How to Exploit the

‘Great Gold Lag’

The 2003–2011 boom turned four mid-sized miners into global

powerhouses. Bringing early share investors along for the ride.

Who might be next? See below…

Is ANOTHER ‘Big 4’ rising? A veteran

explorer makes his picks below…

The 2003–2011 boom turned four mid-sized miners into global

powerhouses. Bringing early share investors along for the ride.

Who might be next? See below…

JAMES ‘WOODY’ WOODBURN:

One morning in the early 2000s over coffee…a guy called Andrew outlined a crazy plan to his wife Nicola.

He was about to gatecrash a party…

At the time, three big players dominated Aussie mining.

This was Australian mining’s ‘Big 3’.

They’d emerged victorious after the consolidation wars of the 90s.

But at the dawn of a new century…

That guy — Andrew Forrest — plotted a new war…

‘The big boys said we’d never get it done,’ he later claimed.

‘But we did…’

It was this vision he laid out to his wife at the breakfast table.

He was going to start a new mining company. It would be called Fortescue Metals Group. And it would transform the ‘Big 3’ into a ‘Big 4’ within a decade.

He was a farm-boy, a hustler and a story-teller. Labelled by the press as a ‘tousle-headed stock broking legend,’ he had uncanny vision and timing.

A master networker, he knew how to get the smartest people around him. Most of all, Forrest knew mining — and the Pilbara — better than anyone.

Even so, as his wife watched him create an imaginary map using forks and salt and pepper shakers…she had her doubts:

‘He said to me…

‘“What we’re going to do is build a port. And the tenements are here. And we’re going to build a railway line. And we’re going to link them up. And we’re going to sell the iron ore.”

‘And I said, alright. What’s it going to cost??? And he said,

‘“Oh, about two billion dollars…”’

Nicola Forrest

Forrest predicted before anyone, Chinese iron ore demand reaching 700 million tonnes per year within a decade.

Doing mega-airmiles, he blagged capital from around the world.

He upended the ‘rules’ of the business, getting prepaid contracts for ore bodies that weren’t even proven yet.

He locked in vast disused iron ore tenements, and built the infrastructure single-handedly.

When China's rapid industrialisation and urbanisation happened…‘Twiggy’ was ready.

Steel and iron ore demand exploded — the crazy plan worked — catapulting Forrest to Australia’s richest person by 2008.

It was, as the AFR put it…

Forrest burst his way into the ‘Big 3’…making it a ‘Big 4’.

But why, in 2025, should YOU care about any of this?

Well, stick with us. We’re going to make the case today that a new era of daring wealth creation is dawning…

The purpose of this presentation is to show YOU how to invest for it.

Because, as Forrest showed…

Those who moved first…made the most money.

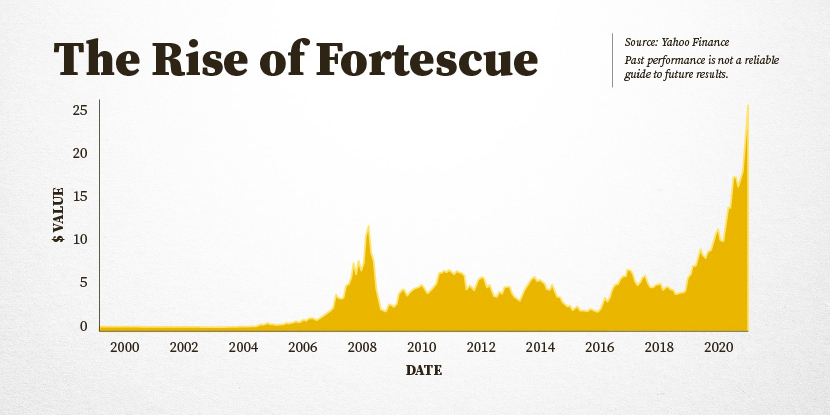

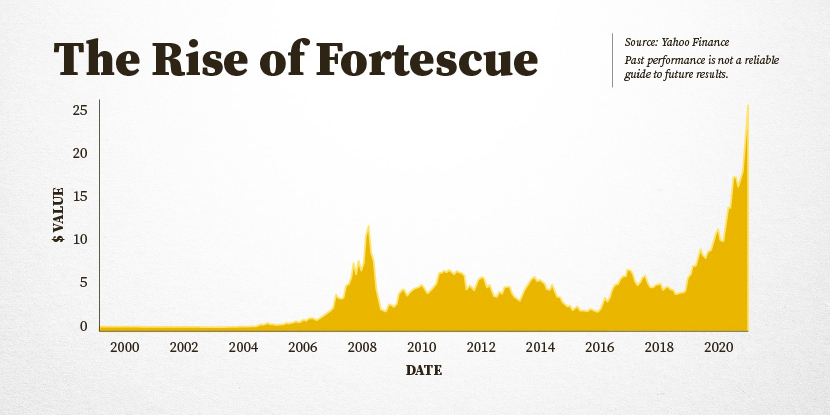

At one point, Forrest’s Allied Mining and Processing — which became Fortescue — traded on the ASX at 2 cents a share.

It hiked to $10 in the first five years.

A 50,000% return. It peaked at $30. Now it’s around $20. You do the maths if you got in below 30 cents.

And then there were the divvies.

At one point Fortescue was the biggest dividend-payer on the ASX. Forrest himself was earning $2 million A DAY from dividends alone.

Even going into 2025, Fortescue is still paying a dividend yield of 7%.

Now, Fortescue was clearly an outlier case. And we’re not here to hero worship Andrew Forrest.

We’re here to look forward.

The tectonic plates under the Pilbara are shifting again. Just as they did in 2002–2003…

And the mining industry balance of power’s shifting, as well.

What we’re interested in today is where that power is shifting.

You’re about to hear from an exploration insider who was at the heart of the last mining boom.

Today, he’s one of the most effective and specialised mining stock analysts in Australia.

If you’re going to speculate on these companies, you need intel from someone who knows how to dig into actual dirt just as well as balance sheets.

You need someone who’s tapped into the industry. And not just tapping away on a laptop in an investment bank office.

This insider meets these criteria.

When he wasn’t passing on his geology expertise at international schools…he was managing rigs, analysing soil samples, and organising field crews in far-flung places.

He’s now turned his attention to a small cluster of relatively unknown companies…

You won’t hear about these on CNBC…and it’s unlikely you’ll read about them in The Herald Sun or The Australian Financial Review.

For example, today you’ll learn about…

A lesser-known mining magnate who turned a one-cent shell into a billion dollar behemoth…with one audacious move.

He’s earned his early stock investors 17,500% and counting.

But now he’s gotten out…and become the CEO of a NEW tiny company he’s designated to rule the NEXT mining boom…

Then there’s…

Let’s be clear. No company could possibly match what Nvidia has done in the last five years. They came from virtually nowhere to enter America’s tech ‘Big 4’. It’s now surpassed Apple to become the largest publicly traded company in the United States.

We’re not saying this little tech miner could do anything like that. But they ARE a tech-focussed player that’s about to really reshuffle the deck of the industry.

If any stock can disrupt Australian mining like Nvidia upturned tech…this is our pick…

Now, we’ve targeted this play because there are three potential scenarios.

It wants to be the next mining trailblazer, but this time with critical metals rather than iron ore.

If it pulls that off, scenario one is that it makes — or at least gets near — the ‘Big 4’. And this 73-cent nobody right now becomes a massive player in a few years.

Scenario two is they stuff it up. The share halves…or even delists.

But there’s an interesting scenario three…a buyout. If that happens you could see a huge gain pretty much overnight…

And lastly, you’ll hear about…

A drilling and underground mining specialist trading around one dollar…which could expand massively as demand increases in the next few years.

As our insider’s going to show you…the future of mining will be underground, rather than surface or open pit. And that’s where these guys come in.

They’re a bit of an outlier of the bunch…because they’re a contractor, not a miner.

But as you’ll see, they could soon lead a pack of NEW BOOM companies that help miners unlock deeper pockets of critical minerals as surface deposits deplete.

Could a ‘pick and shovel’ company really become one of the big guns of the next cycle? Stay tuned to find out…

James Woodburn

Before we go any further, let me quickly explain how I came about this intel…and why I’m sharing it with you.

My name is James Woodburn.

I’m the head of Fat Tail Investment Research.

And our industry insider who’ll be explaining these plays is another James, James Cooper.

James is fresh off the road.

Back from a fact-finding tour that included hitting up his contacts at the IMARC mining conference in Sydney and the Noosa mining conference (where he was asked to speak.)

This wasn’t just a jolly with old mates.

He’s been busy finalising a set of recommendations for the next mining up-phase exclusively for a private group of investors.

Now, James Cooper is the guy to listen to here.

He was the exploration geologist for Equinox Minerals in Zambia when it got bought up by Barrick Gold. They paid a crazy 140% premium over Equinox’s trading price. The whole deal was worth $7.3 billion.

Through the pandemic he was with gold mining behemoth Northern Star. (In fact his experience and contacts here figure into our first stock recommendation…)

In 2021, he was headhunted to be Dacian’s Senior Exploration Geologist...in charge of the company’s growth in gold, rare earths and other minerals.

James was there when Dacian made its own play to expand its footprint. It took over a smaller gold producer called NTM. That gave early NTM shareholders a bottom-to-top share price gain of 1,600%.

James has been involved in massive ore discoveries and multibillion-dollar takeovers...soul-crushing failures and delistings...and everything in between.

The crux of it is:

If you’re going to search out the miners with the best chance of hitting it big in the NEXT cycle...

So, James…we’re looking forward to what you have in store for us. You’re back from an epic fact-finding mission. Did you get what you were looking for?

JAMES COOPER:

Hey Woody. Yeah, it wasn’t exactly a fact-finding mission, more building on what I already understood about these companies…

Talking to management and pressing them for developments.

These ‘New Big 4’ stocks are core picks in our portfolio, and I’ve been watching them closely for a long time.

I’ve got a solid grasp on where things are heading…what to focus on…and who the new big players to emerge might be.

For instance, I’ve had a strong hunch for some time of the kind of companies that could rise to disrupt the current ‘Big 4’.

Critical metal stocks are a little like iron ore companies from 2003…heavily sold off, but looking to emerge into a major new trend.

Back then it was China growth.

Today it’s the need to secure alternative supply chains and shift reliance on Chinese supply.

WOODY:

I think viewers might be familiar with critical minerals.

Critical metal stocks have been really bad performers the last 18 months.

Pilbara Minerals, for example — a big lithium producer — is down 30% from its peak in 2023.

More speculative ones like Chalice Mining…which covers the platinum group elements…are down even more. Chalice was around $9 in early 2023. Now it’s under $2!

So, this outlines the risks involved in these stocks. This is high risk investing.

We should be very clear on that.

It’s hard to see how these stocks get any lower from here.

They’re astoundingly cheap. There’s a bunch of bad press around them. But the long-term case for them is super-solid.

Governments everywhere are trying to secure their supply chains.

And both Andrew Forrest and Gina Rinehart have just started spending benders on new projects in that space.

So that’s critical minerals.

But James, you also reckon ‘tech’ is going to break its way into mining in this coming cycle.

What do you mean by that? Are you saying a TECH company could displace one of the Big 4 miners in the next 10 years?

JAMES COOPER:

No, not a pure tech company, but…

A smart mining brain that pivots to tech in the right way between now and 2030.

You see Woody, mining has long been considered the ‘last frontier’ for tech.

Mining tech listings are few and far between on the ASX. I can assure you now…that’s about to change.

I’m talking imminently.

I reckon you’re going to see some big success stories here on the Aussie market in the next few years.

I’ve picked what I believe could be the biggest one. No one seems to be tracking them.

I’ve likened them to an Aussie mining version of AI chipmaker Nvidia. That’s a bit of a crazy comparison, you could buy Nvidia for 50 cents in 2015. Now it’s a $140 stock.

I’m not saying at all this stock will do that. But there are similarities.

Mining’s traditionally been pretty crap at adopting new innovations. I know this from experience!

But that’s about to reach a turning point.

Rising operating costs, mineral scarcity, and declining grades…

Those three things are hitting the sector all at once. Tech is the solution.

That’s the core thesis behind my mining tech-disruptor Big 4 recommendation.

Automation, including driverless trucks. AI, obviously. Optimising processing, recovering more metal for every tonne of rock extracted.

That’s going to help offset declining grades happening across mining operations worldwide.

AI’s also supercharging exploration…logging drill core and processing data to generate drill targets.

All this has been in the early adoption phase.

But now we are reaching the breakout point, and…

I got to see the prototypes and how this could really change the mining landscape over the coming years.

WOODY:

Who’d you talk to?

JAMES COOPER:

Well, I’ve spent the last six weeks or so hitting up some old colleagues — and some new ones — to get second opinions.

For example, IMARC — the International Mining and Resources Conference — is one of the largest meetups of mining insiders in the world.

Thousands of delegates from across the globe, including government officials and major mining and service companies.

That’s where you really feel the pulse at a macro level.

Noosa gets down into the Aussie nitty-gritty. It’s my own turf: the junior explorers and developers. CEOs of little disruptors laying out their table to investors.

I was really there just to reconnect with some old geo mates for a beer and get an even better read on the junior mining sector.

But because I’ve been at the coalface here, the Noosa organisers gave me a slot as a keynote speaker.

Presenting what I’m laying out here today.

It struck a chord with the audience.

They just need someone to spell it out for them and find opportunities to benefit!

That’s why I’ve come up with this idea…The ‘New Big 4’.

WOODY:

Before we get to those, it’s important to cover WHY these stocks…and why NOW.

Long-time followers of our advisory business will know we were right at the forefront of the last Australian mining boom.

We were there when it crested. Peaked. And then receded.

We recommended — very early — many of the key players.

After years of underinvestment…exploration spending’s ticking up.

Copper…known as Dr Copper, as it signals the health of the commodities sector…continues to trend higher.

There’s China’s recent stimulus move.

But possibly more important is the new rate-cutting cycle started by the American Federal Reserve…

JAMES COOPER:

Yeah, it’s important to make this clear. All that’s true, Woody. But the key word I’d pull out is this:

Critical mineral scarcity, in my opinion, will drive the commodity cycle into a much more bullish phase.

We’ve been pulling ore out of the ground but not finding replacement reserves…there’s been no thought on the future here.

Mines are getting older and that means grades are falling.

Lack of investment in new supply will be the foundation that drives prices higher.

If you want a shot at this opportunity...then you need to identify those stocks that are working to solve this challenge.

See, there are bargains galore everywhere right now.

And the insiders are starting to make their moves.

One of my current recommendations, for instance, is a lithium miner called Arcadium.

Arcadium is one of the few lithium miners that can process ore outside of China’s domination.

Rio Tinto just made a multi-billion dollar bet on them in October.

This was all about grabbing hold of Arcadium’s prized processing capacity.

Gina Rinehart has been pouring billions into critical metal projects across the globe for months…

And that’s exactly what Andrew Forrest has been doing too…

Not with Fortescue, but with his family-owned critical mineral company, Wyloo Metals.

And look, these guys would know.

They’re the two richest people in Australia and they understood what was coming 20 years ago in the iron ore boom.

They positioned themselves back then, and they’re doing the same thing again today.

WOODY:

Follow the breadcrumbs the insiders are sprinkling for you!

That’s the key to all these recommendations, as viewers will see shortly.

So, let’s assume the stage is set and the foundation is laid.

What we know for a fact is that the balance of power shifts in these periods.

Western Mining Corporation — founded in 1933, and a titan since the 60s due to its nickel discoveries in WA — fell off the map in 2005.

But Fortescue’s market capitalisation quickly grew from virtually nothing to $60 billion by 2011.

The point we want to make today is this.

If you get on the right side of these power shifts…

At the right time in the cycle…

You can make a heck of a lot of money.

Of course, you can lose a lot or all of what you invest if you make the wrong call. You need to be smart about how you manage these stocks, if you decide to buy into them.

But if you’re interested, we’re going to do a bit of future-casting.

James is about to give you his predictions.

Before that, just a quick recap on the current ‘Big 4’.

We’ve covered Fortescue — the great disruptor.

Mind-boggling riches if you were lucky enough to get in at 2 cents.

Then there’s BHP.

Still the flag-bearer and world leader. Market cap: AU$160 billion.

At the start of the last boom, you could have picked up shares in BHP for about $4 each. Today they’re worth $42.

Rio Tinto’s another old-guard heavyweight.

Shares $15 at the start of the last boom. $120 today.

Rio dividends paid in 2000 were 41 cents a share. Today they’re $3.53. Meaning: for every $10,000 invested in 2000, you could have since earned $41,200 in dividend income ALONE. And way more if you reinvested those dividends.

Number four of the current lot was gold miner Newcrest.

You could’ve picked up Newcrest shares for under two bucks in the late 90s. At their mining boom peak they traded around $43.

In October 2023, Newcrest got taken over by even bigger miner, Newmont. Newcrest has since delisted from both the ASX and Toronto exchanges, so it’s technically no longer a member of the Aussie Big 4.

But…

If you were a shareholder, you’d have an INSTANT 39% share price bump when that deal happened, plus a special takeover dividend.

JAMES COOPER:

Yeah, before I do that, a word on risk.

Nothing is certain here. And each of these stocks have different degrees of risk.

Remember…

Andrew Forrest’s ‘grand bet’ on iron ore seems obvious today. But a Chinese steelmaking boom was no foregone conclusion in 2001.

Backing explorer and producer stocks then took guts.

Digging up rocks and shipping them to other countries to turn into useful things was distinctly untrendy.

There was a fundamental dislike of miners in general.

You could say that’s the case again going into 2025.

Companies making similar bets to Fortescue.

But instead of iron ore…these bets are being made on the coming boom in critical minerals.

WOODY:

Here at Fat Tail Investment Research, we put out fairly controversial stuff from time to time.

We’re not deliberately contrarian just for the sake of it.

We just don’t put much trust in mainstream commentary.

At the turn of the century, many analysts and media outlets massively underestimated the scale and speed of China’s growth.

They overlooked the iron ore supply/demand imbalance.

And they massively undervalued certain mining companies.

That’s very much the case now.

And with one company in particular…

He previously made a big bet in an unloved market…

Turned a penny stock into one of Australia’s new mining kings…

And brought early stock investors along for the ride.

From bottom-to-top, the stock went from 10 cents in 2003 to rise 17,500% by this year.

What’s more, you have a direct connection to this story, right James?

JAMES COOPER:

Yeah, we’re all vaguely connected in the Aussie mining biz. And I do have a connection to this story…

It goes back to 2014 when gold prices were slumping…

I was working for Barrick at the time, and they were looking to offload their Aussie gold assets.

I’d stuck with Barrick after it paid over $7 billion for Equinox, the company I originally worked for.

But we all knew in-camp that Barrick had overextended itself and was ripe for the picking.

And just like Forrest, this guy saw a once-in-a lifetime opportunity. A chance to pounce on this wounded Canadian miner.

And bring some of our country’s largest gold mines back under Australian ownership.

His group took full advantage…

…and secured a deal that landed them more than 3 million ounces of gold for just over $100 million in cash!

That’s simply staggering in today’s market. The acquisition cost the group a mere $30 an ounce!

That’s less than the price of silver today!

It meant almost 300,000 ounces of pure profit.

It was a move every bit as audacious as what Fortescue did.

WOODY:

Okay, that was then, and this is now.

The SUPER important point is:

JAMES COOPER:

Absolutely.

That’s the premise behind my first ‘New Big 4’ recommendation.

Now there’s a lesson I learned early on as an exploration geologist.

They have an uncanny ability to buy the right projects at precisely the right time in the market.

But the most exceptional insiders also know when to get out of a peaking market.

This ‘Son of Twiggy’ guy…

…and smart viewers might already have guessed who he is…

…sensed the top in gold and, after making his big move, decided to leave at the peak.

WOODY:

Right, but the crux of this first recommendation is he has a new ‘grand bet’ on the boil, right?

JAMES COOPER:

Yes, he does — via a super small company that hardly anyone knows about.

He’s taken a mammoth stake in a NEW company.

And taken the reins as CEO.

THIS company is tied to the NEW mining boom we’ve been talking about today…in critical metals.

‘Son of Twiggy’ is attempting to pull off a similar trick again. But with a different company. In a new boom.

Only, if I’m right…and he ‘reads the play’ as he has in the past…

…then this is a BIG, BIG stock to speculate on.

High risk, of course.

But this one seriously has ‘Big 4’ disruption potential.

And it currently trades for under $2.50.

Like I say I have some inside experience with the guy driving this project. We’ll get to the name and my findings shortly.

But this is really a common thread through all four recommendations today. And that’s:

There always tends to be a small group of characters who crop up again and again…leapfrogging from company to company…getting appointed as non-exec directors on the next wave of explorers.

These guys are just as adept at mining the stock market as mining ore.

And if you look closely — and actually know what you’re looking for — you can see they’re setting up to do it all over again…

These heavyweights are going long on the critical metals mega-theme.

WOODY:

Which brings us to our next recommendation…

Now we shift to mining converging with tech.

That’s going to be a big theme between now and 2030.

And this is James’s primary pick for that.

Now, it’s tempting to switch off when you hear about AI these days.

But it’s going to have a big impact on WHICH mining stocks rise up and form the New Big 4.

The demand for semiconductors — the chips that drive AI — has exploded in the last two years.

The biggest stock in the world is now Nvidia.

The chipmaker just surpassed Apple to become the highest-valued company on Earth.

That’s shocking when you really think about it. Hardly anyone knew who they were even five years ago.

Nvidia’s basically the tech Fortescue.

It’s currently worth more than Amazon and Meta combined.

Think about that.

James, your second pick here is much less of a sure-thing than the first one.

But AI semiconductors have been likened to the ‘picks and shovels’ of previous mining booms.

And these guys are in the driver’s seat, right?

JAMES COOPER:

Yeah, AI and the green energy transition are basically the ‘iron ore’ and ‘China’ of this next mining cycle.

And semiconductors are at the heart of both.

There are massive growth opportunities here.

And this opportunity is producing a critical material used in the manufacturing of certain semiconductors.

Not many people have heard of this company, let alone the commodity it produces…

It’s known as High Purity Alumina, or HPA for short.

And Play #2 is set to become one of the world’s largest suppliers.

That’s because demand for HPA is diverse and driven by those two MAJOR growth drivers I just mentioned: renewables and artificial intelligence.

This is truly a metal for the future.

According to Grand View Research, the global HPA market is expected to grow 22% every year between now and 2030.

That’s the edge I see with this play.

Now, it’s on the downstream processing side — rather than the mining side.

But I won’t get into the weeds of what downstream means here.

All you need to know is it’s basically the stuff that happens AFTER the raw materials are dug up.

You take the minerals or metals, and use your expertise to make them more valuable.

‘Upstream’ is the actual extraction — which dominated the last boom.

It won’t just be about digging up dirt and shipping it to China.

It’s about putting your flag in the ground on a critical mineral deposit. And building downstream capacity FIRST.

On my travels I’ve spoken personally to managers who’re making plans to do exactly that, right now.

It’s these companies that will be the top contenders for the next group of mining giants.

Two examples of the early movers that have already built downstream capacity for their respective commodities are Lynas with rare earths, and Arcadium with lithium.

Lynas went from $1 to $25 in TWO YEARS at the end of the last mining boom. Cratered to 50 cents…but has since quietly risen back to $7.

They’re downstream guys.

As are Arcadium, who were $3 in September 2024 but trade around $8 now.

These are examples of a new way of doing things in this next boom.

You find a strategic niche…

…and a raging new surge in demand…

…and you become the MASTER of it.

And this is exactly what a home grown, ASX-listed downstream producer I’m tracking is doing, right now.

They’re ideally positioned to serve major tech firms and EV markets throughout Asia and beyond.

WOODY:

Okay, so who are these guys?

Well, let me just say it’s a bit of a delicate situation with all four of these stock recommendations.

You need to realise how lucky we are to have James sharing them with us today.

Because when it comes to which stocks might shine brightest in this next supercycle…

…you should probably listen to the geologist insiders, rather than investment website editorials.

You see, the geologists sit at the forefront of exploration…

First come the geos, then come the discoveries…then come the next wave of miners that disrupt the old guard.

I can’t stress this enough…

Now, these New Big 4 plays remain dirt cheap.

But there’s a risk that if a guy with James’ contacts and background names them in the public forum…loads of people will buy all at once…and we’ll blow the share prices up artificially.

So, here’s what we’re doing instead…

James has packaged everything he’s found on these four companies into this brand new report:

It’s easy to download, and we’ll give you the instructions in just a moment.

It contains everything you need.

Detailed analysis on each company…showing clearly why James believes these guys are about to upend the mining hierarchy in the next cycle.

You’ll get the names, projections, stop loss levels…and the unique risks.

But, this way, the important stuff is kept out of the public forum…and made available only to those who take a simple step to get them.

What is that step?

It’s joining James’ mining stock advisory service, Diggers and Drillers.

This service is INCREDIBLY inexpensive, as you’ll see in a second.

And you’re also covered by our guaranteed trial period. So, you have nothing to lose, and everything to gain.

But consider what you can pay for mining stock advice these days.

It’s hard to do an apples-for-apples comparison. Every outfit has a different business model. And some of those business models can put you back a fair bit of money!

But honestly, NONE OF THAT approaches what you’ll be getting with Diggers and Drillers.

When James came onboard, we made a pact to make this project as accessible and affordable as possible.

So, what’s it cost to join today?

$99 is all you need to pay upfront to get immediate access Diggers and Drillers…and to download James Cooper’s NEW Big 4 report immediately.

$99 is all you need to pay upfront to get immediate access Diggers and Drillers…and to download James Cooper’s NEW Big 4 report immediately.

Look, I took a work buddy to our local pub up the road, The Railway, for a couple of chicken parmas and one beer each…and we basically paid that much!

Look, I took a work buddy to our local pub up the road, The Railway, for a couple of chicken parmas and one beer each…and we basically paid that much!

And yet for a hundred bucks, you’ll be getting urgent stock intel from a guy who’s been contracted by the small explorers as well as the major developers.

James with his field crew undertaking

remote exploration in the Zambian bush

At the peak of the last boom, he was recruited by copper explorer Equinox Minerals and sent to the frontier in Zambia to look for the red stuff.

That experience ended in a MASSIVE takeover.

He tells the story of sitting around a campfire after Equinox’s CEO flew in to site.

The CEO showed James the initial $1 million cheque he used to start his company…

…a company which had just been bought out by Barrick Gold for over $7 billion!

He was also with gold mining behemoth Northern Star…at the exact time they were preparing a takeover of Saracen Mineral Holdings.

And as I said, even that low entry fee comes with a satisfaction guarantee.

So, pay your 99 bucks.

Get the full Diggers buy-list.

Download and read James Cooper’s NEW Big 4 report.

In the full comfort that if, for any reason or for no reason at all…you do want a full refund…we’ll give it to you, no questions asked.

Does that sound like a fair exchange?

If so, you’ll see a button below.

When you click on it, you’ll be shown how to get access to James Cooper’s NEW Big 4 report within minutes.

Or…

If you’d prefer to hear about the two other challengers on James’ hitlist — stick around…

Because this is where things get even more interesting.

James, I’ll leave you to explain this one — because it has an element in play that the first stocks don’t…

JAMES COOPER:

I’ve targeted this play because there are three potential scenarios.

It’s an up-and-comer with a long-term gameplan with a clear-eyed objective.

Its story centres around the heightening scarcity of a poorly understood metal. It’s a really rare, not-talked-about resource whose important role has been left out of the critical metals rush.

They want to be the Australian critical metal disruptor of the next resources upswing.

And if what I’m reading is right, they just might pull it off.

So, scenario one — long odds, but if it comes off — they could go from a 73 cent nobody to a major blue chip player in a few years.

That’s the ‘Big 4’ scenario…

And that’s why I think it’s worth betting on RIGHT NOW.

Scenario two, is they DON’T do that. And I’m wrong on what I’ve found on these guys.

The expected mine life of what they’re sitting on already sits at a quarter of a century. But they still have to unlock it. And to do that requires a huge capital investment. That’s always risky. Their shares may halve…or even delist.

WOODY:

OK, but you mentioned three scenarios…

JAMES COOPER:

Yeah, there’s a third possibility with these guys.

And that’s a buyout.

As we’ve mentioned, Newcrest was a Big 4 miner recently and even they got snapped up by a bigger player.

That move gave shareholders an overnight gain of 39%...after years of 100%+ gains as Newcrest rose and rose.

But if that happens…you could WIN just as much if you’re an early share investor.

The sharks are already circling here.

One of the current ‘Big 4’ just took a 20% stake.

That’s a REALLY substantial bite for a junior this small.

That shows the bigger player means business…and a full acquisition could be on the cards in the months ahead.

And if scenario three DOESN’T happen…

Well, then we’ll be in the running for either Big 4…or bust!

WOODY:

Okay, as a financial publisher I see a lot of set-ups and scenarios and ‘next big thing’ recommendations.

But this whole thesis really gets me amped.

It’s pretty simple.

If you’re willing to take the plunge on these cheap companies…and to trust this research and advice from James…

You’ll be in the running for outsized returns…PLUS potential dividend income…plus a possible buyout premium.

Click on the button below to get started immediately.

And remember: we’ll even refund that hundred bucks if you decide this advisory is not for you.

Look…

We have a mining insider…who was at the heart of the last boom…who’s sticking his neck out and making some big calls.

As I mentioned, I’m the publisher in charge of Fat Tail Investment Research, Australia’s largest publisher of independent stock research.

We’re not attached to mainstream financial media or the brokerages.

We can tell it how we see it.

We’re contrarian by nature. But this quote from mainstream investment hero Warren Buffett is STILL very pertinent to today’s presentation…

Warren Buffett

This perfectly sums up the opportunity in front of you today.

Cyclical mining booms start in Australia roughly every 30 years.

The last one started in the early 2000s.

The big one before started in the late 1960s.

If you can correctly pick the start of a new one…

…you can go about finding ‘wonderful businesses’ that might rule the next 30 years or so.

At a hundred bucks with a 30-day satisfaction guarantee, this seems like a no-brainer to me.

Especially when you consider James’ fourth pick for his ‘New Big 4’ portfolio.

Not just the best miners. But the ‘pick and shovel’ sellers…

You may have heard the saying the best way to get rich in a gold rush is NOT to spend time and money mining…but to SELL stuff to the miners.

Today, these are called mining services companies.

They’ve always had a part to play. But in previous booms they’ve only been supporting players.

James reckons there might be scope in this next cycle for one or two to become massive blue chips.

Many small ASX resource stocks are branching into this space…

…leveraging their local knowledge to become global ‘pick and shovel’ sellers in the critical minerals market.

James, what do you see is the best way to get into this this sector?

JAMES COOPER:

I’d rather keep details on this one out of the public forum at this stage. So, you’ll need to get the report.

But what I can say is this…

It’s a drilling and underground mining specialist trading for around one dollar…and I think it has the potential to do very well out of its contracting work.

Look, in all honesty…it would be a stretch to predict these guys are going to find themselves among the top four capitalised Australian miners in the 2030s.

They’re not even technically a miner…

Miners pay these guys for the service work they do.

But as I’ve said, this is going to be a different kind of boom.

And I’ve designated this company as my fourth pick here for a good reason.

The future of mining will be underground.

That’s opposed to surface or open pit mining we’re used to in Australia.

And that’s where these guys come in.

They specialise in underground mining and drilling.

And, as you’ll see when you read my briefing, these are going to be MASSIVE growth areas between now and 2030.

Why?

Well, deposits are becoming deeper, harder to extract and more difficult to find.

They’re aiming to bring their underground mining experience into the new boom.

As near-surface deposits deplete, explorers are searching deeper to unlock the next generation of minerals.

You can buy these guys for around one dollar at the moment.

That’s because we’re yet to see a major pulse in this sector…but I reckon that’s coming.

And if I’m right, this company could capture a lot of the investment that flows back into mining developments.

That’s all I’m going to say on these guys here.

It really reminds me of around 2002, when things were starting to move. But there were still mixed signals and uncertainty back then.

When the mainstream was really unsure…or even bearish…on most commodity stocks.

If our viewers missed making the right mining stock moves while they were cheap as chips 22 years ago…

…they may have just been given a second go at it today.

That’s why I hope to see them inside Diggers and Drillers soon.

WOODY:

Alright, there we go, thank you James.

Click the button below to try out Diggers and Drillers for yourself.

Or if you’re still on the fence, have a read of some feedback from James’s current members, starting with Martin Breen…

‘As a former senior exec of one of the largest energy companies listed on the NYSE, I can’t overemphasise how impressed I’ve been with James Cooper’s Diggers and Drillers subscription.

‘I was cautious and wary at first, wondering what I was getting into. But now that I’ve been a customer for several months, I feel very confident that James is exceptionally well qualified to find top-quality resources investments on the ASX.

‘For the modest subscription fee, if I placed a value on my time, I would make that money back in half a day.

‘I have invested in three of his recommendations and even though it’s early days, I am already well ahead and feel safe with the profit margin buffer that has been built since the day I purchased.

‘If that’s not convincing enough for you, then I would strongly recommend you subscribe for James’ knowledge of both resources companies and markets.

‘Having been a senior exec myself, surrounded by global technical experts at the highest level, it is obvious to me that James knows how resources companies work, how to value their assets and assess their risks, and most importantly how to value the share price relative to the resources in the ground and risks from exploration phases through to development and production.

‘That is exactly what I’m looking for in a resources company adviser. Not just a chart geek, but someone who understands the industry, the world commodity markets and the stage/phase the particular company is at within the bigger picture. That knowledge allows me to make a properly informed decision about managing my money.

‘But James is also a technical expert with the ability to read and understand charts…

‘…With my investments in the market so far, I have made ten times the subscription fee in less than a month. I have seen more than enough to know that I will be a long-term customer of Fat Tail Investment Research and Diggers and Drillers.’

—Martin Breen

James has DOZENS of endorsements just like this.

Absolute devotees.

That’s because Diggers is for serious investors rather than pure punters.

And unlike previous booms, this one’s likely going to be driven by SCARCITY. That means there are certain investments you can make right now that stand to benefit greatly from this…

Especially as an investor situated in one of the most resource-rich nations on Earth.

Diggers and Drillers is for you if you already have a gut feeling this is the case — if you recognise we’re only at the early stages of this new cycle — and would like some guidance on how to invest for it.

Now, James is not claiming anywhere near complete certainty on how this next phase plays out.

Investing in mining stocks is always risky. Just as much in boom periods as in lulls. Because when commodity prices and mining stocks are rising, everyone wants a piece of the action.

That leaves space for dodgy players to come in.

Point is you’re much better off getting advice in these periods from someone who actually knows what they’re talking about!

As member Darby Monro says:

‘James is a one of these decent honest blokes you can trust.

‘He's not up there with the shiny pants mob pretending, but down in the dirt, where he can see, hear and smell what’s going on.

‘He speaks the language of the workers, knows what’s really happening. And has the decency to share his honest gut feeling along with his forensic analysis for details.

‘As well, he has the ability to fully understand his subject — being a geologist.

‘I have been an investor for over 40 years and you get to know who you can trust. I trust this bloke.’

—Darby Monro

Mining stock prices, on the whole, remain deeply undervalued.

If what you’ve seen makes sense to you…and you see what’s on the horizon...

Now’s the time to be brave and make a few speculative moves.

Diggers and Drillers is going to help you do just that.

And James Cooper’s NEW Big 4 is the core of that portfolio.

So why not have a look at it?

So why not have a look at it?

Just $99 today — with a 30-day satisfaction guarantee.

There’s also a whole lot of intel and stock tips we haven’t even mentioned here.

There’s also a whole lot of intel and stock tips we haven’t even mentioned here.

For instance, James reckons takeovers — or M&A activity — is going to ramp up massively in the next few years.

He’s devoted a whole separate resource solely to that topic.

It’s called ‘The Takeover Trident’.

Again, this will all come to you from an actual exploration and takeover veteran.

That’s what makes this advisory so unique in Australia...and so valuable!

To get instant access to James Cooper’s NEW Big 4 report….plus his entire Diggers buy-list…click the button below now.

When you do, you’ll be taken to a secure order form that lays out everything you’re getting for your $99 investment.

On behalf of James Cooper and Fat Tail Investment Research, thank you for joining us.

I’m James Woodburn, have a great day.

Cheers,

James Woodburn,

Publisher, Fat Tail Investment Research

‘You have knocked the ball out of the park recently!’

– DR

‘I call Callum's trades “money in the bank” because of the high probability that most of his recommendations will appreciate and often quickly.’

– Wel G

‘Probably the best advice around when it comes to investing in small caps.’

– Moss