Hi, Murray Dawes here.

On Sunday, 13 August 2023, we hit a critical date in the markets...

This date marked exactly 24 months since the ASX 200 hit its all-time high of 7,633 in 2021.

But this date holds a key significance for another reason.

There are certain times when the storm clouds part...and a window of tremendous opportunity opens.

I’m convinced that date — 13 August — may represent that cloud-parting moment when you look back on your investment results in a year or two.

Here’s why you need to sit back...and pay attention.

The last time we entered this window, I was able to near DOUBLE the portfolio I’m in charge of...within the space of 12 months.

Simply by targeting a specific set of heavily oversold stocks.

You’ll hear how I did it...

And how I’m getting ready to try and repeat this feat.

To do this, you’ll learn about the kind of smashed ASX stocks I’m targeting.

One was trading close to $16 pre-correction. As recent as July, you could get it for around $3.50.

And you’ll hear from followers who swear by this simple system.

One from New South Wales says it’s ‘guided me through some sharp downturns and kept my trading principles aligned with safety’.

‘In for two years now and made a trading profit of around $150,000.’

Here’s the thing...

When a big, bull market ends...and a long-term growth trend fades...we enter a period of RISK-OFF...

...where volatility and sideways movement wrong-foots you time and again.

This has been your investing landscape for two years now.

For most investors, it’s not been fun.

It can feel like an eternity before the market truly breaks its post-peak deadlock.

I know from talking to Fat Tail readers that this is an uncomfortable headspace to be in.

Particularly if you’re in retirement...or nearing it.

Or even if you’re just building a conservative long-term portfolio.

You might be holding a bunch of stocks that are still way down. Not even checking your account statement anymore.

Or perhaps you’re out of shares entirely, waiting until ‘the world settles down’. Marking time in term deposits, while inflation nibbles at your nest egg.

As you can see from this glimpse of reader emails, you’re not alone:

But here’s the thing…

When investors are this browbeaten...

THE TIME TO BUY

IS APPROACHING

History also shows that when that break comes...as it always does...it comes in a flash.

Most investors are unprepared for it.

By this time, they’re trained NOT to act...by a nothing market that’s let them down time and time again.

Most investors won’t jump through the window we’re going to explore today.

They’ll sit back and watch. Not realising that ‘risk-off’ just became ‘risk-ON’.

Still in cash. Or in the same damaged stocks they were left holding the bag with a few years ago.

All while the opportunity of a lifetime gets away.

Well, today...I want to make sure this doesn’t happen to you.

If you want to get your portfolio ready for the next up-move in stocks...then you’re in the right place.

Something I call ‘Window 24’ is open again.

It happened on 13 August 2023.

I believe...if you play this window with the right moves...it could be massively impactful to your long-term returns.

To get an idea of just how impactful, look at this…

Source: Retirement Trader

What you see here is the P&L of a very special portfolio I’m in charge of since inception.

This is why I’m making this big, line-in-the-sand call today. And I show you it so you listen.

Provided you followed all my recommendations...risked 2% of your capital on each trade...and reinvested profits...

You could have absolutely smashed the wider market each year since the end of 2018.

Through the dangerous peak of the last bull market...the big falls that signalled its end...and the volatility that’s dogged us ever since.

During the last bull markets final big burst, the ASX 200 rose 24%.

But as you can see, our trades resulted in a portfolio jump of 94% in that time:

Source: Navexa

That’s nearly four times the return of a booming ASX 200.

‘Window 24’...which is what we’ll be covering here…is actually my second major prediction in four years.

The first came in June 2021...two months before the market peak.

When the bull market came to an end...in August 2021...my followers were pre-warned and prepped in advance.

See here…

Source: Retirement Trader

Profits were taken on long holdings.

Losing and highly speculative positions were let go.

The result to date?

Our portfolio has crushed the index since its inception in 2018…and achieved a 33% average annualised gain.

Again:

Source: Retirement Trader

That excludes trading fees. And again, assumes 2% risk on each trade and that you reinvested your profits.

This is the same strategy I deployed for years when I helped steward the portfolio of one of Australia’s richest families, the Smorgons.

In 2018, Fat Tail Investment Research brought me into the fold to help self-directed traders and investors grow their own long-term capital.

I do this via my premium investment service, Retirement Trader.

I started Retirement Trader with a big, hairy goal: Portfolio growth of 30% a year for anyone who followed my instructions to the letter.

I was told by friends and colleagues alike at the time that sounded ambitious.

But in the four-and-a-half years since, I’ve actually beaten my own target…

Leaving index tracker

funds in the dust

Now, of course, past performance is no guide to the future.

Track record is a great data point. It’s what you and I want to know about any strategy.

But we also know that there’s no guarantee that past success will be repeated.

However...

Being part of a team of analysts covering many different market areas via many different services...I’ve got a good sense on how this recent correction has played out.

What’s worked. What hasn’t.

And, most importantly, how investors have tried to grind through it.

Some of your stories from the last 24 months make for grim reading.

I can tell you now, our small-cap stocks have had a real uphill battle...and continue to do it tough.

As you can see, it’s been a bloodbath at the small end of town:

Source: Fool.com.au

As we hit two years since the last peak, most smaller capitalisation stocks remain in survival mode.

Why?

One word: FEAR.

When a giant bull market finally ends...and interest rates start rising for the first time in a long time...a common reaction is ‘lose the really risky stuff’.

You rotate out of less-liquid, highly speculative stocks and into perceived ‘safer’ assets.

That’s been the general trend of the last 24 months.

Like I say...RISK-OFF.

But as you’re about to see, those conditions…I believe…could soon be about to change...

And you need to be ready!

You see, if there’s one thing I’ve learned in 30 years of trading, it’s that the market is always changing.

It never stays the same.

And you need a strategy that’s able to cope with EVERY different type of market that you’re going to go through.

I’ve also learned that these periods have a ‘use-by’ date.

You go from bull markets…and then into the bear market.

I’ll show you how they usually play out — and how we are approaching for another direction move.

But the way to succeed long-term is to get aggressive during the uptrends…when things are looking good...

And batten down the hatches when things turn down...slow down your trading...and don’t take on too much risk.

I can show you how this works in practice.

Take a look at my trading results since we started:

Source: Retirement Trader

This graph tracks every trade I’ve recommended in Retirement Trader since I joined Fat Tail Investment Research.

You can see we started with a $100,000 amount.

Please don’t let that scare you. You don’t have to have $100,000 to start trading with me. This is simply a neat, hypothetical starting point, purely for tracking and illustrative purposes.

There’s a key thing I want you to focus on…

See the way the P&L has grown over time?

Some of those periods we saw huge volatility...such as the 2020 COVID crash.

And yet it had a very minor downdraft impact on the P&L.

Now, I’ll explain the process we use, which helped us avoid the impact of that huge crash.

But as good as the process is, the real power of it is the confidence it gives you.

You see, when you’re not materially affected by a huge crash…you feel much better when things start to turn up.

In this way, my clients were prepared and ready for when the market did bounce back.

And when the trend turned up...we attacked.

You can see a huge uplift in the portfolio during the period when the market trended higher:

Source: Retirement Trader

In the up-trend period after the COVID crash, we picked up Paladin [ASX:PDN] at 12 cents...and we rode that all the way to 80 cents.

We picked up Telix [ASX:TLX] for less than $2...and rode that to more than $8.

It’s about seeing these big downdrafts...these big corrections…which clear many people in the market out of their positions...

…and then jumping in once I get the signal that things are starting to turn back up.

Like I said, I believe we’re entering a phase now that’s starting to look like this will happen again.

One more point on the P&L you see above…

You can see we had a huge growth towards the end of that bull market — $350,000 in only a matter of years...

Since then, we haven’t had a huge correction down the portfolio.

We’re still at around the $300,000 level.

When you are making big money...four times what the index does in the up times...usually, you’d expect big volatility to the downside.

This is where my approach is different.

Again, we attack the upside…and step aside during those tough times…ready to go going after it when the good times return.

And this is the point…

As of 13 August, we’re two years into this correction.

History tells you we are now nearing the end of that down period.

Very soon, it’ll be time to attack again.

Right now, I’m running the ruler over a number ‘Window 24’ trades which I’m seeing pop up.

But before I tell you more about them, let me just clarify, specifically, who this is for.

Only serious investors

need apply

This is for serious-minded investors who know that in order to maximise long-term wealth...you need to be ACTIVE in the market.

Especially in periods where inflation is flaring up.

My strategy is based on making hay while the sun shines...and battening down the hatches when the storm arrives.

This philosophy...backed by a rigid trading methodology...has put Retirement Trader members at the head of the pack here at Fat Tail in terms of track record.

Given market performance of the last two years especially...many are grateful to be in this position.

‘Now more than ever, I need Murray’s guidance. I trust him. I love his model.’

~ S. Lacey

‘Murray’s record is well known in retirement. I wanted some good advice, so I joined Retirement Trader.’

~ Denis Pickwell

‘Firstly and honestly...I feel I can trust him. He talks sense in a way I can understand and doesn’t talk down to you. So often when listening to people explain the markets it’s overly complicated and boring to the point I switch off.’

~ Steve W

‘I have great faith in Murray and his selection process. I’m more than happy for him to wait until the right trades present. It is a very tough market at the moment and Murray and his sit and wait attitude give me great confidence for future trades.’

~ Ron Bray, VIC

Trading confidence is hard to come by right now.

And no wonder.

The ASX is almost exactly where it was two years ago. That’s not really how markets are supposed to work, is it?

You’re meant to get rewarded for the risk you take on.

Except there’s not much in the way of rewards for most investors during an aggressive rate hiking cycle.

You just have to suck it up and try and stay out of trouble.

My followers, however, have done quite a bit better than that through all the volatile sideways motion.

But what if ‘staying out of the market’ is no longer the best play?

That’s the premise we’re about to explore.

Firstly, it centres around a period of time that began on the 13 August.

Now, we call it a window for a reason. Historically, it doesn’t stay open for long!

Right now, commodities remain weak as global growth slows. The jury’s still out on interest rates. Selling pressure in financial and consumer discretionary stocks is still there.

The idea is to get this set of trades on while all that is still the status quo.

Secondly, the game we’ve played so far has been a winning one...

You’ve seen my record.

Part of the reason for this outperformance is that I’m a veteran of these bull/bear transition periods...navigating them for 30-plus years...including several on the trading floor of the Sydney Futures Exchange.

(Here I am circled in this picture circa 1994.)

(Here I am circled in this picture circa 1994.)

And thirdly, what I’m about to suggest is easy to implement...

I’m not talking drastic moves here. This is not about buying tech stocks that have been dumped -75% or using leverage.

It’s large- and mid-cap focused. With the odd special situation small-cap thrown in there.

The key thing I look for is established and solid businesses, with cash flow and revenues.

All this involves you being a little more active in the market than you might have been over the last year or two.

Every trade we do, I split up into three sections and I want to explain those sections by asking, ‘what do we want to achieve when we enter the market?’

#1: SURVIVAL. I want to survive. I want to make sure that I can survive anything.

#2: KEEP MAKING MONEY. I’d like to be making a bit of money…ticking over. I would like my PNL to be slowly hitting higher.

#3: ACCESS TO BIG WINS. I’d like to have access to really big wins, if I could. If I can get onto a really big trending stock, I want to ride that as far as I can.

That’s why I split the trade up into three phases…

PHASE I

First, I will sell a third of the position at an initial target…and I will tell you to adjust your stop-loss to a point where they would break even on the trade.

So that means we either breakeven — which means you get your money back that you put in — or we make money.

Now, consider how you’d feel when you’re at that point...

No more watching the stock go up...and down...in the money...out of the money...

Instead, the worst that can happen is you walk away with the money you came in with.

That’s a big, important step...because mentally you feel so good after it.

PHASE II

Then my next profit target...where I sell another third...moves the trade from being breakeven at worst case…to making a bit of money at worst case.

You adjust the stop-loss to a point where, if you get stopped out, you walk away with a win.

But if the stock keeps going, you’re going to walk away with a BIGGER win.

That point forward is now the last phase…

PHASE III

This is where the uptrend is confirmed…and you let the final third run.

From this point...even if the trade suddenly goes bad, we walk away with a win.

But if you catch a strong momentum run…that final third can really go.

As was the case with Paladin....

I didn’t know the Paladin was going to go from 12 cents to 80 cents in a couple of years.

I just liked the stock. It looked good.

But when it took off, we had that final third in place after derisking the trade by taking profits in phases one and two...and we ran that third phase for hundreds and hundreds of percent.

And we COULD do that because we were CALM.

We knew that we were going to walk away with a win.

Now, bearing that in mind, consider that P&L again…

Source: Retirement Trader

The reason we were well positioned through the COVID crash was because of that first profit taking section of the trade.

I had already taken part profits in a lot of those stocks...

And look, we got taken out of some great positions...but when we got stopped out, we got stopped out without losing more than the original capital.

We got our original capital back.

So, you can see that our draw down in that period did not go back below $100,000.

We never went into negative territory. And that’s because of the FIRST part of the trade.

When things turned back up...and the market took off...and we had a huge uplift...that was because of the THIRD section of the trade. All of a sudden, stocks were trending.

I took part profits on the way, but then the third phase took off.

With my risk management process, I never know which part of it is going to help us.

During the 2020 crash, the first part helped.

During the big bull market, the third part helped.

I don’t know which one it will be…but that’s exactly why I set the trades up to HANDLE ANY MARKET CONDITIONS.

That is how you successfully manage the tough times…and set yourself for the good times.

And now you can see where we’re sitting right now...

Source: Retirement Trader

We’ve achieved this by sticking to four principles:

- A shift away from speculative stocks around June 2021

This was when I stuck my neck out and definitively warned of a coming correction.

I told members at the time:

‘There’s no need to be massively leveraged long because the odds of a correction are increasing by the day.

‘Better to have plenty of powder dry ready to take advantage of any correction that may be coming.’

That correction came in August, just as predicted.

- Adapting to bear market trade management

This meant taking profits out of long-term positions...streamlining the portfolio...and dumping positions that weren’t performing.

- Trading less, but making each trade count

After the bull market ended, we used what I know about bear market dynamics to engineer a better outcome in every trade.

Even as the wider markets buckled. Even tighter stop-losses. And taking partial profits off the table to ‘derisk’ winning trades.

And finally...

- Building and retaining positions in companies bucking the bad times

This meant being heavily in mining with positions in Woodside [ASX:WDS], Strandline [ASX:STA], Chalice [ASX:CHN], De Grey [ASX:DEG] and Newcrest [ASX:NCM], to name a few.

Share prices change every day. But fundamentally, businesses like these are strong.

Down periods present opportunities to carefully accumulate, with a healthy respect for the risks.

The aim is to ‘keep our powder dry’ and capital intact for when the market turns up again.

Which brings us to right now.

When the market conditions shift...you need to adapt.

As such...I am now getting ready to MOVE UP A GEAR.

Ready to pounce on Window 24

First, let me just lay down a bit of groundwork because anyone involved in the markets will know it is pretty chaotic, right?

You get information coming at you from all angles.

One commentator you follow is bullish, another’s bearish. Sometimes it’s hard to know which way is up.

Personally, I look at the markets like a sea of grey.

Imagine yourself in a little boat...in an ocean that’s rocking around the storms coming in...

It’s night and you’ve got no idea where you are.

But if you look up...and you see a big lighthouse on the top of a cliff, straight away you know exactly where you are.

Well, this is how I see market peaks over time.

They essentially tell you where you are in the market.

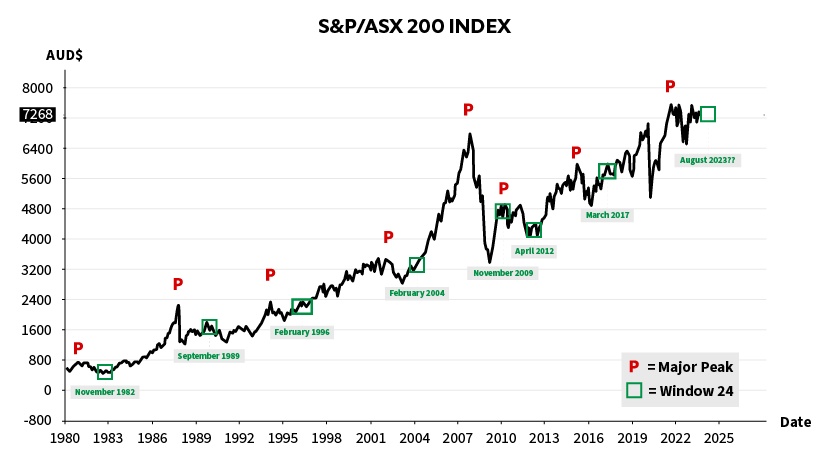

To see what I mean, check out this chart…

You can see on the chart below, there are ‘Ps’, which are, of course, the peaks in the past:

Source: Retirement Trader

This is 50 years of data on the ASX 200.

All those ‘Ps’ you see are the big peaks in that time.

Take note of the first peak, or ‘P’, then see the little green square window, marking two years exactly after that peak.

Was that a good time to start buying stocks?

I’d say yes.

Now look at the second ‘P’...

There was a little sideways motion for another year or two...but markets moved higher.

Now look at the next few ‘Ps’...

Two years — 24 months — after the February 1996 peak…the ‘window’ always opens up.

Would you have liked to have been buying stocks then?

Of course you would!

And then you have the peak in 2001…the sell-off to 2003…before the window opens up.

This was a particularly big move, as you can see:

Source: Retirement Trader

Again, ask yourself…

Would you have liked to BUY stocks before that huge commodity-driven rally?

That was the big China-based rally into 2007...what a huge move in stocks you saw there!

If you bought in that window, you would have been pretty happy.

Moving along again after the crash, your window opens up again in November 2009…

Source: Retirement Trader

We then went sideways for a year or two, but it didn’t go down much...

And then look at that next ‘Window 24’ in April 2012...right at the start of the bull market going into 2016.

Source: Retirement Trader

And then again in March 2017…

Your window opens up…and there is another couple of years of hard rallying.

And so we come to today…

Source: Retirement Trader

The peak was in two years ago...

Sunday, 13 August represented 24 months to the day.

What will happen this time?

I’m not saying I know exactly.

But I do know history.

I know this is the period where it’s time to start thinking about where the opportunities are.

And there are a lot of beaten-up stocks out there…

For example, back in April, I profiled Megaport [ASX:MP1] in my weekly Closing Bell video.

Since then, the stock’s up about 70%.

Since then, the stock’s up about 70%.

This is the type of opportunity I’m starting to see out there…

Megaport was a former market darling...flying up around $20, before crashing to $4–5.

People didn’t want a bar of it.

But the business hadn’t changed. Revenue was still growing.

Hit the play button below for a brief explanation of what happened…

My point is, I love this kind of set up.

I look for these huge waves…and the correction which clears out all of these positions...

Then I wait for the share to fall back into my BUY ZONE.

That’s when I get interested.

And if you have a long enough time horizon...it’s definitely time to go shopping for quality, oversold companies like Megaport.

Of course, nothing about this is ‘safe’.

Markets remain volatile. You’ll be actively trading. And that means risk.

Certainly, more risk than keeping your cash in the bank.

And of course, you could lose capital if we make the wrong moves here. I’m not sugarcoating anything.

There’s nothing in the markets that’s certain.

No trader is going to tell you, ‘I think there’s a 100% chance that this will happen’…that’s just not how markets work.

But the fact is...

I have a trading model to help us navigate whatever market conditions there are.

You’ve seen on my P&L that we’ve sidestepped the COVID crash...and we’ve managed to hold on to our winnings during this past period where markets have gone nowhere...

These are periods where you could have lost a lot of money if you didn’t know what you were doing.

So regardless of what comes next, I’ve got the strategy that can handle it and react quickly if things turn back down.

But having seen that five times out of seven over 50 years…THIS was the time to be getting in.

And if I’m right on ‘Window 24’...and my trades are on point like you’ve just seen with Megaport...

Then this calculated shift in strategy could be one of the most lucrative you ever make.

NOT by going to be going after ultra-risky speculative stocks…

My service is called Retirement Trader for a reason...people who want something a bit more conservative.

A trading methodology that’s all about risk management.

Here, let me show you another trade example…

This one will really give you a sense of how I manage risk...and how it can really help when you’re in the markets to behave in this way.

So let’s have a look at De Grey Mining [ASX:DEG].

I’m sure many people will know this stock well and a lot of people would like to be long with it, I’m sure.

Hit the play button below…

So that’s really how I use charts to help me.

It’s to help look for those points of mean reversion that happen time and again...and use that mean reversion to get us to a position where we can’t lose our original capital.

And from then on, we sit back...

You just let the market do what it needs to do...and away we go.

So the strategy isn’t going to change with ‘Window 24’...but it IS going to be utilised in a way to set people up to really take advantage of it.

And that’s what I’m inviting you to today.

With Retirement Trader, you’ll still be trading in my trademark style:

Conservatively...and with capital preservation at the forefront.

It’ll tend to be stocks above a $500 million market cap. Often more than a billion.

If a special situation presents where a small cap with a solid business is at a key buy zone, I may decide to trade it.

But this will mostly be large and deeply oversold mid-caps that have the right technical set up.

You won’t always be trading every week or even every month. And you won’t be using leverage like options or CFDs.

But...

You WILL be targeting a possible window of opportunity at this juncture in the markets.

You’ll be making a bet on big, fast bounce-backs...among a specific set of stocks that have retraced back to that buy zone.

And you’ll be recognising that buying within this 24-month window of weakness could...if I’m right...give you WAY larger long-term returns.

You just need to pre-empt WHICH stocks will

move first...and highest...BEFORE the crowd…

Remember...my subscribers were able to pre-empt the recent peak.

We adjusted our strategy with stellar results.

Now I’m making another ‘line-in-the-sand’ call...and another strategy realignment.

If I’m right on this one too, I reckon you could see a sizable uptick in that 33% annualized return over the next 2–4 years.

The only question is: Are YOU keen to get amongst it?

Because this window won’t stay open for long — and the strength of my track record to date — my publisher has greenlit an incredible deal on a one-year Retirement Trader subscription.

This deal also comes with a 30-day subscription refund guarantee, which means you get to check out my strategy, along with any live and open trades, and still get a subscription refund if you want.

That is a HUGE backstop.

There aren’t a lot of advisories out there that I know of that let you get behind the curtain and explore specific recommendations...and STILL get a full subscription refund if you decide it’s not right for you.

It means that...provided you only paper trade in that first 30 days...you literally lose nothing except the small amount of time invested in reading and watching my trade alerts.

If you join, you get the names, stock codes, buy limit, stop-loss, profit target, and the risks on each trade.

Everything you need to take your first steps on this attack plan for buying oversold ASX stocks...in a format that’s quick to understand and easy to follow.

I make sure everything is clear and simple because I know how scary it can be getting involved in the markets, especially if you haven’t got much experience.

You want to know what you’re doing every step of the way.

So, when I send an email:

- You get the stock code...

- The entry price: exactly what you should pay, what you shouldn’t pay beyond...

- You get the stop-loss: where you should get out of the position...

- You get the initial target, and I’ll tell you what you should do at the initial target as far as taking part profit, that sort of thing…

- You get a full fundamental analysis of the stock showing you what the risks are...

- You also get my full a technical analysis...

- And then I’ll also keep you updated on the trade all the way through.

Here’s an example of a trade snapshot at the top of a buy alert:

After that, I hold your hand all the way through the process to make it as simple as possible.

Retirement Trader member John F puts it like this:

‘A conservative approach with a lot of research and trading experience behind it. I feel that I can trust Murray’s advice and overall end up with profitable results.’

And Shane from Queensland says:

‘Murray has helped protect my account brilliantly. He’s got a great track record since I’ve been following him and he explains his reasoning very well, so it makes sense to trust him.’

If you’d like to join John and Shane alongside me in the next...potentially most exciting phase in Retirement Trader...we’ve hooked up something for you.

A significant ‘Window 24’ discount that gets you in the door and with details of my next trades.

If you’ve already decided this is something you want to try…

Simply click this link.

It will take you to a secure order page that lays out the subscription discount...and everything you’ll receive.

If you’d like to see what you’ll get explained in a bit more detail...and what kind of ‘Window 24’ trades I’m looking to pull the trigger on...read on.

The record of Retirement Trader speaks for itself.

If you’re the kind of investor that values a careful, judicious approach to stock trading…

And realistically and steadily building a portfolio over time...through all conditions…

Again, below is how the Retirement Trader portfolio has tracked versus the ASX since inception:

Source: Retirement Trader

As I keep saying, past performance is not a guide to the future.

But I am aiming for the Retirement Trader line to diverge from the ASX, even further in the next few years.

That’s what’s on the table.

To be clear, if you’re only after highly speculative trades like super risky junior explorers or tech microcaps, Retirement Trader is not your service.

But it’s worth pointing out one more time...

My unique style of conservative trading has done considerably better than all the services that we have specialising in those more speccy areas over the last few years.

Simply put:

THIS IS A SERIOUSLY PERFORMING ADVISORY.

FOR SERIOUS LONG-TERM INVESTORS ONLY.

BUT...you need to be willing to actually trade in and out in the near-term horizon.

Now, if that’s not you...if you’d rather stay in the bank a bit more and see where all the cards fall for another six months...then by all means, sit this one out.

It’s not just about track record though…

The point is, Retirement Trader has provided consistency in game plan, and execution, in a highly volatile period.

That psychological advantage, in my opinion, is worth the subscription on its own.

As member Scott D puts it:

‘I like the psychology of Murray. He analyses the macro market according to his strategy.’

And it’s often completely contrary to the vibes you get from the mainstream financial media.

I think you would be hard-pressed to find a trading service out there that provides the level of detail I go into with each and every decision made.

Magda from East Hills in New South Wales, says:

‘Murray has been a great teacher. I managed to follow his advice most of the time and as a result I was shielded from big losses and managed to accumulate good profits.

‘I have doubled (and more) my money.’

Look, it’s amazing and humbling to get emails like this from current subscribers.

And let’s face it, honest, independent advice is like gold dust right now.

When market conditions are bad...we adapt. I give you clear capital preservation moves. And I explain what we need to see before you should start raising exposure levels.

When there looks to be a little opening...as is the case right now...I pivot again.

So, let’s quickly talk specifics on some upcoming trades.

What ‘Window 24’ trades can you expect if you

become a Retirement Trader member today?

One of the most exciting things I’m looking at right now is the huge energy transition we’re going through.

It will mean a massive uplift in demand across all battery metals.

Yet a lot of those stocks have been dumped in the recent sell-offs.

But…thinking in terms of the next decade or two...what’s going to be making you money as you head towards retirement?

It’s going to be picking up those beaten-up stocks at the right time!

Copper, graphite, uranium...

I’m looking across the board in all of those kinds of sectors.

For example, right now, I’m looking at a lithium stock...

I can’t tell you the specific name, as that’s unfair to members.

But to give you an idea, have a look at these two charts:

Source: CQG Integrated Client

The chart on the left is Megaport, the stock I profiled in the Closing Bell and walked you through a moment ago.

The one on the right is a trader I’m teeing up right now…

Now, can you see the connection between these two charts?

The huge wave to the upside...and then the collapse...with people getting cleared out of positions back into that green box (the buy zone)...an attempted rally which failed...and then a false break...

I sent the alert there to buy...and BOOM!

Off it goes to the upside, heading towards that point of control.

Now, on the right, here we are in this stock...

Source: CQG Integrated Client

A massive run all the way up to $17 over the last few years.

The big clear out...the first attempted rally, which is now taking everyone out...the final false brake in the green box...the buy zone and the monthly buy pivot about to come this month.

I’m ready to pull the trigger on this one in Retirement Tarder, and you can see how the overall chart set up is nearly exactly the same...

It’s a spitting image.

I’m seeing that across the board, these big clear outs are just waiting for the momentum to turn back up...

And we are even seeing it now...with inflation coming off the boil...US stocks are again starting to rally.

And we are even seeing it now...with inflation coming off the boil...US stocks are again starting to rally.

I think people are really surprised that markets are actually moving higher at the moment.

No one thinks it should be and that’s often what markets do!

Get every new ‘Window 24’ buy

signal from here on in

Right now, Retirement Trader has several current positions that are well under their buy limit...and poised for a potential ‘Window 24’ resurgence.

If you choose to do so...you’ll be able to enter these trades as soon as the next market opening.

You’ll get all the details on this immediately after joining.

You’ll get all the details on this immediately after joining.

Stock ticker, buy-up-to price, profit target, and stop-loss.

Remember, again, this is an ACTIVE service.

You’re not being passive.

The key to success is the ability to be nimble and adapt strategy in individual trades as the market changes.

And to remain on the right side of each trade...where possible.

To that end, I will contact you every time you need to take action, including when it’s time to sell.

You’ll also get a weekly video update where I’ll give you a health check on every open trade. I’ll show you how each trade is traveling...what the next target is...and what you can expect going forward.

I also use the video to update you on developments in the market and how they shape my thinking...not just in terms of the trades I’m managing on your behalf, but also for any potential new trades on the horizon.

When you join Retirement Trader today, you immediately get access to the Retirement Trader ‘Video Master Series’.

These are five video tutorials that offer a detailed look at how my system selects stocks...finds entry points...and manages trades through to completion.

There’s one that lifts the bonnet on my exclusive momentum indicator...CRUCIAL as stocks begin to rebound.

One on how price distributions and ranges are formed, which is also crucial for selecting the right stocks to trade...

Another that looks more closely at how my proprietary ‘pivots’ find optimal entry and exit points in stocks.

And another shows you how stock price trends develop...and how quickly they can change.

This one gives you an insight into my reasoning behind taking part profit and moving a stop-loss.

Of course, if you just want the actionable trades, that’s absolutely fine too. But all this is at your disposal should you want it.

The point is, you wouldn’t get this attention to detail from most other trading products out there. I can promise you that.

As Member Tony H points out:

‘I have made more consistent money with Murray’s recommendations than any other Fat Tail subscription.

‘As much as I’m craving Murray’s recommendations, I respect his market knowledge and integrity.’

So, now the big question...

What is the Retirement Trader

service worth?

And what’s the ‘Window 24’ discount you can take advantage of today?

Well, usually you’d pay $2,999 for annual membership.

Today we’re cutting that back by 50%.

$1,499 for your first year. Half-price discount.

Just $1,499...instead of $2,999...for your first 12 months of Retirement Trader.

Huge reduction.

‘Window 24’ moments do NOT happen often. But it’s here.

And to mark that, we’re giving you the chance to get in the door at HALF PRICE.

If you like what you heard so far today, then this deal will be an absolute no-brainer.

But it can’t last forever.

Just like Window 24.

As you can see from the testimonials, this is a pretty appealing investing approach as we head into 2024.

If you’re interested, then join up and see what Murray is planning for the next few months with ‘Window 24’ in mind.

As MV in WA says:

‘I think he’s by far the best forecaster of the market’s directions.

‘He has well-backed data for his predictions.

‘And the strength of character to back his decisions.’

He also has a killer track record.

Ball is in your court now.

Look, regardless of what comes next, I think I’ve shown you that I’ve got a model that can handle all market conditions.

And by being laser focused on risk management…it doesn’t mean it leads to low returns.

That’s actually what helps you to go after the BIG returns.

As you saw in 2020 to 2021...when the market’s behaving and trending...we really try it aggressively and go for it.

That’s that third phase I’ve been talking about.

Again:

Source: Navexa

But then when the markets turn bad...we’ve got the model that gets us out quickly...that makes sure we’re never risking our initial capital as quickly as possible.

So, I believe regardless of whether this ‘Window 24’ works this time...we’ve seen that it’s worked five out of seven times perfectly.

And even the other two times, it didn’t end up being that bad.

There are definitely signs with inflation coming off the boil…

US stocks are almost at all-time highs.

As we head towards that ‘Window 24’, there are signs of life in the market...

...and there’s a hell of a lot of beaten-up stocks out there like I showed you.

Like Megaport...up 70% in three months.

Like Megaport...up 70% in three months.

Those stocks are out there.

And it’s my job to find them for you.

Remember, you can step inside today for half the usual price for your first year.

And you’re covered by a 30-day subscription refund guarantee.

It means that you can test out my trading system however you want. And still get your 50% discounted subscription back within 30 days if you choose to do so, no matter what.

It means that you can test out my trading system however you want. And still get your 50% discounted subscription back within 30 days if you choose to do so, no matter what.

Click the button below...and complete the form on the next page.

Thanks for reading.