GREG CANAVAN:

See this coin?

It’s a 50 gram bar of bullion — mined and minted here in Australia.

50 years ago, you could pick up one of these up for a little over 50 bucks.

These days, it will set you back more than five grand – nearly 100 times as much.

I’m here to show you why gold like this could soon become so expensive that they’ll be out of reach for all but the rich.

To explain why, I need to tell you an extraordinary story.

It begins underground.

150 metres beneath the 20-acre prospect owned by ASX-listed Cassius Mining [ASX:CMD], to be exact.

Staffed by just 21 people, it’s a small outfit.

But as they drilled their pitch, those miners began to have suspicions about their neighbours… the Chinese-state-connected Shaanxi Mining.

Despite having a much smaller prospect… Shaanxi had a small army of miners onsite.

Their ventilation shafts were creeping ever closer to Cassius territory.

And strangest of all… they’d laid explosives at the entrance to the site.

What were they hiding?

That’s what Andrew Head set out to discover.

A subterranean laser underground exposed tunnels extending horizontally from the Chinese patch… right under the Cassius mine.

After months of tension, Head was finally allowed access to the Shaanxi mine.

In the darkness underground, he evaded his Chinese ‘minders’… and made a shocking discovery… one that would culminate in cold-blooded mass murder.

The Chinese were

stealing gold

Deep underground, Shaanxi miners had trespassed on the Cassius mine.

‘It went for hundreds of metres. It was a drive for underground vehicles,’ Head told the Sydney Morning Herald.

‘They stole a lot of gold…[not] the millions but the tens of millions of dollars.’

And they were prepared to bribe…and even kill…to protect their scheme.

Why?

Why would a Chinese state-linked company risk so much to get its hands on Aussie gold?

That’s the question I asked the best gold investor I know.

Brian Chu

This is a guy whose private family fund is dedicated entirely to ASX-listed gold stocks.

His name is Brian Chu.

And over the past seven years, his fund has tripled the return of the ASX Gold Index.

And his answer to the battle over Australia’s ‘blood gold’ was eye-opening.

BRIAN CHU:

Quietly…behind the scenes…the most powerful players in the financial world are LOCKING UP as much of the gold supply as they can.

Sometimes the purchases are above board.

And sometimes they’re about as black as the black market gets like you’ve just heard.

But the thread that links them is the same…

The move into gold by the extremely powerful has begun.

For instance, we know that Chinese company officials were later caught at the airport with $800,000 in gold bullion on them…

…and attempted to bribe a Sydney Morning Herald journalist with a motorbike to suppress the story.

But let’s speculate: where might the rest of the gold have gone?

We can’t say for certain.

But for years, several well-respected gold experts have suggested that China is attempting to accumulate ‘off-book’ gold…vast reserves of bullion that don’t appear on its official Central Bank reserves…but exist in secret.

Could this gold have been bound for those secret reserves?

Stranger things have happened.

According to gold analyst Simon Hunt, China’s secret gold reserves amount to more than 30,000 tonnes…far more than almost every other major nation put together.

Source: The World Gold Council — Figures from February 2020 rankings

In fact, he speculated that China may have more than eight times as much gold as there is in Fort Knox…hidden away.

Of course, OFFICIALLY China has been on a huge gold accumulation spree in recent years…

And they are willing to acquire by any means possible.

It’s official reserves — the gold the Chinese authorities are prepared to admit they own — hit 2,000 tonnes at the start of 2023.

These huge purchases aren’t an anomaly.

And it’s not just China…

They’re part of a clear,

well-established pattern

Powerful, fast-growing countries are RAPIDLY ramping up their gold holdings.

Suddenly…many of the world’s most powerful players are doing everything they can to lock up as much of the world’s gold supply as they can.

…in Switzerland, billions of dollars of gold are on the move…going straight into Chinese vaults.

…in Dubai, the ‘Gold Mafia’ is busy smuggling South African and Zimbabwean gold into Chinese hands.

…in Russia, Vladimir Putin had Wagner Group mercenaries smuggling gold out of Sudan…pegged the rouble to gold…and doubled his country’s bullion reserves in less than a decade.

But this isn’t just about Russia and China.

The more you look…the clearer the signs become.

…Brazil increasing its gold holdings by more than 100% in three months…

…Singapore increasing its gold holdings by 30% in a single month.

…Poland buying more gold…even AFTER repatriating 100 tonnes from London’s gold vaults.

…Turkey buying more gold than any other nation in 2022…

…India adding more than 100 tonnes in two years…

…billionaires like John Paulson, David Einhorn and Ray Dalio turning to gold…

…and overall gold demand hitting 11-year highs…

There’s a common thread here.

Powerful insiders and global players are

hoovering up all the gold they can

GREG CANAVAN:

The question is, what do they know that you don’t?

That’s what this expose will attempt to uncover.

One thing we know for certain: it has some extremely compelling implications for investors — especially those right here in Australia.

That means YOU.

For example…

- We believe there is a hidden connection between the events I’ve just described in Africa…and what governments are doing on a global scale. This connection explains EXACTLY why these powerful players are buying so much gold…and why this could be the start of $3.2 trillion in insider capital moving into gold. (Ultimately Central Banks could buy up a quarter of all the gold that’s ever been mined.)

- We predict this gold ‘lock up’ could soon make gold more expensive than at any time in living memory…and have an outsized impact on Australia and the ASX. (With the world’s biggest gold reserves and 218 listed gold stocks, any shift in the gold market changes things for Australia — but what could be around the corner will surprise a lot of people.)

- And we want to show you precisely where our in-house gold expert is putting his own family’s money ahead of all this. (He’ll tell you all about what he calls The Ultimate Australian Gold Gameplan a little later in this video.)

One thing is 100% clear:

BRIAN CHU:

This is no normal

bull market

As this year’s ‘In Gold We Trust’ report put it:

‘It is not often that we see numbers that could be described as parabolic in the gold industry, but central bank purchases of gold in 2022 represent such an occurrence.’

That’s already driven gold to record-breaking new highs in at least four major currencies in 2023 alone.

But this bull market isn’t being driven by speculators…millennials trading meme stocks for fun…or even private investors.

The people monopolising gold are INSIDERS.

They’re the very people whose job it is to protect and steward the financial system.

And they’re rushing into the oldest safe haven there is.

GREG CANAVAN:

So why is that?

Well, 109 years ago, a single event in the Balkans brought the world to its knees.

Serbian nationalist Gavrilo Princip assassinated the heir to the Austro-Hungarian Empire, the Archduke Franz Ferdinand.

No one knew it at the time…but it would be the spark that would set the world alight.

Soon, millions of men were on the move all over the world.

Within four years, tens of millions were dead…centuries-old Empires lay in ruin...and the world order had been turned upside down.

It’s a classic example of how real, radical change really reshapes the world.

It almost always begins at the margin…with events that often feel innocuous, at first.

But it’s the chain reaction of events that’s so dangerous.

No one would have predicted a single Serbian nationalist in Sarajevo could have brought the world to its knees.

But it did.

And the same dynamic is playing out in the financial markets right now, in 2023.

This time, the ‘shot that echoed’

was fired on 28 February 2022

It wasn’t anything as dramatic as an assassination that sparked the chain reaction.

It was something far more subtle…

It came as Russian tanks rolled across the border into Ukraine.

You’ll remember it well.

24/7 coverage of troop positions as columns of Russian armoured vehicles advanced on Kiev…

Chaos in the financial markets, as oil, gas, nickel and wheat prices all spiked.

Amidst all that, it was easy to miss the single, crucial development that turned the financial system on its head.

On 28 February, the US Government chose to use its most powerful weapon…the US dollar.

It froze every Russian dollar-based asset it could.

And it helped to push Russia out of the SWIFT banking system.

The idea was this would bring the Russian economy to its knees.

President Joe Biden said it’d make the ‘Rouble into rubble’.

Nice phrase.

But — as subsequent events proved — completely and utterly wrong.

Soon, the Rouble was actually STRONGER than it had been to begin with.

And as the shot echoed around the world…the wave of inflation that had already begun with the Pandemic money printing…went into overdrive.

BRIAN CHU:

When people write the history of our times, they’ll see the move to weaponize the US dollar as FAR more significant than Russia’s invasion of Ukraine.

Why?

Because when the Americans froze Russia’s dollar-based assets, they began a chain reaction.

A lot of people in the media cheered what was happening.

But only because they didn’t understand it.

The problem with using the dollar as a weapon is…it makes it a LOT less desirable as the world’s payment and reserve currency.

Think about it.

How do you think the authorities in China…Brazil…India…South Africa…or Saudi Arabia saw the move to freeze Russia’s dollars?

These countries ALL rely on the dollar.

They all have huge dollar reserves…or rely on the dollar to export their energy and commodities abroad.

And these countries watched as Russia saw its dollar assets unilaterally frozen.

Or perhaps ‘stolen’ is a better word.

Now, we can debate whether the Russians deserved this or not.

But the American response sent a powerful signal:

If we don’t like you, we’ll turn the DOLLAR against you.

You don’t have to be a rocket scientist to guess what conclusion other nations reached:

They realised they can’t trust the US dollar.

And the early signs are…they’re looking for an alternative.

GREG CANAVAN:

It’s hard to overstate just how important a development like this is.

The US dollar is the lifeblood of the world economy.

Every day, 6 TRILLION US dollars change hands.

It’s the currency the world uses to buy oil and gas…commodities…food…and a million other things besides.

For instance, if an Australian company wants to buy Saudi Arabian oil, we don’t pay in Aussie dollars or Saudi Rial.

We use US dollars.

When we SELL Aussie LNG abroad…

We get PAID in US dollars.

It’s been like this for decades.

There’s been an established order — with the US dollar at the heart of it.

But now…quietly…and away from the headlines…

BRIAN CHU:

The dollar-based order

is FRACTURING

**Russia and China have almost completely dropped the dollar when they’re trading with each other. (Trade between the two increased EIGHTY-FOLD last year.)

**The French are now buying natural gas in Chinese Yuan.

**China is pushing the Saudis to sell their oil in Yuan.

**India is buying energy using the yuan and the rupee…while Russia is already trading with Turkey in Rubles.

**The Saudis are preparing to start selling oil for Yuan or Roubles. (Their bitter rivals, the Iranians, are preparing to do the same — which says a lot.)

**The Brazilian president even said explicitly: ‘Every night I ask myself why all countries have to base their trade on the dollar. Why can’t we do trade based on our own currencies?’

**China has even launched something called the Shanghai Petroleum Exchange — a place Arab nations can sell their oil…without ever using the dollar. It’s all settled in Yuan, China’s currency.

And Australia’s a part of this story, too.

Last year, we agreed to start selling China Iron Ore…settled in Chinese Yuan.

Everywhere you look…it’s the same story.

And none of it is happening by accident.

This is a clear, well-established TREND.

Powerful nations are turning AWAY from the dollar…and looking for alternatives.

Let’s be clear here…we’re watching the financial order that’s existed since the end of World War Two come to an end.

It’s already led to what one strategist called a ‘stunning collapse’ in global US dollar reserves.

The trend is clear.

Powerful, commodity-rich countries like China, Russia, Brazil and South Africa are seeking alternatives to the dollar.

The Chinese authorities have been selling down their American treasury bonds at a rapid rate — another way of exiting the dollar.

Source: Bloomberg, Apollo Chief Economist

And some have speculated that these nations will even CREATE their own currency to rival the dollar.

Early this year a Russian minister announced that:

‘We could introduce a new international payment and settlement instrument — a stablecoin pegged to gold — and offer it to all Asian countries.’

It’s certainly possible.

But trying to predict what the Russians or Chinese will do next is futile.

The truth is…NO ONE KNOWS what’s coming next.

Just as no one knows quite what the world will look like once American monetary dominance ends…there’s no way to know what ‘life after the US dollar’ will be like.

But all the evidence suggests it’s coming…and coming fast.

And THAT is why powerful nations are hoovering up as much gold as they can get their hands on

GREG CANAVAN:

Perhaps it’s no surprise the dollar’s dominance is coming to an end.

After all, as in life…nothing in the financial markets lasts forever.

And America hasn’t exactly been a careful steward of the world’s most important currency.

The US Government has borrowed an insane amount in recent decades…taking its debt to north of $30 trillion USD.

Source: TRADINGECONOMICS.COM | US DEPARTMENT OF THE TREASURY

That debt isn’t backed by real economic growth, either.

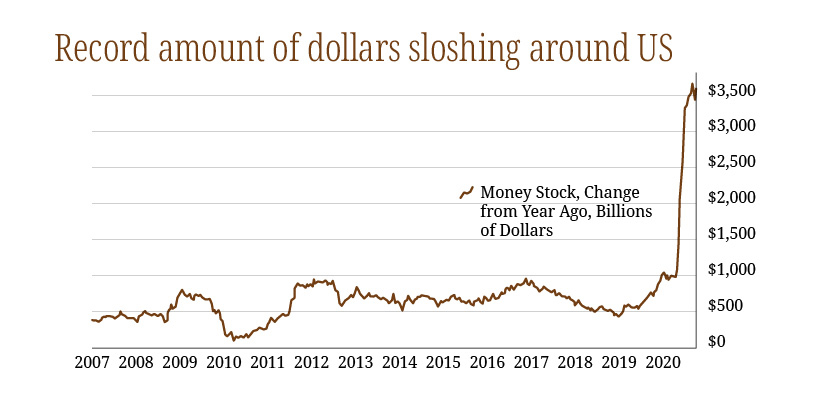

Much of it has been funded by a massive increase in money printing and currency debasement…

Source: RiskHedge

Add all that up…and throw in the fact the Americans are prepared to PUNISH their rivals for holding dollars…

And it’s not hard to see why nations are seeking an alternative.

On this point, the lessons of history are clear.

Gold is REAL money.

But it’s more than that.

Gold is power.

When the world’s financial system is being broken apart and remade anew…he who holds the gold has the power.

For instance, the US dollar became the world’s reserve currency at the end of the Second World War…when America had hoovered up half the world’s gold reserves.

Source: The World Gold Council

You can bet the authorities in Beijing, Moscow, Sao Paulo and Delhi understand this.

They may not know what’s coming next.

But they know they need gold to survive it.

BRIAN CHU:

Once you understand this…a lot of the gold buying we’ve seen in the last year makes total sense.

It’s why China is buying up billions of dollars of Swiss gold.

It’s why Brazil doubled its gold holdings.

It’s why Turkey bought more gold than any other nation.

It’s why India just bought 100 tonnes of bullion.

It’s why Singapore upped its holdings by 30% in a month.

It’s also why, at the ground level like we’ve seen in northern Ghana, COMPANIES are fighting tooth and nail — even outside the bounds of the law — to control new in-ground supply.

And it’s why overall gold demand is going ‘parabolic’, according to a recent report, hitting 11-year highs.

And here’s the really important part:

THEY’RE NOWHERE NEAR OVER.

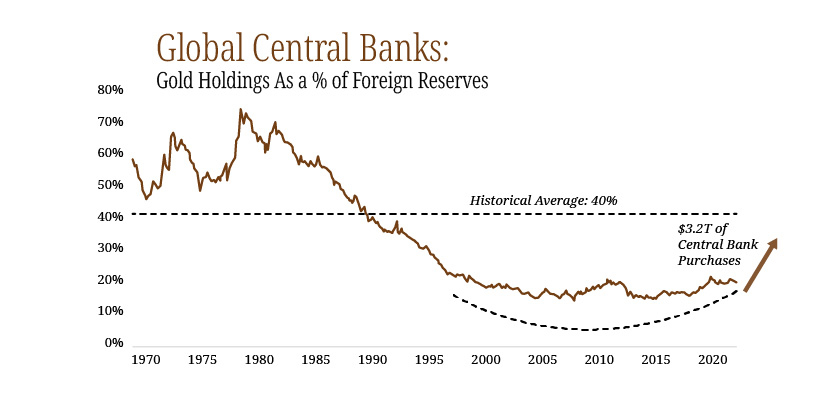

When you zoom out and look at how much gold central banks have historically held, you begin to see that there’s a lot way to go from here.

Just to get back to the historical average of 40% of foreign reserves, global central banks would have to buy another $3.2 trillion from here…

Source: Bloomberg, Tavi Costa

To put that into perspective, buying that much gold would mean locking up a QUARTER of all the gold ever mined in human history.

A bidding war like that — amongst some of the world’s most powerful nations — would have a huge impact on the price of gold.

And that’s just the world’s Central Banks.

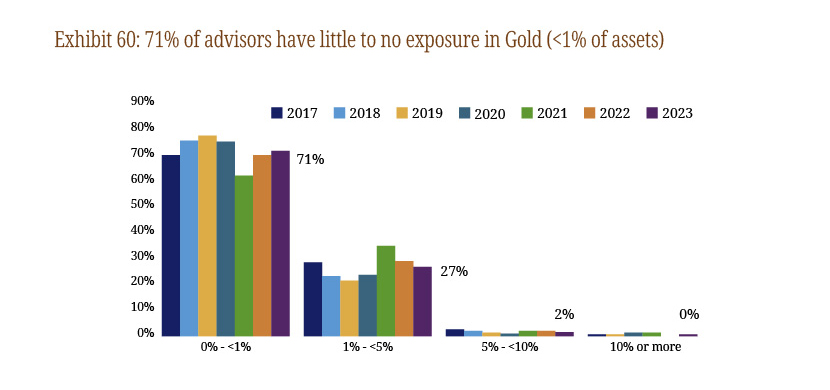

Institutional investors the world over are majorly underweight when it comes to gold.

According to one survey I saw, 71% of advisors have little to no exposure to gold.

Source: Bank of America Merrill Lynch — As of 9 March 2023

So there’s a lot of money on the sidelines, waiting to move into gold.

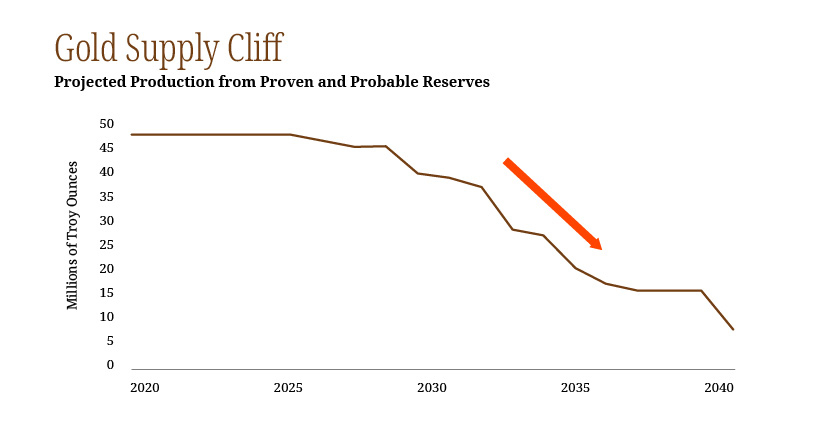

The big question we need to be asking ourselves is…is there enough gold to go around to meet this demand?

Look at the projected production from the top 20 gold producers and you see that the gold supply could fall off a cliff in the coming decades.

Source: S&P Global Market Intelligence

If demand for gold keeps going parabolic…and institutional investors bring trillions of dollars off the sidelines and into the market…just how expensive will gold get?

It’s hard to say.

But I believe a ‘scramble for gold’ like this DOES put gold-producing nations like Australia right at the heart of the story.

With 10,000 tonnes of gold under our soil and a well-established gold mining sector, we’re in the perfect position to capitalise here.

And that means YOU are in a perfect position, too.

In fact, I think there’s a huge opportunity on the table for Australian investors today — and I want to help as many people as possible take it.

That’s why I created a one-stop-shop guide for investors called ‘The Ultimate Australian Gold Gameplan’.

And I want everyone watching this presentation to download a copy today.

GREG CANAVAN:

Now, like I said before, no one can see the future.

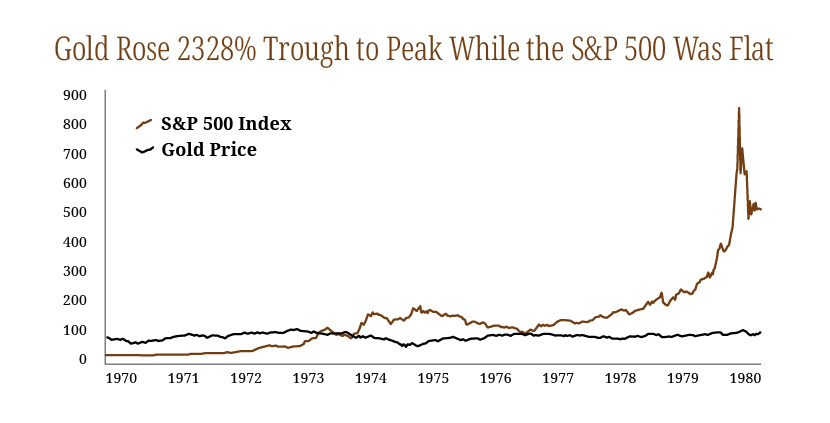

But the past DOES give us some clues as to how high gold COULD go if Brian’s right.

There have been two great gold bull markets in the last century.

The first came in the 1970s after Richard Nixon broke the link between the US dollar and gold.

In 1971, gold traded at US$35 an ounce.

By the end of the decade, it touched US$850.

That’s a 2,300% return inside a decade.

At the same time, the US stock market was flat.

Source: Deutsche Bundesbank Data Repository

The next bull market came between 1999–2011.

This time around, gold rose 700%.

In other words: when gold gets moving…it often rises further and faster than people expect.

According to our colleague and internationally respected gold expert Jim Rickards, these past bull markets hold a clue for what could be next.

’Rickards said recently:

‘I would put gold at $15,000 an ounce before 2025,’

‘If you just take the average of the prior bull markets… you would say the next bull market is going to be a little over 10 years and it’s going to go up 1500%.’

In Aussie dollars, that’d imply a price of more than $20,000 for a single ounce.

That’s nearly a FOURTH of the average Australian annual salary…to get just one ounce of gold.

A move like that could price many regular investors out of the market for good.

It’s a bold claim to make.

But we certainly can’t rule it out.

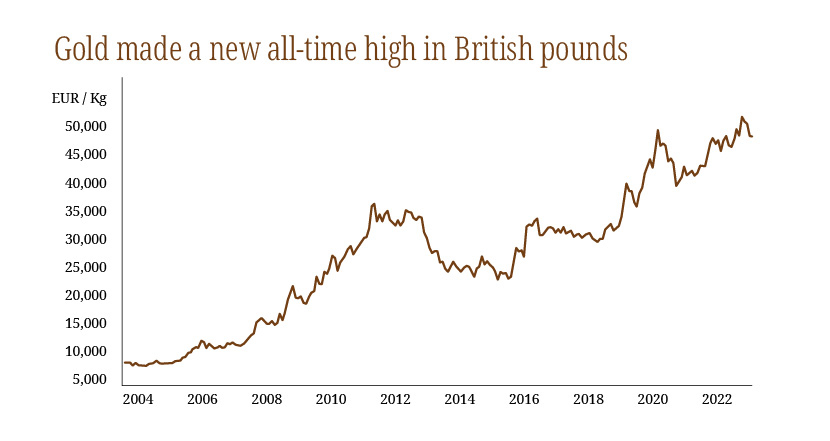

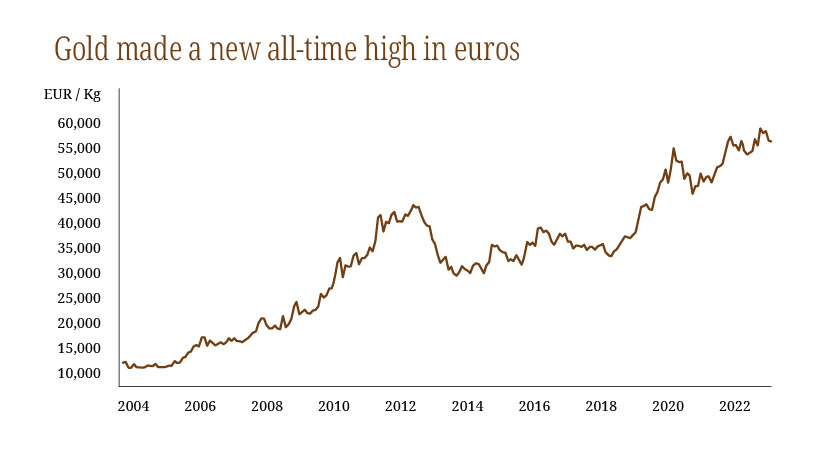

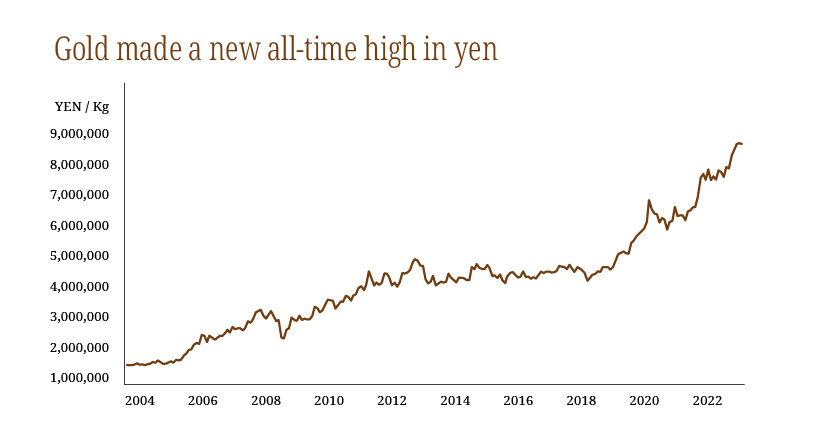

Especially when you consider the fact that in many major currencies it’s ALREADY made all-time highs this year:

In Aussie dollars…all-time highs this year:

Source: The Melbourne Gold Company

In British pounds…all-time highs:

Source: BullionVault

In euros…all-time highs:

Source: BullionVault

In Yen…all-time highs:

Source: BullionVault

If Brian’s right, it won’t be long before we see gold get VERY expensive in US dollars, too.

And that’s where the report Brian’s created for you, ‘The Ultimate Australian Gold Gameplan’, comes in.

BRIAN CHU:

There’s a right way to play a gold bull market…and a wrong way.

Most people will take the wrong route.

They’ll come to the market LATE…and they’ll SPECULATE wildly to try and get caught up.

It’s always the way.

Just look at the frenzy we saw around cryptocurrencies.

Most people only got interested AFTER prices had gone up thousands of percent.

By then, cryptos were in the news and it seemed like every taxi driver or barman had a tip to share.

We haven’t reached that point in the gold cycle…yet.

But I reckon we’ll get there.

And I’m willing to bet THAT is when a lot of people will decide it’s time to get in.

That’s a big mistake, in my book.

So I’m offering people a much smarter route.

A way of building a REALLY high-quality gold portfolio, designed to help people profit from a rising gold price.

The good news is, Australia is arguably the best place on the planet to do this.

Gold is in our DNA — and has been for centuries.

In fact, without gold…Australian history could have taken a very different course.

The gold rushes of the 1850s saw millions of people emigrate here, looking to build a better life.

In the two decades after we struck gold, the Australian population QUADRUPLED.

More than anything else, it was GOLD that helped set our country on its path.

We still live with the aftereffects of that today.

In Perth, we have one of THE most respected gold mints in the world, producing a million ounces of high-quality Australian gold every year.

But gold isn’t just a part of our past.

It’s going to play a huge role in our FUTURE, too.

We’re the world’s second-largest gold producer, accounting for 10% of global production (only China produces more gold than us).

And it may not be long before we’re #1.

Because we also have more known gold resources than any other country in the world.

The latest estimates suggest there are TEN THOUSAND TONNES of gold buried under Australian soil.

That’s a fifth of all known gold reserves on the planet.

By the way, at gold’s recent high of AU$3,000, those gold reserves would be worth $960 BILLION.

We’re literally walking around with buried treasure beneath our feet.

And we’re perfectly placed to exploit these resources.

The Aussie gold industry here is HUGE.

But not just that.

It’s teeming with smart people, innovation, state-of-the-art technology and more.

Some of our world-class miners are worthy of investment, even when the market conditions for gold aren’t all that favourable.

But in a market that looks like it’s getting ready to soar?

Believe me, there’s no better place to invest in gold than right here in Australia, right now.

GREG CANAVAN:

Yet despite all of that…it appears many Aussies are behind the curve when it comes to owning gold.

Our Central Bank holds just 79 tonnes of gold — less than Libya, Iraq, Venezuela and Thailand.

In fact, even a country like Portugal holds FOUR TIMES more gold than us.

It looks like it’s the same story on a household level.

In 2019, an Association of Superannuation Funds of Australia report found that as little as 0.1% of Aussie Super funds have gold exposure.

That figure is four years old.

But even if it’s grown TENFOLD since then, you’re still looking at just 1% of Aussie Superannuation funds holding gold.

And you certainly won’t hear your financial advisor telling you to buy some!

BRIAN CHU:

It won’t surprise you to hear that I think every Australian needs to seriously consider holding gold.

It’s the oldest and safest form of money there is.

It’s a great hedge against crisis and uncertainty.

You only have to look at the HUGE amount of gold Central Banks have bought in recent years to see that.

But just holding gold bullion misses the biggest opportunity here.

It means you’d miss what could be some of the bigger, faster gains of the bull market.

To capture them, history tells us you have to look beyond bullion…and consider swiftly building a portfolio of other gold investments, particularly certain gold miners primed to move higher…

And that’s not easy. Nor is it risk-free. Gold mining stocks are speculative and can be highly risky. They can fall just as dramatically as they can rise.

But when the conditions are right…they can help you RAPIDLY build wealth, at a time when other investments suffer.

The last big gold bull market — between 2008-11 — proved that emphatically.

Coming out of the Global Financial Crisis, gold nearly doubled — it rose 94% in three years.

But the ASX Gold Index more than doubled that return — it rose 206%.

And some of the top-performing gold STOCKS I study went up much more.

Northern Star Resources [ASX:NST] rose 3,079%

Perseus Mining [ASX:PRU] went up 1,566%

Kingsgate Consolidated [ASX:KCN] rose 452%.

Saracen Mineral Holdings [ASX:SAR] rose 1,566%

Tyranna Resources [ASX:TYX] shot up 1,161%

And Regis Resources [ASX:RRL] went up 5,185%

Now, there’s no guarantee that those historical examples will be repeated. And of course, not all gold stocks performed like these. You should not speculate on these types of stocks with money you can’t afford to lose.

But I share those numbers to underline my point:

When the conditions are right, the Aussie gold sector can rise HARD and FAST.

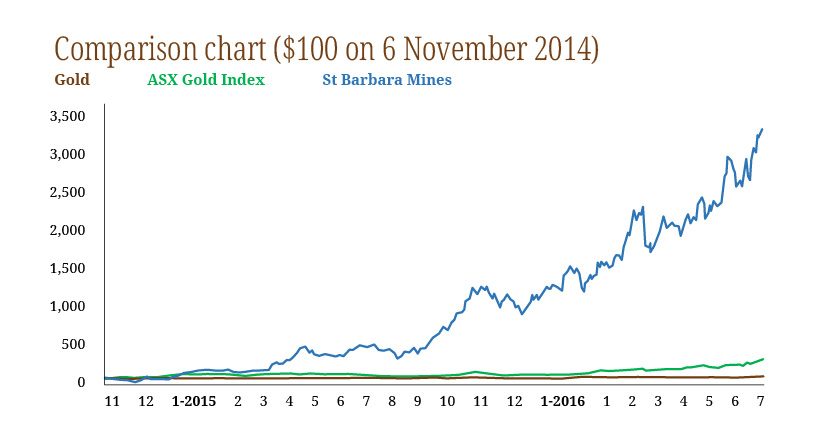

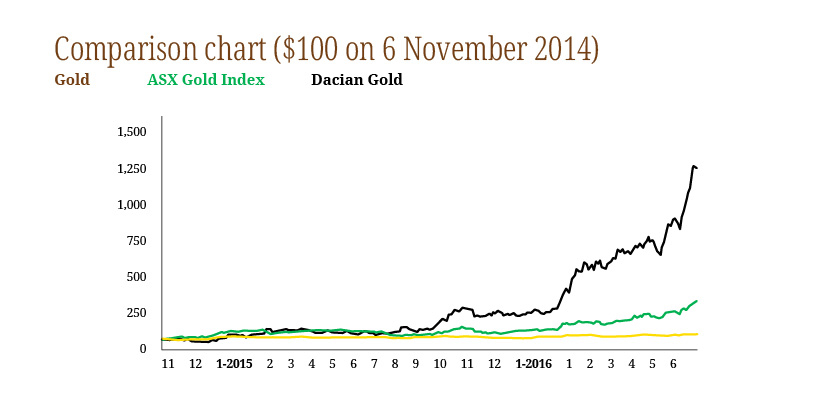

It happened again between 2014–16.

While gold only rose a modest 38%, stocks like St Barbara [ASX:SBM] or Dacian Gold [ASX:DCN] absolutely blew the index out of the water.

Source: Thomson Reuters Refinitiv Datastream

Source: Thomson Reuters Refinitiv Datastream

Why?

Because certain gold stocks are EXTREMELY sensitive to even small moves in the gold price.

So when gold goes up say, $20, $50, $100...certain stocks can go up 20%...50%...100%, or even more.

That’s what I love about trading these stocks in a big, gold up-cycle phase.

The basic setup is really easy to grasp.

Gold moves up.

Certain gold stocks move up higher.

We’re lucky to have extraordinary, world-class companies like Chalice Mining here in Australia.

And at a time like now, I think it’s CRUCIAL you have exposure to stocks like these.

In fact, I can’t remember a better time than right now to load up on gold and a handful of specific speculative gold investments.

That’s why I’ve put everything you need to know to capitalise on gold in a brand-new report called: ‘The Ultimate Australian Gold Gameplan’.

This report contains my personal gold investing plan, designed to help you make the most of this gold bull market before gold gets any more expensive.

This is based entirely on the same ideas I use to manage my own gold portfolio.

Get this report, and you’ll learn all about...

- How to buy and store gold the SMART way. When you’re buying gold — whether that’s bullion, coins or any other physical asset — there are a few golden rules you need to stick by to make sure you get it right. I’ll talk you through how and where I buy my own gold — so you can buy like a pro.

- The simplest, safest way to buy physical gold — without having to store it. Setting up a private vault or safety deposit box isn’t for everyone. But the good news is, there are some really quick and easy ways to get physical gold exposure without ever worrying about that stuff — I’ll talk you through your options.

- How to buy physical gold through the stock market. If you have a share dealing account, it’s really easy to get exposure to both physical gold AND Australia’s top gold mining stocks, without ever having to buy shares in them directly. I’ll walk you through how it’s done.

- Two ‘Core Gold’ plays to add to your stock portfolio…One play I’ll show you has grown its resources by 300% and tripled its reserves since 2011…owns four major gold mines…and pays a healthy dividend — so you get paid to own it. The other is deeply discounted against its peers — I think it’s going cheap — yet it just had a series of strong drill results.

- My #1 Aussie ‘Rising Star’ gold play for 2023. My final pick for you is smaller…riskier…but with vast potential upside. Right now, it trades for less than $1 billion. So it’s on the smaller side. But it’s due to DOUBLE its annual gold production in the next two years. That creates opportunity — and makes this third play a great speculative gold play for 2023.

There’s more, of course.

But that’s just a taste of what you’ll discover when you download a copy of ‘The Ultimate Australian Gold Gameplan’ today.

I’m biased. But I think it’s a terrific way for someone who doesn’t have a lot of knowledge or time, to take an informed position in the gold market.

GREG CANAVAN:

So why exactly should you listen to Brian?

It’s a fair question.

And one that’s easy to answer.

Brian’s the founder and manager of his own private family fund, The Australian Gold Fund — one of the only investment funds in the country dedicated solely to gold mining stocks.

He’s also spent more than 16 years in the higher education sector teaching finance, statistics, accounting, economics, and risk management.

Since he started buying and selling gold stocks, Brian’s numbers have been up there with the best.

- His private family gold fund has beaten the ASX Gold Index since 2015…

- In fact, in that time it’s more than tripled the return of the index…

- And it made TEN TIMES more than the index between 2019–2022 when gold broke out.

EVEN MORE impressive is that Brian started The Australian Gold Fund with his own family’s money.

But most importantly, since 2021 Brian has been sharing his expertise with private investors like you.

A quick look at what they have to say shows you — Brian is the real deal.

‘His insights & recommendations into the gold market are in my opinion absolutely spot on especially seeing that the gold prices have seen so much volatility in the past two years plus.’

— Mike H M

‘Being a miner for 20 years think I have a good understanding of the industry. Your information is cutting edge and rewarding.’

— Pete

‘Your investments are in sound, experienced hands with Brian Chu's deep knowledge of the gold markets.’

— Anne

‘I like Brian's honest and informative' no BS way of communicating. He gets to the point and doesn't build flash hopes.’

— J R Daniel

‘Brian Chu's expert and micro knowledge of Gold Stocks is exactly what I need to help improve my active Gold Sector Investing.’

— Spiro

So how can you access Brian’s work?

Well, the report Brian just told you about — ‘The Ultimate Australian Gold Gameplan’ — is a great starting point.

But it’s just that.

A start.

Brian wants to go much further than that — and take a look at his gold and mining-focused newsletter...called The Australian Gold Report…in which you’ll get ongoing analysis and recommendations designed to help you capitalise as this story plays out.

If you’re into gold...and want to know how to potentially make money from it... you’ll love Brian’s research.

And if you’re just starting out on your journey in gold…this is the place to do so too.

Put simply, it’s your one-stop shop for understanding and investing in the gold market.

Whether you’re new to gold — and you want to buy your first bullion or coins…

…or whether you’re looking for expert insight to build a high-quality portfolio of Australian gold stocks…

Brian is your man.

When you sign up, you’ll get instant access to:

- Your copy of ‘The Ultimate Australian Gold Gameplan’, which shows you a quick way to construct a gold investment portfolio. You’ll get your copy as soon as you sign up.

- Full access to The Australian Gold Report portfolio — including Brian’s entire buy list of Aussie gold stocks. This is a core mission of this advisory — to show you precisely what to buy to potentially profit from gold. When the opportunities present, Brian will add new picks, share his full research on what’s going on, and explain why he thinks you should buy.

- Quarterly Market Reports — four times a year, Brian will share a ‘big picture’ review of how the market and the portfolio are performing, alongside updated advice on the best course of action to take.

- Regular portfolio updates — once a stock enters the portfolio, Brian will keep you right up to date with it. He’ll share any important news and give you specific buy, sell and hold advice — so you always know exactly what’s going on and what you need to do.

Brian Chu

The Australian Gold Report

Plus, there are several special research reports you’ll get access to when you sign up:

- SPECIAL REPORT #1: Unveiling the VPM Filter. In this report, Brian will share a tool he’s developed to help you value gold stocks — and make the right decisions with your gold portfolio as a result. He calls it the VPM filter, which is a ‘secret weapon’ he’s used to help his private family gold fund outperform the ASX Gold Index since 2015.

- SPECIAL REPORT #2: How to ‘Read’ the Gold Market. In this report, Brian will reveal to you a recently developed tool to help you allocate your precious metals portfolio between gold stocks and precious metals ETFs. Within the gold price cycle, there’s a time when one will deliver better returns than the other. The ‘Gold Stocks Valuation Index’ will provide a simple interpretation of how the market is performing to help you best position your precious metals portfolio.

In other words, if you’re interested in gold...or thinking of diversifying...

...or you just want to know how to seed your money in what could be the biggest gold bull market of all time.

…then I’d urge you to make The Australian Gold Report part of your regular reading.

And the last thing you need to worry about is the price. A one-year subscription costs just $199.

But sign up today and you can get your first year for a discounted price of just $99.

That subscription fee is FULLY REFUNDABLE for the next 30 days. So if you’re not DELIGHTED with Brian’s work, you can walk away, no questions asked.

That’s a very fair offer.

And all you need to do to accept it is click on the button at the bottom of this page.

You’ll be taken to a secure order form where you can start your subscription right away.

My suggestion is, with gold demand at an 11-year high and Central Banks piling in — it’s time to make your move. Click that button to get started.

BRIAN CHU:

This isn’t a story that’s going to play out in five or 10 years.

It’s not a ‘tomorrow’ story at all.

It’s playing out TODAY — right now, in front of our very eyes.

Central Banks are ALREADY buying gold at their fastest pace in half a century.

Gold demand is ALREADY at an 11-year high.

Gold is ALREADY making new all-time highs in Aussie dollars, as well as pounds, euros and yen.

And a whole laundry list of countries — China, Russia, Brazil, India, Saudi Arabia, Iran, South Africa — are all openly discussing ditching the US dollar.

We’re watching the dollar-based order fall apart before our eyes.

This is a MOMENTOUS EVENT.

It’ll probably never be repeated in our lifetimes.

And it presents a huge opportunity for Aussie investors.

I think it’s a chance to build real, lasting wealth as gold gets ever more expensive.

That’s why I invest my own family capital in gold.

And it’s why I’m urging everyone watching at home to give The Australian Gold Report a try today.

How long before everyone you know is talking about gold being in a bull market (like we saw with Bitcoin [BTC] in 2017)?

If I’m right, I think people will kick themselves if they have a chance to be early…but miss their shot.

That’s what’s really on the table today.

A chance to be EARLY, be SMART and set up some potentially SIGNIFICANT returns down the line.

GREG CANAVAN:

One final reminder:

You can start your subscription to The Australian Gold Report by clicking on the button directly beneath this video.

As I said, your subscription is FULLY REFUNDABLE for the next 30 days.

And you get instant access to everything mentioned above.

The move into gold has begun.

If Brian is right, now is the time to capitalise.

And he wants to help you every step of the way.

Hit the button below now.

Thank you for joining us — and we’ll see you on the inside.

(You can review your order on the next page)