What follows is a simple formula designed for spectacular share returns…

It’s a stock buying (and selling) strategy for Aussie investors.

Set up for where we are right now in 2025.

This strategy has generated 25% average annualised gains over the last five years.

I’ll repeat that:

25%. Year-on-year.

And we haven’t closed out a single position entered in the last 12 months at a loss.

I’m going to show you exactly how we’re pulling it off.

What’s more…

I’m going to ACTUALLY NAME every stock in my live portfolio. You’ll see the name and ticker symbol of each live holding that is contributing to that 25% record.

Murray Dawes

My name is Murray Dawes.

I’ve been trading the markets practically every day for over three decades…since I began in the Sydney futures pits in the early 90s.

I’m 52 and started my career in the financial markets after getting a graduate position with Swiss Banking Corporation and Dominguez Barry (now UBS) in 1992.

They put me on the Sydney Futures Exchange trading floor.

That’s where my love affair with the rough and tumble of the markets began.

I went on to trade for high-net-worth individuals, including one of the top 10 wealthiest families in Australia.

I was also a broker to many boutique hedge funds — using my proprietary trading techniques to help them find winning

trades.

Currently, I run a niche advisory called Retirement Trader for share investors looking for extraordinary returns.

And we’re getting them…

I recently canvassed my current members to see how they’re doing. The responses I got were pretty remarkable.

Rob Alder, FCPA writes:

‘After two years of Murray and Retirement Trader I'm double the return I was with other larger brokers. Running my own SMSF as a qualified accountant, his recommendations have always been absolutely spot-on…”

L.L. writes:

“I’ve been following Murray’s Retirement Trader since the beginning and couldn’t be any happier with the results of his stock picks and also his insight into trading. So often picks a stock just before it breaks out…”

Keith R. writes:

“His comments and recommendations are clearly aimed at assisting me to make sensible decisions resulting in exceptionally strong financial results…

He will not cloud reality by offering other meaningless, ridiculous investment opportunities that so many other so called "advisors" miraculously uncover and then strongly endorse. He persists with sharing facts with members… for he has only the best interests of each and everyone of them in the forefront of his mind.”

Retirement Trader was established in December 2018.

Since then, members like the ones above who followed each trade had the chance to make an average annualised gain of 25%.

25% on average. Every year.

From 2018 to 2025.

Let me remind you…

This period was the choppiest…most unpredictable…and, frankly, BIZARRE market in my 30-plus years as a trader.

Read on and I’ll show you how a 25% annualised return can transform your wealth over time.

I’m convinced the formula you’re about to learn, which comprises of six simple trading secrets, will make you a better investor.

Here’s how I’ve been doing recently. All trades recommended since August 2024 (as at 23 January 2025)…

First off, look at the speed of the gains.

DEG is up 54% in four months. Regis up 37% in three months. IFL up 40% in three months.

For context, the big stocks on the ASX 200 have delivered around 5% over the same period. The smaller caps roughly the same.

The second point you’ll see in the table above? Every trade is in the money.

Most investors will tell you they’ve had a tough time getting any traction in the last six months.

So that’s a phenomenal recent track record by any metric.

But many traders can get on ‘hot runs’ from time to time.

For completely transparency…let’s stretch out and look at the FULL current portfolio of Retirement Trader. These are all the still-live trades since we started at the end of 2018 (as at 23 January 2025)…

Again, it’s a very rare thing for an advisor to share specific names and performance stats like this.

Usually they at least hide the names, to try and get you to subscribe to see what the trades are.

I’m not going to do that. Because, as I say:

I’m about to teach you

some valuable lessons for effective

trading in 2025 and beyond.

And, before that, it’s important you see the full picture of what I’m doing.

So, in that table above, note the one trade that is well down. Stavely Minerals.

-96% is an almost-complete wipeout. Ouch. But there’s a reason for it. It’s a microcap stock, which makes it a total outlier in the Retirement Trader portfolio.

We bought Stavely before Retirement Trader started. It is a legacy position from long ago, and we are just holding on in case they strike something huge with their drilling.

Since then, we altered the strategy so we only buy stocks with a market cap above $500m. So Stavely isn’t representative of what we currently do.

Take Stavely out of the equation…and then do the numbers…

EVERY position is in

the money bar one. And

that stock is only down 5%.

Although we have closed some older trades for losses, this is an exceptional and, trust me, highly unusual record.

One that many professional traders would envy.

Of course, it’s important to point out the old disclaimer here:

Past performance is not a guide to the future.

You should never make investing decisions based solely on historical record. Anyone with a brain should know that.

A 25% average annualised gain is tremendous, but it’s just one piece of data. And there are no guarantees it’ll continue for the next five years.

However, this level of performance IS way above the norm, for several reasons:

- Small- and mid-cap stocks in Australia have generally had a really hard time over this period. The Small Ordinaries has basically gone nowhere in five years.

- Since 2018, markets have experienced some pretty crazy and unpredictable moves, including the COVID-19 crash and rebound, record rate hikes, bank panics and the Ukraine war. These have blindsided even some of the best traders out there.

- Maintaining a live portfolio registering only one stock out of the money over several years suggests an extraordinary level of risk management. One far exceeding typical trader performance. Trust me, it doesn’t come easy.

That said…

I’m going to give you some simple lessons — these are my secrets on how I do this today. So you can try it with your own portfolio in 2025 and 2026.

At Retirement Trader, we haven’t closed out a single position entered in the last 12 months at a loss.

Not one.

That’s 12 months of

trading without one loser.

It can’t be overstated what a difference that makes to your results.

Every single trade as a winner is just adding to your P+L without any detracting from it.

The gains add up incredibly quickly when you do that…

The Retirement Trader portfolio value is at new highs since inception.

Like I said, over 25% average annualised gains.

Now, I do need to point out that many of the stocks recommended in Retirement Trader are small caps. Which are some of the riskiest stocks on the market.

Don’t let the name of the advisory fool you. This is NOT passive, conservative investing. To get the results we’re achieving, you need to take some calculated risks.

Which is where my formula comes into play…

Let’s get to the

Retirement Trader

formula now…

I’m about to show you:

- How to strip emotion out of every stock buying and selling decision you ever make.

- How anticipating the dumb moves of other investors led to 20–30% average annualised gains over the last five years.

- How to trade in phases…and turn stocks you buy into ‘free runs’. Where you can’t lose. You can only win.

- How to plant seeds in your portfolio. How we attacked gains of up to 500% when the timing was right. And pulled back when things looked dicey.

- The secret of mean reversion in turning a trade into a no-lose proposition.

- How to make an infallible plan. And stick to it.

But almost more importantly than all the above…

You’ll be able to sleep at night while you do all this.

That’s the key.

That, I believe, is what has kept my loyal followers stuck to me like glue over the last five years.

As Mark Lucas says:

‘Murray is a true gem! His market insights and charting skills are second to none.

‘I have been with Retirement Trader from day one and can sleep soundly, knowing that my investments are in good hands.’

As another of my members Michael says:

‘I think Murray is fantastic and we are lucky to have his expertise.

‘He has very good technical knowledge. I also think he is a very decent highly principled person. Trust is very important.’

Steve W says:

‘Firstly and honestly, I feel I can trust him. He talks sense in a way I can understand what he’s trying to get across and doesn't talk down to you.

‘I suppose that means he explains things clearly — so often when listening to people explain the markets it’s overly complicated and boring to the point I switch off.’

My intention is to keep you ‘switched on’ as I reveal these six lessons to you.

If you’re serious about long-term wealth building, get out your notepad…

LESSON #1

Human emotions drive prices:

Be an owl…

Trump’s return has led to some big moves in markets, both up and down.

Hotshots thinking they know exactly what’s going to change in the markets in the next few years. And making decisions based

on emotion…rather than common sense.

It’s times like right now when my number one lesson comes into play: human emotions, not facts, drive prices.

You’re seeing it as you read this.

Yes, the world’s biggest economy just had a dramatic change in leadership.

The reality is we won’t know for months what this really means for the markets. But investors big and small are acting like they know, right now.

This is a silly way to invest.

Making sweeping predictions about the markets in a year’s time is pointless.

That’s a big reason why we’ve not made a single trading loss in 12 months . I’ve steered away from this common trap.

It’s funny how even the professionals get sucked into prediction-making…and let their emotions get the better of them.

So Lesson #1: don’t fall prey to emotive investing this year.

Instead: exploit it.

I spent many early years trying to ‘predict’ the markets.

Forward-thinking what new administrations might mean.

Studying fundamental analysis, reading every announcement I could get my hands on, testing technical analysis methods, looking for a ‘black box’ trading system (one that needs no human intervention at all).

I thought all I needed was the fact that I was a smart guy who worked hard. Eventually I would figure out an answer that worked for me and go from there.

That’s what’s happening right now.

Everyone…from the top hedge fund guys to the smallest investors…is trying to ‘guess’ where the Trump markets will go.

Bottom line:

Now and always…with the right cool-headed strategy…emotive investing can be exploited…

When I cottoned on to the fact that I couldn’t consistently work out what was coming next, I started to listen to the market more deeply.

Rather than listening to whatever view my mind dreamed up about the reason for this or that happening…I released myself from having any concrete view at all.

What if being a bull or a bear is part of the problem?

Don’t be either.

Just be an owl.

Listen closely and make wise decisions.

Only trade when the odds are in your favour…based on clear market signals, not opinions.

Every winning move we’ve made at Retirement Trader is based around this first lesson.

We get a bit more technical with the next one…

LESSON #2

The magic of reading

‘false breakouts’

What’s coming in the next few years?

A giant sustained rally carrying into 2026?

More of the same sideways movement from the last few years?

Or another big pullback at some point?

Anyone making any solid prediction on the above is just guessing.

But ONE thing is certain.

Knowing how investors behave in certain situations is a key element behind that 25% average annualised returns figure.

I had many major realisations during my five years working at the Sydney Futures Exchange.

The false breakout was the biggest.

There are genuine breakouts in stocks, where they just go higher and higher over months.

But then there are all the false signals…what I call false breakouts. These happen much more often than the genuine ones.

When I say the word ‘breakout’, I mean a ‘breakout’ above a key resistance level. And a ‘breakout’ below a key support level.

This is going to get a bit jargony, but it’s SUPER important.

So, I’ll explain as simply as possible.

One of the first things I observed on the trading floor was the ‘locals’…the guys trading with their own money…gunning for stop losses.

They knew traders placed their stop losses just below major support levels (a previous major low, for example).

If the price got close to that level…the locals would attempt to push prices through the level by a few points to see what was there. If a large stop-loss order was set off, they could make some easy money.

How?

If the stop losses are set off, a large flow of sell orders will push prices down quickly.

Buyers back off. And lower the price of their bids due to the strength of the selling. Or they back off completely and wait to see what happens.

Once the sell orders have been filled, new buyers will step back in if there is no further selling.

And prices will often jump right back to where they were before the stop losses were set off.

It all might sound a bit complicated.

But all you need to know is that this is what’s called a ‘false breakout’.

The False Breakout

The strong selling pressure caused by the stop losses going off can often be the end of the move to the downside.

And a new rally begins…

When you understand how the process unfolds…you know that buying breakouts above a resistance level can be fraught with difficulty. You will often buy at the wrong moment and get shaken out of your position for a loss.

Basically:

Mean-reversion happens far

more often than people realise.

The novice investor usually thinks about prices going up or down.

Rarely does an investor consider the likelihood that prices will remain stuck in a range for an extended period of time.

Novice traders get bullish at the top of a range. And bearish at the bottom of a range. They are the cannon fodder for traders like me, who know what they are doing.

Look…

In year one of Trump World, NO ONE is going to truly know what the new rules are…or how the market will react in years two and three.

Now is not the time to stick your neck out and make long-term big calls about future market direction.

Instead…it is a time to study where the lines in the sand are above and below the market…so you can change tack quickly if necessary.

Will Trump’s tariffs and tax cuts cause a serious trade war that hurts everyone and forces rates higher? Or will his business-friendly policies spark a massive bull market?

All this uncertainty creates one GIANT certainty you can bet your house on…

MORE FALSE BREAKOUTS

Understanding why false breakouts occur…and knowing that mean-reversion happens often…is my second lesson.

My approach is to use mean-reversion. It’s the high-probability outcome that we can target in our trades.

Think of it like this…

We let other people do the guessing about what this or that short-term event means.

Then we wait until a major support level fails.

And plenty of stop losses get executed.

If there is no follow-through and prices return to the previous range, we buy with a target set at the middle of the range.

Because we KNOW mean-reversion happens often.

Then, when prices hit the middle of the range, we sell a third of the position. And place a stop loss at a point that will ensure we walk away with our original capital intact.

In other words, after hitting that initial target, we will either break even or make money on the trade.

The breakeven stop loss is usually a long way from where the price is trading. Which means we have a good shot at surviving future volatility and staying in the trade.

I often ensure that the breakeven stop loss is below a major support level. So, the price must fall below that major support level to exit.

I don’t blame you if you find this a little complex. But it all makes more sense when you take in:

LESSON #3

Try and turn every trade

into a ‘free run’

I can’t tell you how satisfying it is to hit the initial target and sell a third of the position.

When you do that, you’re basically turning a trade into a free run. A NO-LOSS proposition.

Of course, it doesn’t happen with every trade.

But the ‘no-loss’ position is always the ideal end goal for each trade.

When you get yourself in a position where you KNOW the worst outcome will be breaking even.

That’s a game-changer.

Your stress disappears.

You no longer care what happens from that point on…because you know you won’t lose money.

I call this PLANTING SEEDS.

I want to plant as many of these low-risk seeds as possible…and then watch which one bears fruit.

A disciplined profit-taking approach ensures that my mental state is always on the front foot.

It’s a great strategy to employ always.

But even more valuable right now…when we are not in a bull market or a bear market…but somewhere in between. When so many variables are up in the air.

THE FACT WE HAVEN’T

HAD A SINGLE LOSS IN 12

MONTHS WAS ALL ABOUT PLANTING THE RIGHT SEEDS.

And then smart profit-taking.

Let me explain how it works.

Imagine you had $100,000 to invest in the trades I picked when I started Retirement Trader in December 2018.

When you buy a stock, my money management rule is that you risk a maximum of 2% of your capital in any one trade.

So, at the start, with a hypothetical $100,000, you risk $2,000 on the first trade.

If I gave you a stop loss on the trade that was 25% below the entry price, you buy $8,000 worth of stock when you enter.

That’s because a 25% fall in the price would lead to a $2,000 loss. Which is exactly 2% of the capital you are trading with.

From inception in December 2018 to the peak of the market in mid-August 2021…provided you followed ALL instructions exactly and re-invested all gains…the hypothetical portfolio jumped from $100,000 to $267,000.

A 167% return in two years and nine months.

During that time period, 2019 to August 2021, the S&P/ASX 200 was up just 34%.

Remember that the 2020 COVID crash also occurred during that timeframe.

So, our portfolio of trades…based on the lessons I’m outlining now…outperformed the index by nearly five times (4.91 times).

This is what I mean about smart profit-taking.

And trying to turn trades into ‘free runs’ by taking money off the table at key points.

It doesn’t always come off.

But it means you don’t have to predict what might happen next, like everyone else is trying to do.

When you do that, you’re setting yourself up for failure.

Because you end up reading 10 different views that are contrary to each other. Then what are you supposed to do?

You are back at square one.

An analogy is cricket.

A batsman hasn’t got a clue whether he will get a duck or score a hundred when he goes out to bat.

But he has a fair idea that he will average, say, 30 runs over his next 20 innings.

If you have ever played cricket, you may know what usually happens when you’re batting and decide on a shot before the ball is bowled.

There is a gap in the covers, and you tell yourself that’s where you should try and score some runs.

You will probably get out because you are playing the shot rather than reacting to the ball that is bowled.

A good batsman stands ready, without any view on what shot he will play next. He just trusts that he has the tools to cope with whatever will come his way.

He can’t predict whether he will get a bouncer or a yorker. It’s pointless trying to predict it and is counterproductive to do so.

His skill is in honing his ability to respond in the blink of an eye with the correct shot.

If the ball calls for defensive play, he will do that. If the ball is terrible, he will clobber it.

You should view trading markets in the same way.

You don’t need to predict what’s coming next. You just need to hone your skills, so that whatever happens, you remain standing.

This is exactly what we did at Retirement Trader before the COVID crash in 2020 (I took profits in many positions just before it occurred).

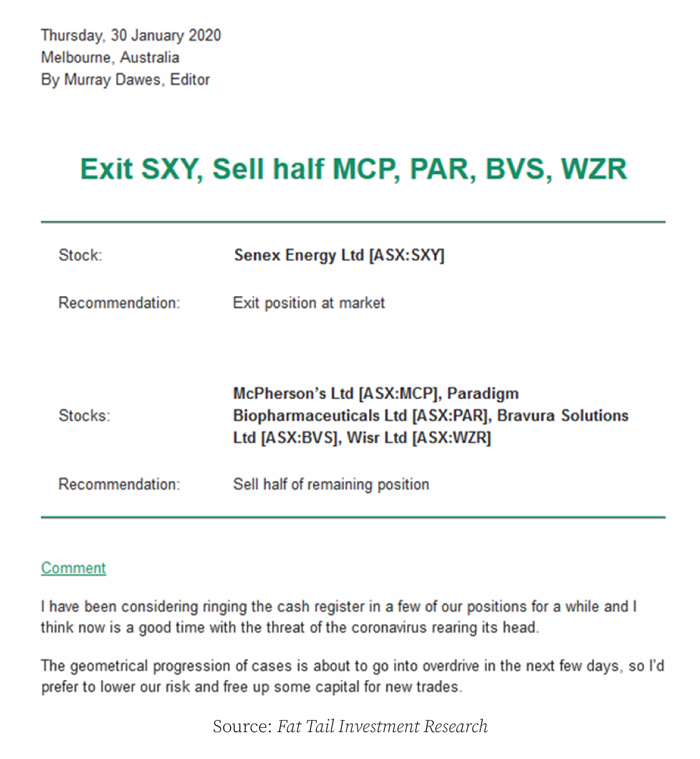

Sell alert sent on 30 January 2020

And outperformed the index by nearly five times during the bull market.

Then, when market conditions changed, we changed!

Turning your trades into ‘free runs’, whenever possible, is the key.

That means position sizing, taking part profits, sitting on the sidelines when volatility is high, executing stop losses without thinking, and changing your view if price action changes.

You’ll have far more success focusing on those things.

Rather than trying to work out whether Trump’s tariffs will crash the market or not.

This is the market behaviour model Retirement Trader adheres to. We have managed to hold on to the incredible gains made from 2019–2021. And traded smartly since. With the hypothetical portfolio value sitting at $333,098 on 16 January 2025.

That is how members could have made average annual returns of 25% since inception.

And so we get to:

LESSON #4

Make hay when the sun shines…Batten hatches in storms…

As an investor, you have to understand when it is time to attack.

And when you have to sit on your hands and wait it out.

You can only learn the difference through bitter experience.

Or…

You can listen to someone who has been there and done that…and knows when there’s money to be made. And when it’s time to protect what you have.

2025 is a period where things could go either way.

And this is the PERFECT strategy for such a period…

That is the essence of my Retirement Trader advisory.

But you won’t really know unless you try it.

It’s incredibly well-priced for such a high-performing service.

But because we’re at such an ideal point in the markets to start this kind of trading, I’ve set up a special ‘test-run’ situation.

Test-run Retirement Trader for

three months for just 17% of

the full annual price upfront

That right. Pay 83% less upfront than what full annual members pay…if we hear from you right now.

The next three months…whatever they hold…will likely be rife with new positions to enter.

Despite the stellar current track record, my advisory still might not be for you.

So I want to give you a chance to give it a proper run…without committing to a full subscription.

If you’re interested, click here

for the details on how to try Retirement Trader

for three

months for 83% LESS upfront

than the full annual membership

But even if you’re NOT inclined to join my trading service…

…stick around. There are a few more lessons I think will aid you greatly in managing your own portfolio in the strange but exciting times ahead.

For instance, knowing when NOT to trade.

Over the last couple of years, many of the best decisions I’ve made have involved not trading at all.

I make no apology for not promising a certain number of trades a month.

The market decides when we trade.

My view is that the more you learn about the markets, the less you realise you know.

Trading markets isn’t about predicting the future.

It is about knowing that you can’t predict the future.

It’s about playing each ball as it’s bowled.

Why I split each trade

up into three parts…

There are three key things we all want to achieve when we put our money on the line.

Firstly, we want to ensure survival.

Secondly, we want to make a bit of money consistently.

And thirdly, we want to shoot for the really big returns.

By splitting up each trade into three parts, I aim to achieve each of those outcomes.

My first profit target is about ensuring survival.

I set an initial target, which is the midpoint of the wave or range that prices have been trading in.

I see that as the high-probability event.

After the initial target is hit, the risk on the trade drops massively.

Unless the share price gaps down below the breakeven stop loss on bad news…the outcome from the trade will either be walking away with the money invested or making money.

That is the survival part taken care of.

You’re looking to plant the right seeds. Get away more winners than losers. And make sure your winners are way bigger in percentage terms than your losers.

That’s how you get a 25% average annualised return over time.

Think about it.

If you got 50% of your trades right…and made as much on a win as you lost on a loser…you wouldn’t end up making anything.

But when you double the amount you make on a winner versus the amount you lose…and you are getting 61% of your trades right…that’s a consistently successful P+L over the long term.

THAT’S the power of the first profit target…

By hitting that first profit target more than 50% of the time, it gives us the best chance of survival.

Now let’s get to the next phase in the trade. The second profit target.

The second profit target is about making sure we are in a win-win situation.

I LOVE it when we get here on trades.

I will wait until we get concrete signs that the momentum on the rally is waning…and then sell another third of the position.

After the second profit target has been hit…we know that we will walk away with profit in the kitty…or more profit to come.

Sometimes it means that even if the company goes bankrupt…we STILL walk away with a win!

That is the definition of having a completely free run on a position.

Just imagine what it’s like to be in a position which is either going to make you some money…or potentially a lot of money.

Where a loss is now out of the equation.

Pretty cool position to be in, right?

And so, we progress to the promised land of trading.

The third phase

‘firecracker’ explained…

As long as the long-term trend is heading higher…we will hold on to the position for as long as possible.

That’s not going to happen overnight.

If we’re very lucky, we’ll get to the third phase in the space of months.

Mostly, it takes one year or more.

But the third phase is the firecracker…

That’s when the REALLY big gains can start piling up.

The 167% gain made from 2019 to August 2021 was mostly due to stocks that we had going ballistic during the third phase.

We rode Paladin Energy from 12 cents to 71 cents.

Neuren Pharmaceuticals from $1.80 to $7.48.

Lynas Corporation from $2.15 to $8.27.

Telix Pharmaceuticals from $1.84 to $7.10.

You only need a few of your trades going up multiple hundreds of per cent to really kick your returns into high gear.

As you can see from the trades above…we picked some great winners and managed to ride them a long way.

That is not because I have a crystal ball.

It is because we have a method to firstly ensure survival.

Secondly, make a bit of money consistently.

And thirdly, shoot for the big firecracker returns.

We never know which phase of the trade will come in handy at any one time.

Because the market doesn’t let us know whether it is about to rally strongly or sell off.

Sometimes the first phase of the trade is a godsend. As it was during the COVID crash.

We got stopped out of trades like everyone else. But we had taken part profits on many of the positions.

So we walked away unscathed. Phew!

When markets took off to the upside after the COVID crash, the second and third phases started to prove their worth.

This three-phase trading means

we can cope with whatever the

market throws at us

Let’s drill down on an example.

The West African Resources

[ASX:WAF] trade.

These guys are a Burkina Faso (Africa) based gold producer.

They’d been stuck in a range for three and a half years between 72 cents and $1.45.

Remember what I said at the start about stop losses being placed just below major support levels?

Well, after three and a half years holding above major support at 72 cents…you can bet there were plenty of stop losses lined up below that level.

In October 2023, the price for West African Resources fell below 72 cents. And a flurry of selling took the price down to 65 cents.

But then the buyers returned. And the price bounced dramatically over the next month.

That is the type of set up I love.

Let me explain why…

LESSON #5

The PIVOT

I like to wait until there are concrete signs that the momentum has turned up after a period of selling pressure.

But you can’t wait too long. Otherwise you will miss the opportunity.

This is where the ‘monthly buy pivot’ signal comes in.

It gives me confidence that the worst may be over.

It sounds complex, but PIVOTS are simply a logical necessity when markets change direction.

They aren’t dependant on a lot of past data. So they aren’t lagging in nature like so many other indicators.

If prices will change direction in whatever timeframe you are using, a buy or sell pivot is the first thing that must occur.

But just because they happen, doesn’t mean a long-term trend is about to start in the other direction.

Think of a very simple market where prices are continually marching higher day after day.

The low of each day is higher than the low of the previous day.

The high and close of each day is also higher than the last.

If prices ended up falling over and returning all the way to the lowest price…what must occur?

The very first thing that must happen is that we see a closing price below the low of the highest-priced candle.

Again, all of this sounds a bit like technical jargon, but let me show you a picture of what I am talking about.

Buy and sell pivots explained

The green bars in the picture refer to days when the share price went higher.

Whereas the red candles show days when the share price went down.

I am making this chart as simple as possible to describe the concept of buy and sell pivots for you.

Hopefully you are starting to see that prices can’t go very far in the opposite direction…without creating a buy or sell pivot.

If you go to a bird’s eye view of prices by looking at a monthly, quarterly or even semi-annual chart, you will see that buy or sell pivots occur far less frequently than they do on the shorter-term charts.

That makes them far more powerful.

So let’s jump to the WAF chart to see what I saw when we entered the trade.

West African Resources bounces

after false break of 72 cents

West African Resources had developed a fabulous mine in Burkina Faso, which was making a lot of money.

The price had been rallying for years. But range trading began in 2021.

So, when I got the buy signal, we joined a very long-term uptrend but were buying short-term weakness.

That is what you want to do.

We bought the stock at 93 cents and $1.01 with half a position bought at each level in December 2023 and March 2024 respectively.

I placed the stop loss on the position at 55 cents, which is well below the lowest price hit in the last four years.

In other words…

The price would have to collapse to get us out.

I gave Retirement Trader members an initial target on the trade at $1.26. That is where I told members to sell a third of their position to lock in some profits.

The stop loss on the position would be moved to 83 cents after the initial target at $1.26 was hit.

That is because if the price fell to 83 cents, the whole position would break even.

The profits made on the stock sold at $1.26 would be lost by the remaining stock sold at 83 cents.

So, the initial capital would be safe.

Let’s have a look at what happened after we entered the trade.

West African Resources blasts off

Can you see the advantage in understanding how other traders behave?

We bought West African Resources after the stop losses had been set off at 72 cents.

And the buyers had returned.

We waited until there was proof that prices may be rebounding by waiting for the monthly buy pivot.

The initial stop loss was set at a level that would definitely prove us wrong in our view that the uptrend of the past eight years was going to continue.

The initial target was hit within four months.

So we didn’t have to wait long until the trade became a breakeven or winning trade (the ‘free run’ situation I’ve been talking about).

The price hit $1.60 within six months of entering the trade.

You need to be clear

what that means…

If you were one of my members, you’re in a stock that is trending higher rapidly…and you would have ALREADY taken part in profits.

So…you know the worst that can happen is that you will break even.

The breakeven price is at 83 cents, which is miles away from where the price is trading. So the chance of being shaken out by short-term volatility is minimal.

Can you imagine how good it feels to be in that position?

No stress.

Another seed is planted and then you move on to the next one.

No need to keep checking the price every day, fearful that it will fall and take all your profits and hand you a loss.

While not every trade gets to that point, that’s the aim. Giving you confidence you are following a detailed trading plan…focused on managing risk so you can sleep easier at night.

It’s important to emphasise the risk element one more time.

This is NOT risk-free investing by any means. A portion of the stocks we cover are small-caps. These rise and fall with more volatility. The quickest and biggest gains are often made from small-caps. But the same goes for losses. Which makes Retirement Trader’s risk management approach so crucial.

As Retirement Trader member Wayne says:

‘He minimises risk by having a trading plan which uses stop losses and takes profits at regular planned intervals.

‘Leading to the creation of a free call position which means we can let winners run their course.

‘This is a low risk and highly profitable trading approach, and Murray is simply the best.’

Which brings us to:

LESSON #6

Make a plan. Stick to it.

Again, that seems like a ‘Well, DUH!’ thing to say.

But you’d be surprised how many traders…even professional ones…break this rule.

You’ve two simple choices:

1.Make decisions based on a solid trading plan.

2.Or get tossed around like a ragdoll by the market.

Have you made rash decisions in the moment in the past because you didn’t really have a plan?

Have you taken profits too early?

Or dumped a stock even though the stop loss hasn’t been hit, just because of some negative news?

Without a rock-solid approach to trading stocks, you will end up losing money. Pure and simple.

As Retirement Trader member David D puts it:

‘I have been following Murray's educational style on charting and for his stock tips from earlier services (2012) and now under his Retirement Trader service.

‘I can only say his methods blow my mind.

‘I have strong regard for his entry triggers and exit risk reduction strategy. Some current examples DYL up 58.5%, PRU up 136%, RRL 27.6%, DEG 4.9% (early days). BHP, WDS and TLS harvested a couple of times over the years, all profitable.

‘From the early days PDN painful for years but now up 2,539% and EVN up 51.8%. There have been a few duds, but where I follow exit advice and now apply the risk reduction strategy for a free option, I am minimising downside and allowing upside to run.’

Nicholas D writes:

‘I have been investing with the guidance of Murray's investment services for a number of years now. Retirement Trader delivers good returns for minimal risk.

‘I love the technical explanations and the clarity at which Murray explains the process. His honesty and openness give me great confidence in the service.

‘Nearly all my trades are in the money at this point in time, with part profits taken on a number of them. Not every trade is a winner, of course, but Murray’s trading approach minimises losses on these occasions.’

Alan R writes:

‘After years of barely making 3% on a portfolio of term deposits and Australian stocks, I am now safely and comfortably in front, thanks to Murray and Retirement Trader.’

If the chance at being ‘safely and comfortably in front’ appeals to you…

…then why not give my Retirement Trader advisory a go?

We’ve set up something new that allows you to do this for a really low introductory fee.

Try Retirement Trader

for

three months for

$499

instead of $2,999 annually

Retirement Trader’s official membership is $2,999 per year.

Don’t worry. You’ll never pay that if you take this deal today.

We’ve set something up that’s much more affordable.

This is not a basic investment newsletter. It’s a trading advisory with a model portfolio.

But given my record — and the trades, portfolio management and ongoing education you get — it’s really very decently priced, even if you pay the full annual fee. Especially when you consider there are no further performance costs.

As member Angus points it, the fee can pay for itself very quickly…

‘Hesitated to pull the trigger as it's not cheap but has returned the subscription price and more, which is actually pretty rare. Murray has a good hit rate.’

As member SS attests, this kind of guidance is pretty unique:

‘After a couple of decades looking for guidance that would grow my wealth instead of the brokers’, FINALLY, someone who talks my language, and is cautious.

‘Murray gives advice as if it were his own money on the line. I get the feeling that it is.

‘I get his liking for graphic presentation and trust his reading of the signals. Finally, someone who is not losing me money.’

However, you’ve not seen how I work to ‘not lose you money’ from the inside.

You really need to join and trade alongside me, over time. But $3k is a lot to stake on someone. Even if you like my ethos and what I say resonates with you. Especially in today’s market.

So…

I’ve created an option that lets you give Retirement Trader a test-run…for a much more acceptable outlay.

$499 for three months.

That will let you give the service a full whirl. All the new trades. All the buy and sell signals. Discover and track every live recommendation in my portfolio.

Put Retirement Trader

through the ringer yourself

Without having to stump up the three-grand fee. In fact, you’ll get keys to the whole safe for JUST 17% of the full price.

Three months should be ample for you to get to know me, learn how I trade, and see what I’m about.

In fact, I’ll even provide you with a further backstop…

Get even that $499

REFUNDED

IN FULL

if you

decide this isn’t

for you within 30 days

That’s right.

That’s right.

Even with this special new three-month deal, a full 30-day subscription refund guarantee applies.

So if you join, and assess within a month that Retirement Trader isn’t for you…I insist on refunding that $499 in full.

All you need to do is let our customer services team know, and I’ll ensure the $499 is returned to your account.

You won’t be a cent out of pocket for giving this a go.

Does that sound reasonable?

To try Retirement Trader for

three

months for 17% of the

full annual fee,

click through

to this secure order page

If:

- You are curious and interested in building an active portfolio…but are busy and don’t want to be constantly trading every day…

- You want a voice you can trust to help you find solid investments in the stock market…to help you build wealth towards retirement…

- You are fearful of how volatile stocks can be…especially at the moment…and wish to avoid wild risks…

- You want to keep your stress levels down while investing in stocks that make sense to you…

- You want a curated selection of thoughtful, TARGETED trades…rather than dozens of ideas thrown at you which you then have to choose between…

- You respect RISK MANAGEMENT. And recognise that sometimes, in some periods, the best action is TAKING NO ACTION…

- You are looking for someone with no conflicts of interest. And who wants you to succeed…

If you don’t make money

with

me you won’t remain a member. Simple as that.

My desire is to have you as a member for many years to come.

That will only happen if you know I am in your corner every step of the way, giving you the best advice I can.

If the above resonates with you…and you understand how useful it is to have a trader with 30 years’ experience guiding you through the trading minefield…

Try Retirement Trader for just

three months for 17% of the

full annual fee by clicking here

Here are a few more words from current members.

Darren S. says:

‘Murray is one of the rare “stock pickers” who I trust completely. Down to earth, professional, humble and f***ing great at what he does.

‘His strategy has proven itself. My mistake initially was just investing in some of his tips. Follow his strategy to the letter and you cannot go wrong!’

EB says:

‘Retirement Trader is the only financial advisory newsletter I read. I have tried many others but always seem to go backwards financially.

‘With RT I like the rigid mathematical/graphical empirical approach based on historical trends and researched facts.’

Dave says:

‘Murray’s approach to investing, educational videos and communications exactly matches my needs, as I approach retirement.

‘I do not have the timeframe or excess funds to risk on the more speculative alternatives.’

Dee says (keep in mind Fat Tail Investment Research is my publisher):

‘I have followed Fat Tail for many years and never had the guts to take the plunge. With Murray’s help, I have jumped in, and love it.

‘Insightful and accurate, I now act when the emails or texts come in.

‘Your understanding of the market, and needs of retirees, has given me the courage and confidence to have a go, and has opened a new world of fun and challenge.

‘Thank you so much.’

A Dykes says:

‘I really enjoy Murray’s advice and whilst I don’t invest in all his recommendations I have made significant amounts on the ones I have.

‘I really appreciate his trading style and especially like his ability to sit on the sidelines when needed. This is actually what gives me the most confidence in him.’

Rob Adler says:

‘Great so far — Murray is ideal for his advice to a semi-retired accountant like me.’

Matt R says:

‘Murray has a great talent to both risk manage and stock pick very proficiently through his own unique approach.

‘If you follow Murray’s guidance with discipline, you can be very successful.’

Mark R says:

‘I have great confidence in Murray’s ability to identify the right time to buy and sell stocks. His mix of technical and fundamental analysis inspires confidence. His use of video updates to explain and educate is first class.’

AA says:

‘Really like his style and knowledge. Seems to be straight down the line and no BS. Feel very confident in acting on his suggestions.’

As these words show, I take the responsibility of providing stock trading advice very seriously.

What you’ll get if you take

this special $499 offer

So, this is a new opportunity to put this type of trading to the test for three months…for 83% less than the official annual membership fee.

A fairly radical discount.

What that means is you pay just $499 now. Which gives you full and unrestricted access for three months.

90-ish days is a very long time in the markets. Especially THIS market…where things seem to change on a dime.

You can cancel any time.

Meaning you’re not locked

into an annual membership

You can constantly judge — on a three monthly-basis — if Retirement Trader is living up to the standards set out in this letter.

If it’s not…simply cancel.

No questions asked.

As a member, you will receive:

Retirement Trader Trade Alerts

The core of the advisory. But…as mentioned…these will only come when the opportunities present themselves.

I personally find investment newsletters that promise ‘a buy recommendation on the first of every month’ a bit daft.

It may work for them. But markets don’t really work that way.

As such, you’ll need to monitor your email fairly regularly, so you’ll get my trades when they’re generated.

Sometimes there might be a couple within a few weeks.

Sometimes we might go a month or more without entering new positions.

Again:

The market, not a schedule,

will dictate our trading

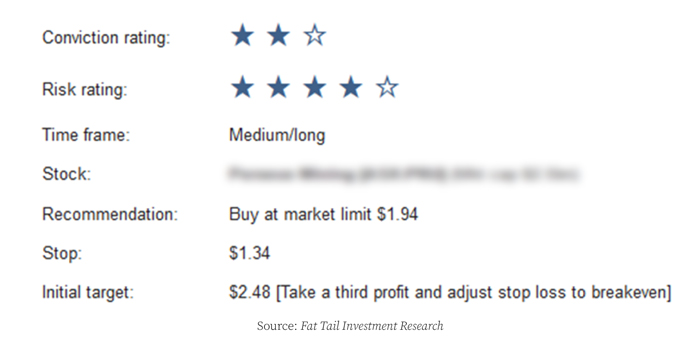

The top of each trade alert will contain the key information you need to enter a trade. It will let you know:

- The name and code of the stock to buy.

- A conviction rating out of three stars.

- A risk rating out of five stars.

- Expected timeframe to hold the position.

- Recommended price to pay to enter the stock.

- Stop-loss level to exit the stock and avoid further losses.

- An initial target with instructions on taking some profits and moving the stop loss to ensure the worst outcome will be breaking even on the trade.

This is what it will look like:

Below this key information you will get a comprehensive analysis of each trade, based on fundamental and technical criteria. So you can make an informed decision on every trade.

THE TREASURE TROVE!

Unrestricted Access to the

Entire

Retirement Trader

Buy and Hold List

It’s a pretty great deal you’re getting here.

Pay just 17% of the full annual

ticket price for three months…

and get keys to the entire

Retirement Trader bank vault!

Join now for just $499 and you’ll get instant access to the entire portfolio.

This includes all OPEN POSITIONS. (At the time of writing, there are currently 13. Just know that this can change.)

You will also be able to see the entire list of CLOSED POSITIONS…and whether they made a gain or a loss. (There are currently 82 closed positions, with an average hold time of around 50 days.)

Want to know what we bought…

and what trades we’ve currently got on? Take this $499 deal now to find out!

Video Masterclass Series

Essential viewing, as soon as you decide to take this $499 deal.

This is your ‘soft introduction’ to what we’ll be doing and how we’ll be trading.

In these five video sessions, I walk you through the important elements of the technical analysis model we use to enter trades.

It’ll all be in plain English. As you’ve seen, a big reason members stick with me is that I break things down in a very easy-to-understand way.

The topics covered are the basics: pivots, distributions, trends, indicators…and how I use all these to find you trades.

If you want to educate yourself to become a consistently profitable trader, you have come to the right place. I want to ensure you understand the process we follow so you have confidence in the decisions made.

Once you have familiarised yourself with the trading approach, then I encourage you to dip into:

The Entire Retirement

Trader Update Archive (UNRESTRICTED ACCESS)

Every two weeks, you will receive a comprehensive market update video that looks at major markets around the world, upcoming trading opportunities, and reviews all open positions.

If you are looking for education about trading markets, the market update videos contain a wealth of information about how I analyse markets and look for opportunities.

You will also receive a written document that covers many topics related to trading the markets.

I discuss trading psychology, money and risk management, macroeconomics, upcoming opportunities, and open trades.

When I receive a trading signal, I will send you a trade alert, which contains all of the information you need to enter a trade with confidence. We can also send you an SMS to alert you to the fact that a trade has been sent to your inbox.

I encourage you to go through at least the last month or so’s updates when you join. These will give you a feel of how we’ll be initiating and managing trades…so you’ll know what to expect when you get your first live one!

The Retirement Trader

‘Direct Access’ Email

Members love this. If you have any questions along the way, I’ve set up an email address where you can contact me directly.

In the early days, we had a cumbersome process that meant emails went through a few hands before arriving in my inbox.

I’ve streamlined it so you can send me them directly, any time.

Sometimes I’ll be able to shoot you a direct reply, if it’s relatively short. Otherwise, I allocate a time during the week when I reply to emails in batches. This is usually on Monday afternoon.

Test it out when you join. Shoot me an email and say hello.

Maybe you would like me to discuss bitcoin. Or wish to know my take on a company you’re already tracking.

Whatever you’d like to say, don’t be shy, and let’s get the communication channels open. Just remember that I cannot provide any personal financial advice.

The Extended Lessons:

Retirement Trader

Strategy Report

Perhaps worth the $499 just on its own.

As I’ve said, my career in the markets has spanned from the Sydney Futures Exchange trading floor, fresh out of uni…to stewarding the portfolio of one of Australia’s wealthiest families…to helping thousands of Aussies today trade the market in a calculated, risk-controlled way.

This report outlines everything I’ve learned along the way in more detail.

You will learn about ‘widening distributions’ and ‘points of control’ and how we use them to enter profitable trades. It explains the money and risk management tools we use, such as creating ‘free’ call options…and how to work out how much money to invest in each position.

If you found what we’ve covered here useful, wait until you get a load of this…

SPECIAL RESOURCE #1

How to Trade Shares

that Go Down

As I mentioned earlier, we may see a shorting opportunity in the banks at some point.

Many people are in the dark about how short selling can add to their investment profits. Others don’t even understand what it is or how to do it. But let me set your mind at ease. Short selling does not have to be difficult.

In this special report, I’ll explain exactly what short selling is, how you do it, and how it’s possible to make money when share prices fall. I’ll take you through everything you need to know. But I’ll do it without the jargon. And remember, if you have any questions, you can always contact me via the direct member email address.

SPECIAL RESOURCE #2

How to Trade Using CFDs

A CFD (contract for difference) is a tradeable contract between a client and a broker, who are exchanging the difference in the current value of a share, currency, commodity or index and its value at the contract’s end.

CFDs involve leverage. They are not for everyone. And they are by no means an essential part of Retirement Trader. The portfolio returns cited in this letter are from good old-fashioned trading stocks…no leverage at all.

But if you’re a slightly more sophisticated trader, you may be tempted to employ CFDs on our trades. This report gives you a warts-and -all breakdown on how to do that…again all in plain English.

So, there we have it.

You’ll get all of the above for three months for 83% less than the annual membership fee.

$499 instead of $2,999.

That gets you everything I’ve just mentioned…plus access to the live updates and trades for the next three months.

And you’ve a guaranteed option of getting even that $499 refunded in full within 30 days. No questions asked.

It’s a stunning ‘intro’ to what we do here.

Thanks for giving me your

time to read this letter

I hope you got something out of it, even if you don’t take this deal today.

It’s been a tough five years. But Retirement Trader members have been insulated from much of the craziness coursing through global markets.

Now…at the time of writing at least…things are starting to look VERY interesting again…

To join Retirement Trader for three months for $499 instead of $2,999 annually, click the link below.

And thanks for reading.

Regards,

Murray Dawes,

Editor

Retirement Trader

JOIN NOW

Still undecided?

Then check these out…

You’ve seen loads of member testimonials in this letter.

These are genuine words from regular investors who are seeing way-above-normal returns from my trades.

If you want to know how Retirement Trader could work for you, don’t listen to me. Listen to them!

Here’s a fresh batch of feedback from the middle of January, 2025. Just look at the sheer volume! You don’t generate words like this unless you’re doing

Nigel D

I have followed Murray Dawes for some time now and I find his method of trading very simple and effective. It’s a trading method that resonates with me. I have not taken all the trades he has recommended but almost all the trades that I have entered with his recommendations, have done well. What is most important from my perspective, is that Murray is very honest; he explains why he recommends a stock and what can go wrong in a trade. And when a trade does not work out like we want it to, he admits it and recommends corrective action, such as closing out. If you do not have the time or ability to do your own research on which stocks to invest or trade in, then Murray's service is the best to use.

Rob K.

New to the Trader Experience and enlightened with Murray's approach where timing of recommendations and outcomes are just great.

D.M.

Murray's Retirement Trader, exactly matches my investment needs as I head into retirement. Good honest "down to earth" advice that minimises the risks to my un-replacable capitol, while delivering consistent returns.

Steve

Your technical advice I’ve learnt from in order to have confidence trying to become a better investor. I’ve liked your method of getting a “ free ride” when a share gains value. I do appreciate your service and look forward to continuing my learning experience from you. Well done Murray.

Trevor O

Murray delivers good honest advice without the BS. So hard to find nowadays. Brilliant.

David O

I have been delighted by the results I've achieved from Murray's "Retirement Trader" service. My SMSF portfolio is in very good shape and it is all thanks to Murray's recommendations. I cannot recommend this service highly enough if you want a disciplined approach to maintaining your retirement nest egg.

Stu W

Murray’s approach is very much aligned with my philosophy. He doesn’t jump in to crazy trades and then peddle excuses for why you lost out. He is careful to explain his thinking, a tad conservative when it makes sense and prepared to sit on the sidelines when there are no trades that fit his criteria.

J.G.

Murray is very insightful when it comes to making or selling trades. He provides excellent information to make an informed decision, many of which have been successful. Wish I had found Retirement Trader sooner than I did.

The Patient Punter

Murray is a real quiet achiever that consistently provides great trading (and investing) opportunities that provide real gains in timeframes that I seldom experience (i.e. really short!!(. Not every tip rockets up straight away but some patience will usually get you into the green there as well. I've already paid for my subscription to his service a few times over and expect that multiplier to keep on rising. Go Murray you good thing!!

PAP, Sydney

Murray is a "down to earth" and very experienced trader whom we are very lucky to have access to his skills. He is direct with no false promises even though we are going through very volatile and new times at present. This is why his experience and candid approach is key - right now!

Kevin Jackson

Fantastic in a word. I have traded for many years thinking the charting I used was the best until I came across Murray and his explanations and education of reading the charts correctly. Nearly correctly anyway. The chart is your friend and learning from MD is the best for AU shares which I only invest in, using MD's guidance by watching his charts and listening his commentary on the closing bell videos.

Paul Ea

I previously had a Retirement Trader subscription but did not renew it several years ago. Now I have always read with great interest everything he publishes, and he is known as "A Guru" by some very well respected people. In short, Murray really knows his stuff and you would be well advised to listen to him carefully.

Peter

I like your honesty and integrity, along with your understated way of delivery. It’s hard to wade through all the rubbish that is out there, yes I subscribe to a couple of other of competitors also. I have done well from your advice and are looking forward to what this year brings.

Ted

Murray shares his wealth of experience in the share market and has a great way to support his decisions with technical charts and simplifying the information for anyone to understand. Thanks Murray keep up the great work!

Steve M

Murray has a very measured approach to his trading recommendations. His analysis is based on what the data tells him rather than some story based on assumptions.

John Harris

What’s important to me is Murray gives clear advice when to enter, exit and take partial profits in a trade. I don’t have to check markets myself but just act when he sends a text or email. I am well in front by following his advice.

J.Scott

Murry has earned my trust which doesn't come easily at all. He’ll own up if he’s been wrong which isn’t that often. I have found him brilliant, disciplined and well rounded with amazing depths.

Andrew

Excellent service, accurate and repeatable. I have recommended Murray to other potential new Fat Tail members.

TB

I have found the experience with Retirement Trader over the past two years to be very helpful and financially beneficial. Murray provides informative and helpful information that helps you better understand investing in shares in all types of markets which is not an easy thing to do.

Roger Hanckel

Highly impressed. The only aspect I consider could be better is that (even on a PC screen) it is often very difficult to identify which company's (or other) graph is being discussed (if we don't catch it when you say it at the start).

RH

Very informative, enlightening and sometimes - profitable! Have been a follower of "Closing Bell" for sometime, Murray has always given very considered stock and investment tips. Murray is very good at the educative process in using his evidence and analysis and the way it is explained gives a lot of confidence.

Keith R.

I am proud to endorse Murray's professional approach to providing me with knowledgeable and accurate investment advice. His comments and recommendations are clearly aimed at assisting me to make sensible decisions resulting in exceptionally strong financial results, thus allowing me to achieve my long term objective to build a financial base upon which my wife and I can enjoy our retirement without the pressure of worrying where the next dollar is coming from to pay for the rising cost of living, as well as maintaining the life style we have worked so hard to achieve. Patience in investing is an essential element if you want to achieve. Murray knows this and is not afraid to warn when the conditions are not favourable to success. He will not cloud reality by offering other meaningless, ridiculous investment opportunities that so many other so called "advisors" miraculously uncover and then strongly endorse. He persists with sharing facts with members subscribing to Retirement Trader, for he has only the best interests of each and everyone of them in the forefront of his mind. He acknowledges however that the final decision on any action to be taken is up to the individual subscriber but I would strongly caution turning a blind eye on what he suggests. Caution will avoid severe losses; as much as common sense will result in financial strength and happiness. Thank you Murray and keep up the great and honest work you are doing.

Sam V.

Love Murray’s straight forward no nonsense approach. It makes it easy to follow and my understanding is growing the more l learn, Murry is a great teacher while he advises.

L.L.

I’ve been following Murray’s retirement trader since the beginning and couldn’t be any happier with the results of his stock picks and also his insight into trading. So often picks a stock just before it breaks out convincing me his trading method works so well. Keep up the good work.

LCJ

The service provides a conservative approach with a safe pair of hands.

JD

Murry gives great advice and is fair dimkum without any BS and is well worth following.

DM

His charts! I love how Murray uses the charts. I'm a visual learner. This has helped me understand market moves and what to anticipate. It's been game changing for me.

G Povey, Victoria

Great communicator, zero fluff. Everything Murray says is pertinent and concise.

TC

It's been a great ride so far. I have faith in Murray's financial markets expertise.

David Egan

Gday Murray, I never miss reading you weekly update, thank you. I like the way you show us on a chart the buy zone, sell zone, and the point of control of a stock. Also i use the monthly buy pivot when i look at a stock. You have taught me some good stuff thank you.

Rose P

I’ve been with Retirement Trader for 3 years. His stock recommendations have been very good. Occasionally there is a loser but there have been a lot more winners. Murray advises as soon as he sees a buy, has upper and lower limits for selling. Weekly report is provided weekly. I highly recommend Retirement Trading.

Alexander John Churchill

I rate Murray's advice very highly which is especially helpful in interpreting trends both in the market in general and managing my portfolio.

Christopher

I look forward every time to Murray's wisdom and his cautious advice. It has given me the courage to make profitable trades in a volatile area of the market.

Jaci

I have been a member of Murray Dawes Retirement Trader for some time and I can't fault either his system, view of the market or his stock selections. If there is nothing to trade Murray doesn't just send out buys. He waits patiently, and explains his strategy while he does that, and then selects a trade when the time is right. I more than covered the membership cost early on and am looking forward to some prosperous trades in 2025.

Julian

Murray’s approach is very professional, giving a thoughtful presentation, with an in-depth explanation that is easy to follow! I find Murray to be as honest as the day is long!

S.L

Murray is my preferred go to person to find out what is going on micro and macro levels of stock markets. I've followed him for years. I'm 78 and learning all the time. I love his teaching his style his thinking and trust he has my /our best interests in mind. Trading shares is extremely tricky but Murray emphasizes risk management which l need as l’m a gung ho personality. Thank you Murray.

DB

A terrific service, I can just follow Murray's picks with confidence or get as informed as I want. His advice on market movements and chart reading has helped me immensely.