There I was, sitting in my pyjamas…

Bleary-eyed, shaking my mouse at 7am on Saturday, 20 September 2008. Scanning what happened in the US session while I slept.

Lehman Brothers had just gone bust.

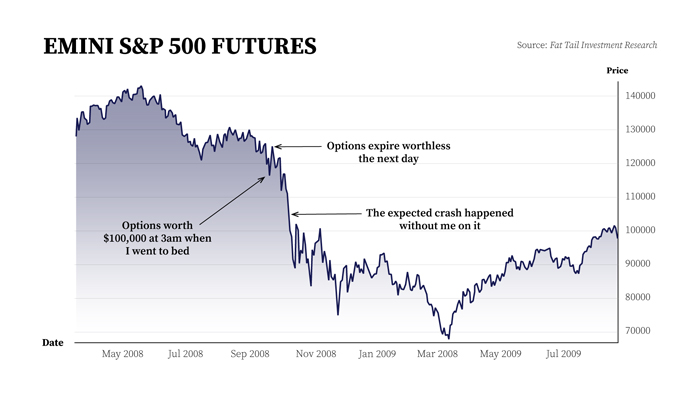

And I had a bunch of S&P 500 futures put options I’d bought before Lehman’s downfall. (Put options make money when the price of the underlying security falls.)

They were massively in the money when I went to bed.

And were expiring IN THE NEXT 24 HOURS.

When I last checked the S&P 500 at 3am, it was selling off aggressively. An almost crash-like sequence.

My $10,000 options were now $100,000 when I hit the sack.

Sweet dreams!

When I woke, I was excited to see if they’d shot to an even higher level. I planned to bank the gains on expiry…and reinvest a portion into more put options.

A full-scale crash seemed inevitable.

Unfortunately, 20 September 2008

didn’t work out that way…

I got out of bed. Fired up the screens. And came the closest I think I’ve ever been to a full-blown heart attack…

Soon after I turned in…the line on the S&P 500 chart went vertical. The S&P 500 ended the night UP 14%.

Yep, you read that correctly: UP 14% in a trading session.

That…I believe…is around the fifth-biggest daily move in the history of that market. Still is to this day.

Un-bloody-believable.

An announcement from the US government about a bank bailout sparked it.

The options that I had were now…worthless.

The crash I had been expecting did come eventually.

I was inches away from it.

It actually started from that exact moment — with the 14% rally on that day being the peak of the move. Stocks started heading down again in the following days. The S&P dropped 43% in the next two months after that fateful day.

Sadly, that was no use to me that morning.

My options (which I was planning to buy again with a different expiry date after banking gains on the ones I had), would have been worth about $500,000 in November.

Half-a-mil in two months.

Not a bad outcome, right?

But it wasn’t to be.

Instead, $100k turned to zero in four hours.

My mental state was wrecked.

I didn’t keep buying options. Instead, I watched the crash occur without me on it.

Now…

Why am I regaling you with this 16-year-old sob story?

My professional trading career spans over 30 years.

But looking back, it can be split into two distinct parts.

BEFORE 20/9/2008.

AFTER 20/9/2008.

Since that morning, I’ve never looked at, or traded, the markets in the same way. And, as I’m about to show you…my results since speak for themselves.

I have a set of six simple investing rules to share with you.

I call them THE LESSONS. These same core principles are what drive a special advisory that I run.

It was established in December 2018.

Since then, members who followed each trade had the chance to make an average annualised gain of 25%.

That’s 25%...on average…every year.

In what has been the choppiest…most unpredictable…and, frankly, BIZARRE market periods in my 30+ years as a trader.

I’m absolutely convinced the six secrets you’re about to learn will make you a better investor. And could radically improve YOUR overall returns over the next few years.

I’m going to show you:

- How to strip emotion out of every stock buying and selling decision you ever make.

- How anticipating the dumb moves of other investors led to 20–30% average annualised gains over the last five years.

- How to trade in phases…and turn stocks you buy into ‘free runs’. Where you can’t lose. You can only win.

- How to plant seeds in your portfolio. How we attacked gains of up to 500% when the timing was right. And pulled back when things looked dicey.

- The secret of mean reversion in turning a trade into a no-lose proposition.

- How to make an infallible plan. And stick to it.

But almost more importantly than all the above…

You’ll be able to sleep at night while you do all this.

That’s the key.

That, I believe, is what’s kept my loyal followers stuck to me like glue over the last five years.

As Mark Lucas says:

‘Murray is a true gem! His market insights and charting skills are second to none.

‘I have been with Retirement Trader from day one and can sleep soundly, knowing that my investments are in good hands.’

This is going to be a bit of a lengthy letter.

Because I’m laying it all on the table for you.

I’m going to show you how to build and manage a portfolio without being emotionally involved.

And in this market, that’s a highly valuable skill to learn.

But why should you listen to me?

Trust is extremely important in this arena.

As another of my members Michael says:

‘I think Murray is fantastic and we are lucky to have his expertise.

‘He has very good technical knowledge. I also think he is a very decent highly principled person. Trust is very important.’

Steve W says:

‘Firstly and honestly, I feel I can trust him. He talks sense in a way I can understand what he’s trying to get across and doesn't talk down to you.

‘I suppose that means he explains things clearly — so often when listening to people explain the markets it’s overly complicated and boring to the point I switch off.’

My intention is to keep you ‘switched on’ as I reveal these six lessons to you.

On the outset…a story where I turned $100,000 into nothing in four hours hardly inspires trust and confidence!

Well, all I ask is you read on with an open mind.

I’m not an ‘advertising copywriter’.

This is not a regular ‘pitch for your investment business’.

I’m going to share some home truths that most brokers and traders would prefer not to be aired in public.

Yes, I’d like you to join my Retirement Trader advisory.

But only if these six lessons feel right to you.

And, because you already watch my Closing Bell sessions, I’ve arranged a special ‘try me out’ deal.

Take Retirement Trader for a three-month spin. For 87% LESS than

the annual membership fee

This is a way to test-run the service for 90 days. Paying just 13% of the annual subscription upfront.

But even if you DON’T join…

…the lessons that follow SHOULD be very helpful to you when it comes to buying and selling stocks.

The truth when it comes to investing is often not pretty.

I rip open the scab of my 20 September 2008 story…because everything changed for me after that point. And I was a good 15 years into my professional trading career by then.

It was a day I realised that literally anything can happen in the markets.

Put simply…

If you don’t have one eye on

risk management…every step

of the way…you’re a dead

investor walking

But the upside of that statement is what I want to show you today. I’m going to show that if you understand how to manage risk effectively…it ensures your survival in all market conditions.

Then you are in the box seat to go after the big gains on offer…by investing in individual stocks with much less stress.

Since inception, members of my Retirement Trader advisory have had access to some fabulous trades.

Neuren Pharmaceuticals [ASX:NEU] from $1.80 to $7.48.

Lynas Corporation [ASX:LYC] from $2.15 to $8.27.

Telix Pharmaceuticals [ASX:TLX] from $1.84 to $7.10.

Paladin Energy [ASX:PDN] was one of our longer-term plays, which we rode from 12 cents to 71 cents (a 491% gain) in less than two and a half years.

Of course, we took some losses along the way too. Needless to say, investing is not tiddlywinks and always carries risk!

As someone at the forefront of this risk for 30 years, it seems a bit patronising to point out the blindingly obvious. But it’s an important point.

Overall, however, members who took on this risk…and followed my guidance…had the chance at average annualised gains since December 2018 of 25%.

Past performance, as the adage goes, is not a guide to the future. But if you have any kind of experience in trading stocks, that 25% annualised gain should speak pretty loudly to you.

How did we do it?

That’s what we’re about to cover.

Before we get to THE LESSONS, let me save you some time.

What follows will be

of little use to you if:

- You’re looking for a flurry of short-term trades to essentially punt (like you’re at the Crown casino) on quick gains.

- You are trading markets just for fun and don’t care whether you win or lose. My lessons won’t provide you with enough regular entertainment to hold your attention.

- You think risk management is for pansies.

- You think the only way to build a consistently growing portfolio is through ‘hot tips’.

- You believe buying and selling loads of stocks, all the time, is the key to successful investing. And that if you’re not buying new stocks and selling existing stocks every week, you’re not ‘investing properly’.

If the above five criteria apply to you…thanks for reading this far. By all means keep watching my Closing Bells. But the six lessons that follow will likely fall on deaf ears.

However…

If you’re serious about long-term wealth building,

get out your notepad…

But one final thing before we get stuck in.

I’m going to be showing a few charts.

Charts form a key part of my methodology.

There’s no way we could have entered…managed…and exited trades like Paladin Energy without following a few key chart signals.

If you’re a fundamental investor and remain suspicious of technical analysis…please DON’T let that stop you from reading on.

I want to reassure you that I only enter positions where the fundamentals and technicals agree.

As you’re about to learn, reading charts is not akin to reading tarot cards.

Instead, it’s like looking at a windsock. A risk management tool that helps you to make better decisions.

So, if you are sceptical about technical analysis, I get it.

Charts can seem hard to understand and similar to reading tea leaves.

But just give me the next 20 minutes or so.

I’ll show you how professional traders use charts as a risk management tool which give them much higher odds of success.

Above all…

I want to show you how I built a new trading model from scratch…which I’ve been using since December 2018 to give thousands of Australian investors the chance to grow their capital…

…for an average annualised gain of 25%.

Now, it’s worth mentioning again why that is a fairly special level of return during this crazy period.

Trade wars, hot wars, interest rate hikes (and cuts), a 1-in-100-year pandemic, a historic market crash, soaring inflation, a war in Ukraine, a renewed crisis in the Middle East, slowing global growth and recession fears, the list goes on…

To give you perspective…

Over the last five years, at the time of writing, the S&P/ASX 200 has gone up around 17%.

In total.

So, an average YEARLY gain of 25% starts to look pretty compelling, right?

Of course, again, past performance should never be taken as a given for future returns.

And we’ve had some rough riding over that time. Some bad trades. Some nail-biting periods.

But if you managed to even-out at 25%-per-year overall in this recent market, you were WINNING. Big time.

What’s the secret?

Well, there are

SIX OF THEM

I’m going to reveal them to you now.

Murray Dawes

So, let’s start with a proper introduction.

My name is Murray Dawes.

You’ve watched at least one or two of my Closing Bells.

Either on YouTube or through Fat Tail Daily.

But maybe you don’t know my full background.

I’m 52 and started my career in the financial markets after getting a graduate position with Swiss Banking Corporation Dominguez Barry (now UBS) in 1992.

They put me on the Sydney Futures Exchange trading floor.

That’s where my love affair with the rough and tumble of the markets began.

I went on to trade for High Net Worth individuals including one of the top 10 wealthiest families in Australia. I was also a broker to many boutique hedge funds — using my proprietary trading techniques to help them find winning trades.

But let’s start right at the beginning…

At the Sydney Futures Exchange in 1992…

My first job was standing behind the trader in the pits taking orders from the brokers who were manning the phones. They would flash out the orders with hand signals. Then I had to let the trader know what to do. And relay what trades had been done back to the brokers.

Most of the time, it was a pretty simple task.

But when things went crazy, it was pretty bloody stressful.

Especially for a newbie who was still getting used to the hand signals.

There was nothing fun about telling the brokers they had been filled for their order to buy 200 10-year bond futures…only to be told by the red-faced, screaming broker that the order was only for 20 contracts and not 200!

‘So sell 180 contracts right now you F*#&$*% idiot!’

An error like this would cost us $14,400 for every tick we lost.

So, the senior broker’s anger was not without merit. I never did that again!

Standing in the trading pits day after day — watching every single trade that went through — was my university.

Experiencing the ebb and flow of trading — as unexpected news hit, and traders scrambled out of losing positions — gave me my first epiphany:

SECRET #1

Human emotions

drive prices

Seems obvious. But it’s funny how even the professionals let their emotions get the better of them.

I got to know the ‘locals’ who were trading on their own accounts.

I eventually worked out that the locals would often spend their time observing the signals sent from the brokers to the traders.

If they saw a big order on the way, they could quickly front-run it and make some easy money.

Why spend hours trying to work out which way the market might go…

…when you could grab a few points without taking much risk at all?

Modern High-Frequency Trading (HFT) basically does the same thing. But it uses an incredibly fast connection that enables it to front-run orders in nanoseconds.

Locals would also gun for stop losses.

They knew most traders place their stop losses just below major support levels (a previous major low, for example).

If the price got close to that level the locals would attempt to push prices through the level a few points to see what was there. If a large stop loss order was set off, they could make some easy money.

I tell you this for several reasons.

First is that being involved in trading markets is an incredibly competitive activity. Consider it like the Olympics rather than little athletics.

Your losses are someone else’s gains. And plenty of incredibly smart people are out there trying to work out how to put your money in their pockets.

But the big point is, which I learned very early: even the ‘pros’ are human.

They have the same mental frailties as the rest of us.

And, with the right strategy, those frailties can be exploited…

SECRET #2

The magic of reading

‘false breakouts’

This is going to seem a bit jargony for beginners. But I’ll make it as simple as I can. Understanding how and why prices move in the way they do is INSANELY important.

Most retail investors have no idea.

If you also get how traders will behave in certain situations…you have a better chance of creating a plan that can give you 20–30% annualised returns, in any market.

I had many major realisations during my five years working at the Sydney Futures Exchange.

The false breakout was the biggest.

It’s something very few traders notice…and if they do, most either ignore it…or get suckered in by it.

Know this…

False breakouts occur much more often than genuine ones.

When I say the word ‘breakout’, I mean a ‘breakout’ above a key resistance level. And a ‘breakout’ below a key support level.

Going back to my example of the locals gunning for stop losses. If the stop losses are set off, a large flow of sell orders will push prices down quickly.

Buyers back off. And lower the price of their bids due to the strength of the selling. Or they back off completely and wait to see what happens.

Once the sell orders have been filled, buyers will step back in if there is no further selling.

And prices will often jump right back to where they were before the stop losses were set off.

This is what’s called a ‘false breakout’.

The False Breakout

The strong selling pressure caused by the stop losses going off can often be the end of the move to the downside.

And a new rally begins…

When you understand how the process unfolds, you know that buying breakouts above a resistance level can be fraught with difficulty. You will often buy at the wrong moment and get shaken out of your position for a loss.

Basically:

Mean-reversion happens far

more often than people realise.

The novice investor usually thinks about prices going up or down.

Rarely does an investor consider the likelihood that prices will remain stuck in a range for an extended period of time.

Novice traders invariably get bullish at the top of a range and bearish at the bottom of a range.

They are the cannon fodder for traders who know what they are doing.

Understanding why false breakouts occur…and knowing that mean-reversion happens often…is the first step towards understanding my trading model.

My approach is to use mean-reversion as the high-probability outcome that we can target in our trades.

Think of it like this…

We wait until a major support level fails.

And plenty of stop losses get executed.

If there is no follow-through and prices return to the previous range, we buy with a target set at the middle of the range.

Because we KNOW mean-reversion happens often.

Then, when prices hit the middle of the range, we sell a third of the position. And place a stop loss at a point that will ensure we walk away with our original capital intact.

In other words, after hitting that initial target, we will either break even or make money on the trade.

The breakeven stop loss is usually a long way from where the price is trading. Which means we have a good shot at surviving future volatility and staying in the trade.

I often ensure that the breakeven stop loss is below a major support level. So, the price must fall below that major support level to exit.

Which brings me to:

SECRET #3

Try and turn every

trade into a ‘free run’

I can’t tell you how satisfying it is to hit the initial target and sell a third of the position.

When you do that, you’re basically turning a trade into a free run. A NO-LOSS proposition.

Of course, it doesn’t happen with every trade.

But the ‘no-loss’ position is always the ideal end goal for each trade.

When you get yourself in a position where you KNOW the worst outcome will be breaking even.

That’s a game-changer.

Your stress disappears.

You no longer care what happens from that point on…because you know you won’t lose money.

I call this PLANTING SEEDS.

I want to plant as many of these low-risk seeds as possible…and then watch which one bears fruit.

No more waking up at 7am…like I did in September 2008…and realising I’ve lost the lot. Because I rolled the dice on the whole position.

Instead…

A disciplined profit taking approach ensures that my mental state is always on the front foot.

I’ll get into more detail about that strategy a bit later.

But first, let me come back to exactly what the outcome of this approach looks like.

Here’s how it has worked out for members of my Retirement Trader advisory over the last five years.

As I said above, since I began this portfolio advisory I have given my members the chance to get a 25% average annualised return.

But it’s important I put that figure into context...

Imagine you had $100,000 to invest in the trades I picked when I started the advisory in December 2018.

When you buy a stock, my money management rule is that you risk a maximum of 2% of your capital in any one trade.

So, at the start, with a hypothetical $100,000, you risk $2,000 on the first trade.

If I gave you a stop loss on the trade that was 25% below the entry price, you buy $8,000 worth of stock when you entered.

That’s because a 25% fall in the price would lead to a $2,000 loss. Which is exactly 2% of the capital you are trading with.

From inception in December 2018 to the peak of the market in mid-August 2021…provided you followed ALL instructions exactly and re-invested all gains…the hypothetical portfolio jumped from $100,000 to $267,000.

A 167% return in two

years and nine months

During that time period, 2019 to August 2021, the S&P/ASX 200 was up just 34%.

Remember that the 2020 COVID crash also occurred during that timeframe.

A 5X index return

So, our model portfolio of trades based on the above rules…outperformed the index by nearly 5 times (4.91x).

In August 2021, the S&P/ASX 200 hit its peak. And spent the next few years gyrating wildly. But essentially going nowhere.

Small-cap companies collapsed as inflation took off. And then central bankers raised rates rapidly to chase down inflation.

The S&P/ASX 200 only rose above its August 2021 peak in mid-2024.

However, as I write this, the index is less than 2% above that 2021 peak.

So, the S&P/ASX 200 has risen less than 2% in almost three years.

For average investors…it has been incredibly tough to make money in a market that isn’t rallying.

My goal is to batten down the hatches during the tough times…to ensure that I hold on to gains made during the good times.

And that is exactly what we’ve done in Retirement Trader since the peak in August 2021.

We have managed to hold onto the incredible gains made from 2019–2021. With the hypothetical portfolio value sitting at $294,000 on 29 July 2024.

That is how members could have made average annual returns of 25% since inception.

It is important to understand this: the markets have not been kind over the last few years. Many people have suffered serious losses as mid-cap and small-cap companies have collapsed.

However…

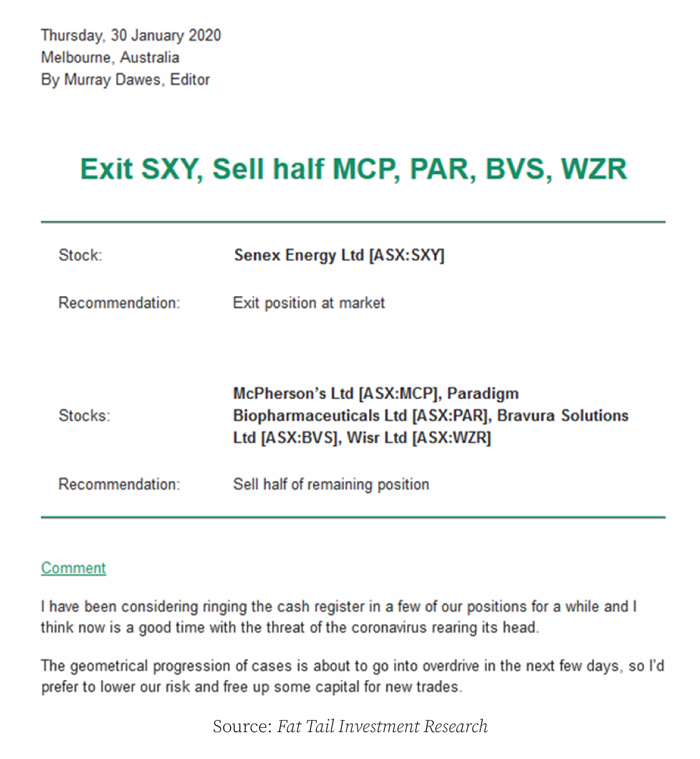

My trading strategy handled the COVID crash in 2020 (I took profits in many positions just before the crash occurred).

Sell alert sent on

30 January 2020

And outperformed the index by nearly 5x during the bull market.

Then, when market conditions changed, we changed!

By doing so, we avoided the sharp corrections that occurred and held onto the gains made during the good times.

And so we get to:

SECRET #4

Make hay when the sun shines…Batten hatches in storms…

As an investor you have to understand when it is time to attack.

And when you have to sit on your hands and wait it out.

You can only learn the difference through bitter experience.

Or…

You can listen to someone who has been there and done that…and knows when there’s money to be made. And when it’s time to protect what you have.

As I said, if any of this makes sense to you and you’d like to give my Retirement Trader advisory a go, I’ve set up a special ‘test-run’ situation.

We’ve never done it before.

And it’s a special deal for Closing Bell viewers.

Test-run Retirement Trader for

three months for just 13% of

the full annual price upfront

My advisory might not be for you.

So I want to give Closing Bell viewers a chance to give it a proper run…without committing to a full subscription.

If you’re interested, click here

for the details on how to try Retirement Trader for three

months for 87% LESS upfront

than the full annual membership

But even if you’re NOT inclined to join my trading service…

…stick around. There are more lessons to come which I think will aid you greatly in managing your own portfolio.

For instance, knowing when NOT to trade.

Over the last couple of years, many of the best decisions I’ve made have been not trading at all.

I make no apology for not promising a certain number of trades a month.

The market decides when we trade.

My view is that the more you learn about the markets, the less you realise you know.

Trading markets isn’t about predicting the future.

It is about knowing that you can’t predict the future.

When you accept your ignorance…you can adopt an approach to investing with risk management at the top of the totem pole.

We all want the big gains.

But before you can run, you have to walk.

Before shooting for the big gains, you have to make sure you will survive.

Survival is easier said than done, especially in this market!

My approach is about ensuring survival so we can give ourselves the best chance of achieving the big gains when they come.

Let me explain what I mean by walking you through the three- phase profit taking approach that I use…

Why I split each trade

up into three parts…

What is it that you want to achieve when you buy a stock? Have you thought about it?

When you drill down into it, I believe there are three key things we all want to achieve when we put our money on the line.

First, we want to ensure survival.

Second, we want to make a bit of money consistently.

And thirdly, we want to shoot for the really big returns.

By splitting up each trade into three parts, I aim to achieve each of those outcomes.

My first profit target is about ensuring survival.

As I said at the start, I set an initial target which is the midpoint of the wave or range that prices have been trading in.

I see that as the high-probability event.

After the initial target is hit, the risk on the trade drops massively.

Unless the share price gaps down below the breakeven stop loss on bad news…the outcome from the trade will either be walking away with the money invested or making money.

That is the survival part taken care of.

Since starting Retirement Trader, we have traded 95 times (at the time of writing).

42 were closed at a loss or are open positions with a loss currently showing.

That means 53 of the trades have been closed as a win. Or are open positions showing a gain.

Another way of understanding the figures above is to say that we have had a 56% win rate.

So…56% of the trades have been winners or breakeven and 45% have been losers.

When we win…we have averaged a gain of 42% on the trade.

When we lose…we have averaged a loss of 22%.

Therefore…

With the 56% of the winning trades…we made nearly 2x the amount than on every lost trade.

This needs repeating:

We’re getting more winners than losers. And the win…on average…nearly DOUBLES the loss …

That’s how you get a 25% annualised return over time.

Think about it.

If you got 50% of your trades right…and made as much on a win as you lost on a loser…you wouldn’t end up making anything.

But when you nearly double the amount you make on a winner versus the amount you lose…and you are getting 56% of your trades right…that’s a consistently successful P+L over the long term.

THAT’S the power of the first profit target…

By hitting that first profit target more than 50% of the time, it gives us the best chance of survival.

Now let’s get to the next phase in the trade. The second profit target.

The second profit target is about making sure we are in a win-win situation.

I LOVE it when we get here on trades.

I will wait until we get concrete signs that the momentum on the rally is waning…and then sell another third of the position.

After the second profit target has been hit…we know that we will walk away with profit in the kitty…or more profit to come.

Sometimes it means that even if the company goes bankrupt…we STILL walk away with a win!

That is the definition of having a completely free-run on a position.

Just imagine what it’s like to be in a position which is either going to make you some money…or potentially a lot of money.

Where a loss is now out of the equation.

Pretty cool position to be in, right?

And so, we progress to the Promised Land of trading.

The Third Phase

‘firecracker’ explained

As long as the long-term trend is heading higher…we will hold onto the position for as long as possible.

That’s not going to happen overnight.

If we’re very lucky we’ll get to the third phase in the space of months.

Mostly, it takes one year or more.

But the third phase is the firecracker…

That’s when the REALLY big gains can start piling up.

The 167% gain made from 2019 to August 2021 was mostly due to stocks that we had going ballistic during the third phase.

As you saw earlier on, we rode Paladin Energy from 12 cents to 71 cents.

Neuren Pharmaceuticals from $1.80 to $7.48.

Lynas Corporation from $2.15 to $8.27.

Telix Pharmaceuticals from $1.84 to $7.10.

You only need a few of your trades going up multiple hundreds of percent to really kick your returns into high gear.

As you can see from the trades above…we picked some great winners and managed to ride them a long way.

That is not because I have a crystal ball.

It is because we have a method to first ensure survival.

Secondly, make a bit of money consistently.

And third, shoot for the big firecracker returns.

We never know which phase of the trade will come in handy at any one time.

Because the market doesn’t let us know whether it is about to rally strongly or sell-off.

Sometimes the first phase of the trade is a godsend. As it was during the COVID crash.

We got stopped out of trades like everyone else. But we had taken part profits on many of the positions.

So we walked away unscathed. Phew!

When markets took off to the upside after the COVID crash, the second and third phases started to prove their worth.

This three-phase trading means

we can cope with whatever the

market throws at us

Let’s drill down on a recent example.

The West African Resources

[ASX:WAF] trade.

These guys are a Burkino Faso (Africa) based gold producer.

They’d been stuck in a range for three and a half years between 72 cents and $1.45.

Remember what I said at the start about stop losses being placed just below major support levels?

Well after three and a half years holding above major support at 72 cents…you can bet there were plenty of stop losses lined up below that level.

In October 2023 the price for West African Resources fell below 72 cents. And a flurry of selling took the price down to 65 cents.

But then the buyers returned. And the price bounced dramatically over the next month.

That is the type of set up I love.

Let me explain why…

SECRET #5

The PIVOT

I like to wait until there is concrete signs that the momentum has turned up after a period of selling pressure.

But you can’t wait too long. Otherwise you will miss the opportunity.

This is where the ‘monthly buy pivot’ signal comes in.

It gives me confidence that the worst may be over.

It sounds complex, but PIVOTS are simply a logical necessity when markets change direction.

They aren’t dependant on a lot of past data. So they aren’t lagging in nature like so many other indicators.

If prices will change direction in whatever time frame you are using, a buy or sell pivot is the first thing that must occur.

But just because they happen, doesn’t mean a long-term trend is about to start in the other direction.

Think of a very simple market where prices are continually marching higher day after day.

The low of each day is higher than the low of the previous day.

The high and close of each day is also higher than the last.

If prices ended up falling over and returning all the way to the lowest price…what must occur?

The very first thing that must happen is that we see a closing price below the low of the highest-priced candle.

Again, all of this sounds a bit technical jargony, but let me show you a picture of what I am talking about.

Buy and sell pivots explained

The green bars in the picture refer to days when the share price went higher.

Whereas the red candles show days when the share price went down.

I am making this chart as simple as possible to describe the concept of buy and sell pivots for you.

Hopefully you are starting to see that prices can’t go very far in the opposite direction…without creating a buy or sell pivot.

If you go to a bird’s eye view of prices by looking at a monthly, quarterly or even semi-annual chart, you will see that buy or sell pivots occur far less frequently than they do on the shorter-term charts.

That makes them far more powerful.

So let’s jump to the WAF chart to see what I saw when we entered the trade.

West African Resources bounces

after false break of 72 cents

West African Resources had developed a fabulous mine in Burkino Faso, which was making a lot of money.

The price had been rallying for years. But range trading began in 2021.

So, when I got the buy signal, we joined a very long-term uptrend but were buying short-term weakness.

That is what you want to do.

We bought the stock at 93 cents and $1.01 with half a position bought at each level in December 2023 and March 2024 respectively.

I placed the stop loss on the position at 55 cents, which is well below the lowest price hit in the last four years.

In other words…

The price would have to collapse to get us out.

I gave Retirement Trader members an initial target on the trade at $1.26. That is where I told members to sell a third of their position to lock in some profits.

The stop loss on the position would be moved to 83 cents after the initial target at $1.26 was hit.

That is because if the price fell to 83 cents the whole position would breakeven.

The profits made on the stock sold at $1.26 would be lost by the remaining stock sold at 83 cents.

So, the initial capital would be safe.

Let’s have a look at what happened after we entered the trade.

West African Resources blasts off

Can you see the advantage in understanding how other traders behave?

We bought West African Resources after the stop losses had been set off at 72 cents.

And the buyers had returned.

We waited until there was proof that prices may be rebounding by waiting for the monthly buy pivot.

The initial stop loss was set at a level that would definitely prove us wrong in our view that the uptrend of the past eight years was going to continue.

The initial target was hit within four months.

So we didn’t have to wait long until the trade became a breakeven or winning trade (the ‘free run’ situation I’ve been talking about).

The price has hit $1.60 recently.

So that means the position is 65% above the entry price within six months of entering the trade.

You need to be clear

what that means…

If you were one of my members, you’re in a stock that is trending higher rapidly…and you have ALREADY taken part in profits.

So…you know the worst that can happen is that you will breakeven.

The breakeven price is at 83 cents, which is miles away from where the price is trading. So the chance of being shaken out by short-term volatility is minimal.

Can you imagine how good it feels to be in that position?

No stress.

Another seed is planted and then you move onto the next one.

Now we can just allow the uptrend to continue. And if I see signs that the uptrend may be faltering…we can sell another third of the position and ensure that the trade will be a win-win.

If we still like the stock and the prospects for the gold price, we can hold onto the final third of the position, safe in the knowledge that no matter what…the trade is a winner.

No need to keep checking the price every day fearful that it will fall and take all your profits and hand you a loss.

While not every trade gets to that point, that’s the aim. Giving you confidence you are following a detailed trading plan…focused on managing risk so you can sleep easier at night.

Important to emphasise the risk element one more time.

This is NOT risk-free investing by any means. A portion of the stocks we cover are small caps. These rise and fall with more volatility. The quickest and biggest gains are often made from small caps. But the same goes for losses. Which makes Retirement Trader’s risk management approach so crucial.

Simple point is this:

Anyone who tells you

managing risk is ‘boring’

is almost certainly NOT

a consistently

profitable trader

Managing risk is the opposite of boring.

Managing risk means you can have confidence to go after the big ‘firecracker’ gains.

By ensuring your survival, effective risk management helps you endure the tough times and be present for the good times.

By lowering your stress levels as you take profit along the way, it means you will have the ability to remain unaffected by the inevitable volatility in the price.

That means the risk that you will be shaken out of your position at exactly the wrong moment is much less.

You give up some of the upside when you sell part of your position. But it is worth it when you realise your mental state remains calm and on the front foot.

As Retirement Trader member Wayne says:

‘He minimises risk by having a trading plan which uses stop losses and takes profits at regular planned intervals.

‘Leading to the creation of a free call position which means we can let winners run their course.

‘This is a low risk and highly profitable trading approach, and Murray is simply the best.’

Which brings us to:

SECRET #6

Make a plan. Stick to it.

Again, seems like a ‘well, DUH!’ thing to say.

But you’d be surprised how many traders…even professional ones…break this rule.

You’ve two simple choices.

1.Make decisions based on a solid trading plan.

2.Or get tossed around like a ragdoll by the market.

Have you made rash decisions in the moment in the past because you didn’t really have a plan?

Have you taken profits too early?

Or dumped a stock even though the stop loss hasn’t been hit, just because of some negative news?

Reacting in the moment to market volatility is a recipe for disaster. You become like all the other traders and investors flying by the seat of their pants.

When they’re confident…after a few wins…they start taking on too much risk. When they have a few losses…they lose hope and trade too small. Or, don’t take the trade that would have been the big winner.

Without a rock-solid approach to trading stocks, you will end up losing money. Pure and simple.

As Retirement Trader member David D puts it:

‘I have been following Murray's educational style on charting and for his stock tips from earlier services (2012) and now under his Retirement Trader service.

‘I can only say his methods blow my mind.

‘I have strong regard for his entry triggers and exit risk reduction strategy. Some current examples DYL up 58.5%, PRU up 136%, RRL 27.6%, DEG 4.9% (early days). BHP, WDS and TLS harvested a couple of times over the years, all profitable.

‘From the early days PDN painful for years but now up 2,539% and EVN up 51.8%. There have been a few duds, but where I follow exit advice and now apply the risk reduction strategy for a free option, I am minimising downside and allowing upside to run.’

If you’re interested in trading according to MY plan…

…and giving my Retirement Trader advisory a go…

…then we’ve set up something new that allows you do to this for a really low introductory fee.

**Closing Bell VIEWER SPECIAL**

Try Retirement Trader

for

three months for

$399

instead of $2,999 annually

Retirement Trader’s official membership is $2,999 per year.

Not chump change by any means.

But given my record — and the trades, portfolio management and ongoing education you get — it’s really a pretty decent fee. Especially when you consider there are no further performance costs.

As member SS attests, this kind of guidance is pretty unique:

‘After a couple of decades looking for guidance that would grow my wealth instead of the brokers FINALLY, someone who talks my language, and is cautious.

‘Murray gives advice as if it were his own money on the line. I get the feeling that it is.

‘I get his liking for graphic presentation and trust his reading of the signals. Finally, someone who is not losing me money.’

However, you don’t know me.

I put a lot of work into my Closing Bell summaries. But there’s only so much you can get to know about someone in 15-minute YouTube videos.

You really need to join and trade alongside me, over time. But $3k is a lot to stake on someone. Even if you like my ethos and what I say resonates with you. Especially in today’s market.

So…

I’ve created an option that lets you give Retirement Trader a test-run…for a much more acceptable outlay.

$399 for three months.

For less than four hundred bucks, you get to give the service a full whirl. All the new trades. All the buy and sell signals. Discover and track every live recommendation in my portfolio.

Put Retirement Trader

through the ringer yourself

Without having to stump up the three-grand fee. In fact, you’ll get keys to the whole safe for JUST 13% of the full price.

Three months should be ample for you to get to know me, how I trade, and what I’m about.

For under four hundred bucks.

I want to give you ample chance to give this a good go-over without breaking the bank. In fact, I’ll even provide you with a further backstop…

Get even that $399

REFUNDED

IN FULL

if you

decide this isn’t

for you within 30 days

That’s right.

That’s right.

Even with this special new three-month deal, a full 30-day subscription refund guarantee applies.

So if you join, and assess within a month that Retirement Trader isn’t for you…I insist on refunding that $399 in full.

All you need to do is let our Customer Services team know, and I’ll ensure the $399 is returned to your account.

You won’t be a cent out of pocket for giving this a go.

Does that sound reasonable?

As I say, this is a special deal for Closing Bell viewers.

To try Retirement Trader for

three

months for 13% of the

full annual fee,

click through

to this secure order page

I’ve set this deal up so you can get a decent feel of what I’m about. Without forking out money that could also be spent on a holiday to Fiji!

It’s important I have people who are 100% on the same page.

So, I’ll make it really simple to decide if my investing style fits with what you’re looking for. This is for you if:

- You are curious and interested in building an active portfolio…but are busy and don’t want to be constantly trading every day.

- You want to find a voice you can trust to help you find solid investments in the stock market…which can help you build wealth towards retirement.

- You are fearful of how volatile stocks can be…especially at the moment…and wish to avoid wild risks.

- You want to keep your stress levels down while investing in stocks that make sense to you.

- You want a curated selection of thoughtful, TARGETED trades…rather than dozens of ideas thrown at you which you then have to choose between.

- You respect RISK MANAGEMENT. And recognise that sometimes, in some periods, the best action is TAKING NO ACTION.

- You are looking for someone with no conflicts of interest. And who wants you to succeed.

If you don’t make money

with

me you won’t remain a member. Simple as that.

If that sounds like you, my $399 ‘give me a whirl’ option should be a no-brainer.

My desire is to have you as a member for many years to come.

That will only happen if you know I am in your corner every step of the way, giving you the best advice I can.

If the above resonates with you…and you understand how useful it is to have a trader with 30 years’ experience guiding you through the trading minefield…

Try Retirement Trader for just

three months for 13% of the

full annual fee by clicking here

Look I’ll be frank.

Most stock tipping services are a load of BS.

People who don’t know how to trade markets promising people the world and delivering nothing but losses.

Retirement Trader is not that kind of advisory.

But you’d be a mug to just take me on my word.

It is far better to listen to people who are just like you and have been a member of the service a while now.

You’ve seen some very generous words of praise from some of my members through the course of this letter.

Before I show you some more, please keep in mind:

Regulations on testimonials from members of the public are very strict. We can’t quote someone unless they have been a member of the advisory and made their statement in the past 24 months.

We have to keep contact details for those people. So regulators can verify that the words attributed to them are true.

I only say that because I would be cynical myself about reading such words of praise!

But rest assured, every word that follows is genuine…

EB says:

‘Retirement Trader is the only financial advisory newsletter I read. I have tried many others but always seem to go backwards financially.

‘With RT I like the rigid mathematical/graphical empirical approach based on historical trends and researched facts.’

Dave says:

‘Murray's approach to investing, educational videos and communications exactly matches my needs, as I approach retirement.

‘I do not have the timeframe or excess funds to risk on the more speculative alternatives.’

Dee says (keep in mind Fat Tail Investment Research is my publisher):

‘I have followed Fat Tail for many years and never had the guts to take the plunge. With Murray's help, I have jumped in, and love it.

‘Insightful and accurate, I now act when the emails or texts come in.

‘Your understanding of the market, and needs of retirees, has given me the courage and confidence to have a go, and has opened a new world of fun and challenge.

‘Thank you so much.’

A Dykes says:

‘I really enjoy Murray’s advice and whilst I don’t invest in all his recommendations I have made significant amounts on the ones I have.

‘I really appreciate his trading style and especially like his ability to sit on the sidelines when needed. This is actually what gives me the most confidence in him.’

Rob Adler says:

‘Great so far - Murray is ideal for his advice to a semi-retired accountant like me.’

Matt R says:

‘Murray has a great talent to both risk manage and stock pick very proficiently through his own unique approach.

‘If you follow Murray's guidance with discipline, you can be very successful.’

Mark R says:

‘I have great confidence in Murray's ability to identify the right time to buy and sell stocks. His mix of technical and fundamental analysis inspires confidence. His use of video updates to explain and educate is first class.’

AA says:

‘Really like his style and knowledge. Seems to be straight down the line and no BS. Feel very confident in acting on his suggestions.’

As these words show, I take the responsibility of providing stock trading advice very seriously.

To join Retirement Trader for

three months for $399 (instead

of $2,999 annually) click here

Remember: my standard 30-day subscription refund guarantee STILL APPLIES to this deal

If very early on you decide this kind of trading is not your thing…no problem. I insist on refunding even that $399.

But I also realise this is not just a membership price you’re risking.

You will also be placing your investment capital at risk following the suggestions that I make.

That duty I do not take lightly. As I hope my member testimonials prove.

$399 is relatively small fry to give me a try. (Especially with the 30-day guarantee). But you could lose a heck of a lot more on your investments if I give you bad advice.

Which is why I pride myself on only sending out investment ideas when I really believe in them.

If that means I don’t trade for a month or more while market conditions are REALLY difficult…that is what I’ll do. Although these fallow periods are pretty rare. Things have to be pretty bad to go into complete hibernation.

That goes back to Secret #4:

Go hard when the opportunities

are ripe. Cool your jets when

things are dicey.

I would prefer to send you a few great trades a year rather than many mediocre ones to keep you entertained.

I fully understand that building trust in someone to the point where you are willing to follow their advice can take a long time.

Losing that trust only takes a moment.

As you read in the comments above, long-term members of Retirement Trader trust that my advice is given without any conflict of interest. And know that I only send them investment ideas that have ticked all the boxes of the trading model.

They know that the risk management approach works. Because they have seen it in action and now follow it religiously.

Are you ready to take the plunge and back me to help you build wealth towards your retirement?

It doesn’t matter how old you are.

All we mean by ‘Retirement Trader’ is that you take investing in the stock market seriously. And have an eye on your long-term wealth building goals when you buy stocks.

What you’ll get if you take

this special $399 offer

So, this is a new opportunity to put this type of trading to the test for three months…for 87% less than the official annual membership fee.

A fairly radical discount.

What that means is you pay just $399 now. Which gives you full and unrestricted access for three months.

90 days is a very long time in the markets. Especially THIS market…where things seem to change on a dime.

You can cancel any time.

And I’ve arranged to lock in that DISCOUNTED three-month price for as long as you remain a subscriber.

Meaning you’re not locked

into an annual membership

You can constantly judge — on a three monthly-basis — if Retirement Trader is living up to the standards set out in this letter.

If it’s not…simply cancel.

No questions asked.

As a member you will receive:

Retirement Trader Trade Alerts

The core of the advisory. But…as mentioned…these will only come when the opportunities present themselves.

I personally find investment newsletters that promise ‘a buy recommendation on the first of every month’ a bit daft.

It may work for them. But markets don’t really work that way.

As such, you’ll need to monitor your email fairly regularly, so you’ll get my trades when they’re generated.

Sometimes there might be a couple within a few weeks.

Sometimes we might go a month or more without entering new positions.

Again:

The market, not a schedule,

will dictate our trading

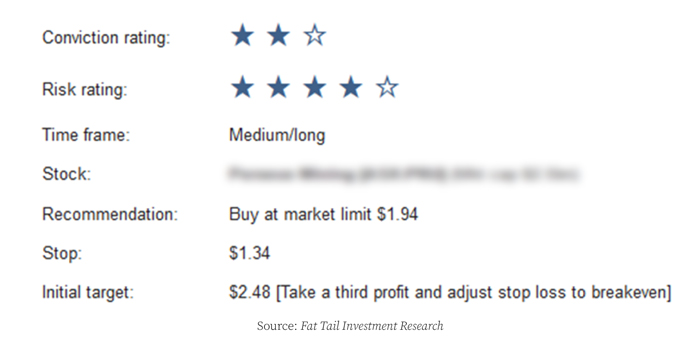

The top of each trade alert will contain the key information you need to enter a trade. It will let you know:

- The name and code of the stock to buy.

- A conviction rating out of three stars.

- A risk rating out of five stars.

- Expected timeframe to hold the position.

- Recommended price to pay to enter the stock.

- Stop loss level to exit the stock and avoid further losses.

- An initial target with instructions on taking some profits and moving the stop loss to ensure the worst outcome will be breaking even on the trade.

This is what it will look like:

Below this key information you will get a comprehensive analysis of each trade, based on fundamental and technical criteria. So you can make an informed decision on every trade.

THE TREASURE TROVE!

Unrestricted Access to the

Entire

Retirement Trader

Buy and Hold List

It’s a pretty great deal you’re getting here.

Pay just 13% of the full annual

ticket price for three months…

and get keys to the entire

Retirement Trader bank vault!

Join now for just $399 and you’ll get instant access to the entire portfolio.

This includes all OPEN POSITIONS. (At the time of writing, there are currently 12. Just know that this can change.)

You will also be able to see the entire list of CLOSED POSITIONS…and whether they made a gain or a loss. (There are currently 81 closed positions, with an average hold time of 51 days.)

Want to know what we bought…

and what trades we’ve currently got on? Take this $399 deal now to find out!

Video Masterclass Series

Essential viewing, as soon as you decide to take this $399 deal.

This is your ‘soft introduction’ to what we’ll be doing and how we’ll be trading.

In these five video sessions, I walk you through the important elements of the technical analysis model we use to enter trades.

It’ll all be in plain English. As you’ve seen, a big reason members stick with me is that I break things down in a very easy-to-understand way.

The topics covered are the basics: pivots, distributions, trends, indicators…and how I use all these to find you trades.

If you want to educate yourself to become a consistently profitable trader you have come to the right place. I want to ensure you understand the process we follow so you have confidence in the decisions made.

Once you have familiarised yourself with the trading approach, then I encourage you to dip into:

The Entire Retirement

Trader Update Archive (UNRESTRICTED ACCESS)

Every two weeks you will receive a comprehensive market update video that looks at major markets around the world, upcoming trading opportunities, and reviews all open positions.

If you are looking for education about trading markets, the market update videos contain a wealth of information about how I analyse markets and look for opportunities.

You will also receive a written document that covers many topics related to trading the markets.

I discuss trading psychology, money and risk management, macro-economics, upcoming opportunities, and review open trades.

When I receive a trading signal, I will send you a trade alert which contains all of the information you need to enter a trade with confidence. We can send you an SMS to alert you to the fact that a trade has been sent to your inbox if you wish.

I encourage you to go through at least the last month or so’s updates when you join. These will give you a feel of how we’ll be initiating and managing trades…so you’ll know what to expect when you get your first live one!

The Retirement Trader

‘Direct Access’ Email

Members love this. If you have any questions along the way, I’ve set up an email address where you can contact me directly.

In the early days, we had a cumbersome process that meant emails went through a few hands before arriving in my inbox.

I’ve streamlined it so you can send me them directly, any time.

Sometimes I’ll be able to shoot you a direct reply, if it’s relatively short. Otherwise, I allocate a time during the week when I reply to emails in batches. This is usually on Monday afternoon.

Test it out when you join. Shoot me an email and say hello.

Maybe you would like me to discuss bitcoin. Or wish to know my take on a company you’re already tracking.

Whatever you’d like to say, don’t be shy, and let’s get the communication channels open. Just remember that I cannot provide any personal financial advice.

The Extended Lessons:

Retirement Trader

Strategy Report

Perhaps worth the $399 just off its own bat.

As I’ve said, my career in the markets has spanned from the Sydney Futures Exchange trading floor, fresh out of uni…to stewarding the portfolio of one of Australia’s wealthiest families…to helping thousands of Aussies today trade the market in a calculated, risk-controlled way.

This report outlines everything I’ve learnt along the way in more detail.

You will learn about ‘widening distributions’ and ‘points of control’ and how we use them to enter profitable trades. It explains the money and risk management tools we use, such as creating ‘free’ call options…and how to work out how much money to invest in each position.

If you found what we’ve covered here useful, wait till you get a load of this…

SPECIAL RESOURCE #1

How to Trade Shares

that Go Down

Many people are in the dark about how short selling can add to their investment profits. Others don’t even understand what it is or how to do it. But let me set your mind at ease. Short selling does not have to be difficult.

In this special report, I’ll explain exactly what short selling is, how you do it, and how it’s possible to make money when share prices fall. I’ll take you through everything you need to know. But I’ll do it without the jargon. And remember, if you have any questions, you can always contact me via the direct member email address.

SPECIAL RESOURCE #2

How to Trade Using CFDs

A CFD (contract for difference) is a tradeable contract between a client and a broker, who are exchanging the difference in the current value of a share, currency, commodity, or index and its value at the contract’s end.

CFDs involve leverage. They are not for everyone. And they are by no means an essential part of Retirement Trader. The portfolio returns cited in this letter are from good old fashion trading stocks…no leverage at all.

But if you’re a slightly more sophisticated trader, you may be tempted to employ CFDs on our trades. This report gives you a warts and all breakdown on how to do that…again all in plain English.

So, there we have it.

You’ll get all of the above for three months for 87% less than the annual membership fee.

$399 instead of $2,999.

That gets you everything I’ve just mentioned…plus access to the live updates and trades for the next three months.

And you have the first 30 days to request a full refund of that $399 if you decide this isn’t right for you. No questions asked.

It’s a stunning ‘intro’ to what we do here.

Thanks for giving me the

time to read this letter

I hope you got something out of it, even if you don’t take this deal today.

It’s been a tough five years. But Retirement Trader members have been insulated from much of the craziness coursing through global markets.

Now…at the time of writing at least…things are starting to look VERY interesting again…

Soft US inflation figures are kicking off some rotation out of large cap tech stocks and into the smaller end of the market.

In Australia, banks, property and other interest rate sensitive stocks (e.g. Telstra Group [ASX:TLS]) have also caught a bid.

Recent buying has taken the S&P/ASX 200 to a new all-time high which is great to see. I’d like to see the buying gathering steam rather than stalling again if this is a proper breakout.

If things keep on this trajectory…we could well be about to enter ATTACK MODE, with a flurry of new trades.

Of course, things can change on a dime. I don’t know when you’re reading this.

But…if you join me…you’ll be prepared, and able to adapt!

To join Retirement Trader for three months for $399 instead of $2,999 annually, click the link below.

And thanks for reading.

Regards,

Murray Dawes,

Editor

Retirement Trader