It’s the world’s most important natural resource

—and there’s less than four days of it stockpiled.

Fat Tail Investment Research Presents

Take a look at this rock…

Real close up…

With its rough, jagged edges…it doesn’t look particularly special or significant.

But…

Before 2023 is out…without a miracle…I expect rocks like this to bring the economy to a standstill.

Because this ore contains an element that’s easily going to be the most important resource of the next 20 years.

For many industries, it’s more important than oil…natural gas…lithium…rare earths…or any other headline grabbing resource…

Without it, there’d be huge problems with our electrical grid.

Crucial communications systems like WiFi…5G…and TV would be at risk.

Infrastructure projects like China’s ‘One Belt One Road’ would grind to a halt.

And the push to reach ‘Net Zero’ by 2030?

Without this, it’ll be a complete non-starter.

That’s why rocks holding this precious metal are in huge demand right now.

Almost any industry you name needs it…from Silicon Valley tech giants like Tesla, Google, and Apple…to homebuilders here in Australia…

But...there’s a problem.

A ‘defect’, of sorts.

It’s invisible to the untrained eye.

But it could soon trigger a chain reaction of shortages…panic…and a sudden price-spike all over the world.

For thousands of companies, that’s terrible news.

My name is James Cooper.

I’ve spent the past 15 years working as a geologist, throughout Australia and Africa.

I call this looming supply crunch the ‘RED DROUGHT’.

I’ve been watching it unfold on the ground for the past 20 years.

But to paraphrase Ernest Hemingway, resource shortages happen first slowly…and then all at once.

We’re about to hit the ‘all at once’ phase.

Despite the fact this element is essential to the entire global economy…

And despite many of the world’s top research firms warning of shortages — including analysts at Goldman Sachs…Bank of America…Wood Mackenzie…S&P Global…and Wells Fargo…

…and despite analyst predicting DEMAND will double in the years ahead…

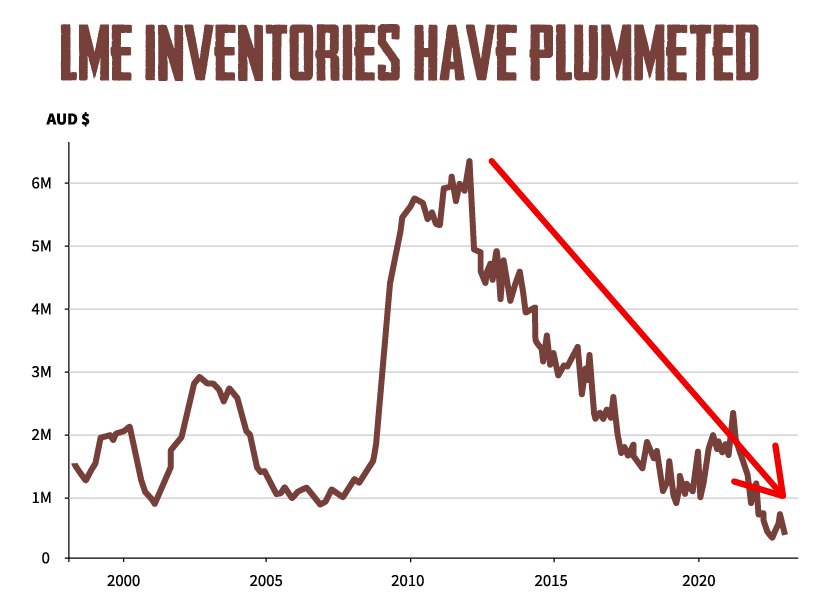

Global inventories have collapsed.

Worldwide, warehouses only have enough supply on hand to satisfy FOUR DAYS of demand.

That means there’s no real ‘margin of safety’ if something goes wrong.

But thanks to three separate supply shocks…unfolding as we speak…

Like the last drops of water drying up in a heatwave, the world could soon wake up to find THE metal it can’t live without…is in critical short supply.

If that happens — or rather, WHEN that happens — I think there are several stocks that should be top of your watchlist.

They’re all Aussie listed…with great long-term prospects.

But short term, they’re EXACTLY the kind of stocks the ‘late money’ — that is the speculators, punters, gamblers — could flood into as this story tips into the mainstream news.

Snap them up today and if I’m right…

That flood of speculative capital could multiply your stake several times over.

We’ve seen this happen before, of course.

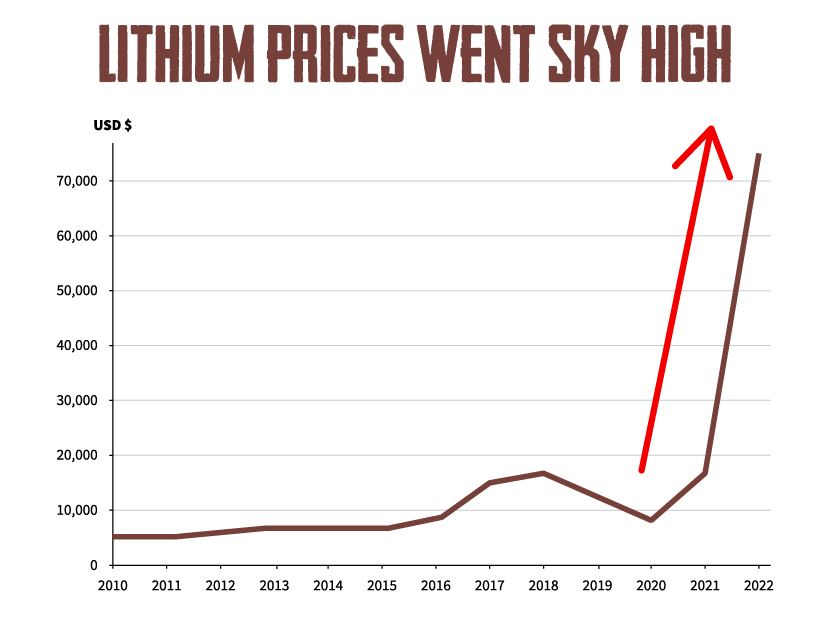

Think back to what happened with lithium in 2021 and 2022.

For a few months it seemed like every EV company on the planet (and a few national governments) would do anything to get their hands on the stuff.

The result?

The price of lithium took off.

And some Aussie lithium stocks went with it.

AVZ — 2,490%

SYA — 3,733%

PLS — 2,192%

AZL — 4,900%

LKE — 7,945%

CXO — 9,284%

LTR — 3,985%

VUL — 6,713%

ESS — 500%

AGY — 1,553%

GLN — 1,445%

And that’s not the only time a cycle of sudden shortages…panic…and profit has played out…

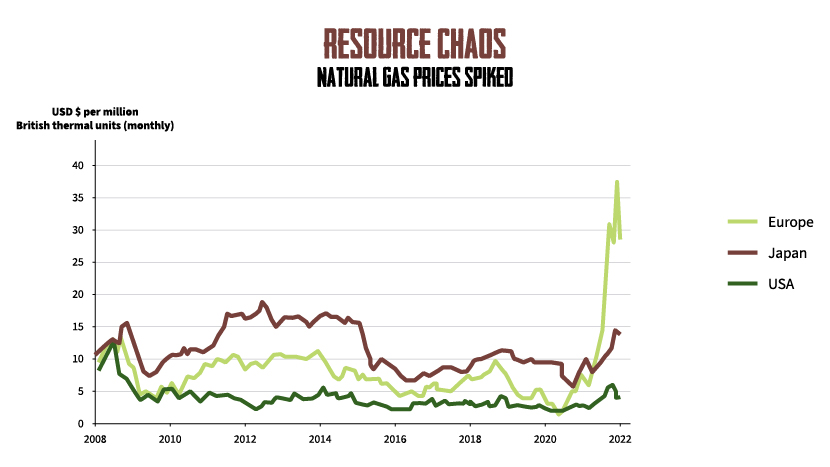

It happened in the natural gas market when Russian tanks rolled over the Ukrainian border last year.

Soon enough, there were gas shortages across Europe.

And the price of natural gas did exactly what you’d expect — it surged as panic buying began.

Bad news if you’re heating a home in London, Berlin, or Paris.

But great news if you own Aussie LNG stocks.

Our LNG export revenues surged 90% in a year.

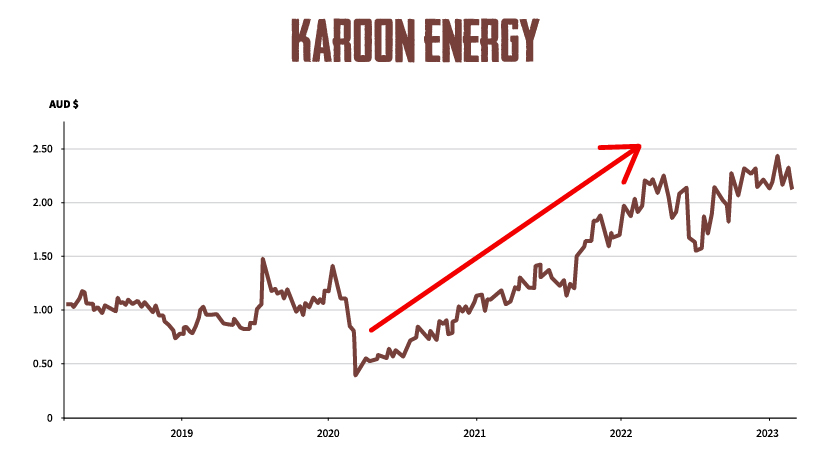

Creating perfect conditions for stocks like Karoon Energy, which doubled in less than a year…

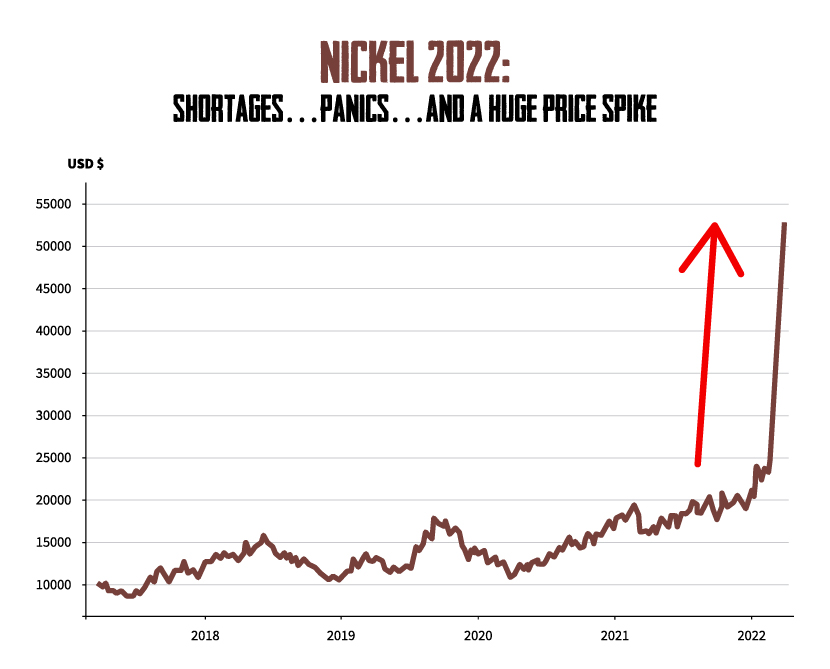

Then you had the ‘Nickel Panic’ of February 2022.

War in Ukraine effectively triggered a ‘run’ on the nickel supply…sending prices into a frenzy…and forcing the London Metal Exchange to cease trading.

It was chaos.

For a while, any nickel for sale commanded a crazy premium.

And companies were willing to do whatever they could to get their hands on supplies.

The shortage got so chaotic that JP Morgan ended up buying what it thought was nickel…only to find it’d bought nine bags filled with rocks instead.

And once again, ASX-listed nickel stocks like IGO and Mincor Resources more than doubled as prices rose.

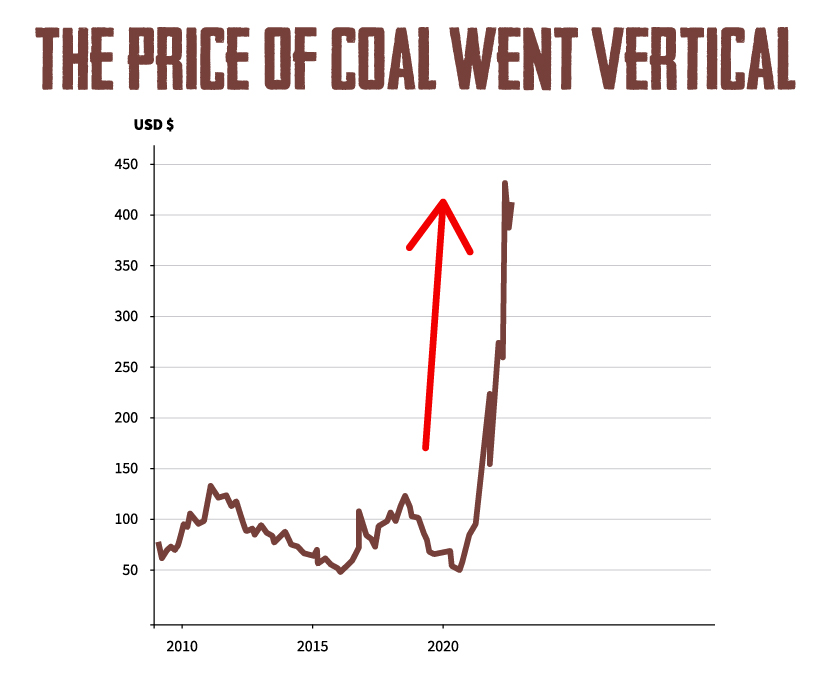

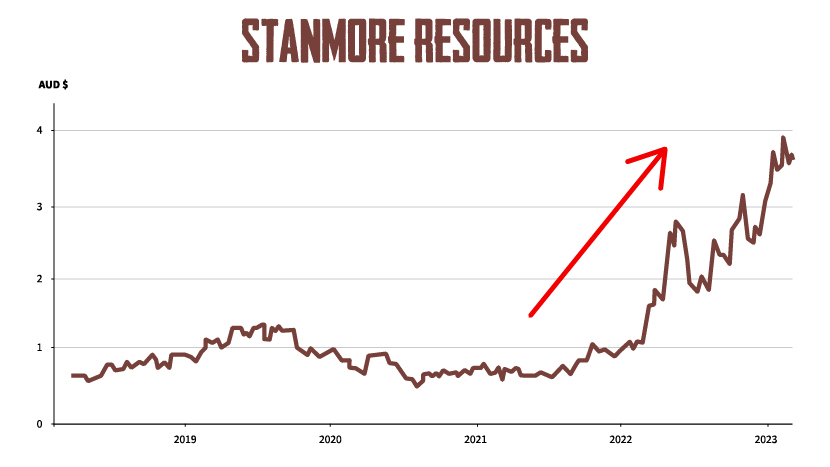

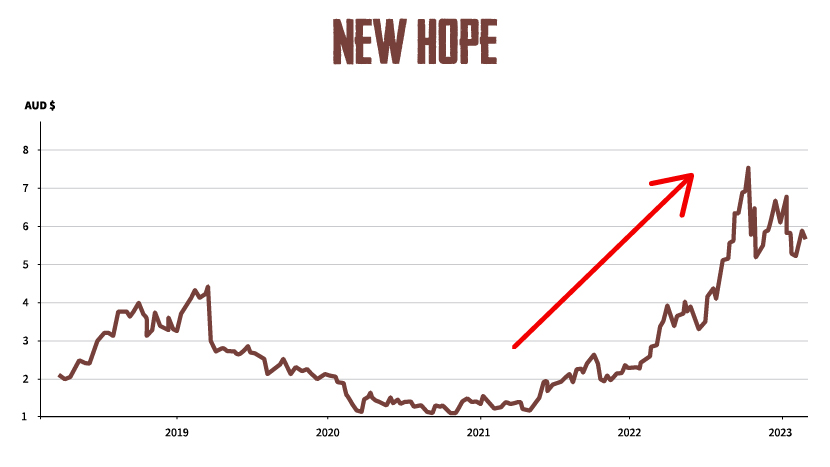

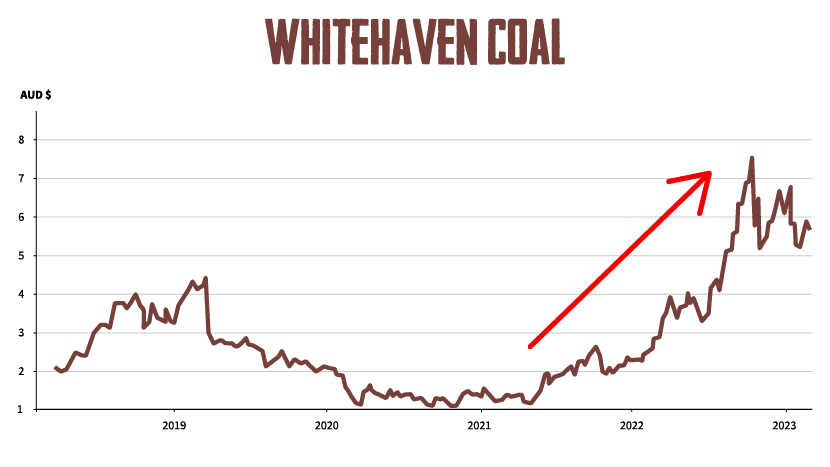

It happened too when the world realised it still needed coal to keep the lights on — triggering another round of bidding wars and price spikes…

ASX-listed coal plays like Stanmore Resources, New Hope, and Whitehaven Coal more than tripled as a result.

The same pattern played out in each case.

Shortage.

Panic.

Profit.

Well, I’m here to tell you:

But this time, it won’t be lithium, nickel, or coal tearing higher.

It’ll be a commodity found in the very rock I’m holding in my hands right now.

So what IS this?

It’s the unprocessed form of a VERY important commodity.

But once it’s crushed and refined, it’ll take on a much more distinctive orange-red colouring…

And look a lot more familiar.

Copper.

It’s critical to everything from wind turbines to solar panels to the power grid.

Which is why S&P Global dubbed it the‘the metal of electrification’.

Or why copper is the ‘new oil’, according to the head of BNY Mellon’s Natural Resources fund.

The problem is…

The available SUPPLY of copper has been in decline for a decade.

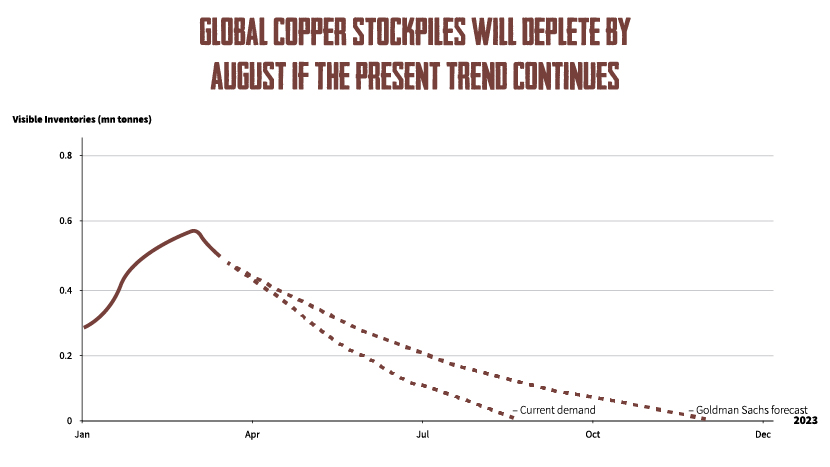

As of the start of 2023, the world had less than four days’ supply stockpiled.

That means you could scour every corner of the London Metal Exchange, the Shanghai Futures Exchange, and bonded warehouses in China…

And you’d only find enough copper to meet four days of demand.

That’s it. Four days.

I know, it’s hard to believe. This is not widely reported.

Insiders at copper miner Trafigura even suggested inventories could have shrunk to just 2.7 days by late 2022.

Such low inventories offers no margin for error…no slack in the system, if there’s a supply shock.

That’s bad news.

Three countries supply the vast majority of the world’s copper.

Chile ranks first…supplying 27% of the total market.

Then comes Peru on 10%

Then comes the Democratic Republic of the Congo, on 8%.

If there were an ‘OPEC’ of the copper market…those three countries would be it.

But supply in all three places is at serious risk of decline.

In Chile…the world’s biggest supplier of copper…by a long way…output is expected to FALL by more than 5% in 2023 alone.

That’s thanks to decade old mines and declining grades.

Plus, Chile has just hiked taxes over the world’s biggest copper miners operating in its borders.

But it could be about to get far worse…

Chile’s left-wing government has just nationalised its lithium industry…that means all lithium mines will fall under state control.

A disaster for the international miners operating there.

But the copper miners could be next.

This makes Australian copper stocks even more valuable as companies flee the world’s biggest copper producing nation.

But things are even worse in Peru.

Political unrest is threatening to knock the entire mining complex out.

In January, Glencore announced it was suspending operations at one mine after protestors set fire to it.

Three other mines are at similar risk of major disruption.

Peruvian exports dropped 20% in January alone.

And in the world’s third largest supplier, the Democratic Republic of the Congo (DRC)…what Bloomberg dubbed ‘an “ugly battle” is playing’ out, as the authorities and the Chinese Government battle for control of a major copper mine.

War, dictatorships, bribery, and corruption make it hard for miners to invest in the DRC.

And really, no sane person wants their money tied up in such a corrupt place.

Add all that up and what do you get?

Global inventories at record lows…and 45% of the world’s copper supply at risk.

It’s a recipe for chaos.

As I said, this stuff is ‘raw’.

It comes out of the ground like this, then it’s sent off for processing.

The idea, we refine it…remove all the impurities…then we’re left with pure copper ready for industry.

But there’s a problem.

The amount of actual REAL COPPER we’re left with once all the processing has been done…the end yield…this has been in freefall for decades.

In Australia alone…the average copper ore grade has HALVED since 2005 (it’s much worse overseas).

I’ve seen this playing out, first hand.

As old mines near exhaustion, I’m seeing a worrying trend of major miners sending ‘low-grade’ waste through processing facilities.

Pushing operations well past their use-by-date.

The industry is relying on the dregs of old, tired mines…and hoping for the best.

Take a step back and you begin to see why.

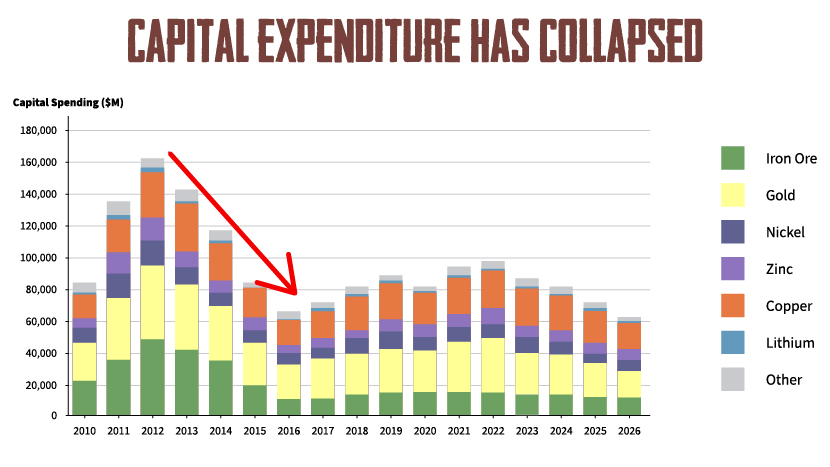

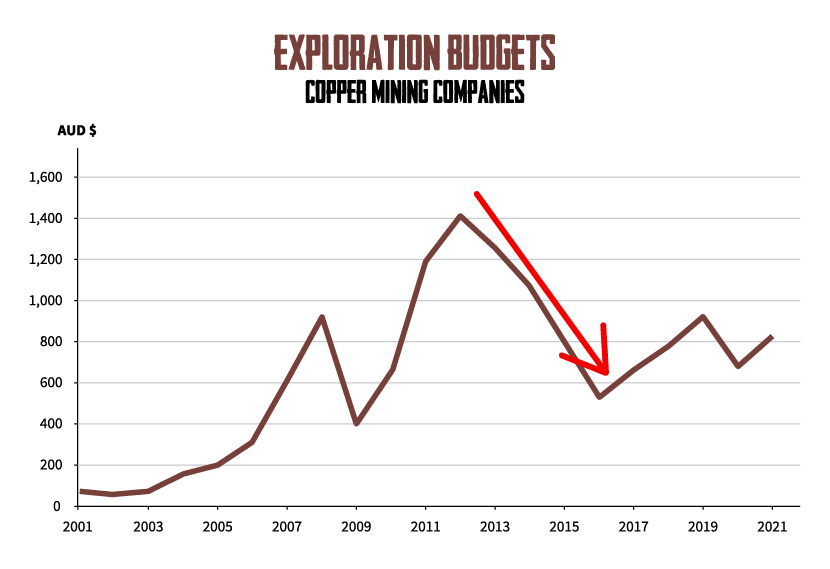

We’ve spent the last decade starving the entire resource sector of the things it needs to succeed.

First the mining industry cut new investments in half…

Then it cut back on even LOOKING for new resources…

Now, we are not even training the PEOPLE we need to keep the industry going.

In 2020, the University of Newcastle killed its geology Bachelor’s degree.

A year later, Macquarie University did the same thing, culling its earth sciences degree.

We’re now desperate to find new supply to avoid shortages…

But we literally don’t have the people to go look for it. Or the capital investment to make it happen.

I know this first hand…we put out adverts for new geologists at the last company I worked for.

No one applied.

Geologists are as rare as the metals they’re trying to find.

The numbers back this up…of 224 copper deposits discovered in the last 30 years…only 16 have been found in the last decade…and only TWO major copper mines were brought online between 2017 and 2021.

According to S&P Global Market Intelligence, new copper discoveries have fallen by at least 80% since 2010.

Not only that…it costs TEN TIMES as much to produce a tonne of copper today, compared to the year 2000.

That’s bad news…

The world is in the middle of several of the most copper-intensive projects in the history of mankind.

First and foremost amongst them is the commitment to ‘Net Zero’.

Like it or not, the world has committed to a carbon free future.

Whether that’s actually possible or not remains to be seen.

But all the signs suggest…the authorities are going to TRY.

That’s going to DOUBLE the demand for copper by 2035, according to S&P Global.

Why?

Because copper is ‘the metal of electrification’.

It’s a crucial component in solar panels — every mega-watt of solar energy produced needs roughly 5.5 TONNES of copper.

It plays a vital role in wind power generation — every 1.5-megawatt turbine requires 1,900 pounds of copper.

And without copper, the electric vehicle ‘boom’ is a nonstarter. There’s three times as much copper in an electric car as a diesel one.

‘The energy transition is going to be dependent much more on copper than our current energy system’, says S&P Global Vice Chairman Daniel Yergin.

In other words:

In fact, to meet demand from here, we’d need to discover a new mine the size of the gigantic Chilean La Escondida copper mine — the biggest mine of any resource anywhere in the world…

Not only that, we’d need to get it up, running, and producing copper right away.

And we’d need to do that EVERY YEAR FOR THE NEXT EIGHT YEARS.

Not going to happen.

There’s a good chance the copper supply is just not going to keep up with demand.

Long term, that’s extremely bullish for copper prices…and copper miners.

To be clear: That DOESN’T mean every copper miner will go up.

A badly run project can fail, even in a bull market.

But find the RIGHT companies…with talented management teams, experienced geologists and great geology…I think there’s a major opportunity on the table.

I know how to find these companies.

I’ve spent my career working with them.

That’s a big differentiator in the resource game, believe me.

There are plenty of so-called mining experts who’ve never been onsite…never headed underground…and don’t understand the science of exploration.

They’re little more than jumped up journalists.

I’ve clocked years of geologist ‘walkabout’ in the Outback and in Africa, contracted by both the small explorers and the major players.

I’ve poured over everything from diatomaceous clays (used in kitty litter)...to copper in Zambia...to helping develop an iron ore project that fed directly into making Toyota Prados and Outlanders.

As I keep saying, I think actual rock-hunters are who you should be listening to when it comes to up-and-coming mining stocks.

Not posters on mining stock forums. Or investment journalists.

You need a guy who knows how to dig into actual dirt just as well as balance sheets.

You see, I’m not a hobby-pundit; I’ve been right in the thick of it since the rise and fall of the LAST boom…

Through the pandemic, for instance I was with gold mining behemoth Northern Star.

In 2021, I was headhunted to be Dacian’s Senior Exploration Geologist...in charge of the company’s growth in rare earth projects.

Put simply: I know how the industry works.

I haven’t just been a spectator watching on from the stands.

I’m biased…but I think that experience is going to be valuable in the next few months.

According to Goldman Sachs research, if current trends persist global copper stockpiles will hit zero by August of this year.

That gives you a short window of opportunity to act.

And if you want a simple way in, there are worse places you can park your money than the Global X Copper Miners ETF [ASX:WIRE].

It’s an exchange-traded-fund you can buy like any stock on the ASX.

But it tracks the performance of an index of global copper miners — so it’s a great way to gain broad exposure to the market.

If that’s all you want…great. It’s a ‘vanilla’ way of playing the story. Unlikely to go ballistic…but unlikely to go to zero, either.

But I think we can be a lot more ambitious than that.

Why?

Those aren’t my words — they’re the words of Peter Milne, in the Sydney Morning Herald last year.

I think he’s right.

Why?

Because the exact same dynamics playing out in the copper market are shaping countless other resource sectors, too.

According to Goldman Sachs’s head of commodities Jeff Curie:

‘2008 was a financial crisis — this is a molecule crisis.

‘We’re out of everything: oil, gas, coal, copper, aluminium, you name it, we’re out of it.’

It’s not just copper facing a severe supply crunch in the years to come.

It’s lithium.

Cobalt.

Tin.

Graphite.

Rare earths.

The Financial Stability Board — the agency central banks set up after 2008 to provide an early warning alert ahead of a crisis — has even warned commodity shortages could cause the next financial collapse.

There are even signs the INTELLIGENCE community is beginning to worry.

According to reports last year, the Five Eyes alliance — Australia, Britain, the US, New Zealand, and Canada — are monitoring the emerging ‘mineral war’.

Bad news if your business needs to get hold of copper — or any of these key resources — to survive.

Why?

Because as supply from Chile, Peru, and the DRC declines…

Our copper reserves become even more valuable.

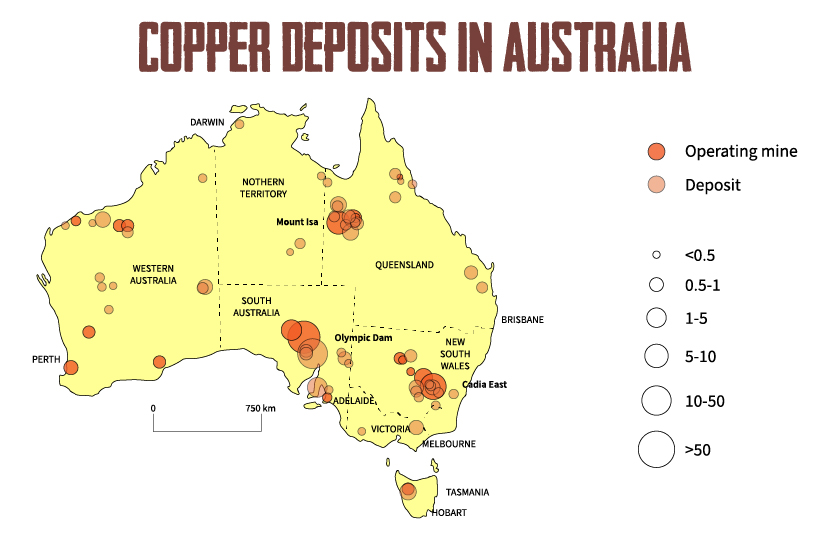

Australia has enormous copper resource potential.

Much of it is concentrated in the north of South Australia, the Mt Isa region of Queensland, and Cadia, New South Wales.

Just take a look at this map:

If I’m right and we’re on the cusp of a major supply crunch in the copper market…these are the places that’ll benefit most.

As prices rise, I’m expecting exploration to accelerate as companies fast-track copper projects…

Plus, we’ll see more capital — both long term and speculative — flood into the sector.

That’s exactly what NEEDS to happen to get us out of this mess.

As that happens, I reckon some investors will have a genuine chance to make a small fortune.

But there are absolutely no guarantees here. This is the story market. No one can see the future.

If central banks hike rates enough to push economies into recession, then demand for copper — a pivotal industrial metal — will weaken.

That could mean we DON’T see shortages.

Or we could see some miracle…a vast new copper resource, or some way to reuse and recycle existing copper.

Both would change the supply/demand dynamics.

And both are possible.

Though not — in my opinion — all that likely.

That’s why I’m happy predicting at least a THREAT to supply shortages…

…and a new all-time high for copper before long.

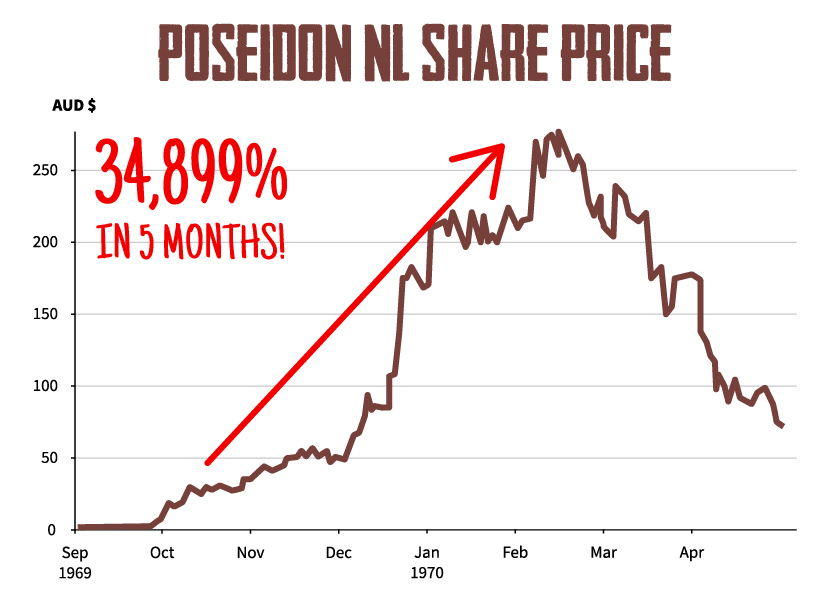

If you’re old enough to remember the incredible story of Poseidon NL, you’ll know exactly what I’m talking about.

This is what happened in 1969…

For a few months in 1969, Poseidon NL briefly became perhaps THE hottest stock on the entire planet.

It was all thanks to the kind of supply crunch that could hit the copper market in the near future.

But in this case, it wasn’t a shortage of copper that drove Poseidon up…it was NICKEL.

Given what we’ve just been talking about, the story will sound very familiar to you.

First, DEMAND for nickel ramped up…thanks to the Vietnam war.

By the late ’60s, 500,000 US troops were in the region. And with them an awesome amount of military supplies, weaponry, and firepower.

Consider…over the whole campaign the US dropped more than seven million tonnes of bombs on Vietnam, Laos, and Cambodia. That’s more than twice the amount dropped on Europe and Asia in the Second World War.

That’s not to mention the tanks, helicopters, rifles, and other supplies for the war effort.

And nickel was a vital component in all of them.

Demand for the metal reached an all-time high during that period.

Then a crisis at the world’s largest nickel mine crippled global SUPPLY.

A workers strike at the major Canadian producer, Inco, forced the closure of one of the world’s biggest nickel mines.

It choked production…and sent the price of nickel skyrocketing.

The price reached £7,000 per tonne on the London market at the beginning of November 1969…

That’s when Poseidon NL caught the public’s attention.

What happened next made history.

On 25 September 1969, Poseidon’s shares started to rise…

Earlier that month shares traded for 80 cents.

By Friday, 26 September they’d hit $1.85.

The following Monday the company confirmed they’d ‘hit paydirt’ and found nickel out in Western Australia.

The shares then raced from $1.85…to $5.60…to $6.60…then $12.30…and kept going up all the way to $75 and beyond.

Take a look…

By 5 February Poseidon’s stock hit $280…a 34,899% gain in five months.

Can you imagine that?

A $5,000 stake in Poseidon would have turned into more than $1.5 million in less than six months.

And the boom quickly spread.

Later that year, Poseidon acquired another tiny miner called SAMIN.

Soon after, it was floated on the stock market at 50 cents.

But when the opening bell rang, SAMIN shares jumped to $30.

That’s a 6,000% return…in a few moments of trading.

Which was, according to financial planner Andrew May:

Now, no one with even half a brain would predict we’ll see another situation like that.

I mean…it COULD. It’s theoretically possible.

But it’s a pure outlier. A real ‘edge case’.

And let’s be honest — stocks like that are VERY high risk.

For every example like that…there are probably 10 that went bust.

But it underlines just what extraordinary things are possible in these kinds of supply crunches.

With that in mind, which stocks should you be looking at right now, in 2023, as the copper market rushes headlong towards a major shortage?

There are two particular ASX-listed stocks I’m recommending my readers buy right now.

Nothing gets an exploration company’s share price moving like a set of positive drill results.

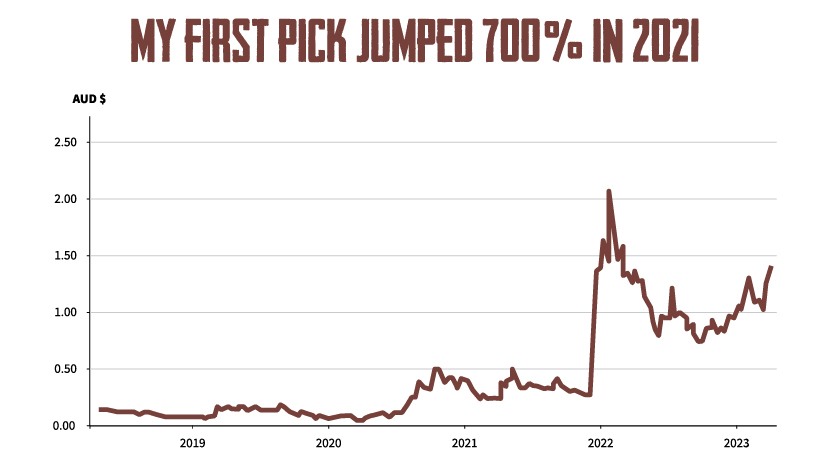

And that’s exactly what happened to my first copper play a couple of years back.

It hit paydirt at one of its properties up in north west Queensland.

And the market liked what it saw.

Shares jumped 700%.

But it’s what happened NEXT that has me excited.

Fresh from that success, management pushed on with exploration at several other sites nearby.

And it did so using a ‘secret weapon’.

Think of it like an X-Ray.

But instead of using electromagnetic radiation…it involves firing electrical impulses into the ground.

That measures what’s known as the ‘chargeability’ of the resources underground, which helps geologists understand what’s going on down there.

It’s known as ‘induced polarisation’.

I’ve massively simplified how it works. This is complex stuff that people spend their entire careers mastering.

But what really matters to us as investors is the results this technique is yielding.

Because last year, this company tested three different copper targets on its tenements…and ALL THREE returned wide zones of high-grade copper.

That’s huge.

Hitting three out of three…a 100% strike rate…that’s astounding.

Ask anyone in the mining industry. They’ll tell you the same thing.

In other words, this little company hit it big in 2021…and saw its share price rise 700%.

It then followed that up with THREE MORE STRIKES throughout 2022.

And yet…

It saw its share price get cut in half during brutal trading through 2022.

As I speak, shares are still well below their peak from 2021.

Despite the fact the situation on the ground just keeps getting better and better.

That’s the stock market for you.

Things don’t always make sense. Markets overreact…and underreact. They’re inefficient.

But that’s your opportunity.

It means you have the chance to get into a PRIME copper explorer…

…with a great team, plenty of recent success and a ‘secret weapon’ that promises more to come…

…for a BIG discount on 2021’s share price.

Now this is a fast-moving stock. Depending on when you’re watching this, it may be trading above my recommended ‘Buy-up-to’ price.

But that’s where volatility can work in your favour. If you’re disciplined and wait, there's every chance you’ll get a chance to buy in below that price in the near future.

It’s speculative, for sure. All exploration stocks are. They’re volatile. They’re high risk. And a couple of bad results can have shares moving in the wrong direction uncomfortably fast.

But if you’re happy with those risks…

I think this is a GREAT way to play the ‘Red Drought’.

The ‘macro’ picture for copper looks great — as you’ve seen.

And the ‘micro’ situation — on the ground in Queensland — just keeps getting better.

I’ll show you how to grab a stake in just a second.

Because that’s just the first stock I’ve found for you…

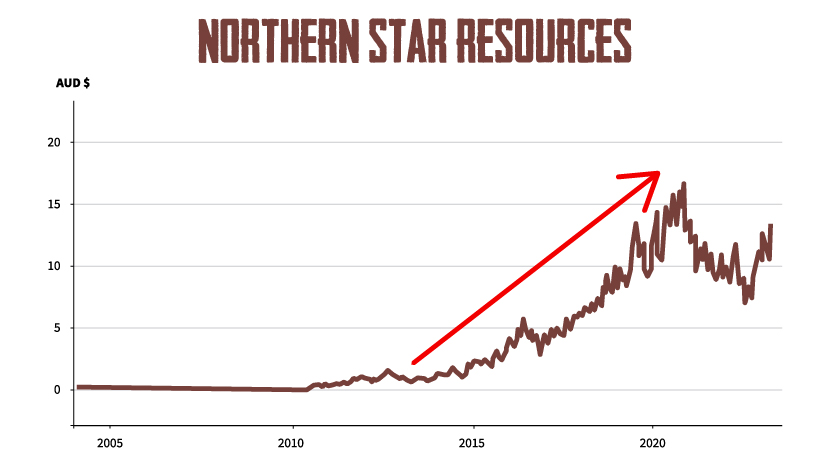

In mining circles, he’s a legend…

The man who convinced Barrick Gold to sell him 300,000 ounces of gold for just $100 million.

That works out at roughly $30 per ounce.

Today, an ounce of gold changes hands for nearly $3,000.

In other words, Bill Beament got the deal of the century.

And he did it all by running headlong towards the market when most people were going in the opposite direction.

In doing so, he founded Northern Star Resources…which is now one of the biggest gold producers in the world.

And a company any investor would have been glad to own in recent years…

But the most exceptional insiders also know when to get out of a peaking market.

After successfully turning Northern Star from a 1-cent shell to a major $15 billion gold producer, Beament sensed the top in gold and decided to leave.

But this is NOT a bloke inclined to sit on a Tahitian beach drinking gin and tonics, counting the millions from his Northern Star windfall.

This is a mining insider who is constantly hungry for the next challenge.

And this time around, he’s eyeing not gold but critical minerals — like copper, zinc, and silver.

And we can join forces with him by making just one investment in a late-stage exploration stock prospecting out in the Pilbara.

Right now, it has two ‘flagship’ projects.

Including one that could turn out to be a major copper resource — with zinc and silver deposits thrown into the mix.

It’s a great way of playing the copper breakout…by investing alongside one of Australia’s canniest resource insiders.

Now look.

I could give you chapter and verse on why I think this stock is a great buy.

But by now, I’m hoping you’re with me.

You see the opportunity here…and you want in.

So the best way to get my full, ‘no holds barred’ write up on both of the companies I just told you about is to grab a brand new report I’ve just put together.

It’s called ‘Two Stocks to Buy as the Copper Supply Crunch Hits’.

I’d like to send you a copy of that today.

Inside you’ll find everything you need to buy these stocks.

You’ll get the names and ticker symbols, of course.

But you’ll also get my entire ‘buying rationale’ — my analysis of the management team, the geology of key projects, the financials — and of course the risks involved.

I’ve done all the hard work and research for you.

To get your hands on this report, there’s just one thing you need to do.

‘Perfect storm for commodity prices’ is a cliché.

But there is no truer description of what’s coming.

A decade of underinvestment in new supply…as demand lifts off…means copper may be the NEXT commodity to see shortages, panics, and profit opportunities.

But I doubt it’ll be the last.

That’s why last year I teamed up with Fat Tail Investment Research to launch a new investment advisory called Diggers and Drillers.

I believe it’s perhaps the most important newsletter you could subscribe to between 2023 and 2030...

Why?

Because a decade of underinvestment in exploration has set the stage for a decade of undersupply and rising commodity prices.

Consider…

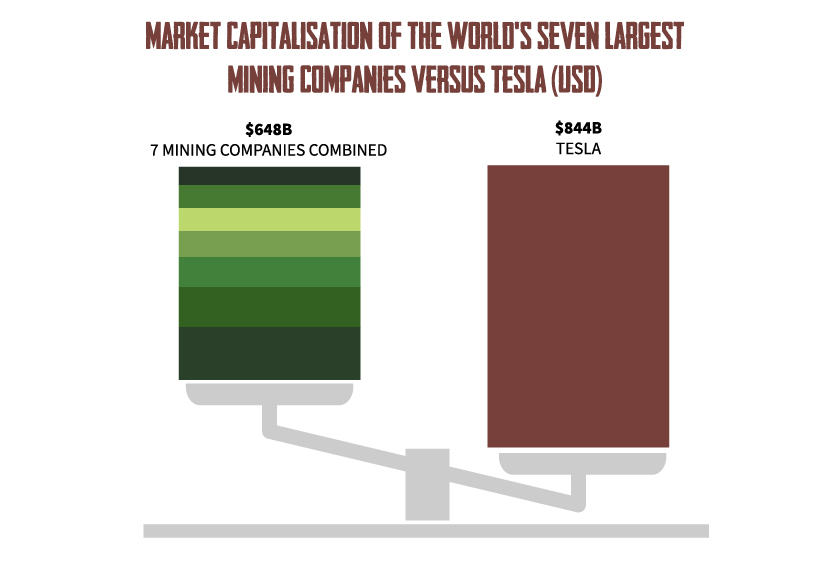

By the start of 2022, Tesla — a luxury electric vehicle firm — was more valuable than the top seven mining firms in the world ADDED TOGETHER.

It’s the same wherever you look.

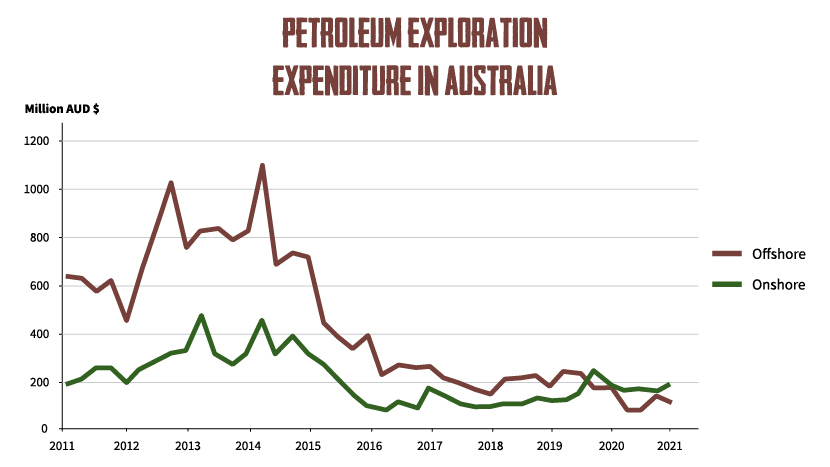

The amount we invest in energy exploration has collapsed in the last decade:

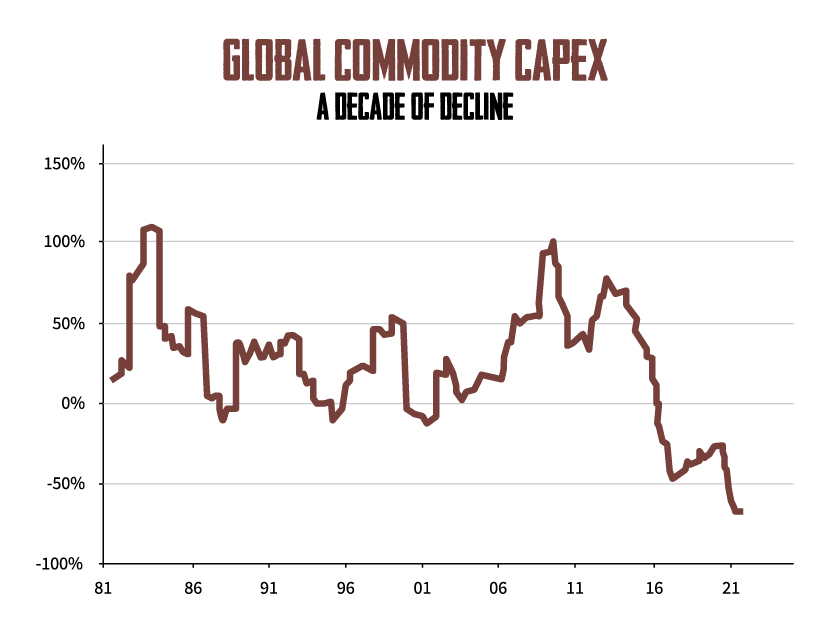

In fact, new investment in the entire commodity market has collapsed since 2011.

And if any one chart tells the whole story…it’s this.

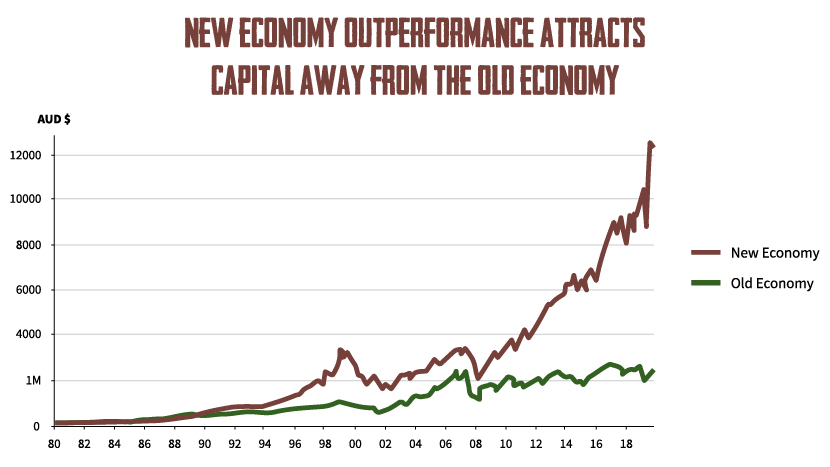

The period from 2013–21 has mistakenly been termed the ‘everything bubble’.

It actually wasn’t.

Resources were NOT part of that boom period…far from it.

The term itself diminishes the significance of resources as an asset class, assuming that ‘everything’ means the NEW economy.

Resources — vital commodities we all need to survive — got left behind.

As the ‘new’ technology economy soared, the ‘old’ world of raw materials, food, energy, and other commodities fell behind.

In short, there’s a simple but compelling story playing out.

The world has underinvested in new sources of resource SUPPLY.

While committing to projects like Net Zero, which are extremely resource intensive — sending DEMAND up.

That’s creating perfect conditions for rising commodity prices…and a wider boom for well-run resource stocks.

We’re already seeing that begin to play out right here in Australia.

There were around 90 new companies listed on the ASX in 2022.

For most, it was a bad year to IPO.

Well over half ended 2022 in the red.

Fintech IPOs got really hammered — with companies like Beforepay Group [ASX:B4P] and Equity Story Group [ASX:EQS] both down more than 70% from their listing price.

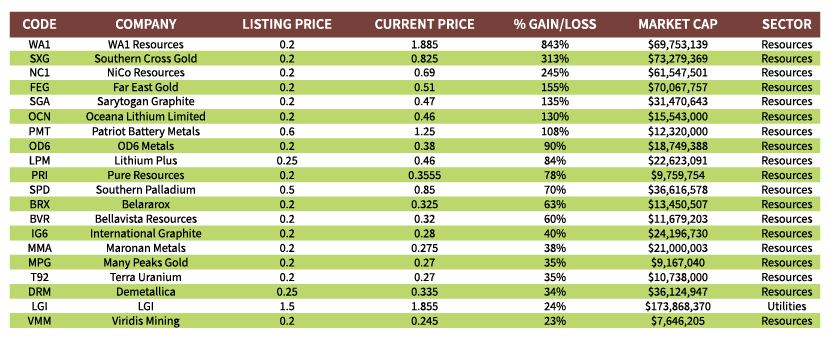

But have a look at the top 20 IPO performers in 2022.

The ones that listed strong…and then just kept on rising…despite the bad market.

All but one was related to mining.

And the TOP performer — WA1 Resources — rose 843% in that year.

Look:

It’s a small sample.

But an important one.

And it tells me something crucial.

And that’s why I’m inviting you to become a subscriber to Diggers and Drillers today.

My aim in this advisory is simple:

To get you into the right companies...at discounted prices...before everyone else.

As a Diggers and Drillers subscriber, you get a steady stream of new, fully researched resource stock recommendations, so you regularly have access to new opportunities to grow your wealth. (Though, of course, I’ll recommend more stocks when market conditions are good.)

You get regular updates from me, meaning you can stay on top of the stocks I’ve told you about without spending days chained to your computer doing research (leave that to me).

You get specific buy, sell, and hold advice, so you’re always completely clear about what to do next. I tell you when to buy…what price to pay…and when to sell, either to take profits or cut losses.

Plus, you get regular reports and analysis on the resource market, so you’re always up to date with what’s going on. Today, I’ve been telling you about copper. But it could easily be LNG…nickel…lithium…or…rare earths that’s in the spotlight next month.

As a Diggers and Drillers subscriber, you’re always up to date with what’s happening across the industry…

And you get a regular supply of new investment opportunities to turn that knowledge into action.

We only began this project last November. But already I’ve been humbled by the dozens of responses I’ve already received from those who have joined me.

No more so than this one from Martin Breen:

‘As a former senior exec of one of the largest energy companies listed on the NYSE, I can’t overemphasize how impressed I’ve been with James Coopers Diggers & Drillers subscription.

‘James is exceptionally well qualified to find top quality resources investments in the ASX. Having been a senior exec myself, surrounded by global technical experts at the highest level, it is obvious to me that James knows how resources companies work, how to value their assets and assess their risks.

‘That is exactly what I’m looking for in a resources company adviser.’

Or this, from AV:

‘Very excited about this service and what’s ahead. I lived up the North West for 30 years and have seen development both onshore and offshore so understand what is going on.’

And this, from Josh:

‘Amazing work getting James Cooper on board. You’ve found a unicorn having a seasoned geologist that understands the field and inner workings of mining companies well.

‘James also puts the pieces of the puzzle together that most can’t see (yet). There’s a wealth of opportunity in the years to come and likely something not too far ahead on the horizon in the mining diggers and drillers space for Australia. Knowing who to back and who some of the rare earths and precious metals players are likely to be (now) is invaluable.’

And James got in touch to say:

‘I have been thoroughly impressed with the new Diggers and Drillers’ service and the value for money it offers. James has produced some very well researched long-term ASX listed recommendations so far while clearly outlining the upside and downside risks for each recommendation.’

Which reminds me…

That word — RISK — is key.

All investments carry risk. There are no guarantees in the stock market. That’s why you should only ever invest capital you can afford to lose.

But resource stocks are extra speculative.

They’re high risk and volatile. I do all I can to mitigate those risks, by vetting and thoroughly researching each stock before I recommend it.

But I can never eliminate risk. You need to know — and accept that — going in. There’ll be times when things go against us and you lose money on one of my picks.

Equally, I hope there’ll be plenty of times where the stocks I tell you about do exactly as I predict — and make you money.

That’s my goal.

Because what these readers and myself are doing is targeting a new kind of resource boom.

Australia’s last mining boom revolved around a steel-intensive economic transformation taking place in China...and, to a lesser extent, other emerging Asian countries.

We think this next one is going to be bigger.

As another commodity trading insider predicted on 12 September 2022, we’re now on the verge of ‘the biggest commodity supply squeeze ever in history’.

Not just iron ore and coking coal.

Rare earths, energy, and other critical resources are now going to be in the mix, too.

My mission is to help you capitalise on it.

That starts with your report ‘Two Stocks to Buy as the Copper Supply Crunch Hits’.

But that’s really just the start.

If you accept my offer, you’ll also get:

A 12-month subscription to

A 12-month subscription to Including new investment recommendations, buy and sell alerts, updates, big-picture commentary, risk analysis, and a full portfolio of resource plays.

STOCK RECOMMENDATION: ‘Son of Fortescue: The Kingpin of the Second Mining Age’.

STOCK RECOMMENDATION: ‘Son of Fortescue: The Kingpin of the Second Mining Age’.This is my ‘swing for the fences’ speculation for right now. It’s a tiny, obscure company that’s already well ahead of the majors in its exploration — and it could be about to join a very exclusive club of top performing resource stocks.

BONUS REPORT: ‘Six Tactics for Spotting Winning Mining Stocks in Australia’s NEXT Resources Boom’.

BONUS REPORT: ‘Six Tactics for Spotting Winning Mining Stocks in Australia’s NEXT Resources Boom’. If you want to see ‘behind the curtain’ of my stock picking strategy — and see HOW I find well-run resource stocks with great long-term potential — you’ll love this report. It’s your essential guide to my strategy…and it’s yours when you join Diggers and Drillers.

You’ll get all of that the second you sign up.

And don’t worry about the cost.

Just $199-per-year is the official annual subscription.

That’s great value, given the potential of the stocks involved.

BUT...

For new subscribers, we’re slashing that by half.

And that crazy-low price is covered by a 30-day subscription refund guarantee.

Meaning, you can read my full due diligence in ‘Two Stocks to Buy as the Copper Supply Crunch Hits’.

...and STILL choose to get a full refund of your membership fee within 30 days if you so desire.

Look around. There aren’t many players in this game that swallow a subscription risk like that.

Recommendations like these tend to get locked right behind a paywall without any remote possibility of a refund.

It’s a great deal.

Hopefully it shows you how much conviction I have in what we’ve kickstarted here.

I think once you dig into these stocks and our gameplan going forward...you’d have to be crazy not to stick around after the trial period!

So now you have my take on what I think is happening in the Aussie resources space right now.

As you’ve seen, I think copper is going to be at the heart of the action this year.

But there’s a bigger story here.

Aussie resource stocks have broken away from other stock sectors in 2022.

You’ve seen some pretty golden words of endorsement from my first Diggers and Drillers subscribers.

I don’t think this trend is a fleeting thing.

As Umair Haque puts it in Medium:

‘It is a Big Deal — as big as the Industrial Revolution before it.’

The Industrial Revolution made generational wealth for those who played it correctly.

I think this new resource boom playing out in Australia will too.

If you agree, you should join me.

And learn about the stocks I’m recommending you buy now.

Remember: there’s a 30-day refund period.

You can learn all about these stocks…and STILL get a refund of that modest $99 outlay inside 30 days if you want.

Up to you.

But I’m convinced this boom is only just beginning.

Join us now and we’ll give you a roadmap for playing it.

$199 normally.

$99 today.

And with a full 30-day refund guarantee.

Click the Subscribe Now button below and let’s get cracking.

Regards,

James Cooper,

Editor, Diggers and Drillers