A $340 Million Company,

Snapped Up for Just

$30 Million?

Impossible!

So they said...

But I know who’s doing the deal.

He buys ‘broken’ assets nobody else wants for peanuts — then turns them into cash-generating machines. It’s his MO.

In 2014, this guy took a one-cent shell company and turned it into a $16 billion mining giant.

The stock price went up 1,000% in just six years. Early investors made a fortune.

So you bet I’m taking an interest in his next move.

You should too.

Because in less than 180 days, his new operation switches from cash burning...to cash flowing.

When that happens, big funds and managers will suddenly take an interest.

And the share price?

I wouldn’t be surprised to see it take off.

That puts you in a good position...if you like to speculate on small stocks.

The big institutional money hasn’t arrived yet.

The brokers aren’t paying attention.

But the catalysts that could send this stock surging are lining up perfectly.

‘Impossible’ things happen

more often

than you think

in the stock market

When you know what to look for, you can spot the signs long before others catch on.

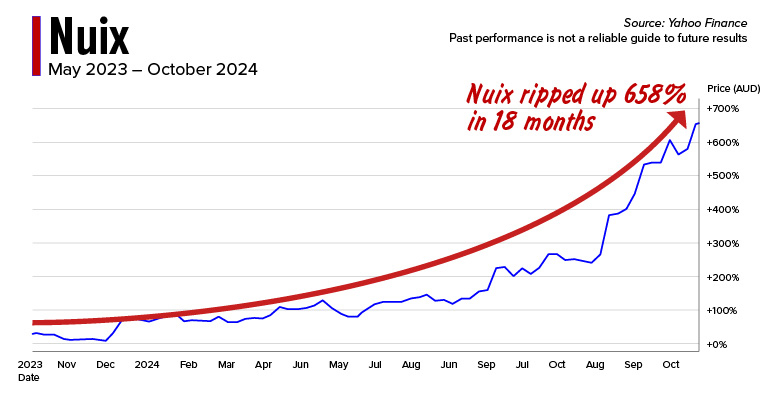

Like back in May 2023, when I alerted my followers to a data analytics company called Nuix.

At the time, the market had completely written Nuix off.

The company was being hammered by negative sentiment, court cases and management problems.

One analyst even called the stock ‘rancid bacon’.

But I saw something others missed:

A powerful AI platform called ‘Nuix Neo’, launched right as artificial intelligence was starting to dominate the tech conversation.

I recommended Nuix while everyone else was running away. Those who followed my recommendation had the opportunity to make a 658% gain in under 18 months.

I see a similar kind of ‘impossible’ setup again now.

You wonder how someone can acquire a $340 million business for less than a tenth of that.

Well, I’ll tell you...

He’s bought a copper mine. But not just any copper mine...

It’s located in the famous Lachlan Fold belt in New South Wales — an area known for world-class mineral deposits.

This mine was highly productive 30 years ago...but back then you could basically get at the ore with a knife and fork. That’s all gone now. The rest of the deposit is much deeper underground.

The previous owners spent hundreds of millions of dollars figuring out how to get at the deep copper and went bust in the process.

Our guy swept in and picked up the mine at a 90% discount to its true value.

That’s like buying a million-dollar house for a hundred grand. An impossible discount in any other market.

And he’s already nearly

doubled the proven reserves

How?

Because he has the know-how and the confidence to drill deeper — around 230 metres deeper, in fact, than the previous operators.

In just two years, this guy’s team has not just doubled the known reserves, they’ve extended the mine life from three years to ten.

Now he’s about to start generating serious cash flow — right as copper demand is soaring.

This is one of the best investment cases I’ve seen in 13 years of analysing small stocks on the Australian market.

Why?

We’re entering what I believe could be a 10- to 15-year bull market in copper and other critical minerals. The global energy transition is driving big demand.

Some are saying copper demand will go up 50% by 2040. Meanwhile, getting permits for new open-pit mines is nearly impossible in many countries.

Like I say, most of the world’s easy-to-reach copper has already been mined.

The good deposits are increasingly underground, where most miners don’t want to go.

That’s where our man excels.

And he’s not even done exploring

The mine he just acquired has been historically underexplored at depth. There’s a real chance they’ll find even more copper as they drill deeper.

If they do, you’ll be glad you bought this stock now. My guess is you’ll want to hold it forever.

It reminds me a lot of the Pilbara Minerals story.

Back in 2016, Pilbara was the leading pure-play lithium miner on the Aussie exchange...right at the moment all hell broke loose in the EV battery market and demand for the metal went berserk.

Pilbara’s share price went up 10 times in just five years.

Like I say, I’ve been tracking small-cap stocks for 13 years.

Setups like Pilbara and my new copper mine play are rare. But when they come off these are the kind of plays that can turn a mediocre year into a great one.

I can’t offer you any guarantees, of course. But if you feel like you’re due a great year, you need to drop everything to look at this opportunity.

Because timing is critical here...

You have a six-month window

By mid-September, this company expects to report its first positive cash flow.

When it does, I’m certain the big money will establish positions...and the price advantage you have today will vanish overnight.

This is exactly the kind of asymmetric opportunity I specialise in finding before other investors catch on.

And that’s why I want to get this company’s details into your hands as soon as possible.

I’ve put all my research together for you in a new and valuable report titled: ‘5 Small Australian Stocks to Buy in April’.

Inside, you’ll learn:

- The name and ticker symbol of this copper miner...

- My full analysis of its operations, prospects and risks...

- When and how to take a position to maximise your potential returns...

- The specific price I recommend paying (don’t overpay!)

- When I’ll be looking to take profits

If you’re interested in speculating on small stocks, this is just one company I think you should take a look at.

I’ve identified four more small-caps with similar ‘impossible’ setups that almost nobody is talking about...yet.

Like this tiny gold explorer that could be about to benefit from what I think will be intense merger and acquisition activity in the gold sector.

Have you noticed gold lately?

It's on fire — up around US$1,200/oz just since May last year...and now trading at record highs around US$3,000.

In Aussie dollar terms, that's over AU$4,700/oz.

For the major gold producers, all their Christmases have come at once.

They are swimming in cash right now. Their profit margins haven’t been this good in a decade.

And what happens when gold majors make rivers of money?

They go shopping for more gold!

I expect a wave of mergers and acquisitions to sweep across the Australian gold industry in the next 12 to 24 months. The big producers will look to buy up the best juniors.

Well...I’ve found a tiny two-cent developer perfectly positioned for this M&A gold rush.

It controls THREE MILLION ounces across three historic goldfields in Western Australia.

The previous owners underfunded and underexplored these old mines. But this small developer is proving there’s way more gold in the ground here than anyone realised.

Now you might be thinking this gold miner is worth a punt anyway at just two cents a share.

Well, maybe. I mean there are no guarantees, even when the shares are this cheap.

But you don’t even know the best bit...

This miner is already producing

20,000 ounces of gold per year

It’s generating cash flow while it prepares for something much bigger...

It’s working towards a 10-year, 100,000-ounce-a-year operation, with a final investment decision coming in 2025.

If that decision is positive, the stock could re-rate higher — significantly — as investors wake up to what’s happening.

Some already have.

In fact, several resource funds have taken positions in this cracking little gold junior.

They see what I see — a massively undervalued gold resource in a tier-1 jurisdiction.

And they believe, as I do, that a cashed-up major producer could swoop in at any moment with a takeover offer.

It reminds me of when I recommended 67-cent gold explorer Spartan Resources to my followers in May 2024.

Within a month of my recommendation, major producer Ramelius Resources charged in and took a 9% stake in Spartan.

Sure enough, in March this year, Ramelius moved to take full control of Spartan — which prompted me to issue a ‘sell’ recommendation.

Those who got in and out when I advised them to had the chance to bank a ripping 164% win, as you can see here.

This all happened within

the space of 10 months

One of my followers, Dimitri, emailed the very same day to tell me:

Made some good money on this trading over the year...currently sitting on $9,144 profit.’

Another, Paul G, said:

Just letting you know my average buy price for Spartan was 51.11 cents. I sold all my Spartan holding yesterday at $1.74. A nice profit of 239%.’

Spartan’s ‘Never Never’ gold discovery made it an irresistible target.

The gold junior I’m telling you about today has a similar resource base to Spartan...making it as attractive to cashed-up majors looking to secure their future production pipeline.

And look, there aren’t any guarantees that this will go the same way as Spartan. But right now, you can own a part of this business — along with all of this future potential — for around two cents a share!

You’ll find all the details of this company — name, ticker symbol, and my recommended buy-up-to price — in my new report, ‘5 Small Australian Stocks to Buy in April’.

There's more.

I’ve spotted another exciting up-and-comer in an entirely different sector...

The niche banking powerhouse

investors are completely overlooking

While gold, crypto and AI stocks have been getting all the headlines, there’s a financial revolution unfolding out of the spotlight.

I’m currently tracking an ASX-listed ‘challenger bank’ that’s dominating a market the big four have all but abandoned.

A ‘challenger bank’ — if you’re wondering — is simply a smaller, newer financial institution that competes against the established major banks.

They typically use modern technology and focus on under-served niches to outmanoeuvre the banking giants who are weighed down by legacy systems and outdated thinking.

The company that’s grabbed my attention doesn’t waste time with mortgages like Commonwealth Bank or Westpac. It focuses exclusively on a far more profitable niche: business lending.

The numbers tell

an

incredible story

This Melbourne-based banking upstart grew its loan book by 46% and saw its net profit surge by a staggering 589% between July 2022 and June 2023.

How?

By serving Australia’s 2.5 million small businesses — the backbone of our economy.

This is not a story you’d hear on the evening news or read about in your local paper.

But it’s exactly the kind of opportunity I’ve been unearthing for years.

It reminds me of another little-known company in the same space, MA Financial Group — a tiny non-bank lender I recommended to my followers back in September 2023.

MA Financial was perfectly positioned to ride what I call the ‘65 Money Wave’ — a massive $170 trillion global liquidity cycle that’s lifting asset markets worldwide.

Since I recommended MA Financial, its share price has soared 74%...while the Small Ordinaries Index has crawled up just 12% over the same period.

It’s still an open position in our portfolio, continuing to perform brilliantly — at the time of writing this.

Now look, I can’t give you any guarantees, but this new banking opportunity — the one in my report — looks even more compelling to me than MA Financial was back then.

Why?

Because it’s positioned to benefit from the exact same liquidity wave...but with an even more focused business model and higher profit margins.

While MA Financial earns a solid 2.8% margin on its lending, this challenger bank maintains a net interest margin of 3.5% — making it one of the most profitable lenders in Australia!

That would be motivation enough to take a close look at this two-dollar company...

But there’s an even more

compelling reason to invest

See, despite managing $11 billion in loans, this company’s share price still trades below its IPO price!

Why?

Pure market fear.

Back in 2021, most mainstream financial experts were predicting a ‘mortgage cliff’ and deep recession.

Investors panicked and dumped this stock, sending it down for TWO STRAIGHT YEARS.

But that cliff never emerged.

And the recession never happened.

So now, Australian banks are sitting on a potential $6 billion treasure trove of unused provisions for bad loans that may never materialise.

And you can pick up shares in this rapidly growing challenger bank at a lower P/E ratio than Commonwealth Bank...

...despite it growing TEN TIMES faster.

That’s an opportunity you

rarely see in today’s market

The downside?

It’s a small stock.

Which means — if I’m right and it does take off — you can find yourself priced out of the action pretty quickly.

The clock is ticking...

There’s already market chatter about this company becoming a takeover target.

The Australian has named a potential suitor. Once acquisition rumours intensify, you can forget buying this stock at such a steep discount.

If you want to know more — including the stock ticker symbol, and my recommended buy-up-to price — get yourself a copy of my new report, ‘5 Small Australian Stocks to Buy in April’.

You know, looking outside of the big banks and mining giants is how you discover these hidden gems.

Another one I’m tracking right now is a tiny engineering firm based on the Gold Coast.

The mechanic who founded this company started out by building cooling systems for race cars in his workshop.

Now, every single Formula 1 team in the world uses his technology.

That’s an incredible feat for an Aussie company of this size.

But it’s what this company is doing next that made me take notice...

This is going to sound like something from a 1950s sci-fi novel, but companies around the world are actually building flying taxis.

Toyota just invested US$500 million in one such company. Another is planning commercial operations in Dubai by 2026.

Your average Collins Street analyst might scoff at this kind of thing, but...

It’s happening, whether

you believe it or not

And guess who’s already in talks with these companies?

Our Gold Coast mechanic and his team.

These flying vehicles generate enormous amounts of heat that needs to be managed. And that’s exactly what this guy’s firm specialises in.

The potential market here is staggering — US$60 billion by 2035 according to industry experts.

So why am I amped up about this company now?

Well, the stock price just dropped around 40%, which I think has created the perfect entry point for you.

There’s nothing wrong with this company whatsoever.

The stock fell because the founder announced he’s investing heavily in future growth instead of focusing on next quarter’s profits.

Investors got spooked by this and sold their shares.

That’s the thing about small-caps. It doesn’t take much volume for them to swing big in either direction.

For educated speculators who understand where real money is made...

This looks like a

wonderful opportunity

The founder still owns 17 million shares.

He’s building for the next 20 years, not just the next earnings season.

Whether this turns out to be the transport revolution of our lifetime is anybody’s guess.

But right now, you have a chance to invest alongside one of the most exciting entrepreneurs in Australia at a bargain price...with a ton of future growth potential ahead of you.

All the details of how to invest — the stock ticker, risks, and what to pay — are in my report: ‘5 Small Australian Stocks to Buy in April’.

You’ll be able to get your hands on a copy in just a moment.

But first I want to tell you about the fifth and final stock in it...

In terms of out-and-out potential, this might actually be my favourite little stock in Australia right now...

This company has got all

the ingredients we love

It’s tiny.

Hardly anyone knows about it.

And it operates in an industry where demand is set to ramp up massively.

In fact, it controls an asset that has quietly become the best performing commodity of 2024. I call it ‘digital gold’, but it’s a humble metal that’s absolutely essential for our modern world.

Without it, you couldn’t be reading this right now.

Your phone wouldn’t work.

And those AI chips everyone’s raving about?

They’d be paperweights.

I’m talking about tin — the unsung hero of the electronics revolution.

Right now the tin market is tiny — worth just $11 billion annually compared to iron ore’s $300 billion.

And the supply chain?

It’s a complete mess, with most production coming from conflict zones or areas with questionable labour practices.

Meanwhile, demand is rising rapidly.

Every electronic device, every solar panel, every AI server farm needs this stuff.

The ASX-listed company I’m tracking controls one of the few tin mines in a stable, Western jurisdiction.

It’s sitting on a decade’s worth of production and over $200 million in cash with zero debt.

The company’s on track to generate $100 million in free cash flow this year...

Yet its market cap

is laughably small

This could be one of those rare opportunities where you get in before the big money even notices what’s happening.

Seriously. Right now investors are either obsessing over AI stocks or worrying about which way interest rates are headed next.

They’re missing these huge growth opportunities right here in our own backyard.

But listen, you don’t need to miss anything.

You can get all my research on this awesome 65-cent tin miner today.

You’ll get the full story on this stock, including ticker symbol, what to pay, and a detailed summary of the risks and opportunities ahead.

Everything I’d want to know if our roles were reversed, in other words.

It’s all waiting for you in my new report: ‘5 Small Australian Stocks to Buy in April’.

Download your copy

today and discover:

- The tiny copper miner that just acquired a $340 million operation for an initial payment of just $30 million — with production set to begin in six months...

- The two-cent gold developer controlling THREE MILLION ounces across Western Australia — perfectly positioned as a takeover target in the coming M&A gold rush...

- The Melbourne-based ‘challenger bank’ that grew its profits by a staggering 589% FY23 — while still trading below its IPO price...

- The Gold Coast engineering firm that went from building cooling systems for race cars to supplying every Formula 1 team in the world — now poised to enter the $60 billion flying taxi market...

- The 65-cent tin miner sitting on a decade’s worth of production and 220 million in cash with zero debt — controlling one of the few tin mines in a stable, Western jurisdiction...

Best of all, you can access ‘5 Small Australian Stocks to Buy in April’ at a small cost of just $49.

Why am I making you

this generous offer?

It’s my way of introducing you to Australian Small-Cap Investigator, my monthly newsletter dedicated to finding the most promising small companies listed on the Australian market.

Your purchase today gives you three months’ access to my newsletter.

As a subscriber, you’ll enjoy at least one new small-cap recommendation every month — stocks with the same thrilling potential as the five I’ve just told you about.

You’ll receive detailed analysis of each stock, including when to buy, what price to pay, and — crucially — when to sell to either lock in your profits or cut any losses quickly.

Every recommendation comes with a breakdown of the risks and potential rewards, so you can make informed decisions about where to put your money.

And you’ll get immediate alerts whenever it’s time to take action on any of our open positions.

Even better, you’ll get instant access to the Australian Small-Cap Investigator portfolio, meaning you can take a position in any of the small companies you like the look of that are currently under their buy limit.

I’ll tell you more about my service shortly. First:

A quick introduction

Callum Newman

My name is Callum Newman.

I’ve been analysing and writing about small Australian stocks for the last 13 years.

When you’ve been focused on one section of the Aussie market for as long as I have, you tend to pick up on what makes a worthwhile punt and what to run a mile from.

At the time of writing this, the average gain across all my live recommendations at Australian Small-Cap Investigator is 60%. That includes winning AND losing positions.

Let me spell that out for you.

If you’d bought every single recommendation in the current Australian Small-Cap Investigator portfolio, at the time I told you about them, your AVERAGE position right now would be a 60% gain.

Now this is just where we’re at today. I can’t give you any guarantees about tomorrow. An average, by nature, means there are losing positions too — as you’d expect from small-cap stocks.

But where else are you going to do this?

My service is one of the best kept secrets in the country.

This is partly because I don’t advertise it very often. But also because most investors are too busy following the crowd, buying the same big stocks at the same prices.

They may do okay, but they miss the chance for truly exceptional returns.

Small-caps offer something different.

The potential to transform your investing results — quickly.

This is not just coming from me either. It’s coming from my subscribers.

I challenge you to find

better feedback than this

They tell me all the time over email.

Take this note I got from Peter F:

My small caps have remained in profit overall after the first 12-14 months. Thank you for all your recommendations and please keep up the good work.’

Paul S writes:

Callum’s service is fantastic, and I recommend it 100%. I have made money on the following: TUA, SPR, and NXL around 30%.’

While ‘Moss’ simply says:

Probably the best advice around when it comes to investing in small caps.’

Maybe I can have the same effect on your share portfolio!

Listen, I figured out years ago that it helps to specialise if you want to get good at a particular type of investing.

Otherwise you’re only ever going to get average returns and plod along with the market.

Some guys only look at mining stocks. Others are into tech firms or crypto. Some — God help them — love the bigger companies: banks, retailers, telcos and what have you.

Each to their own.

But in terms of sheer excitement and capital growth potential, let me tell you nothing comes close to small-cap stocks.

Which is why I write a monthly newsletter dedicated to them.

But what IS a small-cap stock, and

how do they give you an advantage

over funds, institutions and pros?

Well, by now you know that small-caps aren’t household names like Commonwealth Bank or BHP.

They’re younger, smaller companies worth less than $2.5 billion that are often creating new solutions or exploring untapped opportunities.

Aside from their lower share prices (often just dollars or even cents), these companies have two powerful advantages that the blue-chips simply don’t.

For starters, small-caps can move FAST.

Because these stocks are so small, it doesn’t take much to move their price. A bit of good news, a promising deal, or a new discovery can send shares soaring quickly.

Think about it — a company like Commonwealth Bank needs to add billions in value to move its share price just a few per cent.

But a small company only needs a few million dollars of new investor interest to potentially double in value.

See here... This is a chart of tiny defence tech company DroneShield from New South Wales.

It makes military hardware and AI-powered software systems to protect against drone attacks.

I recommended this stock to Australian Small-Cap Investigator subscribers in February 2024 when it was selling for 70 cents a share.

I thought it was one of the most exciting stories on the market. And my research pointed to a huge expansion in revenue.

Sure enough, DroneShield sealed a deal with the US government and blasted off to a $1.2 billion valuation.

It didn’t take much buying volume

to double the share price

In fact it happened within a few weeks — as you can see on the chart.

I instructed readers to sell their shares in July — just six months after buying them. Those who did had the opportunity to bank a 133% gain.

Anthony, one of my subscribers, wrote:

I have bought some of your recommendations and done well, thank you. Especially DroneShield. I got my outlay back and still hold more than half so thanks heaps.’

Colin says:

I doubled my investment in DroneShield. I have learned though that I do need to listen to Callum’s sellout advice [regarding] timing.’

He makes an important point.

Knowing when to sell is crucial with small-caps.

That’s part of the service I provide — not just finding these stocks, but also helping you time your exit.

Timing is a valuable skill to master when you’re buying and selling these riskier, small-cap stocks. They’re a totally different beast to the bigger companies that sit on the ASX 200 index.

Those companies tend to plod along, never really going anywhere. You’d have more fun sitting outside watching the grass grow.

The ASX 200 returned just 2.3% over the 12 months to March 2025. On $10,000 you’re making 230 bucks in profit — before tax.

That’s hardly going to get your pulse racing.

But small-caps?

Some of them can 10x that

move — in a SINGLE DAY

For example, look at what happened on 11 March this year:

These were the top movers on the Australian stock market that day.

All of them are small-caps.

And every single one beat the ASX 200’s entire 12-month return — in just one trading day.

That potential for fast gains is the biggest draw of small-cap investing.

Obviously they have the potential for fast losses too — so you need to have your wits about you.

But with these shares the idea is: you get in, ride them and then get out, with a view to taking a pile of cash with you.

It’s as fast and thrilling as the turn of a card...or backing a horse that leads the field with the finishing line in sight.

Like I said, this is not like owning shares in big companies like Wesfarmers or ANZ.

You don’t hold on to small-cap shares for the long term. And you certainly don’t buy them for the dividends.

When you buy a small-cap,

you’re looking to make

money now...to enjoy now

Not in 20 years, 10 years...or even five years’ time.

That’s why I love these investments. And it’s why I’ve dedicated my career to writing about them.

They give ordinary Australians — people who don’t have millions to invest — a genuine shot at the kind of returns that can meaningfully change their financial situation, sometimes in a matter of months.

And maybe the best part of all is that you have this entire world of opportunity practically all to yourself.

The mainstream financial media rarely covers small-caps. And most Aussie stock analysts ignore them completely.

Why?

They’re too focused on the next quarter’s results...and stocks with predictable earnings.

Analysts at the big institutions tend to stick to what they know — the same 20 or so Aussie blue-chip stocks pretty much everyone else buys.

It’s safer for them.

And frankly, it’s easier.

Plus, even if they wanted to invest in small-caps, they couldn’t.

A major fund manager has billions of dollars to invest.

Even a tiny slice of their capital sunk into a small-cap stock could be enough to buy the entire company!

But this lack of attention creates another big advantage for small-caps — something I call ‘information asymmetry’.

Your biggest weapon

as an investor

This happens when the market doesn’t know everything about a company because it’s not getting coverage from analysts or the media.

These knowledge gaps can create golden opportunities for investors who do their homework.

You see, when good news eventually becomes public, the share price can ‘gap up’ quickly, delivering fast profits to those who got in while the stock was virtually unknown.

That’s ‘information asymmetry’ at work.

Here’s a perfect example...

Last June I recommended Sydney-based medical equipment company Nanosonics to my readers.

Back then few investors would have known about this tiny company, trading for around $2.70.

But I did.

And my research showed that Nanosonics was growing revenues, had cash in the bank, and was set to announce strong growth.

I positioned my subscribers precisely for this announcement.

I knew the market had no clue about the potential here.

And I knew we could use that to our advantage.

Sure enough, in February this year, those trading results came out and they were every bit as strong as I was expecting...

The share price gapped up 30% in just four trading sessions — look at it!

Now this doesn’t happen every time. I wish it did. But you’ll learn more about how I can help you use ‘information asymmetry’ to your advantage in the pages of Australian Small-Cap Investigator.

Yes, I’m biased. I love these tiny stocks. And when everything goes right, you can do extremely well.

BUT...

It’s not all sunshine

and rainbows

Small-caps are also the riskiest stocks on the market.

There’s no escaping it. A stock that can double in a day can just as easily halve. And it doesn’t matter if the economy is booming or struggling.

I’ve been doing this a long time and I understand the dynamics of small companies probably as well as anyone else.

But even I pick stinkers from time to time.

I’d love to tell you that every stock I recommend in Australian Small-Cap Investigator goes up. But they don’t.

Some head south. Some give back gains because we hold on too long. And some just don’t fire at all.

For instance, after holding it for over a year, we cashed out of a mining service stock called Perenti for a meagre 5% gain.

Not my finest hour

We also took a position in a speculative company called Avita Medical.

I recommended subscribers buy in at $3.33 per share. The stock then flew up and hit $5.60. But I didn’t send out a sell alert because I thought there was more upside to come.

What happened?

The stock collapsed to $2.65, and we sold out below our buy price.

That’s the reality of small-cap investing. These are low-liquidity stocks that can move quickly in both directions.

You will take losses if you subscribe to my service. But my aim is to make sure your winners outnumber and outgun them.

I’m doing pretty well on this score right now.

The secret to 60% average gains

across all winners and losers

Remember, at the time of writing this, the Australian Small-Cap Investigator portfolio is showing an average 60% gain across all positions, winners AND losers.

How am I achieving this? In a word: research!

It takes a lot of hard work to find these tiny companies right when they’re about to take off.

Winning stocks don’t just fall into your lap. It takes a ton of reading, financial analysis, phone calls, Zoom meetings, late nights, early mornings and missed family time.

Most of the time I’m up to my eyeballs in quarterly statements, earnings reports and industry announcements that most Aussie market analysts never even look at.

Is it exhausting work? Absolutely.

Do I sometimes question my sanity while analysing the 30th annual report in a week? You bet.

But then something

magical happens

I stumble across a gem — like little telecom company Tuas.

I recommended this stock to Australian Small-Cap Investigator subscribers back in March 2023.

I’d discovered that Tuas was set to roll out a low-cost mobile network in Singapore.

Its service promised to undercut established players by up to 80%...while slashing operating costs AND delivering faster data speeds.

Like I say, most Aussie analysts are so focussed on the ASX 200 they completely missed what I saw:

A disruptive telecom poised to capture significant market share in one of Asia’s most profitable regions.

As of today, that stock is up 300% since I told my readers about it.

Had you put $5,000 into it back then, there’d be around $20,000 sitting in your trading account today.

Peter M, one of my subscribers, shared his experience with me on email:

Tuas is at an unrealised profit of over 300% after 19 months. Nuix shows an unrealised profit of 240% after only 7 months. The other two are also well in the money. I highly recommend it to anyone who is interested in joining the service.’

Subscriber DJS added:

Callum’s calls in the small cap space have been prescient. Most of my positions are in profit (TUAS, SPR > 100% profit). Overall gains for Callum’s recommendations have been remarkable!’

Emails like this make all

the late nights worthwhile

Then there’s IMDEX Limited — a brilliant mining technology company based in Perth.

I recommended this one to Australian Small-Cap Investigator readers in February 2024.

Just over a year ago, I learned that this company was at the forefront of using AI and data analytics in the mining industry.

It uses drones and cloud-connected sensors to help explorers find and mine ore bodies faster than ever before.

AI and mining are a match made in heaven.

The more I read, the more I realised that IMDEX was positioned for significant growth.

And that’s pretty much exactly what happened, as you can see here:

Those who acted on my recommendation are currently sitting on a 100% gain.

Put yourself in their shoes...

Your position has literally doubled in just over a year...

...and the trade is still open with potential for even bigger growth.

And all from a stock you’ve most likely never even heard of!

This is why I live and breathe small-caps. Where else can you find these kinds of opportunities?

Definitely not on the ASX 200.

Look, I’m not saying you should sell all of your blue-chip stocks tomorrow and throw all your money into these much riskier small-caps instead.

That would be madness.

But...

If all you’re doing is what every other investor is doing, you’re only ever going to get the same result as them.

And you’ll never beat the market because those top 20 stocks practically ARE the market!

Meantime, I’m on the hunt for smaller, little-known Aussie companies with strong fundamentals that the market has ignored or misunderstood. Companies on the verge of a breakthrough, a turnaround, or a major announcement.

Like Beacon Lighting.

In April 2023, Beacon was a beaten-down retail stock investors had written off during the housing slump.

But I saw something different

I saw a company with strong fundamentals and a business model that would thrive as interest rates eventually came down.

That’s what I told Australian Small-Cap Investigator readers when I recommended the stock.

If they’d acted on that recommendation, they’d be sitting on a gain of 87% at the time of writing this.

Of course, Beacon is a standout example. I don’t pick bangers every time.

Sometimes I’m early. Sometimes I’m wrong. But it demonstrates what’s possible when you look where others aren’t looking.

And be clear, you don’t need to pile ALL of your money into small-cap stocks.

You only need one or two decent winners a year to make a big impact on your overall account.

I always tell people that this type of investing is only for a small portion of their capital.

An amount they’re happy to speculate with...knowing they could lose it if the market turns against them quickly, which it can do.

But obviously, when things DO go to plan, you have the opportunity to make outsized returns from these special stocks.

And if you want my help to do that, you can have it...today!

Join Australian Small-Cap Investigator and I’ll tell you about the stocks I think look the most promising each month...then show you how to manage each position from entry to exit.

So how can you get started?

There’s a button at the foot of this page.

Click it.

Fill out the short form on the next page.

The first thing you’ll get is a copy of my ‘5 Stocks to Buy’ report.

It’s a PDF that you’ll receive in your email inbox immediately.

You’ll be able to read it and put your buy orders in right away if you want.

You can access the report today for just $49.

It’s a ridiculous offer, frankly.

Think about what could happen if just ONE of these five stocks does what I expect it to do. That $49 will seem like nothing to you.

Why so cheap?

Because, like I say, it’s my way of introducing you to Australian Small-Cap investigator, my monthly advisory service.

Because, like I say, it’s my way of introducing you to Australian Small-Cap investigator, my monthly advisory service.

I honestly believe that small-caps are the last remaining way for the ‘little guy’ to beat the market in Australia.

I honestly believe that small-caps are the last remaining way for the ‘little guy’ to beat the market in Australia.

I think I’ve shown you today how that’s possible, and how it could be possible for you.

Not with every stock you buy or with every dollar you have.

But with a small, targeted portfolio of these tiny, high-potential companies that hardly anyone else knows about.

That’s why your purchase today includes three months’ access to my newsletter.

This gives you the chance to act on more high-potential stock opportunities like these five.

Here’s what you’ll get

instant access to

First, you’ll get our full portfolio of current small-cap recommendations.

You can read all my research on the recommended stocks and take a position in any of them you like that are under their buy limit.

Then, each month going forward, you’ll receive a new issue of Australian Small-Cap Investigator via secure email.

Every issue contains at least one new small-cap recommendation.

You’ll get my analysis of each company — what it does, why I believe it’s poised for growth, and a straightforward assessment of both the potential rewards and the risks.

You won’t want for anything.

I’ll give you the name and ticker symbol.

I’ll tell you exactly what to pay for the stock, when to buy, and — crucially — when to sell.

I can’t promise you a nice big profit every time.

Sometimes we have to sell to stop a small loss from turning into a bigger one.

But I monitor each stock the entire time the position is open, and I’ll email you the moment something happens that changes my recommendation.

You’ll also get weekly updates via email on all of our open positions, along with details of the targets I’m tracking, and my market outlook for the short and long term.

So what happens

after three months?

If you like the investment ideas and research you get from Australian Small-Cap Investigator, and you want to keep receiving it, you don’t need to do a thing.

The newsletter will continue to arrive in your inbox each month.

After three months, your card will be charged another $49 for the next three months — and so on.

The official price for a one-year subscription is $299, so you’re saving more than $100 over the next 12 months with this offer.

But if you decide Australian Small-Cap Investigator isn’t for you, no dramas.

Just let us know before your first three months are up and we’ll cancel your subscription and give you a full refund of the money you pay today.

That’s right. You’ll get it all back.

That’s right. You’ll get it all back.

No hassles. No hard feelings. And no questions asked.

Best of all, the ‘5 Stocks to Buy’ report is yours to keep no matter what you decide.

Look, I’ll be straight with you...

Small-cap investing isn’t for everyone.

These stocks can be volatile.

They don’t always work out.

And they’re certainly not where you should put your retirement fund, next month’s mortgage payment or your last $500.

But...if you can handle the extra risk on a portion of your investing capital...and you’re tired of seeing the same mediocre returns as everyone else...this could be exactly what you’re looking for.

Just look at what some Australian Small-Cap Investigator subscribers have experienced:

Wel G writes:

I call Callum’s trades “money in the bank” because of the high probability that most of his recommendations will appreciate and often quickly.’

Steve Floyd says:

Very satisfied with Callum's service, mostly winners. Last year, 40% gains...I’ll take that!’

Paul Matthews wrote to say:

400%+ on Nuix. Very happy with that.’

And Wayne, one of my long-time subscribers, emailed to tell me:

Extremely happy with your service... I did pretty good with DroneShield, 500% plus. Currently holding Nuix +432% and rising. I have had many others that have done very well. I can highly recommend Callum to you.’

I can’t promise results like these ones every time. No one can. But I can promise you’ll get my absolute best research and recommendations every month.

And remember, you’re not risking much to find out if this approach works for you.

Just $49 gets you three months’ access to Australian Small-Cap Investigator AND my ‘5 Stocks to Buy’ report.

There’s no pressure to commit to anything after that — just see how you get on.

So, what do you reckon?

Will you take this opportunity to discover some of Australia’s most exciting small-cap companies before most investors get to hear about them?

If the answer’s ‘yes’, click the button below now, and I’ll rush everything to you by private email.

If you’ve nodded your way through this presentation, I urge you not to sit back now and think, ‘I’ll take action later’.

Putting this off just allows doubt to creep in.

And doubt will ALWAYS stop you from taking positive steps to improve and enrich your life.

Look, we know how quickly time goes by...

Before you know it, a month will have passed. And then another...and another.

I’m sure you don’t want to be sitting in the same spot this time next year, thinking, ‘Why didn’t I take action sooner?’

Take it from me. The time to step onto the road to wealth is always RIGHT NOW.

Not next month or next week...

NOW.

So click the button below. Let me send you five great small-cap opportunities right away — and let’s get you started.

Sincerely,

Callum Newman,

Editor, Australian Small-Cap Investigator