‘Dig tunnels.

Store food.

And prepare for war.’

It’s a direct order to the Chinese people.

And it comes right from the top — from leader of the communist revolution, Chairman Mao.

It’s 1969.

War with the Soviet Union seems inevitable.

And if full scale conflict breaks out, it’ll almost certainly involve nuclear weapons.

Which is why Mao Zedong orders the creation of the Dìxià Chéng — a vast underground complex dubbed The Dungeon, designed to home more than a million people in the event of an attack.

It’s still there today.

Millions of low-paid workers — known as the ‘Rat Tribe’ — live there.

If you have a strong stomach and the right connections, you could visit it today.

Half a century on and China’s Communist Party is ready for war again.

But not with a nuclear bomb shelter.

Instead, it’s built what we call a ‘Doomsday Vault’.

Its exact location is a closely guarded secret. Depending on who you believe, it could be hidden beneath Beijing…or inside a military base.

Either way, it’s almost certainly guarded by a special division of the People’s Liberation Army.

Why all the secrecy and security?

Inside this ‘Doomsday Vault’ is a weapon.

But not a conventional one.

It’s not a bomb or cyber weapon. And it’s not a genetically enhanced virus.

But it could trigger a radical reset of the world order — a ‘fundamental convulsion’, as The Telegraph put it — with big implications for everyone.

You see, Xi Jinping is preparing his people for a ‘great struggle’ in the near future.

And I believe we’ve uncovered the

centrepiece of China’s grand strategy

Just like Mao did in 1969, Xi’s ordered the preparation of a huge underground defence network…

He’s been busy above ground, too…expanding the navy…building up China’s ‘space layer’…and developing the world’s most active and sophisticated ballistic missile force.

Most ominously of all, the Chinese military recently surrounded Taiwan.

‘Look, peace is all well and good,’ Xi told President Biden in 2023.

‘But at some point we need to move towards resolution.’

I’m sending you this analysis not to scare you or warmonger…but because I believe Australia could soon play a unique role in that ‘resolution’.

In fact, it’s going to play out right on our doorstep — with potentially dramatic consequences for everyone.

And not because we’re first in the geographical firing line if, God forbid, war does break out. (Though there are now more American military units positioned here than any time since The Second World War).

You could feel the consequences

on a personal and financial level

Your Super. Your stock portfolio. Your retirement plans.

Your business, if you have one.

How and where you travel.

China’s plans could impact it all.

But there’s an investment angle to this story too…

In particular, there’s one significant sector of the ASX that’ll play a central role in China’s plans.

I’m not talking about defence stocks…cybersecurity firms…or anything like that.

No…there’s another group of Aussie stocks altogether that, historically speaking, can rise a lot at a time like this.

You’ll see exactly what it is a little later in this briefing.

You may have seen talking heads on TV discuss parts of China’s plans. You may read about the latest war-games or military drills in the newspaper.

But you’ll almost never hear anyone explain what it all means for you — or what you should be doing with your money — to prepare.

That’s why I’d urge you to read this right to the very end.

It won’t make for pleasant reading. But it’s crucial you read this message in full.

In short, I’m sending you this analysis to help you end up on the right side of history — because dramatic change could be coming.

As a division of the Australian army put it:

‘The clock is ticking; we must be ready

for the moment it strikes midnight.’

As I’m sure you’ve noticed, the world is becoming more violent and unpredictable with every passing day.

You see it everywhere you look.

War in Ukraine...

Iran attacking Israel...

Houthi rebels terrorising the Red Sea…

China wargaming an invasion of Taiwan…

Russia testing ‘tactical’ nuclear weapons in Europe...America installing nuclear warheads in England...and arming the Australian military with nuclear-powered submarines.

This growing number of conflicts and threats to national security may nominally be about nationalism, religious divisions…energy security…or competing political ideologies.

But in reality, underneath it all, they’re actually connected in a much deeper way…

Today, you’ll see why this is happening and what looks like the inevitable next step…

I’m sharing this message as the head of one of the biggest independent publishers of financial advice in Australia — Fat Tail Investment Research.

If you’ve never heard of us before, we’re a fully ASIC regulated business based in Melbourne.

Many investors in Australia turn to us when they want independent and unbiased advice on what to do with their money — particularly when the media lets them down.

And that’s why I’m sharing this message with you today.

I believe you’re about to need our insights and advice more than ever.

If our research is right, we’re on the cusp of a new and troubling era.

And the key to understanding it all — and surviving with your wealth intact — sits deep underground in Beijing.

You see…

China’s ‘Doomsday Vault’

holds a very strange secret

To understand why that is, I need to take you back more than 80 years.

The dark days of the 1930s.

The Great Depression has crushed the world economy.

Trade has collapsed.

The world order is…fragile.

And all over the world, new conflicts are emerging.

The Spanish Civil war.

Japan’s invasion of China.

Italy’s invasion of Ethiopia.

And of course, Germany is led by a man hell-bent on taking revenge for the Treaty of Versailles…he’ll soon annex Austria and take the Sudetenland.

But for now, that’s all in the future.

I want to draw your attention to something that happens before war actually breaks out.

Quietly…away from the headlines…and often in the utmost secrecy…vast amounts of gold bullion begin to move.

This begins in Russia.

The Bolsheviks had confiscated the Tsar’s gold after taking power. Then they looted the Orthodox Church.

In 1931 Stalin went even further. He promised to provide Spanish revolutionaries with tanks and other war materials.

The catch?

He wanted paying upfront in gold before he’d ship anything.

The Spanish coughed up the gold. The tanks never arrived. Stalin kept it. (The Spanish still call this ‘the Moscow gold’ today.)

Next to move are the French.

With Hitler set on war, the French send 600 tons of gold to the USA — to pay for military equipment, should war break out.

The Belgians follow suit, moving a third of their reserves to London.

When war breaks out, the French quickly empty their vaults — using 300 trucks to transport the rest of their reserves to the sea, and then to America.

Meanwhile, the Nazis are hoovering up the gold reserves (as well as silver, platinum and diamonds) from Austria, Poland, Belgium and the Netherlands.

Hitler claims ‘we don’t need it as backing for a currency,’ but his actions suggest otherwise.

Next, Norway smuggles its gold reserves abroad, in the face of the oncoming Nazi army.

And then comes the biggest movement of all…Operation Fish…

In the summer of 1940, Churchill sends a convey of armoured ships across the Atlantic — which is already infested with Nazi U-boats.

Onboard are crates marked ‘fish’.

But of course, it’s gold that’s on the move. It’s met in Halifax harbour by officials from the Bank of Canada, before nearly 300 armed guards take the crates to Montreal, where they’re stored in newly built vaults.

Britain kept its gold out of German hands…and had the resources to fight on for another five years.

It was the largest physical transfer of wealth in history — across 4,600km of enemy patrolled waters.

But it’s a record that could

be broken in the near future

Because as I’m sure you’ve already sensed, there’s more to these stories than mere history.

There are eerily similar geopolitical parallels with what’s happening right now.

Once again, gold is on the move — in a big way.

It’s not just being bought by jewellers or financial speculators, either.

The single most powerful players in the financial system are buying gold at a rate not seen for over half a century.

Russia. India. Singapore. Poland. Brazil. Turkey. The UAE. They’re all massively increasing their gold reserves.

As you’ll see in a second, China even has an entire military division dedicated to gold.

The single most important thing you need to understand right now is this:

This isn’t happening randomly — it’s part of a very clear and troubling pattern.

A pattern we’ve seen before.

See, gold isn’t like a stock, a bond or any other ‘normal’ financial asset.

It’s much more historically and economically valuable than all those things.

When the world order fractures, elites and insiders turn to gold.

They know gold’s true value can’t be measured in dollars and cents.

When war starts, gold isn’t just a part of a nation’s financial plans.

It becomes central to military strategy, too.

In the 1930s, European powers began to secure

their gold supplies in preparation for war. I believe

the same thing could be happening again today.

Are we on the cusp of another all-out world conflict?

It’s too early to say.

But what’s beyond doubt is that powerful players inside the financial system are worried.

Collectively, they’re buying thousands of tons of gold — more than they have since the days of the gold standard.

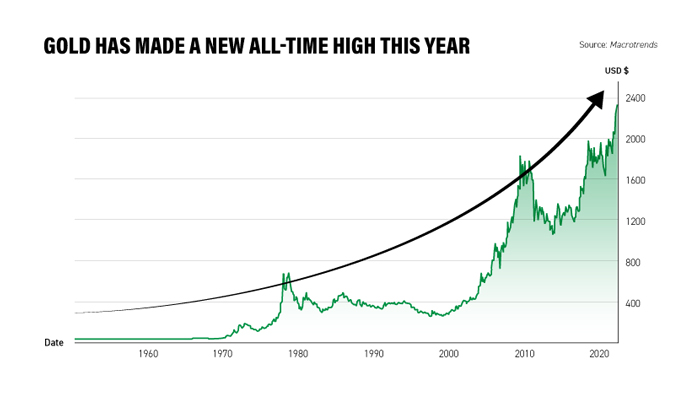

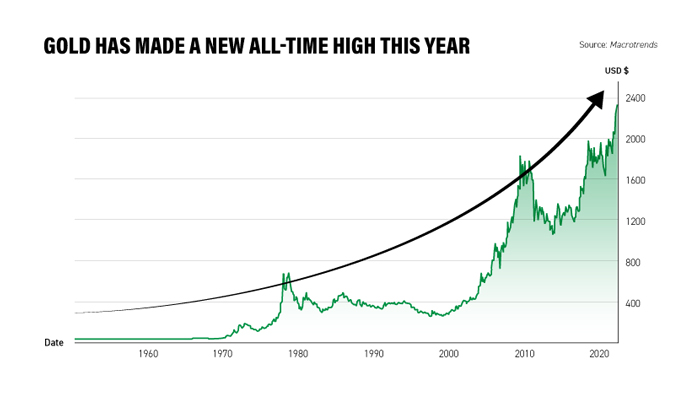

This has already driven the price of gold to new all-time highs, above US$2,400 an ounce.

Not only that, the financial elite are repatriating as much gold as they can — bringing it back within their own national borders. Just like nations did in the era between The First and Second World Wars.

Now, you might remember Germany did this. It had stored its gold in New York. In 2014 it demanded the gold back.

That’s now happening all over the world.

Poland, Hungary and Romania have all repatriated their gold.

The Netherlands and Belgium have done the same.

And there are reports both France and Germany are doing the same, too.

One central banker said ‘we did have [our gold] held in London…but now we’ve transferred it back to our country as a safe haven asset and to keep it safe’.

That doesn’t happen by accident.

History shows it’s what happens when the authorities are preparing for the worst case scenario.

In the 1930s, that was a Nazi invasion.

Today, it could be something just as troubling.

31,000 tons of gold…missing?

It’s no secret China has been buying incredible amounts of gold in recent years.

President Xi’s communist regime is notoriously secretive about its holdings.

But recently it’s been willing to publicly disclose at least a portion of them.

Starting in October 2022, China went on a 17-month gold buying spree.

It increased its gold stash by 16%...to a record high of 2,262 tonnes, according to World Gold Council data.

With gold trading above US$2,300, that amounts to roughly $170 billion in gold holdings.

Quite a war chest.

And that’s just what’s on the public record.

Unofficially, many experts believe China has a lot more gold than it admits.

Since 2000, China has mined roughly 6,800 tons of gold.

It’s illegal to export this gold.

China keeps it all tightly within its own borders.

So no one knows where those 6,800 tons of Chinese gold have gone, or who’s holding them.

All we know is, they’re inside China…somewhere.

No gold leaves the country.

And LOTS of gold is coming in.

China’s also the world’s biggest gold IMPORTER.

Via Hong Kong alone, 6,700 tons of gold have entered China since 2000.

Again: No one knows where this gold has ended up. It could all have been used in watches and jewellery, for all we know.

But it’s a hell of a lot of gold.

And THEN you have the fact that China owns the Shanghai Gold Exchange — a huge gold trading market.

Since 2008, another 22,000 tons of gold have been withdrawn from the exchange.

It’s been marked ‘for physical delivery’.

That’s another 31,000 tons of gold, unaccounted for within Chinese borders.

Has all of that ended up in government hands?

I doubt it.

But even half of that amount would be a huge deal for the balance of power globally.

It’d be roughly double all the gold in Fort Knox.

And it’d make China by far and away the world’s top ‘gold power’.

Of course, this is all speculation…for now.

But what we DO know for sure is…gold appears to be a big part of China’s future.

China’s gold army

You see, China isn’t just accumulating lots of gold.

It’s deploying its army to guard it, too.

No one knows quite where China’s official gold reserves are held.

Could be under Beijing — part of the complex of underground vaults built in the 1960s as I described earlier.

Or it could be on a military base.

Either way, it’s kept closely guarded by a special division of the army.

In the 1970s, China created The Gold Armed Police — a special unit dedicated to obtaining and protecting China’s gold.

Between 1976 and 2014 China’s gold holdings increased 2,964%, largely thanks to its efforts.

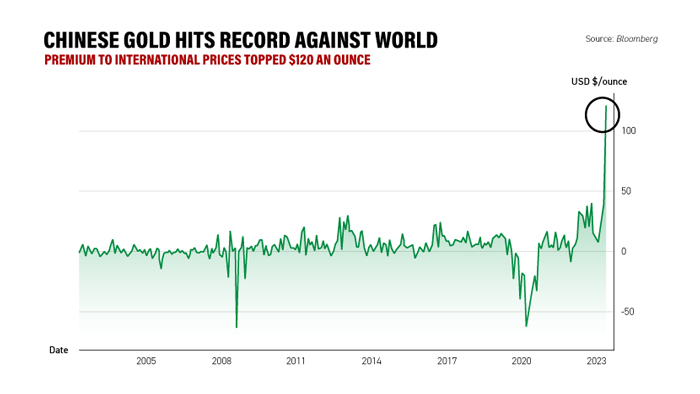

In fact, Chinese gold demand is increasingly moving the price of gold itself.

In 2023, the ‘premium’ on gold bought in China topped US$120 an ounce.

In other words, gold is much, much more valuable in China than it is in the rest of the world…

Ask yourself why that is.

Why is China accumulating vast gold reserves?

Why is it tasking its military to acquire more bullion?

Why is it willing to pay way above the asking price to get gold within its borders?

The answer…once you take a step back…starts to look obvious.

Taiwan in the crosshairs

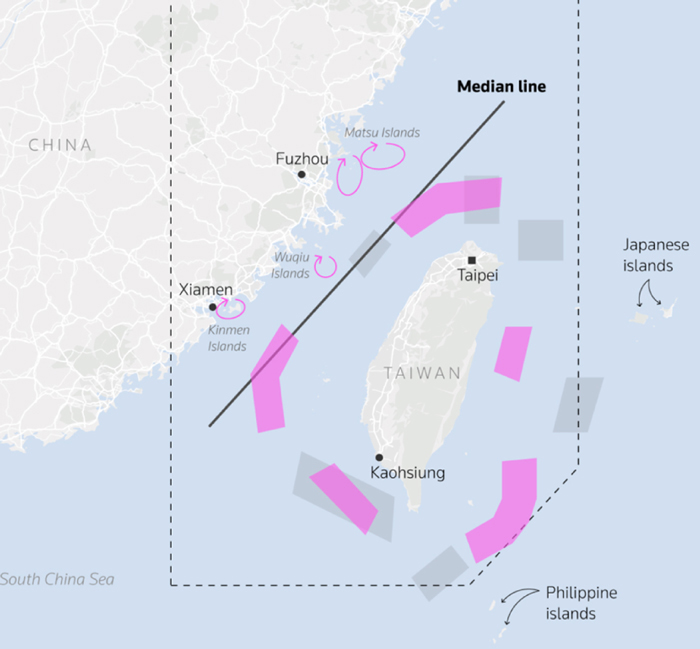

In May of this year, China’s military surrounded Taiwan.

Scores of naval units encircled the island for two days, with warplanes launching practice bombing raids during the same time.

It was a training exercise.

‘Punishment’, for the separatist republic’s election of an anti-China leader.

That was the official line, at least.

But it begs the question:

Training for what?

For three quarters of a century, the Chinese communist party has looked across the Taipei straights and vowed to reunify Taiwan with the mainland.

It’s a vow President Xi takes very seriously.

He’s made reunifying Taiwan a signature policy, preparing his people for a ‘great struggle’ and ‘major test’ in the future.

It’s not just rhetoric.

Look at the evidence:

- More than half of China’s Politburo now have Taiwan-related experience — it’s now ‘more akin to a War Cabinet’, according to one recent analysis. The general who’d be responsible for invading Taiwan leapfrogged others and joined the Politburo with no prior experience.

- President Xi has overseen the biggest military build-up since the Cold War. He’s accelerated key milestones from 2035 to 2027 to give him more firepower. He’s built vast underground complexes, a modernised space layer, new air defences, sophisticated cyber and hypersonic forces, plus the world’s largest navy.

- It’s built up its petrol reserves in above and below-ground facilities — far beyond normal peacetime reserves. And it’s building key relationships with oil powers like Russia, Iran, Saudi Arabia and Brazil.

- China and Russia have begun working more closely together on military issues, including a potential invasion of Taiwan. As the US Director of National Intelligence said, ‘this is a place where China wants Russia to be working with them’.

There’s no doubt, China’s preparing for some kind of future conflict.

It appears those preparations may be complete.

As News.com put it:

‘China’s almost ready. Its first aircraft carrier capable of going toe-to-toe with the US embarked on its first sea trials this week. Its combat jets are circling Taiwan daily in ever-growing numbers.’

What’s more, according to the European Parliament, it’s now stockpiling key resources it’d need if it were cut off from global commodities markets.

‘China is preparing for something major. That seems increasingly obvious judging from the stockpiling of important resources,’ warned Andreas Larsen, CEO of US investment firm Steno Research.

T-Day: 2025

China’s own military says it’ll be ready to invade in 2025.

That’s less than six months away.

And it means it’s time for you to start preparing, too, for this possibility.

Again, I’m not saying this to alarm or scare you.

To me, it’s a logical step to consider.

Because the financial implications of China’s war plans are already obvious.

In 2022, President Xi told his banks to begin preparing to survive ‘severe US sanctions’.

He saw what happened in Ukraine.

The West didn’t respond with military force.

It responded with financial measures.

It cut off Russia from the Swift system…confiscated its Treasury holdings…and seized other financial assets.

Xi knows, if he wants to take Taiwan…he’ll need to survive probably the harshest series of financial sanctions in history.

His answer?

Turn away from the US dollar system…

And turn towards gold.

That’s no surprise.

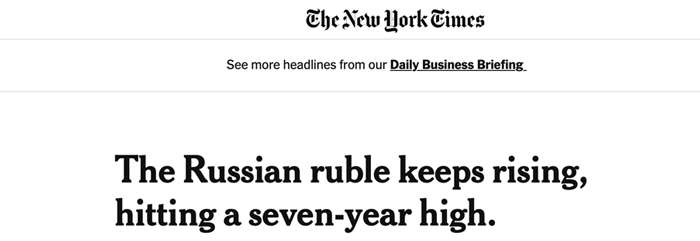

When Russia invaded Ukraine, the West struck back with sanctions designed to cripple the Russian economy.

Putin’s answer?

It pegged the Ruble to gold.

In doing so, it actually briefly saw its currency go UP against the dollar, not down.

Whatever China’s planning, it looks like gold will play a key role.

As The Daily Telegraph put it earlier this year:

‘There is a strong suspicion among gold experts that China is behind the surge in [gold] buying, building up a war-fighting bullion chest through state-controlled banks and proxies.

But others, too, can see that we are living through a fundamental convulsion of the global order, and that the dollarised financial system will not be the same at the end of it.

Gold is the hedge against dystopia.’

There can be no doubt that behind the scenes, something very troubling is happening.

It’s going to leave a lot of people feeling scared and confused.

But you don’t have to be one of them.

See, we’ve been here before. This isn’t unprecedented.

In fact, this is the third time in the last century we’ve seen the Great Powers of the world turn to gold like this.

It happened in the 1930s…

As the Great Depression hit, governments around the world did everything they could to get their hands on gold. (Most famously, the US government outlawed private gold ownership entirely. It forced people to give up their gold. That’s how it filled Fort Knox.)

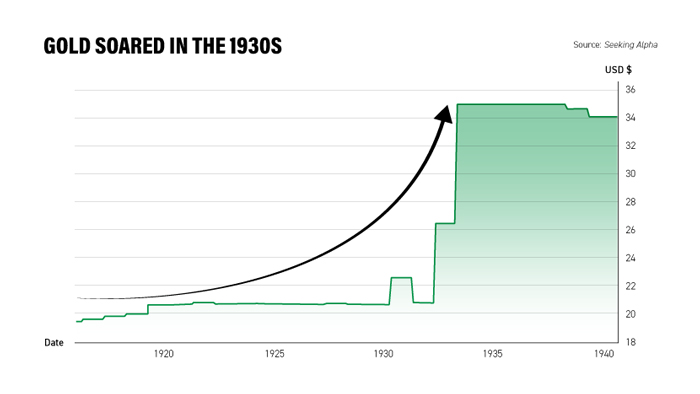

Then gold shot up in value, almost doubling between 1932 and 1934…

Then certain gold stocks soared.

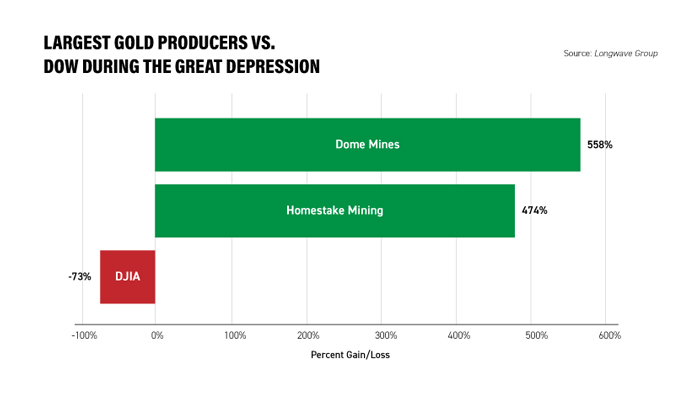

The two you’d want to own were Dome Mines and Homestake Mining. Both went up more than 400%...while the Dow Jones collapsed 73% in value.

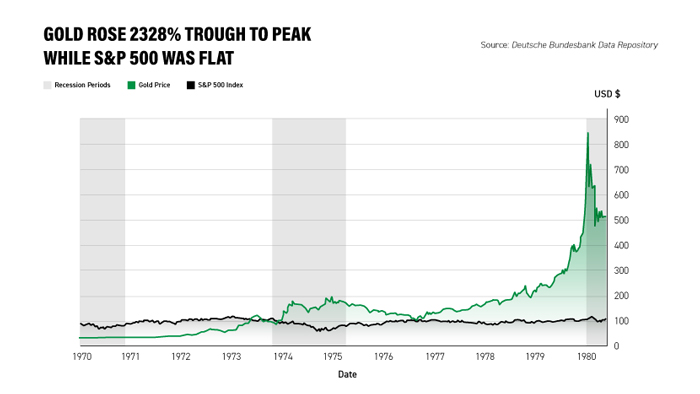

It happened again in the late 1960s and 1970s…

The world’s Great Powers scrambled to secure their gold supply (France even sent a warship to New York to demand its gold back).

The price of gold took off…

It shot up a 2,300% return inside a decade, while the stock market went nowhere.

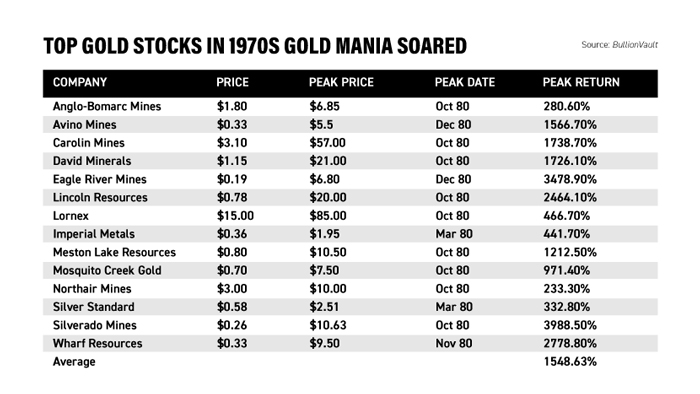

And finally…a real speculative frenzy began in the gold market.

It was mostly focused around a small group of junior gold stocks in the Canadian and American stock market…smaller, widely unknown stocks.

But in the right conditions, at least seven different stocks went up more than 1,000%.

In other words, history suggests there’s a pattern to how these situations play out…

Powerful nations start buying gold…

Gold goes up massively in value…

And certain gold investments go up 5, 10 or even 30 times in value…often in just a few years.

It happened in the 1930s.

It happened in the 1970s.

And it could be happening again now.

This time, there are powerful countries who are weaning themselves off the US dollar and moving into gold…and many will follow suit.

Russia made its first move.

China’s all set to do the same.

Then you have India…Turkey…the UAE…

We’re already seeing record breaking demand amongst the elite.

Like hedge fund manager Ray Dalio. He says all investors should have a 10% allocation to gold saying: ‘If you don’t know gold, you know neither history nor economics’.

Gold is already rising against the US dollar as a result…and it’s gaining momentum!

Of course, not all gold stocks will outperform. There are no guarantees in the stock market.

But if the pattern repeats…history suggests that the next thing we’ll see is a huge surge in the price of certain gold stocks.

That’s why today I think

you have a choice to make

Make the right call and I think you could grow your wealth rapidly in the coming years.

Make the wrong call and you could find yourself on the wrong side of history.

Your choice is simple:

Do nothing…ignore what’s happening…and pray to God that China’s plans turn out to be nothing but hot air…

Or take action…take control of your own fate…and turn these worrying trends to your advantage.

I’ll tell you right now — I can pretty much guarantee you that 99% of the people reading this right now will do nothing.

Please don’t be one of them.

See, gold may be hitting new all-time highs.

But so far, the regular punter is yet to figure out what’s happening.

In fact, earlier in 2024…as gold was making new all-time highs…investors in the West were actually taking money OUT of gold ETFs.

As gold veteran Peter Schiff put it earlier this year:

‘What’s unprecedented about gold’s new high is that there’s no fanfare, there isn’t any media coverage, there isn’t even any retail participation. Not only is the public not buying into this rally, they’ve been selling during the entire rally. The public keeps on selling as gold keeps rising. That’s not normal.

Somebody else is buying. Somebody who knows a lot more than the people who are selling.’

In fact, globally gold is still a tiny fraction of the financial markets.

There’s roughly $266 trillion invested in financial assets globally.

Roughly 1% of that is held in gold. A tiny fraction.

If that number increased to something like 5%, we’d likely see the gold price go parabolic.

It’d be a panic IN to gold

Just how expensive will gold get?

It’s hard to say for sure.

According to my friend and internationally respected gold expert Jim Rickards, past bull markets hold a clue for what could be next.

‘I would put gold at $15,000 an ounce before 2026,’ Rickards said recently.

‘If you just take the average of the prior bull markets…you would say the next bull market is going to be a little over 10 years and it’s going to go up 1,500%.’

In Aussie dollars, that’d imply a price of more than $20,000 for a single ounce.

That’s nearly a FOURTH of the average Australian annual salary…to get just one ounce of gold.

Now if gold rises to $20,000 an ounce in the next three years, it’d be disastrous for almost everyone on earth.

That’s because a surging price of gold means everything else will go up with it, food, electricity, fuel…everything!

And don’t expect your income to rise almost ten-fold from now.

Unless you own a room full of gold, you’d be extremely poor.

A more likely scenario…and a more hopeful one…is that gold will continue to rise steadily in the coming years.

But as is prudent with everything in life, pray for the best and plan for the worst.

There’s every chance you’ll see gold at AU$4,000 in the next year.

If you’re quietly accumulating gold during this time, you should do well.

But buy the right gold stocks and you could see a significant windfall, if the conditions favour the mining industry.

That’s why gold stocks need to be firmly on your radar right now.

A simple, proven strategy

for Aussie gold investors

These are strange times to be an investor.

And here in Australia, we haven’t exactly had a great time of it in recent years.

The ASX 200 has gone almost nowhere for half a decade.

It’s up a little over 16% since 2019.

Not exactly mind-blowing.

So it’s no wonder a lot of Aussies are turning to overseas markets to grow their money.

Collectively we sent a trillion dollars to the USA last year — most likely chasing returns in the tech sector.

We sent another half a trillion to the UK.

It’s not hard to see why. The biggest stocks listed on the ASX don’t exactly get the pulse racing.

There’re resources giants like BHP Billiton, Newmont and Fortescue Metals, the Big Four banks (five if you count Macquarie Group), the biotech giant CSL and conglomerate Wesfarmers.

So it’s no wonder increasing numbers of people are turning abroad.

But I think turning away from the ASX could prove a big mistake.

Given what’s going on with China — and the wider pivot to gold amongst the rich and powerful — I think right now is the right moment to start getting very excited about the Aussie gold sector.

Why?

Because there are thousands of tonnes of gold under our soil. In fact, Australia boasts the world’s largest gold resources and reserves beneath the ground.

And we have a world class gold mining sector to exploit those resources.

Gold is in our DNA.

Without it…Australian history could have taken a very different course.

The gold rushes of the 1850s saw millions of people emigrate here, looking to build a better life.

In the two decades after we struck gold, the Australian population QUADRUPLED.

More than anything else, GOLD helped set our country on its path.

We still live with the after-effects of that today.

In Perth, we have one of THE most respected gold mints in the world, producing a million ounces of high-quality Australian gold every year.

But gold isn’t just a part of our past.

It’s going to play a huge role in our FUTURE, too.

We’re the world’s second largest gold producer, accounting for 10% of global production (only China produces more gold than us).

And it may not be long before we’re #1.

Because we also have more known gold resources than any other country in the world.

The latest estimates suggest there’s TEN THOUSAND TONNES of gold buried under Australian soil.

That’s a fifth of all known gold reserves on the planet.

We’re literally walking around with buried treasure beneath our feet.

And we’re perfectly placed to exploit these resources.

The Aussie gold industry here is HUGE.

But not just that.

It’s teeming with smart people, innovation, state-of-the-art technology and more.

Some of our world class miners are worthy of investment, even when the market conditions for gold aren’t all that favourable.

But when conditions are right and gold starts rising, as we’ve seen in recent months…

Some of these stocks transform into wealth building machines.

500% returns…on

30 different stocks

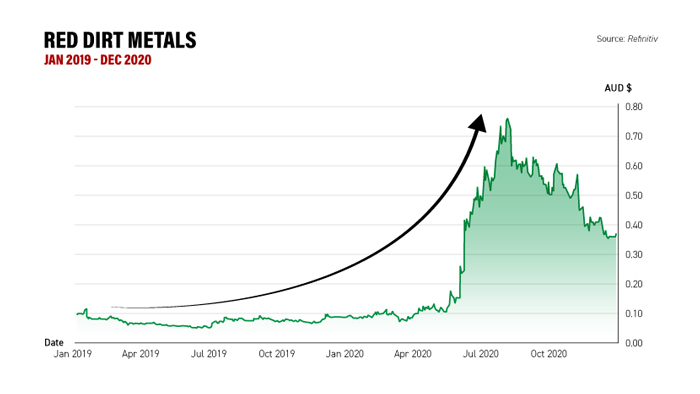

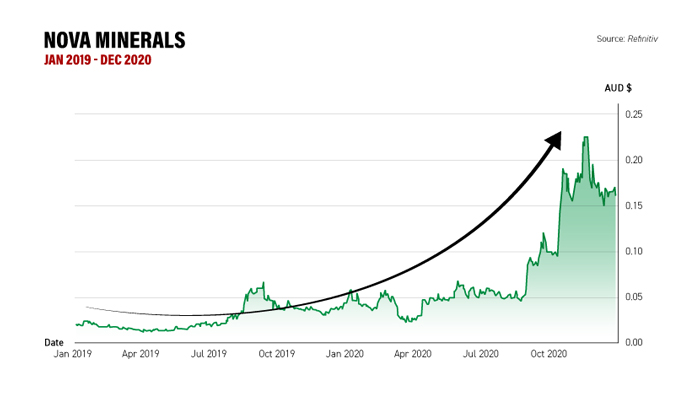

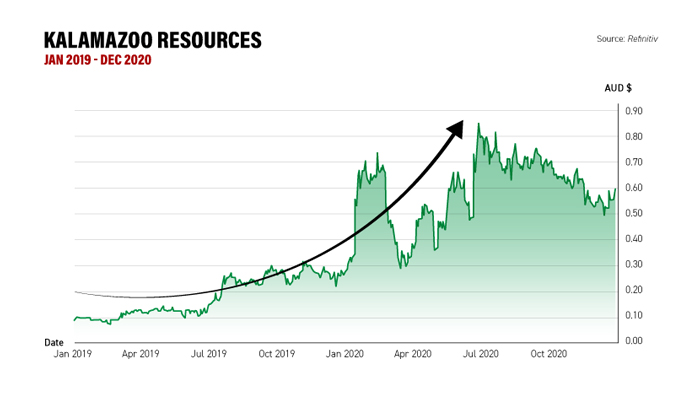

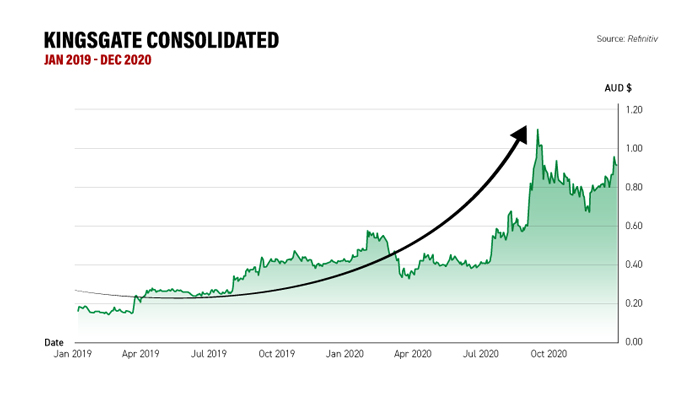

Consider…when gold broke out in 2020, certain top performing ASX gold stocks went stratospheric.

91 gold stocks went up 50% or more.

87 of them more than doubled.

And 30 different stocks rose by 500% or more.

That came from gold rising a mere 39% in the space of six months.

It’s rare for gold to rise that much in such a short time given it is a US$12 trillion market. But those were exceptional times.

Yes, owning the right stock back then would have given you some life-changing returns.

Like Red Dirt Metals…

Nova Minerals…

Kalamazoo Resources…

Or Kingsgate Consolidated…

Back in 2020, conditions were PERFECT to trade these world class Aussie miners.

And if you were prepared to look at the real ‘10-cent tiddlers’ like Chalice Mining or Thomson Resources…

You could have seen returns of more than 3,900%.

Returns like that are outliers. And obviously, not all gold stocks rose during this period.

But when the conditions are right, they DO HAPPEN.

Best of all, you don’t need to ride it from the bottom to the tippy top. No one can do that. But even riding part of that you’ll definitely be all smiles.

In short, trading those top-performers back in 2020 would have made you more money in FIVE MONTHS…

…than you’d have made holding bullion for HALF A CENTURY.

It’s happened over and over again:

When the conditions are right,

owning the right Aussie gold stock

can be a very smart move

I’ll give you another example…

Between 2014 and 2016, gold rose 38%.

That’s good.

But not exactly mind-blowing.

At the same time, the ASX Gold Index.

And certain individual stocks went up WAY more.

Just take a look:

Top Performing Gold Miners, 2014–2016

Dacian Gold — 1,479%

Gascoyne Resources — 1,126%

West African Resources — 760%

Evolution Mining — 603%

Resolute Mining — 845%

St Barbara Mines — 5,024%

Regis Resources — 296%**Past Performance is not a guide to future results.**

West African Resources, Evolution Mining and Resolute Mining — all up more than 500%.

Then you have the real king hits like Dacian Gold, Gascoyne Resources and St Barbara Mines — all up more than 10-fold.

Look back to 2008 and you’ll find the same thing happened.

Gold rose 94% over the next three years.

But some of Australia’s top performing gold STOCKS went up much more.

Northern Star Resources rose 3,079%

Perseus Mining went up 1,566%

Kingsgate Consolidated rose 452%

Saracen Mineral Holdings rose 1,566%

Tyranna Resources shot up 1,161%

And Regis Resources went up 5,185%

It was the same story:

Gold rose…

And certain gold stocks went ballistic.

That’s because gold stocks have what’s called ‘natural leverage’ — they can rise many times more than gold in a bull market.

That’s why now is a great time to start getting very excited about Aussie gold stocks.

These stocks aren’t risk free by any means. They’re speculative and can be highly risky. There are no guarantees in the stock market. That’s why you should never invest more than you can afford to lose.

But when the conditions are right…they can help you RAPIDLY build wealth.

I believe that’s the kind of opportunity

that’s on the table for you today

There’s no denying it — we’re living through a historic moment in the gold market.

Think about what you’ve just seen…

China appears to have some very troubling plans for the future…they might be buying up vast amounts of gold.

Central bankers around the world are doing the same, and at the fastest pace for well over half a century.

Most importantly…this is ALREADY driving gold to new all-time highs.

These are facts that cannot be denied.

And they paint a very bullish picture, for gold…and for gold stocks.

Yet here’s the most compelling part:

So far, Aussie gold stocks are yet to go up.

The ASX Gold Index went up just 6% between June 2023 and June 2024.

Many experts say that can’t go on.

With gold riding high, it feels like only a matter of time before certain gold stocks catch up with the gold price…and begin to deliver the kind of returns we saw in 2020, 2016 and 2011.

Make the right moves and there’s a simple way you can turn all this to your advantage.

In short, I think right now is the perfect time to start building a high-quality portfolio of top-rated Australian gold stocks.

As I said, we’re lucky to have some of the best gold stocks in the world, listed right here in Australia.

And many of these stocks have shown themselves capable of generating huge returns — far beyond what you’d make investing in gold alone.

And at a time like now, I think it’s CRUCIAL you have exposure to stocks like these.

In fact, I can’t remember a better time than right now to load up on gold, and a handful of specific speculative gold investments.

That’s why we’ve created a one-stop-shop guide for investors called The Ultimate Australian Gold Game Plan.

That’s why we’ve created a one-stop-shop guide for investors called The Ultimate Australian Gold Game Plan.

Put simply, it contains everything you need to know for the chance to capitalise on the current run up in the gold price.

And I’d like to send you a copy today.

See, there’s a right way to play a gold bull market…and a wrong way.

Most people will take the wrong route.

They’ll come to the market LATE…and they’ll SPECULATE wildly to try and get caught up.

It’s always the way.

Just look at the frenzy we saw around cryptocurrencies.

Most people only got interested AFTER prices had gone up thousands of percent.

By then, cryptos were in the news and it seemed like every taxi driver or barman had a tip to share.

We haven’t reached that point in the gold cycle…yet.

But I reckon we’ll get there.

And I’m willing to bet THAT is when a lot of people will decide it’s time to get in.

That’s a big mistake, in my book.

So I’m offering people a much smarter route.

I’ve asked the smartest gold investor I know to put everything you need to know to potentially profit from the rising gold price in a new report.

It’s called The Ultimate Australian Gold Game Plan.

This report contains your personal gold investing plan, designed to help you make the most of this gold bull market, before gold gets any more expensive.

Get this report, and you’ll learn all about...

1.How to buy and store gold the SMART way. When you’re buying gold — whether that’s bullion, coins or any other physical asset — there’s a few golden rules you need to stick by to make sure you get it right. I’ll talk you through how and where I buy my own gold — so you can buy like a Pro.

2.The simplest, safest way to buy physical gold — without having to store it. Setting up a private vault or safety deposit box isn’t for everyone. But the good news is, there are some really quick and easy ways to get physical gold exposure without ever worrying about that stuff — I’ll talk you through your options.

3.How to buy physical gold through the stock market. If you have a share dealing account, it’s really easy to get exposure to both physical gold AND Australia’s top gold mining stocks, without ever having to buy shares in them directly. I’ll walk you through how it’s done.

4.Two ‘Core Gold’ plays to add to your stock portfolio. One play you’ll see has grown its resources by 300% and tripled its reserves since 2011…owns four major gold mines…and pays a healthy dividend — so you get paid to own it. The other is deeply discounted against its peers — it could be going cheap — yet it just had a series of strong drill results.

5.The #1 Aussie silver play for 2024. Silver is a great way to play a precious metals bull market more aggressively. And compared to gold, it’s going cheap. Gold is at or near an all-time high in many different currencies…yet silver would have to double from here to reach an all-time high. You’ll hear about the one ASX-listed stock I’ve found that could be a smart way of playing things.

There’s more, of course.

But that’s just a taste of what you’ll discover when you accept our offer today.

Put simply, this report is the simplest way for you to give yourself the chance to turn Beijing’s war plans…and the wider scramble into gold…to your advantage.

I don’t think anyone else out there is doing this right now.

Yes, you might read about Central Banks buying gold at a rapid rate in the papers.

And you might hear about China’s latest military posturing over Taiwan on the TV.

But in my experience, you never get a clear, actionable plan for what you can actually DO about any of it.

That’s what makes The Ultimate Australian Gold Game Plan so valuable.

It’s ‘all action’.

It turns the trends you’re seeing in the world today — worrying as they are — into actionable recommendations.

It’s your chance to take control of your financial fate.

Because it’s times like these the mainstream lets you down most.

Journalists. Pundits. TV talking heads. Money managers. Brokers. How many of them do you think take ideas like this seriously?

Not many.

The status quo works just fine for the establishment. Why take a risk? Why explore the ideas that might make your viewers or corporate partners uncomfortable?

That’s why you need independent,

unbiased thinking now more than ever

These are strange and dangerous times to be an investor.

Confusing.

Chaotic.

Downright scary.

And at times like these, you need clear thinking and good, honest advice.

Not some TV talking head who only cares about ratings.

Not some journo who cares more about looking ‘respectable’ to his advertisers.

And not some fund manager who only cares about assets under management or annual fees.

You need a plan.

One with no ulterior motive or hidden agenda.

That’s what The Ultimate Australian Gold Game Plan is all about.

Because there’s a bigger story here.

China could invade Taiwan.

Or it could continue its preparations for another 5–10 years…slowly building its forces up, ready to strike.

No one can say for certain.

But the very fact we’re talking about this seriously is revealing in itself.

10 or 20 years ago we’d never have even had this conversation.

Back then, the idea China would challenge ‘the West’ so directly over Taiwan seemed fanciful.

America was the world’s dominant superpower. We were living in a unipolar world — with America at its apex.

As a key American partner, that worked well for Australia.

But now it’s changing.

Now, the world order is breaking apart.

It’s becoming World Chaos

75% of Aussies now believe China will pose a direct military threat to Australia in the next two decades.

US intelligence agencies have warned we face an ‘increasingly fragile world order’, with China, Russia and Iran all challenging America’s role as the sole superpower.

Earlier this year, the International Institute for Strategic Studies said the world is witnessing a ‘deteriorating security environment’.

That’s what’s really happening today…and why so many elite players are hoarding gold.

Just as we saw in the 1930s, we’re witnessing a shift from a ‘post-war world’ — to a pre-war world.

And let’s not forget, we’ve been here before.

In 1914 plenty of experts said Germany would never make war — that capitalism and global trade would keep the peace…that the Germans were making too much money to make war.

Wrong.

In 1939 the British claimed there’d be ‘Peace in our time’ — that appeasement would keep Hitler from starting a cataclysmic war.

Wrong again.

The moral of the story is simple:

Sometimes it pays to think the unthinkable.

Sometimes the ‘tail risks’ turn out to be on the money.

And that’s precisely what our business — Fat Tail Investment Research — exists to do.

We study the ‘fat tails’.

We specialise in exploring the high impact, low probability ideas that the mainstream ignores, until it’s too late to do anything.

I’ll give you an example. In January of 2020, we sent a stark message to tens of thousands of Australian investors:

‘BANK YOUR CASH BEFORE THE CRASH’, it said.

Six weeks later, COVID caused the fastest bear market in history.

Did our analysts see a bat virus triggering a collapse of the world economy?

No. We saw risk — where others didn’t.

And we were willing to back that view up with simple and direct advice.

Because that’s what’s valuable to people like you.

Knowledge and insights are one thing. Turning them into action is another.

But we’re not all just about the ‘big picture’.

We don't get everything right, no one does. But on many occasions over the past 19 years we've helped readers get into booming markets long before other investors picked up the scent.

- In resources and mining we spotted the opportunity coming out of China following the market fall of 2008. Our analysts led some members to gains of 220% from MEO Australia, 243% from LNG Ltd and 458% from Bow Energy.

- In technology we’ve been on the front foot over the last decade, leading some members to gains of 886% from Zip Co, 833% from Advanced Micro Devices and a whopping 1,448% from AfterPay back in 2020.

- While in crypto — an asset we were talking about back in 2014, long before the mainstream — some of our members have had the opportunity to make gains of 2,936% in bitcoin and 1,538% in ethereum.

Now it’s important to point out that we’ve cut losses on many of our recommendations too. They didn’t all go up.

Investing is risky, remember, and it isn’t just about making money.

We've also protected our subscribers from market falls, saving them a lot of cash in the process.

For example, back in 2005 one of our analysts predicted the global financial crisis two years ahead of time. He told readers it would start in the US property market and spread worldwide.

In September 2007, the same analyst issued urgent sell alerts on all US stocks — which was a timely call. In 2008, Lehman Brothers went under, bringing Wall Street and the world's financial markets to a grinding halt — and sending US stocks tumbling.

In 2011, we predicted the European debt crisis, which started in Greece but quickly spread across the entire continent. By the end of that year, Cypriot pension funds were frozen and the European Central Bank ordered emergency ‘bail-ins’.

More recently, our chief trading analyst told his subscribers to take profit on five of their positions at the end of January 2020, just before the COVID crash that sent the market down 30%.

He said:

‘I have been considering ringing the cash register in a few of our positions for a while and I think now is a good time with the threat of the coronavirus rearing its head.’

These positions sold for gains as high as 188%, six weeks before the market tanked, and some people lost almost a third of their invested wealth.

Of course, our past calls are no guarantees of future success. But these examples underline how valuable our work can be at a time like this.

That’s why tens of thousands of people all over Australia follow our work.

Today we’d like you to join them.

Because if we’re right about what’s going

on now, our work could change your life

No one’s saying you need to build a bomb shelter in the backyard.

And no one can say for sure when China will make good its threats…or what the first move will look like.

But you cannot deny:

The warning signs are there.

Sure, you can do nothing. Listen to the same experts who were wrong about COVID, and wrong about Russia.

If you wake up to find China’s blockaded Taiwan…launched a trade embargo…or even a full assault…you’ll kick yourself for doing nothing.

Because that’s the thing.

You don’t have to sit there and do nothing.

You don’t have to be passive and ‘wait and see’.

You can get on the front foot and be positive here.

You can turn all of this to your advantage, right now, using the recommendations you’ll discover in The Ultimate Australian Gold Game Plan.

Like I said, this report was written by one of the best gold investors I know — Brian Chu.

Brian’s the founder and manager of his own private family fund, The Australian Gold Fund — one of the only investment funds in the country dedicated solely to gold mining stocks.

He’s also spent more than 16 years in the higher education sector teaching finance, statistics, accounting, economics, and risk management.

Since he started buying and selling gold stocks, Brian’s numbers have been up there with the best.

- His private family gold fund has beaten the ASX Gold Index since 2015…

- In fact, in that time it’s more than tripled the return of the index…

- And it made TEN TIMES more than the index between 2019 and 2022, when gold broke out.

EVEN MORE impressive is that Brian started The Australian Gold Fund with his own family’s money — it’s a private fund.

Lots of our readers ask if they can invest in it. The answer is always the same: no!

But that’s why since 2021 Brian has been sharing his analysis and stock recommendations with private investors like you.

A quick look at what they have to say shows you — Brian is the real deal.

‘This is a fantastic service. Investing in the gold sector is a very difficult exercise and Brian's guidance has been invaluable. Brian is a real critical thinker and I read his e-mails assiduously.’

Peter Donald

“I’m very pleased I signed up with Brian and The Australian Gold Report a few years ago, Brian’s attention to detail and knowledge of the Gold resource sector is second to none.’

Phil C

“Thank you for all the research you do to make my investing job a little easier. I would be lost without your guidance.”

G.S.

So how can you access Brian’s work?

Well, the report Brian just told you about — The Ultimate Australian Gold Game Plan — is a great starting point.

But it’s just that.

A start.

Brian wants you to go much further than that — and take a look at his gold and mining focused newsletter... called The Australian Gold Report…in which you’ll get ongoing analysis and recommendations designed to help you capitalise as this story plays out.

If you’re into gold...and want to know how to potentially make money from it... you’ll love Brian’s research.

And if you’re just starting out on your journey in gold…this is the place to do so too.

Put simply, it’s your one-stop-shop for understanding and investing in the gold market.

Whether you’re new to gold — and you want to buy your first bullion or coins…

…or whether you’re looking for expert insight to build a high-quality portfolio of Australian gold stocks…

Brian is your man.

When you sign up, you’ll get instant access to:

- Your copy of The Ultimate Australian Gold Game Plan, which shows you a quick way to construct a gold investment portfolio. You’ll get your copy as soon as you sign up.

- Full access to The Australian Gold Report portfolio — including Brian’s entire buy list of Aussie gold stocks. This is a core mission of this advisory — to show you precisely what to buy to potentially profit from gold. When the opportunities present, Brian will add new picks, share his full research on what’s going on, explain the risks involved, and explain why he thinks you should buy.

- Quarterly Market Reports — four times a year, Brian will share a ‘big picture’ review of how the market and the portfolio are performing, alongside updated advice on the best course of action to take.

- Regular portfolio updates — once a stock enters the portfolio, Brian will keep you right up to date with it. He’ll share any important news and give you specific buy, sell and hold advice — so you always know exactly what’s going on and what you need to do.

Plus, there are several special research reports you’ll get access to when you sign up:

SPECIAL REPORT #1: Unveiling the VPM Filter.

In this report, Brian will share a tool he’s developed to help you value gold stocks — and make the right decisions with your gold portfolio as a result.

He calls it the VPM Filter, which is a ‘secret weapon’ he’s used to help his private family gold fund outperform the ASX Gold Index since 2015.

SPECIAL REPORT #2: Three Advanced Indicators for Gold Market Success.

In this report, Brian will reveal to you a recently developed tool to help you allocate your precious metals portfolio between gold stocks and precious metals ETFs. Within the gold price cycle there’s a time when one will deliver better returns than the other.

The ‘Gold Stocks Valuation Index’ will provide a simple interpretation of how the market is performing to help you best position your precious metals portfolio.

In other words, if you’re interested in gold...or thinking of diversifying...

...or you just want to know how to seed your money in what could be the biggest gold bull market of all time…

…then I’d urge you to make The Australian Gold Report part of your regular reading.

And the last thing you need to worry about is the price. A one-year subscription costs $499.

But sign up today and you can get your first three months for just $99.

That subscription fee is FULLY REFUNDABLE for the next 30 days. So if you’re not delighted with Brian’s work, you can walk away, no questions asked.

That subscription fee is FULLY REFUNDABLE for the next 30 days. So if you’re not delighted with Brian’s work, you can walk away, no questions asked.

That’s a very fair offer.

And all you need to do to accept it is click RIGHT HERE.

You’ll be taken to a secure order form where you can start your subscription right away.

My suggestion is, with China hoarding gold ahead of a potential invasion of Taiwan…the price of gold at all-time highs…and Central Banks piling in — it’s time to make your move.

Click HERE to get started.

Hands down, this is one of the biggest stories

in the financial world today — and right now

you have a chance to take advantage

This isn’t a story that’s going to play out in 5 or 10 years.

It’s not a ‘tomorrow’ story either.

It’s playing out TODAY — right now, in front of our very eyes.

China is ALREADY hoarding gold ahead of a potential invasion.

Central Banks are ALREADY buying gold at their fastest pace in half a century.

The price of gold is ALREADY making new all-time highs.

We’re watching the dollar-based order fall apart before our eyes.

This is a MOMENTOUS EVENT.

It’ll probably never be repeated in our lifetimes.

And it presents a huge opportunity for Aussie investors.

I think it’s a chance to build real, lasting wealth as gold gets ever more expensive.

That’s why you’re reading this today.

And it’s why I’m urging you to give The Australian Gold Report a try today.

How long before everyone you know is talking about gold being in a bull market (like we saw with bitcoin in 2017)?

If I’m right, I think people will kick themselves if they have a chance to be early…but miss their shot.

That’s what’s really on the table today.

A chance to be early, be smart and set up some potentially significant returns down the line.

You can start your subscription to The Australian Gold Report by clicking on the button below .

As I said, your subscription is FULLY REFUNDABLE for the next 30 days.

And you get instant access to everything I’ve told you about.

The move into gold has begun.

If Brian is right, now is the time to capitalise.

And he wants to help you every step of the way.

Hit the button below now.

Thank you for joining us — and we’ll see you on the inside.

Cheers,

James Woodburn,

Publisher

Fat Tail Investment Research

Click here to subscribe to

The Australian Gold Report now

(You can review your order before it’s final)