The world is on the brink of a technological revolution…driven by the advancements in artificial intelligence.

This revolution is set to dwarf all those before it.

It will be a ‘$15.7 trillion game changer’ by 2030 according to PWC.

As AI transforms industries and reshapes the global economy, investors are looking for opportunities to capitalise on this monumental shift.

But while the world’s attention is on the tech giants leading the charge…the real opportunity for exponential portfolio growth lies in the overlooked realm of small-cap stocks.

Just as the microchip revolution of the 50s and 60s paved the way for the rise of consumer electronics…and the birth of tech behemoths like IBM, Intel and later Microsoft and Apple…the AI revolution is poised to create a new generation of winners.

But can you identify and anticipate the potential breakout stars?

The key lies in understanding ‘AI Collisions’… small companies that find themselves colliding at the intersection of AI and other pre-existing trends, industries and technologies.

The story of Applied Optoelectronics - AOI- is a prime example of the power of an AI Collision.

Once a little-known company…AOI saw its stock price skyrocket by 2,300% in just six months when its fibre optics proved critical for AI data centres..

Moves like this in any market are outliers of course. But it shows you how a small, seemingly unrelated company can suddenly find itself at the forefront of the AI wave.

As the AI boom gathers momentum…the challenge for you is to identify the next set of companies poised to benefit from the surge of Big Tech and AI investment into the small-cap space.

This requires a trained eye for companies at the critical junctures of the AI ecosystem…as well as an understanding of the technologies and trends driving this revolution.

Here at Fat Tail Investment Research, we have developed a framework to identify these potential AI Collision stars.

Small-cap specialist, Callum Newman, and his team focus on four principles of “Collide, Lock, Build and Explode” and aim to uncover the stocks with the potential to deliver world-class returns.

Make no mistake. The AI revolution is still in its early stages, so these stocks are volatile and risks are high. But so are the potential rewards.

And the window of opportunity to capitalise on the pioneers of the AI Collision…is closing.

Those who act now, armed with the right knowledge and guidance, are poised to secure the early mover rewards.

In the next few minutes, Callum will introduce you to five ASX-listed AI Collision stocks that he believes have the potential to become leading stars in Australia’s AI revolution.

These companies, while not yet well-known, are strategically positioned at key intersections within the AI ecosystem, ready to capture the flood of investment and innovation...

Callum Newman

Now here’s Callum Newman, who will lead you through the frontiers of the AI revolution and five key opportunities that await...

CALLUM NEWMAN:

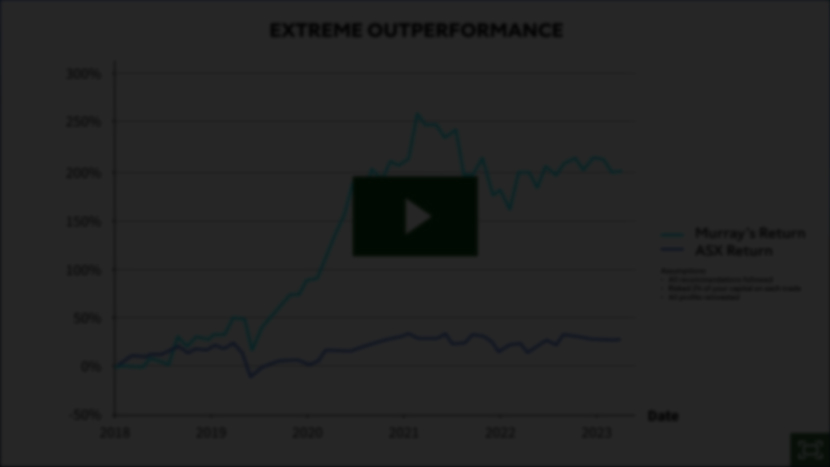

If you were an early mover on microchip collision stocks...when they were small and their future was uncertain...

...well, as you can see, the gains are fairly legendary by now.

The ‘next Microsoft’ and the ‘next Apple’ are well-worn investment cliches.

But look, that is actually on the table here.

If Artificial Intelligence really turns out to be ‘the biggest platform transition in the history of computing’...

...then it’s almost certain some new future giants will emerge...crawling out of the small-cap swamps to rule new AI landscape by the 2030s...

OpenAI, the creator of ChatGPT, for instance, is being touted as a new Big Tech giant.

As is Nvidia.

I’m guessing, though, that some future AI mega-caps will be stocks no one has heard of yet.

It’s those stocks we’re going to focus on in a second.

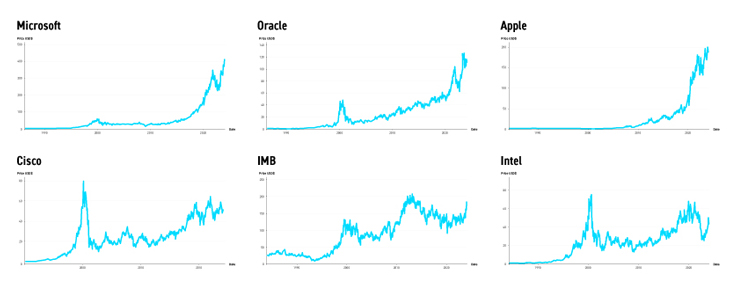

Of course...just like previous collisions...many, many companies will be born with great promise and then go extinct.

That’s the gamble you take as an early investor.

Example...

There’s a parallel universe where you’d be mentioning a company called Wang Laboratories alongside IBM and Microsoft today.

They were a prime microcap collision future giant in 1960s.

But the rise of personal computers in the 1980s actually made Wang’s centralised minicomputers obsolete.

Its stock tanked and it went bankrupt in 1992.

Point being, there are NO sure things here.

But I like this Economist quote on the topic:

‘The creation of a new market is like the start of a long race.

‘Competitors jockey for position as spectators excitedly clamour. Then, like races, markets enter a calmer second phase. The field orders itself into leaders and laggards.

‘The crowds thin.’

As those crowds thin with AI Collision, who might be left running?

Keep reading! We’re about to get to my five contenders.

The AI megatrend is already following the same roadmap of previous tech collisions.

If you can track that roadmap, you give yourself a good chance at getting into some spectacular opportunities — very early in the process.

Stocks that follow the trajectory of Applied Optoelectronics and Arm Holdings.

That’s the reasoning behind the five selections we’ll get to in a minute.

And as I said, the criteria of selection rests on four words:

COLLIDE is the first one.

The great tech collision where the match is lit.

Then:

If you look back at every collision event in tech, it’s been followed by THESE THREE SPECIFIC INVESTMENT PHASES.

Take the Internet.

The mid-90s was its ‘Lock-Up’ phase.

The battle for first-mover advantage.

It was dominated by tech incumbents like Microsoft and IBM. The ‘adults in the room’ who assumed the riches were theirs for the taking.

They battled the US Government...and then new upstarts like AOL, UUNet, Netscape, Netcom, etc.

Everyone was jostling for a monopoly over early web browsers.

The LOCK-UP phase of a tech collision is where key players try to secure technology and assets needed to rule the next evolution.

This is the phase we’re in NOW with AI.

This is what’s starting to send second-order small caps into the mainstream conversation.

But the phase we’re transitioning to this year is the BUILD OUT.

With the Internet...this phase entailed thousands of miles of fiber optic cables being laid beneath the world’s oceans...just as telegraph wires had spanned the globe a century and a half before them...

Communications and telephone companies pivoted to become ‘Internet providers’: starting an arms race of high-speed connectivity.

The Internet infiltrated every home, office and school.

And the companies building out this technology prospered from the 90s to present day.

Stocks like Cisco Systems plundered this period.

If you invested just $10,000 into its 90s IPO you’d be sitting on $6.6 million 30 years later.

Other companies like Qualcomm and Oracle made early investors fortunes during the Internet build out.

Then...

The Cambrian Explosion.

That refers to a time around 500 million years ago...when most of the major animal groups just suddenly appeared in the fossil record. Out of nowhere.

Tech collisions always conclude with a similar explosion.

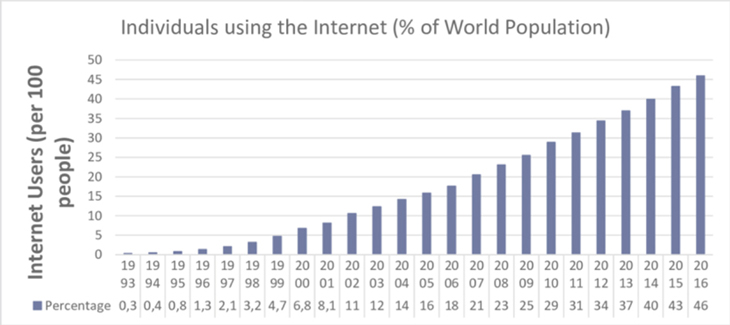

In 2000 about 400 million people were online globally. By 2020, it was 4.5 billion. Over half the world's population.

In this time, we saw an eruption of innovation. New thinking, novel business models, and a deluge of revolutionary concepts.

E-commerce, social media, smartphones, streaming giants like Netflix, all of it came and more evolved in the EXPLODE phase.

Lock Up.

Build Out.

Explode.

The Internet’s a mega-example.

But it’s a pattern that’s persisted with multiple smaller-scale tech collisions in the last 70 years.

We’ve been in the AI LOCK-UP phase since 30 November 2022 — the day ChatGPT burst onto the scene.

The big names are rolling out their AI roadmaps.

And the investors are flocking to those easy picks first.

Just take the ‘MAGNIFICENT SEVEN’.

This was a term coined last year by Bank of America analyst Michael Hartnett.

It refers to the heavy-hitter US tech stocks, most of which you’ll know.

Microsoft, Amazon, Meta, Apple, Google parent Alphabet, Tesla and Nvidia.

Needless to say, these are not ‘growth’ stocks.

They’re the giants of the giants.

‘Leading large cap technology companies such as Apple, Google, Meta, Microsoft, and Nvidia have been aggressively investing in AI and have experienced strong stock price appreciation...

‘Microsoft, through its partnership with OpenAI, has been a clear beneficiary, and Google has also made rapid strides, launching its competitive product called Bard.’

In a mirror of the lock-up phase of the Internet...

...the ‘adults in the room’ are all jockeying for dominance over this new AI thing.

Also just like the early web lock-up days...

...you smashed it last year if you owned these blue-chip shares.

A classic pattern of the lock-up phase.

These big guys had the money and nous and resources to start developing and marketing applications first.

Take Apple’s scheme for total AI lock-up.

They’re looking to snaffle the whole thing...like they did with smartphones in 2007.

Apple’s beavering away at integrating a large language model (LLM) into its devices.

If it succeeds...they will disrupt the smart phone industry again, just like they did with the iPhone itself.

But, as you’ve seen, smaller companies are now starting to get some lock-up action, too.

Innovators with the ‘stuff’ the big names need to build their AI roadmaps.

** Symbotic Inc sits at the collision point of AI and robotics.

It listed in March 2021.

If you owned the stock right before ChatGPT debuted, it was worth $9.

Now it trades around $42.

** Super Micro Computer is trying to lock-up AI server technology.

In February ‘23 you could buy a share for US$90.

By Feb ‘24 that same share was trading for over a THOUSAND DOLLARS!

A 1,000% return in 12 months.

** Applied Digital is a little forerunner at the intersect of AI and data centre tech.

Its shares went from $1.90 to ten bucks in four months in 2023.

At the same AI/data collision point is a company called Innodata.

Shares around $3 in 2022. Pushing $8 today.

** Samsara Inc is melding AI with vehicle tracking.

It’s up 320% since November ’22.

** WeTrade sits at the collision of AI and large language models.

It returned a whopping 950% in 2023.

By some estimates...shares of AI lock-up participants tacked on a combined $6 trillion in market capitalisation in 2023.

But here’s what you need to realise...

We’re not done with this phase just yet...

Those early lock-up stocks I just named might get another bump in the coming year.

But as Bank of America tech analysts recently advised their clients...

...other lock-up plays ‘may emerge where not expected’...and the ‘upside is unlikely to be fully priced in.’

I have five stock selections that encompass the LOCK, BUILD and EXPLODE phases.

None of them are in the mainstream newsfeeds yet.

They’re like Applied Optoelectronics a year ago.

They’re either not considered a direct AI collision play at all...OR, if they are, analysts have really underestimated how AI is going to impact their value.

One of these picks trades at just 80 cents.

That makes them risky.

If you’re going to speculate on the following five stocks...you must do so with care, diligence and caution.

But, as you’ll see, each of these selections sits at the forefront of critical AI collision.

If that collision begins to get mainstream coverage...the potential gains could be extraordinary.

We’ll begin with:

Just off a remote stretch of road in Phoenix, Arizona...giant cranes loom over an area bigger than 60 footy fields.

This is the first of five mammoth ‘data bunkers’ being built there. 30 miles away, engineers are planning out another.

This is the AI lock-up in action.

Massive private equity firm Blackstone is shelling out $25 billion for these mega-data centres.

It tells Bloomberg it could be ‘one of its best investments ever’.

Without premium data access — the AI boom stops dead.

Simple as that.

Like I said: Lock up the data. Lock in the profits.

Some speculate this is the real reason Elon Musk bought Twitter.

AS A BACK-DOOR AI LOCK-UP PLAY...

Even though the rebranded X is nosediving in popularity...it’s still a treasure trove of human conversations and knowledge...which are perfect for training generative AI models.

Any company with access to ongoing, unique, propriety data...will now have a valuable lock-up asset.

The opportunity lies in finding such companies before the market realises the value of this hidden balance sheet item.

Which leads us to your first recommendation...

It’s a company perfecting an engine that’s going to be capable of processing the coming data deluge...

...at speed and scale.

This is at the core of what Artificial Intelligence does — make sense of gigantic data sets to make better predictions.

The tech this small-cap is nurturing is a key lock-up asset that supports a whole bunch of upcoming AI Collisions: HR and employee management, legal research and litigation, data protection and more.

This company is operating in relative obscurity... for now...

For perspective, it currently has a total of 400 employees.

Big data giant Teradata has 7,000.

This first recommendation only has a market cap of AU$520 million.

A similar business, at least in terms of business model, is a company called SiteMinder. That has a market cap three-times higher at $1.5 billion.

That gives you the scope for growth here.

The world is watching to see how firms can commercialise the AI/Data collision.

And recent price action leads me to believe investors are finally starting to hunt this stock down as a lock-up play.

You’ve seen the first wave of market darling AI stocks go ballistic in an otherwise flat market.

I think these guys are next.

I won’t name them just yet.

You can find out who they are shortly.

But there’s a second lock up move you should have on your radar...

Applied Optoelectronics is what can broadly be described as an AI Collision ‘shovel seller’.

So is this next recommendation...

Investopedia defines the pick and shovel strategy as investing ‘in the underlying technology needed to produce a good or service, instead of the final product’.

ChatGPT — for instance — needed around 20,000 Nvidia chips just to get off-and-running.

As such, Nvidia has been a lock-up beneficiary with a 230% share price gain in the last year.

Trillion-dollar companies don’t tend to do that.

But further down the food-chain...

...I think you’re about to see smaller specialist AI chip designers have their share prices start to rip higher. Applied Optoelectronics was just one of many to follow.

I won’t get deep into the jargon here.

But the AI collision means computation on a scale unimaginable even a few years ago.

And as AI explodes in the next few years...it’s going to require ever-greater amounts of something called on-chip memory.

This is a central theme of this ‘lock-up’ phase.

As the Wall Street Journal reports: ‘Strategies to boost the power of advanced processors are in demand as limited chip supplies force companies to get creative.’

Trust me: the obscure stock I’ve landed on here is getting VERY creative.

What if there was an AI memory-enhancer that was ten-times cheaper than its nearest competitor?

That’s the Intellectual Property (IP) these little guys are sitting on.

The lock-up market here is already gigantic. Memory chip sales are at US$130 billion annually.

But with the onset of AI some estimates put that at $1 trillion by 2030.

In the closing stages of the AI lock up, companies honing new methods to squeeze more out of the AI chips at their disposal are going to benefit.

A trillion-dollar market that relies on faster, more efficient, and cheaper processing power.

That’s what this crew have up their sleeve.

And they’ve actually had a massive head-start on this boom. The AI memory tech they’re about to roll out has been in development for the best part of a decade.

It’s not a SUPER small cap: market cap around AU$700 million.

But compared to Nvidia, it’s a speck.

It’s just received its first blast of revenue from its semiconductor IP.

It’s in talks to nail a bunch of commercial agreements — in industries ranging from medical to industrial.

But as far as I can see, only a couple of analysts are tracking them.

It’s a risk — you need to think like a venture capitalist when you approach this AI chip small cap.

Their success largely rests on locking in two more deals with big semiconductor ‘foundry’ companies.

But if you’re looking for a single small-cap play that could cut Nvidia’s lunch in 2024 and 2025...I reckon it’s this company.

Who are they?

I name them and provide the full backstory in a comprehensive new research report.

It’s called Lock. Build. Explode: Five AI Collision Disruptors to Own for the Next Five Years.

I’ll show you how to download it straight to your phone or computer in a second.

You see, Lock. Build. Explode rests on a simple premise.

If you’ve been watching this trend from afar for the last year...that’s fine. You were right to be cautious and keep your powder dry until things became a bit clearer.

But NOW is the time to start making some speculative moves.

The capabilities of generative AI have finally started to bang into and intersect with a whole bunch of other stuff.

These are five non-obvious ways to exploit this period.

They’re big bets. They’re risky.

As I’ve pointed out, more small companies fail after big collision moments than prosper.

That’s just a fact.

So you should NOT invest a cent more than you’re prepared to lose in the stocks I’m recommending here.

But, look, you’ve three choices here when it comes to investing in AI.

The first is, well, don’t do it.

You won’t make money, but you won’t lose money.

Second, you can absorb superficial information from the mainstream media and technology ‘news’ platforms...and invest based on that.

Go after the popular AI candidates getting all the bandwidth: Nvidia, Palantir, C3.ai etc.

That’s where the crowd’s attention will remain for most of this year.

Or...choice three: you can do a bit of thinking.

Speculate on where those ‘collisions’ might occur soon. And extrapolate which stocks might best benefit.

That’s exactly what we’ll do together if you download Lock. Build. Explode.

As you’ll see in the report...we’re transitioning to the BUILD phase of this trend.

By 2025, it should be in full swing.

You’ll want the right stocks stored away before that happens...

The BUILD phase will be characterised by AI starting to accelerate drug discovery...enhance climate change models...and shorten the time it takes to invent new products by orders of magnitude.

These will be the years that decades of test-lab theory are built out into the real world.

Take Australia’s biggest industry...

Mining has always been at the pinnacle of big tech collisions — going all the way back to the steam engine.

The invention of steam power and the build out of the railways set off a chain reaction. Steam engines both NEEDED coal...and were now able to transport it long distances. A mutually beneficial collision.

Same’s about to happen with AI and mining in the next few years.

But it’s a complex business, trying to pick stocks here.

Who’s the mining version of Applied Optoelectronics likely to be?

Do you go for outfits looking to put geologists out of a job...and using AI for more efficient exploration? What about new AI techniques to maximise extraction?

I’ve thought long and hard about this.

Here’s my answer, and a play for the coming BUILD OUT phase...

Just like AI itself, mining lives or dies on data.

‘In South Australia, mining companies already have access to a massive library of core samples, which are literally centuries of data.’

That’s mining tech specialist Mark O’Brien.

The problem is that it would take a team of humans hundreds of years to go over it all.

But ‘using AI-enabled algorithms, we’re now finding resources that were originally missed.

‘The process is relatively similar to the advancement in DNA technology that has allowed criminologists to review and solve old cases.’

So what’s the best stock to back as AI rebuilds the mining exploration game?

My selection here is a bit left-field.

Its AI solutions drop into three broad buckets — drilling optimisation, rock sensors and data analytics.

In other words, they take data and knowledge...crunch it with AI...and use it to make predictions about what a miner should do next with regards to an ore body.

Don’t forget...resource companies spend billions of dollars on exploration. Any advantage here is worth more than...well...gold!

This company’s AI build out tech is coming at a critical time.

Not just in Australia, but around the world, many miners have the same challenge.

The easy ore bodies are tapped out.

Miners are now dealing with greater depths, lower grades and fewer new discoveries.

This makes ore body knowledge more important than ever.

Step in this one small AI pioneer...market cap just AU$800 million.

As I say, it’s working on a tool that uses AI to turn raw data into usable ore body intel...pretty much in real time.

This is a very small company with very big ambitions.

It’s openly saying it wants to become the ‘gold standard’ of the AI/mining data build out.

That’s all I’m going to say on them here.

But I really think they can do it, or I wouldn’t be recommending them.

You’ll see why when you download Lock. Build. Explode.

This report has been a long time in the making.

I didn’t want to rush it.

While experts and finance and tech journos have spent the last year making wild predictions...I’ve been researching.

Talking to people at the coalface, reading the right papers, tracking investment money. And scoping out local and international industries where collisions seem most likely.

‘There are no easy answers in AI,’ says Karmel Allison, a technical advisor at Microsoft who is stating the obvious.

‘Which is part of what makes it fun. It’s an open-ended exploration of what we want the future to look like.’

And so now we get to the REALLY fun part.

The EXPLODE phase.

Picking small caps that might go supernova here is harder to do.

Because we’re looking further out, and there are a lot more variables.

Kevin Kelly is a technology writer who once said:

‘The business plans of the next 10,000 startups are easy to forecast: take X and add AI’.

But only a tiny fraction of these start-ups will truly explode in price.

I’ve decided to put my chips on TWO...

‘Whoever becomes the leader in this sphere will become the ruler of the world.’

Who said this?

Maybe you already guessed: Vladimir Putin.

This was before he invaded Ukraine.

What was Putin talking about?

Artificial Intelligence, of course.

You don’t need me telling you how off-the-charts geopolitical tensions are right now.

What you might not know is that defense spending is skyrocketing.

It was at a record high in 2023, following on from a record high in 2022.

Governments are going to shower money into this AI/Military Collision...in the race for supremacy.

Think of it as the space race for the 21st century.

Recently...OpenAI very discretely walked back a ban on military use of ChatGPT and its other Artificial Intelligence tools.

Its policies still state users should not ‘use our service to harm yourself or others,’ including to ‘develop or use weapons.’

But the company is now openly working with US Department of Defense on developing AI tools.

Saying there are now ‘national security use cases that align with our mission.’

This collision of AI and military is unsettling...

And a bit further along the phase scale.

But it’s also inevitable.

And if you can get ahead of it with one or two of the right stocks, you could do very well in the coming years.

Which is where your fourth recommendation comes in...

It’s very small fry at this stage: just AU$400 million market cap.

But if I’m right...its AI-powered military systems are going to be in white-hot demand in the scary geopolitical timeframe of the next 24 months.

In fact...I judge this stock...at the time of recording trading around 60 cents...to be at a massive inflection point for a possible major expansion in revenue and profitability.

I want to maintain a bit of secrecy about these guys in this open forum.

But I’m very familiar with this outfit...and its potential.

I’ve actually recommended them before, in May 2019.

By October that year it was up 150%.

But...that was just a precursor of what’s about to happen if these guys play the role I predict in the AI/military collision.

As you’ll see in Lock. Build. Explode, this company is already selling to the biggest defence customer in the world: the US military.

Its management speculate that they currently have a potential sales pipeline of $400 million.

Now...

That should be taken with some healthy scepticism.

Juicy sales projection always get thrown around by insiders talking their own shop.

But this is exactly the type of tiny business that can release an announcement to the market of a big contract win...and see a big upward share price rerating as a result.

Conversely, nothing could happen.

My judgement might be wrong. They don’t get any attention at all. And you’ll lose money.

But I’m taking the opposite side of that bet.

And, if you look at my small-cap track record in the last few years, many of my bets have been good ones.

This company is a quintessential AI EXPLODE phase play.

As such, I’m willing to take a risk on them.

That’s why I’m opening up a position again.

And maybe you should too.

But there’s another AI Collision ripe for explosion.

And that leads us to my final recommendation today...

Video games might not be your cup of tea.

But they will be if this sub-$1 stock pops to $3-plus in the next year or so...

The AI/Gaming collision has been slower to take off than you might expect.

2023 was a crappy year for the gaming industry — with a bunch of layoffs and budget cuts across major and small studios.

But this has actually incentivised developers to add AI to their bag of tricks to get an edge.

Which makes this next play a must-own stock right now...

Dev teams are scrambling to harness AI in a bunch of key areas — better graphics, better sound, slicker interfaces, more realistic worlds, smarter NPCs.

This little software outfit sits at the heart of all that.

And I mean little. It’s technically a microcap.

Which puts it among the riskiest of these recommendations.

It’s also yet to catch any of the AI heat — barely putting on 2% in the last year.

I’m convinced that’s about to change.

This company is sitting on an AI gaming superpower.

It currently only has 300 staff, and I talked to one of them recently. He told me they’ve been exploring for a long time how AI can improve their productivity and output in tandem to help grow the business.

They’ve just landed a ginormous deal with the second-biggest entertainment studio in the world.

As CTech puts it, the coming AI/gaming collision will kickstart ‘a dynamic period of transformation in the gaming world that will affect the entire software development ecosystem’.

My prediction is this little stock will play a leading role.

All is revealed in Lock. Build. Explode: Five AI Collision Disruptors to Own for the Next Five Years.

You can download it now...by doing one simple, inexpensive thing.

Subscribe to my newsletter.

It’s called Australian Small-Cap Investigator.

And it was our company Fat Tail Investment Research’s very first advisory, launched way back in 2007.

As an independent financial publisher, we try...with varying degrees of success...to look at the investment world from the outside.

With a sceptical eye. Like advanced aliens might be tracking Earthlings from afar, right now.

For nearly 20 years we’ve used this approach to help Aussie investors chart a course through various emerging megatrends — using small-cap stocks as tools for exponential growth.

As I said, we’re completely independent. We’re not compromised by egos, advertising deals, commissions, or kickbacks on any stocks recommended.

We are not infallible.

We’re just outsiders looking in.

We preempted the Aussie LNG boom of the late 2000s.

This was a significant increase in investment and production in the country’s liquefied natural gas industry. Driven by rising demand for natural gas in Asia, particularly in China, Japan, and South Korea.

Several huge LNG projects came online in Australia, including the Gorgon Project, which was operated by Chevron.

Australian Small-Cap Investigator got our readers into a company called Bow Energy...at the time, a little-known Queensland coal seam gas explorer.

We tipped it at 17 cents and issued a sell when it was 458% up just eight months later.

We covered the epic small-cap turnaround situations that came up from the wreckage of the GFC.

We were there for the rise — and then fall — of the Australian pot stock mania.

Where small caps like Cann Group floated for cents...shot up to $4...then fell back to cents.

We were ahead of the Great Blockchain Collision.

Where crypto-adjacent stocks emerged to briefly rule the small caps gains tables.

We were way ahead of the curve here, telling our readers in 2015:

‘There’s a piece of technology you should get to know. This tech is only about five or six years old now. That makes it new, confusing, exciting, scary, and a huge opportunity.

‘But not everyone is quite sure what to make of it just yet.’

We were ahead of the collision between finance and technology (Fintech) well before the crowd — with wins like 1,448% from AfterPay [ASX:APT], and 886% from Zip Co [ASX:ZIP].

The rise of green energy and then the battery stock boom...pandemic stocks and meme stocks...the brief frenzy in metaverse stocks...

...Fat Tail and Australian Small-Cap Investigator have been at the centre of it all.

Of course, we’ve not gotten it right with all our picks. But let’s look at the recommendation list to see how it’s faring...

All things considered, really good!

As you might know, apart from AI stocks and the odd resource play, small caps on the whole have had a rough time of it lately.

Take a look at this chart...

That white line is the ASX Top 20, grinding along, but holding together.

See that purple line?

This tracks the ‘emerging companies’ index on the ASX.

Stocks in this index range from as little as $33 million to $1.1 billion, with a median market cap of $232 million.

This is the EXACT range and hunting ground for my small-cap advisory service.

As you can see, 2023 was tough.

Most investors were lucky to even stay break even.

Junior resource stocks got taken to the cleaners. Retailers were dumped. Property stocks...my goodness...dumped!

It seemed at times as if there were no sanctuaries.

Lucky for my followers, I’ve been in this game a while. The grey in my beard is testament to that!

Here’s what some of my ASI positions did over that same period and into 2024:

Maas Group

Avita

MLG Oz

MA Financial

Beacon L

RMC

Tuas

+68%

+54%

+39%

+19%

+49%

+16%

+145%

These are ripping results considering the wider context of the market.

And remember, in under 12 months for most.

They’re all still prospective for more gains, by the way.

We also just took profits on a stock I’ve already mentioned, Siteminder (75%)...as well as BGL Gold (60%)...and Arufura (330%)...

We’ve got a few laggards on my buy list, but give ’em 12 months and I reckon these will be in the green too.

We’re holding small losses with:

RAM ESS STPL

Hotel Property Inv

Australin Fina

Perenti

Mount Gibson

Tourism Holdings

-13%

-2%

-7%

-12%

-17%

-17%

But overall, we’ve done the business in a very tough market.

But this is not investing for the timid.

Speculation is making a call on the future based on a few hazy data points that exist in the present.

It’s an inexact investment science. It always has been. Don’t let anyone try and tell you otherwise.

And it’s not for everyone.

You can lose a lot of money if you make the wrong calls. Or get too carried away with the whole thing, especially when you see your stocks go supersonic. And then see them nosedive.

What sets us apart is we don’t hide or shy away from our losses.

Nor do we hold back when the time is right to aggressively attack a new megatrend.

And I’ll be completely honest with you.

No trend that we’ve covered since we set up shop in 2007 was ANYWHERE NEAR the magnitude of what we see coming with Artificial Intelligence.

As such, I’d like to invite you to claim Lock. Build. Explode right now.

You can do that by taking an annual subscription to Australian Small-Cap Investigator.

That subscription fee is fully guaranteed and refundable...at any point inside the first 30 days.

You can KEEP the intel inside our new AI Collision report...whether you stay on or not.

I just want to get this research in your hands ASAP...so you can attack the phases of the Great AI Collision alongside us...in real time...as it plays out.

What is the Australian Small-Cap Investigator subscription fee?

Well, the usual price for 12 months is $199.

That’s already a steal...when considering the value of the ideas you’re getting in return.

But if you respond to this invitation by filling out this secure Order Form...you can receive a full year of my work for half that price —

Just $99.

In other words, the first six months are essentially free.

That means for about $8.25 a month...you can take advantage of everything I’ve highlighted today.

Starting, of course, with my special opportunity report:

The ‘Megatrend of Megatrends’, as Blackstone calls it.

The ‘Megatrend of Megatrends’, as Blackstone calls it.

Or from InvestorPlace:

‘It will create passageways to sweeping, even mind-blowing, change.

‘But as it does so, it will disrupt the status quo and leave behind the wreckage of dated technologies and hollowed-out industries.’

As a speculator, it’s your job to think where this all goes next. And which small stocks could become much larger stocks as a result.

We’ll likely be adding significantly to this portfolio as new intersects and opportunities emerge.

But remember, Australian Small-Cap Investigator is not just an AI advisory. (Although we’ll be focusing the majority of our research there for the foreseeable future.)

But remember, Australian Small-Cap Investigator is not just an AI advisory. (Although we’ll be focusing the majority of our research there for the foreseeable future.)

Read the current issue. Scour the archives.

Get the FULL list of live recommendations that are currently sitting in buy zones.

Examine the track record — the wins, and the losses.

Like I said, treat the next 30 days like a guaranteed trial run to see if ASI is right for you.

Then, if you wish to stay on after your refund period, that’ll be your choice .

So...what do you think?

Does parting with $99 sound like a reasonable investment for all the above?

Hit the JOIN NOW link below to get started.