TOP GUNS WANTED

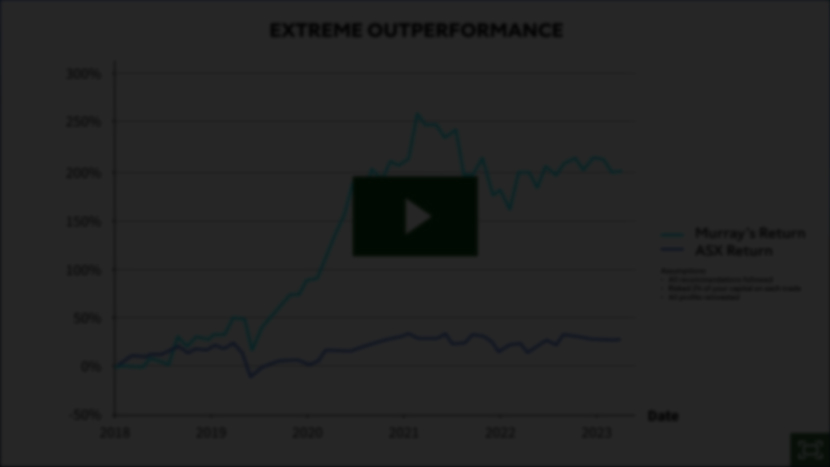

I’m looking for 125 Fat Tail subscribers who want

to go after big returns in a newly surging market

Welcome to

TOP GUNS WANTED

This event will go live at 12:00pm (AEDT) sharp.