James Cooper

Dear Reader,

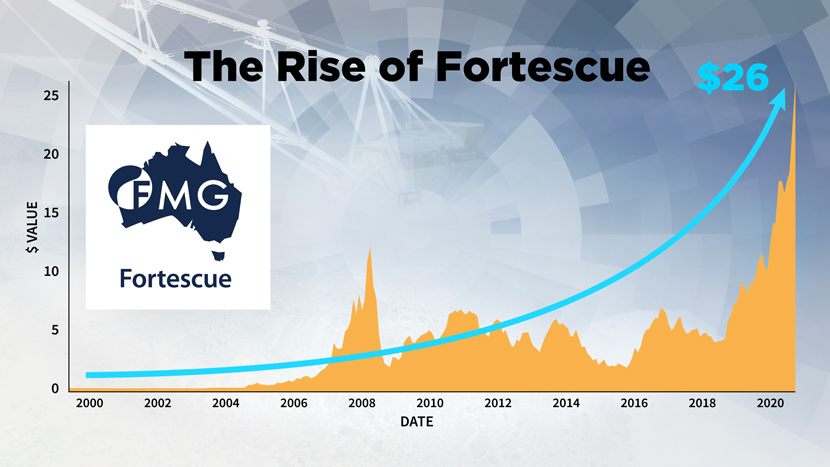

Is it possible that ANY stock could replicate an iconic rise from 2 cents to $26?

Especially now, with stock markets around the globe so much in the red?

A seasoned exploration geologist and mining insider has just arrived at our Melbourne HQ from the field.

He brings us some explosive intel…

There IS an ‘heir apparent’ to Fortescue Metals Group out there…

…hatching an epic plan from its base in the Northern Territory.

We anoint this stock in the following presentation.

Hello, and welcome to ‘The Age of Scarcity’.

Now…right off the bat, you’re right to be sceptical.

Let’s be honest, the phrase ‘the next Fortescue’ has been a cliché for years.

And stock markets, on the whole, suck right now…

There are very few bright spots anywhere in any country.

EXCEPT…THAT IS…

…FOR THE ONES STARTING TO BLINK FROM THE DESERTS OF WESTERN AND NOTHERN AUSTRALIA…

Whisper it, but…

Our mining sector’s powering up again

Resource shortages are worsening daily…

Source: Forbes

In 2022, 27 commodity prices ranging from metals to energy to agriculture have soared at the fastest pace on record…

The Aussie Government is now fast-tracking project approvals.

Source: Mining.com

Do a bit more sleuthing…and you’ll notice something else…

The same motley characters who gobbled riches in the last mining boom are mysteriously popping up again…

…getting appointed as non-exec directors on the next wave of explorers.

As our inside man tells us:

‘These guys are just as adept at mining the stock market as mining ore. And they’re setting up to do it all over again...’

This may explain something…

Source: Motley Fool

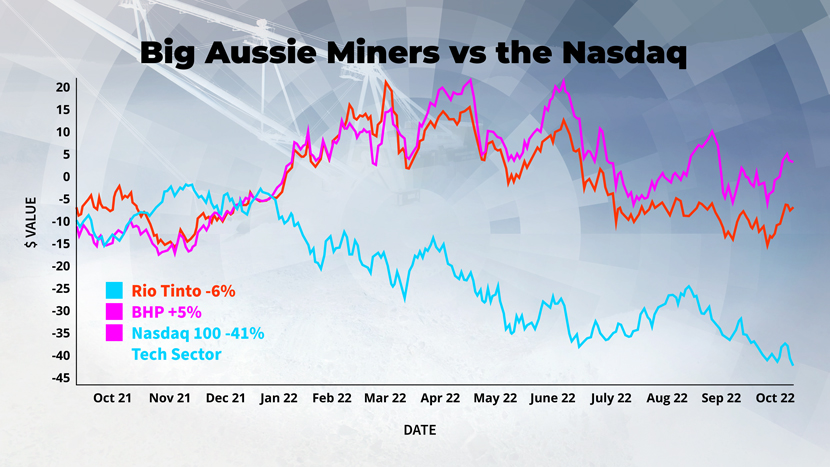

In recent weeks, certain Australian mining stocks have started to ‘decouple’ from the beleaguered global equity markets. Just as they did 20 years ago.

Some of these stocks — the class we’re going to be focusing on today — have recently splashed out high double-digit gains in SINGLE TRADING SESSIONS.

What’s the deal here? Were they flukes?

‘The years ahead will be like

the mining boom on steroids’

…predicts Peter Milne in The Sydney Morning Herald.

Is that true? Or just media fluff?

And even if it IS true…is it worth sticking your neck out in such an uncertain market?

Keep watching.

There are certain times in the market when fortune favours the clear-sighted and the brave. We reckon this is one of them. Because, here at Fat Tail Investment Research, there’s a distinct sense of déjà vu in the air…

Back in the mists of time — when our independent stock-picking business was just a single newsletter sent out by post — Australia’s LAST mining boom was also in its infancy.

Addressing our very first readers, we called it…

…‘The Big Dig’.

We covered it as it crested…finally went mainstream…and then supersonic. And in those pioneer days, we didn’t mince words…

‘A giant exploration and production rush is about to hit Australia, the likes of which have not been seen in 25 years.’

Our prediction seems obvious in retrospect.

Trust me, most scoffed at the time we made it.

The Australian mining boom that peaked in 2011 came on SO fast…and SO hard…it blindsided even the veterans.

‘The word “boom” is a misnomer,’ a shocked Rio Tinto CEO said at the time.

‘I don’t know what the right word is — maybe it’s a paradigm shift.’

Whatever it was, while the rest of the world got smacked by a credit crisis, the first ‘Big Dig’ created a recession force field around Australia.

National wealth grew exponentially.

Sadly, for the average Aussie, the boom years did little more than change the morning newspaper headlines.

HOWEVER…

Some non-professional investors…with the smarts to own the right stocks early…made colossal wealth.

For a brief time, it was a speculator’s paradise.

China’s huge appetite for minerals was a tide that lifted all boats.

High grade, low grade, long mine life, or short mine life…it didn’t really matter.

Any company with a decent possibility of going into some form of production benefited.

As did those who owned the stocks before everyone else.

But just ONE company can lay claim to TOTALLY OWNING this First Age in modern Aussie mining:

Fortescue Metals Group.

Their rise from a ‘penny dreadful’ to one of the biggest miners on the planet…in less than five years…was SOME story…

…a tale of towering ambition, brilliant forecasting, consummate salesmanship, burnt bridges, missteps, and misfires…

…then, ultimately, UTTERLY IMMENSE share price gains.

Source: Yahoo Finance

Past performance is not a reliable guide to future results.

20 years later…on the cusp of a SECOND big Australian dig…

Is this tale about to be repeated…

…by another ballsy, currently anonymous miner...?

Maybe. Let’s find out.

Prepare to meet the Son of Fortescue…

September 11, 2001...

An Aussie bloke sits in a hotel room in Manila.

Beside him is a convicted drug dealer.

Like the rest of the world, they’re glued to the TV, watching two steel skyscrapers implode on repeat.

Back home, the Aussie bloke’s world is imploding too.

He’s in Manila for money. Lots of it.

He’s just been booted from the mining company he founded 10 years earlier. His investors are coming with pitchforks. He’s about to lose the family home.

This church-going country boy isn’t used to feeling like a villain. But he’s now in self-exile. With a good riddance from the Aussie mining establishment.

Fast-forward 10 years later...

Source: Zimbio

This same bloke named Andrew Forrest, ‘Twiggy’ to his mates, is standing at Westminster Abbey.

Before him are the late Queen, the then-Prince Charles, and heads of government. He’s the only Aussie invited to speak at the Commonwealth Day ceremony.

The bankrupt man from 2001 is now Australia’s richest man.

His Fortescue Metals Group has made early stock investors rich too.

Its rise from 2 cents to its all-time high of $26.58 in 2021 represents a gain of more than 130,000%.

Most of those gains accrued at the beginning, between 2003 and 2007.

Source: Motley Fool

In fact, depending on how much you invested, if you’d bought Fortescue early...you could be funding your lifestyle today on the gigantic dividends alone.

In August 2022, the stock had a mind-boggling dividend yield of 15.5%.

Forrest himself has earned an average of $2.3 million A DAY in dividends...each and every day since Fortescue started paying them in 2011.

Love him or loathe him...Andrew Forrest blazed a trail.

He didn’t just create billions in wealth.

He gave us a pathway...

If you closely study what Fortescue did in the last mining boom...

...you get a clearer idea of who might pick up the mantle in the NEXT one.

That is the central focus of this presentation.

James Woodburn

My name is James Woodburn, and I head up a company called Fat Tail Investment Research.

We came into the Australian financial advice scene in the 2000s, and set about disrupting it in much the same way as Andrew Forrest upended mining around the same time.

Our motto was and is BUGGER THE ESTABLISHMENT.

Independence is true strength when it comes to financial guidance.

We’re not tied to any bank, brokerage, financial institution, listed company, shareholders, industry, old boys’ club, or major media organisation.

Meaning we could arrive and tell you EXACTLY how to play the last mining boom as we saw it...in a completely unbiased, no-strings-attached way.

We did it fairly effectively the first time.

Although we NEVER got our readers into Fortescue — the best time to buy was several years before we arrived.

In that sense, it was our white whale.

Today, we seek to make up for that ‘big one we missed’...

We’re about to introduce you

to a set of FIVE stocks

We think there’s a strong case for buying all of them, right now, at their current prices.

One, in particular, is extra special.

We have dubbed this little-known company the ‘Son of Fortescue’…for reasons that will become apparent soon.

Before we go any further, though, we need to hit the elephant in the room. The state of the wider market.

It’s terrible. As you’ve no doubt noticed.

2022 and early 2023 might go down in the books like 2008, 2000, and 1987 in terms of index declines.

This wholesale selling is happening because central banks are on the warpath against inflation. The US Fed is committed and won’t waver on this war.

In the past...when equities collapsed...they’d print money or lower interest rates. And you’d see markets turn up again.

They’re not doing that now. And that’s new, at least, in this century.

Which leads to the question…

Who in their right mind would buy ANY stock right now? Even a potential new Fortescue of the next mining cycle?

KEEP WATCHING!

Go back exactly 20 years, and you hit the start of the last Aussie mining boom.

If you don’t remember, the end of 2002 was a super-volatile time in markets — and the world generally.

We had crazy geopolitical risks.

September 11 was still fresh. The US was ramping up multiple wars.

The dotcom bust had just happened. Investors who couldn’t get enough of growth a few years earlier now HATED anything new and speculative.

The heavily tech-weighted Nasdaq had just fallen 78% from its 2000 peak. Zero-earning stocks suffered the biggest losses.

Sound familiar?

2002 is a mirror to right now.

Back then, Fortescue Metals was little more than a light bulb above Andrew Forrest’s head.

But this was the backdrop to his big China-driven mining boom bet.

Forrest saw then what WE see now.

An enormous opportunity...if you pick the next trend...select the right plays...and BUY IN against a tidal wave of fear and anxiety.

With the benefit of hindsight...we can look back on 2002 as a major TRANSITIONAL shift in asset allocation.

By 2004, central banks started raising rates, like they’re doing today.

The global financial fraternity moved AWAY from tech companies...fast at first...and then stayed away...

...and moved INTO stocks with exposure to real assets.

Mining, real estate, and banking.

Look around you. What happened then is happening again right now.

But if you remember, it was the MINERS that really lifted the Aussie stock market out of oblivion...helping the ASX 200 post a 150% gain from the dotcom lows.

Source: RBA

By the mid-2000s, our market was the toast of all the indices.

But smart, private investors who speculated on the right stocks early on were the ones who REALLY benefited.

You saw what Fortescue did.

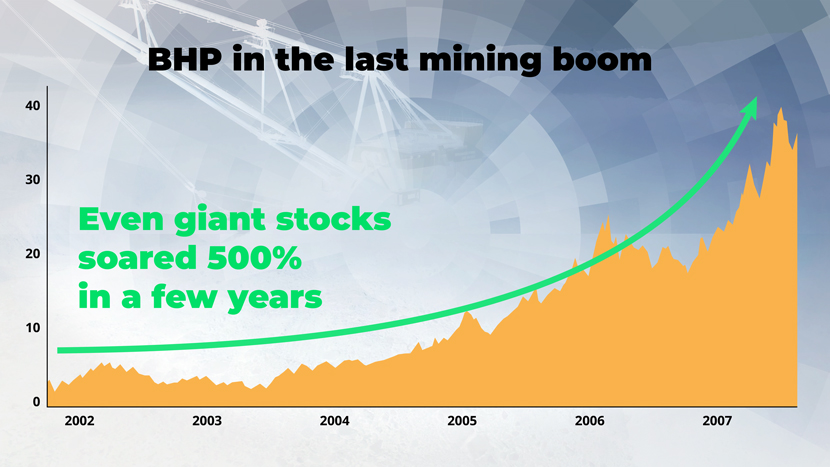

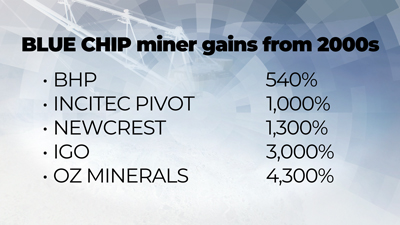

But even the blue-chip miners Twiggy set about disrupting grew exponentially.

If you owned BHP Group at the right time, you would have made more than 500%:

Source: ProRealTime

Past performance is not a reliable guide to future results.

That wasn’t punting on a tiny small-cap. That was from a massive blue-chip!

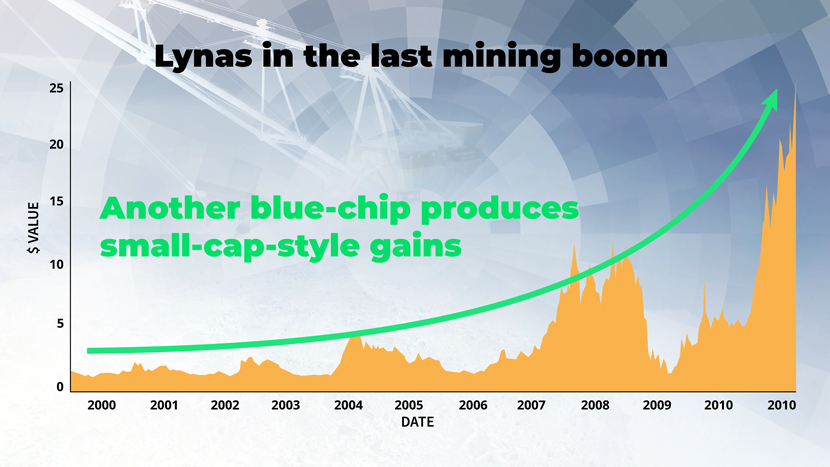

Another large-cap play was Lynas Rare Earths, which socked away a whopping 1,200% within a short burst later in the boom cycle:

Source: Google Finance

Past performance is not a reliable guide to future results.

(We’ll come back to Lynas later. As you’ll see, they have a part to play in what happens next...)

Of course, not every producer saw massive price rises in the last mining boom. It’s also worth noting that many saw huge falls back to Earth when the boom wound down. Coal baron Nathan Tinkler famously lost his fortune when coal prices collapsed.

Point is...

Source: Google Finance

Past performance is not a reliable guide to future results.

...it tends to be ONLY ultra-boom times where you see blue-chip stocks clocking gains akin to a small-cap growth company.

That hardly ever happens, in any industry. But it DID happen for many of the large mining producers in the last cycle.

And you could have directly benefited if you took action and bought these stocks in the doldrums of a totally crap market.

Source: Google Finance

Past performance is not a reliable guide to future results.

If you took a punt on the right SLIGHTLY SMALLER companies...many of them BECAME blue chips WHILE you owned the shares...before your very eyes...

Fortescue Metals Group is a prime example.

My point is all this arose out of the exact market conditions we have we have RIGHT NOW...

History is rhyming.

And you should be buying.

But not just any old mining stock...

Now, a very clear caveat must be made here.

Past performance is not a guide to the future.

Mining stocks are always risky...in ANY market. Buy the wrong ones and you can lose money.

And no cycle is ever the same.

Indeed, as we’re about to show you, the big bet Andrew Forrest made amid the chaos 20 years ago wouldn’t work again today.

That last bet was on iron ore commanding a premium...and getting a jump on the coming price rise before everyone else.

Today...a NEW trend is evolving in Aussie mining.

And a NEW contender is rising from nowhere to completely own it...

In 2023, Australia sits in an enviable position (yet again).

But this time around, our competitive advantage will look much different.

China will still be a huge player. But perhaps not in the way you would think...

You probably sense the tide rising in Aussie resources already. Even if you’ve not been directly following it.

We are entering a new kind of commodities boom.

A ‘Second Age’.

The last one was driven by demand.

This one...as we’re going to clearly show you...is going to be all about SUPPLY.

Specifically, lack of it.

For the moment, governments have convinced the public that the supply shortages of key commodities are a temporary dilemma.

And it’ll sort itself out.

It won’t.

And just like in the early 2000s, few people grasp that we’re entering a new age...

Inflation, interest rates, war, and dodgy markets are getting all the news headlines.

But resource scarcity is the core story bubbling beneath it all.

If you can JUST GET this idea now.

Like Twiggy did 20 years ago...

And make the right moves — moves we’re going to suggest to you shortly —you could do just as well as the early resource stock investors who came in...in 2001 and 2002.

See...

What governments know — but aren’t willing to admit — is that the supply of commodities can’t be turned on at the flick of a switch.

While leaders scramble in the background to find new avenues for providing vital commodities...

...there’s a hard truth waiting for them...and just about every other person on the planet.

That truth is that substantial investment has failed to reach the exploration of key metals, oil, and gas for more than a decade.

This means NO major discoveries to replace depleting reserves.

The war in Ukraine, the disruptions to supply chains, the eye-watering shipping costs, and the labour shortages...THEY’RE thrown at you as the reasons that prices are soaring.

But, really, they’re just smokescreens.

Since the last mining boom, exploration investment has fallen off a cliff. We still rely on major discoveries made 15–20 years ago to maintain our current needs.

This is the REAL reason you’re seeing certain parts of the Australian mining industry roar back to life.

While Australia alone won’t be able to ‘solve’ the enormous supply crunch that’s coming, a handful of local explorers are about to shift into production...

...just as the issue reaches a tipping point within the next two years.

Owning these companies now could be your ‘Get Out of Jail Free’ card as a private investor for the rest of this decade.

Buying the stocks we’re going to recommend...and one very special one in particular...will take some guts.

Source: OMFIF

Make no mistake, most investors are still scared stiff of equities. Systemic inflation breeds fear as to how far interest rates will climb.

But cash is a terrible investment in times like this.

Our bet...just as happened in 2002 and 2003...is you’re going to see investors jump back into certain REAL ASSET stocks.

Indeed, as you can see here, some Aussie mining stocks are already showing signs of ‘decoupling’ from the wider market:

Source: ProRealTime

Past performance is not a reliable guide to future results.

This transition is

already underway...

Quietly...throughout 2022...

A growing host of Wall Street banks, from Goldman Sachs to JPMorgan to the Bank of America, have started putting their high-net-worth clients back into commodities. Just as they did in the early 2000s...

The ‘smart money’ is called that for a reason.

It sees average earnings in the material and energy sectors starting to surge. Even as the wider market has declined.

And the ‘smart money’ knows what’s coming...

Resource scarcity, we believe, is about to become the only game in town when it comes to making exponential gains over the next 10 years.

Forget tech. Forget cryptos. They’ll ebb and flow, and cycle again no doubt, but their time in the limelight is over for now.

If you want to make a lot of money from whatever speculative capital you have on hand...then you should be buying cheap stocks now that could become much, MUCH more expensive stocks...as this Age of Scarcity plays out.

If you look beyond the current inflation and interest rate jitters...and keep your gaze firmly fixed on critical resource supply issues...you could do multiples better than most others in the market over the next five years.

What you need to do is select the right investments and BE IN THEM before the exodus from cash into ‘real equities’ properly begins.

Because when it DOES really kick off...it will be rapid and unexpected by the mainstream...just as it was in 2002 and 2003.

Years of underinvestment means the industry hasn’t been able to deliver additional reserves to meet future demand.

Companies with superior grades and long mine lives are rarely discounted like they are RIGHT NOW.

Few investors have the audacity to press the buy trigger at the moment.

That’s exactly what we’re suggesting you do.

But which stocks?

You’re about to find out...

We’ve just recruited a seasoned exploration geologist to help us pick the stocks that could massively outperform over the next few years.

It took us more than a year to find and attract the right person.

But we carefully spent this time because this will not be a game for amateurs or fly-by-nighters.

It takes years of dedicated mineral exploration to find the NEW bodies of minerals that are going to be needed in the next few years.

The guy we’ve just recruited has clocked years of geologist ‘walkabout’ experience in the Outback and Africa, contracted by both the small explorers and the major players.

He’s poured over everything copper in Zambia...to helping develop an iron ore project that fed directly into making Toyota Prados and Outlanders.

As a financial publisher, you encounter a lot of guys who talk a good talk.

They’ll write thousands of words about tech breakthroughs and AI stocks...but have never met a software engineer or been in the boardrooms of Silicon Valley.

I knew from experience that this wouldn’t cut it for this new resource stock project.

Which is precisely why we’ve

connected with James Cooper...

James on a geological field trip

in New Zealand

Our Editorial Director, Greg Canavan, and I realised pretty quickly that with a new ‘scarcity-driven’ boom forming...we needed a SEASONED EXPLORER.

The career of a geologist is a wild ride of adventures, booms, and busts.

James Cooper has followed that exact path.

He’s been involved in massive ore discoveries and multibillion-dollar takeovers...soul-crushing failures and delistings...and everything in between.

When he wasn’t managing rigs, soil sampling, analysing data, and organising field crews in far-flung places, James was TEACHING geology at international schools...

There’s a bit of Indiana Jones about him.

For instance, one minute he was having beers with the exploration manager of Equinox Minerals in a Perth bar…several beers in, he’d signed a contract, boarding a set of five flights to Solwezi in Zambia to look for copper.

James with his field crew undertaking

remote exploration in the Zambian bush

James was actually right at the heart of it when Barrick Gold came in in 2011 and bought out Equinox for a staggering $7.5 billion.

He tells me:

‘While the big major mine companies were not really my cup of tea, it was interesting to see the takeover, then play a role in what was the biggest resource drill-out that ever took place in Africa.’

The crux of it is:

If you’re going to search out the miners with the best chance of hitting it big in the NEXT cycle...you need an actual ore hunter with these credentials as your guide.

Not a hack or a keyboard ‘expert’.

James at a mobile exploration camp in Zambia.

Office tent in the background.

You need a guy who knows how to dig into actual dirt just as well as balance sheets.

James knows through experience how hard it is to make these finds.

Right now, he’s seeing direct evidence of resource companies starting to frantically sift through old drill cores...in the hope of finding a strike in critical metals.

It’s an inexpensive strategy that could gift a company an instant windfall.

But it’s a long shot.

And these small wins won’t be enough to supply the breathtaking level of demand that’s coming.

Many exploration geologists have spent careers spanning 40-plus years unable to make a single find that led to the development of a mine.

This is not due to a lack of skill or knowledge either.

It is based squarely on the issue that viable bodies of ore, as well as oil and gas fields, are becoming increasingly harder to find.

This is happening at a time when exploration has suffered from critical underinvestment for more than a decade.

‘Perfect storm for commodity prices’ is another cliché. Just like ‘the next Fortescue’.

But, according to James, there is no truer description of what’s coming.

Remember, he’s not a hobby pundit.

He’s been right in the thick of it.

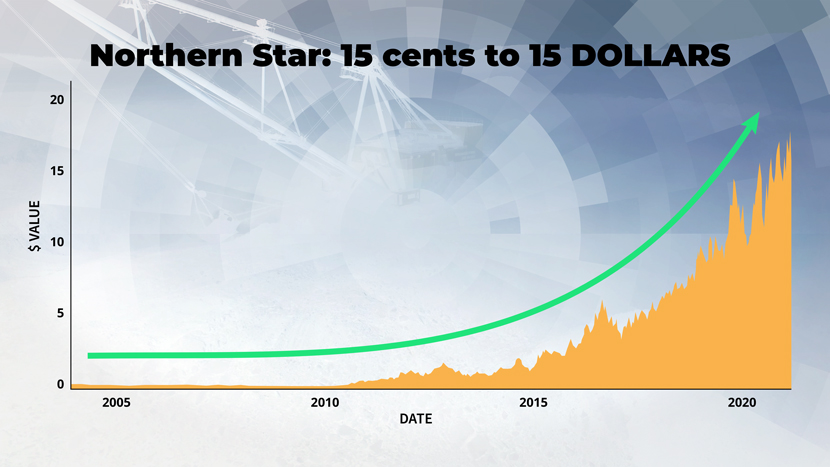

Through the pandemic, he was with gold mining behemoth Northern Star.

In 2021, he was headhunted to be Dacian’s senior exploration geologist, in charge of the company’s growth in rare earth projects.

Each stock selection we’re going to show you now

is based on EXACTLY what James is seeing and

hearing in the space at this very moment

Which brings us to those stock selections.

James has identified FIVE core players.

Each are first movers in key areas.

Each are trying to define critical resources for the new Age of Scarcity.

Each...James believes with high conviction...has the potential to outperform the wider market significantly in 2023 and 2024.

But...

One, in particular, has brought our entire office to a standstill...

If you consider buying just one single share to harness the impact of critical supply shortages, it should be a company that we’ve dubbed the:

Son of

Fortescue

Let’s dig into this company now by circling back to Mr Forrest.

‘We took the view in 2003 that China had awakened’, he explained.

In retrospect, this audacious $10 billion bet on a China-driven iron ore boom seems like a no-brainer.

But no one at the time imagined exports of the bulk commodity were about to expand fourfold.

‘On a visit to China I saw how deeply the Chinese respected the iron ore, nickel and cobalt resources, which we in Australia took for granted,’ he said.

‘It taught me how serious a resource deficit could be for their country. So we started with a vision to be a major iron ore player.’

While the two big multinational miners were ignoring the federal government’s pleas to expand production...

A new company called Fortescue was building railways, ports, and mines...and soon hurling millions of tonnes of iron ore at a hungry China...

...while iron ore was TRIPLING in price.

So, here’s our first big reveal...

James is seeing a similar set-up right now. But this time...it’s happening in the RARE EARTH ELEMENT space.

Now, you MAY already know that rare earths and several other critical metals are ground zero in the coming scarcity era.

I’m not going to go deep into making that case here.

Suffice to say...

James calls them

critically endangered metals

for good reasons...

It’s the stuff you need for EVs, iPhones, 3D-printed houses, automated homes, and ultra-efficient renewable energy power generators.

With the stroke of a pen, governments across the globe have started to build out a carbon-free, pollution-free, automated utopia.

Whether it’s going to work out for the best is beside the point.

The POINT is this...

There is one KEY factor that environmentalists, leaders, CEOs, and celebrities have left out...

How do we get the critical materials to build this multitrillion-dollar green dreamland?

Exploration geologists like James were not invited to the Paris or Glasgow Climate Summits.

Because of that...

Policymakers have made BIG and IGNORANT assumptions that resources will just BE AVAILABLE.

Those responsible for actually making them available know better.

Supply of rare earth elements and critical metals is not a straightforward process of increasing production like it is for iron ore mining.

Twiggy had that in his favour. He knew if he could get all his ducks in a row to get to production before everyone else...the ore was there. Heaps of it.

Like I said, we’re not going to go any deeper into the supply crunch case for rare earth elements.

But it’s actually much bigger than just the ‘great green energy transition’.

It’s a scarcity problem for ALL segments of the economy.

A tidal wave of changing technologies means an enormous shift in the types of raw materials needed.

From healthcare to defence to manufacturing, the commercial need for these metals is rising by the month.

Right now, China dominates the extraction and processing of almost everything needed here.

The latest US Geological Survey report found China as the dominant supplier for no less than 25 critical minerals.

For this reason...

Unease is brewing throughout the developed world.

Non-Chinese manufacturing of EVs, solar panels, iPhones, smart TVs, laptops, and defence technology will come to a standstill should China decide to ramp up its pressure against Western powers.

The very threat of cutting off supplies will send shivers down the spine of major manufacturers.

So what’s the contingency plan for the US or Europe?

Nothing.

China has played a VERY smart long-term game.

And the West may have an enormous price to pay for its stupidity in ignoring early warning signs.

As resource companies collapsed during the depths of the last commodity downturn, China stepped in and purchased major deposits for pennies on the dollar.

The downturn gifted China an enormous opportunity to dominate global supplies of critical metals.

In 2023, we’re going to see what happens when the West is forced to make a charge onto this battleground.

And, if our analysis is correct, one little-known Australian miner could be about to lead it...

Let me explain a bit more about how we know this...

Our new guy, James Cooper, has come directly to us from his last job as a senior exploration geologist for a miner called Dacian...

Look them up. They just had a $75 million takeover bid launched on them from a bigger miner called Genesis.

Dacian was primarily a gold producer. But when James arrived, it was starting to pay attention to the CRITICAL METALS it was finding too.

He and his team spent much of 2021 scouring the mineral-rich grounds surrounding the small Western Australian township of Leonora, around four hours’ drive north of Kalgoorlie.

This, you may know, is right next to the largest rare earth elements deposit outside of China, Mt Weld. This is operated by Lynas Corp...the big kahuna player in rare earths.

The Genesis takeover of Dacian is — according to James — just the tip of the iceberg.

A massive transition is about to take place in this part of the Aussie resources sector.

And one single, for-now unknown player

could be about to take a starring role...

The coming global supply crunch in rare earths cannot be overstated.

Tension is brewing and shots are already being fired.

In 2020, China threatened a RARE EARTH EMBARGO against US defence contractor Lockheed Martin as the contractor upgraded Taiwan’s Patriot air defence missiles.

But it was an Australian company that benefited from this political contest.

Lockheed Martin struck a deal between the US Department of Defense and an Australian producer to construct a rare earths separation facility in Texas.

The Australian company involved was one we’ve already mentioned: Lynas Rare Earths.

A stern warning has been made to the world.

China is prepared to weaponise its dominance of critical metals.

But there is a silver lining.

A potentially massive one.

And it sits in our very own backyard...

Leaders of advanced manufacturing economies are finally scrambling for reliable alternatives to the things they must have.

Meeting this spectacular demand will need vast global investment to drive exploration.

Even if that miracle happens, exploration needs to be successful...

And more enormous global capital will be needed to build sophisticated processing facilities required to extract critical metals from ore.

Again, a process that requires far more infrastructure and technology compared with the relatively straightforward method of processing iron ore.

In summary: Just like with iron ore in the early 2000s, you need a DISRUPTOR...

You need a NEW Twiggy...

and a NEW company...

with a NEW disruptive vision...

Dacian is not that company, according to James.

But there is another...

- The small explorer we’ve dubbed the ‘Son of Fortescue’ is looking to ‘own’ the Northern Territory rare earths scene...just like Fortescue ram-raided the Pilbara in the 2000s...

- Son of Fortescue is aiming to directly attack Lynas Corp’s almost complete game dominance...again, like Twiggy gazumped BHP and Rio Tinto…

- Like Fortescue, it’s not satisfied with just the small crumbs of a big pie. A modest market share of a gargantuan revenue pot that 99 out of 100 small-cap miners would be more than happy with. THESE GUYS WANT MORE. Much more. Son of Fortescue is gunning for hyper-dominance: supplying a full 10% of the world’s entire demand. With advanced exploration in place...once it moves to mining...it will be in a very exclusive club of dedicated REE suppliers...

- Another feature that puts these guys way ahead is that its rare earth ore body contains an enrichment of neodymium praseodymium oxide (NdPr). Again, we won’t get into the geology weeds here, but these are the most hyped elements in the 15 metals that get branded under the ‘rare earths’ title. NdPr creates the strongest magnets known to man, which, in turn, convert electricity into motion. These magnets are used in everything from wind turbines, solar farms, medical equipment, smartphones, military tech, and even aerospace equipment…

- The final icing on the cake: Son of Fortescue...just like its forbear...has some serious stuff going on behind the scenes with the Australian federal government. It’s playing several chess moves ahead of the game. And picking up millions of dollars in grants to fast-track its plants into production before its nearest competitors.

Now, it’s important to point out, we’re in no way predicting a similar bottom-to-top share price rise to Fortescue Metals Group.

That was...by all accounts...a massive outlier.

$5,000 invested in Fortescue in 2003 would be worth around $4.2 MILLION today! That is an absurd gain that almost certainly won’t be replicated.

There is also significant risk in investing in this stock right now. Just like there was in Fortescue back in the day. Our comparisons could be off the mark. And you could lose money on it.

There were zero guarantees of Fortescue’s success in 2003...and there are zero with this play.

THE POINT IS...

In the mire of a very challenging stock market...THESE GUYS...in our opinion...are the one ultra-speculation to rule them all.

OK...

Because we THINK we’ve spotted incredible potential in this play that the wider market has not wised up to...

And because of the small market cap of this company...weighed up against where it could potentially be in three years’ time...you’ll need to take another step to get the full details.

James Cooper has compiled a comprehensive due diligence report on this opportunity.

It’s called ‘Son of Fortescue: The Kingpin of the Second Aussie Mining Age’.

You can get this report as part of a new investment advisory we’re launching with James Cooper at the helm.

It’s called Diggers and Drillers.

And it has a storied history.

Let me quickly explain why I think our new James Cooper-helmed Diggers and Drillers is perhaps the most important newsletter you could subscribe to between 2023 and 2030...

Our last mining boom may have

been big. BUT TIMES THAT BY 10...

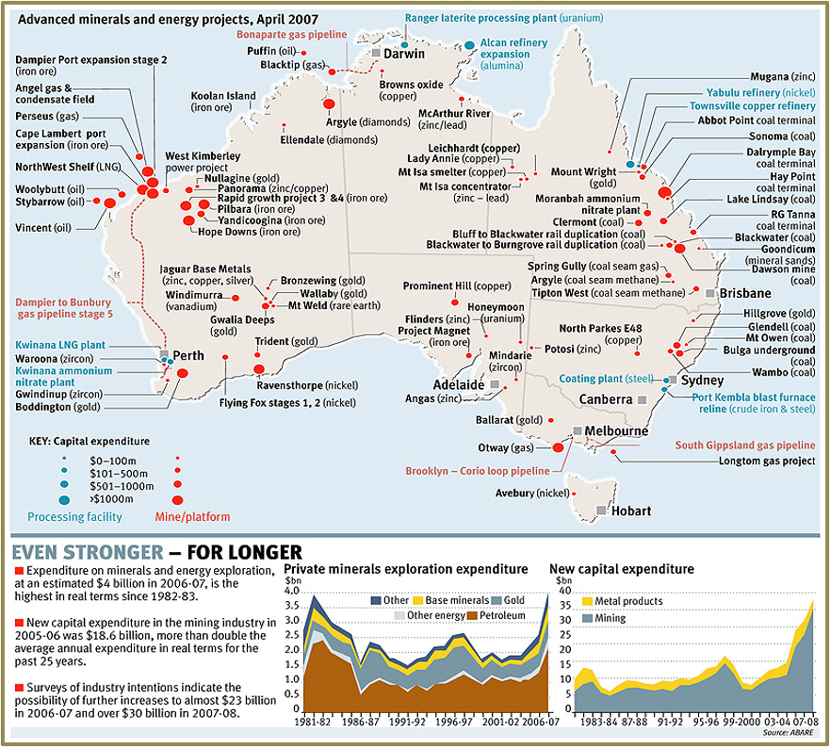

Diggers and Drillers was actually our company’s first-ever newsletter. We established it for the last mining boom. And our call to arms was just as emphatic as this one. As we said at the time:

‘The sheer magnitude of what’s about to take place is incredible.

‘I can honestly say I’ve seen nothing like it. Australia is about to become the commodities centre of the world.’

This was the magnitude of those projects by April 2007:

Source: ABARE

Past performance is not a reliable guide to future results.

I’m sure you’re aware of the wealth our country and SOME early stock investors made over those boom years.

China had an insatiable appetite for our iron ore.

But that boom, like all booms, wound down.

Mining stocks started to correct...the opportunities began to dry up...and we put Diggers and Drillers on indefinite hiatus.

One of the benefits of being an independent financial research company is we have one remit only: is this research in our readers’ interest?

We don’t publish newsletters for the sake of it.

We don’t put out a mining stock newsletter just because ‘there’s a bunch of mining stocks on the ASX’.

The timing of the cycle has to be exactly right.

Well, the cycle has turned again. And, as such, with the help of James Cooper, we’re officially taking Diggers and Drillers out of retirement.

The aim of this next-gen 2.0 version is simple:

To get you into the right companies...

at discounted prices...before everyone else

Australia’s last mining boom revolved around a steel-intensive economic transformation taking place in China...and, to a lesser extent, other emerging Asian countries.

We think this next one is going to be bigger.

As another commodity trading insider predicted on 12 September 2022, we’re now on the verge of ‘the biggest commodity supply squeeze ever in history’.

Not just iron ore and coking coal.

Rare earths, energy, and other critical resources are now going to be in the mix too.

It’ll involve almost every country and every supply chain in the world.

The company we’re dubbing ‘Son of Fortescue’ is our prime, swing-for-the-rafters speculation on all this.

As I say, James has spent many years in the field, be it on the side of a dusty drill rig or mapping rock outcrops through remote Australian bush and African jungles.

He’s seen what’s happening firsthand, and says:

‘This very obscure company appears to have read the tea leaves just as Twiggy did 20 years ago.

‘It’s spotted what’s coming.

‘It’s advanced its exploration well before the majors.

‘And it could be about to shock the world by joining a very exclusive club, almost overnight...’

This kind of disruption only ever takes place inside a small window of time.

When Forrest mapped out his plan on a kitchen table in 2003...he didn’t mess around.

The goal was to tear down the entire status quo.

Not just join the game.

RUN it.

Forrest grew up in the remote Pilbara region in Western Australia. A region dominated by the complacent duopoly of BHP Billiton and Rio Tinto.

He ended up achieving the seemingly impossible: gatecrashing that party and creating ‘Australia’s third force’ in iron ore.

In just a couple of years, Forrest had expanded 100 times over, massively overtaking the tenements of both Rio and BHP combined.

WE RECKON YOU’RE ABOUT

TO SEE A REPEAT

You can download the full report now simply by becoming one of the foundation members of our rejuvenated Diggers and Drillers advisory.

It’s very reasonably priced.

$199 per year is the official subscription for full access to James’s intel and recommendations.

BUT...

To mark the reopening of this advisory, we’re slashing that by half.

JOIN NOW...CLICK THE LINK BELOW...AND YOU CAN LOCK IN YOUR FIRST YEAR’S SUBSCRIPTION FOR JUST $99.

And that crazy-low price is covered by a 30-day subscription refund guarantee.

Meaning, you can read ‘Son of Fortescue: The Kingpin of the Second Aussie Mining Age’...and get James’s four other foundation ‘Age of Scarcity’ picks right out of the gate...

...and STILL choose to get a full refund of your membership fee within 30 days if you so desire.

Look around. There are not many players in this game that swallow a subscription risk like that.

Recommendations like these tend to get locked right behind a paywall without any remote possibility of a refund.

It’s a testament to how much we rate James...and what a coup we think it is to have landed him to helm this project.

You’ll see what we mean within half hour of joining.

Once you read his stuff, study his insights, and start tracking his recommendations, you’d have to be crazy not to stick around!

But that’ll be your choice.

If you DO stick around...here’s the

Diggers and Drillers game plan...

So, simple premise here.

We’re entering a Second Age in Australian mining.

It’ll be based around a new, expanded set of resources.

The wheels are already moving.

And it’s going to be based on a transition shift from ‘abundance’ to ‘scarcity’.

Chronic underinvestment in mines worldwide is presenting you with a very contrarian opportunity; one that only crops up to the smart investor every 20 years or so — if you’re lucky.

There are massive discounts in the resource sector on offer right now.

The aim of Diggers and Drillers is to help you find them.

But those discounts are just gravy.

Even if the resource stocks James is going to introduce you to WEREN’T trading at sell-off discounts...we’d STILL be putting them as urgent buys.

This is not merely a case for buying against bear market sentiment.

It’s way bigger than that.

We’re on the cusp of a trend that could send certain resource stocks much higher in 2023 and 2024.

Even if the wider equities markets go nowhere.

It’ll make certain stocks ‘break away’ from the wider indices in a spectacular fashion.

You just need to own the right ones.

As I’ve said, we’ve been in this position before, we called it right then, and we think we’re right now.

We believe it’s the only game in town if you’re going to be involved in the markets over the next few years.

This is still going to be highly risky. Just as speculating on the early mining boom was in 2002/03. There were no guarantees you’d make money then...and there are none here. But if you’re one of the lucky ones who have capital to play around with...and that you can afford to lose...then we firmly believe this is the best place for it over the next year or two.

To further understand the investment ethos behind Diggers and Drillers, here’s a quick quote from a very important recent speech:

‘What we are currently living through is a kind

of major tipping point or a great upheaval...

‘We are living the end of what could have seemed an era of abundance...the end of the abundance of products of technologies that seemed always available...the end of the abundance of land and materials including water.

‘Of endless cash flow, for which we must now face the consequences...

‘We are living through a huge shift.’

This apocalyptic quote in itself is not that remarkable.

A lot of smart folks are now saying a new ‘Age of Scarcity’ is here.

What’s surprising...what shows that this Age has TRULY arrived...is who actually spoke those words recently.

This guy: French President Emmanuel Macron.

Basically, the face of 21st century neoliberalism.

Poster child of the growth-at-all-costs technocrats.

When Macron was re-elected president in 2022, the Financial Times put it this way:

‘Elite metropolitan globalists [are now] toasting the liberal international order...’

Point is...

When you get a guy with those credentials announcing a new ‘Age of Scarcity’, you KNOW something’s up.

There are certain investments you can make right now that stand to benefit greatly from this shift.

Especially because you’re an investor situated in one of the most resource-rich nations on Earth.

Which brings me to another resource you’ll get instant access to if you click the link below and join us right now...

Four Prime

Age of Scarcity

Stocks to Own Now

Make no mistake, the Son of Fortescue is our showcase play for our resurrected Diggers and Drillers.

Make no mistake, the Son of Fortescue is our showcase play for our resurrected Diggers and Drillers.

If you were to buy and track just one single recommendation from James over the next few years, it should be that one.

But, as I’ve said, it’s by no means a sure thing.

And this is a boom that’s going to be bigger in scale than just one company.

Fortescue, remember, was a prime beneficiary of the last mining boom. But it was hardly the only one.

In ‘Four Prime Age of Scarcity Stocks to Own Now’, James gives you blanket coverage on four key scarcity areas and four mining companies he reckons are best positioned to nail them in the coming years.

Without trying to make this sound like a Year 10 Science class...there are some bizarre-sounding metals now shaping future investment in mining.

There’s promethium...a healer and a weapon.

This element is a critical component for making pacemakers, but it’s also used for building self-guided missiles in defence.

Or niobium...scientists have capitalised on its unique ‘superconducting’ properties allowing them to develop new kinds of superfast, highly energy-efficient large-scale computing...without the need for semiconductors.

Or there’s zirconium...a key metal used for cladding nuclear reactor fuel cells.

The potential for critical metals is endless...the only limitation is SUPPLY.

But this is not just a critical metals story.

The Age of Scarcity is going to involve the old-guard resources as well: nickel, aluminium, and copper...and you’ve seen what’s going on in the energy world recently.

That’s why a mineral known as natural graphite is being increasingly sought. It’s used in cathodes of lithium-ion batteries...and needs a massive 600% increase in its current production to meet future demand!

‘Four Prime Age of Scarcity Stocks to Own Now’ puts you into what James sees as the four best resource stock speculations on the planet right now.

-

PLAY #1 IS ‘ONE OF THE BEST SCARCITY STORIES ON THE ASX’, says James. In fact, it was a contender for Son of Fortescue...but was ruled out only because of its singular focus on one mineral only: cobalt.

The commodity exists almost exclusively within the Democratic Republic of the Congo. The Age of Scarcity problem for tech companies is that all kinds of horror stories come out of the Congo: corrupt government, child labour, guerrilla warfare. Cobalt is needed for iPhones, Macs, PCs, you name it. Apple and Google don’t really have any other option despite the public blasting they receive.

Step in our first Age of Scarcity pick...

This Aussie company is the standalone cobalt solution for the tech giants. When it comes into production, it’s set to instantly make Australia the second-largest global supplier of cobalt, thanks to the DRC dominating the world’s reserves.

Again, this isn’t just idle speculation using Google. James has worked in Zambia, just across the border from the DRC. His time in Central Africa means he’s seen firsthand why this ASX company could be such an important solution for the tech industry...an ethical Age of Scarcity option to lock in stable cobalt supply. BUY NOW!

PLAY #2 IS A $400 MILLION PILBARA DOMINATOR. The Pilbara is about to undergo an Age of Scarcity upgrade. The region is increasingly coming up with new base metal and lithium discoveries. Once thought of as a giant slab of iron ore, it’s now seen as a richly endowed mineral province which will only increase investment in the region, create more competition for land holdings, and attract a wider spectrum of investors. This company is James’s prime pick to dominate the space. It covers copper, zinc, and silver.

PLAY #3 IS A SUB-40-CENT STOCK WITH PLANS TO OPEN UP THE WORLD’S SECOND-LARGEST GRAPHITE RESERVE. And it’s a PROVEN reserve. Why the hell is this stock still only trading so cheap then? You’ll need to download the report to find out. But, again, it’s going to become a unique non-Chinese processing option for graphite in the scarcity years ahead.

A lot of graphite stocks seem to be breaking out of their multiyear sideways lows. Get James’s intel on this stock and you’ll see why...

- PLAY #4 IS THE PRIME PICK FROM JAMES’S ‘FORMER HUNTING GROUND’. It’s a great example of the quiet ‘decoupling’ from the rest of the market that some of these stocks are undergoing. It’s steadily moved up in the last year as swathes of other stocks have sold off. But, in our opinion, it’s still MASSIVELY underpriced. It’s a WA-based producer with projects that span from the Pilbara to just north of Perth. It has a former CEO of a HUGE player that’s just come on to run the show. That’s all we’re going to share on these guys here.

Look, if you take just one thing away from this presentation, please make it this...

The Age of Abundance is over.

The Age of Scarcity has dawned.

I don’t need to bombard you with more evidence.

It’s all around you.

The shelves at Coles are missing stuff that’s always been there. And if you can find it, it’s getting more expensive by the month.

If you’re lucky enough to find an affordable house...good luck fitting it out.

Furniture is disappearing from warehouses...and currently rising in price in Australia by 7% PER QUARTER.

Plane tickets, pins, power cords, PlayStations...

All harder to find...and more expensive if you can.

This is not a fleeting thing.

As Umair Haque puts it in Medium:

‘Everything is now changing.

‘Suddenly, catastrophically...’

That’s a bit doomy.

But Diggers and Drillers is going to be a defiantly positive advisory.

As Medium goes on to say:

‘It is a Big Deal — as big as the Industrial Revolution before it.’

The Industrial Revolution made generational wealth for those who played it correctly.

The Age of Scarcity will too.

Especially for those lucky enough to be sitting on the things that are about to become scarce...

This is what you’ll get if you join us right now:

But all that will be just for starters.

This boom is only just beginning.

Join us now and we’ll give you a roadmap for playing it.

$199 normally.

$99 today.

And with a full 30-day refund guarantee.

Click the link below, and let’s get cracking.