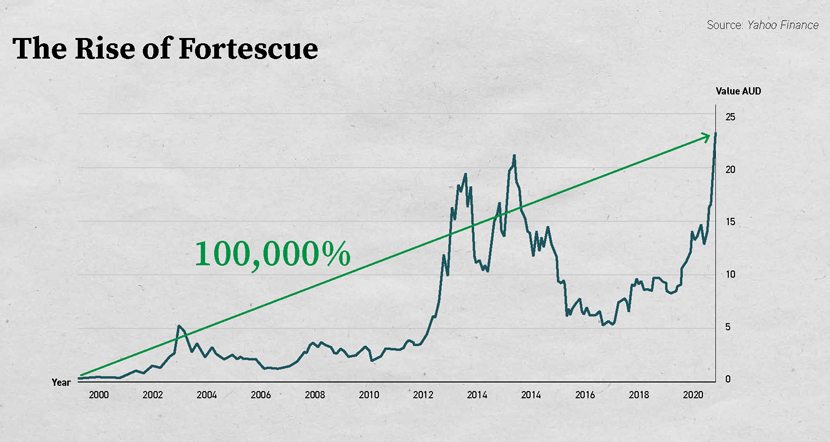

Can anyone repeat Fortescue’s iconic early 2000s rise?

It’s a tall order.

The last mining booms’ superstar turned 2 cents-a-share into $10 in the first five years.

A 50,000% return.

Two decades later, that 2-cent share is worth $20.

Around 100,000% gains.

That’s nuts. So let’s be real.

Fortescue’s rise was an outlier for the history books.

‘The most remarkable self-made business success story of this century,’ as the Australian Fin Review puts it.

But what I want to show you today, is that Fortescue’s story is actually a guiding light for you in 2025…

Andrew ‘Twiggy’ Forrest correctly picked…before anyone…the biggest mining mega-theme of the 2000s:

China’s voracious appetite for steel.

He predicted it. He cornered it. He NAILED IT.

And became Australia’s richest man off the back of it.

Now…a new mega-theme is building.

And a NEW crew of mining renegades are vying to stake it out.

Quietly…drowned out by the noise of AI and tech…certain mining stocks are starting to rise…

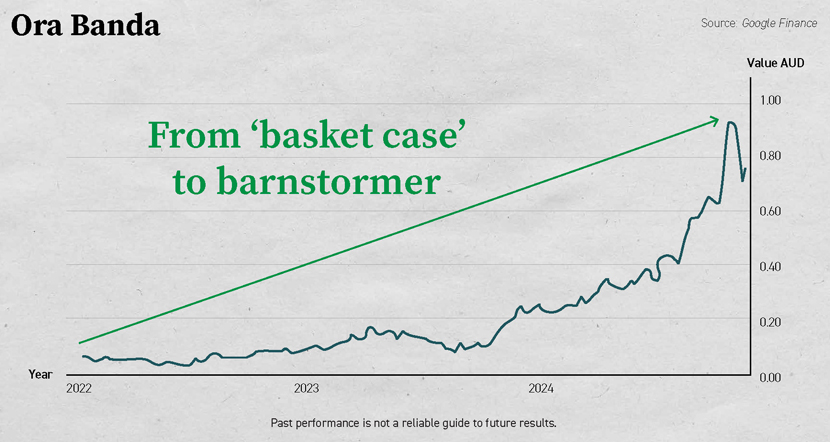

Take Ora Banda…

In mid-2022, this ASX stock traded for only 3 cents a share…

It was losing $4 million a month…and some in the media called it a ‘basket case’.

Well, that ‘basket case’ just hit a high of 96 cents…

A 3,100% gain within three years.

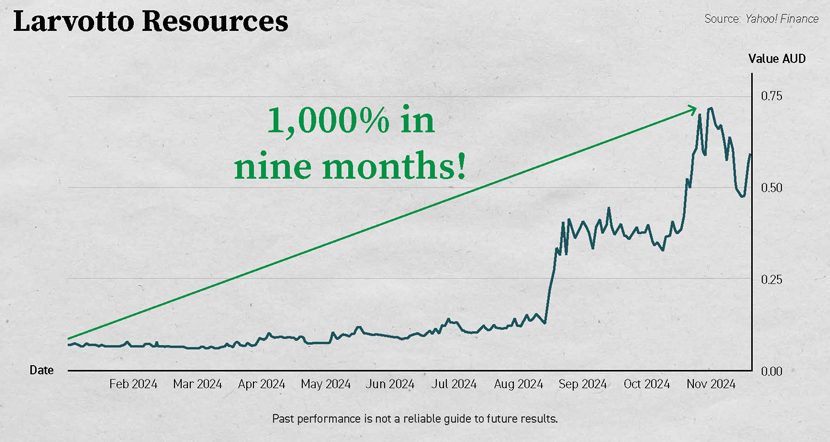

Or how about an explorer called Larvotto Resources…

A market cap of just $220 million.

6 cents in February 2024.

69 cents by October.

Over 1,000% in under nine months.

It’s around 55 cents now.

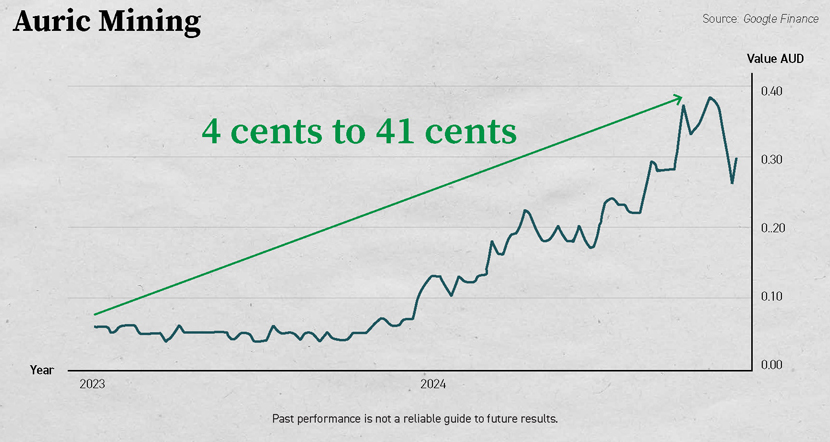

Another company called Auric Mining just released a bunch of great results from one of its projects.

In 2023, you could buy their shares for 4 cents each.

By November 2024, they’d hit 41 cents…

That’s a 925% gain.

Osmond Resources keeps hitting paydirt in South Australia and Western Victoria.

Shares were 7 cents last August.

They were worth 50 cents by November.

A 614% gain in three short months.

James Bay Minerals has been looking for lithium out in Quebec.

Their shares shot up from 10 cents to 70 cents — a 600% gain in just TWO MONTHS.

And since then, they’ve stabilised at around 50 cents.

Now, these are not representative of ALL mining stocks.

They’re a unique bunch, focusing on a specific set of minerals.

Iron ore explorers, for instance, had a nightmare 2024 — in line with the falling iron ore price.

Out of 42 iron ore stocks, only five were positive by the end of the year.

Some, like Hawsons Iron, fell as much as 93% from their all-time high.

I say this to make two important points.

- Mining stocks are inherently risky. They’re volatile and exposed to resource price plunges. So, you need to tread carefully. And…

- Right now, Australia has TWO mining industries operating in tandem.

The old school, iron ore-based one that drove the last boom.

That’s winding down and struggling.

And a whole different set of explorers and producers…

…focussing on the minerals of the future.

These guys are just starting to ramp up.

And it’s THIS emerging boom we’re about to focus on…

This new breed of miner is ‘decoupling’ from global share markets. Just as iron ore juniors and producers did 20 years ago.

This resurgence has gone largely ignored.

Now, what’s the reason for that?

Back in 2003, Andrew Forrest saw what was about to happen with iron ore. And looked to break the monopoly of a sector dominated by mining giants Rio Tinto and BHP.

Well…as a new boom in the most in-demand area of the Australian resources sector bubbles up…

One of Australia’s most battle-hardened exploration geologists believes there are a number of small…widely unheard-of ‘disruptors’…with a similar Fortescue vision.

One stock in particular shows many of the traits and ambition and foresight that Forrest had in the early 2000s.

It has a market cap of $450 million.

And a gameplan that’s addressing many of the same challenges Fortescue Metals Group faced back in the 2000s.

This small company is about to unlock a very big deposit of a critical metal…the largest of its kind IN THE WORLD.

Its potential has arrived from nowhere, busting into ‘Tier 1’ status and attracting mining behemoths…including Rio Tinto.

This has all the makings of a classic rags to riches story.

Now, of course, it’s NOT the same story as Fortescue’s.

And we are in no way saying this stock will emulate that historic rise.

It’s rare to see a single company change the game like Fortescue did 20 years ago.

But this near-producer could do it.

They hold a large chunk of the world’s reserves of certain critical metals…within a single deposit.

That’s what you’re buying into with these guys. We’ll get to them soon…

Point is…

If you sense a resurgence in Aussie mining…

…and want to make some very early, very speculative, but very smart stock moves to play it…

…then read on to discover WHO MIGHT RULE Australian Mining Boom 2.0…

Now, ‘What mining boom?’ you might ask.

Well, to the casual observer, there’s a lot of mixed messages when it comes to Aussie resources right now.

The gold price, after firing for most of 2024, has cooled off.

Copper has calmed down, too — for the moment.

And iron ore is still in the hole.

The bellwethers…BHP, Rio Tinto, and yes…Fortescue…all those share prices are down in the last year.

So, how exactly does that translate into a new mining boom?

Well, as I said, Australia now has TWO mining industries that have split off from each other.

The old school one, which I just mentioned.

And the future-facing one…centred around critical metals…rare earths…and green energy…

We’re about to talk about which stocks could be emerging to dominate this arena in 2025 and 2026.

And one particular stock we believe is about to graduate into the big leagues…

As I just mentioned, the big miners are down recently…

While in the last year, the ASX Info Tech index is UP 60%.

On the surface that says:

Keep buying tech stocks!

And keep ignoring mining stocks!

That’s what the dumb crowd will keep doing for the foreseeable future.

But that’s a mistake.

Something entirely new, and very exciting is brewing in the deserts of Western and Northern Australia…

We anticipate resource shortages in certain critical metals are going to ramp up in 2025.

A great example is one called antimony.

It’s a vital mineral for the military and tech industries.

And it’s facing serious supply shortages right now, as Chinese export restrictions drive prices to unprecedented highs.

Now, picture that scenario…but on a much wider scale, and with a bunch of different resources…

Including some resources you haven’t even have heard of!

That’s what we see coming in the next few years.

And that’s what certain Aussie explorers and near-producers are gearing up for in 2025.

But where is the smart money focusing?

‘When we talk about watching insiders, I mean the big players in industry,’ reports Mining.com.

‘That is, the directors of multi-billion-dollar companies, mining magnates and executives from investment banks tied up in mega-deals that shake the industry.’

And right now…

‘The biggest (insider) breadcrumbs lead to critical metals…’

The same motley characters who amassed riches in the last mining boom are mysteriously popping up again…

…getting appointed as non-exec directors on the next wave of explorers.

The mainstream narrative remains ambivalent on critical metals stocks.

But the world’s most liquid insiders continue to build exposure.

That includes mining tycoons like the one we’ve already talked about, Andrew Forrest. But also Gina Rinehart and Robert Friedland.

These heavyweights are GOING LONG on the critical metals mega-theme.

Why?

Well, as our inside man who you’ll meet shortly tells us:

‘These guys are just as adept at mining the stock market as mining ore. And they’re setting up to do it all over again...’

And he’s not the only one who thinks this, by the way…

‘The years ahead will be like the mining boom on steroids’, predicts Peter Milne in The Sydney Morning Herald.

There are certain times in the market where fortune favours the clear-sighted and the brave.

We reckon this is one of them.

Because…here at Fat Tail Investment Research…there’s a distinct sense of déjà-vu in the air…

Two decades ago — when our independent stock-picking business was just a single newsletter sent out by post — Australia’s LAST mining boom was also in its infancy.

Addressing our very first readers, we called it ‘The Big Dig’.

We covered it as it crested…finally went mainstream…and then supersonic. And in those pioneer days we didn’t mince words…

‘A giant exploration and production rush is about to hit Australia, the likes of which have not been seen in 25 years.’

Our prediction seems obvious in retrospect.

Trust me, most scoffed at it, at the time we made it.

The Australian mining boom that peaked in 2011 came on SO fast…and SO hard…it blindsided even the veterans.

‘The word “boom” is a misnomer’, a shocked Rio Tinto CEO said at the time.

‘I don’t know what the right word is — maybe it’s a paradigm shift.’

Whatever it was…while the rest of the world got smacked by a credit crisis…the first ‘Big Dig’ created a recession ‘force field’ around Australia.

National wealth grew exponentially.

Sadly, for the average Aussie, the boom years did little more than change the morning newspaper headlines.

HOWEVER…

Some non-professional investors…with the smarts to own the right stocks early…made colossal wealth.

For a brief time, it was a speculator’s paradise.

China’s huge appetite for minerals was a tide that lifted all boats.

High grade, low grade, long mine life, short mine life…it really didn’t matter.

Any company with a decent possibility of going into some form of production benefited.

As did those who owned the stocks before everyone else.

But just ONE company can lay claim to TOTALLY OWNING this First Age in modern Aussie mining:

Fortescue Metals Group.

Their rise from ‘penny dreadful’ to one of the biggest miners on the planet…in less than five years…was SOME story…

…a tale of towering ambition...brilliant forecasting...consummate salesmanship…burnt bridges, missteps, and misfires…

…then, ultimately, UTTERLY IMMENSE share price gains.

It’s unrealistic to expect any stock to repeat that performance.

But 21 years later — on the cusp of a SECOND big Australian dig…

…there are a set of up-and-comers…and one stock in particular…who are looking to corner the critical metals scene…

…using similar tactics to the ones Andrew Forrest employed to challenge Rio Tinto and BHP dominance in the 2000s.

We’ll showcase those stocks in just a moment.

But first, allow me to introduce myself…

James Woodburn

My name is James Woodburn, and I head up a company called Fat Tail Investment Research.

We came into the Australian financial advice scene in the 2000s.

And set about disrupting it in much the same way Andrew Forrest was upending mining around the same time.

Our motto was and is: BUGGER THE ESTABLISHMENT.

Independence is true strength when it comes to financial guidance.

Now, we’re not tied to any bank, brokerage, financial institution, listed company, shareholders, industry, old boys club or major media organisation.

Meaning we could arrive and tell you EXACTLY how to play the last mining boom as we saw it...in a completely unbiased, no-strings-attached way.

We did it fairly effectively the first time.

Although we NEVER got our readers into Fortescue — the best time to buy was several years before we arrived.

In that sense, it was our white whale.

In 2025, we seek to make up for that ‘big one we missed’...We’re about to introduce you

to a set of FOUR stocks

We think there’s a strong case for buying ALL of them, right now, at their current prices.

One, in particular though, is extra-special.

We have dubbed this little-known company ‘The Next Potential Aussie Mining Disruptor’.

For reasons that will become apparent soon.

There was a headline that The Age put out in July 2003:

‘Andrew Forrest has a grand $1.2bn plan for tiny Perth mining company.’

If you don’t remember, this was a super-volatile time in markets — and the world generally.

September 11 was still fresh. The US was ramping up multiple wars.

We had crazy geopolitical risks.

The Internet (like AI today) was this weird new thing we’d known about for a while…but was now finally disrupting everything.

Gold was making new highs.

Sound familiar?

Back then, Fortescue Metals was little more than a light bulb above Andrew Forrest’s head.

What Forrest saw in the early 2000s was a ‘super-squeeze’ in iron ore and base metal prices.

A ‘super-squeeze’ is when the prices of certain resources go up…not just because of demand…but also because of supply constraints.

In 2025 and 2026, another

‘super-squeeze’ is forming…

Only this time, it’s not iron ore.

Only this time, it’s not iron ore.

It’s in what our exploration geologist expert calls ‘critically endangered metals’.

Now, remember that phrase. I’m talking about…

Aluminium, Copper, Cobalt, Nickel, Lithium, Palladium Platinum, Silver and Rare Earths and more.

FX Empire puts it down to ‘the perfect storm of geopolitics, climate change and energy transition.’

But how do you best take advantage as an everyday Aussie investor?

Well, you try and buy the right shares.

Early.

Before most people cotton on to this trend.

Just like back in the 2000s, Australian mining stocks remain undervalued.

THIS is your ‘in’.

It’s these stocks you should be honing in on while they’re still criminally cheap. Basically, 2025 is like 2005:

A resource super-cycle

Groundhog Day

If you remember, it was the MINERS…NOT tech companies…that lifted the Aussie stock market in the early 2000s...

Helping the ASX 200 post a 150% gain from the dot com lows.

At the height of the last super-cycle, our market was the toast of all the indices.

But smart, private investors who speculated on the right stocks early…were the ones who REALLY benefited.

You saw what Fortescue did.

But even the blue-chip miners Twiggy set about disrupting grew exponentially.

If you owned BHP Group at the right time, you made more than 500%:

That wasn’t punting on a tiny small cap. That was from a massive blue chip!

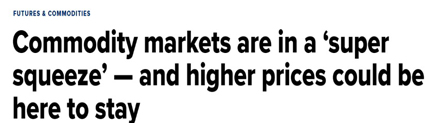

Another large-cap play was Lynas Rare Earths, which socked away a massive 1,200% within a short burst later in the boom cycle:

Of course, not every producer saw huge price rises in the last mining boom.

Coal baron Nathan Tinkler famously lost his fortune when coal prices collapsed.

Point is...

...it tends to be ONLY ultra-boom times where you see blue-chip stocks clocking gains akin to a small-cap growth company.

That hardly ever happens, in any industry. But it DID happen for many of the large mining producers in the last cycle.

If you took a punt on the right SLIGHTLY SMALLER companies...many of them BECAME blue chips WHILE you owned the shares...before your very eyes...

Fortescue Metals Group is a prime example.

My point is all this arose out of the exact market conditions we have RIGHT NOW...

History is rhyming.

And we think you should be buying.

But not just any old mining stock...

This time round...our competitive advantage will look much different.

China will still be a huge player, no doubt. But perhaps not in the way you would think...

We are entering a new kind of commodities boom. A ‘Second Age’.

Now, the last one was driven by demand.

This one...as we’re going to clearly show you...is going to be all about SUPPLY.

Specifically, lack of it.

For the moment, governments have convinced the public that the supply shortages of key strategic commodities are a temporary dilemma.

And it’ll sort itself out.

It won’t.

And just like the early 2000s, few people grasp that we’re entering a new age...

The Age of Scarcity is dawning

If you can JUST GET this idea now.

Just like Twiggy did 20 years ago...

And make the right moves — moves we’re going to suggest to you shortly — you could do just as well as some early resource stock investors who came in...in 2002 and 2003.

See...

What governments know — but are not willing to admit — is that the supply of key commodities can’t be turned on at the flick of a switch.

Since the last mining boom, exploration investment has fallen off a cliff.

We’re still relying on major discoveries made 15–20 years ago to maintain our current needs.

Demand for these materials is rapidly outpacing supply.

For example, global demand for rare earths alone is expected to triple within the next 10 years.

And now that Trump is in…trade wars loom, and these supply crunches are only going to get worse.

This is the REAL reason you’re seeing certain parts of the Australian mining industry roar back to life right now.

While Australia...by itself...won’t be able to ‘solve’ the enormous supply crunches that are coming...

A handful of local explorers are about to shift into production...

...just as the issue reaches a tipping point within the next two years.

Owning these companies now could be a very smart move.

Just as happened in 2002 and 2003…you’re going to see investors shift away FROM TECH…and back into certain REAL ASSET stocks.

Resource scarcity, we believe, is about to become the only game in town when it comes to making exponential gains over the next 10 years.

If you want a good shot at speculative gains in the next few years...then you should be buying cheap stocks now that could become much, MUCH more expensive stocks...as this Age of Scarcity plays out.

Because when the next boom DOES kick off...it will be rapid and unexpected by the mainstream...just as it was in 2002 and 2003.

Years of underinvestment means the industry hasn’t been able to deliver additional reserves to meet future demand.

Companies with superior grades and long mine lives are rarely discounted like they are RIGHT NOW.

Few investors have the audacity to press the buy trigger at the moment.

That’s exactly what we’re suggesting you do.

But which stocks?

You’re about to find out...

As I say, our business is called Fat Tail Investment Research. We’re one of Australia’s leading independent publishers of financial and investment research for the self-directed investor.

As our 50,000-plus like-minded followers will attest, we tend to be contrarian.

For over 20 years, we’ve used this approach to help Aussie investors chart a course through various emerging megatrends.

That included the LAST secular resources bull market, which we labelled ‘The Big Dig’.

In late 2022, it became crystal clear to us that a NEW kind of mineral hunt was kicking off.

And so, we went on a

little hunt of our own…

We recruited a seasoned exploration geologist to help us pick the stocks that could massively outperform over the next few years.

It took us over a year to find and attract the right person.

But we carefully spent this time because this will not be a game for amateurs or fly-by-nighters.

It takes years dedicated explorers to find the NEW bodies of minerals that are going to be needed in the next few years.

The guy we recruited has clocked years of geologist ‘walkabout’ in the Outback and in Africa, contracted by both the small explorers and the major players.

He’s poured over everything from copper in Zambia...to helping develop an iron ore project that fed directly into making Toyota Prados and Outlanders.

As a financial publisher, you encounter a lot of guys who talk a good talk.

They’ll write thousands of words about tech breakthroughs and AI stocks...but have never met a software engineer or been in the boardrooms of Silicon Valley.

I knew from experience that this wouldn’t cut it for this new resource stock project.

Which is precisely why we

connected with James Cooper...

James on a geological field trip

in New Zealand

Our Investment Research Director, Greg Canavan, and I realised pretty quickly that with a new ‘scarcity-driven’ boom forming...we needed a SEASONED EXPLORER on our team.

The career of a geologist is a wild ride of adventures, booms, and busts.

James Cooper’s has followed that exact path.

He’s been involved in massive ore discoveries and multibillion-dollar takeovers...soul-crushing failures and delistings...and everything in between.

When he wasn’t managing rigs, soil sampling, or teaching geology at international schools…James was organising field crews in far-flung places…

James with his field crew undertaking

remote exploration in the Zambian bush

You see, there’s a bit of Indiana Jones about him.

For instance, one minute he was having beers with the exploration manager of Equinox Minerals in a Perth bar…several beers in, and he’d signed a contract...boarding a set of five flights to Solwezi in Zambia to look for copper...

James was actually right at the heart of it when Barrick Gold came in and bought out Equinox for a staggering $7.3 billion.

He tells me:

‘While the big major mine companies were not really my cup of tea…

‘It was interesting to see the takeover, then play a role in what was the biggest resource drill-out that ever took place in Africa.’

The crux of it is:

If you’re going to search out the miners with the best chance of hitting it big in the NEXT cycle...you need an actual ore hunter with these credentials as your guide.

Not a hack or a keyboard ‘expert’.

You need a guy who knows how to dig into actual dirt just as well as balance sheets.

James knows through experience how hard it is to make these finds.

James at a mobile exploration camp in Zambia.

Office tent in the background.

Right now, he’s seeing direct evidence of resource companies starting to frantically sift through old drill cores...in the hope of finding a strike in critical metals.

It’s an inexpensive strategy that could gift a company an instant windfall.

But it’s a long shot.

And these small wins won’t be enough to supply the breathtaking level of demand that’s coming...

Many exploration geologists have spent careers spanning 40-plus years...unable to make a single find that led to the development of a mine.

This is not due to a lack of skill or knowledge either.

It is based squarely on the issue that viable bodies of ore, as well as oil and gas fields, are becoming increasingly harder to find.

This is happening at a time when exploration has suffered from critical underinvestment for more than a decade.

‘Perfect storm for commodity prices’ is another cliché. Just like ‘the next Fortescue’.

But, according to James, there is no truer description of what’s coming.

Remember, he’s not a hobby pundit.

He’s been right in the thick of it.

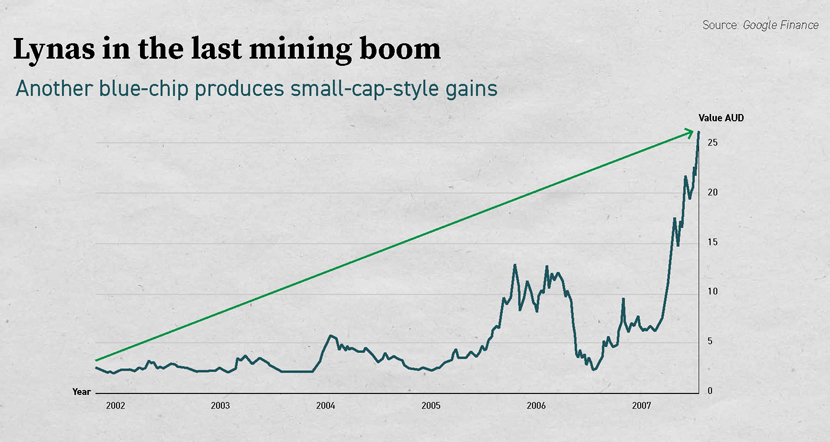

Through the pandemic he was with gold mining behemoth Northern Star.

In 2021, he was headhunted to be Dacian’s Senior Exploration Geologist...in charge of the company’s growth in rare earth projects.

Each stock selection we’re going to show you now is based on EXACTLY what James is seeing and hearing at this very moment

So, James has identified FOUR core players.

Each are first movers in key areas.

Each are trying to define critical resources for the new Age of Scarcity.

Each...James believes with high conviction...has the potential to outperform the wider market significantly in 2025 and 2026.

But...

One in particular has brought our entire office to a standstill...

If you consider buying just one single share to harness the impact of critical supply shortages, it should be a company that we’ve dubbed:

‘The Next Potential

Aussie Mining Disruptor’

Let’s dig into this company now by circling back to Mr Forrest.

‘We took the view in 2003 that China had awakened’,he explained.

In retrospect, this audacious $10 billion bet on a China-driven iron ore boom seems like a no-brainer.

But no one at the time imagined exports of the bulk commodity were about to expand four-fold.

‘On a visit to China I saw how deeply the Chinese respected the iron ore, nickel and cobalt resources, which we in Australia took for granted’, he said.

‘It taught me how serious a resource deficit could be for their country. So, we started with a vision to be a major iron ore player.’

While the two big multinational miners were ignoring the federal government’s pleas to expand production...

A new company called Fortescue was building railways, ports, and mines...and soon hurling millions of tonnes of iron ore at a hungry China...

...while iron ore was TRIPLING in price.

So, here’s our first big reveal...

James is seeing a similar set-up right now. But this time...it’s happening in a poorly-understood segment of the critical metal market.

A niche but hugely important metal.

One where war and geopolitical uncertainty is completely reshuffling the supply chain.

And yet, the coming ‘super-squeeze’ in this metal is getting very little airtime by the mainstream press.

Now, you MAY already know that critical metals are ground zero in the coming scarcity era.

I’m not going to go deep into making that case here.

Suffice to say...

James calls them

critically endangered metals

for good reasons...

With the stroke of a pen, governments across the globe have started to build out a carbon-free, pollution-free, ‘green utopia’.

Whether it’s going to work out for the best is beside the point.

The POINT is this...

There is one KEY factor that environmentalists, leaders, CEOs, and celebrities have left out...

How do we get the critical materials to build this multitrillion-dollar-green dreamland?

Exploration geologists like James were not invited to the Paris or Glasgow Climate Summits.

Because of that...

Policymakers have made a BIG and IGNORANT assumption that resources will just BE AVAILABLE.

Those responsible for actually making them available know better.

Supply of critical metals is not a straightforward process of increasing production...like it is for iron ore mining.

Twiggy had that in his favour. He knew if he could get all his ducks in a row to get to production before everyone else...the ore was there. Heaps of it.

Like I said, we’re not going to go any deeper into the supply crunch case for critical minerals.

But it’s actually much bigger than just the ‘Great Green Energy Transition’.

It’s a scarcity problem for ALL segments of the economy.

A tidal wave of changing technologies means an enormous shift in the types of raw materials needed.

From healthcare to defence to manufacturing, the commercial need for these metals is rising each month.

Right now, China dominates extraction and processing of almost everything needed here.

The latest US Geological Survey report found China as the dominant supplier for no less than 29 critical minerals.

For this reason...

Unease is brewing throughout the developed world.

Non-Chinese manufacturing of EVs, solar panels, iPhones, smart TVs, laptops, and defence technology will come to a standstill should China decide to ramp up its pressure against Western powers.

The very threat of cutting off supplies will send shivers down the spine of major manufacturers.

So what’s the contingency plan for the US or Europe?

Nothing.

China has played a VERY smart long-term game.

And the West may have an enormous price to pay for its stupidity in ignoring the early warning signs.

As resource companies collapsed during the depths of the last commodity downturn, China stepped in and purchased major deposits for pennies on the dollar.

The downturn gifted China an enormous opportunity to dominate global supplies of critical metals.

In 2025 and 2026…we’re going to see what happens when the West is forced to make a charge on to this battleground.

And, if our analysis is correct, one little-known Australian miner could be about to lead it...

Let me explain a bit more how we know this...

James Cooper came directly to Fat Tail Investment Research from his last job as Senior Exploration Geologist for a miner called Dacian...

Look them up. They just had a $75 million takeover bid launched on them from a bigger miner called Genesis.

Dacian was primarily a gold producer. But when James arrived, it was starting to pay attention to the CRITICAL METALS it was finding too.

Dacian was primarily a gold producer. But when James arrived, it was starting to pay attention to the CRITICAL METALS it was finding too.

He and his team spent much of 2021 scouring the mineral-rich grounds surrounding the small Western Australian township of Leonora, around four hours’ drive north of Kalgoorlie.

This, you may know, is right next to the largest, rare earth elements deposit outside of China, Mt Weld. This is operated by Lynas Corp...the big Kahuna player in rare earths.

The Genesis takeover of Dacian is — according to James — just the tip of the iceberg.

A massive transition is about to take place in this part of the Aussie resources sector.

And one single, for-now

unknown player could be about

to take a starring role...

Now here’s the thing.

Very few in the year 2000 guessed iron ore would be the star resource of the coming decade.

And VERY few are focused on the rise of another very important metal in 2025.

Ask most so-called insiders what they think the go-to metals will be in the next few years…and you’ll get the standard answers: cobalt, lithium, nickel, graphite and various rare earth elements.

But one resource…which is NONE of the above…is about to experience the ultimate super-squeeze…

…and virtually no one is paying attention.

Despite that, miners specialising in this metal have started exhibiting some VERY curious price rises.

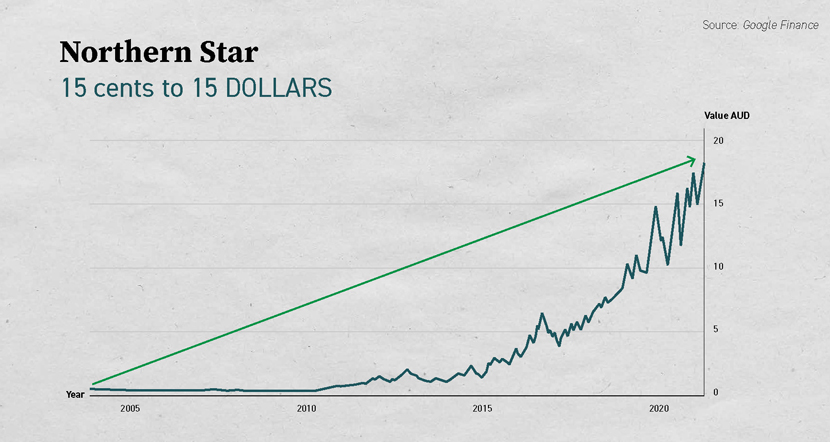

It started in 2023, when a company called Empire Metals announced a ‘globally significant’ strike of this metal.

Their stock price soared 720% in six months…

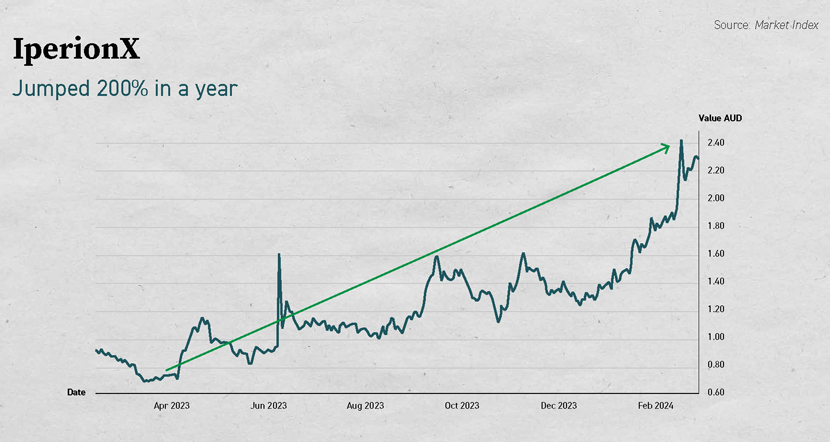

ASX-listed IperionX has developed a new, low-cost way to process this metal for the defense industry. Its shares rose 256% in a year….

CVW CleanTech Inc. developed a new proprietary tech to recover this resource. Over just eight days in 2024 its shares jumped 48%...

Those are just some initial rumblings.

Our pick here, we believe, is actually way ahead of all these guys.

Just like Fortescue…these guys are looking to unlock a truly massive resource to generate DECADES of supply.

Just like Fortescue…they’re targeting a specific supply-squeeze that the market is currently underestimating. In fact, this resource has almost compleletely been left out of the critical metal rush so far.

Just like Fortescue…they’re targeting shallow, flat-lying deposits that are simple to mine…there for the taking…but have previously been ignored because prices have been so low…

Just like Fortescue…it’s an unprofitable company pouring cash it doesn’t have into ONE SINGLE BIG BET.

Now, it goes without saying, there are big risks buying this stock.

In 2003…Fortescue’s revenue was…wait for it…

$980,000.

Not even a million dollars.

By June 2010 that figure was $3 BILLION dollars.

But Fortescue was…by no means…a dead-set buy in 2003.

It looked like a dog of a stock.

Right now, our ‘Next Disruptor’s quarterly report shows a healthy cash balance of just over $31 million.

But that falls well short in terms of what’s needed in development.

So, this is no sure bet.

And it’s not (barring a miracle) going to become a $25 billion revenue generator like Fortescue.

But OUR wager here is they start seeing similar exponential growth…and really quickly.

Why?

It’s sitting in potentially the biggest resource of its kind in the world right now…and just 3 metres below the surface.

But getting it out. Getting the right structures in place. And getting the attention of investors.

None of that is a done deal.

So…you must approach this very small stock with all that in mind.

But the coming global supply crunch for its highly prized critical metal cannot be overstated.

Tension is brewing and shots are already being fired.

What has our ‘Next Potential Aussie Mining Disruptor’ seen forming on the horizon?

Well, Twiggy set his sights on becoming ‘the new force in iron ore.’

These guys are gunning to be:

The New Force in TITANIUM

Now, wait on, you might be thinking.

Titanium the new iron ore?

What am I smoking?

Bear with me.

Because if I’m right…we could be looking at multiple opportunities mirroring certain iron ore players from the early 2000s.

Hardly anyone realises how quickly this poorly-understood metal has become irreplaceable — in lightweight electric vehicles, aircraft structures, medical implants and a whole bunch of military applications.

.

Demand is soaring.

And supplies are drying up.

Titanium shortages are snowballing…and causing major manufacturing disruptions in a bunch of industries.

Aerospace companies, for instance, are having to push back deadlines and cancel deliveries.

Why?

It’s the general critical metal super-squeeze I’ve already mentioned.

Plus, something else…

Right now, Russia dominates supply.

And Ukraine is ALSO one of the largest producers of titanium in the world. Specifically deposits located in the Zaporizhia region.

That’s a big problem! For obvious reasons.

And it’s not going away.

The Russia-Ukraine war has already led to the closure of ports, congestion in shipping routes, container shortages, and increased freight costs.

Then there’s the spectre of Russia using titanium as a geopolitical weapon.

There’s a reason titanium is one of the few Russian exports yet to be sanctioned.

WE NEED IT VERY BADLY.

As the Airbus CEO puts it:

‘We think sanctioning titanium from Russia would be sanctioning ourselves.’

So…for now…

Russian titanium is still flowing into Western hands.

But Russian President Vladimir Putin has just announced Moscow is considering export restrictions on several critical raw materials, including titanium, in response to Western economic sanctions.

Titanium looks like it’s about to be used as a trade weapon in 2025.

When that economic blackmail comes into play…companies sitting on huge deposits outside Russia will become SUPER-important.

SOME smart investors are starting to anticipate the coming titanium super-squeeze. As I just showed you with those recent stock moves.

But for the most part…mainstream finance remains oblivious.

The same was true for the China boom in the very early 2000s.

When Forrest was making his war plans on a kitchen table…lining up Chinese customers who didn’t want to be captive to the three iron ore giants — Brazil's Vale, Rio Tinto and BHP.

So, what’s the play here?

Well, new titanium supplies need to be found outside of Russia.

Very quickly.

This is a process that requires far more infrastructure and technology compared with the relatively straightforward method of processing iron ore.

In summary: Just like with iron ore in the early 2000s, you need a DISRUPTOR...

You need a NEW Twiggy...

and a NEW company...

with a NEW disruptive vision...

There’s a specific no-name company here that has our attention.

It has a bit of a renegade at its helm.

A relatively young guy to lead a mining company…like Forrest was at the time…but with 20 years’ experience down in the dirt of the mining world.

Orchestrating the financing, permitting, development and operation of mining projects in some of the harshest regions on the planet.

This guy knows his stuff.

And he’s making a big play…

- The small explorer we’ve dubbed ‘The Next Potential Aussie Mining Disruptor’ is looking to ‘own’ the titanium scene...just like Fortescue ram-raided the Pilbara in the 2000s...

- They’re aiming to directly attack the two biggest players: Russia and Ukraine. Again, just like Twiggy gazumped BHP and Rio Tinto.

- And they’re not going to be satisfied with just the small crumbs of a big pie. Forget a modest market share of a gargantuan revenue pot — something that 99 out of 100 small-cap miners would be more than happy with. THESE GUYS WANT MORE. Much more. ‘The Next Potential Aussie Mining Disruptor’ is gunning for hyper-dominance: supplying almost the entire supply for Western economies. With advanced exploration in place...once it moves to mining...it will be in a very exclusive club as a dedicated titanium supplier...

- What’s the X-Factor here? What puts these guys way ahead of the other titanium players I mentioned? An absolutely MAMMOTH rutile deposit. Rutile is the highest-grade titanium mineral. And these guys have hit the largest deposit of its kind anywhere in the world. It’s also shallow, making it easy to extract.

And get this…

This disruptor’s ‘largest deposit in the world’ could be about to get EVEN LARGER

Again, we won’t get into the geology weeds here, but titanium is used in everything from defense missiles and aircraft wings…to corrosion prevention in turbine blades.

Ever wondered how those multi-billion offshore wind farms survive out in the elements? Titanium plays a major role.

That means this is not solely about new skyscrapers in China, which pretty much single-handedly fuelled the last boom.

This is global in scope.

Now, it’s important to point out we’re in no way predicting a similar bottom-to-top share price rise to Fortescue Metals Group.

That was...by all accounts...a massive outlier.

$5,000 invested in Fortescue in 2003 was worth around $4.2 MILLION in 2024! That is an absurd gain, and one that almost certainly won’t be replicated.

And there is also significant risk investing in this stock right now.

For one, these guys need to raise capital, just like Fortescue in their early days.

Plus, these guys are based in Africa.

Now, the last mining boom witnessed a plethora of Aussie mining expats working in Africa. James Cooper was one of them. And a large part of his role was training locals in mining and exploration skills.

The region where the deposit is located is very stable.

But not as stable as, say, Western Australia.

So, to summarise: this is no sure thing.

Huge potential rewards. But also, big risks.

THE POINT IS...

In the mire of a very challenging mining market...THESE GUYS...in our opinion...are the one ultra-speculation to rule them all.

OK...

Because we THINK we’ve spotted incredible potential in this play — potential that the wider market has not wised up to...

And because of the small market cap of this company...weighed up against where it could potentially be in three years’ time...you’ll need to take another step to get the full details.

James Cooper has compiled a comprehensive due diligence report on this opportunity.

James Cooper has compiled a comprehensive due diligence report on this opportunity.

It’s called ‘4 Stocks Driving Australia’s NEXT Mining Boom: 2025–2030’.

You can get this report, as part of James’ investment advisory.

And that’s called Diggers and Drillers.

Now, let me quickly explain why I think our James Cooper-helmed Diggers and Drillers is perhaps the most important newsletter you could subscribe to between now and 2030...

Our last mining boom may have been big.

BUT TIMES THAT BY 10...

Diggers and Drillers was actually our company’s first ever newsletter. We established it for the last mining boom. And our call to arms was just as emphatic as this one. As we said at the time...

‘The sheer magnitude of what’s about to take place is incredible.

‘I can honestly say I’ve seen nothing like it. Australia is about to become the commodities centre of the world.’

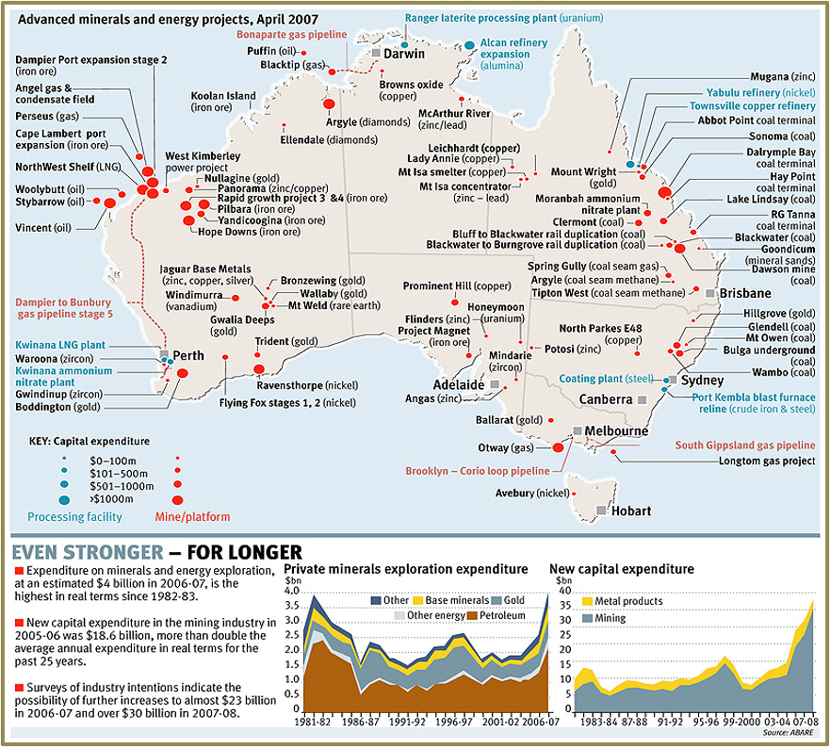

This was the magnitude of those projects by April 2007:

I’m sure you’re aware of the wealth our country and SOME early stock investors made over those boom years.

China had an insatiable appetite for our iron ore.

But that boom, like all booms, wound down.

Mining stocks started correcting...the opportunities began to dry up...and we put Diggers and Drillers on indefinite hiatus.

One of the benefits of being an independent financial research company is we have one remit only: is this research in our readers’ best interests?

We don’t publish newsletters for the sake of it.

We don’t put out a mining stock newsletter just because ‘there’s a bunch of mining stocks on the ASX’.

The timing of the cycle has to be exactly right.

Well, the cycle has turned again. And, as such, in late 2022 we took Diggers and Drillers out of retirement.

The aim of this next-gen 2.0 version is simple:

To get you into the right companies...at

discounted prices...before everyone else

Australia’s last mining boom revolved around a steel-intensive economic transformation taking place in China...and, to a lesser extent, other emerging Asian countries.

We think this next one is going to be bigger.

In a case of history rhyming, critical metal developers sit at the edge of enormous opportunity.

Critical metals stocks are the iron ore developers from 2003.

Sitting at the precipice of a major upward leg in the commodity cycle — yet hobbled by enormous cost of capital required to get projects underway.

Just like it did with iron ore in the early 2000s, expect downbeat sentiment to shift rapidly in line with rising prices.

This is how commodity cycles work. This is how inconceivable capex finds its way into new projects.

The world’s biggest insiders are moving.

But we’re in a pocket where the stock prices of many great projects AREN’T MOVING.

I don’t think that will last for long.

NOW is the time to buy.

This next boom is not just a China story.

It’ll involve almost every country and every supply chain in the world.

The company we’re dubbing ‘The Next Potential Aussie Mining Disruptor’ is our prime, swing-for-the-fences speculation on all this.

As I say, James has spent many years in the field, be it on the side of a dusty drill rig or mapping rock outcrops through remote Australian bush and the African jungles.

He’s seen what’s happening firsthand, and says:

James Cooper

‘This very obscure company appears to have read the tea leaves just as Twiggy did 20 years ago.

‘It’s spotted what’s likely coming with titanium.

‘It’s advanced its exploration well before the majors.

‘And it could be about to shock the world by joining a very exclusive club, almost overnight...’

Now, this kind of disruption only ever takes place inside a small window of time.

When Forrest mapped out his plan on a kitchen table in 2003...he didn’t mess around.

The goal was to tear down the entire status quo.

Not just join the game.

But RUN it.

Forrest grew up in the remote Pilbara region in Western Australia. A region dominated by the complacent duopoly of BHP Billiton and Rio Tinto.

He ended up achieving the seemingly impossible: gatecrashing that party and creating ‘Australia’s third force’ in iron ore.

In just a couple of years, Forrest had expanded 100 times over, massively overtaking the tenements of both Rio and BHP combined.

Now again, it’s unlikely we’ll ever see a rise with that kind of velocity in our lifetimes. We’re in no way saying the stock James is zeroing in on is a direct comparison in 2025.

From near-zero to $20 a share is a one-in-a-million.

But here’s what’s clear…

The resource cycle stars are aligning once more here in Australia.

We have the exact type of fertile conditions that fuelled Fortescue’s rise.

A new mega-theme (the energy transition).

A new super-squeeze (titanium and several other critical metals).

A new set of geopolitical headaches and supply chain problems.

A preoccupation with tech stocks that has left miners deeply undervalued.

And…underlying it all…just like in 2003…a mining industry that’s unprepared for the new cycle.

15 years of underinvestment in mines. Mothballed projects. Not enough geologists. And massive capital costs in getting new projects cranking.

These are PRIME conditions

for a NEW disruptor

And James has singled out one in particular.

Plus, three others following hot on its heels, which we’ll get to shortly.

You’ll get the full details in ‘4 Stocks Driving Australia’s NEXT Mining Boom: 2025–2030’.

You can download the full report now simply by becoming a member of our Diggers and Drillers advisory.

It’s very reasonably priced, considering James’ experience, the value of his recommendations, and the effort that goes into them.

Just $99.

$99 is all you need to pay today to get immediate access Diggers and Drillers…and to download ‘4 Stocks Driving Australia’s NEXT Mining Boom: 2025–2030’ immediately.

That is insane value for what we’ve been talking about.

When you click the button below, you’ll be taken to a secure order page.

What you’re about to discover is urgent stock intel from a guy who’s been contracted by the small explorers as well as the major developers.

So, let’s be real, $99 is a steal here.

And even that low entry fee comes with a 30-day satisfaction guarantee.

So, pay your 99 bucks.

Get the full Diggers buy-list.

Download and read James’ report, ‘4 Stocks Driving Australia’s NEXT Mining Boom: 2025–2030’.

In the full comfort that if, for any reason or for no reason at all…you do want a full refund…we’ll give that $99 back to you, no questions asked.

Look around. There are not many players in this game that swallow a subscription risk like that.

Recommendations like these tend to get locked right behind a paywall without any remote possibility of a refund.

$99 to get James’ full buy-list.

Plus, a 30-day satisfaction guarantee.

Does that sound like a fair exchange?

If so, simply click the button below now.

When you do, you’ll be shown how to get access to James’s four prime picks for 2025 and 2026 within minutes.

Or…

If you’d prefer to hear about the three other little-known miners vying for ASX supremacy, keep reading…

Because this is where things get even more interesting.

In ‘4 Stocks Driving Australia’s NEXT Mining Boom: 2025-2030’, James gives you blanket coverage on four key scarcity areas and four mining companies he reckons are best positioned to nail them in the coming years.

In ‘4 Stocks Driving Australia’s NEXT Mining Boom: 2025-2030’, James gives you blanket coverage on four key scarcity areas and four mining companies he reckons are best positioned to nail them in the coming years.

Without trying to make this sound like a Year 10 Science class...there are some bizarre-sounding metals now shaping future investment in mining.

There’s promethium...a healer and a weapon.

This element is a critical component for making pacemakers, but it’s also used for building self-guided missiles.

Or niobium...scientists have capitalised on its unique ‘superconducting’ properties allowing them to develop new kinds of superfast, highly energy-efficient large-scale computing...without the need for semiconductors.

Or there’s zirconium...a key metal used for cladding nuclear reactor fuel cells.

Or natural graphite…used in cathodes of lithium-ion batteries...a material which needs a massive 7X increase to its current production to meet future demand!

The potential for critical metals like these is endless...the only limitation is SUPPLY.

But this is not just a critical metals story.

‘4 Stocks Driving Australia’s NEXT Mining Boom: 2025-2030’ lets you in on what James sees as the four best resource stock speculations on the planet right now.

I’ve already told you about the first play, based around titanium.

-

PLAY #2 IS HELMED BY A GUY JAMES CALLS ‘THE SON OF TWIGGY’.

With a market cap just above $500 million, you would say this late-stage explorer is knocking on the door to production.

And the guy at the heart of this stock recommendation has all the hallmarks of a NEW Andrew Forrest.

He previously made a big bet in an unloved market…

Turned a penny stock into one of Australia’s new mining kings…

And brought early stock investors along for the ride.

From bottom-to-top, the stock went from 10 cents in 2003 to rise 17,500% by 2024.

We’re not saying he’ll repeat this exact same feat again. But…

Just like Twiggy, he’s a mix of mining engineer and entrepreneur.

Just like Twiggy, he has an uncanny ability to raise capital in a dead market.

Just like Twiggy, he and a group of three geologist mates saw a big gap and hit — in the words of Business News — a ‘wealth sweet spot’.

And just like Twiggy, through sheer balls, he turned a one-cent shell into a mega-billion dollar producer.

Now, James reckons he could be about to pull off something similar…with ANOTHER relatively unknown miner.

So that’s the second play you’ll discover more about inside ‘4 Stocks Driving Australia’s NEXT Mining Boom.’

PLAY #3 IS AT THE COLLISION OF MINING AND AI.

This is going to be a big theme between now and 2030.

The demand for semiconductors — the chips that drive AI — has exploded in the last two years.

The biggest stock in the world is now Nvidia.

The chipmaker just surpassed Apple to become the highest-valued company on Earth.

Nvidia’s basically the tech Fortescue. It’s currently worth more than Amazon and Meta combined.

What if a transformation like that took place in Aussie mining within the next 10 years?

AI and the green energy transition are basically the ‘iron ore’ and ‘China’ of this next mining cycle. Semiconductors are at the heart of both.

And Play #3 is producing a critical material used in their manufacturing.

Not many people have heard of this company, let alone the commodity it produces. But these guys are set to become one of the world’s largest suppliers.

According to Grand View Research, global demand for this element is expected to grow 22% every year between now and 2030.

Hardly anyone understands this yet.

And that’s the edge James sees with this recommendation.

-

PLAY #4 IS AN UNDERGROUND MINING SPECIALIST.

As mineral scarcity worsens, deposits are becoming tougher to find and harder to extract.

Solving this problem is precisely what Play #4 specialises in.

As we’ve said, this is going to be a different kind of boom. And James has designated this company as his fourth pick here for a good reason.

Mining engineers he’s spoken to recently all agree on one thing…

The future of mining will be underground.That’s opposed to surface or open pit mining we’re used to in Australia.

And that’s where these guys come in.They’re aiming to bring their underground mining experience into the new boom. As near-surface deposits deplete, explorers are searching deeper to unlock the next generation of minerals.

You can buy shares in Play #4 for around one dollar at the moment.

That’s because we’re yet to see a major pulse in this sector…but James reckons that’s coming.And if he’s right, this company could capture a lot of the investment that flows back into mining developments.

That’s all we’re going to say on these guys here.

Honestly, the absolutely BEST time to move on these four plays is early on in the cycle…

Typically, that’s when prices have been hit hard — conditions like we have today.

Look, if you take just one thing away from this presentation...please make it this...

The Age of Abundance is over.

The Age of Scarcity has dawned.

This is not a fleeting thing.

As Umair Haque puts it in Medium:

‘Everything is now changing.

‘Suddenly, catastrophically...’

Now, that’s a bit doomy.

But Diggers and Drillers is a defiantly positive advisory.

As Medium goes on to say:

‘It is a Big Deal — as big as the Industrial Revolution before it.’

The Industrial Revolution made generational wealth for those who played it correctly.

The Age of Scarcity will too.

Especially for those lucky enough to be sitting on the things that are about to become scarce...

You can get your mining stock advice from a lot of different avenues, of course.

These are not apples-for-apples comparisons, since every provider has a different business model, but…

If you go the conference route, full packages can easily put you back $2,000 per ticket.

Top tier investment banks can charge up to $5,000 for individual company reports…

And as much as $20,000 for full sector reports.

But honestly, in my opinion, NONE OF THAT approaches what you’ll be getting with Diggers and Drillers…

This is what you’ll get if you join us right now.

But all that will be just for starters.

This boom is only just beginning.

Join us now and we’ll give you a roadmap for playing it.

Remember, just $99 today.

And, if you want, we’ll even refund that $99 in full within your first 30 days.

So, that’s it from me. Thank you very much for your time.

Click the button below, and let’s get cracking.