James on a geological field trip

in New Zealand

Hello, James Cooper here.

I come to you today with a stock recommendation.

An urgent one.

And perhaps the most significant in my tenure as Fat Tail Investment Research’s head resource stock analyst.

Let me give you the background...

It’s now hard to ignore the firing-up of the Australian commodities space.

Explorers kicking back to life...

The Federal Government splurging cash again on certain ‘critical metal developers’...

The copper spike bumping AI stocks from the headlines...

Gold’s bull market making more records, silver not far behind...

BHP’s audacious bid for Anglo American...

You don’t need to be a mining aficionado to sense a train finally pulling out of the station...after years of delays, false-starts and neglect.

Here’s an on-the-the-ground example:

I’ve been following with interest a new world-class automation and robotics-testing facility for miners that’s expanding at a rate of knots in Western Australia.

I can tell you from extensive operational and financial experience in the mining industry....

A project like the Australian Automation and Robotics Precinct (AARP) wouldn’t have seen the light of day even a few years ago.

This comeback by some projections will add at least $75 billion to the economy by 2030.

‘This is a BIG deal,’ says the lead of AARP.

As focus...and money...starts to shift back to Tier 1 miners...startups...and everything in between...

WHAT’S THE BEST SINGLE-STOCK

MOVE TO TAKE ADVANTAGE?

Well, that’s always a matter of opinion.

But I think I have one for you.

And that’s what this urgent report is about.

Now, this current revival will not be a surprise to you if you’ve tracked my work since I joined Fat Tail Investment Research.

As you’ll see, I’ve been predicting what’s now unfolding...and laying the groundwork for it...since 2022.

My background in exploration geology during the last mining boom has given me a small advantage.

I’ve worked for major and junior companies throughout Australia and Africa, including Barrick Gold, Equinox Minerals, Crosslands Resources, and Northern Star.

Getting ‘in the dirt’ with all phases of exploration across a host of different commodities...has meant I’ve been able to read the tea leaves a little sooner than your average punt on this new resurgence.

Only now, though...

...are some of the stock plays I’ve seeded in the last year starting to really fire up.

The NEW recommendation I have found for you today...which, for now, we’ll classify as ‘LAST BARREL’...is on a different level, though...

Right now, the ‘firing up’ stocks on my buy-book centre around my sphere of personal experience.

Copper, strategic metals (what I call critically endangered minerals) and industrial metals.

Also mining services, the ‘shovel-sellers’.

(That section of the portfolio is now up an average of 35%.)

Not everything’s firing, though.

Soft commodities are still cold. I think I backed them too early. The ‘Food Basket’ section of my buy-list remains -9% in the red.

But, what I’m seeing now is

a clear shift in momentum...

If you were to buy a single stock to capture that, what would it be?

That brings me to my latest play.

It falls into NONE OF THE ABOVE categories.

Indeed, it falls a little further out of my direct expertise.

I’ve never explored for an outfit like this.

We’re turning over new ground here.

But you REALLY need to hear my rationale behind buying this stock, and doing it very quickly.

If I’m right about the general theme...and the company in particular...

...this could pan out to be one of the most promising resource speculations in Australia to own throughout 2025.

Or...

...it could flatline for the rest of this year and LOSE you money next year.

I want to be brutally clear on that, right at the outset.

But this particular company is the one stock preventing me from sleeping right now.

I can’t stop thinking about it...

As I’m about to lay out for you, it sits at the nexus of a new cyclical boom.

One I’ve not covered much in Fat Tail Daily. Or my paid newsletters.

It’s still getting piss-poor coverage in the mainstream finance media.

And yet, the last time this boom flared...this specific stock went off like a coiled spring...

Past performance is not a reliable guide to future results.

Look at that.

It emerged from 15-cents-nowhere to reach over $10.

6,300% returns.

It then crashed back to under 40 cents.

That’s the cyclical risk aspect I’m talking about.

I believe the cycle that initially propelled this stock has turned again. Literally in the last few months.

I think they’re even better-positioned than they were in 2003. Meaning…

Massive potential upside in 2025

At the time I type this at least, these guys are buried under the radar.

Almost zero coverage.

Despite the fact they’ve undergone a massive growth in earnings per share.

If I’m right, what’s happening COULD send this share back above the $5 range.

If I’m wrong, and you buy it...

It’s a stock you’ll want to erase from your memory. You’ll lose money, even at its current low price.

I don’t think I’m wrong though.

Let me explain why, and give you

the full backstory...

A new squeeze in resource supply and demand is something I predicted back in 2022.

It’s not yet in full swing.

But in my opinion, it has definitely started.

That’s also the feedback I’m getting from old mates in the industry.

Some of these guys went away and did other stuff in the lean times...but are being lured back.

In Australia, the mining industry is expecting a shortage of 27,000 workers by 2027, in what the AREEA is now calling ‘the worst skills crisis in a generation.’

It’s enough to make this veteran rock-kicker consider dusting off the old rucksack!

But not just yet...

Money talks.

And right now, I see a lot of money on the table if you pick the right stocks, and get in them early...

As I said, copper’s the 2024 standout so far.

‘Bulls jump deeper into copper amid supply challenges, AI-fueled demand,’ Reuters just reported.

I was at least 18 months ahead of that.

The copper plays I recommended last year are already up an average of 45%.

I actually think copper may be TOO hyped by the mainstream at present.

We might get a small pullback there before it pushes even higher over the next few years.

What I call critically endangered metals are starting to achieve escape velocity, too.

These are the key minerals for the green transition to EVs, wind power, AI chips, and military hardware.

One of my critical metal developer plays just got $400 million backing from the Federal Government.

Its shares have gone from 79 cents to $1.10 in three weeks.

My graphite play just received a similar government backing.

It’s up 25% in a month.

Gold’s up 50% since 2022 and over 20% this year.

It’s outperformed Western stock indices, which happens very rarely. It’s even beaten bitcoin’s recent rise.

But this is an example of how this new mining boom is not impacting all stocks across the board yet.

Two of my gold stock plays are up 10% and 21%, but a third has yet to fire, down -10%.

However...

Evidence mounts daily that the

‘smart money’ is mobilising again

The old crew who made billions from the FIRST mining boom in 2002 to 2007 are coming out of the woodwork.

And making their plays to make another billion or so from Mining Boom 2.0.

The latest being good-old Gina Rinehart.

It’s just come to light she’s been on a massive strategic metal mine buyout spree...

...swooping in on numerous rare earth mining companies across the globe.

‘Hancock is a very sophisticated mining investor,’

says Don Swartz, CEO of American Rare Earths.

‘And I think people should take note that when someone who has patient capital, who wants to play the long game and is interested in the space…

‘It’s a signal.’

I’ve ALSO detected a new signal.

To me, it couldn’t be louder.

It’s screaming at me that the time to act is now.

So, I am.

THIS SIGNAL IS

COMING FROM THE

OIL SECTOR

I’m placing a single stock bet that a new...and maybe FINAL...giant up-move in oil and gas has just begun.

FINAL, you ask?

Yes, stay with me and I’ll explain.

Some are saying a next oil ‘super-cycle’ has ignited.

Personally...and I think I speak for many of my exploration colleagues...I cringe at the term super-cycle.

It gets bandied about whenever commodity prices start to move.

All commodities have their own unique dynamics.

There’s nothing super about these cycles.

But you CAN predict them.

If you know the signs to look for...

I reckon what’s teeing off in energy COULD be the last GREAT bull market in fossil fuel stocks.

Remember...

In what I see as the exact same conditions and timing of the previous oil cycle...

...the oil explorer I’m now marking as a buy went from 15 cents to TEN DOLLARS in the last boom.

Now it would be unrealistic and irresponsible to predict a repeat performance of that magnitude.

Lightning like that rarely strikes twice in the stock market.

But...

...these guys have been in this position, at this stage of the cycle, before.

They ‘know the drill’ (no pun intended!).

If, like me, you believe the odds are you may never see an opportunity like this in oil, ever again...

This is the logical play to back now.

That’s why I pushed my publisher to put this report out as soon as we can.

First, I want to stress what may seem an obvious point.

Pre-empting any kind of cyclical boom (super or otherwise) before it’s in full-motion is always risky.

And costly if you’re wrong.

But if you’re right, and you select the right stocks, you could make a LOT of money.

They don’t even have to be small-cap stocks, either. (Although my recommendation today is very much a small cap...)

Let me give you an example from the last conventional energy boom...that took place between 2003 up until the Global Financial Crisis that closed out that decade.

Shipping company Frontline.

It’s the biggest oil tanker outfit in the world.

Was then. Is now.

You could call it a ‘pick and shovel’ energy play.

It’s not an oil producer or explorer.

Frontline MOVES oil and oil products from A to B.

A super-cyclical business.

Buy at the wrong time, the stock goes nowhere. Or down.

But pinpoint the right time…

When oil’s on the up and shipping ‘day rates’ start to explode...and you have pretty much won the lottery.

This is what happened with Frontline in the 2000s.

All of a sudden, vessel demand went ballistic.

Frontline began re-deploying mothballed tankers.

This was a time when producers were in survival mode...rigs were gathering dust...oil was cheap...and shipping companies were twiddling their fingers and piling up debt.

Frontline was ready when oil started to surge again.

As day rates began to climb again, it was one of the only tanker outfits in the world with capacity.

It could basically charge what it wanted.

Past performance is not a reliable guide to future results.

From its low on 1 September, 2001 to 2004 its shares soared 1,400%.

And keep in mind...

...this was a massive blue chip stock.

Not a speccy small cap.

$10,000 invested around the time of the Twin Towers attacks turned into $150,000 in just three years.

From there they fell back for a bit.

But by June 2008...around the end of the last oil boom...Frontline shares traded at $348.

Of course, not all oil shipping stocks performed like this in the last boom.

But many flew. Nordic Tankers, Overseas Shipholding Group, Tsakos Energy Navigation, Teekay Tankers.

By the time all these stocks peaked in 2008, crude oil was over $140.

Today, it’s trading for less than $80.

A year ago, it was $66.

Frontline shares have quietly rebounded 25% so far this year to $25.

A year ago, they were $14.

So, momentum is already there in energy. Largely thanks to geopolitical unrest.

But — as I’m about to show you — I think most analysts are vastly underestimating how high the oil price COULD get over the next 24 months.

Why the LAST great oil boom may be dawning. And one stock to play it...

Whether you’re pro or sceptical about climate change...

...one thing is fairly clear to honest observers.

Fossil fuels are now on bought-time.

Sweeping changes are in motion that I don’t see being reversed.

As Nafeez M Ahmed of the Age of Transformation newsletter puts it:

‘When the world’s pre-eminent energy watchdog says that the age of fossil fuels is over, it’s time to pay attention.

‘Some 98 countries in the world are oil producers: they are fundamentally unprepared for what the International Energy Agency (IEA)’s flagship World Energy Outlook describes as the ‘unstoppable’ decline of oil.’

As Noah J. Gordon of the Sustainability, Climate, and Geopolitics Program puts it:

Producers around the world are now in a race to ‘PUMP THE LAST BARREL’.

The winners of this race could see very rich rewards.

Which is where today’s stock recommendation comes in...

Now, we can argue till the cows come home about whether the end of oil is a good thing.

Whether oil and gas will ever truly disappear.

On what timescale.

And how damaging and chaotic ‘an orderly transition from oil’ might be.

I have my personal opinions.

But that’s not what we’re going to focus on today.

You don’t invest based on what YOU think.

You invest based on what you think THE CROWD is going to think.

And the conclusion I’ve reached is this:

We could be at the cusp of history’s LAST really big oil and gas boom.

It may well have already begun.

And, if it has, there’s one single play on the ASX I think you should consider getting exposure to.

Obviously, despite the Greenies’ best efforts to speed up this transition...

...we remain a world fuelled by oil.

If you believe, like I do, that we’re embarking on broad commodity price inflation over the coming years...oil should not be ignored.

In fact, its last hurrah could be quite a sight to behold...

As the early 2000s China-led boom demonstrated, oil tends to rise in partnership with other commodities.

To show you what I mean...

At the beginning of the resource boom in 2001, crude traded as low as US$19.70/ barrel.

As I mentioned, crude almost reached US$150/barrel at its 2008 peak.

People forget this...

But in the last resources boom, oil’s performance was actually on a par with copper. The commodity most associated with those boom years.

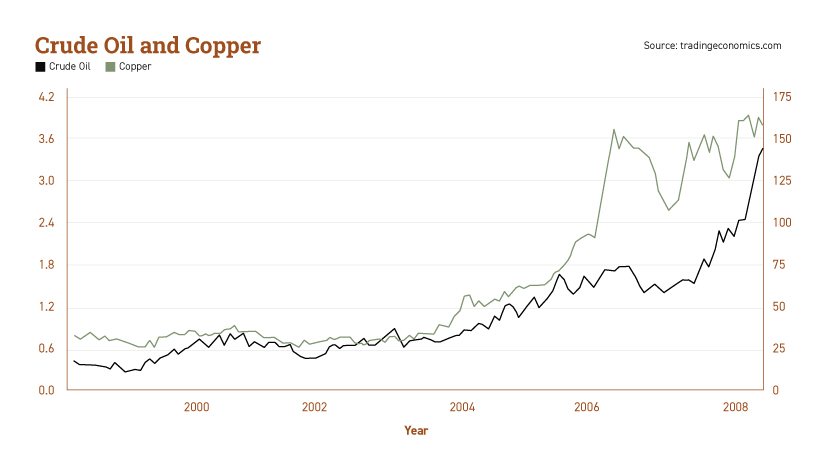

Just take a look at the chart below from 2000 to 2008, showing the stellar rise of these two commodities:

Past performance is not a reliable guide to future results.

History shows energy prices rise alongside metals in major commodity booms.

Despite poor public opinion and government opposition...there’s no reason to believe oil can’t repeat this stellar performance in the years to come.

In fact, terrible sentiment against oil and gas companies will likely push prices even higher...as development projects face opposition.

That’s why you should be open to opportunities in this sector, right now.

But it’s important to understand that while commodities tend to rise broadly over the upward leg of a cycle...each has its own demand and supply fundamentals.

These distinctions will cause commodities to peak at different times throughout the cycle.

I’ll briefly outline three key factors that MAY drive oil prices higher over the coming months and years.

Let’s start with the most important one...

Last Oil Boom Driver #1

Exploration in Terminal Decline

Put simply...

There are very few fit contestants remaining who can participate in the race for the last barrel.

The field is lean.

Last year, one big one stepped up.

The US government approved the Willow project.

An enormous operation that lets ConocoPhillips go after oil on virgin public land in Alaska.

As Noah Gordon writes:

‘If Willow produces as much oil over thirty years as expected, the consumption of that oil would release the equivalent of 277 million tons of carbon dioxide into the atmosphere.

‘That’s about 4% of US annual emissions, from one project, at a time when emissions need to fall rapidly for the country to achieve its goal of net-zero emissions by 2050.

‘By approving Willow, U.S. President Joe Biden broke a campaign promise that there would be “no new drilling, period” on federal lands.’

But look...

Project Willow is an outlier.

Across the resource sector, major operators have shown little appetite for spending capital on exploration.

The problem has been especially acute for the oil and gas sector.

As new petroleum fields become harder to find, exploration budgets should increase to meet the challenge of exploring deeper offshore basins.

Yet the opposite is true.

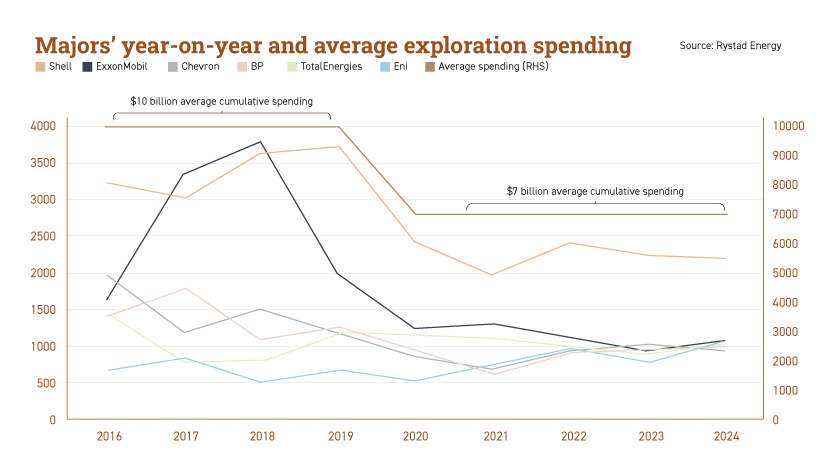

As you can see below, average cumulative spending on exploration has declined from US$10 billion to around US$7 billion over recent years.

Past performance is not a reliable guide to future results.

The net result has been historically low levels of new oil discoveries.

According to IHS Markit, reported oil and gas finds have sunk to their lowest level in over 75 years.

In other words, discovery rates in the early 2020s are on par with the mid-1940s.

Back then the global population was just 2.5 billion.

Today it stands at around 8 billion, or 220% higher.

With many more mouths to feed, homes to heat, and goods to transport, energy needs have grown exponentially.

Yet, a lack of discovery ensures future supply won’t be there as maturing oil fields run dry.

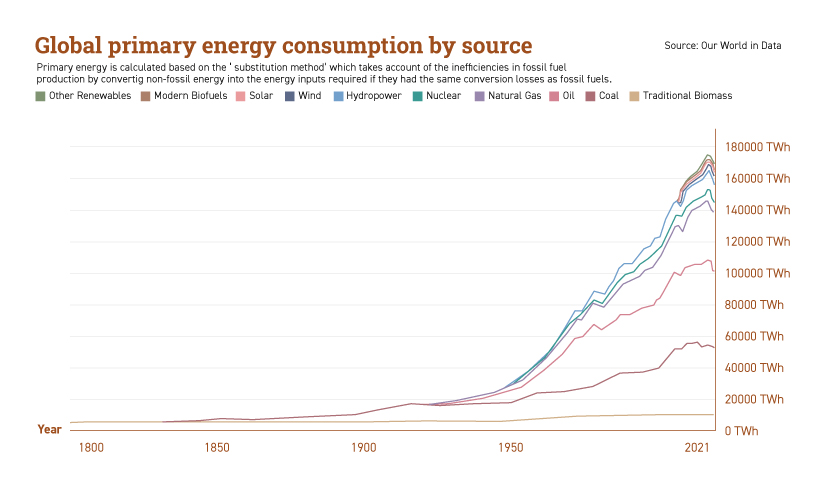

As the graph below shows, in 1946 energy demand stood at 20,000 TWh (terawatt-hours).

Past performance is not a reliable guide to future results.

By 2021, this has escalated to a staggering 160,000 TWh.

Sorry to carpet-bomb you with stats.

The nutshell is this:

The industry’s discovery rate is similar to 75 years ago.

Yet energy demand is around eight times higher!

That puts incredible pressure on current reserves.

And sits at the heart of the race to pump the last barrel.

Rapidly declining oil fields...

without replacement reserves in sight

Given that it takes at least seven years to bring a new oil field discovery into production, future supply will be under pressure.

It’s why the world’s largest oil producer is sounding the alarm on energy security.

According to Saudi Aramco’s chief, global spare capacity for oil and gas supplies is now extremely tight, sitting at around 2%.

Any uptick in demand will put upward pressure on prices.

However, a more immediate threat could come from supply disruption.

Which brings us to...

Last Oil Boom Driver #2

Russia can constrain global supply

Putin has held continuous positions as president or prime minister of Russia since 1999.

Over his tenure, he’s seen four French Presidents, three German Chancellors, six UK Prime Ministers, three Chinese Presidents, and five US Presidents.

If you asked him which one he disliked the most, there’s a fair chance it’ll be the current US President, Joe Biden.

The US Democratic Party has been leading the charge in backing Ukraine’s war effort, directing billions in military aid and prompting NATO allies to do the same.

So, how would Putin seek his retribution?

Simple.

Cut Russian oil and gas production under the guise of ‘maintenance’.

Right before US elections later this year.

That’s why if you consider putting this stock in your portfolio, you should probably do so no later than election day, Tuesday 5 November.

That really could turn out to be the final starting gun of this race.

This would be a repeat of Putin’s 2022 strategy of limiting gas supplies to Europe via the Nord Stream 1 pipeline.

As the world’s second-largest natural gas supplier and third-largest crude oil producer, Russia has proven that it can inflict major pain on Western economies.

I believe it’s keeping this Ace card close to its chest.

Getting ready to play its hand in a way that inflicts maximum pain on the one President he truly loathes.

If Putin wants to inflict maximum damage to Biden’s re-election ambitions, he’ll likely do it just before the US election in November this year.

You’ll want to own the stock I’ve just greenlit well before that situation plays out.

Last Oil Boom Driver #3

US emergency reserves remain

at dangerously low levels

You may have heard about the US Strategic Petroleum Reserves (SPR).

It consists of natural underground salt caverns along the Gulf Coast of Texas and Louisiana and can store hundreds of millions of barrels of crude oil.

This was established in the 1970s in response to Middle East oil embargoes.

In 2021, Biden ordered the release of oil from the SPR to tackle rising fuel prices.

But that drawdown was far more aggressive after Russia attacked Ukraine in 2022.

Since then, SPR stocks have remained historically low, at around 364 million barrels.

According to a US government website, the salt caverns have a capacity of 714 million barrels.

That leaves an emergency reserve of about 50%.

Past performance is not a reliable guide to future results.

That certainly doesn’t sound like a critically low level, but according to the International Energy Agency (IEA), the US economy uses around 20 million barrels per day.

In other words, the US holds just 18 days’ worth of spare capacity.

These are just three drivers behind what I see as an epic...and potentially final...oil and gas boom in the making.

There are many more factors at play that I won’t go into here.

So, let’s just do a simple

breakdown of facts:

- The oil price is steadily rising, and has been for the last year.

- A lack of exploration and development could deliver long-term upward price pressure for certain well-positioned oil and gas stocks. About 97% of the oil produced today was discovered in the 20th century.

- Geopolitical shocks could create even greater upward price pressure. A huge one could come if Putin decides to use his Oil Weapon around the time of this year’s US election. The world’s most important commodity remains more vulnerable to disruption than ever before.

- Replacements for oil are years, if not DECADES away from coming online. ‘We’re in a situation now where in a couple of years’ time we’re going to be very short on supply,’ Occidental CEO Vicki Hollub just told CNBC.

To me, it’s an absolute cut-and-dry case for getting exposure to certain oil stocks now, while the crowd still doesn’t realise what’s about to happen.

We are in a wider commodities resurgence.

The oil and gas sector has yet to fully take off.

I think that’s going to happen, soon.

So what’s the stock I’ve landed on to best take advantage?

Declassifying

CODENAME: LAST BARREL

OK, so I’m going to be frank with you here.

I’m NOT going to unveil this stock name in the final pages of this open-forum report.

This might seem annoying, but it’s for good reason.

And there’s just one simple step you can take to get the name and full results of my investigation on them.

I WILL give you some broad basics on what these guys are about to tap into from their drillholes in a second.

But I’m going to hold back specifics right here.

I know. You just want the stock name. But stay with me.

There are reasons I’m being a bit coy about it.

With this special recommendation...there are factors in play that mean putting their name out in a public forum with 100,000+ potential viewers is not a smart move.

Primarily...

This is a company with a proven record of bringing new oilfields online...relatively quickly and on-budget.

There are actually very few oil explorer-producers in the world that can do that.

The outfits that CAN will be the leaders in the last oil boom.

At the time of writing, these guys have a pivotal exploration program finally in motion.

I’m not going to say where.

But it’s not Australia.

It’s in an area of water where the oil super-majors are currently BETTING BIG.

For instance, Petrobras just uncovered an 8 billion barrel well there. Enough to meet three months of global demand.

The Australian-listed stock I’m backing is a small disruptor in the region.

It only went public with its latest drill intentions earlier this year in 2024.

So, this story is VERY NEW.

Another reason I don’t want to splurge out the stock name in a web-page that anyone can access.

In this environment, markets can get way too excited when new drill programs like this get underway.

But...touch wood...

The market doesn’t seem to have noticed the near-term discovery upside that I see coming from this stock.

In fact, at the time of writing, the share price is DOWN -16% in the last month.

THAT, TO ME, SHOWS THE CAT’S NOT YET FULLY OUT OF THE BAG.

And I want to keep it that way...

We’re not talking about a SUPER-small cap here.

But it’s not a well-known player either.

Certainly not a major oil blue chip.

In fact, you’d be stretching it to call them a mid-cap.

However...

Trading volume is low enough right now that a huge influx of part-time retail investors buying all at once over a few days could definitely distort the price.

That’s a real possibility if I release the name to all-and-sundry in the public domain here.

I want to let the story run its natural course over the next few months, in the lead-up to the American election.

And not artificially impact the price, even in the near term.

So...

I’ve packaged up everything I’ve found on these guys in a new report called ‘Investing in the Final Oil Boom’.

This will only be made available to members of my resource stock advisory, Diggers and Drillers.

This will only be made available to members of my resource stock advisory, Diggers and Drillers.

Don’t worry.

You can join now for a VERY small membership fee.

And...

If you wish, you can have that fee refunded back to you within the first 30 days.

So, effectively, you could take out a Diggers and Drillers membership...read ‘Investing in the Final Oil Boom’...discover the stock...and still get that small membership fee back in your wallet.

I’ll tell you now, though.

Very few people do that. Less than 6% of new members go for the quick refund option.

This is among the lowest refund rates of all of Fat Tail Investment Research’s services.

I’d like to think that’s because of the quality of my research.

There’s no comparable advisory on the market I’m aware of where an actual mining exploration specialist puts his experience into stock selection.

I’d ALSO like to think MOST people aren’t ratbags who get off on gaming the system!

Subscribing, getting the stock name, then getting the refund.

So, I’ve made this very simple.

To get ‘Investing in the Final Oil Boom’ all you need to do is give Diggers and Drillers a try.

With a 30-day full refund backstop.

YOU CAN DO SO BY

CLICKING HERE

It may seem a little mean keeping details on this play for my members only.

But, like I say, there is a very good rationale behind it.

Usually, in these presentations, we give at least a few key details away.

What that can lead to is people doing a bit of sleuthing and dot-joining...and finding the name based on the clues.

Believe it or not, there’s a cottage industry in deciphering tips from independent financial publishers like ourselves.

You might have come across an outfit called Stock Gumshoe.

They don’t do any independent research themselves.

They snoop out what stock is actually being teased. And reveal how it may not be such a good stock pick after all.

In a free market, it’s fine to have outlets like this.

I hesitate to call them financial publishing vultures. There are some smart cookies at Stock Gumshoe.

So smart, they may even be able to puzzle out this stock from the few details I’m about to share with you.

And, to be fair, it keeps us newsletter writers on our toes.

But...

What it CAN do is artificially affect the share prices of the very small companies we’re targeting.

I REALLY don’t want to do that

with THIS particular stock

On a personal level, it would be a disservice to the people who pay for my analysis.

But on an opportunity-level...

I would prefer these guys stay under the radar at least until US election time in November.

So, I’m going to share very few details right now.

Other than...

- It’s an ASX-listed oil and gas company that transitioned from a greenfield explorer to a significant oil producer during the pandemic.

- It boasts an impressive portfolio of deepwater assets in a VERY key basin...ranging from production to early-stage development and exploration.

- It has proven discovery ability and technical expertise that I believe give it a head-start in the race to pump that ‘last barrel’.

- It brought two new oilfields online, and on-budget, last year.

- And, critically, its production is on a steep upward climb. That is VERY rare at the moment. Barrels pumped jumped 52% in the last financial year.

That’s all I’m saying here.

I’ve probably already given too much away!

To acess ‘Investing in the Final Oil Boom’,

simply click through to this secure order form

James Cooper

So, who am I?

What is Diggers and Drillers?

And what else will you get if you become a member today?

Well, the aim of this advisory is simple.

To get you into the right companies...at discounted prices...before everyone else cottons onto the fact we are now in a new, broad boom in resource stocks.

Like I say, my name is James Cooper.

I’m a former exploration geologist with experience in massive discoveries and multibillion-dollar takeovers...soul-crushing failures and delistings...and everything in between.

James with his field crew undertaking

remote exploration in the Zambian bush

I’ve managed rigs and field crews across the world. I’ve looked for copper in Zambia for Equinox Minerals. And I was right at the heart of it when Barrick Gold came in in 2011 and bought out Equinox for a staggering $7.5 billion.

The crux of it is:

If you’re going to search out the miners with the best chance of hitting it big in the NEXT cycle...you need an actual ore hunter with these credentials as your guide.

Not a hack or a keyboard ‘expert’.

James at a mobile exploration camp in Zambia.

Office tent in the background.

You need a guy who knows how to dig into actual dirt just as well as balance sheets.

I know through experience how hard it is to make these finds.

Right now, I’m seeing direct evidence of resource companies starting to frantically sift through old drill cores...in the hope of finding a strike in critical metals.

Because I can tell you now...

This boom is NOT just about oil...

Many exploration geologists have spent careers spanning 40-plus years...unable to make a single find that led to the development of a mine.

This is not due to a lack of skill or knowledge either.

It is based squarely on the issue that viable bodies of ore, as well as oil and gas fields, are becoming increasingly harder to find.

This is happening at a time when exploration has suffered from critical underinvestment for more than a decade.

We are entering a new ‘Age of Scarcity’ for critical resources. Oil being just one of many.

And remember, I’m not a resource stock journalist or hobby pundit.

I’ve been right in the thick of it.

Through the pandemic I was with gold mining behemoth Northern Star.

In 2021, I was headhunted to be Dacian’s Senior Exploration Geologist...in charge of the company’s growth in rare earth projects.

What you’ll discover in ‘Investing in the Final Oil Boom’

is based on EXACTLY what I’m seeing and hearing

at this very moment

Australia’s last mining boom revolved around a steel-intensive economic transformation taking place in China...and, to a lesser extent, other emerging Asian countries.

We think this next one is going to be bigger.

What I call CRITICALLY ENDANGERED METALS are going to be a big part of it, as well as energy companies.

Critical metals stocks are the iron ore developers from 2003.

Sitting at the precipice of a major upward leg in the commodity cycle — yet hobbled by enormous cost of capital required to get projects underway.

Just like it did with iron ore in the early 2000s, expect downbeat sentiment to shift rapidly in line with rising prices.

This is how commodity cycles work. This is how inconceivable capex finds its way into new projects.

The world’s biggest insiders are moving.

But we’re in a pocket where the stock prices of many great projects...just like my latest oil play...AREN’T YET MOVING.

I don’t think that will last long.

The time to buy is now.

This next boom is not just a China story.

It’ll involve almost every country and every supply chain in the world.

For instance, there’s a company I’m dubbing ‘The Next Potential Aussie Mining Disruptor’.

This very obscure company appears to have read the tea leaves just as Andrew Forrest did with Fortescue Metals 20 years ago.

It’s spotted what’s likely coming with titanium.

It’s advanced its exploration well before the majors.

And it could be about to shock the world by joining a very exclusive club, almost overnight...

This kind of disruption only ever takes place inside a small window of time.

You will ALSO get access to ‘The Next Potential Aussie Mining Disruptor’ if you take out a Diggers and Diggers membership right now.

CLICK HERE TO JOIN

When Forrest mapped out his iron ore plan on a kitchen table in 2003...he didn’t mess around.

The goal was to tear down the entire status quo.

Not just join the game.

RUN it.

Forrest grew up in the remote Pilbara region in Western Australia. A region dominated by the complacent duopoly of BHP Billiton and Rio Tinto.

He ended up achieving the seemingly impossible: gatecrashing that party and creating ‘Australia’s third force’ in iron ore.

In just a couple of years, Forrest had expanded 100 times over, massively overtaking the tenements of both Rio and BHP combined.

Now, it’s unlikely you’ll ever see a rise with that kind of velocity in our lifetimes. We’re in no way saying the stock I’m zeroing in on here is a direct comparison in 2024.

From zero to $25 a share is a one-in-a-million.

But here’s what’s clear...

The resource cycle stars are aligning once more here in Australia.

We have the exact type of fertile conditions that fuelled Fortescue’s rise.

A new mega-theme (the energy transition).

A new super-squeeze (titanium and several other critical metals).

A new set of geopolitical headaches and supply chain problems.

Rapidly rising growth in places like India, Mexico and Southeast Asia.

A preoccupation with tech stocks that has left miners deeply undervalued.

And...underlying it all...just like in 2003...an exploration industry that’s unprepared for the new cycle.

15 years of underinvestment in mines and drill rigs. Mothballed projects. Not enough geologists. And massive capital costs in getting new projects cranking.

These are PRIME conditions

for a NEW disruptor

You can get both reports on both stocks simply by becoming a member of our Diggers and Drillers advisory.

It’s very reasonably priced.

$199 per year is the official subscription for full access to my intel and recommendations.

BUT...

To mark the urgency of the stock opportunity, we’re slashing that by half.

IF YOU CLICK THIS LINK NOW…YOU CAN LOCK IN A 12-MONTH SUBSCRIPTION FOR JUST $99.

And that crazy-low price is covered by a 30-day subscription refund guarantee.

Meaning, you can read ‘Investing in the Final Oil Boom’...

AND

‘The Next Potential Aussie Mining Disruptor’...

For a $99 outlay.

...and STILL choose to get a full refund of your membership fee within 30 days if you so desire.

...and STILL choose to get a full refund of your membership fee within 30 days if you so desire.

Look around. There are not many players in this game that swallow a subscription risk like that.

Recommendations like these tend to get locked right behind a paywall without any remote possibility of a refund.

I don’t think you’ll refund though.

Once you read my stuff, study my insights, and start tracking the recommendations, you’d have to be crazy not to stick around!

But that’ll be your choice.

If you DO stick around...

here’s the Diggers and Drillers

game plan...

So, simple premise here.

We’re entering a Second Age in Australian mining.

It’ll be based around a new, expanded set of resources.

The wheels are already moving.

And it’s going to be based on a transition shift from ‘abundance’ to ‘scarcity’.

Chronic underinvestment in mines worldwide is presenting you with a very contrarian opportunity; one that only crops up to the smart investor every 20 years or so — if you’re lucky.

There are massive discounts in the resource sector on offer right now.

The aim of Diggers and Drillers is to help you find them.

We’re on the cusp of a trend that could send certain resource stocks much higher in 2025.

Even if the wider equities markets go nowhere.

It’ll make certain stocks ‘break away’ from the wider indices in a spectacular fashion.

You just need to own the right ones.

We believe it’s the only game in town if you’re going to be involved in the markets over the next few years.

This is still going to be highly risky.

Just as speculating on the early oil and mining booms was in 2003/04.

There were no guarantees you’d make money then...and there are none here.

But if you’re one of the lucky ones who have capital to play around with...and that you can afford to lose...then we firmly believe this is the best place for it over the next year or two.

Which brings me to another resource you’ll get instant access to if you become a member today...

Four Prime

Age of Scarcity

Stocks to Own

‘Investing in the Final Oil Boom’ and ‘The Next Potential Aussie Mining Disruptor’ represent my two primary plays at the moment.

There are a few more you need to know about.

In ‘Four Prime Age of Scarcity Stocks to Own’, I give you blanket coverage on four key scarcity areas and four mining companies I reckon are best positioned to nail them in the coming years.

In ‘Four Prime Age of Scarcity Stocks to Own’, I give you blanket coverage on four key scarcity areas and four mining companies I reckon are best positioned to nail them in the coming years.

Without trying to make this sound like a Year 10 Science class...there are some bizarre-sounding metals now shaping future investment in mining.

Without trying to make this sound like a Year 10 Science class...there are some bizarre-sounding metals now shaping future investment in mining.

There’s promethium...a healer and a weapon.

This element is a critical component for making pacemakers, but it’s also used for building self-guided missiles in defense.

Or niobium...scientists have capitalised on its unique ‘superconducting’ properties allowing them to develop new kinds of superfast, highly energy-efficient large-scale computing...without the need for semiconductors.

Or there’s zirconium...a key metal used for cladding nuclear reactor fuel cells.

The potential for critical metals is endless...the only limitation is SUPPLY.

But this is not just an oil or critical metals story.

The Age of Scarcity is going to involve the old-guard resources as well: nickel, aluminium, and copper...and you’ve seen what’s been going on there recently.

‘Four Prime Age of Scarcity Stocks to Own’ puts you into what I see as four of the best resource stock speculations on the planet right now.

- PLAY #1 IS ‘ONE OF THE BEST SCARCITY STORIES ON ANY LISTED MARKET’. This was a contender for The Next Potential Aussie Mining Disruptor...but was ruled out because it’s not listed on the ASX. Instead, you’ll find this company on the world’s largest exchange for junior mining stocks, the Toronto Stock Exchange in Canada. This company is looking to develop one of the biggest deposits of copper. Recent drilling has hit upon over 1,000 metres of mineralisation. Truly staggering.

- PLAY #2 IS A $400 MILLION PILBARA DOMINATOR. The Pilbara is about to undergo an Age of Scarcity upgrade. The region is increasingly coming up with new base metal and lithium discoveries. Once thought of as a giant slab of iron ore...it’s now seen as a richly endowed mineral province which will only increase investment in the region, create more competition for land holdings, and attract a wider spectrum of investors. This company is my prime pick to dominate the space. It covers copper, zinc, and silver.

- PLAY #3 IS A SUB-40-CENT STOCK WITH PLANS TO OPEN UP THE WORLD’S SECOND-LARGEST GRAPHITE RESERVE. And it’s a PROVEN reserve. Why the hell’s this stock still only trading so cheap then? You’ll need to download the report to find out. But, again, it’s going to become a unique non-Chinese processing option for graphite in the scarcity years ahead.

- PLAY #4 IS BUILDING THE WORLD'S LARGEST PROCESSING FACILITY FOR ANOTHER SUPER-SQUEEZE METAL. I doubt you've even heard of this metal (let alone this stock). It's that rare. But it's going to be like gold dust for the big tech firms and the EV market in the coming decade. Not only is this little ASX stock building a mega-factory in Queensland to handle production...it's breaking ground by uncovering a new way to purify this critical metal. An absolute MUST-BUY.

The ground held by this company has become the hottest place on Earth for copper discovery. The company is tapping into a geological freak of nature known as ‘porphyries.’ These rich motherlodes contain huge amounts of copper, but also silver and gold. That makes them a multi-commodity powerhouse leveraged to the critical metal theme and surging interest in precious metals.

A lot of graphite stocks could be about to break out of their multiyear sideways lows. Get my intel on this stock and you’ll see why...

Look, if you take just one thing away from this presentation...please make it this...

The Age of Abundance is over.

The Age of Scarcity has dawned.

I don’t need to bombard you with more evidence.

It’s all around you.

A report from ABB Motion, entitled ‘Circularity: No Time to Waste,’ reveals that a staggering 91% of industrial businesses are feeling the effects of resource scarcity.

This is not a fleeting thing.

As Umair Haque puts it in Medium:

‘Everything is now changing.

‘Suddenly, catastrophically...’

That’s a bit doomy.

But Diggers and Drillers is a defiantly positive advisory.

As Medium goes on to say:

‘It is a Big Deal — as big as the Industrial Revolution before it.’

The Industrial Revolution made generational wealth for those who played it correctly.

The Age of Scarcity will too.

Especially for those lucky enough to be sitting on the things that are about to become scarce...

This is what you’ll get if you join us right now.

But all that will be just for starters.

This boom is only just beginning.

Join us now and we’ll give you a roadmap for playing it.

$199 a year normally.

$99 today.

And with a full 30-day refund guarantee.