Plan B if you’re losing patience

with this going-nowhere market:

GREG CANAVAN’S

ROYAL DIVIDEND

PORTFOLIO

‘The bear market that has roiled stock investors for the past 12 months has renewed focus on safety and quality...stocks that pay reliable dividends.’

Real Money

‘In a world fixated on cryptocurrency and AI, buying dividend stocks — those of companies who have made years, if not decades, of steady payouts — may seem old-fashioned. But it is also extremely effective.’

Wall Street Journal

‘The best thing about a multi-year bear market? The bargains. Today we’ll talk dividend deals. Big payers.’

Forbes

Dear Reader,

For the first time in what seems like forever…

Investment journos are gushing about income stocks.

No surprise there. Clicks are revenue.

And the click-hungry financial media is nothing if not a mirror to the investor headspace right now…

For income investors, it’s been lean pickings for a long time.

But now the buffet is open.

Forbes calls it:

Trillions have fled traditional bank accounts looking for better returns since the end of 2022.

A ‘bonanza’ in global dividend payouts soared 12% in the March 2023 quarter to a whopping $500 billion.

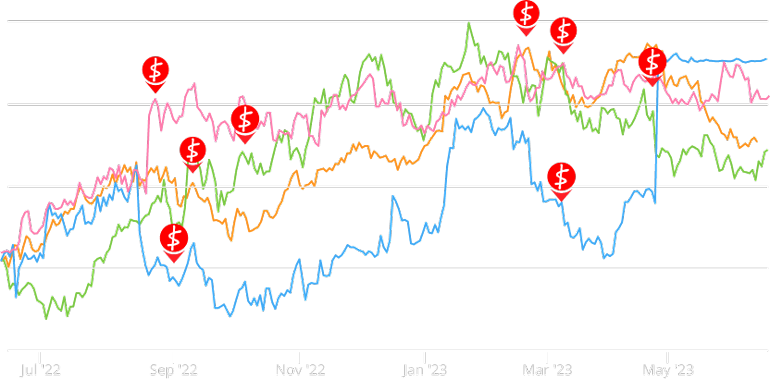

Check it out:

Here you see the evolution of a basket of income-generating assets over time. Yields across the board are back at levels not seen in more than a decade.

As Schroders says we’ve gone ‘from an income desert to an income oasis.’

Retirement savers are losing patience with bank safety.

You need alternatives.

And the buffet is plentiful right now.

But you’ll get food poisoning if you make the wrong selections.

The blind scramble for higher income will backfire on many investors in the next year or two.

No disputing it, though:

We’re at a cycle point where smart investors focus on getting paid by their investments…rather than pure growth.

That’s probably why you’re here with me now.

That’s probably why you’re here with me now.

But what’s the best tactic?

As you can see to the right, the usual personal finance sources are happy to dish basic suggestions in order to get your eyeballs on them.

However…it pays to take a contrarian mindset here.

The obvious solutions are rarely the best ones.

Especially when it comes to income stocks.

There is a smarter course of action than the easy pickings offered up to the right.

Just buying whatever is supposedly ‘the best dividend-payer’ might pay off in the next quarter or two.

But ultimately it could turn out to be a fruitless move.

The highest dividends can be fool’s gold in this current climate.

Same goes with sheltering your capital in the bank.

The current official inflation rate in Australia is 6%.

The very best savings account in Australia right now wonʼt give you more than 5%.

You do the math.

You will LOSE GROUND…even with the historically high rates on offer…if you stay in the bank too much longer.

My name is Greg Canavan. I’m Editorial Director at Fat Tail Investment Research and head up the Fat Tail Investment Advisory.

My name is Greg Canavan. I’m Editorial Director at Fat Tail Investment Research and head up the Fat Tail Investment Advisory.

I’ve been in this industry for over 25 years.

For the great bulk of that time, however…

My ideas on valuation and income with regard to stocks were out of favour.

With interest rates so low…for so long…capital flowed into the stock market. People became ‘bank account refugees’. And stock prices soared as a result.

The higher stock prices went…the less popular ‘income’ in the form of dividends became.

I eventually gave up going on CNBC and Bloomberg to talk about quaint ideas like dividends and gold. You can only piss in the wind for so long.

See…the income valuation process is rational, analytical and calculating.

And those are not three words to describe the investor mindset during the last long bull market.

That epic growth run spanned 2009–20. In that time the S&P 500 only posted a single losing year (2018).

It was a ‘dart board’ market. You could throw a dart blindfolded with good odds of hitting a winning growth stock.

‘The stock markets this year have felt like a rollercoaster so it’s no surprise that the data shows it has been one of the toughest and most volatile on record.’

LPL Financial Portfolio

Strategist George Smith

But in the space of 24 months…this dynamic has completely flipped.

A scary, unpredictable market is pushing investors back to good old-fashioned cash flow and income.

But not all cash flow is equal…

As such…over the last four weeks…I’ve undertaken a serious new valuation project.

It’s a careful curation of a very specific type of income stock.

They’re not the usual rollcall when you Google ‘Best Dividend Stocks’.

You won’t find many of these selected shares in the ‘Top 10’ yield charts. They’re obscure, unpopular, and a little bit ugly.

Needless to say, this income portfolio selection is different.

That’s because it focuses on a very specific sweet spot.

I believe it’s a sweet spot almost all conventional analysis on dividend stocks is completely missing right now.

I call this income share curation:

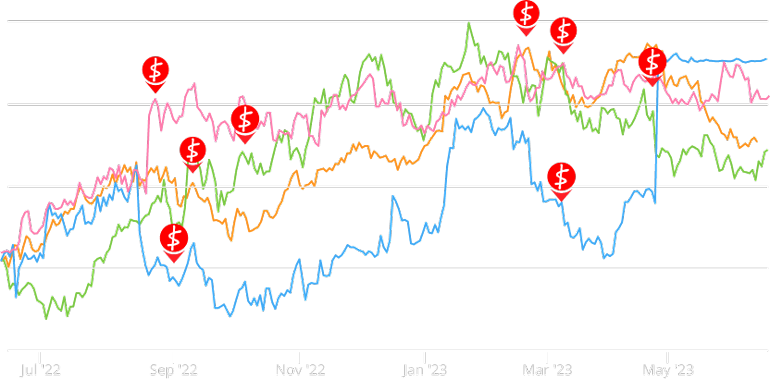

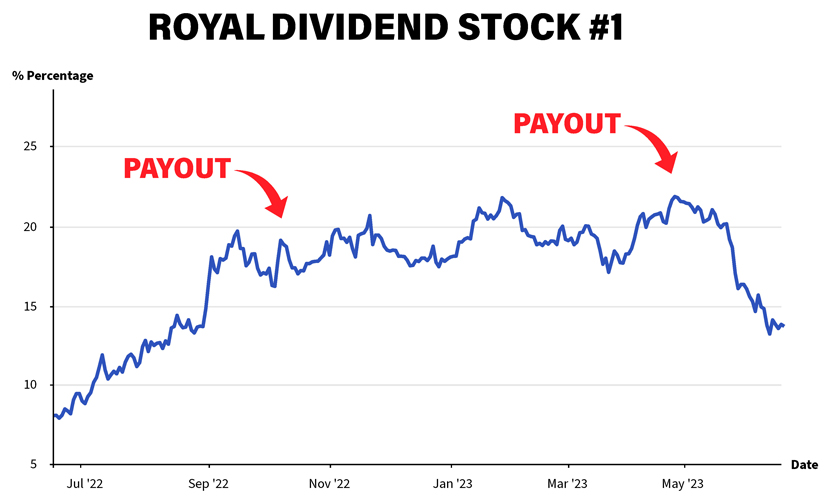

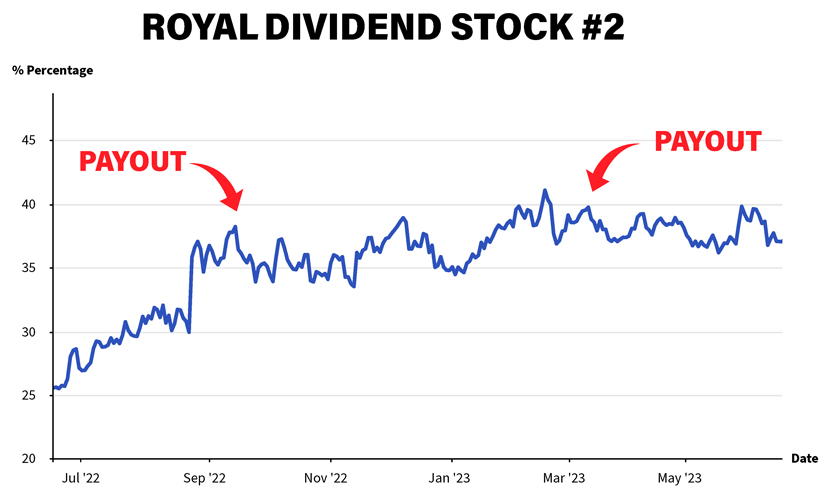

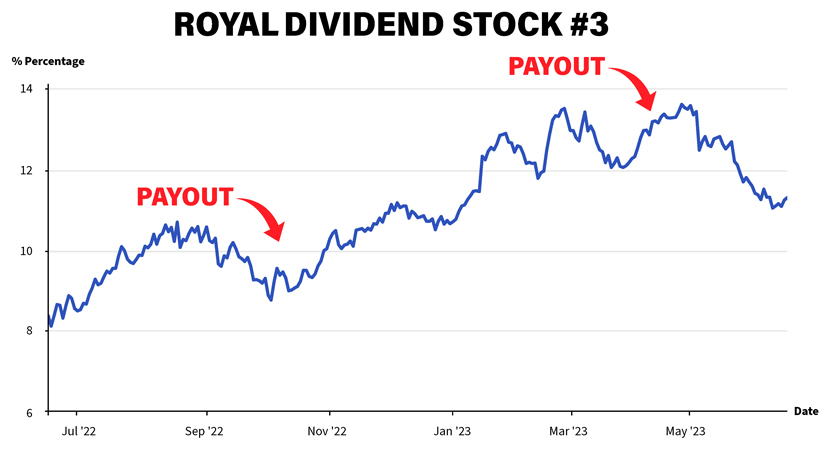

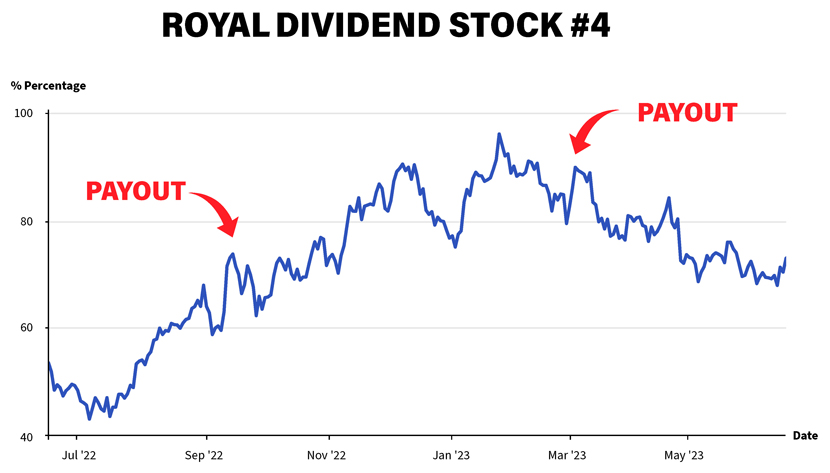

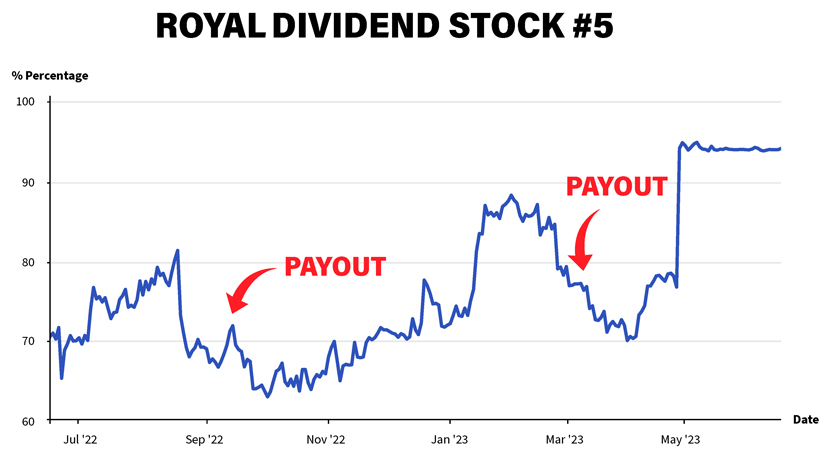

Take a look at these five stock charts, and a couple of things will jump out…

First of all…while the ASX 200 delivered NOTHING over the last year…these companies produced gains ranging from 20% to 46%.

This is not to be scoffed at. We’re in a bear market…which is a sustained period of falling and then flat stock prices.

12-month returns like that in such a climate are like gold-dust.

It’s worth pointing out that these weren’t small-cap growth stocks, either.

The five companies above are sturdy blue chips — with billion-dollar market caps and share prices ranging from $11 to $94.

However…each managed to beat the wider market by a substantial margin over the last twelve months.

But that’s not the main drawcard here…

Look at those ‘PAID’ arrows on the charts.

Each of these shares have been paying out regular dividends…while you sit in them.

You got compensated for your stock market risk.

The only surefire way to avoid losses in a market like this is to stay out of stocks entirely.

But, as I’ve shown, you can’t do that forever.

Sheltering in cash with inflation this high is a losing proposition long-term.

So…what’s the alternative?

You go for stocks that give you the opportunity for price appreciation, like the ones above. But that also REWARD your risk with regular dividend payments.

Ideally ones in the 6–10% range.

This is the magical sweet spot I’m talking about.

And, over the last four weeks, I’ve constructed a tight portfolio of them for you.

All six constituents offer you juicy dividend yields up to 10%.

But with a potential capital growth kicker thrown in…these are six deeply undervalued stocks that could have price bounce-backs in the near future.

Mainstream journos and analysts are not tackling income from this angle.

But I reckon this class of stock could become as popular in 2024 as AI stocks have been in 2023.

I’m not completely alone in cottoning onto this, though.

One of the few early adopters are the folks at Morningstar Dividend Investor, who just said that with Royal Dividend plays:

‘It’s not just about current income or yield…

‘You have both the current income coming from those dividend payments…

‘But also the prospect of capital appreciation.’

In my opinion…

This is not just the smartest income strategy to adopt in present conditions.

This six-share Royal Dividend Portfolio is the best stock market strategy FULL STOP right now.

Because it’s:

- Better than pure ‘growth’ stocks…

You may get lucky with the odd outlier in AI or lithium mining. But, for the most part, for any big gains there will be exceptions to the rule.

It’s ‘The End of Growth’ according to Barron’s. That may be overstating it. But certainly, the days of rampant speculation and easy wins aren’t coming back anytime soon…

- Better than cash in the bank…

With markets going nowhere and so uncertain, a 4–5% risk-free return from cash savings SEEMS like a better trade-off.

It’s really not. Not long-term — with inflation nipping at your heels.

Obviously, when you buy ANY stock you’re upping your capital risk. Especially in this market. But what you have to do is weigh that risk with the wealth erosion taking place if you remain mostly in cash.

If you’re heavily in cash in the bank now…you should think about deploying at least some of it into my Royal Dividend Portfolio.

- Better…even…than the biggest dividend-payers of the moment…

As the investment press is happy to show you, there are quite a few.

‘ASX dividend shares with yields over 10%?’ gushes The Motley Fool. ‘What could be better?’

But the truth is many large dividend yields are a honey-trap right now.

It’s always been a misconception with dividend stocks that the highest yield is best.

Now…with income back at the forefront…and the way this market is poised…even more so.

Don’t get me wrong. High yields are alluring. And SOME high-yield stocks are the real deal. But there are plenty of traps out there.

For example, is the high yield due to a company paying out ALL of its earnings as a dividend (known as a 100% dividend payout ratio), leaving nothing in the tank for growth prospects?

Not ALL stocks that have a 100% payout ratio are toxic. But if that’s the case, you should at least be aware of it and understand why.

I’d wager that most investors have no idea about a company’s dividend payout ratio. Which is not their fault, by the way. It’s just not something mainstream dividend stock articles tell you about.

Another trap is in looking at past dividends and expecting them to continue at a high level. But often, these dividends are the result of a short-lived boom in earnings.

Often…in buying these divvy-payers you’re making a very bad long-term investment for a couple of pay-cheques.

And it may well just be a couple…

Many people who buy purely the highest dividends right now could well see those dividends disappear next year…as the companies issuing them see tougher times and are unable to afford them.

First and foremost, it helps you side-step some huge traps income investors are walking into right now. (I’ll warn you about them in a second.)

Several holdings in the Royal Dividend Portfolio also give you the chance at above double the income you’re currently getting from cash-in-the-bank.

Youʼre getting potential yields of more than 10%.

But…

…and this is the big part…

…that income shot comes with a chaser…of increasingly rare potential capital gains as well.

Buying dividend-payers for the long term is a cliché for a reason.

It works.

But at some key points in the market cycle, it really works.

This is one of those times.

Where the market is giving you a shot at buying stellar businesses with great dividends…but ALSO price-rise potential.

It’s just REALLY important that you pick your targets carefully…

In a moment I’ll show you my targeted portfolio that helps you seize this opportunity. First, though:

This is a graphic illustration of why dividend stocks are now back in the conversation…

The ASX200 has moved sideways for two years.

Rocky two years, for sure. The above picture is one of fear, panic, hope, greed…and boredom…all in one.

But when all is said and done…

In mid-June 2021…the ASX200 stood around 7,200.

And in mid-June 2023…the ASX200 stood around…7,118.

As a share investor, you’ve got nothing back from sucking up all that volatility.

You’ve shouldered the risk.

And got bugger all-in return…assuming you’ve matched the market. But many quality stocks have fallen in price big time.

No wonder a bank account might seem like the best option.

When stocks are going nowhere (or falling) the income you get (in the form of dividend yields) becomes that much more important.

Moreover…companies that lack growth options in a weak economy throw out higher dividends to get you interested.

High yields can often be a marker of a company in distress.

But you shouldn’t let that put you off an income strategy right now.

It just needs to be a clever one…

The most conservative investors are still sheltering in term deposits.

‘Income investing is not just back in favour, it is staging one of the biggest comebacks we’ve seen in generations…’

Livewire

Bank accounts are now trendy.

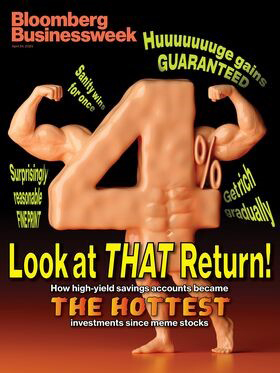

Cryptos, lithium and battery stocks, and most recently, AI have hogged the financial magazine covers.

Now you’re seeing that trend turn.

This is a recent cover of Bloomberg Businessweek:

The subhead says it all.

‘How high-yield savings accounts became THE HOTTEST investments since meme stocks.’

I’m not sure when a 4% return on cash became a hot investment theme.

But it tells you a lot about investors’ psychological state.

They’d prefer the safety of cash to it being in risky stocks.

I’m not bullish on ‘the stock market’ right now. I’m not overly bearish, either.

But this ‘safety in cash’ mindset presents a huge opening.

And it’s one that my Royal Dividend Portfolio is designed to help you exploit.

Now…I don’t at all want to make you feel stupid if you’ve retreated to bank account safety.

In the short term, that was actually a very smart move.

For the first time since April 2012…you’re getting decent returns…

In the context of the paltry interest of the recent past, those are starting to look pretty appealing, right?

And those rates you see above carry ZERO risk. (Assuming you’re under the government savings account guarantee of $250,000.)

The glaring problem is this…

The ‘safe’ option means your idle funds are getting killed by inflation.

Right now, your wealth is DEPRECIATING BY THE DAY if it’s mostly bunkered down in a bank account.

Not only that but there’s an opportunity at cost of being in cash. That is, you’re potentially missing out on income AND capital gains from stocks.

Cash is a good strategy if you’re sitting and waiting to see where the market goes in the next six months or so. I’m holding a decent chunk of cash right now too. And I expect to deploy it as the market continues to throw up opportunities.

After all, we’ve had two years of going nowhere for the Aussie benchmark index.

And it’s mainly been held up by the banks and the big resource stocks. Many quality businesses have lost anywhere from 30–50% of their share price value over the last few years.

The right dividend-paying stocks are now paying you a lot more than they did just a few years ago. Put simply, share prices are much more attractive.

As iShares puts it:

‘Just like certain pieces of clothing, there are some “seasons” when investors rely on dividends more than others.

‘Dividends were certainly fashionable in 2022 when S&P 500 companies paid out a record $565 billion in dividends.

‘In a very challenging year, investors sought the income generated by dividends and looked to companies who provided them. Dividend-paying members of the S&P 500 outperformed the index, as did some dividend-focused ETFs.’

If so, what are the best dividend stocks to own going into 2024?

Let’s evaluate your options.

If you want an easy answer…you could simply Google the best dividend-payers on the ASX and buy them.

At the time of writing, here’s a selection, based on current financial year forecasts…

There are plenty more well-known names giving a 6% plus income. And when you factor in franking credits, the pre-tax yield is even higher.

Much better than the bank is offering you.

But…you’re sitting in an uncertain stock market in order to get those returns.

I’ve been ahead of this curve for a while now.

My current Fat Tail Investment Advisory portfolio has eight standard income-oriented stocks within it. With pre-tax yields ranging from 5–10%.

But…as I keep stressing…the ‘obvious’ investing strategy is rarely the best one.

Let me give you a quick example of what I mean by that…

Three of the stocks above are all heavily exposed to the iron ore price: BHP Group, Rio Tinto, and Deterra Royalties.

Iron ore prices are well off their 2022 highs. Earnings and dividends are at risk for these companies. While the dividend yields LOOK awesome…they are likely a mirage.

This is what I mean about needing to think a bit harder than your average income investor.

Take BHP. It’s up nearly 250% from its cyclical low point reached back in 2016. And only down 15% from its all-time high.

Do you want to be buying this for an income play?

Sure…it’s a great company with world-class assets.

But you don’t want to be buying for income near all-time highs.

No.

You want to buy stocks with attractive yields when the share price is at a cyclical low…or at least well off its highs.

I’m pretty certain hardly anyone is going at income stocks with this take right now.

That is, I’m looking to buy good dividend payers that are also undervalued based on my strict valuation methodology.

That’s why just buying a basket of income stocks based purely on their yield is not a sound move. You’re not taking a company’s actual valuation into account.

Look, some of these yields are the real deal. But many are not as good as they seem.

That’s another thing people plunging into income stocks right now don’t realize.

They’re based on forecasts that may turn out to be too rosy. And that means such companies are likely to be overvalued.

So…if the highest payers are problematic, what SHOULD you buy?

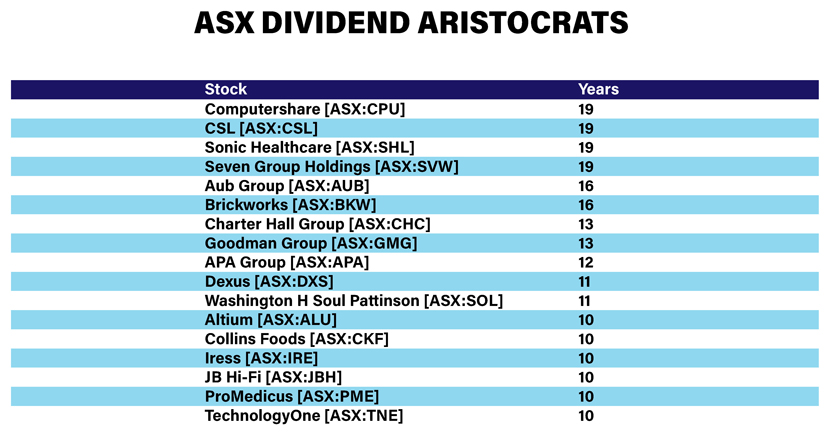

You’ve probably heard of a class of stock called the ‘dividend aristocrats’.

‘If you’re on the hunt for reliable dividend stocks, you've likely heard of the Dividend Aristocrats. These are top-quality dividend-payers — often regarded as ideal picks for novice dividend investors.’

Forbes

Put simply: these are really big companies that have not just paid consistent dividends…but increasing ones…over the last 25 years.

The term springs from companies selected by Forbes from America’s S&P 500.

But there are dividend aristocrat equivalents on markets everywhere.

The idea is a sound one…in principle…

As the pendulum swings away from growth and back to passive income…you should back the proven horses.

It’s a pretty select group.

In the US, there are just 68 publicly traded dividend aristocrats.

These are deemed the 68 best firms in terms of passive income…among the 500 largest publicly traded companies in the US.

These include:

Nothing ground-breaking there, as you can see.

But then…investors have found out over the last two years ‘ground-breaking’ no longer pays the bills.

When payouts now trump capital gains — you go for the most dependable payers.

They’re not going to lose you a ton of money if the market takes another down dip.

Their businesses are steadfast and stable. Many are deemed ‘recession-proof’. Meaning they keep making profits…rewarding shareholders with income…even when other companies are hitting the wall.

The pool here is much smaller than 68.

In fact, if you’re going to get technical about it…

Zero Australian companies fit the US dividend aristocrat criteria of a 25-year streak of rising dividends.

So, let’s lower that bar to 10 years.

Do that and you find that there are currently 17 ASX dividend aristocrats.

Here they are…

Now…if you’re looking to build a portfolio of pure-income stocks…I guess you could do worse than just investing in all of the above.

Investing in shares is riskier than money in the bank.

But when it comes to income…these 17 dividend aristocrats could be deemed the safest option.

Stable passive income.

They’re not necessarily the highest payers on the ASX.

But they’re the most consistent. That ever-increasing dividend paid to investors means they’re on solid financial footing, too.

Which is handy in these uncertain times.

Also…if you choose to reinvest your dividends, it amps up the power of compounding.

What’s not to like about a brilliant dividend track record?

Well, a lot right now, actually…

There’s a problem with blanket-buying dividend aristocrats too…unless you have a VERY long-term time horizon.

And again, it’s that you’re buying with no view on true valuation.

A dividend yield tells you nothing about what a company is actually worth.

Look, most of these Aussie ‘dividend aristocrats’ are good companies. I have no problem with them.

‘There's a good reason we all cringe a little at the word "aristocracy." Marie Antoinette lost her head because the aristocracy — "elite" as it might have been — wasn't particularly good about addressing the needs of the people.

That's the problem with several dividend aristocrats.’

Brett Owens

What I do have a problem with is investing according to simple rules and expecting an above-average outcome.

Take Iress [ASX:IRE], for example. Its share price is the same now as it was back in March 2009! Dividends, yes, but no capital growth.

For this reason, I think you should ignore dividend aristocrats as a strategy…

…and instead, target what I call ROYAL Dividend plays.

Here’s what I mean by that…

Yes, the market’s chopped nowhere for the last two years.

But…

Based on historical ranges… there are a LOT of stocks out there right now that are trading at a significant discount to their intrinsic value.

And many of these stocks are currently paying great dividends.

In other words…

The dividend yields are stellar income right now. Often at least a couple of per cent more than the best term deposit.

But there’s significant VALUE to be found as well…if you know what you’re looking for…

Earlier I mentioned a ‘sweet spot’ with regard to dividend stocks that most investors are ignoring right now.

THIS IS IT.

‘As an investor you want to find shares in a certain sweet spot,’ explains David Brett for Schroders.

‘You want a cheap share price, high income and high dividend growth. But every other investor also wants this.

‘You normally have to sacrifice something.’

But what if you didn’t have to sacrifice anything at all?

You get the chance at growth. Because many stocks right now are trading less than their fair value — in some cases WAY less.

But…you GET PAID while you wait for that value to be realised.

In other words, forget about the usual income stock suspects named repeatedly by the likes of The Motley Fool.

Instead, go for deeply-undervalued income machines.

Makes sense, right?

Of course, this Royal Dividend valuation process is much harder in practice.

Otherwise, everyone would be doing this.

And they’re not. Because it takes a lot of work. You can’t just scan for the highest dividend yields or stocks that have paid a growing divvy for 10 years and put together a portfolio.

You have to do the work. And you have to be prepared to take calculated risks and ignore the crowd.

So, if you’re interested in a calculated and mindful method of joining ‘the great yield chase’…

Let me show you how this works in action — using Holding #1 in The Royal Dividend Portfolio as an example.

‘I continue to make steady gains and income based on Greg's advice. His background knowledge of the whole financial system and how that relates to world events and self-knowledge is invaluable.’

Andrew N

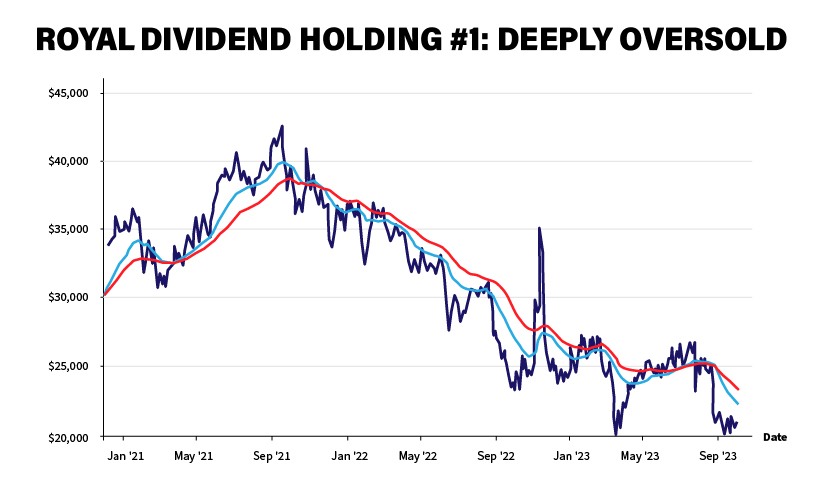

The first income/growth play I’ve selected for you is not a retailer, a miner, a bank, or a property trust.

Instead…it’s in a sector that has been deeply out of favour in recent years. I think that’s about to change. As such, Royal Dividend Holding #1 is now…in my judgement…significantly undervalued.

This is what sets these apart from stock-standard income plays.

With each Royal Dividend holding…there must be the potential for a decent upside in the share price.

This is my screening process springboard.

If you’ve followed my work since I was Senior Equities Analyst at Fat Prophets in the early 2000s, you’ll know that I’m a value guy.

I learned very early on that the path to consistent outperformance is to only buy companies that have potential upside in front of them.

That sounds so obvious. But many people are missing this point right now when going after dividend stocks.

I’m not going to get into the reeds of my valuation process here.

It involves a bunch of metrics including the required rate of return (hurdle rate), payout ratio, cash flow and earnings, and debt levels.

I overlay all that with technical analysis.

With the single aim of screening out solid ASX companies trading BELOW their intrinsic value right now.

That’s the start point.

I want to buy good-value stocks with an attractive dividend — not an attractive dividend from an overpriced stock.

This applies to all six plays in my Royal Dividend Portfolio.

But let’s return to Royal Dividend Holding #1 as an example…

As you can see here, the share price of Royal Dividend Holding #1 has had a rough time since the September 2021 peak.

The share price declined 50% from that high to its March low.

No denying: it’s in a well-defined downtrend.

And just because a stock has fallen hard doesnʼt automatically qualify it as a bargain. Thatʼs where my valuation process kicks in.

Based on a variety of metrics, Holding #1 looks undervalued here. Put another way, the market is betting on continued poor performance. It just has to be a little less poor than expected for the share price to rise in the next 12 months.

And it may already be starting…

What youʼre doing here is buying in at a major low…and collecting a hefty dividend while you wait for the price to change direction.

So…whatʼs that dividend?

‘Greg is one of the best investment advisers I've had, I'm still interested in listening widely, however Greg Canavan is level headed, straight down the line. My only problem is the times I didn't follow his advice.’

DRG

Not a complete showstopper yield, compared to top-rankers.

But…thatʼs the whole point of this strategy. As Iʼve shown you, many of those dazzlingly high 10% pluses are often ʻsucker yieldsʼ.

To repeat: we’re not going for the ultimate best dividends here.

We’re going for Royal Dividends: VERY decent income …but with a potential capital gain kicker.

And 7.5% is hardly chicken feed. It’s a way-above-bank-interest income stream that PAYS YOU while you wait for a capital gain as well.

It’s also an absolutely consistent stream, too.

Another non-negotiable criterium of Royal Dividend plays.

Royal Dividend Holding #1 has paid a consistent dividend…twice a year, without fail…since 2005.

That’s Dividend Aristocrat-level consistency…

While there are no guarantees, of course…

…you can be fairly assured… with that 18-year payout record… the dividends will continue.

It’s a big company, too: market capitalisation of $2.3 billion.

Share price is around $20.50.

My valuation process indicates scope for this $20 share to rise to $26 or higher in the medium term.

But this share price and market cap is another characteristic of Royal Dividend holdings. Except for the odd very special exception…these plays will be large caps.

These arenʼt conventional growth stocks. But weʼre after an income stream with some share price growth too. And if we pay below intrinsic value…weʼll more than likely get it!

Yes, you can lose money on them if things go badly. But those losses, if Iʼm wrong on my valuation, should be small and gradual…rather than fast and brutal

And it’s not just a theory…

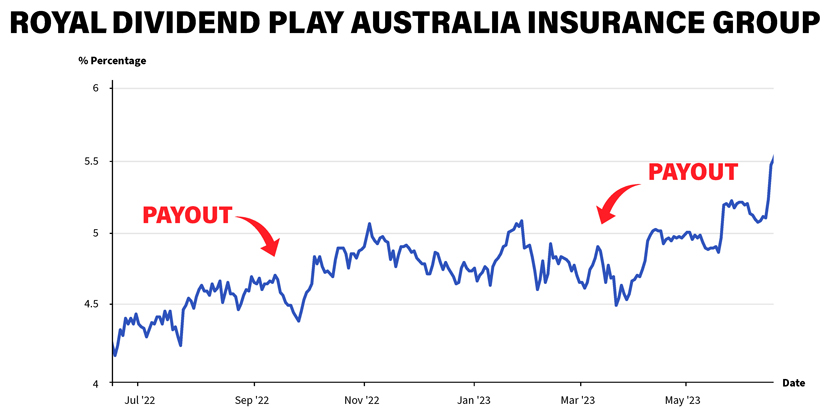

In May last year, I recommended Insurance Australia Group [ASX:IAG] as an early Royal Dividend play.

At the time…just like Holding #1…IAG stock was in the doldrums, having fallen 50% from its peak. It had suffered from COVID-related claims issues, as well as weather events.

It was also trading on a prospective dividend yield of 5.4%.

Fast forward more than a year…

And we sold out for a 36% gain.

With TWO dividend payments banked while the stock was rising.

Over the same time frame, the ASX 200 rose by just 3.8%.

IAG is NOT a holding in new newly-formed Royal Dividend Portfolio, however.

Simply because of its success. We’ve taken profits and moved on.

‘As the Fear Bear overtakes the Greed Bull…Greg Canavan's service is perfectly placed’

‘Greg Canavan has a no-nonsense approach to investment analysis, with a view to investing in undervalued blue chip companies that have been miss-priced and oversold, with an aim, to finding those shares within the ASX 200 that provide value, share price appreciation and dividend payouts.

‘In my early sixties and having retired these last four years, Greg's service provides the right amount of risk / reward fundamental research I am looking for at my time in life.

‘As the Fear Bear starts to overtake the Greed Bull in the coming months and years, the high growth, disruptive, no revenue zombie companies that have dominated the market to a larger degree over the years, will be replaced with a more value based profit making company approach which Greg Canavan's service is perfectly placed to exploit in the coming years. Could not be happier with Greg Canavan's Investment Advisory and highly recommend the investment newsletter.

‘Companies invested in through the service WHC=174% gain ORG=33% gain DCN=81% loss NAB=33% gain (sold) WBC=27% gain BPT=6% gain GOR=19% gain RRL=30% loss.’

Terry

Markets have been so crazy the last few years…it might feel like you’re doing all right if you’ve roughly the same capital you had in mid-2021.

But you shouldn’t settle for treading water any longer.

In my mind…there’s only one prudent option:

Get paid while you wait. A steady income stream to collect while you keep skin in the game for potential capital gain.

Own a set of six undervalued stocks with the potential to flip from CASH machines into GROWTH machines.

This is the core premise of The Royal Dividend Portfolio.

I’ve compiled a complete rundown of all six holdings in a PDF report you can download today.

We’ve covered the first play already.

If you download this report today, I will also give you my detailed valuations on:

This is the first of two holdings in this portfolio based around property.

Weʼre nearing the end of the rate-rising cycle…if weʼre not there already. And when rates stop rising…the real estate industry breathes a sigh of relief.

As such, this is our first deeply-undervalued PROPERTY Royal Dividend play. Itʼs trading at 0.7 times book value. That means the stock price is at a 30% discount to the stated asset value right now.

And it offers you a prospective dividend yield of 6.6%. Not the highest of our six holdings…but the value proposition on this one is tantalising. Iʼll lay it all out for you in The Royal Dividend Portfolio report.

Our second real estate income/growth play. These guys are a Real Estate Investment Trust (REIT). And this one is very much a ʻspecial situationʼ. It recently spun out a bunch of key assets in a newly listed company.

This play trades at an even deeper 50% discount to book value and a juicy 8.2% prospective yield.

The share price copped an absolute pounding in 2022. And it’s under pressure in 2023 too.

But, as Iʼll show in The Royal Dividend Portfolio, I think thatʼs about to change. The market cap for this stock is currently just under $1 billion, with a net asset value of double that.

MASSIVE value to be had here. And an 8% dividend paid to you while you hold the position…

Now…this one holding has been doing the rounds in media circles as a ʻtop ASX dividend shareʼ recently.

Itʼs right up there with the high-yielders I would typically warn against right now. This is getting its predictable attention. But whatʼs being missed is that thereʼs a value proposition here as well…

Iʼve been tracking these guys since June 2022. The stock's been in consolidation mode most of that time. But since the start of June 2023, itʼs seen a significant breakout. I have reason to believe it could continue — for reasons Iʼll lay out in The Royal Dividend Portfolio breakdown. And, again, you get a heaving 10.5% side-plate of income while you wait to see where this stock goes next…

A mining infrastructure play with broad exposure to commodities, particularly coal.

The smallest yield of the six. But it has one of the most compelling cases for price upside. And I can say that from experience…

I know this company well because I recommended it once before…back in February 2019. We sold in September that year…right around the stockʼs last peak…for a 31% gain, or just over 50% annualised.

Not bad, right?

Well, Iʼm re-entering this trade. But this time…as a Royal Dividend play. The share price is now much lower than back then: down from $6 to $3.50. For reasons Iʼll explain, Iʼm anticipating a new up-trend. (With a 5.3% income stream while you wait for it…)

This is the second resources rebound play. And itʼs an interesting one. Itʼs in a sector that the greenies hate. And many people think it will be out of business in a decade.

But I think that is completely wrong. Iʼm willing to bet that in a decade, itʼs product will be in even higher demand.

The company trades on a forecast yield of 6.5%, fully franked. Again — itʼs a capital gain weʼre after from these guys, too.

And I reckon itʼs coming…

Commodities have copped a beating in 2023. The global slowdown has had an impact across the board.

But buying when others are fearful is exactly what you should be doing…and get a 6.5% yield while you wait for prices to turn back up.

I wonʼt pussyfoot around about this:

I give a detailed breakdown and forensic valuation of each in The Royal Dividend Portfolio.

The key point is this…

Buying stocks at or around these yields needs to be done carefully.

Many dividends around these levels denote concerns about future earnings (and therefore future growth and dividends).

But that is not the case with all six of these holdings.

Here, you get a great income. But it’s built on solid foundations and future potential. So potential capital appreciation in the near term is also very much in play.

Obviously…there are absolutely no guarantees. As I’ve stressed, investing in stocks is never risk-free. If we see another concerted leg down in the market, some of these stocks might not see the capital gain we’re after.

And while these are all highly consistent-payers, continued payouts are never a 100%-given either.

This is why I strongly recommend you download and read The Royal Dividend Portfolio…and then make your own considered assessment of what I’ve uncovered.

And I expect to uncover more such stocks in the months ahead.

And I expect to uncover more such stocks in the months ahead.

When putting together this portfolio, a number of stocks were considered but didn’t make the cut. The timing wasn’t quite right.

But new dividend/growth opportunities will be added in the months ahead.

For instance…quality retailers will become prime candidates for good dividends and potential capital growth. They’re too early to buy now…and share prices are getting whacked. But if the opportunity presents itself…we’ll make a move there.

Are you interested in joining me?

You will be given password-protected access to The Royal Dividend Portfolio if you subscribe to my service, The Fat Tail Investment Advisory.

This is the flagship investment service of Fat Tail Investment Research.

This is the flagship investment service of Fat Tail Investment Research.

It’s not strictly an income newsletter.

What we try and do is anticipate...before the mainstream…where things are moving next. And adapt.

We do this very well.

For instance…from 2021, I positioned us very defensively.

But…with what was at the time a very contrarian bet on energy stocks.

It paid off.

The Fat Tail Investment Advisory outperformed a terrible market in 2022, roughly 8% up where the ASX200 sank 7.3%. That’s 15% outperformance!

‘I find Greg's interpretation of the financial horizon about the best of the bunch. I subscribe to a few… and this is my anchor, my mainstay… it is the logical dissection of available financial data that I appreciate, the look at what is happening and what MAY come next (not WILL come next). I just feel Greg tries to take me on a journey of discovery rather ’

Ian T

That’s not just cherry picking either. Since the inception of my service back in November 2014, my average stock pick (all the winners and losers combined) has delivered a 14% return.

That’s much better than the ASX200 over the same time frame, which comes in around 3.5% annually. However, to be fair I need to factor in dividends. The ASX200 total return index includes dividends AND the value of franking credits (which my return doesn’t). It’s delivered an annual return of around 9.3% since late 2014, still well below my 14% performance.

So I hope you can see I have the runs on the board.

Now we’re pivoting again.

I have assessed that…for the medium term at least…the only game in town is going to be the kind of stocks we’ve been talking about today.

If you agree with me…join me.

I get things are pretty dicey right now. And bank account safety might seem alluring. Ultimately, this is a judgement call you’ll need to make yourself.

But I’ve arranged a 30-day subscription

But I’ve arranged a 30-day subscription

YOU always need to be the front-seat driver with your investing.

‘Excellent service from a very intelligent look at all the variants. Good consistent returns from recommended list.’

Brent

‘Over the past few years, I have profited from his knowledge and understanding, particularly for instance when markets have become volatile. The benefit of having a logical and analytical voice on your side to make sense of markets and help identify value opportunities should not be underestimated.’

Carl M

‘Greg's recommendations are always carefully researched and explained. The calculated 'fair value' share price is a tremendous guide. ’

John H

‘Greg's value-based investment approach & quality analysis is much appreciated in the current & coming market…$140,000 in total made in BPT, ORG, EVN, RRL, SLR and PTM…’

Anthony

Especially when things are as murky as they are right now.

I can use my knowledge, valuation skills and experience to help you along the way. But ultimately, you are the one charting your course.

If what I’m doing doesn’t align with your own goals…or with where you see the markets going…you should let us know within the 30-day trial period and we’ll refund every cent of the subscription fee.

And you can keep The Royal Dividend Portfolio with my compliments.

Even if you decide to get the refund.

There’s also a fairly vital companion report you will also receive if you join me today.

It’s called:

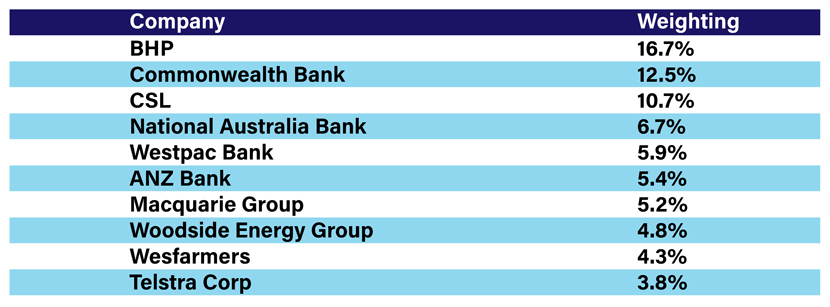

Take a look at the top 10 holdings of the Betashares Australian Top 20 Equity Yield Maximiser Fund (Managed Fund) as of 28 April:

On the face of it, that’s a rock-solid portfolio.

On the face of it, that’s a rock-solid portfolio.

But it’s not one that’s going to give you outperformance. At least, there’s a low probability of it.

And…as we’ve mentioned…there are many hidden traps on some of the best dividends on offer right now.

BHP Group, for instance, has also thrown off big dividends over the past few years…thanks to a robust iron ore price.

But prices have come under pressure lately, and this will have a flow-through effect on BHP. In other words, the dividend forecasts are risky.

The banks are similar. Their earnings cycle has peaked in my view. And earnings will be under pressure going forward. While the dividends look okay at this stage, you’re seeing pressure on share prices.

In ‘Dumb Dividends’ — and How to Spot Them, I break down the tell-tale signs of a ‘sucker yield’. And name several prime candidates that should probably be avoided over the next year at least.

And there’s one last thing I’ve made sure Fat Tail let me include in this package — my book:

Our judgement when it comes to money is consistently prone to error. When markets are so uncertain…and worry and anxiety are rife…even more so.

A lot of investors are making some dumb decisions right now.

A lot of investors are making some dumb decisions right now.

They might seem intuitively right — like staying in cash until the next bull market…or buying Coronado Global Resources [ASX:CRN] because it’s offering the crazy yield of 24%.

But if it’s one thing you’ll learn from this 162-page book on investor psychology, it’s this: you don’t outperform the market on ‘gut feeling’.

Especially this market.

By the time you finish reading You, Your Brain & the Stock Market, you will have all the tools to be a smarter, better, and humbler investor and/or trader.

In advance, just keep in mind that fear, arrogance, overconfidence, and letting emotions get the better of you are all common characteristics of portfolio blow-ups.

This book helps you overcome these hurdles.

So…if you’re keen to join me…

‘It is one of the most thoughtful and well written subscriptions that I receive. I always read it start to end and some I have filed as useful reference material.!’

IDM

‘I have subscribed to Greg's advice for several years, not going to quantify results, other than to say, I would not renew if I wasn't getting good advice and making money.’

RM Mossman

‘Applies the KISS principle, essential to nonagenarians like me! My heirs will benefit.’

Hugh

‘I am a retired 70-year-old self-funded retiree every year I keep saying I am going to stop trading but once again I renewed my subscription with Greg so glad I did he does all the hard work I used to do for the last 25 years. Thank you, Greg. ’

EAM

‘I particularly like Greg's understanding of the macro picture and he explains it in a clear and concise manner, perhaps the best at Fat Tail. Full marks in this area; it's a excellent, achievement in stiff competition. ’

Rod B

It’s $499 per year.

It’s not among our most expensive services at Fat Tail Investment Research, which retail up to $4,000 annually.

But it’s not our cheapest advisory, either.

This is a serious service for serious investors — backed by a solid track record for anticipating key swerves in the market BEFORE the mainstream.

Very few, to my knowledge, is attacking the ‘race of yield’ in the way my Royal Dividend Portfolio has set out to do.

Very few…I think…have my set of valuation skills and are applying them to finding dividend/growth plays right now.

Compared to equivalent investment services and financial planning packages out there…the value of a $499 annual subscription should be self-evident.

My friend and Fat Tail Publisher James Woodburn has agreed to a significant one-off discount for your first year.

Just $249.

That’s a full 50% discount that gets you all of this:

$249 for your first year.

And you’re guaranteed a full refund of that $249 within the first 30 days if you wish.

In my view, it’s a service that’s worth several thousand dollars a year, rather than $249 for the first 12 months and $499 thereafter.

I reckon you could pay $2,500-plus for everything you’ll be getting today, and it would still be a bargain.

Here’s the deal.

Click the ‘SUBSCRIBE NOW’ link at the end of this report and you’ll be directed to a secure order form.

Fill in your details.

Have a really good examination of The Royal Dividend Portfolio and everything else you get access to.

Get a refund if you wish within 30 days.

If you stay on for the duration, you’ll be automatically renewed at the standard price of $499 every 12 months thereafter, unless you tell us otherwise.

Thanks for staying with me.

Hopefully, you’ve learned something today, even if you decide not to get my six-part Royal Dividend Portfolio.

To summarise, here’s what I’m offering now:

You’ll be granted full, password-protected access as soon as your trial period begins.

Unless something very extreme happens in the markets, my aim is to generate at least one new investment opportunity each month.

I’ll finish with this.

I know 2023 has been a trying year for investors.

But two things are blatantly apparent.

The search for yield theme is going to be with us for some time to come.

And yet…

There are deep pockets of value appearing in certain parts of the market.

The smart investor should be building a portfolio based on both of those realities.

The Royal Dividend Portfolio is my take on it.

Yes, there are risks. Any investment and anything you do with your money involves risks.

But we are living in a very dangerous financial time. And I think the much bigger risk is staying in the bank and getting ripped by inflation on a daily basis.

It’s time to make your call.

Click the ‘SUBSCRIBE NOW’ button below.

Sincerely,

|

Greg Canavan,

Editorial Director, Fat Tail Investment Advisory

PS: Here are some further kind words from current subscribers:

‘I am impressed with Greg's ongoing analysis of the markets, including his use of charts to clearly show trends. His company analysis is clear, concise and compelling and the combination of fundamental and technical analysis provides a good basis for his company recommendations. In fact, his Investment Advisory is the one I most look forward to - especially when there is volatility in the markets as it provides a necessary emotional anchor.

‘At present I am 80% (or $1,625) up on Evolution Mining and 123% (or $2,160) up on Northern Star… My profit on these two stocks alone has more than paid for my lifetime subscription many times over. ’

— George S

‘Really appreciate the insightful explanations of market moves and global situation. Greg has a clear writing style that leads you to the conclusions and keeps the interest alive in what could be dull reading. I did well on the uranium stocks recommended after a long hold... WAF has also been a real ripper. Still invested along with Whitehaven coal — very good buy timing and nice observation that the coal price was cyclic regardless of other factors. Well done and thank you!’

— Mark

‘To me, Greg is spot on most of the time, I love the charts he uses for getting the point across, and find he is quite thorough in his research, suggesting buying into the banks were a great example, at the moment some up by 75%. Well done. ‘

— Shane Chasemore, VIC

‘Love your work. Yes made more money from your investments than leaving it in the bank.’

— Marg

‘Extremely happy with the level of info. If you have no prior experience in business and finance it is a valuable resource for learning.’

— Graham

‘Of course I follow Greg Canavan's Investment Advisory, and especially like the insights behind why we might buy and sell some of the stocks. Following along with the Greg and the other members of the Fat Tail Crew, how could you not be in front with your finances.’

— DA

‘Great respect for this service and Greg’s writings. Am retired with limited funds so keen on the dividend stock advice provided. The balanced views provided are a big help for Self Funded account management.’

— Ian

‘I have found Greg’s advice very accurate & professional i have made good returns on Whitehaven Coal , Woodside Petroleum & Beach Energy.’

— KW

‘Greg's attention to detail is excellent as are his well thought out newsletters.’

— J Gall Sydney

‘I appreciate Greg's clear concise evaluations.’

— Russell WA

‘I like Greg's conservative approach to beaten up ASX200 shares and eagerly await each months recommendation.’

— Ray from WA

‘I have followed Greg's market commentary since his very early days, and have always found his market advice to be informative with the right mix of risk & reward. While Greg occasionally has a bum call, in general he anticipates the market well… Overall around 15 stocks from Greg's advice over the last 5 years are up between about 28% and 211% as of today… Keep up the great work Greg, the mix of fundamental and technical risk assessment works well!’

— Smokey

‘Greg explains things very concisely and well and as I invest in the mining space (gold, Silver, Lithium ) I find his work very important in helping me keep a balanced longer term perspective. I would not do without his reports.’

— D.G.H.

‘I believe in Greg's service as his value stock choices will no doubt be of greater assistance in these volatile market conditions.’

—Mark Pfluger