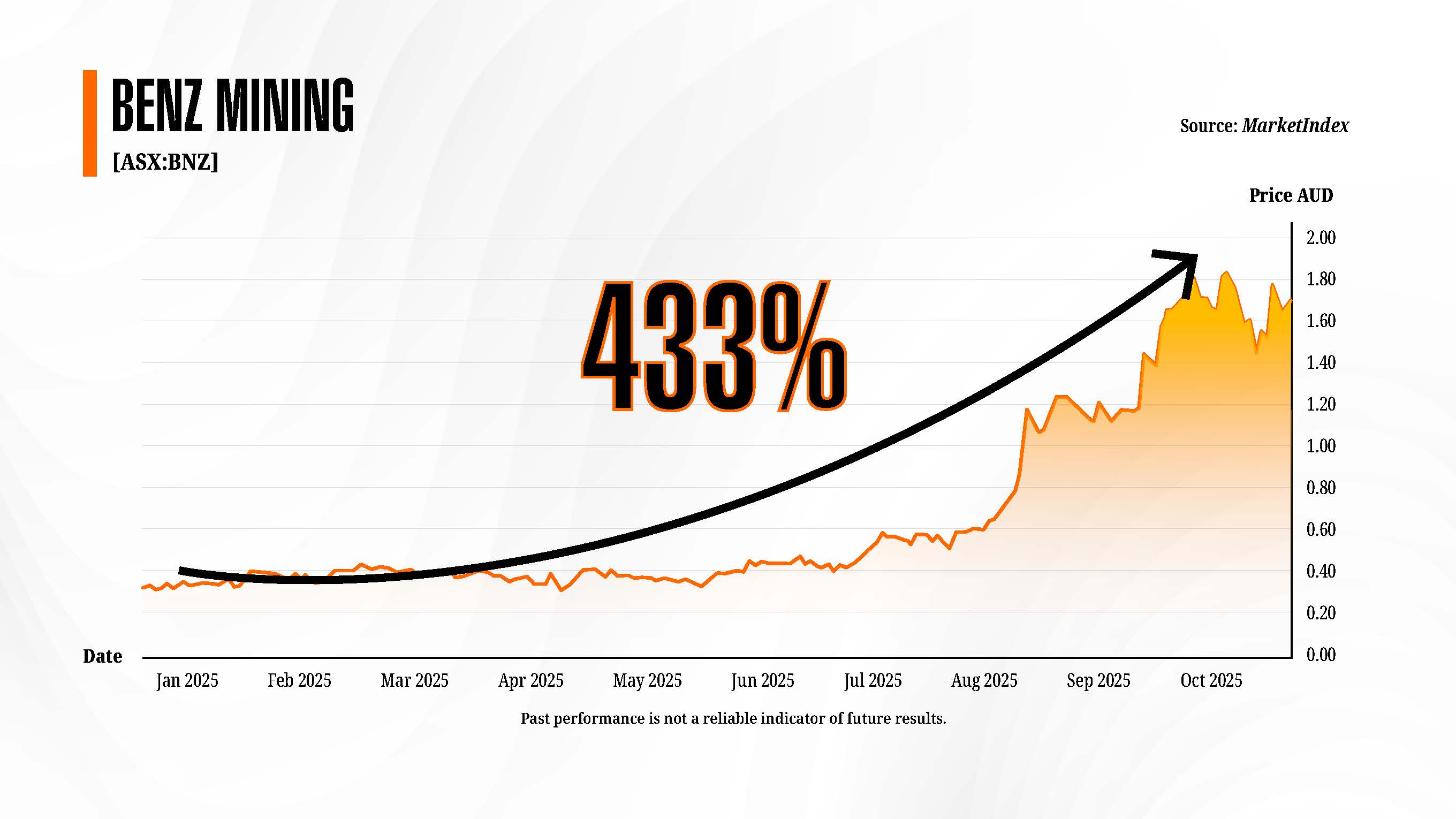

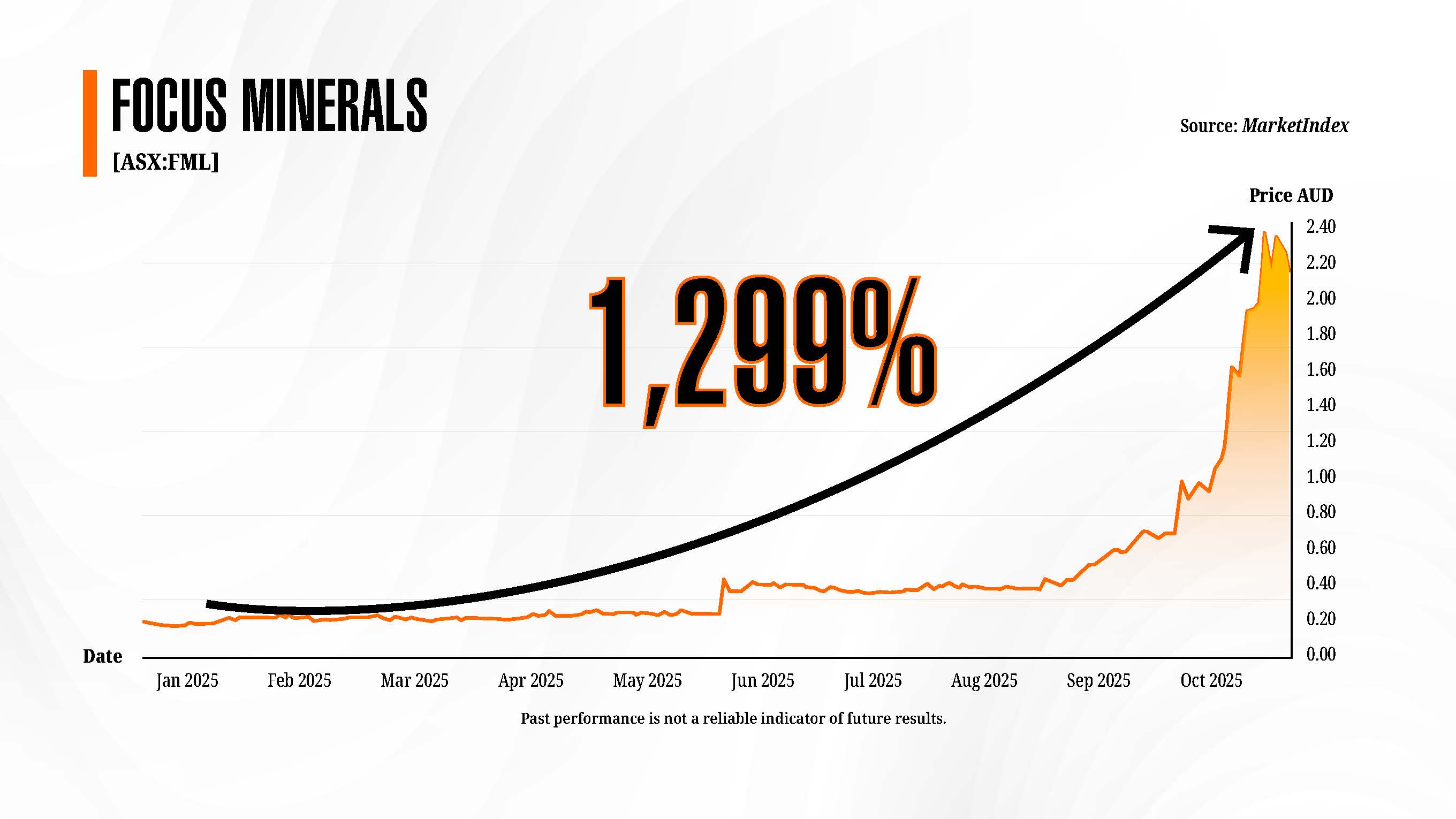

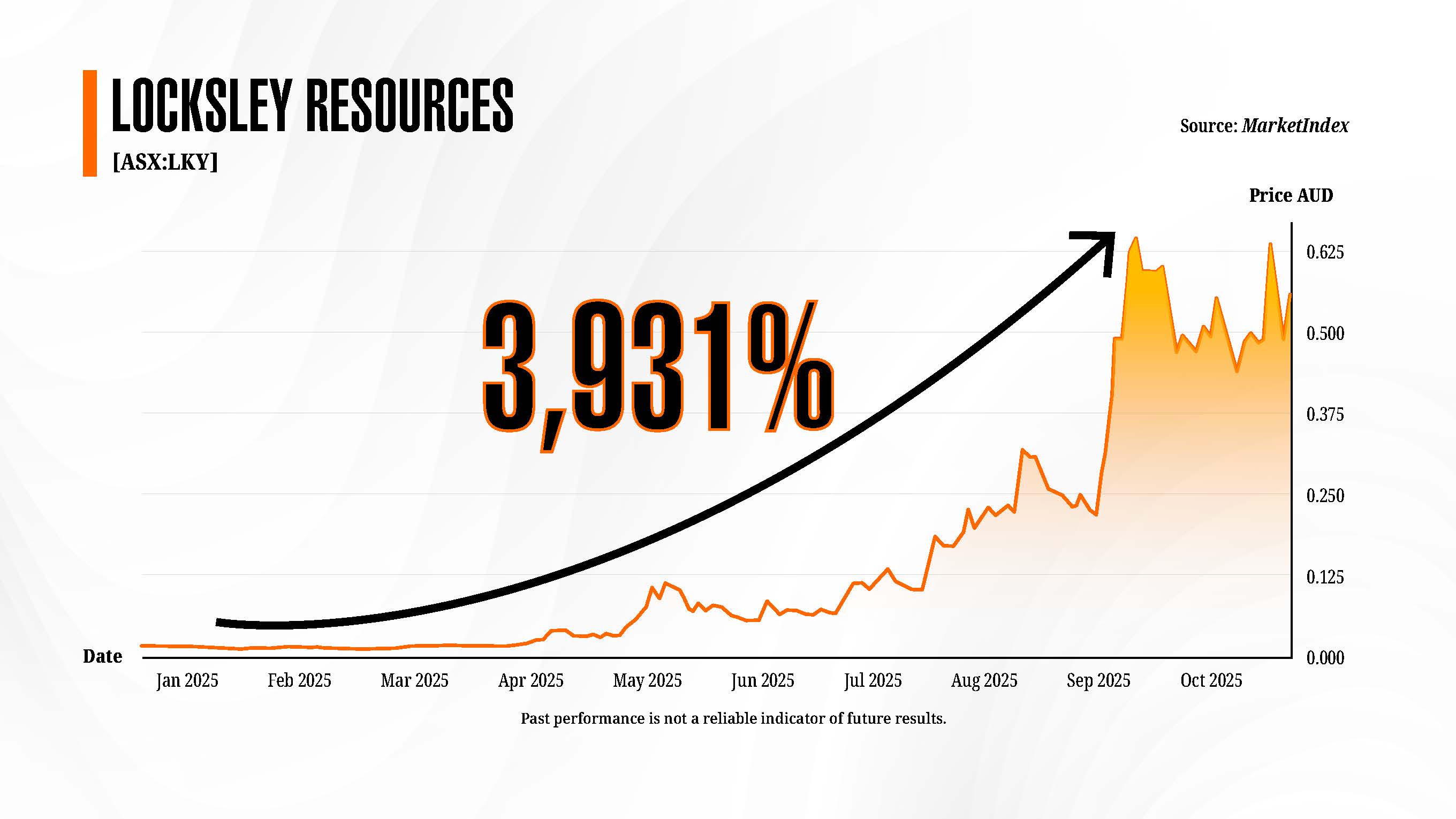

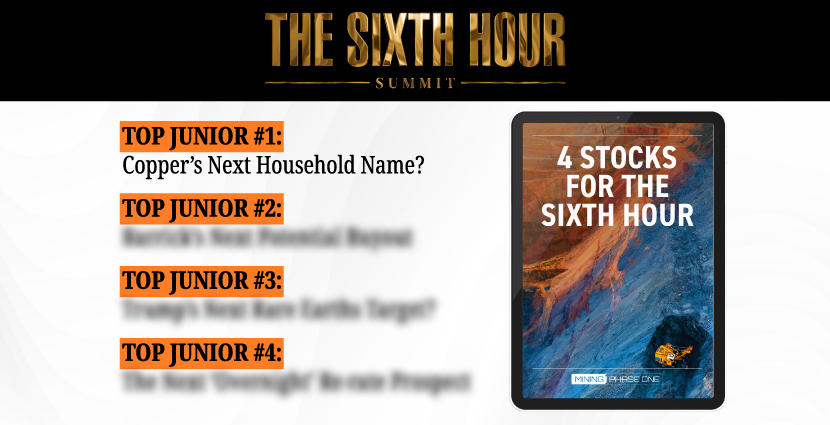

James Cooper believes now

is the best time in 10

years

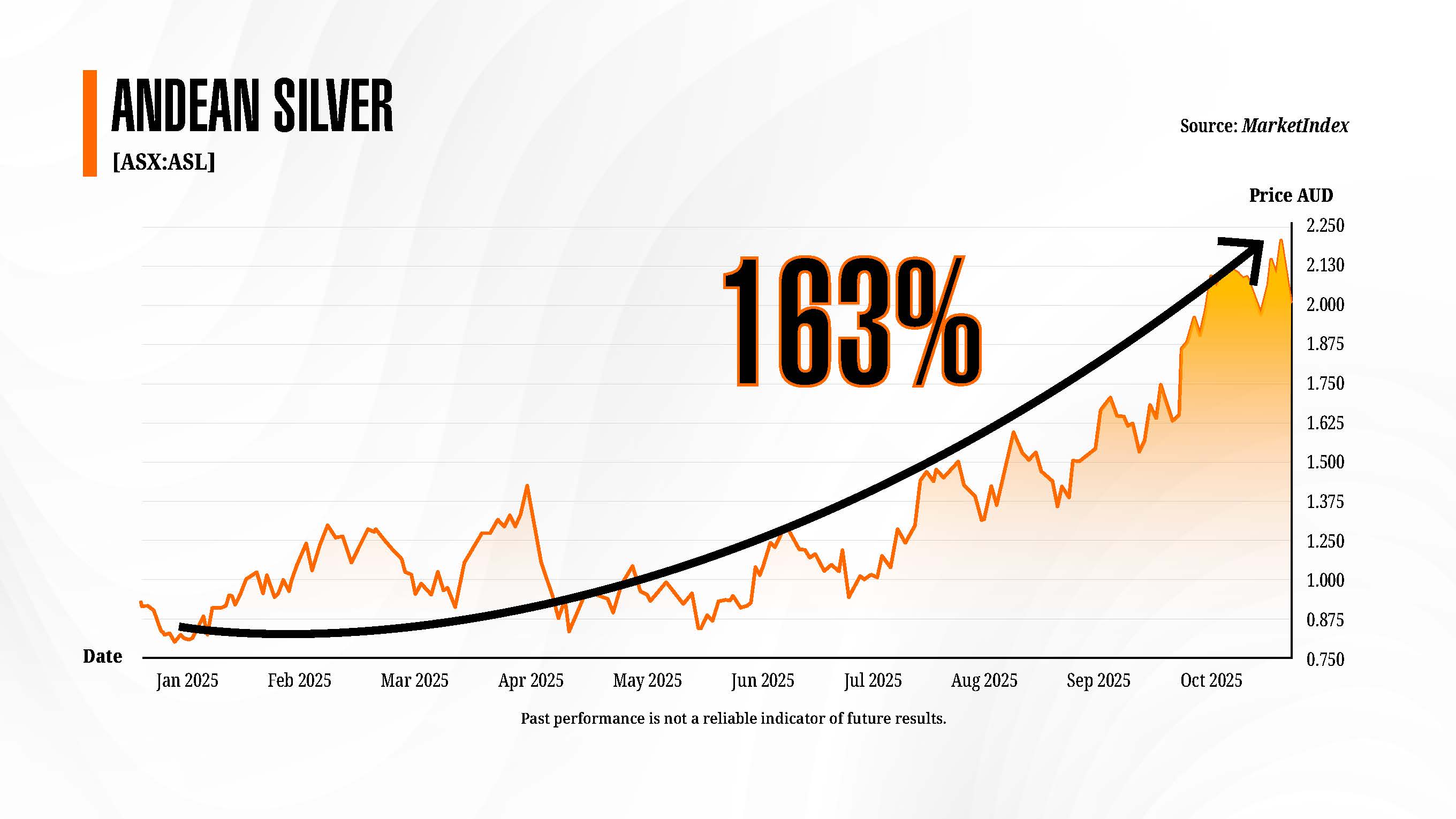

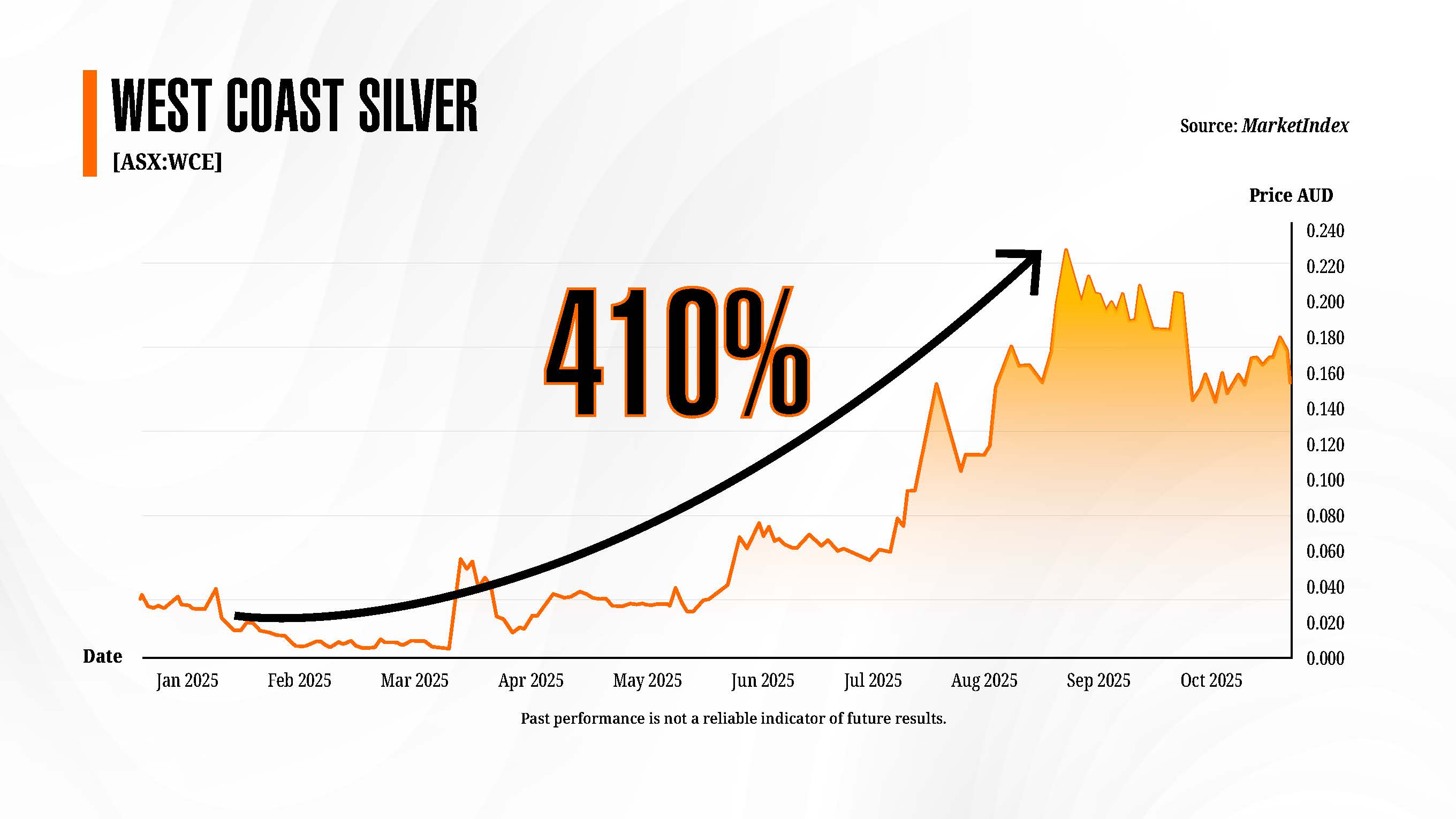

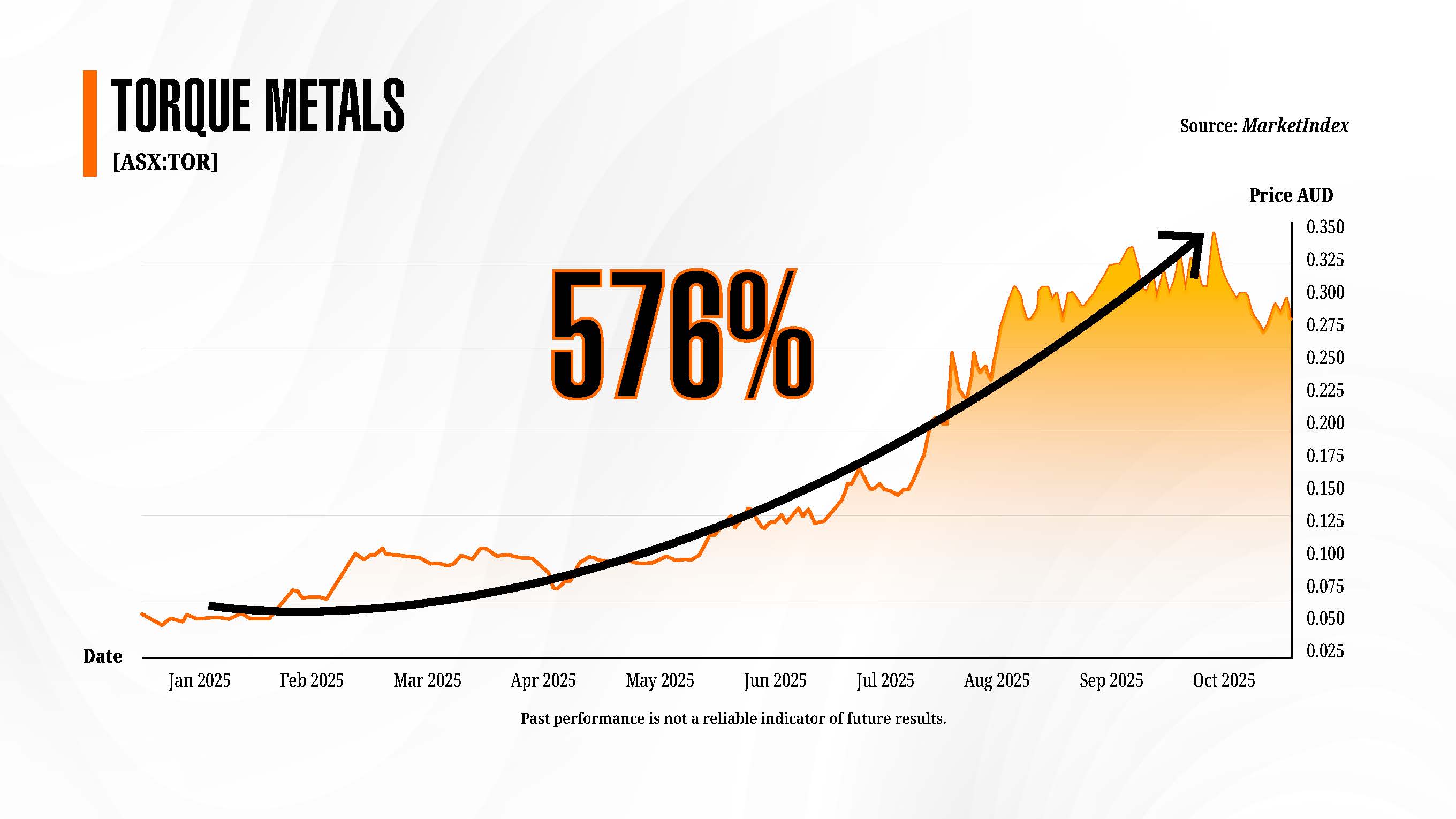

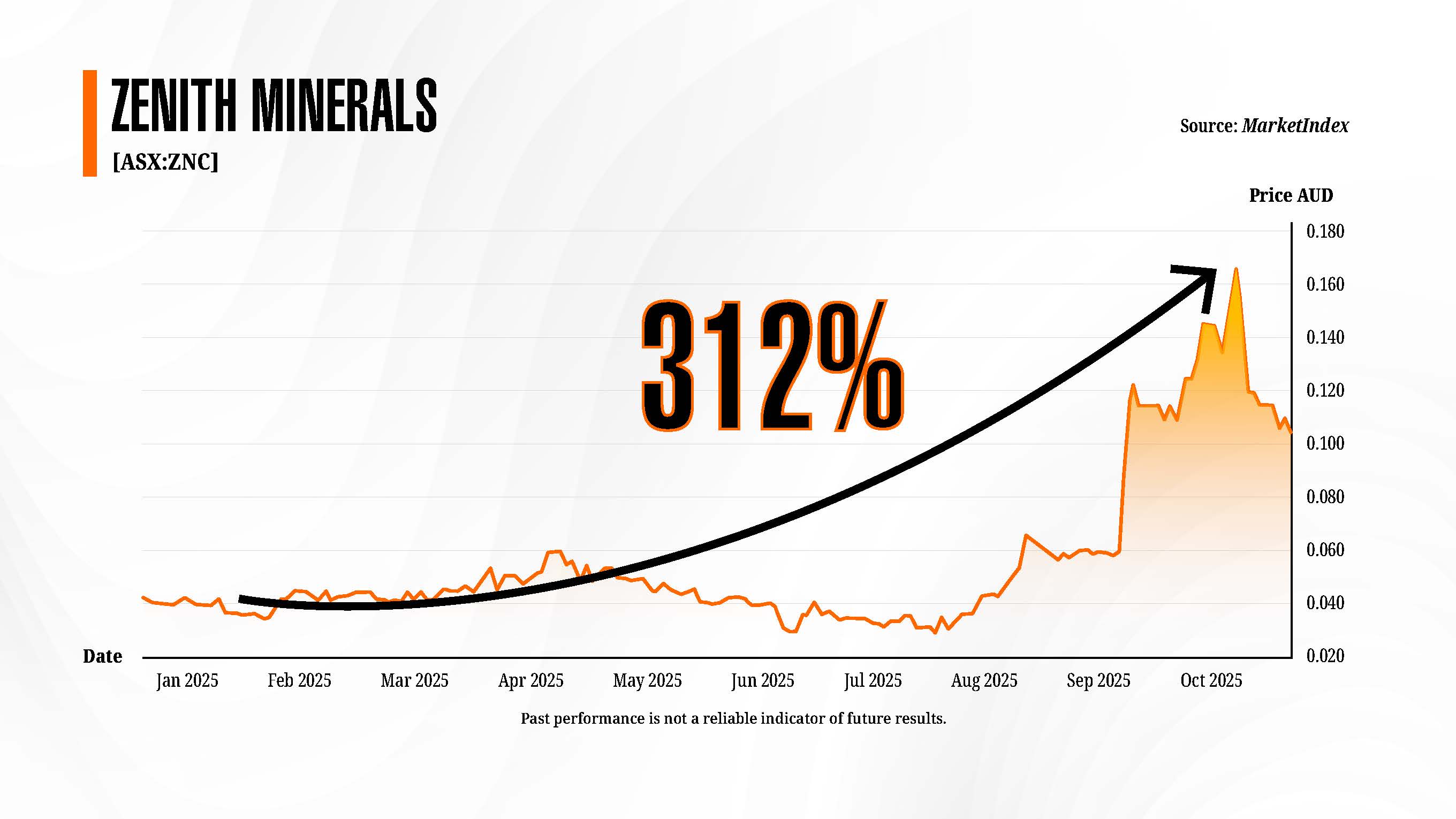

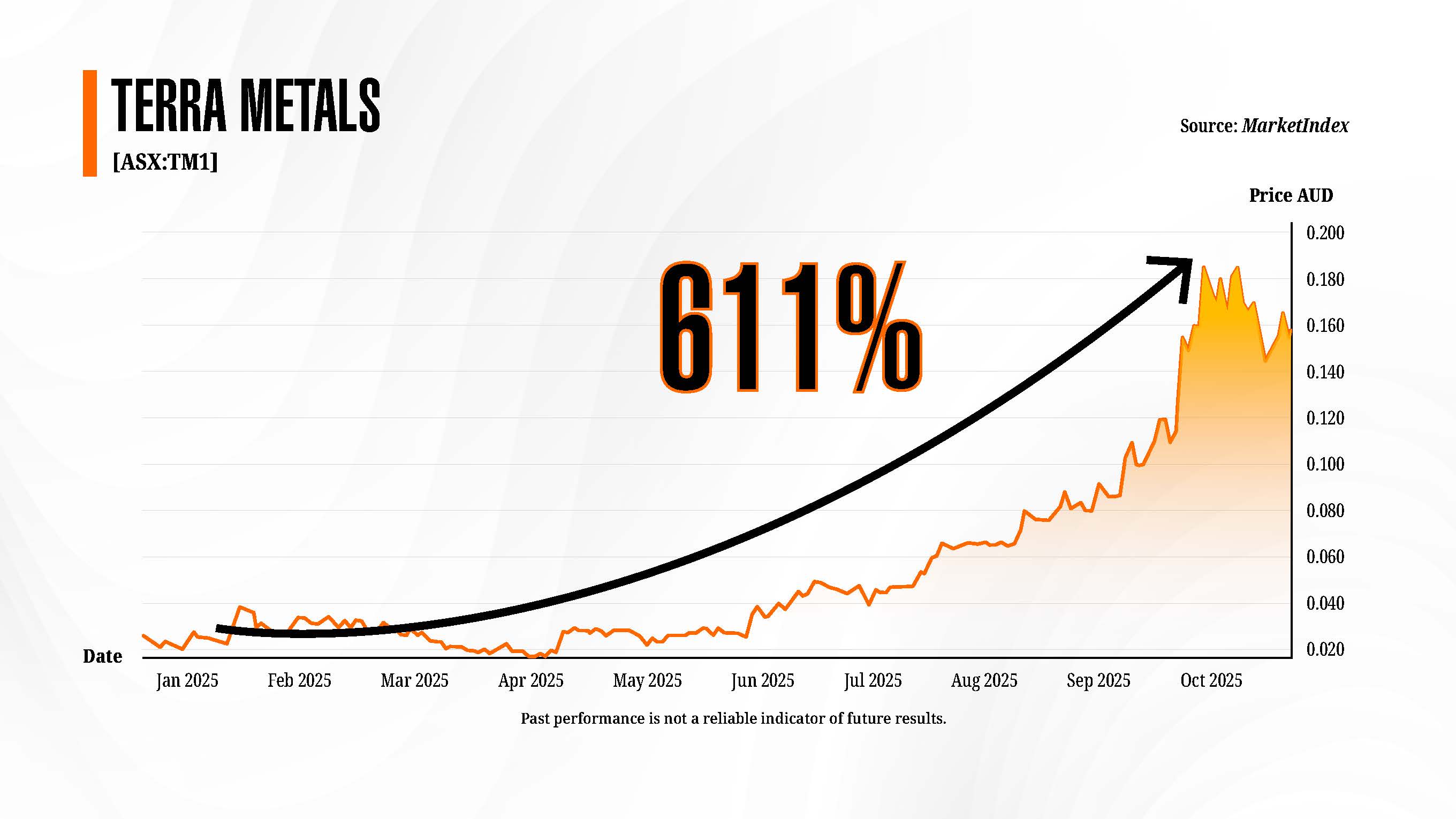

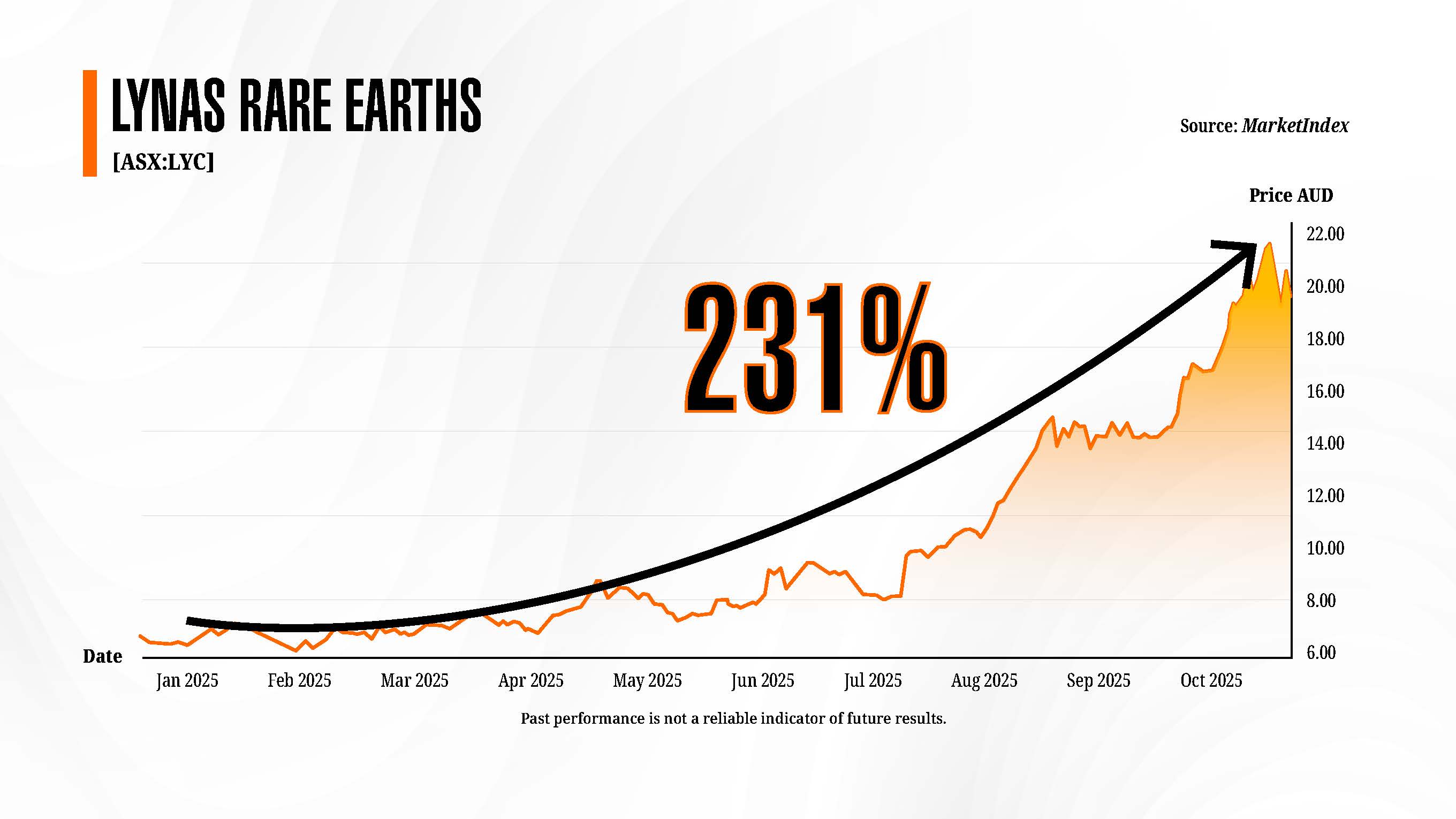

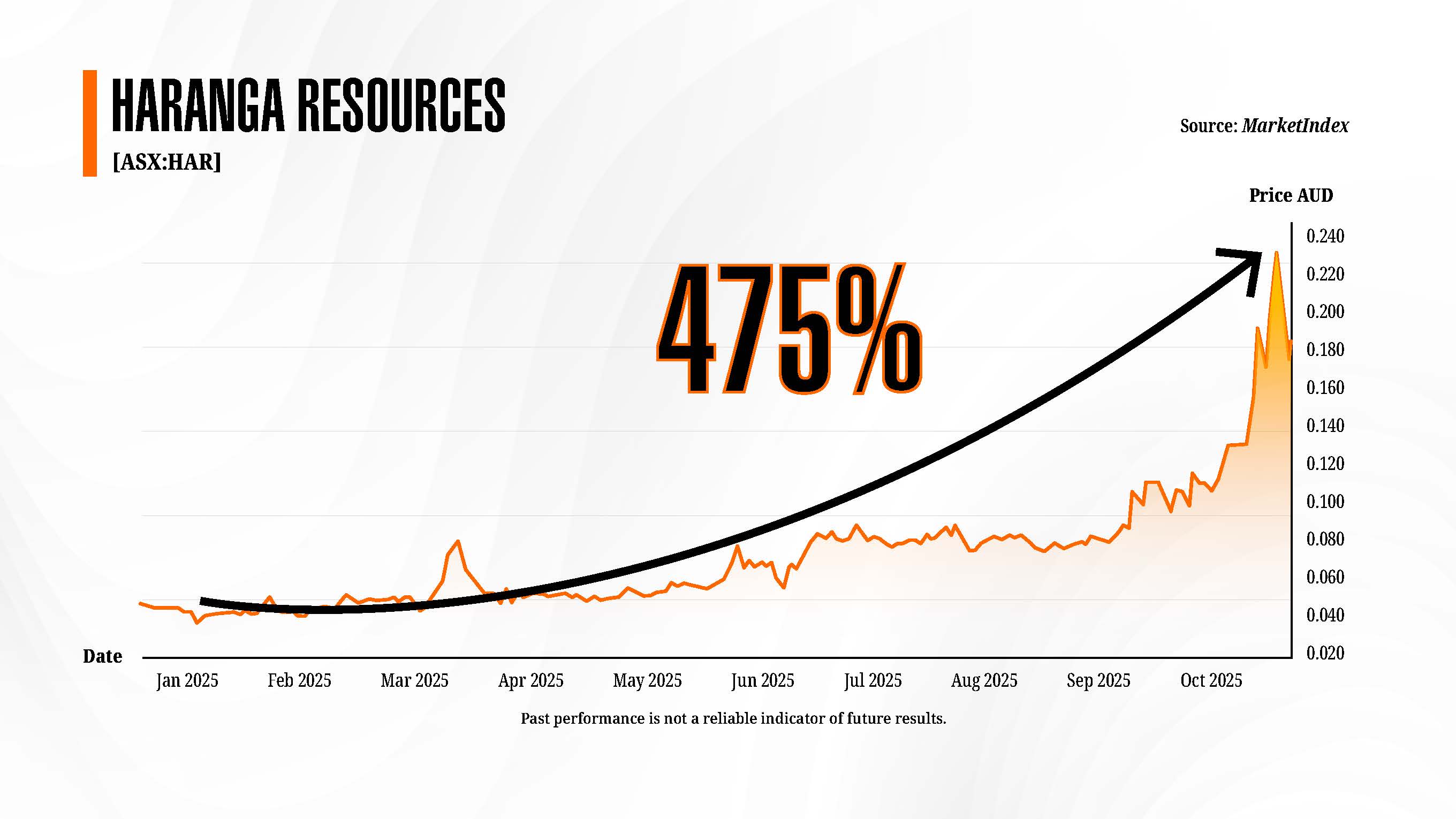

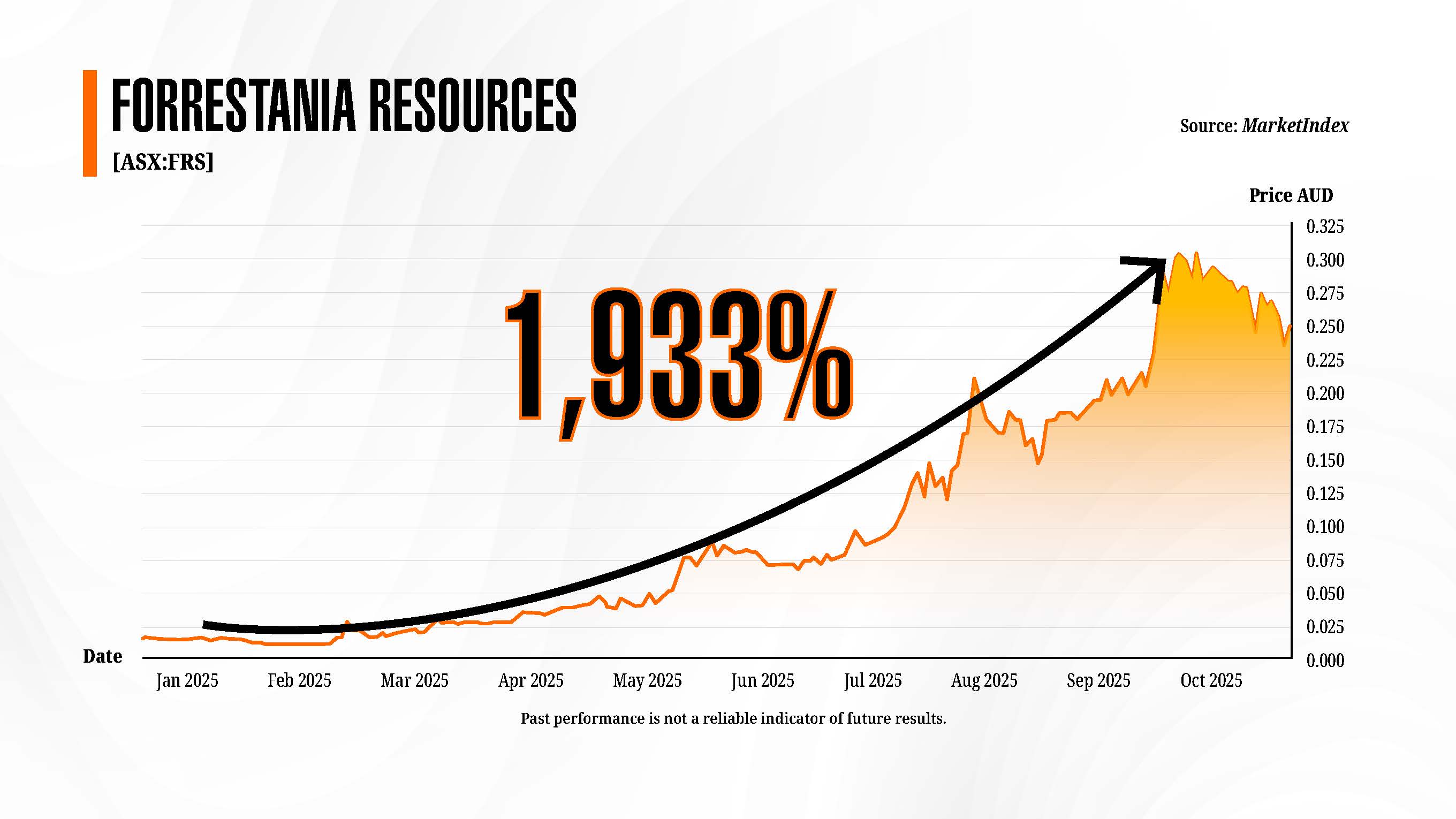

to buy junior

mining stocks.

The question is: Which ones?

Four answers below…

All figures accurate as at . Please download and read our

All figures accurate as at . Please download and read our