs...

...And immediately added 6GW to their domestic electricity production.

'You don't want to imagine if people have to live in cold houses,' said Michael Lux, manager of one of the recommissioned power stations.

- In local elections in the UK in July, voters reacted strongly against net zero policies, like the planned expansion of London’s ultra-low-emissions zone, which is a de-facto ban on cars.

In the days following the elections, Prime Minister, Rishi Sunak, hinted strongly at a U-turn on some of the country’s more aggressive climate policies, telling the BBC: ‘We won’t get to net zero by banning things...’

Even former UK leader, Tony Blair, told the New Statesman, 'Don’t ask us to do a huge amount when frankly whatever we do in Britain is not really going to impact climate change.'

This is where the fantasy of net zero smashes into the reality of life in a developed country. When push comes to shove, no one wants their way of life to suffer.

And believe me — if these net zero policies go ahead, it will.

Even electric car pioneer Elon Musk says that if we attempt to replace fossil fuels with renewable energy...

‘Civilisation will crumble’

He’s right. And when that reality dawns on more Australians — our U-turn will come too.

I want to help you prepare your investments ahead of that. Starting with three stocks that I believe will rocket up...as net zero comes crashing down.

And it will.

Despite all the spruiking in parliament — I don’t think they can keep the game going much longer. I mean, just look at this...

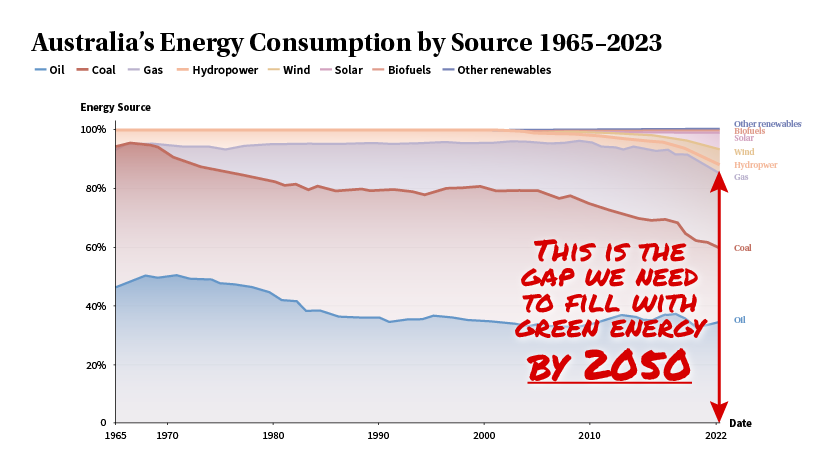

Source: Energy Institute Statistical Review of World Energy (2023), Our World In Data

This chart shows Australia’s total energy consumption by source, today.

If you add all the renewable inputs together — solar, wind, hydro and biofuels — you come out with 14.5% of our current total.

Australia’s fossil fuel inputs — coal, oil and gas — come to 85.5%.

That’s the yawning chasm that needs to be filled by green energy in just a few short years.

And wind and solar aren’t starting from scratch. They’ve contributed to the Australian power grid since 2001.

So, in 22 years, renewables have scraped to barely 15% of our total energy contribution.

In another 22 years, it will be 2045...that’s getting close to the 2050 net zero deadline the government has legally committed to.

Even though we can all see it’s not going to happen...

This is what politicians are

gambling our way of life on

Cheap and plentiful traditional energy made Australia a first-world country and a triple-A-rated economy.

If we want to stay that way, wind and solar need to be able to do what oil, gas and coal currently do...

Provide uninterrupted power on-demand, day and night, rain or shine, to millions of Australians in thousands of villages, rural outposts, towns and cities.

I’ll get to the efficiency part in a moment.

But let me quickly walk you through the renewables infrastructure we’d need to build for this to happen...

To keep Australia on track with net zero, Federal Climate Minister, Chris Bowen, says we need to be at 80% renewables by 2030...

And to do that, we need to install 40 seven-megawatt wind turbines every month, and 22,000 solar panels every DAY, for the next seven years.

Do you know how many seven-megawatt wind turbines have been installed so far in Australia?

None.

We also need 500,000 new, trained technicians to install that many turbines and panels. That’s more than the entire population of Canberra, all working seven days a week for the next seven years.

Even people in the energy

industry think this is bonkers

Former Snowy Hydro boss, Paul Broad, didn’t mince his words on 2GB in May when he said: ‘The notion that we can have 80% renewables by 2030 is bulls**t.’

Brickworks managing director Lindsay Partridge says: 'On the current trajectory Australia is headed for a complete, absolute disaster, there is no question about that.'

And yet, this is where BILLIONS of your tax dollars are earmarked to go — all the while your energy bills are shooting up by $800 or more.

Even if we DID build that many wind turbines and solar panels…

We’d need to expand our power grid by THREE TIMES its current size…just to get the power from those new installations to homes and businesses across the country.

Why? Well, fossil fuels are energy dense, which means coal and gas-fired power stations can be relatively small. And because their operation isn’t reliant on any type of weather, they can be situated close to where people are.

Renewables are not energy dense. Wind and solar farms must be big — way bigger than a regular power station to generate the same output.

And you can’t just plunk them down anywhere. Solar farms need to be where the sun shines. That’s why there are currently 18 of them in rural QLD — the ‘sunshine state’ — and only seven in VIC.

Wind farms need to be where the wind blows, typically on — or just off — the coast, on open flat land or at altitude.

The point is, if you want these expensive new wind and solar installations to work, they need to be built where you have a) the space and b) the right weather conditions.

In other words: places where nobody lives

90% of Australians live in cities.

That’s why we need to TRIPLE the size of our power grid by 2050 and add 10,000 kilometres of new transmission cables to get the power from where it’s generated to where it’s used.

And that’s going to cost Australians trillions of dollars.

Not billions, TRILLIONS.

And it’s not like you can rock up to Bunnings and throw 10,000 kilometres worth of transmission cables in the back of the ute. Those cables don’t exist right now.

We need thousands of tons of copper to manufacture them.

And we don’t have anywhere near enough to hand.

Nor do we know where to find the rest.

Forbes says, to hit net zero by 2050, we need to be opening three new ‘Tier One’ copper mines — each producing 300,000 metric tons of copper every year — for the next 27 years.

Do you know how long it takes to put a copper mine into production?

The prospecting and exploration stage alone takes between two–eight years. Then, once the ore is found, putting the mine into production can take anywhere between four and 12 years.

So, best case scenario, working full pelt without any snags — you’re looking at six years to put one new copper mine into production...but it could be anywhere up to 20.

So — three every year...for the next 27 years?

Impossible

And it’s not just copper for cables. The transition to renewables needs more metals and minerals that we don’t have to hand — nor know where to find.

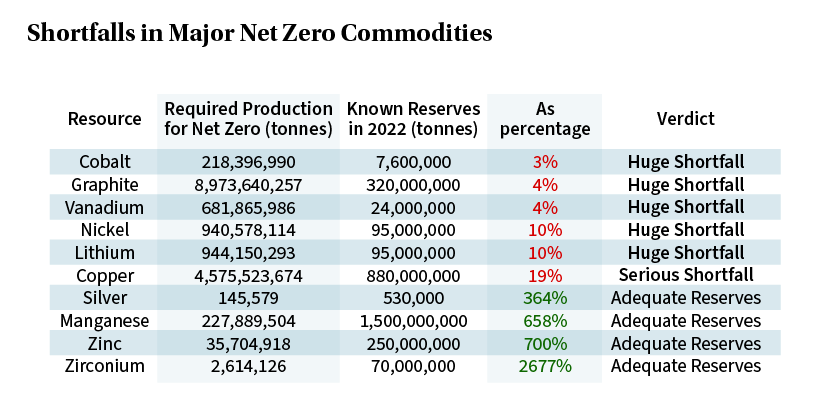

In 2022, Simon Michaux, a mining engineer and Associate Professor of Geometallurgy at the Geological Survey of Finland, set out to discover exactly how much of each key metal and mineral we need to create all the renewables infrastructure necessary for net zero.

He compared that to the known reserves of these commodities — in other words, what we know, for sure, we have in the ground.

In his somewhat understated conclusion, he says the task at hand is: ‘much larger than first thought’.

No kidding!

Just look at the table...

Source: Rincrude / University of Queensland

There are major shortfalls in all the most important resources we need for the renewables transition.

Look at cobalt, nickel, lithium and copper. These are vital commodities for battery storage. And we’re not even close to having what we need.

Just to be clear: without grid-scale batteries, renewables are dead in the water.

Coal and gas-fired power stations would need to run permanently just to provide backup for when the sun doesn’t shine, or the wind doesn’t blow.

Which kind of defeats the object.

This table is the cold hard reality of the net zero transition.

And it’s why it can’t happen

When more people see this data in the cold light of day...the scales will fall from their eyes...the rush back into traditional energy companies will begin...and stocks like the three in the report I want to send you could have an absolute field day.

Now of course you might say, well that’s just the position we’re in now...

2050 is still 27 years away. What if, by some miracle, we DO find major deposits of each of these commodities...

And what if we get lucky and find them all in ‘friendly’ countries?

Well, to get most of these commodities out of the ground requires tough, energy-intensive drilling into hundreds of meters of hard rock — using heavy machinery that is almost exclusively powered by diesel fuel (which we’re supposed to be phasing out).

In his book, Fossil Future, Alex Epstein calculates that extracting the rare earth minerals needed for so-called ‘clean’ tech requires more mining per unit of energy extracted than fossil fuels.

In the case of lithium, the process is anything BUT clean.

The raw ore must be brought to the surface then crushed and ‘leached’ with thousands of gallons of water to extract the lithium. The process of leaching is considered highly toxic to both the surrounding soil and air.

Renowned Australian geologist, Professor Ian Plimer, says wind turbines require more energy to make them than they’ll ever produce in their workable life...

...And more carbon dioxide is emitted in the manufacturing of wind turbines than they’ll ever save in their workable life.

That’s not ‘net zero’, is it?

The ‘workable life’ of a modern wind turbine, by the way, is about 20 years.

So, by the time we get to 2050, all the turbines being built right now — at around $7 million a pop — will have to be pulled down and replaced by an entirely new network of these ‘eco-crucifixes’.

They’ll have to carve up more pristine bushland — just like they’re doing right now in Chalumbin, QLD — to dump thousands of decommissioned turbines because there’s no way to reuse or recycle them.

No wonder, then, that a 2020 University of Queensland study found that mining the commodities needed for net zero could have a ‘worse effect on the environment’ than that averted by climate change mitigation.

In other words:

Manufacturing green tech is most likely doing more damage to the world than the tech itself will ever prevent.

Strangely enough, environmentalists aren’t queuing up to decry this on the evening news.

Nor is anyone in a rush to talk about children as young as 10 being violently coerced to mine cobalt in The Democratic Republic of Congo under horrifying conditions.

But that’s the point.

Nobody in the mainstream WANTS to talk about any of this stuff — because it goes against the ‘climate catastrophe’ narrative — which they dare not do.

Yet, when the UN Secretary-General gets up and talks about ‘global boiling’, that gets boosted by the media and amplified around the world, including in the Australian Parliament.

But no amount of pontificating changes the simple fact that...

There is not one thing a politician

can do to alter future temperatures

In 2023, Australia accounts for just 1% of global CO2 emissions.

Believe it or not, this level has been pretty constant since the year 1750 — long before cars and factories and planes.

In fact, that was even before the British arrived here in 1788.

Do you see what I’m saying?

Net zero policies are utterly pointless in a country like Australia.

They won’t impact the world’s climate one iota.

But they WILL impact our quality of life — for the worse.

Covering thousands of square kilometres of ocean with wind turbines just off the NSW coast at Norah Head won’t lower the world’s temperature.

But it WILL destroy an area of outstanding natural beauty, kill off marine life and upset the locals.

Banning gas connections in all new houses in VIC from January next year won’t reset the global thermostat.

But it WILL make people cold, miserable and poorer too since they’ll have to fork out for heat pumps, reverse cycle air conditioners and induction cooktops.

Do you know what could make a difference in global temperatures?

I’ll give you one guess...

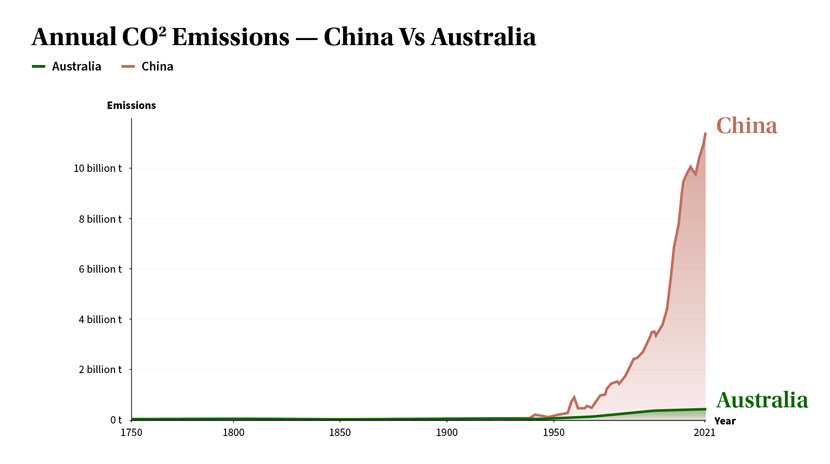

Source: Our World In Data, Global Carbon Project (2023)

This chart is an affront to well-meaning Australians everywhere.

If more people saw this and truly took it in, it would kill net zero stone dead in this country.

Right now, you are being nudged by the government to switch to an expensive, electric car...stop eating meat...not go on overseas summer holidays...and live your life within 20 minutes of your home...

All to save the world

Meanwhile, China is doing whatever the hell it wants.

China does not care about saving the world.

China cares only about economic dominance.

They know that an economy powered by cheap and efficient energy is the way to achieve it. This chart proves that.

China officially contributes almost a third of the world’s CO2 emissions. And that figure is rising. Australia’s emissions are negligible in a global sense and flatlined a long time ago.

While we fall over ourselves to close coal-fired power stations at Yallourn, Liddell and Eraring, the Chinese are ramping UP their coal-fired power generation.

According to The Guardian, China approved more new coal power plants in the first three months of 2023 than in the WHOLE of 2021.

To add insult to injury, they’re importing most of the coal they’re burning from, guess who...Australia.

We’re currently selling $19 billion worth of Aussie coal a month to China. That’s the highest monthly export since records began in 1988.

So the Chinese own our energy security now.

And we think the answer is wind and solar.

Has the penny dropped yet?

Most Australians are good, principled, well-intentioned people.

Most of us want clean air, clean water and less pollution.

Most of us want to leave the country a better place for our kids and grandkids. And most of us are more than happy to ‘do our bit’.

But we’re being taken for a ride. A cleaner world is a virtuous goal in the abstract. But no one’s being truly honest with us about what net zero actually means for Australia.

Instead, it’s all about whether YOU are doing enough to reduce YOUR carbon footprint.

And if you aren’t, get ready to be carbon taxed...because paying the government more money will definitely lower the world’s temperature!

When you see Australia’s contribution to the so-called ‘crisis’ next to China’s, this shifting of responsibility — and guilt — onto everyday people is an outrage.

Pressuring Australians to lead more frugal lives...to sacrifice...to live with less...to do without the things that add meaning and joy to our lives — when our contribution to the problem is minuscule — is a disgrace.

And that’s why our

U-turn is imminent

More Australians are coming around to the insanity of net zero every day.

Even more when the economic realities of the transition hit home.

When that lightbulb comes on for you, one of the biggest investment opportunities of the next decade or more will suddenly come into sharp focus.

You’ll see that if we want to move forward, we have to go back — back to traditional energy sources — because for now at least, there’s no alternative.

As I said earlier, smart money has already anticipated this U-turn and is mobilising as we speak. Many fossil fuel stocks are outperforming the market at the time of writing.

And the outlook for oil is bullish.

- 'We’re in a long-term structural bull market in oil,' Schork Group principal, Stephen Schork, told Yahoo! Finance in August.

- Oil market guru, Danial Yergin, says oil could hit US$121 a barrel over the coming months.

- While JPMorgan CEO, Jamie Dimon, says oil could reach a whopping US$380 a barrel — especially if Russia — Ukraine tensions continue.

That would be a 375% increase from the current price.

Now you can see why Warren Buffett just sank another $123 million into Occidental Petroleum.

But what about you?

Well, the obvious thing to do would be to follow him in — and you might make a decent profit.

After all, Occidental is increasing its drilling activity in the Permian basin in Texas, which is currently the highest-producing oilfield in the US.

So, copying Buffett wouldn’t be the worst move you could make.

But I think there are better ones out there...

Three under-the-radar ways

to play the energy U-turn

I’ve found three investments that could do extremely well over the coming months as net zero unravels.

They’re not global oil stocks. And they haven’t attracted gobs of institutional cash, like some of the other companies I mentioned.

That’s a GOOD thing.

It means, unlike Occidental, BP, or Exxon, you’re not getting in after the fact.

You’re getting in while these investments are under the radar. And that boosts their upside potential dramatically.

Provided, that is, you act now.

So let’s tell you about them...

The first stock in my report is an oil and gas driller with production coming from multiple sources.

This company — not well known to most international investors — is currently in the middle of a major development phase.

I won’t say too much about that here.

Suffice it to say that I see this firm’s revenue and profits exploding in the years ahead, given what should be a renewed appetite for its products.

There’s something else that’s seriously compelling about this stock right now...

By my calculations, its stock price is seriously undervalued right now given its prospects.

How do I determine that?

I’ll show you in my report...then you’ll see for yourself how good this opportunity is.

The only thing is that I’m not sure how much longer this ‘Not Zero’ play will stay at this price. That’s why I’m marking the stock as an urgent buy.

It’s not a small cap by market definition. But it is small for an energy company with the sort of projects it has under development. And that means it's not on most investors' radars.

Getting my report for this one recommendation ALONE is a smart move in my opinion — one that could pay off handsomely.

But let me tell you about the other two anyway...

My second ‘Not Zero’ recommendation is more of a left field take on the energy U-turn.

You might be surprised when you see the name of it.

But when you understand my logic, I’m sure it will click into place. And I’m equally sure you’ll want to take up a position.

Long story short, I think this stock could benefit big time from the ‘second-order’ effects of the energy de-transition.

Right now, no one’s seeing this as an energy play in the same way that I am. But if I’m right about what’s coming, this could turn out to be a really smart energy play over the coming months.

That’s because this investment has resisted all the net zero insanity to date.

Firstly, because of the crazy-high cost of building green tech infrastructure. And secondly, because of the well-documented unreliability of renewables.

The people behind this investment play can afford neither.

So instead, they’re growing their existing energy infrastructure.

Remember what I told you: increased cheap energy consumption is the fundamental building block of economic growth.

When you make this investment you are essentially betting on that growth.

I have the numbers to show that

this could be a very shrewd bet indeed

Especially considering that most of the developed world currently seems to be engaged in self-sabotage.

You will be taking a position on the OTHER side of that madness — which could pay off handsomely, the way things are going.

You will be taking a position on the OTHER side of that madness — which could pay off handsomely, the way things are going.

You’ll get full details of this investment...

...including how and where to buy it, what to pay, and what you can expect as an investor...

in my report: ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

Details on how to get your copy are coming up.

Details on how to get your copy are coming up.

But before that, I want to tell you about the final investment in the report...

This could be the one energy option

where EVERYBODY wins

The world IS — thankfully — waking up to the net zero nonsense.

The reason the project hasn’t fallen in on itself yet — in my view — is that too many people have invested too much of their personal credibility into the movement.

Ideologues and zealots hate losing face. But I think they’ll have no choice, once the economic reality of net zero hits home for more people.

The get-out-of-jail card for these bureaucrats could be nuclear power.

Nuclear, don’t forget, is CO2 emission-free. So ‘net zero’ could still be possible if countries decide to go down that route.

Remember, Sweden just did this.

They ditched renewables and are going all-in on nuclear...which they’ve cleverly re-branded as ‘fossil fuel free’ energy.

This plays to the green lobby while ensuring they get to sidestep the expensive, unreliable, nightmare future of renewables.

France is making a U-turn too. President Emmanuel Macron just announced a plan to build 14 new nuclear power plants by 2050 — after vowing in 2018 to close 12 reactors and move to renewables.

Yet another net zero policy falls victim to the harsh realities of a European winter.

Could more countries

go the nuclear route?

Yes, absolutely. Nuclear power is a GREAT option. For Australia, it would be a Godsend. We would get instant energy security — at least in terms of our electricity.

That’s because we have the biggest known reserves of uranium in the world.

Nowhere else even comes close. Australia has more than TWICE as much known uranium as our closest competitor, Kazakhstan.

Imagine we were able to put it to work for us!

Get this: a uranium pellet is around two and a half centimetres long.

You’d need fewer than 10 of these pellets to power the average household for an entire YEAR.

Whether Australia comes to its senses on nuclear power is another conversation for another time.

But in the meantime, I reckon we can expect interest in uranium to grow — and demand to follow. This is why the third investment in my report is a strategic play on that commodity.

I don’t want to reveal too much more here, except to say that...

I believe I’ve found one of the smartest

uranium plays currently on the market

With this investment, you’re betting on the global nuclear power industry growing...without shouldering any specific territory risk.

In other words, if a country suddenly gets cold feet and cancels its nuclear power program, it shouldn’t directly affect your investment.

In other words, if a country suddenly gets cold feet and cancels its nuclear power program, it shouldn’t directly affect your investment.

That’s not to say that it’s risk-free, of course. No investment is. But I think it’s a pretty smart way to invest in nuclear energy, given the political sensitivity around the subject.

Again, you will get all the details of this investment, along with the other two in my new report: ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

I’ll show you how to get yourself a copy in just a moment.

I’ll show you how to get yourself a copy in just a moment.

Look, it’s easy to get carried away when you feel like the investment tide is turning — and you sense an opportunity to capitalise.

Just keep in mind that net zero is, first and foremost, a political movement. Bad policy has a habit of hanging around long after it should have been wiped out.

That being said...

It feels like only a matter of time

before some of these net zero

projects are walked back

At that point, I think the market will respond in a more meaningful way.

Right now, it looks like we’re ahead of the curve with our investment strategy.

That’s a good thing, but just bear in mind that I can’t give you any certainty on returns and timescales.

You’re making a strategic play here.

Investing before the net zero initiative collapses while traditional energy stocks are hated and cheap.

Tracking the smart money and taking a position on the same side of the trade as them. Albeit a less obvious position.

It goes without saying that no investment is guaranteed.

So, I’d advise you not to put down the kind of money that could cause you problems if this doesn’t pan out as I expect it to — or as quickly as we’d like it to.

But if you have some spare cash and you like the idea of investing ahead of a major market trend...

This is as good an opportunity

as I’ve seen in years

I hope you can see it too. They don’t come around very often, but this has all the hallmarks of a good one.

Remember, I’ve already turned this trend into a set of winning fossil fuel stock recommendations...and helped readers of Fat Tail Investment Advisory capitalise.

And I’ve done so despite huge headwinds in the pro-climate media.

Just imagine what could happen if the whole thing gets called off!

Well, you won’t have to if you get a copy of my report, ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

The three plays I reveal will help you take a position ahead of the fossil fuel rebound I see as all but inevitable at this point.

If you’re interested I’ll show you how to get your hands on a copy in a moment.

But before that, let me quickly tell you about a second investment briefing I just put together...that details another unusual take on a major current investment trend.

But before that, let me quickly tell you about a second investment briefing I just put together...that details another unusual take on a major current investment trend.

This is something I think could be just as profitable as energy stocks over the next few years...so I’d like to send you a copy.

It’s called The ROYAL DIVIDEND Portfolio.

How an investment can pay you twice

How an investment can pay you twice

With interest rates powering up to their highest level in 22 years...

And blue-chip indices flatlining for much of the decade so far...

You might have been giving some thought to buying dividend-paying stocks.

Well, your instincts are spot-on.

Dividend stocks are one of the best investments on the market right now — with yields currently sitting at levels not seen in more than a decade.

But...I’d advise you NOT to rush out and buy the highest-yielding dividend payers.

Many investors do just this and end up losing money.

Why? Because they pay no attention to stock valuations.

They see the dividend yield as the be-all and end-all.

They get blinded by the big number. ‘Oh, this stock has a 12% dividend yield. So I’m going to buy it’.

I call these ‘sucker yields’ and I warn my subscribers off them.

After all, what’s the point of a 12% yield if the capital value of the stock you bought falls by 10–20%?

The stocks I call ‘Royal Dividends’

are different

It’s an investment that still pays a high yield — maybe not the highest — but it doesn’t matter...because the stock is undervalued by my analysis — which means it has great growth potential.

Capital gain AND income are the best of both worlds — and those are the stocks you should be looking for.

The thing is, not many people know how to find them.

Luckily, in your second bonus report, The ROYAL DIVIDEND Portfolio, you’ll learn about six stocks that are currently paying dividends of between six and 10%...but ALL are trading right now under my estimate of fair value.

Of course, there are no guarantees with any of my recommendations.

But the idea is that if these stocks pan out as I expect, it’s a win-win scenario for you. Regular dividend income AND capital growth too. And who wouldn’t want both?

Can you see the underlying theme here?

With these ‘Royal Dividend’ stocks and the ‘Not Zero’ plays, you are getting into big current trends, just not from the same angle as most investors.

That’s what we try to do for our readers here at Fat Tail Investment Research. Help you capitalise on moving markets in ways other investors haven’t considered. We think it can give you an edge.

There’s a third gift I want to send you that goes right to the heart of this ethos.

It’s a digital copy of my 162-page book, You, Your Brain & the Stock Market.

It’s a digital copy of my 162-page book, You, Your Brain & the Stock Market.

This book is about training your brain to think differently about investing.

This book is about training your brain to think differently about investing.

It’s about not following the herd into stocks at the top of their hype cycle.

It’s about not following the herd into stocks at the top of their hype cycle.

It’s about learning to look for buying opportunities when others are selling.

And it’s about spotting the signs of a market about to crash — and having the smarts to get out, even when stocks are going higher.

I’ve been in this game for more than 20 years. Over that time, I’ve led readers to some great results based on ideas that I’m sure would have sounded crazy at the time.

But that’s because I’ve learned to ‘read’ markets and price signals. To understand valuations and sentiment. To ignore market noise. And never to do the ‘popular’ thing just because everyone else is.

If there’s a secret to successful investing, this is it.

And I’ve put everything I know about it into this digital book — You, Your Brain & the Stock Market, which you can have in your inbox today.

In fact, you can have all three of these gifts — at no extra charge — when you subscribe to my monthly newsletter, Fat Tail Investment Advisory.

Your odds of success increase

when you ignore the mob

Every month for the last 13 years, I’ve shown Australian investors where they can add to their wealth and how to avoid danger in the markets.

Every month for the last 13 years, I’ve shown Australian investors where they can add to their wealth and how to avoid danger in the markets.

Nine times out of 10 success comes down to thinking laterally.

Not taking the cowboys and charlatans in the corporate media at face value...

But looking behind the headlines and the agendas to find the less obvious and undervalued investment plays.

Investing is a competitive undertaking, after all. If you do what everyone else does, you will get the same returns as everyone else. In order to get better returns, you have to do things differently.

Mainstream advisors don’t see it this way, by and large. They want to be part of the group and fear being isolated from it.

But here at Fat Tail Investment Research, going the contrarian route is one of our guiding principles. And over the years, I’ve done just that...to help subscribers make money...grow their wealth...and look after their families.

Consider the last three years — while all hell has been breaking loose in the economy and in the stock market...

- In 2021, I closed out 13 positions for my subscribers. 11 of them were sold at a profit.

- In 2022, I closed out 15 positions. 11 of those were sold at a profit too.

- And already this year — 2023 — I have closed eight positions, with four of those making a profit for subscribers.

So over that entire crazy time, my strike rate is 72%. Three-quarters of my positions have been wins and only one quarter were losses.

That’s the kind of result you’d

expect

from a day trader, buying

and

selling fast-moving stocks

Not from a newsletter targeting longer-term value plays!

Talking of the long term, since 2014, my stock picks — all the winners and losers combined — have delivered a 14% annual return on average.

That’s much better than the ASX200 over the same time frame which comes in at around 3.5% annually. And that return includes dividends AND the value of franking credits (which my return doesn’t).

In terms of individual stocks, last year alone, I gave my subscribers the opportunity to make good returns from several surprising names, including...

- 85% from National Australia Bank — yes, a big four bank!

- 58% from Reckon

- 57% from Ventia Group

- 53% from a global energy ETF

- 45% from Smartgroup Corporation

- 43% from Woodside Petroleum

- 37% from Origin Energy

- 36% from NIB Holdings — and

- 12% from Westpac Banking Corporation... another big bank.

As you can see, the name doesn’t matter to me.

I use the time-honoured principles of value investing to target well-priced stocks — no matter who they are — with a big emphasis on risk management.

Value is what really drives stock prices.

What does the company’s cashflow and balance sheet say it’s worth today?

And what does the market think it’s worth?

If the former is greater than the latter...and there’s an emerging trend supporting a higher share price in the future, that’s where I want to put you — regardless of what the media says and what the mainstream investment industry does.

Now I just showed you that I don’t get every call right. But look at how my strategy has worked for a few of the subscribers I’ve written to in recent years...

- Ian T says: 'I find Greg's interpretation of the financial horizon about the best of the bunch. I subscribe to a few, and this is my anchor, my mainstay.'

- DA writes: 'Following Greg and the other members of the Fat Tail crew, how could you not be in front with your finances?’

- While DRG simply says: ‘Greg is one of the best investment advisers I’ve had.’

So how can you take these

same steps right away?

Well, if you take a subscription to Fat Tail Investment Advisory today, I will send you these two research reports and a digital copy of my book.

- You’ll get ongoing insight and analysis as the ‘Not Zero’ trend evolves — I’ll tell you exactly which energy investments to buy as we go. And when it’s time to sell them, you’ll be the first to know...

- You’ll get my monthly newsletter delivered by private email — along with regular correspondence and position updates — all written in plain English to help you take simple actions, quickly...

- You’ll get access to my current open buy and hold list of 23 stocks — and you’ll be able to read my research on each one. You can start building your ‘fat tail’ portfolio at your own pace...

- You’ll get every new stock recommendation I make — and I aim to feature at least one in every issue of my newsletter...

- You’ll get my ongoing help and support — along with that of the 50 or so friendly, like-minded staff at my firm...

- And you’ll get a 30-day money-back guarantee on your subscription fee in case my service doesn’t live up to your expectations.

So what does it cost to get access to my research?

A one-year subscription to Fat Tail Investment Advisory — including everything I just told you about — normally costs $499. That’s what many others pay.

But right now you can try my research for just $199 for your first year.

That’s a 60% discount off the regular annual price.

Or, if you’d prefer to reduce your upfront outlay, you can pay just $75 today and then three further payments of $75 over the next year.

That means you’d pay $300 in total...a saving of $199 — or 40% — on the regular, annual price.

I think you can agree they are both great deals.

And look, nothing in investing is guaranteed. But when you consider the potential of some of the energy stocks that I’ve told you about today, I wouldn’t be too worried about being out of pocket for long.

Remember, whichever deal you take, you can claim a full refund at any time in the next 30 days if you’re unhappy with your decision for any reason.

Remember, whichever deal you take, you can claim a full refund at any time in the next 30 days if you’re unhappy with your decision for any reason.

Just call us and we’ll put the money you pay today back on your card. You can keep everything you receive from me in that time — the Not Zero briefing, the Royal Dividends report, the book, everything.

Just call us and we’ll put the money you pay today back on your card. You can keep everything you receive from me in that time — the Not Zero briefing, the Royal Dividends report, the book, everything.

If that sounds like a good deal to you, scroll down and click the button at the bottom of this page now — and I’ll rush everything to you by private email.

Remember what I said...

We’re currently ahead of the

curve on the energy story

But I don’t know for how much longer.

Across the world, more people are waking up to the fact that net zero is going to seriously impact their standard of living. The political rhetoric grows more desperate by the day...we’re even starting to see some backlash in the mainstream media.

Across the world, more people are waking up to the fact that net zero is going to seriously impact their standard of living. The political rhetoric grows more desperate by the day...we’re even starting to see some backlash in the mainstream media.

To me, it’s only a matter of time before this hare-brained policy collapses — and the department being set up behind me shuts down for good…

If I’m right about that, investors will flood back into traditional energy stocks — and the advantage you currently have will disappear.

But if you take my advice today, you could be tucked into a handful of well-placed energy stocks before any of this happens.

Ready to get started?

Simply scroll down and click on the button below — where it says 'click here to get started' — and you’ll have access to my research in a matter of minutes.

Sincerely,

Greg Canavan,

Editor, Fat Tail Investment Advisory