It’s hard to pinpoint an exact time this phenomenon began…

But 15 March 2017 is as good a date as any…

On that day, an obscure ASX small-cap called Stemcell United became an overnight 80-bagger.

Two days prior, its shares traded at 1 cent.

By 15 March, Stemcell United had hit $1.09.

This was a worthless company.

Doing nothing of substance…with a market cap smaller than the valuation of some houses I’m looking at from my office window right now.

Somehow, though, Stemcell United catapulted 8,284% in two days.

Why?

On 14 March, the company released an announcement:

‘SCU to pursue opportunities in Medicinal Cannabis sector.’

Pot stocks. Remember them?

The mania du jour seven or eight years ago.

Not just here, but all over the world.

While cryptocurrencies were having their first proper boom…cannabis equities were dazzling stock investors.

Many of these companies, like Stemcell United, had done nothing in the real world to further their positions.

SCU’s stock went from zilch…to viral…to ballistic…on the mere possibility it might enter the medical marijuana space.

As we remarked at the time in Money Morning…one of the daily e-letters I publish (emphasis added):

‘Take note people, they don’t have anything to do with this sector yet. Just the idea that they might sent this stock price nuts.

‘It’s not the only one, we might add. There seem to be more companies announcing they’re thinking about getting into medicinal marijuana than companies actually involved in the industry.

‘It absolutely feels like worthless companies are jumping on the bandwagon to boost their share price.’

Weird, right?

An outfit with zero wins on board rising 8,000% in 48 hours?

The marijuana boom blazed up. Then out.

Today, many of those same equities trade for zilch again…or no longer trade at all.

But…

If you bought the right ones and sold at the peak of the viral mania?

You stole away with an absolute fortune.

For instance, Cann Group floated on the ASX to much fanfare for 30 cents on 4 May 2017.

Within seven months, its shares traded more than $4.

Today? You can pick one up for 16 cents.

It’s these kinds of explosive up-down moves we’re about to put under the microscope.

Because while pot stocks may have receded into the background…

The new evolution in speculative investing that arose around the time pot ‘popped’ has stuck around ever since…

We’ve been tracking this curious shift in investor psychology for some time. And, on occasions, helped our subscribers profit directly from it.

Tik Stock booms ‘occur swiftly as mainstream and social media begin to cover the news about a new, innovative industry’.

‘It can't last. But it's a great time to make money, provided you prepare for the next phase…’

Thomas Carroll,

Stansberry Research

Today, for the first time, we give this phenomenon the name it deserves. It’s the perfect moniker for a new approach to the very smallest stocks on the market.

Ephemeral…

Tech-assisted…

Chatroom-fuelled…

No-fee, broker-enhanced…

Semi-addictive…

…and driven…for better or worse…by the shortening attention spans of the human race.

We call them:

TIK-STOCKS

Manias are as old as markets themselves.

All you need is a shiny new thing. With the added ingredients of hope, greed, and exponential potential.

But since around the middle of the last decade, these brief feeding frenzies appear to have sped up…

Like I say, we’re now calling this evolution Tik-Stocks.

TikTok, in case you don’t know or care about such things, is an app that lets users share short videos. It has more than a billion monthly users.

Tik-Stocks have nothing to do with TikTok specifically.

Or social media…or even tech stocks.

It’s TANGENTIALLY related to ‘meme stocks’, which became a big thing during the pandemic.

Meme stocks were companies that got crowd attention from traders on Reddit and other social media sites in 2020 and 2021. These were often BIG companies like GameStop, AMC Entertainment, and Bed Bath & Beyond.

Facebook and Twitter communities banded together to use their influence to initiate ‘short squeezes’ on household name blue chips.

That’s not what we’re talking about here, however.

Meme stocks were more about trolling Wall Street than making true money.

Tik-Stocks are something very different.

They share two characteristics with meme stocks though.

Social media is integral.

As is a new demographic of younger investors.

Both of those things are supercharging the Tik-Stock phenomenon.

‘Next big things’ seem to be coming with more ferocity and frequency than at any time in the history of stock markets.

The potential upside — if you get your timing right — can be jaw-dropping.

The potential downside — if you hang on too long — can be devastating.

Hedge fund manager Whitney Tilson famously called the top of the first Tik-Stock rally in cannabis.

He highlighted a company called Tilray with shares at $300 in September 2018.

12 months on, its shares had cratered 90%. And ultimately fell by 99%.

So, it goes without saying, you should treat the five stock selections we have for you today with extreme caution.

They play into TWO emerging Tik-Stock booms.

One that is starting to crest right now. And one which several key investment ‘influencers’ are signposting for 2024.

What do I mean by that term?

As The Wall Street Journal puts it: ‘The New Stock Influencers Have Huge — and Devoted — Followings’:

‘Stocks surge on tweets from the likes of Elon Musk, Cathie Wood and Chamath Palihapitiya.’

These guys don’t know everything.

But their actions and utterances DO now have a massive impact on which segments of small caps go up really fast.

Each of the five ‘Tik-Stocks’ we cover here have these guys fluttering and tweeting near them.

This will be all about reading where the winds are blowing.

Picking the right companies.

And, most importantly, timing.

Knowing when to enter…but also when to get out.

In short:

What follows is for super-speculators only…

But you must have noticed this new ‘hype-cycle’ uptick yourself, right?

One minute, cryptocurrencies are the investment world entire.

Then in a flash…cryptos are for idiots only.

And lithium stocks are what it’s all about.

Blink…and, no, that’s already over…lithium is yesterday’s news.

Now it’s artificial intelligence, baby! As Salon just put it, AI stocks are now having their ‘Tulip mania moment’.

It never used to be this way, did it?

Sure, there were always booms and busts. But never on a six-monthly basis!

Economics used to teach that stock markets exist to facilitate raising capital so that companies can grow.

In today’s investment world…it feels like stocks are there purely to provide you with constant dopamine hits.

James Woodburn

Just like TikTok…

My name is James Woodburn, head of Fat Tail Investment Research.

As an independent financial publisher, we try…with varying degrees of success…to look at the investment world from the outside.

With a sceptical eye. Like advanced aliens might be tracking Earthlings from afar, right now.

In what follows, we’re going to dissect this Tik-Stock phenomenon.

Forbes’ John Koetsier famously called TikTok ‘digital crack cocaine for your brain’.

‘Prices are not tied to sober reflections about their issuers’ prospects…

‘…but rocket up and down based on internet-fueled speculation.’

Pulitzer Prize-winning

journalist Michael Hiltzik

We’ll look at how Tik-Stocks have become the investment equivalent.

Where ‘influencers’ range from traders and Reddit bloggers to Elon Musk herding followers from one fad stock to the next with a tweet or a post.

We’ll give a theory on why this trend seems to be accelerating.

Even while wider markets remain volatile and worried about things like inflation and interest rates.

And…

We’re going to make some Tik-Stock predictions of our own for 2024.

Before we get those picks, though, let me give you a quick timeline of how we’ve tracked this over the last eight years…

A potted history of Tik-Stocks

From pot way back then…to AI right now

Around the same time as marijuana blew up, a parallel mania was developing in the tech space:

Blockchain stocks…

These crypto-adjacent stocks emerged with pot as the forerunners of the Tik-Stock phenomenon. And like marijuana, we had a jump on the crowd with this one, too.

As we wrote to readers back in 2015:

‘There’s a piece of technology you should get to know. This tech is only about five or six years old now. That makes it new, confusing, exciting, scary, and a huge opportunity.

‘But not everyone is quite sure what to make of it just yet.’

We had an analyst ahead of the curve here, and got readers early stakes in blockchain adopters like Yojee [ASX:YOJ].

Yojee went from 3 cents in 2015 to 32 cents by 2018.

But then the crypto boom fizzled. Concerns about regulatory issues and the sustainability of blockchain-based business models brought investors back down to Earth.

Yojee is now trading back at 3 cents.

Other famous blockchain Tik-Stocks included Riot Blockchain, Long Blockchain, and Overstock.com — each absolutely smashed it in 2017 and early 2018…then followed Yojee back down again.

Chipmaker stocks…

Around the same time, the viral crypto-blockchain frenzy bled into chipmaker stocks.

The surge in cryptocurrency ‘mining’ — the process by which the blockchain is kept accurate — meant a surge in demand for special microchips.

A swirl of other timing factors supercharged the mania: soaring demand for devices, the viral trend of the Internet of Things, a bunch of supply constraints, and trade tensions.

And…just like a TikTok dance craze…the chipmaker frenzy spread among investors like wildfire.

Five of the top 15 performing stocks in the first half of 2017 were chipmakers.

For a brief time, sharpshooters who picked correctly cleaned up.

For much of the 2010s, you could buy shares in Archer Materials for less than 20 cents. At its chip-mania peak, it was $2.37.

Clean tech stocks…

This is an interesting one.

When we launched our financial research business in Australia in 2006, the pro-environmental movement was hitting the investment markets for the very first time.

Billionaire T Boone Pickens made his fortune in the Texas oil business. But in the mid-2000s, he pivoted to green energy.

It kicked off one of the first ‘manias’ we helped our readers navigate here in Australia.

For instance, in March 2007, we recommended a company called Dyesol — the first company in the world developing prototype dye solar cells.

Six months later, the stock was up 190%.

But this was pre Tik-Stock days…

Twitter and Reddit were unheard of, barely one year old. TikTok itself wouldn’t exist for another 10 years.

Clean tech had another go around in 2019, but this time, in Tik-Stock world…

That year, social media channeled our attention spans from semiconductors to Greta Thunberg and the ‘Green New Deal’.

Current tweeter-in-chief Elon Musk is perhaps the spiritual king of Tik-Stock world. And he was a huge driver of the 2019 mania. His company Tesla saw its stock price soar as demand for electric vehicles continued to rise. NextEra Energy was another big hitter that led the way.

For a fleeting moment, much smaller renewable energy stocks became all the rage again too. But this time, the gains were enhanced, with companies like solar player Enphase Energy blowing up by 466% within 12 months.

That didn’t last though. Thanks to an outbreak in Wuhan, a new Tik-Stock trend replaced it that was ‘viral’ in more ways than one.

Pandemic stocks…

It was the perfect recipe for a Tik-Stock boom.

A bunch of bored, stuck-at-home investors…many of them quite young…many with stimulus cheques and nothing much else to do…

…and a host of companies big and small that benefitted from all this: e-commerce, remote work, home fitness, streaming services, healthcare…

Again, bigger companies kicked it all off: Moderna, Netflix, Domino’s, Zoom, Carvana, Peloton.

All of these hit massive highs in 2020/21…and all of them have crashed back to Earth since.

Carvana reached a ceiling of — wait for it — $360 in August 2021.

Today it trades for $9.

A brutal example of the Tik-Stock phenomenon at its most merciless.

Metaverse stocks…

This came and went fast, even by Tik-Stock standards. As we wrote to readers at the time:

‘The metaverse…

‘An emerging trend riddled with misinformation. Titanic amounts of VC money. Power grabs. And…recently…fickle investors getting cold feet.’

As quick as the meta craze was…you still could have made impressively quick gains…if you timed it right.

Aussie game developer PlaySide Studios went from 27 cents to $1.19 in eight months. Pretty much solely on journalists hinting they MIGHT have something to do with the metaverse at some stage…

Vection Technologies was named by the Australian Financial Review as ‘the purest metaverse play’ on the ASX at the time.

Its shares traded at 2 cents in 2020.

Jumped to 28 cents by November 2021 (a 1,400% gain).

And…in true Tik-Stock fashion…traded back under 5 cents at the time of writing.

You could almost feel sorry for the CEOs of these companies.

No sooner were they making expansion plans and booking round-the-world trips for their families…the rug was pulled.

The metaverse’s biggest proponents started scaling back or shutting down spending on their meta visions.

Investors went searching for the next thing.

Even Mark Zuckerberg, who arguably kicked off the mania with his Facebook rebrand to Meta, has since shifted focus to something else…

Artificial intelligence.

You’re well aware of the hype so far. In fact, you’re witnessing a Tik-Stock boom in its earliest stages…in real time.

This year, we’ve seen the large, most-obvious AI plays like BigBear and SoundHound go from 63 cents to more than $6…and $1 to $4.60…both in less than three months.

But where does it all go next?

We’re about to share TWO plays with you…

At present, a lot of the players touting proper AI technology and machine-learning advancements are the big guys: Microsoft, Alphabet, Nvidia, and Adobe.

Same deal at the early stages of the blockchain, chipmaker, and metaverse Tik-Stock booms. The big guys make the first moves.

These are the purest plays. There’s upside there, maybe. But only briefly, and not a heck of a lot given their size.

What comes next are the smaller companies jostling onto the bandwagon.

Sometimes these guys are sheer opportunists — like a little no-name game developer changing their name to include ‘Chat’ in it to catch some of the viral buzz.

But there are other genuine outfits out there who have been working on their own disruptive take on ‘generative AI’ for years.

Will their techs win? Will they seriously change the game? Will they even be around in five years?

That’s not our area of concern today.

The immediate point is…

If previous Tik-Stock cycles are anything to go by, these are equities that could appear out of nowhere…on small-cap indices all over the world…to potentially turn in the kind of gains we’ve been talking about over the next few years.

Which brings us to:

TIK-STOCK PREDICTION #1

In 2024, the viral attention on artificial intelligence will migrate here…

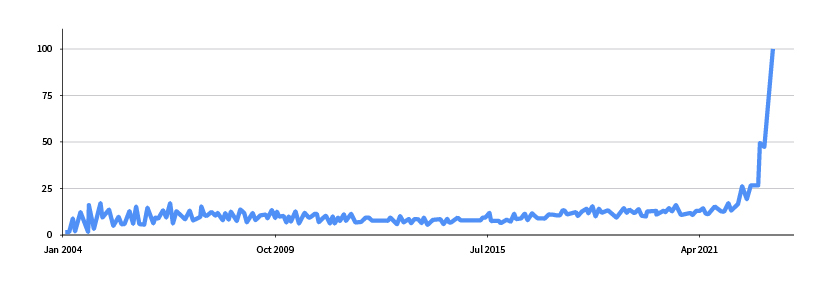

Have a look at this:

Source: Google

It’s a chart of Google searches for AI dating back nearly 20 years.

What you’re looking at here is a plain visualisation of the Tik-Stock phenomenon in action.

Nothing until this year. Then…WHAMMO!

‘AI is at an inflection point,’ claimed Business Insider on 26 April 2023.

It’s going to tap into a US$6 trillion motherlode market.

And ‘accelerate digital acceleration and tech diffusion’ like no other disruption history.

To anticipate which small AI stocks could go ballistic in 2024, it pays to look at what the ‘influencers’ are doing.

As Justin Anderson of Moneywise puts it:

‘Average people looking to successful investors and entrepreneurs for market advice is hardly new. Plenty of folks swear by Warren Buffett’s legendary market advice, and other personalities like Suze Orman and Jim Cramer also draw hundreds of thousands of eyeballs every for every proclamation.

‘But social media has given rise to a new version of this phenomenon. Some, like Musk, are titans of industry themselves. Others are fund managers, venture capitalists or even media personalities.’

These key players are following the money here.

Musk himself just incorporated a new company called X.AI into his holdings in April. He’s planted his flag.

Rockstar tech investor Cathie Wood’s Ark fund is now going full force on AI…

…saying you’ll be in ‘pole position’ if you invest now…

…and ‘companies that utilize AI with large data sets will control the future’.

But let’s be real here.

This is the same Cathie Wood who was saying, not that long ago, ‘the metaverse could be worth trillions and will affect the world in ways we cannot even imagine right now’.

Wood and her Ark Invest fund hemorrhaged big time last year.

But you have to say this for her…

She’s SUPREMELY AWARE of the Tik-Stock phenomenon we’ve been talking about. And how to work it.

The plain fact is this:

Cathie Wood and Elon Musk are going public on AI in mid-2023…

…right after Google, Microsoft, and China’s Baidu have made big AI announcements in the last few months.

This is all following the pattern of Tik-Stock trends’ past.

And it’s a decent (not foolproof, but decent) indicator of what comes next: serious capital inflows from obvious software plays into ‘fringier’ AI small caps.

We’ve pinpointed two ASX-listed stocks

to potentially profit from this…

The AI buzz has eluded them so far.

That makes them a big risk.

But these two unknowns also tick a whole bunch of categories for the kind of fringe plays that often get swept up as these booms reach a crescendo.

We’ll tackle these AI stocks first.

Then project a little further out…

We’ll look at a second NEW Tik-Stock trend we think could take up the baton from AI at some point in 2024.

Right now, there are small signs it’s preparing to invade our collective consciousness in 2024.

And that the same ‘market makers’ who have driven each Tik-Stock trend of the last eight years are preparing to shift their chips to this. Sending a ‘wall of money’ into certain as-yet untouched companies.

Which companies?

We have THREE mega-early, front-run stock plays for you here.

But first, the more immediate Tik-Stock trend…AI.

This is all about catching momentum.

Of course, the concept of buying stocks purely based on momentum is nothing new.

‘It’s always a smart thing to be early into a momentum trade,’ says Susan Webber of Naked Capitalism.

‘Everything trades on momentum and not on fundamentals.

‘And if you’re early on a trade you’re going to win, and therefore people are encouraged to pile on. They think they’ll be smart enough to get out before they’re burned.’

The difference now is this whole process has had gasoline poured on it.

It’s no coincidence all these booms are coming thicker and faster.

So, the million-dollar questions are…

Where’s the biggest AI momentum going to come from going forward?

And which small stocks have the greatest potential to capture it?

As with previous Tik-Stock booms, we’ve assessed that the best upside will come from less obvious stocks that are GENUINELY ADJACENT to the trend.

What happens next with AI Tik-Stocks?

We actually have a roadmap to follow here.

In the middle stages, which we’re getting to with AI, attention in both the blockchain AND metaverse manias switched to medical stocks using both those techs.

Whether it was right or wrong in retrospect is by the by.

It’s just what happened.

Stocks bringing blockchain to healthcare like Teladoc Health and Patientory shone bright in 2017/18.

And even with the metaverse remaining largely science fiction, medical stocks with a whiff of exposure there saw brief but massive gains in 2020 and 2021.

Idexx Laboratories more than doubled.

Avantor is nearly 120 years old and spent most of that time as a chemical company. Yet, it somehow got itself into the conversation of metaverse healthcare…and jumped from $10 to $42 off the back of it.

Past performance is not a guide to the future, especially with these kinds of plays.

But if you’re a betting person, it could be a very smart move to put some chips on medical AI stocks following a similar pattern into 2024.

But who?

If you Google medical AI in the coming months, it’s a good bet you’ll see two types of headlines appear with increasing frequency.

Ones like this:

‘Generative AI in Healthcare Market Set to Reach a Valuation of USD 17.2 Bn by 2032 | Data Analysis by Experts at Market.us’

And ones like this:

‘AI Chatbots Can Diagnose Medical Conditions at Home. How Good Are They?’

What you won’t find…yet…are the names of the two Tik-Stock plays we’re backing here.

In the modern medtech space, a growing number of bit players are scrambling to incorporate some form of AI into their products and services.

But these two stocks are not in the conversation…yet.

That’s why’re so cheap.

‘The future of healthcare will take us to a place where increasing numbers of routine medical decisions are being made by AI alone.

Big Think, 27 April 2023.

They’re not chat-based AI projects looking to replace medical doctors — many of those stocks have already received attention since the pandemic.

In fact, our first move is not even being directly attached to AI in a material way. But our bet with this stock is that the link is going to be made soon…

At a $190 million market valuation…that makes them very small players.

But moves are afoot with these ASX-listed guys. And they have all the hallmarks of picking up AI Tik-Stock heat…IF…that heat migrates to medical as it has in the two previous Tik-Stock cycles.

At the time of writing, our first AI pick has just had a massive spike…doubling in two trading sessions.

That’s NOT to do with AI, though. It came from inking a critical contract with a major university in the world’s biggest clinical market.

But…

If and when ‘world’s best medical AI small-caps’ starts trending in search engines, there’s every chance these guys will be in the frame.

We’ve also circled…and are tracking closely…

a little data stock with potential to become

the ASX AI superstar of 2024…

It’s another medtech. But these guys have been integrating AI into their healthcare disruption plan long before it was ‘on trend’.

They’re not about the flashy stuff that will make good AI headlines in the months to come, better visualisation during surgery, AI-enabled prosthetics, diagnostics, etc.

All that makes good copy. But this outfit actually has a big head start on all the players in those fields.

That, we believe, is going to start attracting investor dollars soon.

This AI small-cap play is all about using AI to facilitate smarter patient data.

Unlike a lot of TikStock AI plays floating around, its financials are strong.

It’s growing revenues and pushing closer to delivering positive earnings and profit.

But it’s their first-mover advantage in putting AI into hospital systems that we reckon is going to get them worldwide attention imminently.

This is one of the few medtechs listed anywhere that has had AI at its heart for several years BEFORE its current heyday.

And better yet, it’s using AI as a tool to make a better clinical product…rather making AI the product itself. (Which is what a bunch of medtechs are touting right now.)

Will they make a material difference in this trend long term?

Very possibly. They’re a front-runner not many have picked up on yet.

But that’s not really the point of going for Tik-Stocks.

Our primary focus is are they positioned to capture maximum investor attention as the AI zeitgeist plays out fully?

We think so.

We’ve judged this stock a nice little morsel waiting to be gobbled by investors looking for the next sugar rush.

Ex-Google exec and tech psychologist Nathalie Nahai calls the driver of this new sugar-rush investing trend a dopamine loop.

Just like with TikTok users, speculative investors get a reward and then quickly seek arousal from the ‘next big hit’.

‘Our brains grow and change based on our surroundings — we pride ourselves on being adaptable creatures.’

The Psychology of TikTok

Medium, Feb 12 2022

This makes the risks higher.

If you hang on too long…

…even a couple of months too long…

…you can see all your gains evaporate.

You saw that with medtech stocks linked to blockchain and the metaverse.

But…if you’re smart with your trend predictions…

…even smarter with the stocks you select…

…and you’re at your smartest in choosing when you take profits and run…

This is SPECULATION DISNEYLAND

Where the opportunities to make money, as well as LOSE money, are amplified.

We’ll get to who these two AI plays are in just a second.

First, why should you listen to anything we have to say on this topic?

Well, to start, you shouldn’t take anything here as a certainty.

And you shouldn’t put lots of money into a really speculative stock just because someone else tells you to.

Or because it’s all over the news.

I’ll assume you’re an adult…and will do your own due diligence before committing to any of the trends and stocks we’re talking about today.

But why do we have credibility here?

Fat Tail Investment Research now has a fairly big footprint on the Australian financial publishing landscape. But we’re still relative newcomers.

We’re completely independent. Our only revenue is from annual subscriptions. Nothing else.

That sets us apart. We’re not compromised by egos, advertising deals, commissions, or kickbacks on any stocks recommended.

We also try very hard not to get wedded to trends…as many other mainstream analysts and journalists often do.

We are not infallible.

We’re just outsiders looking in…and have been since we came on the scene in the middle of the 2000s. When our first and only paid newsletter was called Australian Small-Cap Investigator.

I’m proud of the ground we broke with that service.

Australian Small-Cap Investigator (ASI for short) was one of the first independent stock tip sheets in Australia specialising in exploiting momentum moves in small-cap stocks.

In the early days, those moves might have taken several years to play out. You’d need to wait quite a while to see if your bet on a stock attached to a trend was a winner or a loser.

Gradually, over the last 5–10 years, that wait time has compacted. As I’ve shown, these ‘manias’ are coming and going at a quicker pace than ever before.

But the general remit of Australian Small-Cap Investigator remains the same. We cast a sceptical speculator’s eye on some of the world’s riskiest stocks…hitched to trends that haven’t quite crested yet.

You don’t want to project too far ahead. Or your gains will never materialise.

But you don’t want to get in when the trend has reached saturation point. And is totally played out. By then, it’s likely too late.

It is…and always has been…a tricky balance.

One where the failure rate can be high.

We’ve always made a point to be completely open on that.

When you win…and you match the right stock with the right timing…you can win big. And fast.

For instance, we got Australian Small-Investigator readers in at the near-perfect sweet spot for the darling of the ASX rare earths boom, Arafura.

If you got in when we made the call in 2019, you could have made a monster 420% by the time we issued the sell.

More recently, we enacted a small-cap strategy to exploit persistent inflation.

On 17 April, we exited the first play for a 60% gain in six months.

But then there’s the darker side of this kind of trading. The wrong calls.

We’ve made quite a few in our history. And we’ll make them again.

Sometimes it’s the wrong stock. Sometimes the timing is off. Or it’s both!

With Envirosuite [ASX:EVS], it was mostly timing.

That was a ‘too early’ example. The company still has great credentials in the ‘green’ economy forming around us…but its share price was cut in half since we tipped it in 2021.

So we got out in March for a big loss.

The point we’re making today is not that there’s less risk floating about in Tik-Stock world (there is arguably more)…

Just that the viral mania tailwinds are blowing harder than at any time in market history.

And if you catch the right stocks…with the right trend…they can go to the Moon and the stars. Much quicker than they did in the 70s, 80s, 90s, and 2000s.

This is the Tik-Stock phenomenon

we’ve been talking about…

Australian Small-Cap Investigator has a unique, in-built ability to help you capitalise on this evolution over the next few years.

For instance, we pre-empted the Aussie LNG boom of the late 2000s.

This was a significant increase in investment and production in the country’s liquefied natural gas industry. Driven by rising demand for natural gas in Asia, particularly in China, Japan, and South Korea.

Several huge LNG projects came online in Australia, including the Gorgon Project, which was operated by Chevron.

Australian Small-Cap Investigator got our readers into a company called Bow Energy…at the time, a little-known Queensland coal seam gas explorer.

We tipped it at 17 cents and issued a sell when it was 458% up just eight months later.

We’ve made contrarian moves that were big winners.

Like tipping advertising agency Mitchell Communications in the middle of the Great Recession.

‘Agencies which have a digital component within them will be relatively recession-proof’, we said. And we were right. You could have banked 152% from Mitchell in just 10 months.

And contrarian moves that turned out to be dead ducks.

Around the middle of last decade, though, the options for trend speculation started to just become more plentiful.

There became LESS NEED for contrarian moves.

And a GREATER NEED to simply get into the next big mainstream Tik-Stock trend just a fraction quicker than everyone else…

For instance, for a few years last decade, ‘fintechs’ became proto-Tik-Stocks.

The term refers to companies, like Square, that use technology to improve and innovate financial services.

Australian Small-Cap Investigator managed to land the big one there:

Afterpay.

Today, it’s perhaps Australia’s top fintech company. When we tipped it in 2016, you could buy in for just $1.50. Four years later, it was a billion-dollar company trading for more than $100 a share.

So, with all this in mind…

…what do we see going viral next?

What’s going to usurp AI when it dies down?

Again, zero guarantees here. But we reckon there’s a new hyper-speculative trend that’s just starting to knock on the door.

It’s an echo of several previous mini-manias of the last 10 years.

But it has the capacity and potential to dwarf them all…with more than $4 trillion just waiting to fuel it…

TIK-STOCK PREDICTION #2

‘Countdown to 2030’

The ULTIMATE Tik-Stock mania

One of our first advertising promotions — way back in 2007 — centered around a company called Ceramic Fuel Cells.

It was another stock tied to the very first alternative energy boom that was springing up about that time.

We really believed in that company.

They made a massive deal with Bosch, a German appliance maker, that was going to put a revolutionary new fuel cell (pictured to the right) into every home.

Homes would make their own clean power…and sell it back to the grid.

Pretty forward-looking stuff for 2007.

In retrospect, too forward-looking. Like the company Envirosuite we just talked about, we were too early with this one…way too early.

Part of the problem was, back in 2007, there was no Tik-Stock tailwind behind these guys.

CFC ended up doing nothing.

Doesn’t mean it wasn’t a good idea. Certainly better than the status quo. Today, Germany just shut down its last three nuclear reactors and is actually burning MORE coal to make up the difference than it did when we tipped CFU 16 years ago.

That’s the story with small caps.

Even great ideas can fail. They’ve always lived or died on public perception.

But today…that process has testosterone pumped into it.

Our contention is the MAIN EVENT for small green energy stock plays is about to invade investor’s mind space from 2024.

And that anything we’ve seen so far with regards to ‘green investment’…

…including the lithium and battery stock mania that played out last year…were just appetisers.

False starts.

Growing evidence is pointing to a final blow-off boom in anything NET-ZERO related.

Bigger in scope…perhaps…than any of the hype cycles we’ve talked about so far.

Imagine…what could that boom look like in 2024/25 if it ‘goes Tik-Stock’?

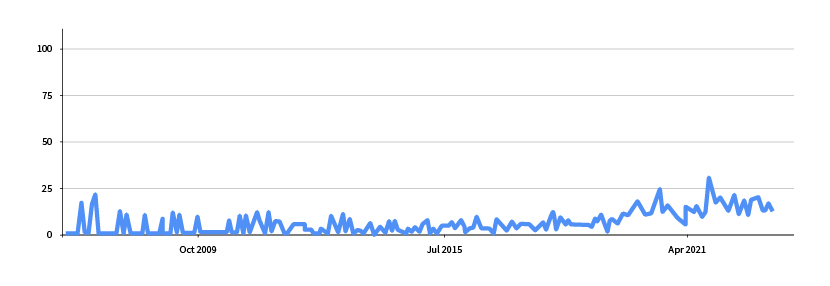

Have a look at this:

Source: Google

It’s a chart of Google searches for ‘2030’ dating back to 2006.

A SLIGHT uptick there at the end, right?

Very marginal, though.

Nothing like the parabolic jump from that earlier Google search chart for AI.

It’s no coincidence you’re seeing a little bounce there…

That’s a sign of a Tik-Stock trend that’s waiting in the wings.

Our contention is you’re going to see ‘2030’ going viral soon.

It’s a big year.

The Paris Climate Agreement aims to get to ‘net zero’ greenhouse emissions by 2050. (We won’t debate whether than can or will happen. Way too contentious…way too far out.)

But 2030 is a catalysing year in that process.

The Paris proposal is to cut emissions in Europe by 55% by then. Many countries have earmarked 2030 as a major stepping stone pledge in getting there. Australia’s current target is to reduce by 26–28% below 2005 levels by 2030.

According to the International Energy Agency, new clean energy investment is going to need to hit more than $4 trillion a year by 2030.

That’s an absolutely loopy figure.

Any way you cut it, no matter where you stand on the issue, that’s now less than seven years away.

Australian Small-Cap Investigator has been at the epicentre of the two ‘warm-up’ clean tech booms so far this century.

But this next one could well be a showstopper:

The ultimate Tik-Stock hysteria:

20 years in the making…

Even the super-greenies admit achieving net zero emissions on the current timeline is a Herculean task.

It will require MASSIVE efforts from all sectors of society, including government, businesses, and individuals.

Even the 2030 benchmark is going to be really tough to hit.

Is a last-minute investment rush of epic proportions on the cards?

Where big money has a final, frantic mobilisation?

And the small money (us, in other words) rushes to follow it. Whipped up into a FOMO frenzy even greater than the crypto boom of 2017?

And, if so, which small stocks have the highest potential to get swept up in it?

‘If Australia seizes the opportunity offered by the world’s transition to zero net emissions it can repeat the experience of the China resources boom that peaked about 10 years ago,’

…Rod Sims wrote breathlessly in The Guardian on 20 April 2023:

‘But this time the opportunity can be sustained for some decades…’

However, you shouldn’t take too much stock in journalist opinion pieces when predicting the next Tik-Stock trend.

A far better indicator is to look at what the genuine ‘influencers’ are starting to telegraph as we head into 2024.

Take Wall Street titan Jamie Dimon.

One of the world’s most famous bankers, the JPMorgan Chase CEO just made a fairly shocking statement…

…saying the US Government should SEIZE private property to boost the number of green projects coming online by 2030.

He told shareholders availability of wind and solar projects needs to be accelerated urgently…as ‘the window for action to avert the costliest impacts of global climate change is closing’.

Stealing stuff for 2030?

That’s a bit extreme, surely.

At the same time, our own Andrew Forrest is doubling down on his famous green pivot.

His renewable venture, Fortescue Future Industries, just appointed Mark Hutchinson to ‘put some discipline into the business’.

According to The Australian, ‘the former chief of General Electric in Europe, overseeing 100,000 staff, Hutchinson had to live and breathe the “GE Way” of highly controlled processes and intense project management in manufacturing.’

‘He also had to win over major German industrial clients by proving GE 2could make things better, commercially and with an eye for quality control.’

In his shift to Forrest’s renewable pivot, THIS GUY has made a clear-eyed call.

He’s following the money.

Forrest is also ramping up his global PR offensive.

He’s just been announced as headline speaker of the Nor-Shipping Conference and says he’s going to ‘focus on renewables’.

George Soros…whether you like him or think he’s the Antichrist…just got on stage to talk about the existential risk of climate change at the Munich Security Conference.

The 92-year-old billionaire’s 2030 solution is brightening the clouds over the Arctic to reflect the sun’s energy away from the melting ice caps.

‘“Staggering”: US on cusp of 600GW clean energy boom.’

Business Green, 23 April 2023

That sounds ludicrous just saying it.

But what’s not in contention is this:

Musk and Cathie Wood have been making their moves here too in recent months.

‘“A new industrial age”: The coming renewable-energy boom’

Al Jazeera, 12 Jan 2023

None of these guys are dummies.

They love money. And KNOW money.

And see where the viral winds are blowing…

If you’re looking for the next viral mania in stocks…the rush to meet 2030 targets is a prime candidate for 2024/25.

Who are we backing here?

At this stage…

Australian Small-Cap Investigator is zoning in on THREE SPECIFIC STOCKS

‘For 20 years we’ve had more and more information available. Now you have zero commission trades and you’ve removed any costs and disadvantages for small investors,’ says Jim Bianco, president and macro strategist at Bianco Research.

What happens when that all culminates in one huge, historic seismic shift?

One deemed even more serious than the COVID pandemic?

Not just crypto or the metaverse or AI…

…but an existential threat to humanity that’s had a 40-year build-up?

We’re about to find out.

It’s early to place bets here.

And, yes, there have already been precursors.

The lithium and battery stock market had a mini Tik-Stock mania last year…even as wider markets fell.

That fell away a bit in the first half of 2023.

But is now picking up again…

So…what are some solid ‘Countdown to 2030’ Tik-Stock plays for the speculative investor right now?

As I say, lithium is already coming back.

An Australian company called Liontown Resources [ASX:LTR] had its stock explode 70% in a single trading session recently.

Remarkable for a billion-dollar company.

But projecting which smaller companies could go significantly higher in terms of gains from 2024 is more challenging.

You need to think a bit more creatively than just battery plays.

We’ve narrowed our shortlist down to three.

Here, we try and put you a few steps ahead of where this is all going, with three carefully targeted equities.

For instance, here’s one small stock we’re backing that is unfamiliar to 99.99% of investors right now…

The 2024 mainstreaming of ‘green steel’…and one 50-cent stock to capture the whole thing

‘After a lull in green steel announcements, it seems like the quiet is being disturbed on many fronts,’ wrote CleanTechnica in April.

You’ll notice we keep namechecking the same motley cast of Tik-Stock influencers. They start to buzz around these emerging trends like bees to dandelions.

You may have seen the term crop up a bit recently. But so-called ‘green steel’, made from hydrogen instead of coal, has yet to go FULLY Tik-Stock.

We reckon that’s about to change.

Elon Musk’s recent Master Plan 3 just included a big lecture on how green steel is utterly essential to the 2030/50 goals.

Andrew Forrest’s Fortescue Future Industries is going head-to-head with companies like Sparc Technologies and GFG Alliance to decarbonise the steelmaking process.

And…as you read this…Europe is in a frantic race to build green steel plants.

Is Forrest right on this?

Will green steel REALLY supercharge Australia’s exports…offset millions of job losses in the fossil fuel industry…and engineer our way out of climate Armageddon?

Maybe.

WHO TRULY KNOWS?

As we’ve said, speculating on Tik-Stocks is not about thinking you’re a god who can guess the future.

It’s about anticipating which sectors get social media-enhanced…and backing the best small caps within them.

What we DO know is that the world is about to go into green steel hyperdrive. Australia has some advantages here. And…very soon…you’re going to see tiny companies LIKE THE ONE WE’VE SELECTED get caught up in the frenzy.

Green steel is just one component of the ‘Countdown to 2030’ Tik-Stock theme.

We’ve highlighted two others…and attached stocks to them as well.

You can find out who they are — as well as our two fresh AI Tik-Stock plays — by subscribing to Australian Small-Cap Investigator.

For some calculated guesses on the

NEXT Tik-Stocks…JOIN US

Total frankness here…

This is risky.

At its core, speculation is making a call on the future based on a few hazy data points that exist in the present.

It’s an inexact investment science. It has always been. Don’t let anyone try and tell you otherwise.

And it’s not for everyone.

You can lose a lot of money if you make the wrong calls. Or get too carried away with the whole thing, especially when you see your stocks go supersonic. And then see them nosedive.

This has happened with many Australian Small-Cap Investigator calls.

What sets us apart is we don’t hide or shy away from it.

Our thesis today is the whole concept of speculation has not been DERISKED…just the opposite. The opportunities to make head-slapping losses are more plentiful than ever.

But…

For the wise speculator, this process has been put into overdrive in the last few years.

You can realise your wins…and your losses…way quicker.

As Fortune just put it:

‘In recent years, the search for a

home-run investment has become increasingly mainstream’

Australian Small-Cap Investor is a NON-mainstream take on exploiting this evolution.

The Tik-Stock phenomenon amplifies your opportunities…and your chances to make really big gains in a really small time frame.

That is what our five new Tik-Stock plays are all geared towards.

This is not hedging, or property, or income, or long-game macro investing.

This is not, in the strictest sense, sensible allocation of capital.

It’s a little bit reckless.

But if you’re a lucky person with a small amount of ‘play money’, even just a few thousand dollars that you’re willing to put out on a limb on a couple of swing-for-the-rafters shares…

…then I invite you now into the Australian Small-Cap Investigator fold.

Bottom line is:

Now’s the time to do it

In a moment, you can have all the details of the stocks we’re tagging to what we deem the two most impactful Tik-Stock themes of the next 2–4 years.

You’ll see names, ticker symbols, a description of who they are, how we see them play into the trend going forward, and analysis of their potential.

You don’t have to invest. You can paper trade at first if you like.

But it’s a great way to get a taster of how we plan to attack this end of the market.

The annual subscription to Australian Small-Cap Investigator is minimal.

Certainly, compared to other small-cap intelligence offerings out there.

$199 a year.

When was the last time you splurged $200?

What was it on? A winter jacket?

Did it buy you intel on stocks that might give you the kind of quick upside we’ve been talking about?

$199 might seem suspiciously cheap.

Fat Tail Investment Research publishes investment services that cost 10 times that amount on an annual basis.

So why is Australian Small-Cap Investigator so cheap it barely covers our running costs of publishing it?

This subscription fee has fluctuated a little since we went out with our first issue of ASI (our first paid newsletter) in the mid-2000s.

But we made it a publishing decision keep it accessible ever since.

It makes sense for you as a customer, but it’s also good business sense.

These have always been reckless stocks to punt on.

Perhaps one in 10 REALLY pay off.

Even with the evolution in speculation we’re talking about, that ratio has not changed in the last 20 years.

It would be irresponsible to charge a thousand dollars a year for a service people might find very quickly is too racy for them.

But you don’t know until you try.

Hence the modest subscription dues.

Australian Small-Cap Investigator also comes with a refund guarantee of your subscription within 30 days.

This means you can get behind the paywall…have a poke around…look at all the stocks on the current buy list…and still decide to back out if you wish…without losing a cent.

No harm, no foul.

I’ll repeat: this game is not for everyone.

Meaning, you can get the names and backstories of our five AI and Countdown to 2030 Tik-Stock plays…

…and still decide this is not a subscription you wish to continue with.

Just call us or contact us by email and we’ll issue you a full refund.

Not many stock services offer that guarantee.

They also won’t do this…

I can tell you now…very transparently…

…that at the time of the writing…

…the rate of new subscribers to Australian Small-Cap Investigator who took up that 30-day refund offer so far this year stands at 6%.

That’s 5% of people who took a look. And concluded, for whatever reason, either we’re no good or this investing style is not for them.

Fair enough.

But it means that 94% of new subs who joined us…in this very difficult wider market…are aligned with what we’re doing, trust us, and are game what for what comes next.

Ready to take the next steps?

Then let me explain

how it works...

As I say, if you subscribe to Australian Small-Cap Investigator now, you’ll be immediately directed to a small set of stocks that tap into two Tik-Stock trends.

You’ll get two plays that tap into what we see as the next chapters in the indisputable AI boom playing out right now…

As we’ve said, Tik-Stock ‘conductor’ Cathie Wood and her team at Ark have been running the numbers and reckon there’s US$14 trillion in revenues up for grabs here by the end of the decade.

Whether that’s true or not…this mania’s not going anywhere.

Join now and you’ll see the two highly speculative positions we’re taking as it unfolds in 2024.

And…we cast out a little further into the future…

You’ll get our three plays on what we see as a looming trend that could become the ULTIMATE Tik-Stock boom: Countdown to 2030.

The world is set to add more renewable power in the next five years than it did in the last 20. The clock is ticking. And all the ingredients are there for a mania as big or BIGGER than anything we’ve covered since we started publishing in the mid-2000s.

Check out our plays. Do your own due diligence. See how it all stacks up. If, for any reason, you’re put off or think it’s all too risky, then just let us know within 30 days and we’ll refund your subscription in full.

If you stay with us, you’ll be sent an Australian Small-Cap Investigator monthly.

2,000–3,000-word research reports containing at least one new small-cap recommendation...for your eyes only.

You can buy and sell all the stocks we recommend through any Australian broker, whether you use an online platform or deal over the phone the old-fashioned way.

Not every recommendation will

be a pure Tik-Stock play

There are fantastic small-cap opportunities out there that aren’t necessarily tied into a viral megatrend.

We’ll be covering some of those as well.

For instance…

You’ll discover a small mini-portfolio (currently five open recommendations) geared towards small caps to take advantage of the Australian property cycle in 2024.

There’s a section devoted to small-cap inflation plays. (We recently took a 60% profit on one of these.)

We have a straight media play that’s up more than 100% at the time of writing.

You’ll find out about a recommendation in the biosurgery space that’s up 40% since it was tipped in September 2022.

We have a nanotech play on the books that’s up 80%.

When opportunities like these present…we’ll pick them off.

But it’s nailing REALLY DIALLED-IN TIK-STOCKS where you potentially make multiples higher on your money.

So that’s going to be our primary focus going forward.

We will show you why you should consider each stock.

Then it’s up to you whether to invest or not.

We will help you manage your risk.

And…perhaps most importantly…

You’ll be told

when to EXIT

As we’ve covered in this report, knowing when to GET OUT is now more important than ever.

It can mean capping your losses to a manageable level if a stock goes against you. (And some will.)

And…

It means not getting greedy, reading the tea leaves, and getting out of a trade with money in the bank before it turns against you.

This has happened time and again with previous Tik-Stock trends.

Investors get hypnotised by a stock breaching 100%...200%...300%...then they hang around too to watch all those gains bleed away.

It’s a tricky business. Some of the toughest calls are choosing when to bank a win.

But, over the years, we’ve learnt a few tricks here.

So…up to you.

With a 30-day subscription refund guarantee…you keen to check out our current Tik-Stock buy list?

As I say, the official annual subscription is $199.

But…

* FLASH DISCOUNT *

$100-OFF your first year

with this invitation (one-time offer)

If you reply to this invitation — right now — I will cut your first-year subscription fee by $100.

Instead of paying $199 today, you’ll pay just $99.

That’s a pretty small price to take a look behind the curtain.

And remember, it’s covered by a 30-day money-back guarantee.

Take a look at the plays we’ve been talking about.

Invest if you feel comfortable. ‘Paper trade’ if you don’t.

Judge us by whatever criteria you like.

If you get cold feet...or change your mind...

Call my customer service team in the next 30 days and you can have your subscription fee back. In full.

No cancellation or administration fee. No penalties. And no questions asked.

I’ll just put the money straight back onto your card.

Ready to make a start?

Click here now to arrange your subscription to Australian Small-Cap Investigator.

Order now, and not only will you get $100 off for your first 12 months...

...but a 30-day refund of your joining fee, if you decide this isn’t for you.

To make a start, click here now:

SUBSCRIBE NOW

Send Me Five Tik-Stock Recommendations Right Now

(You can review your order on the next page before committing)

Sincerely,

James Woodburn,

Publisher, Fat Tail Investment Research