Dear Fellow Investor,

The last 18 months have been HUGE for lithium stocks.

In 2021, eight of the top 10 best-performing stocks in Australia were lithium stocks.

Two of them — Savona Mining and Lake Resources — both increased by more than 1,000%.

What’s driving prices so high?

That’s simple.

So simple, I can sum it up in one word.

Batteries.

They’re the key to more or less every significant trend we’re seeing in the clean energy market…

But let me ask you this…

What good is a swish, new electric car if it needs charging every 100 miles?

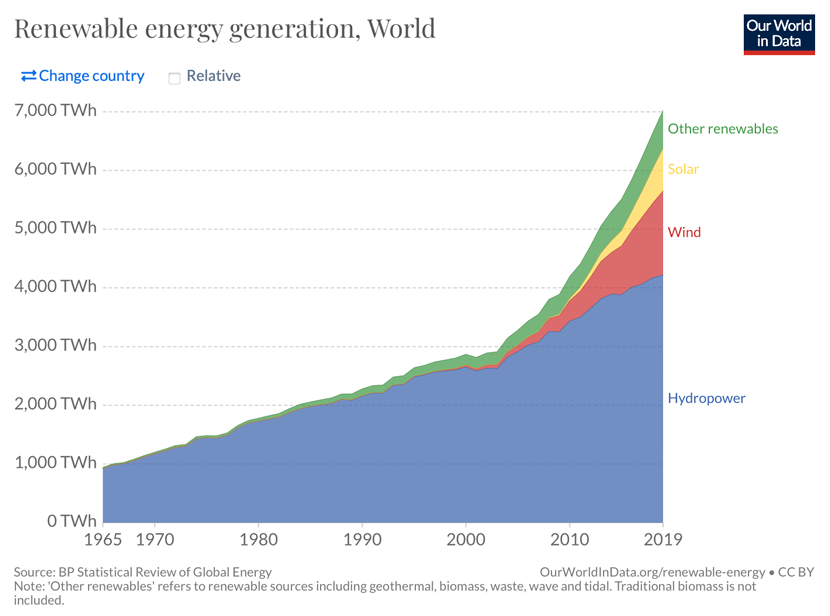

What good is solar energy if we can’t store it for when the sun isn’t shining?

What good is tidal…wind…or ANY renewable energy if we can’t store it for when we need it?

Take a step back for a second and this is obvious.

If we’re going to get green energy to where it needs to be — whether that’s to power a car, home, business, or whole city — we need to store it.

Put another way, we need batteries.

Lots of them.

And we need them to be as smart and efficient as possible.

As Forbes put it:

‘Battery technology may be the keystone of the energy transition.’

That’s why there are governments, energy corporations, and tech giants throwing so much cash at battery tech.

Consider:

- The US Department of Energy announced a new Energy Storage Grand Challenge. The initiative will use R&D funding, prizes, and partnerships to try to create a domestic battery industry by 2030.

- Amazon and 10 other US companies have the Corporate Electric Vehicle Alliance to support electric vehicle (EV) production.

- Breakthrough Energy Ventures, an energy innovation fund backed by Microsoft co-founder Bill Gates and Amazon CEO Jeff Bezos, led a funding round for ESS, an Oregon-based manufacturer of iron-flow battery technology.

One industry executive called battery tech ‘a mind-boggling opportunity for growth’.

And lithium stocks were perfectly placed to capitalise in 2021.

Which has lots of Aussie traders and investors on the hunt for the next big lithium play.

If that’s you, listen up:

Don’t buy lithium stocks — buy THIS instead

See, I think there’s a much smarter way to play this same story.

It involves what you might call lithium’s ‘little brother’.

It’s a material that’s crucial to battery tech.

Just like lithium.

But the difference is, it’s nowhere near as well known.

So it doesn’t grab the headlines in the same way lithium does.

In fact, the company I’ve recommended my readers buy is already supplying Tesla with this crucial material.

Yet, it’s almost completely unknown.

You won’t find it listed in those ‘hot lithium stocks’ reports you find online.

And THAT is your opportunity.

My name is Callum Newman — and my job is to help make people like you money

I’ve been a stock market investor and full-time market analyst since 2012.

Picking stocks is my bread and butter!

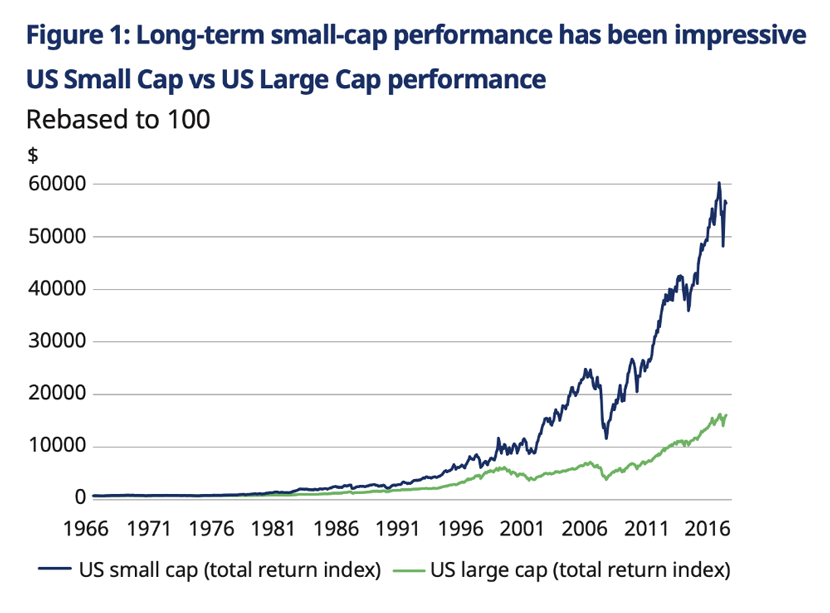

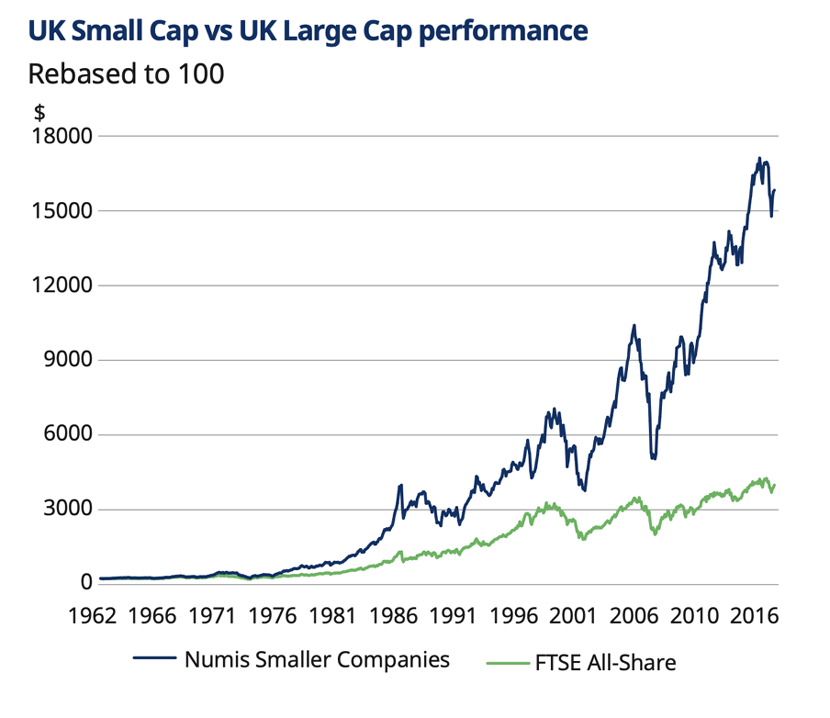

In all this time, I’ve been analysing, writing about, recommending, and investing and/or trading small ASX shares. Especially ‘small-cap’ stocks.

And I can tell you, lots of experience and passion is one consolation for getting older!

I’ve become an expert in hunting for the unheralded Aussie companies developing extraordinary new ideas.

The kind of businesses that could — if things go well — become some of the top-performing stocks in Australia in the future.

The stock I just hinted at is one of them.

But it’s just one of SEVEN opportunities I’m going to tell you about today.

If I do my job right, what I’m about to share will give you a head start on the next big wealth-building opportunity for Aussie investors.

Why?

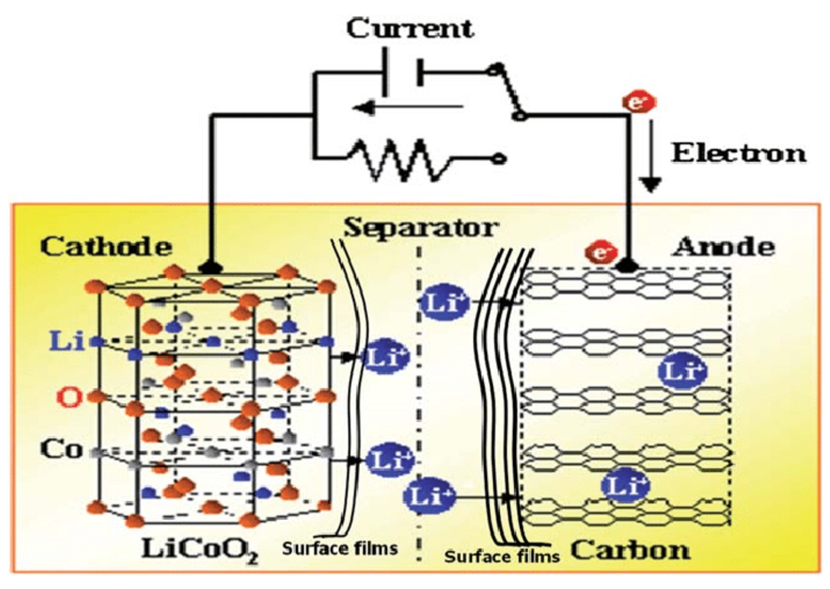

Take a look at this diagram:

Source: ResearchGate

This is what’s going on inside a lithium-ion battery.

As you can see, there’s a cathode and an anode — with lithium ions moving between the two.

Fundamentally, this is what’s turned lithium into one of the world’s most important materials.

But look closer.

There’s more.

See the anode on the right-hand side?

That’s made of carbon.

Specifically, it’s often made of GRAPHITE.

Which makes graphite an absolutely crucial component of the whole battery.

That’s why I call it lithium’s ‘little brother’.

It’s often in lithium’s shadow.

But it’s crucial, nonetheless.

Case in point: at the end of 2021, Tesla cut a deal with a graphite miner to secure its own supply.

As the website Batteries News put it:

‘[G]raphite could be the hottest commodity of 2022…without it, there will be no energy revolution and the trillion-dollar EV market might not exist.’

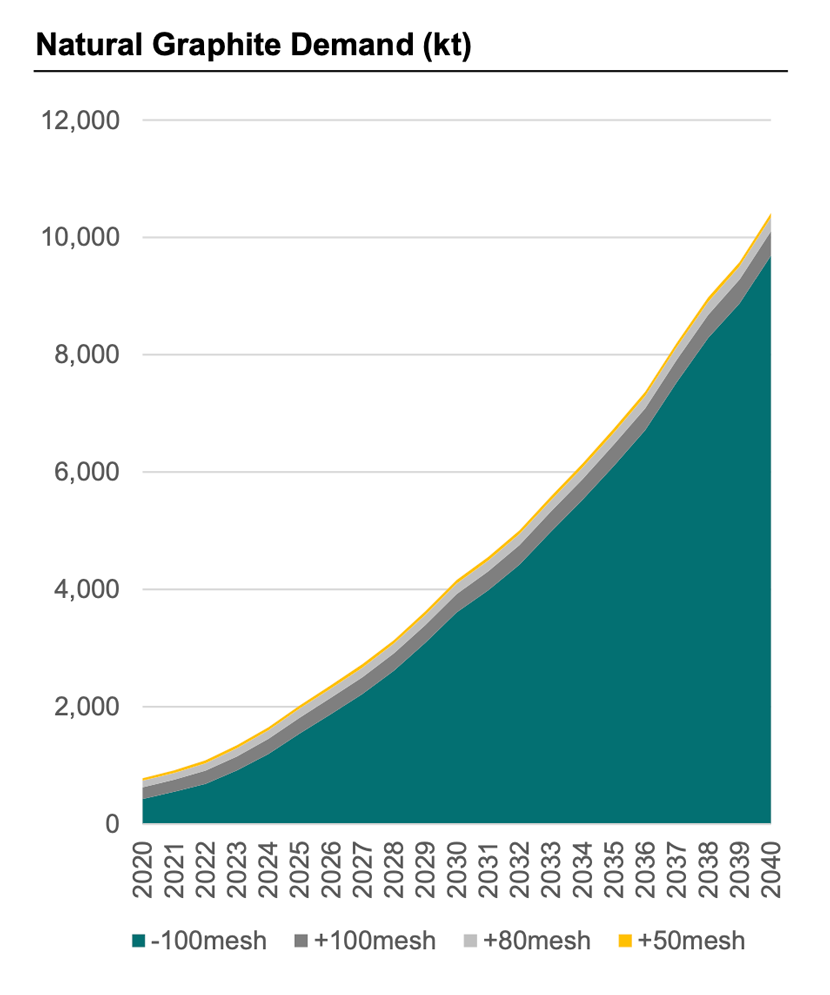

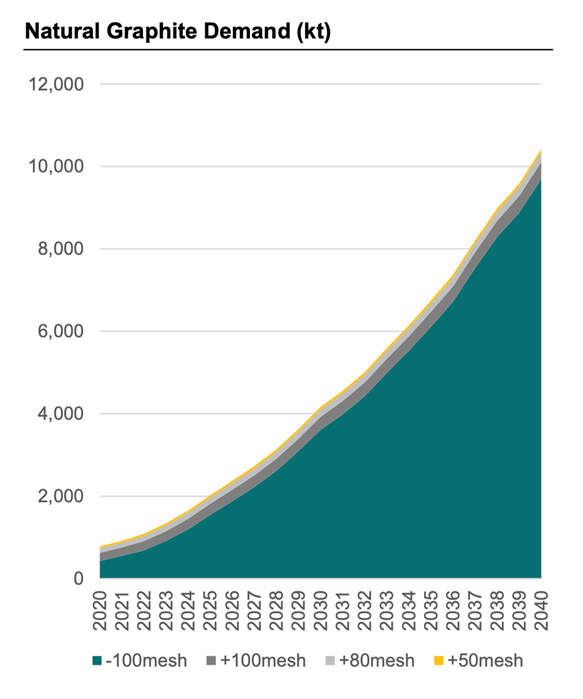

Case in point: graphite demand is forecast to absolutely skyrocket in the coming decade, as this chart makes plain:

And I’ve found an ASX-listed company that’s poised to benefit from that growth.

It owns an absolutely HUGE graphite mine that’s just been brought back into production.

Not only that, it’s already taking that graphite and turning it into battery anodes in the US. It plans to be the first non-Chinese supplier to both the US and Europe.

Move now and there could be big money to be made.

And if you want to make your move, stick with me.

In a second, I’ll show you how to get the name, ticker, and full write-up I’ve prepared on this stock.

But remember: this isn’t just about one stock…one market…or one opportunity.

I’m here to showcase SEVEN of the most exciting companies in Australia today.

Revealed: Australia’s ‘wealth accelerators’

If you want a realistic shot at building rapid wealth in 2022, here’s the first thing you need to know:

Making real money has nothing to do with how fast the economy is growing, where interest rates are headed, or where we are in the business cycle.

The same goes for COVID, the recession, or the recovery.

Yeah, economists might tell you that stuff all matters…

But it doesn’t.

It’s just meaningless noise.

The truth is, REAL wealth creation is driven by something else entirely.

It’s what happens when people come up with new, daring, and disruptive ideas — and are bold enough to give them a go.

You could call these ideas ‘wealth accelerators’.

And the beauty of them is they can create life-changing wealth no matter how good or bad the wider economy is.

Take the Ford Model T…

↓ Click Here to Read More ↓ ↑ Click Here to Read Less ↑

When Henry Ford’s era-defining car rolled off the factory floor, the US had just been rocked by the ‘Panic of 1907’, the worst economic crash in memory.

Did Ford care?

No.

Because he knew that truly disruptive ideas are the real engine of wealth creation. (Ford became the richest man on the planet within two decades.)

I’ll give you another example. In the late 1960s, the US was tearing itself apart over the Vietnam War.

Did that stop Gordon Moore and other Intel engineers refining their microprocessor technology?

No.

Because they knew that the power of a truly disruptive idea is a damn sight more important than nearly every piece of economic data you care to name. (Intel is up by more than 264,900% since its 1971 IPO.)

Those examples are illustrative, of course. I just namechecked two of the defining ideas of the 21st century. Those are rare and exceptional examples.

But the simple fact is this:

There are ALWAYS small companies developing new and disruptive ideas with the potential to change everything — not just for a single company, but for a whole industry (and sometimes even a whole civilisation).

These companies are often small.

They’re on the fringes of the market.

You don’t hear much about them…unless they do something spectacular.

But they are out there

Just take a look at some of the top-performing ‘wealth accelerator’ stocks listed on the ASX between 2020 and 2021, for example:

|

Pointerra Ltd [ASX:3DP] |

1,138% |

BetMakers Technology Group Ltd [ASX: BET] |

406% |

Brainchip Holdings Ltd [ASX:BRN] |

1,060% |

|

Caravel Minerals Ltd [ASX:CVV] |

1,067% |

De Grey Mining Ltd [ASX:DEG] |

303% |

Dotz Nano Ltd [ASX:DTZ] |

286% |

|

Digital Wine Ventures Ltd [ASX:DW8] |

860% |

King Island Scheelite Ltd [ASX:KIS] |

475% |

Magnetite Mines Ltd [ASX:MGT] |

600% |

|

Tesserent Ltd [ASX:TNT] |

216% |

Element 25 Ltd [ASX:E25] |

880% |

EMvision Medical Devices Ltd [ASX:EMV] |

225% |

|

Enegex Ltd [ASX:ENX] |

1,000% |

GWR Group Ltd [ASX:GWR] |

408% |

Imagion Biosystems Ltd [ASX:IBX] |

360% |

|

Estrella Resources Ltd [ASX:ESR] |

390% |

Fenix Resources Ltd [ASX:FEX] |

467% |

FYI Resources Ltd [ASX:FYI] |

940% |

|

Race Oncology Ltd [ASX:RAC] |

789% |

Greenvale Mining Ltd [ASX:GRV] |

1,150% |

Faster Enterprises Ltd [ASX:FE8] |

390% |

|

Intellihr Ltd [ASX:IHR] |

243% |

Redbubble Ltd [ASX:RBL] |

279% |

Rhythm Biosciences Ltd [ASX:RHY] |

894% |

|

Scorpion Minerals Ltd [ASX: SCN] |

160% |

Weebit Nano Ltd [ASX:WBT] |

418% |

Anax Metals Ltd [ASX:ANX] |

365% |

|

Suvo Strategic Minerals Ltd [ASX:SUV] |

313% |

Taruga Minerals Ltd [ASX:TAR] |

810% |

Thomson Resources Ltd [ASX:TMZ] |

500% |

|

Vulcan Energy Resources Ltd [ASX:VUL] |

2,735% |

8Vi Holdings Ltd [ASX:8VI] |

586% |

Chalice Mining Ltd [ASX:CHN] |

570% |

|

Ultima United Ltd [ASX:UUL] |

3,900% |

|

|

|

|

These are all real share price profits between 14 May 2020 and 14 May 2021. Smack-bang in the COVID crisis and lockdowns too.

And they’re positive proof of the key point:

No matter what the wider economic conditions are, there are always small, daring companies developing new and disruptive ideas.

Let me tell you an astounding example, personally.

In March 2020, at the very bottom of the COVID crisis and worst bear market in Aussie history, one small-cap explorer stock called — at the time — Chalice Gold Mines hit a motherlode strike near Perth.

One reader wrote to me to say that stock turned his initial $3,000 stake into…$194,000!

That was a return of 6,300%.

Another reader wrote to me about that same recommendation and told me his ‘extremely small $600 investment has changed our lives’.

‘It was the Catalyst that has allowed me to become an alliance member. And as a whole, my various subscriptions has lead us to pay off our house, sell an investment block for a 75% gain, and turn an initial investment of $20 000 into near as $130 000.

‘So again, a big thank you to everyone at Fattail.’

I tell you…

Small, daring companies are the beating heart of any capitalist economy…and any stock market strategy!

So strap yourself in.

We’re going on a ‘deep dive’ into some of Australia’s most innovative…creative…and potentially disruptive companies.

Every single one of them is small, virtually unknown, and absolutely ripe with potential.

And each of them have the potential to make substantial gains in a short time period.

Starting with…