‘The best tech investor I know has an urgent

message for you — and it’s crucial you hear it

before midnight TONIGHT’

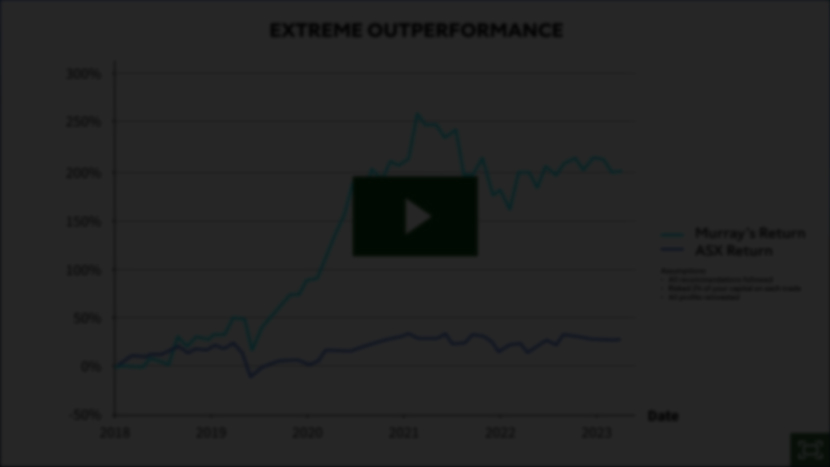

He’s closed 25 tech winners of 100% or more. Now he says AI has set off a

chain reaction in the stock market that can’t be ignored. Until tonight at

midnight, he’s showcasing the five trades at top of his buy list…

James Woodburn, Publisher

And you’ll find full details on it in a new research report I’ve prepared, called ‘AI Alpha: Five Rising Stars to Trade in 2024’.

And you’ll find full details on it in a new research report I’ve prepared, called ‘AI Alpha: Five Rising Stars to Trade in 2024’.

When that happens, you’ll get every short-term speculative trade I share.

When that happens, you’ll get every short-term speculative trade I share.