OFFICIAL TRANSCRIPT

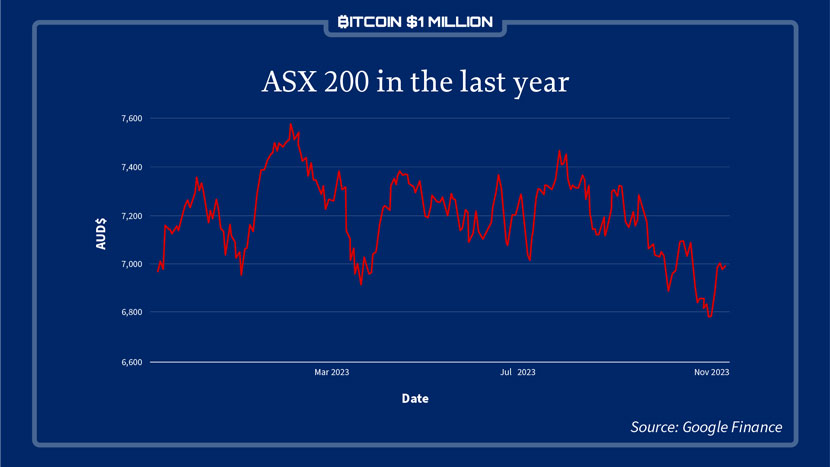

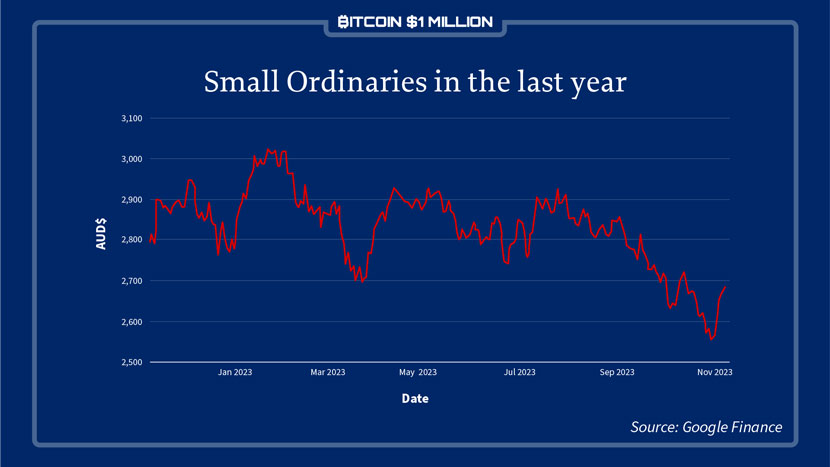

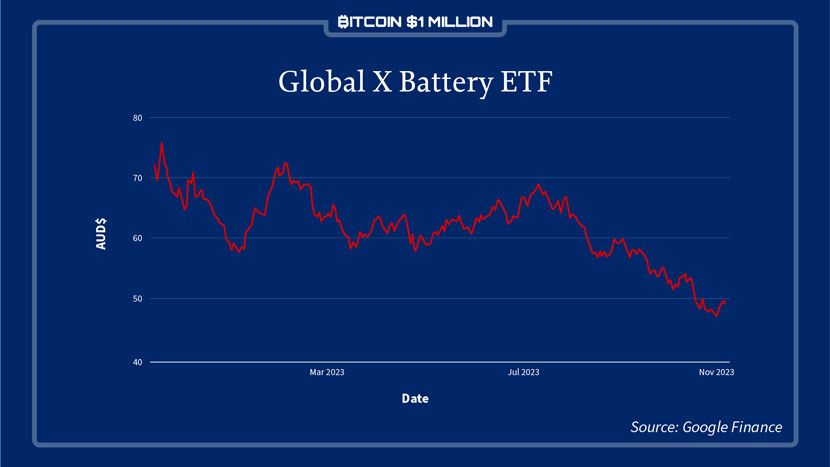

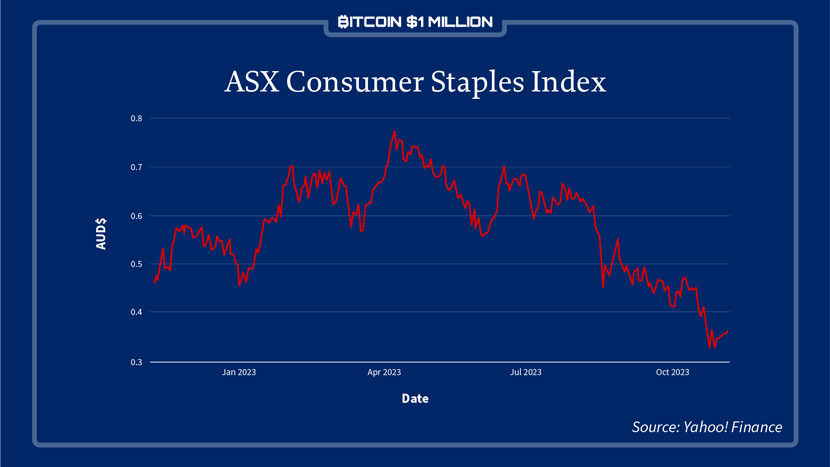

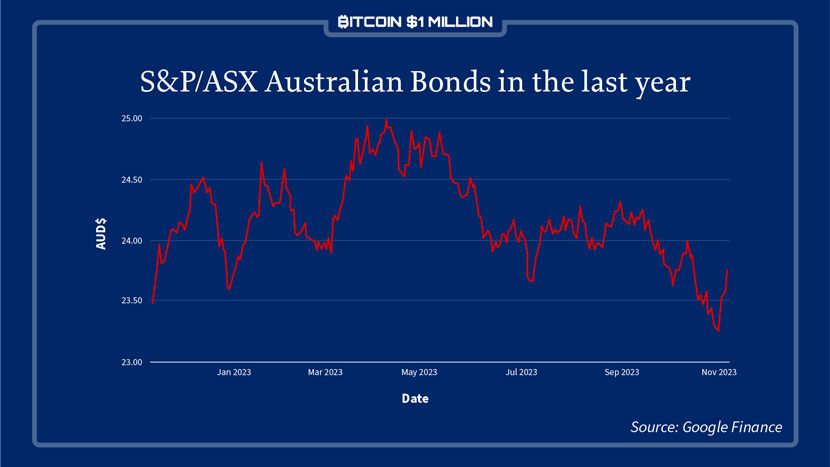

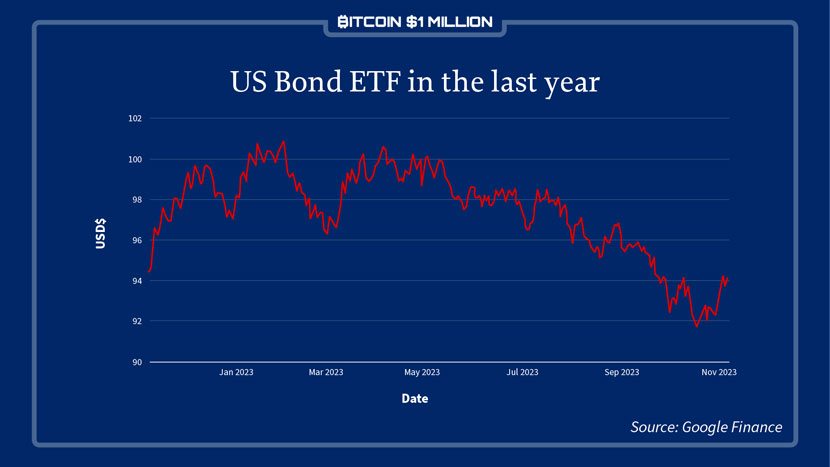

2023 is a year to forget for most investments…

ASX blue chips…small caps…battery stocks…consumer staples…bonds…

All down.

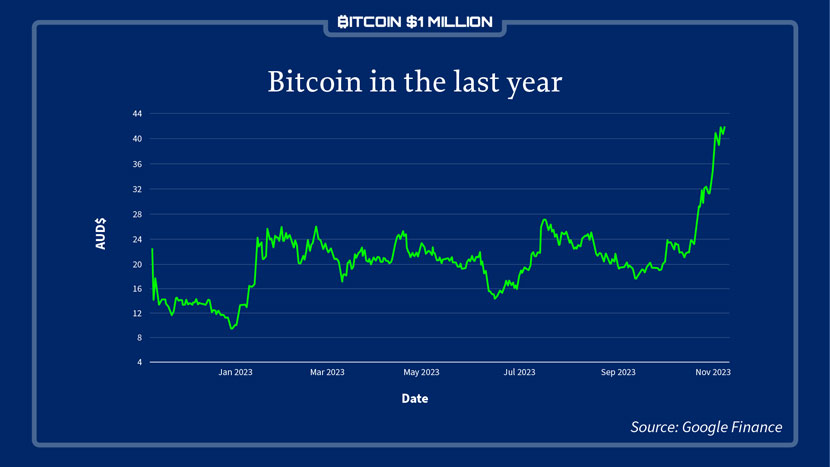

But there’s one asset class that quietly left all these in its rearview mirror in 2023.

Can you guess what it is?

One Bitcoin [BTC] bought on 9 November 2022 cost US$15,700.

Today, at the time of recording, it’s US$35,500.

That’s a 126% gain.

During a terrible 2023.

Blue-chip crypto assets Ethereum and XRP aren’t far behind.

Various altcoins have showed signs of a trend reversal as well.

It’s fairly clear: there’s been a very strong trend-change in crypto.

But it’s flown over the head of most scared investors.

Geopolitical challenges from Ukraine and Israel, ‘higher-for-longer’ stuff about interest rates, recession worries in the US, all that’s got the headlines.

What most people have completely missed, though, is that the crypto winter is now very much OVER.

We appear to have entered the very first stages of the NEXT crypto upcycle.

Way in the background, digital currencies are creeping back into the investment equation again.

Just like they always have since they were invented.

Almost like clockwork.

The difference this time?

The mainstream finance industry is clamouring on board for the ride too.

Larry Fink, CEO of BlackRock, the largest money manager in the world, explains the move as a ‘flight to quality’.

Mohamed El-Erian, head of Allianz — an insurance giant that manages around US$2 trillion in assets — said recently that:

‘You have people talking about bitcoins, about equity, being the ‘safe asset’ because they’ve lost confidence in government bonds being the safe asset because of the nature of the interest rate risk.’

I’ll bet you’re not hearing this from your own super fund or financial advisor yet.

They’re still very much behind the eight ball on this stuff.

They’ll get there…eventually.

But none of this is remotely surprising to those who’ve been following Ryan Dinse’s research and predictions.

In October 2022…almost exactly when cryptos began their latest comeback…he broadcast what was deemed, at the time at least, a rather preposterous forecast video.

It’s structured in the form of a timeline. And was titled:

How Bitcoin Gets to US$1 Million by 2030: A Timeline to ‘HYPER-BITCOINISATION’ Mapped out for You

October 2022, if you recall, the days for the great cryptocurrency experiment were dark, cold, and bleak.

Obituaries were being written daily.

Crypto enthusiasts were the butt of jokes once again.

So such a timeline, stated boldly, specifically and publicly, was a daring move on Ryan’s part.

One year on, it’s not looking quite so crazy, is it?

For the large part…Ryan’s been dead on the money so far…

Step one on the timeline was the crypto winter to end at some point in 2023.

As I just showed you, that’s happened.

This was by NO MEANS assured a year ago. And was a controversial call in itself. Many commentators were debating how many years of winter were to come…or if bitcoin would recover at all.

Well, we can safely say it’s recovered.

One year on from his bold call, Ryan is no longer a lone voice.

BlackRock and JPMorgan are now quietly laying the groundwork for the next crypto bull run.

So, what happens next?

And what’s the best tactic to get ahead of the crowd?

If this is indeed the start of a new bull run, it’ll be exciting, sure.

But it’ll also be dangerous.

Bitcoin and other cryptos are by their nature volatile. Even when they’re in an up-phase.

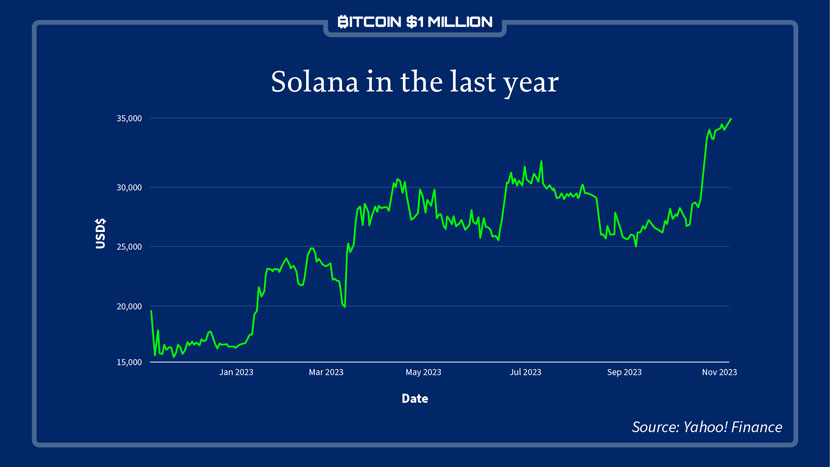

An example is altcoin Solana.

It went from US$9 in December 2022.

To US$26 by February 2023.

Back to US$14 by July.

And now sits at US$37.

A 310% gain overall.

But a wild ride in the process.

That’s crypto.

But it shows that you can suffer big losses, as well as enjoy gains, as the overall trend plays out.

You just need to believe in the big picture.

And hold your nerve.

I’m not telling you anything you don’t already know when it comes to the roller coaster this asset class puts you on.

Super risky. Even when the momentum is behind you.

But my point is…

Getting an outside-the-mainstream opinion on how crypto might play out 2024 to 2026 could be very valuable to you.

A powerful knowledge weapon at your disposal. And that’s what this timeline maps out.

As things ramp up…and if there’s a divergence of cryptos from other asset classes that even the mainstream can’t ignore…you still need to be careful.

You’ll be tempted to take risks, to sell out early, to put money into ‘the next big thing’.

There’ll be scammers online looking to fool you into giving away your private keys and passwords.

On the flip side, the crypto haters will use all their power in mainstream finance, media, and politics to try and shut the bull down.

Or even worse, to try and co-opt it.

Don’t forget, at its heart, Bitcoin is the silent revolution against the existing monetary order.

So as good as things like ETFs will be for our crypto owners’ net worth, there’s risk we need to be aware of in terms of big finance trying to take control.

It’s all taken into account in Ryan’s ‘How Bitcoin Gets to US$1 Million by 2030’ timeline.

As you’ll see, a crypto spring in 2023 is not the only part of Ryan’s projection that’s ticking along…

The bond market collapse he predicted, for instance, appears to be occurring right now, before our very eyes.

THIS IS ESSENTIAL VIEWING if you want to get some advance intel on what could be one of the most surprising and forceful bull markets of 2024.

Keep in mind, the timeline began a year ago.

You’ll need to view it in that context.

But it stretches right to 2030.

It’s tracking very nicely indeed.

And the specific moves suggested are even more relevant now than they were a year ago.

Why should you take me or this timeline seriously?

And even if bitcoin does see the exponential rise Ryan predicts , how’s that going to impact your own wealth?

Obviously, if you own bitcoin going into 2024 at around the $35k mark, you could benefit immensely if it reaches one million in six years.

But, as Ryan’s about to show you, there are certain other moves you can make...right now, with crypto prices in early recovery mode...that can substantially improve your overall financial situation as the rest of this decade plays out.

At the end of this timeline, Ryan will show you what those moves are.

More importantly, by the end of this timeline, you’ll see the financial world completely differently.

Investing in crypto has never been easy.

The worst time to buy is when everyone loves it and is into it.

The best time to buy is when most people don’t want a bar of it.

It’s just starting to trend up again.

This is still one of those ‘not interested’ times.

As you’re seeing now, the payoff — when it arrives — comes thick and fast.

People overcomplicate things, they try to trade short-term volatility, and make the ‘perfect’ trades.

But ultimately, more often than not, they end up on the wrong side of big moves, like we saw in 2023.

The following timeline was recorded in October 2022.

But the big picture it outlines is tracking almost perfectly

You’ll learn why the ‘smart money’...the high-net-worth individuals, the institutions, and the crypto whales...have started to move INTO crypto recently in a massive accumulation frenzy.

And what to do about it yourself.

I’ll now hand you over to Ryan (and just keep in mind this was recorded a year ago…that’s what actually makes it even more startling…).

My name is Ryan Dinse.

Ryan Dinse

I spent the best part of two decades in the ‘traditional finance’ (TradFi) world. First in the credit markets, then on the equity side.

But in 2013, I started to move into the digital asset space. I’ve owned bitcoin as low as US$150.

I’ve traversed three previous winters. And I’m one of the few advisors out there who approach crypto in a common-sense, big-picture way.

In November 2018, I put out a bold call to subscribers of my fledgling cryptocurrency advice service.

We’d just endured a horrendous 12 months.

The price of bitcoin had fallen from US$20,000 to as low as US$3,146.

People were sitting on huge losses.

And the whole world was declaring crypto ‘dead’.

‘Winter’ was upon us, and the mood was sombre.

If it feels like the crowd viciously turned on crypto in 2022...the hate was even worse in 2018.

2017 was crypto’s first ‘mainstream’ bull market.

Where it was all over the TV, all the ads on the radio, and your mates were talking about bitcoin at BBQs.

And 2018 was its first ‘mainstream’ bear market.

The backlash after the big price falls was vicious.

So...

When my subscribers received a note entitled ‘How Bitcoin Hits US$55,000 in 2021’ in their inbox just before Christmas, some probably thought I’d had a bit too much eggnog.

Here’s what you were being fed by the mainstream media at the time:

In that context, ‘How Bitcoin Hits US$55,000 in 2021’ sounded deluded.

But this wasn’t just some overoptimistic guess.

By this time, I’d already charted courses through previous crypto downcycles.

I’d witnessed the evolution of adoption so far.

And I could see an exact path out of that 2018 winter to greater highs.

See...

While most can’t see it...there’s actually an UNDERLYING PATTERN to how bitcoin has ebbed and flowed over the last 13 years.

As I wrote to my subscribers back in 2018:

‘If that pattern holds then bull run #4’s increases will be 17% of bull run #3’s.

‘This suggest a 15.76 X (which is 17% of the X 92.67 from low to high we saw in last bull market) increase in the bitcoin price in the next bull run.

‘Which, in turn, means if the low comes in at around $3,500, this would give a price target for bitcoin of around $55,000 (US dollars) per bitcoin sometime in 2021.’

As it turns out, I was pretty close.

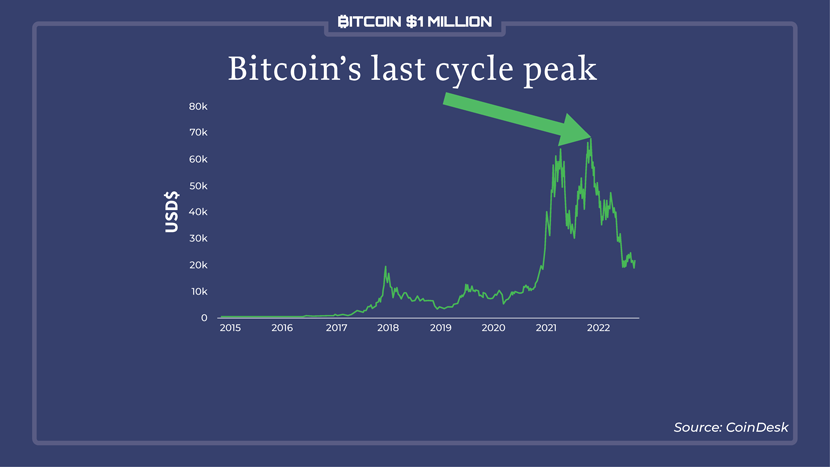

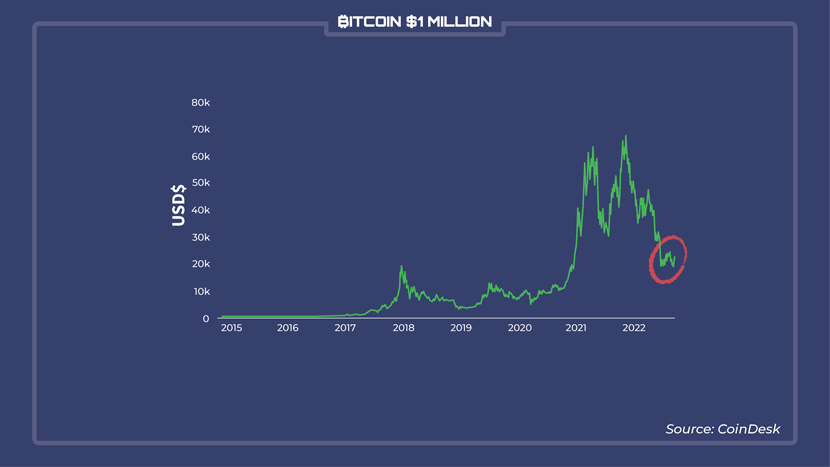

Check this chart:

As wildly optimistic as my prediction sounded to many at the time...I actually UNDERestimated slightly...

Bitcoin ended up peaking at US$69,000 in that last cycle in 2021.

But the prediction was never meant to be an exact one.

More a realistic guide of how cycles play out.

And how the pattern has tended to hold...at least during the relatively short history of crypto so far.

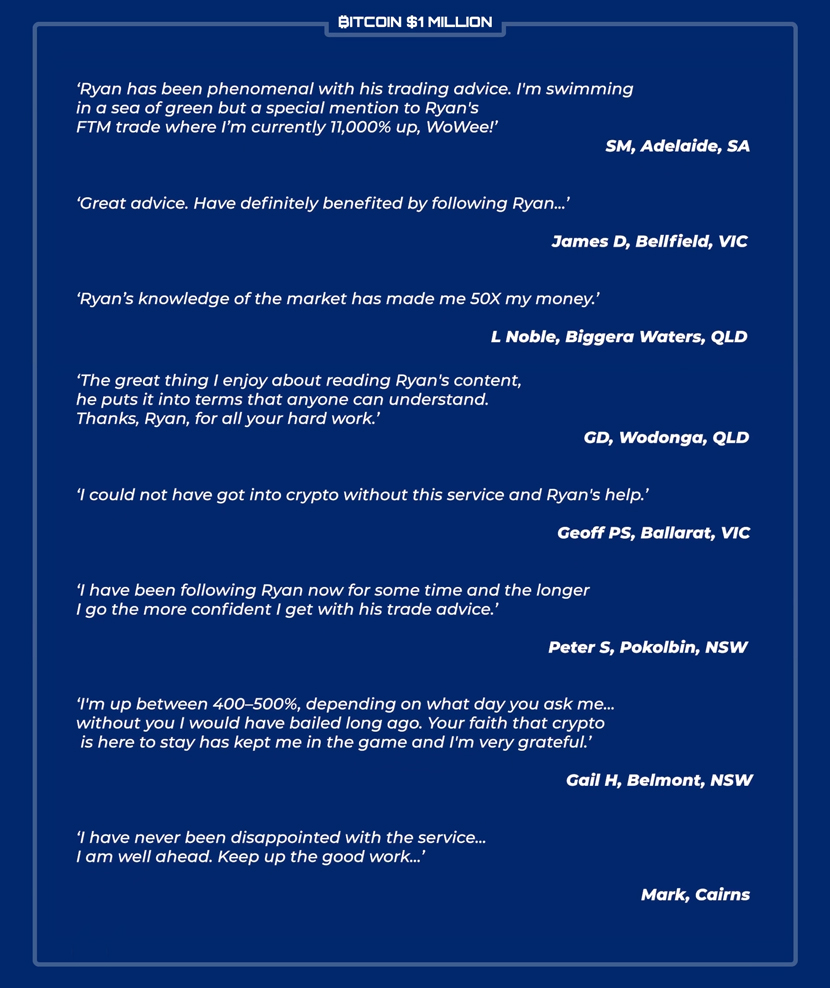

As you can see here, some of my subscribers trusted my prediction. And took my prescribed actions…

‘My total portfolio has grown from an investment of 150K to around 800K. Thanks Ryan, and you might just be my family's ticket to a healthy and fruitful retirement.’

— DS, Somerville, VIC

‘I am very happy...$5,000 now $17,000 and a huge growth potential yet to be realised.’

— SK, Towradgi, NSW

‘I am up 700% in about 3 years.’

— Steve D, Perth, WA

‘From my $20,000 investment over the whole time, my portfolio is worth approximately $135,000 today.’

— Malcolm, QLD

‘Turned $35K into $210K in under 2 years, and it should have been more had I listened to Ryan and stuck with his plan.’

— Barry C, Terrigal, NSW

‘Ryan knows his stuff...I have doubled the money I have invested to this point.’

— GF, Minchinbury, NSW

The point I want to make is...

Knee-deep in the depths of a new crypto winter:

With carbon copies of the same headlines as 2018.

But most of these headlines are ignorant rubbish.

Journalists who don’t know what they’re talking about.

‘Experts’ who always hated crypto.

Incumbents threatened if crypto succeeds.

[RYAN ON CAM]

THESE are the pushers of the ‘crypto-is-dead’ narrative...in EVERY down cycle.

And every down cycle they’ve been proven wrong.

Do a bit more digging, and you’ll see a deeper truth.

There’s actually never been MORE reasons to be optimistic on bitcoin or the whole crypto experiment.

Unfashionable take right now, I know.

My prediction for bitcoin back in 2018 was unfashionable too.

But I was right.

I believe I’m right again as we go into 2023.

When you look at the big picture that I’m about to show you...

...you’ll get a pretty clear understanding why...even in the eye of the storm...the smart money’s mobilising.

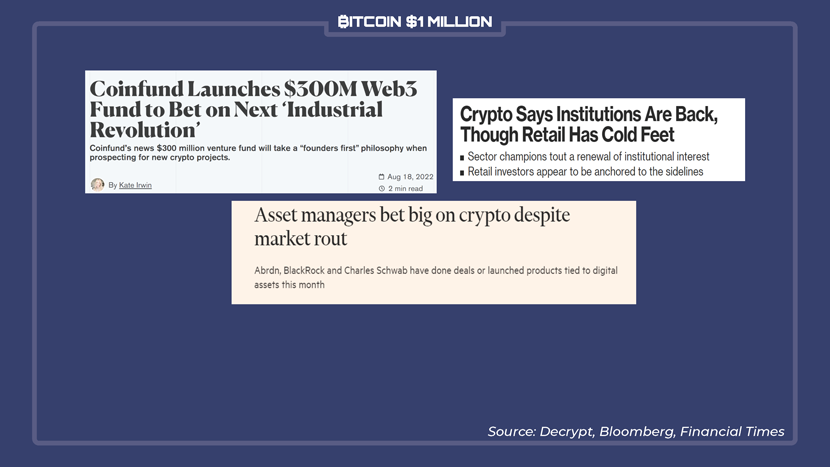

Big-name money managers and institutions have started to lock-up key digital assets.

For example, BlackRock has invested US$1.17 billion in just three crypto firms.

We’re talking about the world’s largest asset manager here.

Tech companies are at it too.

Samsung has invested US$969 million through this crypto winter.

But the biggest name is Google.

Between September 2021 and June 2022, they’ve invested US$1.5 billion in blockchain companies.

They’re all investing even as retail trading volumes have collapsed.

But what happens from here?

It’s about the whole project of crypto.

And the central innovation behind it:

Decentralisation.

The idea that anyone, anywhere, can participate in a financial ecosystem without fear or favour.

You either truly believe that’s the world we’re heading towards…

Or you don’t.

But if you DO...

There are certain decisions you can make...and portfolio moves you can take...RIGHT NOW, in the middle of this downcycle…that could put you WAY ahead of the crowd in the second half of this decade.

These decisions could have a lasting impact on your wealth.

By the end of this, you’ll be convinced that if you don’t own bitcoin yet, this bear market just presented you with a prime entry opportunity.

One you may never see again.

For instance...

If you do already own some bitcoin...you may conclude that it’s time to start INCREASING your overall portfolio allocation.

DESPITE everything you’re seeing in the media.

If you’re, say, 3% bitcoin, depending on your circumstances and risk tolerance, you may want to go to 5%.

Or even 10%.

But there are less obvious — and potentially even more profitable — moves you can make right now.

I’m currently searching out projects that help with furthering the goal of decentralisation.

Ones that have stood up against the bear market stress test.

And that have the biggest potential to surge alongside bitcoin as the new decentralised world goes mainstream.

Many of these projects have bombed out in price by 50% or more in the last year.

And I think there’s now some excellent value right there if you know where to look.

Also...

If my timeline plays out as I predict, expect something else coming onto the crypto scene:

REGULATION.

Now, philosophically, I’m not 100% on board with that.

But it’s coming in some shape or form.

And a more regulated world will open crypto to even more institutional capital.

As a pragmatic investor, there are a few key moves you can make here too.

Projects that could actually benefit from more regulation — even if it goes against the crypto ethos in some ways.

We’ll talk more on specific strategy at the conclusion of my bitcoin timeline.

Before that, though, you need the big picture.

But bitcoin at US$1 million?

Is that really a credible prediction?

Well, yes!

If you’ve followed my work, you’ll know I don’t make outlandish claims.

I’m the polar opposite of those annoying ‘crypto influencers’ on YouTube.

BitBoy, Atozy, whatever their names are. They may have millions of free subscribers, but they talk nonsense most of the time.

They’re bottom feeders.

And they don’t ACTUALLY understand money and finance.

Which is the core of the whole crypto project.

If you look below, you’ll see some testimonials from people from all walks of life who have followed MY advice over the last few years.

I’m not infallible.

But I do have a track record I’d happily put up against any other ‘expert’ out there.

And I come from a professional advisor background.

So, I sort of have a foot in both camps. And that’s pretty rare in the crypto space.

So, with that all in mind...

Here is my timeline for bitcoin to hit US$1 million.

We’ll start in 2023, when I believe bitcoin will exit its current winter.

Possibly quite early in 2023.

Before I explain why, first, you need to know this:

Bitcoin is actually, RIGHT NOW, the most stable asset in the world.

That might seem totally crazy, given what you’ve seen in 2022.

But I’m not talking about the bitcoin PRICE.

That’s obviously all over the shop.

That’s the volatility of price discovery playing out in real time. It’s messy and volatile and will continue to be like that. There’s no way we’re getting to US$1 million in a straight line.

No, I’m talking about the underlying technology.

The network.

For 13 straight years, it’s run like clockwork.

Churning out block after block of transactions every 10 minutes or so.

No downtime. No hacks. No bugs.

It’s the most secure digital network that’s ever existed.

While at the same time being fully decentralised, owned by no person, country, or corporation. Available to anyone, anywhere, anytime.

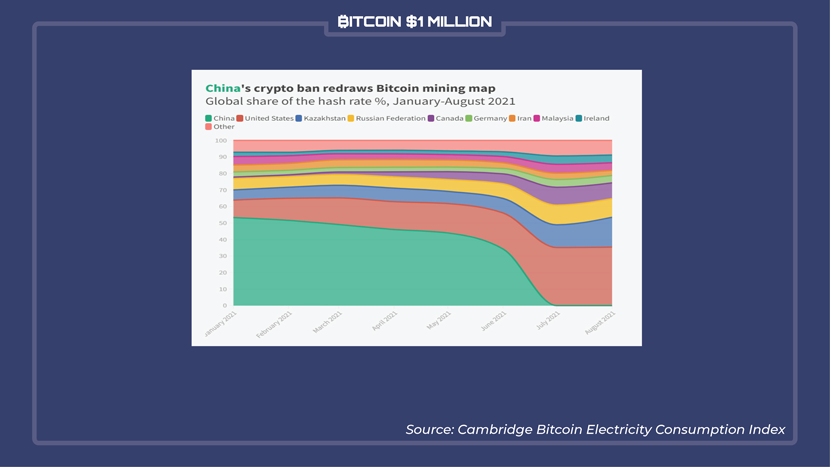

China has banned the Bitcoin industry more times than I’ve had hot dinners. And in 2021, they finally banned bitcoin mining for good.

Within three or so months, network security was higher than it had been before the ban!

You can see it here in the above chart of something called the hash rate.

Hash rate is a measure of the security of the network.

In 2019, China made up 75% of the global hash rate.

After its ban, it made up 0% by July 2021.

And look at that...within months, a whole bunch of ‘other’ countries immediately filled China’s gap.

The US has enemies of bitcoin in its ranks too.

But some big-name politicians, including former presidential hopeful Ted Cruz, are now becoming bitcoin allies. And their numbers grow each month.

But regardless, even a hostile US couldn’t kill bitcoin.

If it could, bitcoin would already be as dead as Bin Laden.

For 13 years, it’s survived the best (and worst) the world can throw at it.

It’s proven itself a reliable and anti-fragile network.

Which means, individual investors, big funds, companies, and even national treasuries are now investing in bitcoin ‘the asset’.

Heck, even a member of European royalty is advocating for bitcoin these days!

I say that because it’s really important you separate what the mainstream financial media is reporting on the bitcoin price...

...and what is ACTUALLY HAPPENING in the crypto world.

As I’ve said, this is not my first crypto winter.

The vicious drawdown in certain key coins over the last six months has shaken even a lot of crypto proponents.

Also, this time the damage wasn’t just limited to tokens.

You had Singapore crypto hedge fund Three Arrows Capital collapsing. Babel Finance and CoinFlex freezing withdrawals.

Voyager, Zipmex, Celsius...for a while there you couldn’t blame some for thinking the whole crypto world was imploding.

Of course, it didn’t.

It was just the natural end to another speculative part of the cycle.

We’ve had ‘em before. And we’ll have ‘em again.

Here’s where bitcoin’s at right now, compared to previous winters.

As you can see, every ‘crypto-is-dead’ period actually ended with a higher bottom than the previous one.

And you can see that it LOOKS like we might have already had our bottom in this downcycle.

Perhaps too early to say.

But I think despite the fact we’ve seen a few dips below, US$20,000 will hold.

And we could see it exit this bear market early in 2023.

One thing is undeniable, though.

The smart money is now mobilising back in.

A recent study shows that...despite the recent falls...80% of institutional investors still think crypto will overtake traditional investment vehicles within a decade.

And 88% believe it will have complete mainstream adoption by then.

Which may explain why key figures on Wall Street and in traditional finance are talking down crypto in public...

...but locking up supply of key projects in private.

BlackRock, the world’s largest asset manager, made one of the most recent moves. In August, it launched a spot bitcoin private trust for its high-net-worth investors.

My bet is the next six months on this timeline will be all about the smart money moving into crypto in a way we’ve never seen before.

This smart money influx is what will end this current winter.

Then we move to:

I won’t get too deep into the macroeconomic weeds here.

Instead, my big 2023 bet is simply this:

At some point in 2023, central banks are going to pivot from tightening to easing again.

Essentially jump-starting the next crypto up phase.

This seems out of whack with mainstream consensus right now.

Fed Chief Jerome Powell has told the world interest rates would be higher for longer.

Despite worrying signs of impending economic catastrophe — especially in Europe — inflation remains enemy number one as far as the cabal of central bankers is concerned.

I don’t believe it will stay that way in 2023.

Eventually, they will have to change course.

I’m looking at their track record for fighting crises. I’m looking at recession threats everywhere.

And, in particular, I’m looking at massive storm clouds gathering over the Eurozone. With rolling energy crises and a potential huge unwind in the euro.

In short:

I’m predicting that GROWTH...or lack of growth...is going to become a MUCH bigger problem than inflation.

Soon.

And that means interest rates will start to fall again, much quicker than most are anticipating.

Now, I’m not completely on my own here.

Erik Nielsen, global chief economist at UniCredit, just told CNBC that ‘there is a very high chance the Fed ends up cutting rates’ next year‘and this is a recession story again’.

If things get REALLY bad in the US and Europe, you could well see the printing presses whir back to life.

Meaning: QE is back.

You know what happens to asset markets...and crypto most acutely...in a scenario like that.

They roar back to life as well.

Remember:

The last time that happened in 2020, we went from bitcoin being US$3,500 to US$69,000 in a flash. Within 12 months.

Look, no one knows the future.

Maybe inflation remains stubbornly high and central banks tighten well into ‘23.

But I don’t think that’s going to happen.

I think, in 2023, you’ll see a big break from bitcoin to the upside.

Meanwhile...

2023 will also see adoption move relentlessly forward.

Especially in developing countries.

As bad as things are economically in the West right now, it’s 10-fold worse in countries outside the G20.

And it’s hitting their currencies hard.

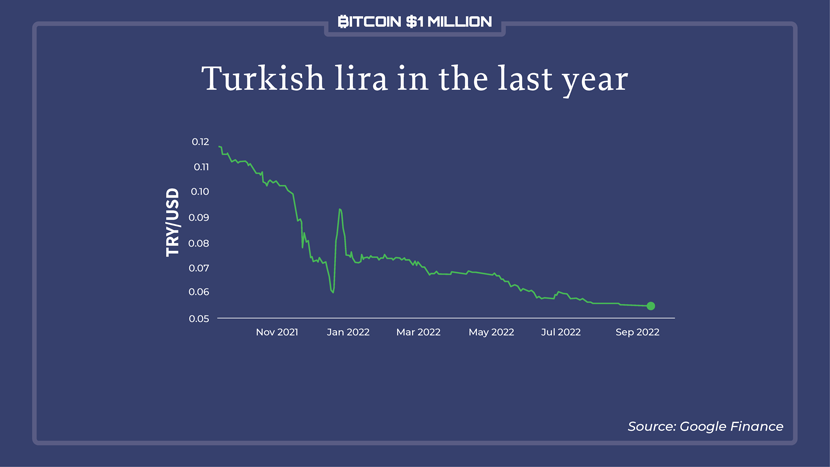

Take Turkey, for example…

While bitcoin is down almost 50% in US dollar terms over the past year...it’s only down 7% in terms of the Turkish lira.

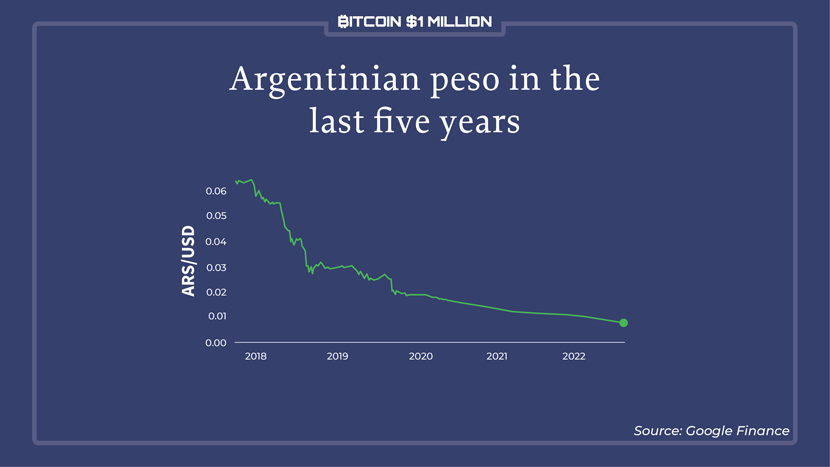

The Argentinian peso has lost 90% of its value over the past five years.

This is the same for many developing countries right now.

These crashing currencies make bitcoin look a lot more attractive as a Plan B.

Especially if US dollars are hard to come by in 2023.

But the REAL fireworks start to happen the following year...when PRE-PROGRAMMED SCARCITY enters the bitcoin timeline once more...

OK, so this is interesting.

In that 2024 actually has a bit more certainty to it than 2023, even though it’s further out.

2023 is murky because we don’t quite know how bad the world economy’s going to get.

And what central banks will do. You now know where I’d put my money, and that’s on easing sooner and more dramatically than most are predicting.

But that’s still up in the air.

In 2024, we move onto firmer ground.

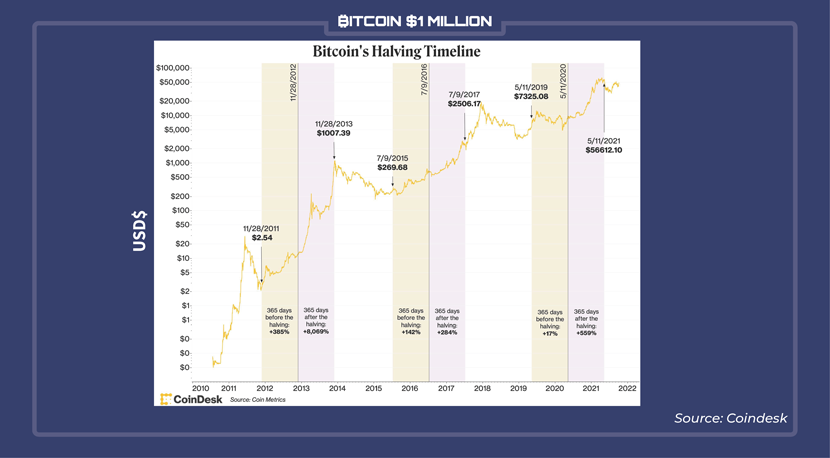

Because in April that year, bitcoin sees its next scheduled ‘halving’ event.

This is where the supply of newly minted bitcoin is halved.

Remember, there will only ever be 21 million bitcoin.

Right now, around 19 million have already been mined.

Meaning just two million fresh bitcoins are yet to be created.

The bitcoin protocol has this contingency baked in. It automatically slashes the number of new coins issued with each new block with regularly scheduled halving events.

It’s dependable.

It literally happens like clockwork.

The first ever halving happened on 28 November, 2012.

It dropped the mining reward from the base start of 50 to 25 BTC.

Exactly one year before that first halving, you could buy a bitcoin for US$2.54.

The following year that one bitcoin sold for...

...wait for it...

US$1,007.

An increase of more than 8,000% in one year.

I am by no means factoring in this timeline an 8,000%-plus increase in the year after the next halvings.

But...

There is a solid pattern here.

And if the same pattern continues from the three previous halvings, we could see US$100,000 bitcoin pretty soon after the next one.

(If it’s not there already...)

This is actually conservative compared to some predictions. The bitcoin stock-to-flow model puts the price at around US$500,000 within a year after halving 2024.

Now, despite the fact there’s an established pattern so far, nothing is set in stone. The old ‘past performance is not a guide to the future’ maxim still applies here.

And remember, there’s nothing certain about this timeline.

We’re making calculated guesses.

But there are a few things we know for certain, as Rob Chang, CEO of Gryphon Digital Mining, points out:

‘Historically, there is a lot of Bitcoin price volatility leading up to and after a halving event. However, the price of Bitcoin typically ends up significantly higher a few months after.’

This is pre-programmed scarcity in action.

It stands in stark contrast to QE, huge debts, and ultra-low interest rates of fiat system.

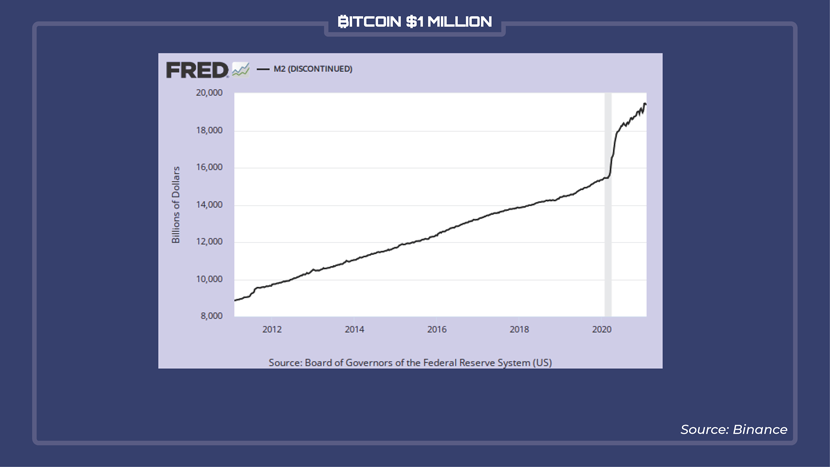

For example, how many US dollars will be in the system in 2024?

No one knows, but if this chart is any guide, it’s not going to be pretty for anyone relying on it as a store of value:

In my opinion, bitcoin’s halving schedule will be a massive upward driver to the bitcoin price in 2024.

Especially against the back drop of fiat money printing which only highlights this feature.

But in my timeline, it’s not the only factor driving bitcoin in 2024...

I also predict you’ll see countries like Russia, China, Iran, and other nations start to use the bitcoin network INSTEAD of the US-dominated SWIFT network. A concerted move further away from the US dollar system.

Again, you’re already seeing this start to happen.

In 2022, Russia and China are already chipping away at the US dollar’s dominance in global payments.

Iran has already started to use bitcoin as a medium of exchange for international trade deals.

In August, they announced their first import order using crypto.

Let me ask you...

If this is starting to happen in 2022, what do you think these national divisions will be like by 2024?

My prediction is by then you’ll be seeing bitcoin used by more and more countries for trade.

And this will naturally push the value of bitcoin higher.

This will cause a knock-on effect.

In particular, I think we’ll also see more Latin American and African nations adopt a bitcoin standard as fiat fails first in those weaker countries.

And WHILE all this is happening in 2024...

Bitcoin mining activity is ramping up...as countries realise its benefits as a grid stabiliser with renewables.

Yep, you heard me right.

Despite the propaganda you hear from the anti-bitcoin crowd, by 2024, I predict we’ll now know that bitcoin mining is actually a Godsend for renewable energy adoption.

And cheaper energy prices!

You don’t hear much about it, but early experiments are already underway in Texas.

As a report from Arcane Research noted:

‘Bitcoin mining as a demand response is not just a possibility — it's already happening. In the ERCOT system in Texas, bitcoin miners provide demand response that strengthens a vulnerable wind and solar-powered electricity grid.’

If this takes off as I think it will, expect a number of states to change their tune on bitcoin mining over the next few years...

Then, finally in 2024, there’s the US presidential election.

Unknowable at this stage, but put a gun to my head, and I’d say Republicans back in. Democrats wiped out.

The primary elections this November may give us an early clue on this though.

While there’s growing support for crypto on both sides of the wonky American political isle...Republicans remain more open to the benefits of decentralisation.

If this happens, this will be a final boost to the crypto project as the year closes out...

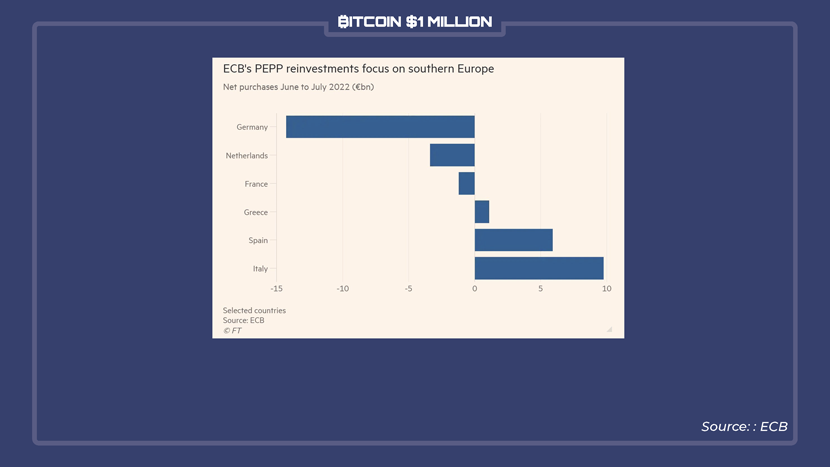

2025 will be the year the euro experiment finally falls apart under the weight of member monetary imbalances.

Once more, I’m not going to get too deep into the quicksand of macroeconomics.

We’re looking at basic assumptions here.

And a basic assumption is Germany, facing an economic crisis of its own, refuses to support Italy, Spain, and other debtor nations.

This is how things look right now:

How long can frugal Germans support their big spending EU partners?

Maybe when things are going well, they will happily do it.

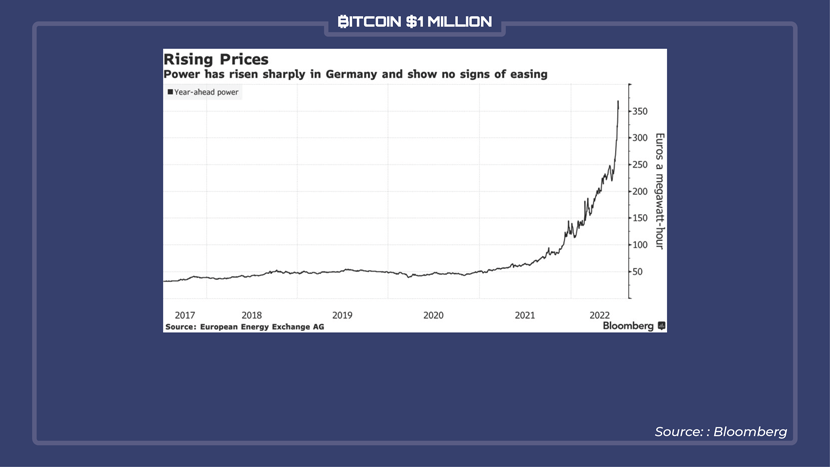

But my predict is by 2025, things will not be going well.

We’re seeing things start to unravel already with surging energy prices providing the trigger point:

German manufacturing is at a crisis point even today.

As Bloomberg pointed out:

As this plays out, what comes next?

Do you think the Germans will spend the next few years spending more of their savings to help their own people get through this mess?

Or on helping pay the debts of Italy and Spain?

I think we know which side they’ll choose...

Between now and 2025, the Germans will look to save themselves first and the debtor countries of the EU will have to fend for themselves.

Bond values will collapse. And the euro — at a 20-year low right now against the US dollar as I speak — finally, starts to really unwind.

Obviously, this too, is conjecture.

But again, I’m hardly alone is predicting this scenario.

Some reckon it could even happen much earlier...

For example, macro commentator Luke Gromen thinks Europe is already on the precipice of economic collapse.

But I think a safer bet is that we’ll see a muddle through for the next year or two, before the Eurozone finally breaks apart in 2025 under the dual stresses of economic and monetary imbalances.

Total chaos in the fiat money system will ensue.

People around the world will finally start to think:

What REALLY is the value of this fiat currency I’m putting so much stake in???

Savvy countries (and people) will have already stockpiled gold and bitcoin for this exact scenario.

But you can’t expect the Euro empire to go down without a fight.

I think Euro regulators will turn to Central Bank Digital Currencies (CBDCs) as one last chance to maintain control.

2025 will see the Great Reset agenda in full swing.

But citizenry will be wise to what’s happening.

And by the middle of the decade, cryptocurrencies will have transformed from ‘risky speculations’ to ‘outright necessities’...

It’s all murky, but here we enter an even less certain period again.

However, I’m fairly sure by 2026/27, bitcoin will be seen as a ‘serious unit of account’ on a par with the US dollar.

Western authorities will have completely failed to undermine confidence in BTC.

Many projections from analysts I respect put the bitcoin price somewhere in the range of US$180,000–220,000 by this time.

I think given what we’ve tracked so far, that’s lowballing it.

And that by this point in the timeline, you could easily see the bitcoin price well above US$350,000.

That may seem crazy high compared to now.

It also may seem like I’m pulling that out of a hat.

And I am, to a degree!

As I keep saying, nothing here is a sure thing.

But one development that could send bitcoin totally stratospheric at this stage in the decade would be really, really scary civil unrest spreading out from Europe.

I don’t want to delve too much into doom-mongering here.

But you see what’s happening now. And I’m sure you have a gut-feeling things are going to get a lot messier this decade before they find a new equilibrium.

We’re talking about a potential failure of the traditional global monetary system.

And when money fails, society is not far behind.

That’s when something called Gresham’s law kicks in.

Put simply, it means people hoard good money. And spend bad money.

This happened in 2008 when Iceland’s economy collapsed during the GFC.

Tourists would pay for things in Euros and be given krona as change by wily shopkeepers!

My rough prediction is that by this stage of the timeline, increasing amounts of people will be fleeing to bitcoin as GOOD MONEY.

On the other hand, they’ll be looking to dispose of as much fiat (bad money) as possible.

It’ll be the Iceland shopkeeper trick all over again...but on a global scale.

CBDCs will become more prevalent in this two-year period. The government propaganda machine will try to push people towards them.

But I don’t think they’ll be trusted.

They have the same failings as previous fiat currencies.

Inflationary, printed at will, centralised control...but even worse — a tool of the surveillance state.

Instead, by 2026, people will hoard hard assets ‘off-grid’.

Assets such as gold and resource stocks will be favoured.

But also BITCOIN.

They’ll also now be transacting ‘off-grid’ in bitcoin too.

More and more people around the world will be conducting ALL of their transactions in crypto.

And totally ditching fiat.

Young people might not even have a bank account anymore. Their finances will live on the blockchain.

Again, this is not just me projecting.

This is pretty much accepted fact.

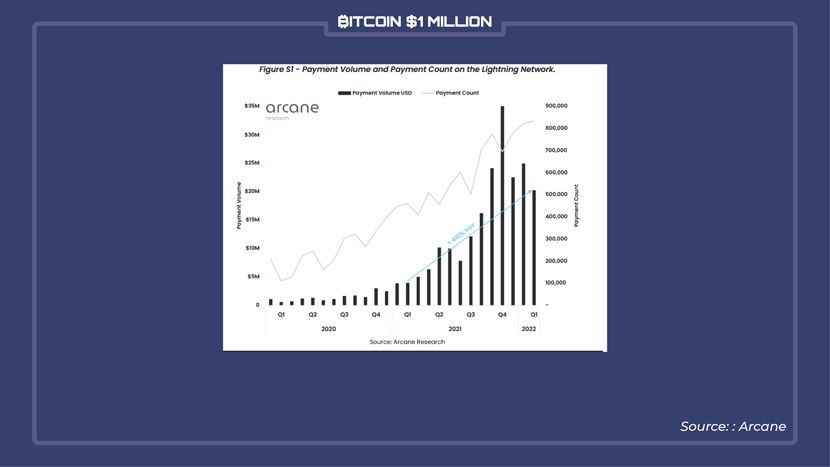

You don’t hear much about this out in the mainstream, but growth of bitcoin as a transactional network is growing exponentially right now:

In fact, banking giant Morgan Stanley recently put out a report that stated bitcoin’s Lightning Network was superior to the US2.35 trillion Visa network:

TradFi stalwart Deloitte even just admitted 85%!!! of merchants believe crypto payments will be the norm by 2026.

Think about that.

That’s massive.

Build into that an undercurrent of the whole fiat money system falling apart by this stage of the timeline...and you have a perfect storm to one-million-dollar bitcoin brewing...

And then, some more certainty enters the timeline again...

Again, we have some ‘known knowns’ enter the timeline.

And they enter with a real possibility of bitcoin already sitting around the half-a-million mark.

By now, my prediction is actually on the lower-end of what some extreme optimists are predicting.

As I’ve said, historically in the year following each halving, the bitcoin price smashes up exponentially.

This happens due to an increase in demand and decrease in supply in the market.

By 2028, the scarcity value of bitcoin is self-evident.

The network is used increasingly for international trade.

Being a whole-coiner — owning one whole bitcoin — will by now be a status symbol...only for the ultra-rich.

At some point in the first half of 2028, bitcoin will undergo its fifth halving. Meaning the mining reward will fall from 3.125 to 1.5625 BTC per block.

Again, here’s what the price did in previous halvings, and what Bitcoin Magazine projects for the next two.

I think US$10,000,000 bitcoin by 2030 is a bit of a stretch.

But the world’s store of value problem by the year 2028 could well make the fifth halving a stratospheric event.

That year we also have another US election.

Completely futile to make any prediction there.

But my guess is that a totally pro-BTC candidate ticket wins.

Ruinous US debt is already a core issue.

And I think a de facto default on US debt will loom in this election year. This could be the final catalyst for the transition to a wholly crypto world.

In the seminal book, The Fourth Turning, 2025 is predicted as the start of a new global crisis point...with 2030 being slated as the end, and the start of a new renaissance.

My guess?

This new world will need a fairer monetary system.

As Credit Suisse Strategist Zoltan Pozsar explains:

‘From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities).

‘After this war is over, “money” will never be the same again…

‘…and Bitcoin (if it still exists then) will probably benefit from all this.’

I think it’ll more than just benefit.

My prediction is that by this point in the timeline, every country on the planet that has not adopted a bitcoin standard has started to lag behind the countries that have.

And that after an eight-year race to accumulate as much BTC as possible, you could well see bitcoin at US$1 million by 2030.

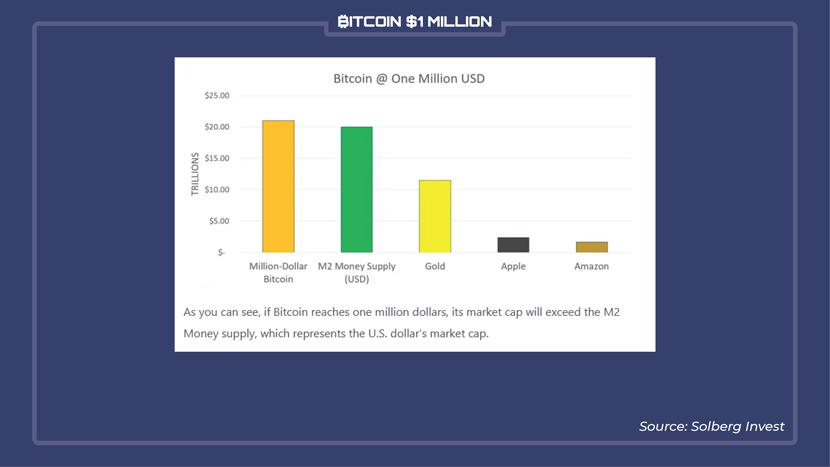

What does bitcoin look like at US$1 million?

Well, let’s compare it to some assets you’re probably more familiar with:

As you can see here, if bitcoin hits one million, its market cap will exceed the M2 money supply.

That’s the whole market cap of the US dollar.

And to be clear, that’s today’s money supply.

If the events play out as I predict in this timeline, then expect the printing presses to go into overdrive again.

So bitcoin at US$1 million will still probably only be a fraction of M2 US dollar value by 2030.

But make no mistake, bitcoin will overtake the low-hanging fruit of fiat over the next eight years.

If it were a country, bitcoin would already be the 25th largest in terms of nominal money supply:

But that’s still just 0.37% of the global market for money.

If a new Bretton Woods does eventuate...and currency returns to its roots —backed by hard assets including bitcoin...then it’s not inconceivable for BTC to overtake almost every country on this list.

And if THAT happens...it would

Of course, all of this is just projection.

Based on how bitcoin has evolved so far...and some big-picture analysis of what I think could come next.

None of it’s guaranteed.

No one knows the future. My timeline includes fundamental assumptions that could be wrong.

You need to judge each one on its own merit.

But here’s an interesting post-script to this timeline...

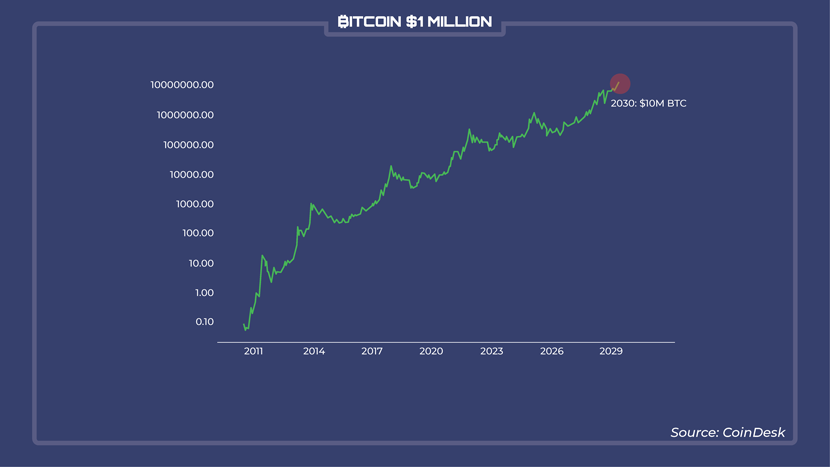

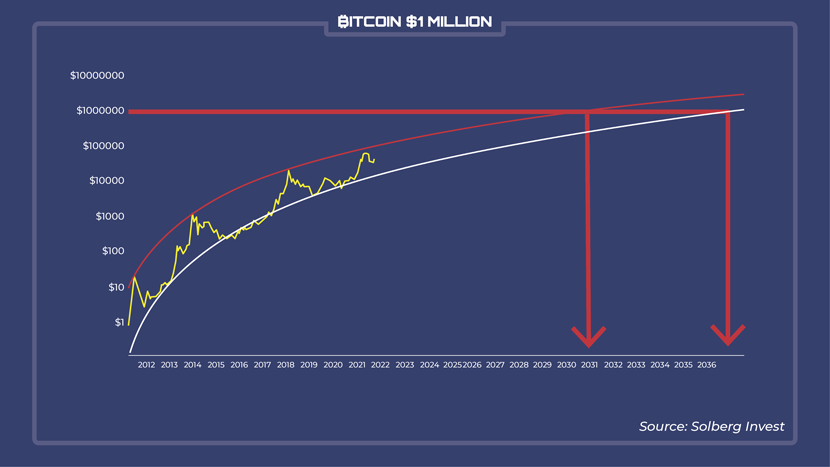

What if we completely stripped out any type of fundamental analysis and just looked at pure price behaviour?

This is more in line with how I framed my 2018 prediction.

Well, even on price action alone, US$1 million by 2030 looks a good bet.

Check out the chart:

This model is purely technical, which means that it doesn’t care about the fundamentals at all.

It exclusively looks at historical price data, nothing else.

This model shows the logarithmic trendlines that bitcoin has been kept within for the past decade.

If this trend continues — and as I’ve just laid out, there’s a heap of factors driving it — then US$1 million by 2030 looks a distinct possibility...and by 2036 a sure bet.

Of course, none of this MAKES it a ‘sure bet’.

There are risks, uncertainties., and many factors out of anyone’s control. Volatility and risk are going to remain in the crypto markets well into future timeline we’ve been covering.

And also, I should point out, a large number of elite types will desperately try to stop what I’ve just outlined from happening.

They’re not going to give up control of money easily.

But over a long enough timeline...I think bitcoin’s value proposition only gets stronger...no matter what happens.

And as it becomes essential for more and more people, the more powerful the incentive for companies and countries to adopt as soon as possible.

Indeed, you’re rewarded by price appreciation for being early.

By planning for this now, you can get in ahead of the game and watch how the chaos plays out. Knowing you have a stake in what 30-year bond market veteran Greg Foss calls ‘fiat insurance’.

Let’s say you find what we’ve covered so far compelling.

For the remaining few minutes, we’re going to talk strategy.

What you need to know is this is about a lot more than just making money on some smart investments.

Although, when I say this is perhaps the greatest risk versus reward investing opportunity you’ll see in your lifetime, I really mean it.

There are certain things you can do right now — above and beyond simply buying bitcoin — to make the most of that opportunity.

So what’s a plan of attack?

First and foremost, I’d suggest you immediately download a new compendium I’ve just compiled.

It’s called

‘The Crypto Capital BLUEPRINT: Practical, Step-by-Step Guidance for Buying Bitcoin (and Other Big Established Cryptos) Right Now’.

As I’ve said, I started out in traditional finance.

But I bought my first bitcoin in 2013 for US$600.

I guess you could call me one of the earliest adopters of cryptocurrency in Australia.

There’s a treasure trove of tips, tricks, and traps to avoid that I’ve collected along the way.

And this year I’ve condensed them all in one place.

You’ll find some extremely useful stuff in ‘The Crypto Capital Blueprint’, even if you’re already an experienced crypto investor.

But primarily, it’s aimed at entry players.

You’re interested in crypto.

You see the way the wind is blowing.

You realise that even if my timeline is only marginally correct, the upside argument for bitcoin over the long term is rock-solid.

But you’ve yet to make significant forays into bitcoin and other tokens.

The ‘Crypto Capital Blueprint’ is a resource that will be absolutely essential to you.

It walks you through EVERYTHING...from the basics of setting up a wallet and buying your first bitcoin...right through to how bitcoin mining works, safely storing your cryptos, the pros and cons of exchanges, and much more.

It’s a full compendium of all the practical knowledge you’ll need to hit the ground running.

It’s the first resource you’ll get if you join my advisory service Crypto Capital Foundation.

The subscription is just $199 a year.

But for viewers of this video, I’ll permanently cut that in half.

With a full refund guarantee in the first 30 days.

Crypto Capital Foundation is for you if you believe in the crypto project long term...

And want clear, step-by-step guidance that transcends both the hype and the hate that infests the mainstream conversation.

Above all...

It’s for you if you sense that times like this are the EXACT POINTS to make your plays...and lock in your stakes.

If what we’ve covered is the true trajectory for crypto, I genuinely believe a $99-per-year investment in Crypto Capital Foundation could be one of the smartest you ever make.

Perhaps most helpfully, I’ll show the kinds of things I’m doing with my own money, right now.

My portfolio is 37% invested in crypto so I’ve skin in the game here.

I hope you’ll learn by watching what I’m doing with it...what I’m testing and trying...and who I’m doing it with...

If that sounds valuable to you, you can start subscription to Crypto Capital Foundation with a 30-day trial period by clicking the link below.

If you do, there are several other key resources I’ll put in your hands straight away.

These are:

‘How to Build a Lock-Up Portfolio Like a Pro: Strategies for Allocating Your Crypto Capital at Basement Prices’.

OK, so let’s say you want to USE this bear market to start piecing together a crypto portfolio from the ground up.

HOW DO YOU DO IT?

How much should you allocate?

In what proportions?

In what order, and over what time frame?

This is a practical look at how to tackle these questions at this pivotal point in crypto history...

‘Could This Be the Start of Your Own Crypto Dynasty? Ethereum Explained – What It Is, the Role It Plays, and How to Buy’.

You’ll have heard of Ethereum [ETH]. But you might not know what makes it different from bitcoin.

And potentially an even more compelling investment opportunity.

In this report, I’ll give you a brief history of how Ethereum came to be...what makes it different to bitcoin...the role I see it playing in the years ahead...and how and when to buy...

‘A Paradigm Shift in Finance Is Coming Fast: DeFi Explained and One Recommendation to Get Your Foothold’.

In this report, I recommend a very easy way to claim your stake in the emerging world of decentralised finance — DeFi for short.

I’ll give you clear instructions on how you can do this in the ‘action to take’ section at the end. Read that part very carefully when you get there. But first, we delve into the background of DeFi, and where I see the space evolving next...

‘Why the Old Money System Will Collapse on Itself: And How to Position Yourself for What Comes Next’.

To understand what comes next after this bear market...and how it might evolve...you have to understand what came before.

So first you’ll get a quick tour of the history of the global monetary system. This is essential knowledge in understanding the true value proposition of bitcoin. It will also give you the ability to see crypto volatility in a new light.

From there, we’ll do a deep dive on bitcoin. Why it will remain the top dog for some time to come...where it could go from here...how to treat your holding if you already own it...and THE BEST STRATEGY FOR BUYING RIGHT NOW if you don’t.

That is an absurd fee.

As well as those resources, every week, we’ll tell you the real stories playing out behind the scenes — the stuff the mainstream doesn’t tell you — to enable you to make informed investing decisions as you explore this nascent asset class.

Look, if you want experience, deep knowledge, and battle-hardened guidance on the crypto world...

...this should be a no-brainer.

The regular price of Crypto Capital Foundation will be $199 per year.

But...if you click the link below...YOU CAN LOCK IN YOUR FIRST YEAR FOR JUST $99.

What’s more, if you take this offer via this invitation...you will lock in that special price EVERY YEAR you renew in the future.

Take a look at everything you’ll get again.

$99 is a miniscule outlay for those resources and the ongoing guidance you’ll receive.

It also comes with a 30-day refund guarantee.

If, for any reason, you find this subscription isn’t for you...we’ll even give that $99 back. No problem at all doing that. Just let us know within the first 30 days.

Click the link below. And let’s traverse the timeline together!

Thanks for watching.

Sincerely,

Ryan Dinse,

Editor, Crypto Capital Foundation