Dear reader,

What if it took a 200km drive and a three-hour wait to fill your car…

What if your next ute was $13,000 more expensive for no apparent reason?

If you think the cost of living in Australia is high now...

Wait and see what happens if the government succeeds in moving every Aussie to switch to an electric vehicle (EV).

They’ve been trying to push this through as part of a policy called the New Vehicle Efficiency Standard (NVES).

Many hail it as a step in the right direction. A much needed push to reduce carbon emissions by 2050 and meet the green energy standards set by other Western countries.

I take a different view.

I think the push to EVs will be the

shortest transport revolution in history

As I’ll show in the next few minutes…

EVs are a less efficient mode of transport. Forcing us all to buy them will encroach on our freedom…lower our standard of living…and even harm the Australian economy.

What’s more, enforcing NVES WON’T reduce our carbon emissions in any meaningful way.

It’s why Judith Sloan of the Spectator called the policy ‘a deluded way of thinking.’

I agree.

So do many people around the world.

Which is why they’ve been pressuring their governments to pull back on absurd EV directives.

For instance, US president Joe Biden recently had to ‘water down’ America’s emission rules that aim to speed up the EV transition. Many Americans believe he should junk it entirely.

It’s the same in the UK. Prime Minister Rishi Sunak has been forced to delay the ban on petrol and diesel cars for five more years after intense public pressure.

And Forbes reports that the EU’s ban on internal combustion engines is ‘stumbling, and some experts believe the only sensible solution is to water down the edict.’

Everywhere you look around the world, EV mandates and directives are being shot down left and right, as consumers revolt.

Our version, NVES, is also under attack.

And the government is under pressure. Climate Change Minister Chris Bowen recently agreed to water down and push back the proposed law for a further six months.

The cracks are beginning to show.

In my mind, there’s only one way this will end:

The EV revolution will

FAIL in Australia

At least for now.

It’s all too hurried. The technology isn’t advanced enough yet. The cars are too expensive. And the charging infrastructure is not sufficient for widespread adoption in Australia.

And that’s before you even come to our country’s unique and ‘challenging’ geography.

Bottom line, more investment is needed — and more time is needed — before the Australian people will happily give up their petrol cars and utes for EVs.

Now, if you’re an investor — don’t worry. Keep your Tesla shares on the backburner by all means.

What I want to talk to you about today is the market’s response to this EV turnaround...

And how it could create a timely and highly lucrative opportunity for you...

With this policy dead in the water, Aussies will continue to buy what they know and love: fossil-fueled utes and SUVs.

Regardless of the number of Teslas you see in our inner-city suburbs, ‘dirty’ SUVs and utes are still the most popular vehicles in Australia…

This will fire up demand for oil...and lead to a shift away from ‘green energy’

We’re already seeing the signs of this energy U-turn.

Since the start of the year, oil and gas indices have been on an uptrend.

The BetaShares Crude Oil Index ETF is up 16.8% as the broader ASX 100 is down -0.6%. The S&P Global Index, which tracks the largest oil and gas companies in the world, is also up 9.38%.

Source: S&P Global

Meanwhile, renewable investments have been on a slippery slope downhill.

The S&P Global Clean Energy Index, which tracks the performance of companies involved in green energy, is down 55%. And BlackRock’s Clean Energy Stock index is now half from its January 2022 peak.

Source: The Spectator

Clearly, markets are realising that EV adoption isn’t taking off as planned.

In fact, much like the rest of the green energy transition — it’s starting to tank.

Smart investors know the economic reality is going to bite soon. So they’re buying stocks they believe will trend higher when this happens — while they’re ‘hated’ and cheap.

If they’re proven right about this course change, they’ll do well.

You could too — if you follow the simple steps I’ll share with you in the next few minutes.

But first, let me clear something up:

I want a greener planet.

I’m all for cleaner air, purer water and unspoiled green spaces.

But I’m a realist. I can’t support green strategies that are ineffective and will end up doing MORE harm than good, as I believe the NVES policy will.

And I’m not just talking about the environment, either.

See, at its core…

EV adoption is about taking

away YOUR freedom

NVES is nothing more than government-sponsored market manipulation and price distortion…all veiled behind the illusion of choice.

Here’s how it works:

‘The New Vehicle Emissions Standard (NVES) is a federal government policy aimed at reducing carbon emissions from new vehicles sold in Australia, primarily by penalizing higher carbon dioxide emitting vehicles.’

It’s essentially a ‘ute tax’ that manufacturers will have to pay for every petrol and diesel-powered car they sell. We’re talking tens of millions of dollars in penalties, especially for popular brands in Australia like Ford or Toyota — companies that don’t have a full EV lineup.

Do you think car companies will wear that added cost?

Of course not! They’ll pass it on to consumers.

If this policy were in place, next time you pull up to buy a new ute, expect to shell out at least $13,000 more than you’d pay now.

The alternative is to buy an EV that’s even more expensive…

… less reliable…

… more problematic…

... and (ironically) dirtier than a gas car, despite what environmentalists want you to believe.

Source: energyskeptic.com

In other words…

The EV policy will take away YOUR freedom to buy an affordable, practical, and useful car of choice…and leave you far worse off…

It’s especially true considering that…

Owning an EV is actually a

BAD IDEA in Australia

Our country offers one of the best arguments of why NOT to buy an EV.

It’s all to do with our geography.

Consider that Australia is roughly as large as the continental United States.

But with only 26 million people, our population is just a tiny fraction of America’s over 330 million residents.

That means we have vast tracts of land with little to no people, infrastructure, and conveniences in between.

And NO EV chargers.

According to EV researcher Gail Broadbent, you’ll need roughly 1 standard EV charger for every 10 electric vehicles on the road.

There are currently around 180,000 EVs in Australia, according to The Guardian. That means we should have a minimum of 18,000 charging stations around the country to serve them all.

How many do you think we have?

By the end of 2024, we’ll have a grand total of 1,600 charging stations nationwide.

That’s fewer than ten percent of what we need!

Worse…

Many of the charging stations situated in rural areas — where they’re needed the most — are either out of order or congested with long queues.

For instance, the rural city of Ballarat in western Victoria has only had one working charger out of four, for months now.

The problem is so prevalent that there’s a phrase for it: ‘range anxiety’. Or…

‘The sinking feeling electric car owners experience when arriving at a charging station only to find it is out of order, or there is a long queue to use the only functioning charger.’

As I said, it’s a recipe for sending Aussies backwards in time, not forwards — which is ironic, given that EVs are supposedly the technology of tomorrow!

Then there’s the most infuriating fact of all:

EVs are WORSE for the environment

than petrol and diesel cars

Did you know that manufacturing Volvo’s Polestar 2 electric car produces 10 tonnes more CO2 compared to the company’s XC40 SUV?

I bet no one told you that an EV’s tires produce 20% more pollution than your typical car, according to research firm Emissions Analytics.

Or that mining key EV battery minerals like cobalt and lithium generate extreme levels of radioactive pollution.

It’s why even International Energy Agency director Fatih Birol said that ‘Electric cars will not save the climate. It is completely wrong.’

The simple fact is that, for EVs to be truly zero emission, every step involved in producing them — from the supply chain to the factory floor — needs to be zero emission as well.

And that’s impossible with current technology.

In fact, we’re not even close to figuring out how to do it.

Because despite what lawmakers and climate scientists would claim otherwise…

Our entire plan to fight climate change

is DOOMED TO FAIL

I’m talking about Net Zero, the worldwide initiative to eliminate all carbon emissions by 2050.

This transition from fossil fuels to renewables is, in my view, a dangerous fantasy.

It’s an impossible task. We simply don’t have the resources and critical metals on hand to make it happen. We don’t even know where to look for more!

I’ll explain more in a moment.

The real danger, though, is that even attempting Net Zero could risk Aussie lives and prosperity.

Joel Kotkin of The Telegraph sums it up best:

Well, green energy is anything BUT cheap and consistent!

In a ‘Net Zero’ Australia, the cost of living for most will be through the roof.

Even the basics will become unaffordable…blackouts will become commonplace in most metro areas and suburbs...overseas travel could well be a thing of the past for all but the wealthiest Australians...even travelling interstate will be too expensive for most of us.

Petrol will be a high-end luxury, not a necessity — as will meat, dairy and much of the fresh produce we take for granted now.

Just paying the bills could wipe out your savings over a few months.

This could be your

reality before 2030

The Spectator calls Net Zero ’a formula for sustained economic immiseration’.

While the British Daily Telegraph calls the initiative ‘lunacy’.

Even The co-founder of Greenpeace says it’s a ‘suicide pact’.

Shadow Environment Minister Jonathan Duniam had this to say about the government’s net zero push:

‘The way Labor are going about it – nothing is going to happen that is in anyway good for our country.

‘They are failing Australians, and they are failing our targets.’

He’s spot on.

Australia’s carbon emissions from electricity actually went UP in 2024 for the first time in seven years, despite renewables in our grid.

According to Centre for Independent Studies director Aidan Morrison:

‘It shows that the energy transition to try to rush in a whole bunch of renewable energy generators to our system is just slowing down.’

Elsewhere, the UK just pushed back on its Net Zero commitments by announcing plans to build new gas-fired power stations…citing the need for a ‘safe and reliable energy source’.

Slowly, everyone is beginning to realise that Net Zero is a pipe dream.

And as countries scrap anti-fossil fuel policies in response…billions of dollars could flood back to traditional energy stocks like oil, gas, and coal…

Kicking off the biggest energy

U-turn in history

Today I want to tell you about three investment plays that could help you take advantage of this U-turn before it takes off.

Fair warning — these are ‘unpopular’ investments.

Most regular investors have been so brainwashed by the ‘climate-crisis’ narrative they won’t go anywhere near these kinds of stocks.

But if you’re the kind of person who likes to make their own mind up about things — you have a window you can exploit.

At the very least, you’ll protect yourself and your family from the fallout…but my guess is you’ll also profit handsomely as this U-turn plays out.

It’s an exciting opportunity and our timing could hardly be better. You can get your hands on all the details in my new report called: ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

But first, let me

introduce myself…

My name is Greg Canavan.

My name is Greg Canavan.

I’m the Chief Strategist at Fat Tail Investment Research, one of Australia’s leading independent investment firms.

Each week more than 75,000 readers receive our market insights and recommendations.

And even though I’ve appeared as an investment expert on major outlets such as CNBC and Sky News...

...And my writing has been featured in The Sydney Morning Herald and The Australian, among others...

The chances are you’ve never heard of me...or the business I work for.

That’s because we rarely advertise ourselves.

Fat Tail Investment Research is different from most other financial firms in Australia. For starters, we’re not owned by a big institution or media organisation. And we aren’t an offshoot of some non-governmental think-tank or lobby group.

We’re independent. The only investment services we promote are our own. And we never sell 'advertising space'.

Which means...

No one gets to tell us what

we can and can’t write about

This is important when you stand — as we do — for free markets, independent thinking and personal liberty.

Our business has been part of the financial landscape in Australia since 2005...but our roots stretch all the way back to 1978.

We exist to give you investment ideas and advice — in the same way other licensed advisers do...

But with one fundamental difference.

We believe you should choose how you build and preserve wealth for your family — not someone else.

The unique position Fat Tail Investment Research occupies in Australia means we can say things other firms can’t. And we can make the kinds of investment calls mainstream advisors won’t.

For two decades now we’ve been way ahead of them when it comes to calling booms in commodities, tech, gold, crypto and more.

These are the kinds of assets most Australian fund managers and brokers typically don’t tell you about, because it doesn’t fit their business model or compensation structure.

But we think the point of investing is to

line YOUR pockets, not someone else’s

This energy U-turn — 'NOT Zero’, as we call it — is the perfect case in point.

No one — aside from a few independent outlets and individuals — is talking about this. Few dare to go against the approved narrative.

But that’s exactly where we find value and opportunity — like the one in front of you right now.

Our subscribers have had the full exposé on climate alarmism since the beginning of 2021.

I’ve shown them — with data — how the economics of renewables simply don’t stack up...

...And I predicted that traditional energy stocks would rise again — because the doomed United Nations ‘ESG’ initiative, was causing value gaps in some of Australia’s world-class oil and gas companies.

ESG — ‘Environmental, Social and Governance’ — is like a corporate social credit system. In effect, it’s state-sponsored market intervention.

Any kind of central planning is a bad idea in markets. It typically leads to price distortion. And it has made many of these stocks cheaper than they’d otherwise be...

I’ve recommended several of them to readers of my newsletter — Fat Tail Investment Advisory — these past two years — and we’ve had a lot of success...

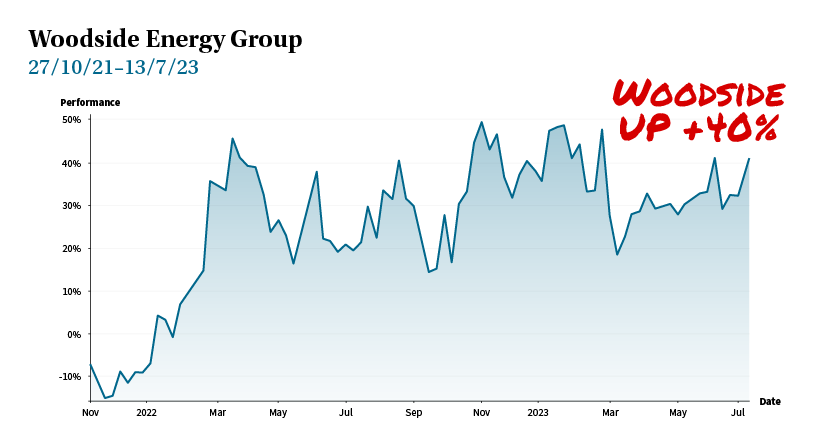

In October 2021 I recommended Woodside Energy Group, Australia’s largest oil and gas company. That’s now up by 23%...

Source: Yahoo! Finance

Origin Energy — which operates our country’s largest coal-fired power station — is up by 99.3% since I tipped it in April 2021...

Source: Yahoo! Finance

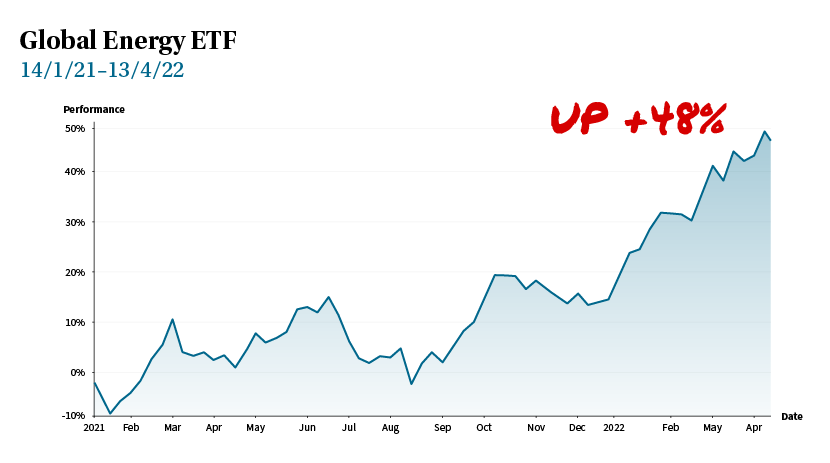

Then there’s the Global Energy ETF — a basket of some of the world’s major oil and gas companies – that went up by 46% from when I tipped it in January 2021 until I sent out the sell alert in April 2022...

Source: Yahoo! Finance

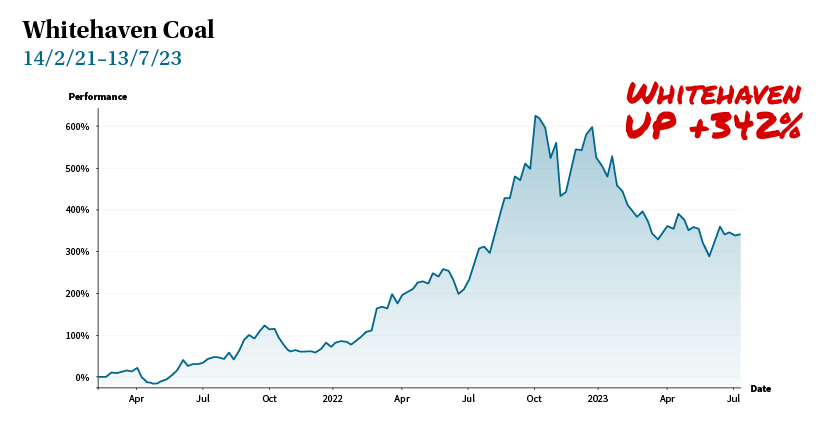

And Whitehaven Coal, the dominant player in our domestic coal industry, is up by 496% since I recommended it to subscribers in February 2021...

Source: Yahoo! Finance

A five grand investment in Whitehaven when I told our subscribers about it would be worth $29,800 today.

This is why it pays to look beyond

the mainstream narrative

And that’s what we do for our subscribers here at Fat Tail Investment Research. By and large, they appreciate it.

- ‘I find Greg’s advice fantastic...' writes M McMahon from West Pymble, NSW.

- 'Fantastic ideas and investment advice — and you do it before all the others,' says Martin from Perth...

- While KW writes: 'I have found Greg’s advice very accurate, and I have made good returns on Whitehaven Coal, Woodside Petroleum and Beach Energy.'

Of course, that’s not to say every stock I recommend goes up like these four.

But I think a lot more will before this ‘de-transition’ trend has played out.

And I’ve picked out three candidates with even greater potential at this point than the ones I just showed you.

In a moment, I’ll explain how you can get hold of my new research report, ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

If anything I’ve said so far has struck a chord with you, I would urge you to get your hands on my report before this net zero initiative falls flat on its face…and more investors flood back into the traditional energy sector.

And yes, I know it might go against the grain. But when investments are hated or shunned by the majority — despite demand for their products skyrocketing — that’s typically a good time to buy them.

This is the opportunity you have with traditional energy stocks now.

You’ve seen it yourself. The media demonises oil and gas companies daily. World leaders denounce them from the lectern at climate summits.

Everyone from the Church of England to local super fund managers is falling over themselves to 'divest' from fossil fuel stocks.

But at the same time, the International Energy Agency is predicting record oil demand in 2024.

We are forecast to use an astonishing 103.2 MILLION barrels a DAY by the end of this year.

So while the corporate media is busy whipping up fear about climate change...

Demand for oil has

never been higher

This is how big oil companies were able to double their profits in 2022. And it’s why, right now, all those major investors are piling into oil and gas stocks.

Their PR releases may say one thing, but you and I both know it’s what they do with their money that really counts. They are betting that there’s a big profit to be made by taking the opposite side of this net zero trade. That’s all they really care about.

You should pay attention to what these big players are doing. And give serious thought to copying their strategy.

And you need to move quickly. This story is developing rapidly. Events that I predicted two years ago are now unfolding on an almost daily basis.

- In June, Sweden announced it was backpedalling out of its ‘net zero’ commitments and scrapping its goal of a 100% renewable energy supply.

Finance Minister, Elisabeth Svantesson, told the Swedish Parliament that solar and wind power are ‘too unstable’to meet the country’s energy requirements.

So Sweden is making a U-turn. It’s reversing its policy to phase out nuclear power in the country. Instead, it’s building more reactors to cope with an expected doubling of electricity consumption by 2040.

- Then you’ve got Germany admitting in June that they’d been completely hooked on cheap Russian oil and gas for decades...until Putin cut off their supply.

They couldn’t switch to nuclear because they’d sacrificed all their 36 power plants on the altar of net zero — despite nuclear being emissions-free.

Their ‘plan C’ was wind power — but they don’t have anywhere near enough to cope with the harsh winters they have up there. In fact, wind installations in Germany have been in steep decline since 2019.

So what did the Germans do?

They made a U-turn

They brought 20 coal-fired power stations out of mothballs...

...And immediately added 6GW to their domestic electricity production.

'You don't want to imagine if people have to live in cold houses,' said Michael Lux, manager of one of the recommissioned power stations.

- In local elections in the UK in July, voters reacted strongly against net zero policies, like the planned expansion of London’s ultra-low-emissions zone, which is a de-facto ban on cars.

In the days following the elections, Prime Minister, Rishi Sunak, hinted strongly at a U-turn on some of the country’s more aggressive climate policies, telling the BBC: ‘We won’t get to net zero by banning things...’

Even former UK leader, Tony Blair, told the New Statesman, 'Don’t ask us to do a huge amount when frankly whatever we do in Britain is not really going to impact climate change.'

This is where the fantasy of net zero smashes into the reality of life in a developed country. When push comes to shove, no one wants their way of life to suffer.

And believe me — if these net zero policies go ahead, it will.

Even electric car pioneer Elon Musk says that if we attempt to replace fossil fuels with renewable energy...

‘Civilisation will crumble’

He’s right. And when that reality dawns on more Australians — our U-turn will come too.

I want to help you prepare your investments ahead of that. Starting with three stocks that I believe will rocket up...as net zero comes crashing down.

And it will.

Despite all the spruiking in parliament — I don’t think they can keep the game going much longer. I mean, just look at this...

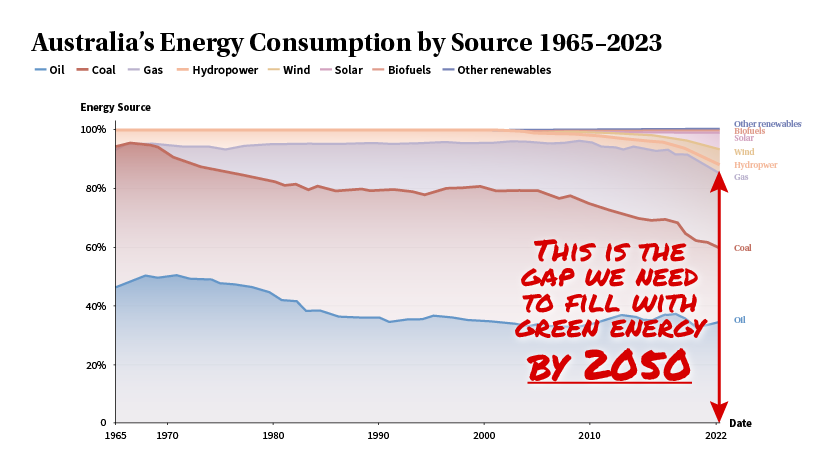

Source: Energy Institute Statistical Review of World Energy (2023), Our World In Data

This chart shows Australia’s total energy consumption by source.

If you add all the renewable inputs together — solar, wind, hydro and biofuels — you come out with 14.5% of our current total.

Australia’s fossil fuel inputs — coal, oil and gas — come to 85.5%.

That’s the yawning chasm that needs to be filled by green energy in just a few short years.

And wind and solar aren’t starting from scratch. They’ve contributed to the Australian power grid since 2001.

So, in 23 years, renewables have scraped to barely 15% of our total energy contribution.

In 21 years, it will be 2045...that’s getting close to the 2050 net zero deadline the government has legally committed to.

Even though we can all see it’s not going to happen...

This is what politicians are

gambling our way of life on

Cheap and plentiful traditional energy made Australia a first-world country and a triple-A-rated economy.

If we want to stay that way, wind and solar need to be able to do what oil, gas and coal currently do...

Provide uninterrupted power on-demand, day and night, rain or shine, to millions of Australians in thousands of villages, rural outposts, towns and cities.

I’ll get to the efficiency part in a moment.

But let me quickly walk you through the renewables infrastructure we’d need to build for this to happen...

To keep Australia on track with net zero, Federal Climate Minister, Chris Bowen, says we need to be at 80% renewables by 2030...

And to do that, we need to install 40 seven-megawatt wind turbines every month, and 22,000 solar panels every DAY, for the next seven years.

Do you know how many seven-megawatt wind turbines have been installed so far in Australia?

None.

We also need 500,000 new, trained technicians to install that many turbines and panels. That’s more than the entire population of Canberra, all working seven days a week for the next seven years.

Even people in the energy

industry think this is bonkers

Former Snowy Hydro boss, Paul Broad, didn’t mince his words on 2GB in May when he said: ‘The notion that we can have 80% renewables by 2030 is bulls**t.’

Brickworks managing director Lindsay Partridge says: 'On the current trajectory Australia is headed for a complete, absolute disaster, there is no question about that.'

And yet, this is where BILLIONS of your tax dollars are earmarked to go — all the while your energy bills are shooting up by $800 or more.

Even if we DID build that many wind turbines and solar panels…

We’d need to expand our power grid by THREE TIMES its current size…just to get the power from those new installations to homes and businesses across the country.

Why? Well, fossil fuels are energy dense, which means coal and gas-fired power stations can be relatively small. And because their operation isn’t reliant on any type of weather, they can be situated close to where people are.

Renewables are not energy dense. Wind and solar farms must be big — way bigger than a regular power station to generate the same output.

And you can’t just plunk them down anywhere. Solar farms need to be where the sun shines. That’s why there are currently 18 of them in rural QLD — the ‘sunshine state’ — and only seven in Victoria.

Wind farms need to be where the wind blows, typically on — or just off — the coast, on open flat land or at altitude.

The point is, if you want these expensive new wind and solar installations to work, they need to be built where you have a) the space and b) the right weather conditions.

In other words: places where nobody lives

90% of Australians live in cities.

That’s why we need to TRIPLE the size of our power grid by 2050 and add 10,000 kilometres of new transmission cables to get the power from where it’s generated to where it’s used.

And that’s going to cost Australians trillions of dollars.

Not billions, TRILLIONS.

And it’s not like you can rock up to Bunnings and throw 10,000 kilometres worth of transmission cables in the back of the ute. Those cables don’t exist right now.

We need thousands of tons of copper to manufacture them.

And we don’t have anywhere near enough to hand.

Nor do we know where to find the rest.

Forbes says, to hit net zero by 2050, we need to be opening three new ‘Tier One’ copper mines — each producing 300,000 metric tons of copper every year — for the next 27 years.

Do you know how long it takes to put a copper mine into production?

The prospecting and exploration stage alone takes between two–eight years. Then, once the ore is found, putting the mine into production can take anywhere between four and 12 years.

So, best case scenario, working full pelt without any snags — you’re looking at six years to put one new copper mine into production...but it could be anywhere up to 20.

So — three every year...for the next 27 years?

Impossible

And it’s not just copper for cables. The transition to renewables needs more metals and minerals that we don’t have to hand — nor know where to find.

In 2022, Simon Michaux, a mining engineer and Associate Professor of Geometallurgy at the Geological Survey of Finland, set out to discover exactly how much of each key metal and mineral we need to create all the renewables infrastructure necessary for net zero.

He compared that to the known reserves of these commodities — in other words, what we know, for sure, we have in the ground.

In his somewhat understated conclusion, he says the task at hand is: ‘much larger than first thought’.

No kidding!

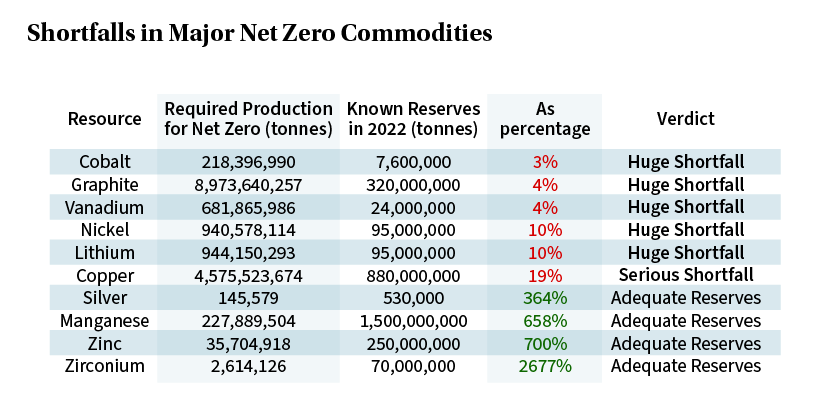

Just look at the table...

Source: Rincrude / University of Queensland

There are major shortfalls in all the most important resources we need for the renewables transition.

Look at cobalt, nickel, lithium and copper. These are vital commodities for battery storage. And we’re not even close to having what we need.

Just to be clear: without grid-scale batteries, renewables are dead in the water.

Coal and gas-fired power stations would need to run permanently just to provide backup for when the sun doesn’t shine, or the wind doesn’t blow.

Which kind of defeats the object.

This table is the cold hard reality of the net zero transition.

And it’s why it can’t happen

When more people see this data in the cold light of day...the scales will fall from their eyes...the rush back into traditional energy companies will begin... and stocks like the three in the report I want to send you could have an absolute field day.

Now of course you might say, well that’s just the position we’re in now...

2050 is still 27 years away. What if, by some miracle, we DO find major deposits of each of these commodities...

And what if we get lucky and find them all in ‘friendly’ countries?

Well, to get most of these commodities out of the ground requires tough, energy-intensive drilling into hundreds of meters of hard rock — using heavy machinery that is almost exclusively powered by diesel fuel (which we’re supposed to be phasing out).

In his book, Fossil Future, Alex Epstein calculates that extracting the rare earth minerals needed for so-called ‘clean’ tech requires more mining per unit of energy extracted than fossil fuels.

In the case of lithium, the process is anything BUT clean.

The raw ore must be brought to the surface then crushed and ‘leached’ with thousands of gallons of water to extract the lithium. The process of leaching is considered highly toxic to both the surrounding soil and air.

Renowned Australian geologist, Professor Ian Plimer, says wind turbines require more energy to make them than they’ll ever produce in their workable life...

...And more carbon dioxide is emitted in the manufacturing of wind turbines than they’ll ever save in their workable life.

That’s not ‘net zero’, is it?

The ‘workable life’ of a modern wind turbine, by the way, is about 20 years.

So, by the time we get to 2050, all the turbines being built right now — at around $7 million a pop — will have to be pulled down and replaced by an entirely new network of these ‘eco-crucifixes’.

They’ll have to carve up more pristine bushland — just like they’re doing right now in Chalumbin, QLD — to dump thousands of decommissioned turbines because there’s no way to reuse or recycle them.

No wonder, then, that a 2020 University of Queensland study found that mining the commodities needed for net zero could have a ‘worse effect on the environment’ than that averted by climate change mitigation.

In other words:

Manufacturing green tech is most likely doing more damage to the world than the tech itself will ever prevent.

Strangely enough, environmentalists aren’t queuing up to decry this on the evening news.

Nor is anyone in a rush to talk about children as young as 10 being violently coerced to mine cobalt in The Democratic Republic of Congo under horrifying conditions.

But that’s the point.

Nobody in the mainstream WANTS to talk about any of this stuff — because it goes against the ‘climate catastrophe’ narrative — which they dare not do.

Yet, when the UN Secretary-General gets up and talks about ‘global boiling’, that gets boosted by the media and amplified around the world, including in the Australian Parliament.

But no amount of pontificating changes the simple fact that...

There is not one thing a politician can do

to alter future temperatures

In 2023, Australia accounted for just 1% of global CO2 emissions.

Believe it or not, this level has been pretty constant since the year 1750 — long before cars and factories and planes.

In fact, that was even before the British arrived here in 1788.

Do you see what I’m saying?

Net zero policies are utterly pointless in a country like Australia.

They won’t impact the world’s climate one iota.

But they WILL impact our quality of life — for the worse.

Covering thousands of square kilometres of ocean with wind turbines just off the NSW coast at Norah Head won’t lower the world’s temperature.

But it WILL destroy an area of outstanding natural beauty, kill off marine life and upset the locals.

Banning gas connections in all new houses in Victoria from January next year won’t reset the global thermostat.

But it WILL make people cold, miserable and poorer too since they’ll have to fork out for heat pumps, reverse cycle air conditioners and induction cooktops.

Do you know what could make a difference in global temperatures?

I’ll give you one guess...

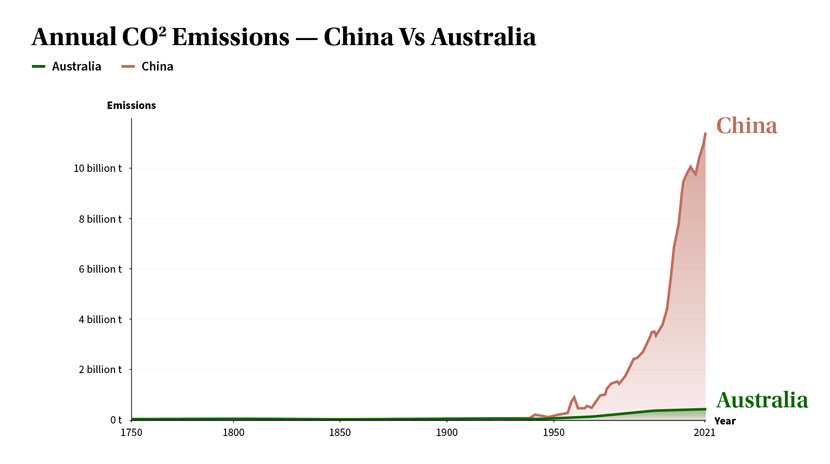

Source: Our World In Data, Global Carbon Project (2023)

This chart is an affront to well-meaning Australians everywhere.

If more people saw this and truly took it in, it would kill net zero stone dead in this country.

Right now, you are being nudged by the government to switch to an expensive, electric car...stop eating meat...not go on overseas summer holidays...and live your life within 20 minutes of your home...

All to save the world

Meanwhile, China is doing whatever the hell it wants.

China does not care about saving the world.

China cares only about economic dominance.

They know that an economy powered by cheap and efficient energy is the way to achieve it. This chart proves that.

China officially contributes almost a third of the world’s CO2 emissions. And that figure is rising. Australia’s emissions are negligible in a global sense and flatlined a long time ago.

While we fall over ourselves to close coal-fired power stations at Yallourn, Liddell and Eraring, the Chinese are ramping UP their coal-fired power generation.

According to The Guardian, China approved more new coal power plants in the first three months of 2023 than in the WHOLE of 2021.

To add insult to injury, they’re importing most of the coal they’re burning from, guess who...Australia.

We’re currently selling $19 billion worth of Aussie coal a month to China. That’s the highest monthly export since records began in 1988.

So the Chinese own our energy security now.

And we think the answer is wind and solar.

Has the penny dropped yet?

Most Australians are good, principled, well-intentioned people.

As I mentioned earlier, I – like most Australians I know – want clean air, clean water and less pollution.

Most of us want to leave the country a better place for our kids and grandkids. And most of us are more than happy to ‘do our bit’.

But we’re being taken for a ride. A cleaner world is a virtuous goal in the abstract. But no one’s being truly honest with us about what net zero actually means for Australia.

Instead, it’s all about whether YOU are doing enough to reduce YOUR carbon footprint.

And if you aren’t, get ready to be carbon taxed...because paying the government more money will definitely lower the world’s temperature!

When you see Australia’s contribution to the so-called ‘crisis’ next to China’s, this shifting of responsibility — and guilt — onto everyday people is an outrage.

Pressuring Australians to lead more frugal lives...to sacrifice...to live with less...to do without the things that add meaning and joy to our lives — when our contribution to the problem is minuscule — is a disgrace.

And that’s why our

U-turn is imminent

More Australians are coming around to the insanity of net zero every day.

Even more when the economic realities of the transition hit home.

When that lightbulb comes on for you, one of the biggest investment opportunities of the next decade or more will suddenly come into sharp focus.

You’ll see that if we want to move forward, we have to go back — back to traditional energy sources — because for now at least, there’s no alternative.

As I said earlier, smart money has already anticipated this U-turn and is mobilising as we speak. Many fossil fuel stocks are outperforming the market at the time of writing.

And the outlook for oil is bullish.

- 'We’re in a long-term structural bull market in oil,' Schork Group principal, Stephen Schork, told Yahoo! Finance in August.

- Oil market guru, Danial Yergin, says oil could hit US$121 a barrel over the coming months.

- While JPMorgan CEO, Jamie Dimon, says oil could reach a whopping US$380 a barrel — especially if Russia — Ukraine tensions continue.

That would be a 375% increase from the current price.

Now you can see why Warren Buffett just sank another $123 million into Occidental Petroleum.

But what about you?

Well, the obvious thing to do would be to follow him in — and you might make a decent profit.

After all, Occidental is increasing its drilling activity in the Permian basin in Texas, which is currently the highest-producing oilfield in the US.

So, copying Buffett wouldn’t be the worst move you could make.

But I think there are better ones out there...

Three under-the-radar ways

to play the energy U-turn

I’ve found three investments that could do extremely well over the coming months as the EV revolution grinds to a halt and net zero unravels.

They’re not global oil stocks. And they haven’t attracted gobs of institutional cash, like some of the other companies I mentioned.

That’s a GOOD thing.

It means, unlike Occidental, BP, or Exxon, you’re not getting in after the fact.

You’re getting in while these investments are under the radar. And that boosts their upside potential dramatically.

Provided, that is, you act now.

So let’s tell you about them...

The first stock in my report is an oil and gas driller with production coming from multiple sources.

This company — not well known to most international investors — is currently in the middle of a major development phase.

I won’t say too much about that here.

Suffice it to say that I see this firm’s revenue and profits exploding in the years ahead, given what should be a renewed appetite for its products.

There’s something else that’s seriously compelling

about this stock right now...

By my calculations, its stock price is seriously undervalued right now given its prospects.

How do I determine that?

I’ll show you in my report...then you’ll see for yourself how good this opportunity is.

The only thing is that I’m not sure how much longer this ‘not zero’ play will stay at this price. That’s why I’m marking the stock as an urgent buy.

It’s not a small cap by market definition. But it is small for an energy company with the sort of projects it has under development. And that means it's not on most investors' radars.

Getting my report for this one recommendation ALONE is a smart move in my opinion — one that could pay off handsomely.

But let me tell you about the other two anyway...

My second ‘Not Zero’ recommendation is more of a left field take on the energy U-turn.

You might be surprised when you see the name of it.

But when you understand my logic, I’m sure it will click into place. And I’m equally sure you’ll want to take up a position.

Long story short, I think this stock could benefit big time from the ‘second-order’ effects of the energy de-transition.

Right now, no one’s seeing this as an energy play in the same way that I am. But if I’m right about what’s coming, this could turn out to be a really smart energy play over the coming months.

That’s because this investment has resisted all the net zero insanity to date.

Firstly, because of the crazy-high cost of building green tech infrastructure. And secondly, because of the well-documented unreliability of renewables.

The people behind this investment play can afford neither.

So instead, they’re growing their existing energy infrastructure.

Remember what I told you: increased cheap energy consumption is the fundamental building block of economic growth.

When you make this investment you are essentially betting on that growth.

I have the numbers to show that this could

be a very shrewd bet indeed

Especially considering that most of the developed world currently seems to be engaged in self-sabotage.

You will be taking a position on the OTHER side of that madness — which could pay off handsomely, the way things are going.

You will be taking a position on the OTHER side of that madness — which could pay off handsomely, the way things are going.

You’ll get full details of this investment...

...including how and where to buy it, what to pay, and what you can expect as an investor...

in my report: ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

Details on how to get your copy are coming up.

Details on how to get your copy are coming up.

But before that, I want to tell you about the final investment in the report...

This could be the one energy option

where EVERYBODY wins

The world IS — thankfully — waking up to the net zero nonsense.

The reason the project hasn’t fallen in on itself yet — in my view — is that too many people have invested too much of their personal credibility into the movement.

Ideologues and zealots hate losing face. But I think they’ll have no choice, once the economic reality of net zero hits home for more people.

The get-out-of-jail card for these bureaucrats could be nuclear power.

Nuclear, don’t forget, is CO2 emission-free. So ‘net zero’ could still be possible if countries decide to go down that route.

Remember, Sweden just did this.

They ditched renewables and are going all-in on nuclear...which they’ve cleverly re-branded as ‘fossil fuel free’ energy.

This plays to the green lobby while ensuring they get to sidestep the expensive, unreliable, nightmare future of renewables.

France is making a U-turn too. President Emmanuel Macron just announced a plan to build 14 new nuclear power plants by 2050 — after vowing in 2018 to close 12 reactors and move to renewables.

Yet another net zero policy falls victim to the harsh realities of a European winter.

Could more countries

go the nuclear route?

Yes, absolutely. Nuclear power is a GREAT option. For Australia, it would be a Godsend. We would get instant energy security — at least in terms of our electricity.

That’s because we have the biggest known reserves of uranium in the world.

Nowhere else even comes close. Australia has more than TWICE as much known uranium as our closest competitor, Kazakhstan.

Imagine we were able to put it to work for us!

Get this: a uranium pellet is around two and a half centimetres long.

You’d need fewer than 10 of these pellets to power the average household for an entire YEAR.

Whether Australia comes to its senses on nuclear power is another conversation for another time.

But in the meantime, I reckon we can expect interest in uranium to grow — and demand to follow. This is why the third investment in my report is a strategic play on that commodity.

I don’t want to reveal too much more here, except to say that...

I believe I’ve found one of the smartest

uranium plays currently on the market

With this investment, you’re betting on the global nuclear power industry growing... without shouldering any specific territory risk.

In other words, if a country suddenly gets cold feet and cancels its nuclear power program, it shouldn’t directly affect your investment.

In other words, if a country suddenly gets cold feet and cancels its nuclear power program, it shouldn’t directly affect your investment.

That’s not to say that it’s risk-free, of course. No investment is. But I think it’s a pretty smart way to invest in nuclear energy, given the political sensitivity around the subject.

Again, you will get all the details of this investment, along with the other two in my new report: ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

I’ll show you how to get yourself a copy in just a moment.

I’ll show you how to get yourself a copy in just a moment.

Look, it’s easy to get carried away when you feel like the investment tide is turning — and you sense an opportunity to capitalise.

Just keep in mind that net zero is, first and foremost, a political movement. Bad policy has a habit of hanging around long after it should have been wiped out.

That being said...

It feels like only a matter of time

before some of these net zero

projects are walked back

At that point, I think the market will respond in a more meaningful way.

Right now, it looks like we’re ahead of the curve with our investment strategy.

That’s a good thing, but just bear in mind that I can’t give you any certainty on returns and timescales.

You’re making a strategic play here.

Investing before the net zero initiative collapses while traditional energy stocks are hated and cheap.

Tracking the smart money and taking a position on the same side of the trade as them. Albeit a less obvious position.

It goes without saying that no investment is guaranteed.

So, I’d advise you not to put down the kind of money that could cause you problems if this doesn’t pan out as I expect it to — or as quickly as we’d like it to.

But if you have some spare cash and you like the idea of investing ahead of a major market trend...

This is as good an opportunity

as I’ve seen in years

I hope you can see it too. They don’t come around very often, but this has all the hallmarks of a good one.

Remember, I’ve already turned this trend into a set of winning fossil fuel stock recommendations...and helped readers of Fat Tail Investment Advisory capitalise.

And I’ve done so despite huge headwinds in the pro-climate media.

Just imagine what could happen if the whole thing gets called off!

Well, you won’t have to if you get a copy of my report, ‘Not Zero: Three Stocks to Buy for the Biggest Energy U-Turn in History’.

The three plays I reveal will help you take a position ahead of the fossil fuel rebound I see as all but inevitable at this point.

If you’re interested I’ll show you how to get your hands on a copy in a moment.

But before that, let me quickly tell you about a second investment briefing I just put together...that details another unusual take on a major current investment trend.

But before that, let me quickly tell you about a second investment briefing I just put together...that details another unusual take on a major current investment trend.

This is something I think could be just as profitable as energy stocks over the next few years...so I’d like to send you a copy.

It’s called The ROYAL DIVIDEND Portfolio.

How an investment can

How an investment can

pay you twice

With interest rates powering up to their highest level in 22 years...

And blue-chip indices flatlining for much of the decade so far...

You might have been giving some thought to buying dividend-paying stocks.

Well, your instincts are spot-on.

Dividend stocks are one of the best investments on the market right now — with yields currently sitting at levels not seen in more than a decade.

But...I’d advise you NOT to rush out and buy the highest-yielding dividend payers.

Many investors do just this and end up losing money.

Why? Because they pay no attention to stock valuations.

They see the dividend yield as the be-all and end-all.

They get blinded by the big number. ‘Oh, this stock has a 12% dividend yield. So I’m going to buy it’.

I call these ‘sucker yields’ and I warn my subscribers off them.

After all, what’s the point of a 12% yield if the capital value of the stock you bought falls by 10–20%?

The stocks I call ‘Royal Dividends’

are different

It’s an investment that still pays a high yield — maybe not the highest — but it doesn’t matter...because the stock is undervalued by my analysis — which means it has great growth potential.

Capital gain AND income are the best of both worlds — and those are the stocks you should be looking for.

The thing is, not many people know how to find them.

Luckily, in your second bonus report, The ROYAL DIVIDEND Portfolio, you’ll learn about six stocks that are currently paying dividends of between six and 10%...but ALL are trading right now under my estimate of fair value.

Of course, there are no guarantees with any of my recommendations.

But the idea is that if these stocks pan out as I expect, it’s a win-win scenario for you. Regular dividend income AND capital growth too. And who wouldn’t want both?

Can you see the underlying theme here?

With these ‘Royal Dividend’ stocks and the ‘Not Zero’ plays, you are getting into big current trends, just not from the same angle as most investors.

That’s what we try to do for our readers here at Fat Tail Investment Research. Help you capitalise on moving markets in ways other investors haven’t considered. We think it can give you an edge.

There’s a third gift I want to send you that goes right to the heart of this ethos.

It’s a digital copy of my 162-page book, You, Your Brain & the Stock Market.

It’s a digital copy of my 162-page book, You, Your Brain & the Stock Market.

This book is about training your brain to think differently about investing.

This book is about training your brain to think differently about investing.

It’s about not following the herd into stocks at the top of their hype cycle.

It’s about learning to look for buying opportunities when others are selling.

And it’s about spotting the signs of a market about to crash — and having the smarts to get out, even when stocks are going higher.

I’ve been in this game for more than 20 years. Over that time, I’ve led readers to some great results based on ideas that I’m sure would have sounded crazy at the time.

But that’s because I’ve learned to ‘read’ markets and price signals. To understand valuations and sentiment. To ignore market noise. And never to do the ‘popular’ thing just because everyone else is.

If there’s a secret to successful investing, this is it.

And I’ve put everything I know about it into this digital book — You, Your Brain & the Stock Market, which you can have in your inbox today.

In fact, you can have all three of these gifts — at no extra charge — when you subscribe to my monthly newsletter, Fat Tail Investment Advisory.

Your odds of success increase

when you ignore the mob

Every month for the last 13 years, I’ve shown Australian investors where they can add to their wealth and how to avoid danger in the markets.

Every month for the last 13 years, I’ve shown Australian investors where they can add to their wealth and how to avoid danger in the markets.

Nine times out of 10 success comes down to thinking laterally.

Not taking the cowboys and charlatans in the corporate media at face value...

But looking behind the headlines and the agendas to find the less obvious and undervalued investment plays.

Investing is a competitive undertaking, after all. If you do what everyone else does, you will get the same returns as everyone else. In order to get better returns, you have to do things differently.

Mainstream advisors don’t see it this way, by and large. They want to be part of the group and fear being isolated from it.

But here at Fat Tail Investment Research, going the contrarian route is one of our guiding principles. And over the years, I’ve done just that...to help subscribers make money...grow their wealth...and look after their families.

Consider the last three years — while all hell has been breaking loose in the economy and in the stock market...

- In 2021, I closed out 13 positions for my subscribers. 11 of them were sold at a profit.

- In 2022, I closed out 15 positions. 11 of those were sold at a profit too.

- And already this year — 2023 — I have closed eight positions, with four of those making a profit for subscribers.

So over that entire crazy time, my strike rate is 72%. Three-quarters of my positions have been wins and only one quarter were losses.

That’s the kind of result you’d

expect

from a day trader, buying

and

selling fast-moving stocks

Not from a newsletter targeting longer-term value plays!

Talking of the long term, since 2014, my stock picks — all the winners and losers combined — have delivered a 14% annual return on average.

That’s much better than the ASX200 over the same time frame which comes in at around 3.5% annually. And that return includes dividends AND the value of franking credits (which my return doesn’t).

In terms of individual stocks, in the past two years alone, I gave my subscribers the opportunity to make good returns from several surprising names, including...

- 85% from National Australia Bank — yes, a big four bank!

- 58% from Reckon

- 57% from Ventia Group

- 53% from a global energy ETF

- 49% from Charter Hall

- 48% from Telstra

- 45% from Smartgroup Corporation

- 43% from Woodside Petroleum

- 37% from Origin Energy

- 36% from NIB Holdings — and

- 12% from Westpac Banking Corporation... another big bank.

As you can see, the name doesn’t matter to me.

I use the time-honoured principles of value investing to target well-priced stocks — no matter who they are — with a big emphasis on risk management.

Value is what really drives stock prices.

What does the company’s cashflow and balance sheet say it’s worth today?

And what does the market think it’s worth?

If the former is greater than the latter...and there’s an emerging trend supporting a higher share price in the future, that’s where I want to put you — regardless of what the media says and what the mainstream investment industry does.

Now I just showed you that I don’t get every call right. But look at how my strategy has worked for a few of the subscribers I’ve written to in recent years...

- Ian T says: 'I find Greg's interpretation of the financial horizon about the best of the bunch. I subscribe to a few, and this is my anchor, my mainstay.'

- DA writes: 'Following Greg and the other members of the Fat Tail crew, how could you not be in front with your finances?’

- While DRG simply says: ‘Greg is one of the best investment advisers I’ve had.’

So how can you take these

same steps right away?

Well, if you take a subscription to Fat Tail Investment Advisory today, I will send you these two research reports and a digital copy of my book.

- You’ll get ongoing insight and analysis as the ‘Not Zero’ trend evolves — I’ll tell you exactly which energy investments to buy as we go. And when it’s time to sell them, you’ll be the first to know...

- You’ll get my monthly newsletter delivered by private email — along with regular correspondence and position updates — all written in plain English to help you take simple actions, quickly...

- You’ll get access to my current open buy and hold list of 23 stocks — and you’ll be able to read my research on each one. You can start building your ‘fat tail’ portfolio at your own pace...

- You’ll get every new stock recommendation I make — and I aim to feature at least one in every issue of my newsletter...

- You’ll get my ongoing help and support — along with that of the 50 or so friendly, like-minded staff at my firm...

- And you’ll get a 30-day money-back guarantee on your subscription fee in case my service doesn’t live up to your expectations.

So what does it cost to get access to my research?

A one-year subscription to Fat Tail Investment Advisory — including everything I just told you about — normally costs $499. That’s what many others pay.

But right now you can try my research for just $249 for your first year.

That’s a 50% discount off the regular annual price.

I think you can agree that’s a good deal!

And look, nothing in investing is guaranteed. But when you consider the potential of some of the energy stocks that I’ve told you about today, I wouldn’t be too worried about being out of pocket for long.

Remember, you can claim a full refund at any time in the next 30 days if you’re unhappy with your decision for any reason.

Remember, you can claim a full refund at any time in the next 30 days if you’re unhappy with your decision for any reason.

Just call us and we’ll put the money you pay today back on your card. You can keep everything you receive from me in that time — the Not Zero briefing, the Royal Dividends report, the book, everything.

If that sounds like a good deal to you, scroll down and click the button at the bottom of this page now — and I’ll rush everything to you by private email.

Remember what I said...

We’re currently ahead of the

curve on the energy story

But I don’t know for how much longer.

Across the world, more people are waking up to the fact that EVs don’t work as advertised and that net zero is going to seriously impact their standard of living. The political rhetoric grows more desperate by the day...we’re even starting to see some backlash in the mainstream media.

To me, it’s only a matter of time before this hare-brained policy collapses.

If I’m right about that, investors will flood back into traditional energy stocks — and the advantage you currently have will disappear.

But if you take my advice today, you could be tucked into a handful of well-placed energy stocks before any of this happens.

Ready to get started? Simply click on the button below and you’ll have access to my research in a matter of minutes.

Sincerely,

Greg Canavan,

Editor, Fat Tail Investment Advisory