In the last great boom, a no-name

miner called Allied Mining and Processing

went from 2 cents to $10 in five years.

You know them today as

Fortescue Metals Group.

Is there a similar no-name mining disruptor

emerging in 2024? Maybe…READ ON to

discover five top candidates…

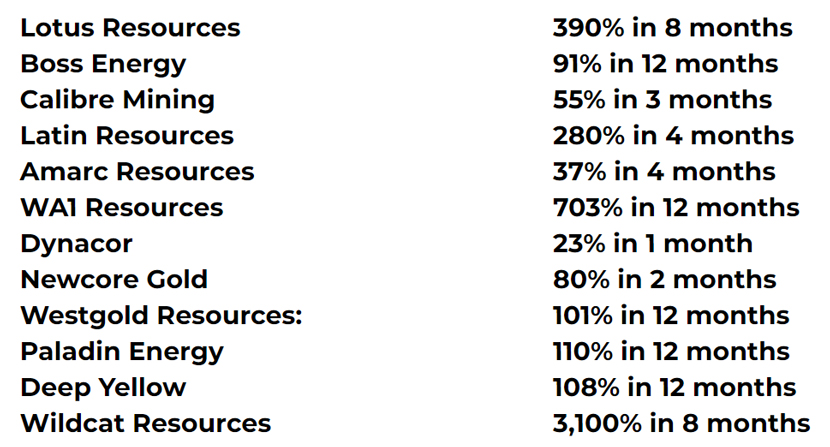

Can anyone repeat Fortescue’s iconic early 2000s rise?

It’s a tall order.

The last mining booms’ superstar turned 2 cents-a-share into $10 in the first five years.

A 50,000% return.

Two decades later, that 2-cent share is worth $25.

Over 100,000% gains.

That’s nuts. So let’s be real.

Fortescue’s rise was an outlier for the history books.

‘The most remarkable self-made business success story of this century,’ as the AFR puts it.

We’re not saying the five stocks we showcase here (and one very special one in particular…) will approach those heights.

But stick with me.

Fortescue’s story is actually a guiding light in 2024…

‘Twiggy’ correctly picked…before anyone…the biggest mining mega-theme of the 2000s:

China’s voracious appetite for steel.

He predicted it. Cornered it. NAILED IT.

And became Australia’s richest man off the back of it.

Now…a new mega-theme is building.

And a NEW crew of mining renegades are vying to stake it out.

Quietly…drowned out by the noise of AI and tech…certain mining stocks are starting to rise…

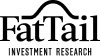

- Lotus Resources - 390% in 8 months

- Boss Energy - 91% in 12 months

- Calibre Mining - 55% in 3 months

- Latin Resources - 280% in 4 months

- Amarc Resources - 37% in 4 months

- WA1 Resources - 703% in 12 months

- Dynacor - 23% in 1 month

- Newcore Gold - 80% in 2 months

- Westgold Resources - 101% in 12 months

- Paladin Energy - 110% in 12 months

- Deep Yellow - 108% in 12 months

- Wildcat Resources - 3,100% in 8 months

All from the last year. Many of these gains are really ramping up in just the last few months.

But have you heard about them in the mainstream financial news? I’m betting not.

They’re not AI chip-makers.

This new breed of miner is ‘decoupling’ from global share markets. Just as iron ore juniors and producers did 20 years ago.

This resurgence has gone largely ignored.

What’s the reason for that?

Back in 2003, Andrew Forrest saw what was about to happen with iron ore. And looked to break the monopoly of a sector dominated by mining giants Rio Tinto and BHP.

As a new boom in CRITICIAL METALS bubbles up…are there small, no-name disruptors with a similar Fortescue vision?

One of Australia’s most battle-hardened exploration geologists believes so.

Right now…he’s placing his chips on five.

One stock in particular shows many of the traits and ambition and foresight that Forrest had in the early 2000s.

You need to know

about this stock

Market cap just $270 million.

And a gameplan that’s addressing many of the same challenges Fortescue Metals Group faced in the 2000s.

This very small company is about to unlock a very big deposit.

The largest of its kind IN THE WORLD.

Its potential has arrived from nowhere, busting into ‘Tier 1’ status and attracting mining behemoths…including Rio Tinto.

This has all the makings of a classic rags to riches story.

Again: it’s absolutely NOT the same story as Fortescue’s.

We’ll never see the likes of that again.

But…when you learn the epic plan this small 50 cent stock is hatching from its base in Western Australia…you WILL see some striking similarities…

If you sense a resurgence in Aussie mining…

…and want to make some very early, very speculative, but very smart stock moves to play it…

…then read on to discover WHO MIGHT RULE Australian Mining Boom 2.0…

‘What mining boom?’ To the casual observer, there’s a lot of mixed messages when it comes to Aussie resources right now.

Gold’s up. Iron ore appears to be holding steady.

But the bellwethers…BHP, Rio Tinto, and yes…Fortescue…all those share prices are DOWN since January.

How exactly does that translate into a new mining boom?

Well, those are the old-school iron ore guys…

The ones who made their nut from the LAST cycle…

We’re about to focus on the Graduating Class of 2024.

And one particular stock we believe is about to graduate with honours…

At the time of writing, the BIG miners…represented by the S&P/ASX Metal & Mining Index, are in-the-red this year.

And tech stocks are still blazing. UP 20% year to date.

On the surface that says:

Keep buying tech stocks!

And keep ignoring mining stocks!

That’s what the dumb crowd will keep doing for the foreseeable future.

But that’s a mistake.

Something entirely new, and very exciting is brewing in the deserts of Western and Northern Australia…

Resource shortages are worsening daily.

Recently, all kinds of commodities…from gold to oil to sugar to uranium to cocoa…have ALL hit record highs.

But where is the smart money focusing?

‘When we talk about watching insiders, I mean the big players in industry,’ reports Mining.com.

‘That is, the directors of multi-billion-dollar companies, mining magnates and executives from investment banks tied up in mega-deals that shake the industry.’

And right now…

‘The biggest (insider) breadcrumbs lead to critical metals…’

The same motley characters who gobbled riches in the last mining boom are mysteriously popping up again…

…getting appointed as non-exec directors on the next wave of explorers.

The mainstream narrative remains ambivalent on critical metals stocks.

But the world’s most liquid insiders continue to build exposure.

That includes mining tycoons like the one we’re talking about, Andrew Forrest. But also Gina Rinehart and Robert Friedland.

These heavyweights are GOING LONG on the critical metals mega-theme.

Why? As our inside man who you’ll meet shortly tells us:

‘These guys are just as adept at mining the stock market as mining ore. And they’re setting up to do it all over again...’

This may explain something…

In the last year…completely overshadowed by the AI tech stock hype…a new generation of Aussie mining stocks have started absorbing investment heat again.

‘The years ahead will be like the mining boom on steroids’, predicts Peter Milne in The Sydney Morning Herald.

There are certain times in the market where fortune favours the clear-sighted and the brave. We reckon this is one of them. Because…here at Fat Tail Investment Research…there’s a distinct sense of déjà-vu in the air…

Back in the mists of time — when our independent stock-picking business was just a single newsletter sent out by post — Australia’s LAST mining boom was also in its infancy.

Addressing our very first readers, we called it ‘The Big Dig’.

We covered it as it crested…finally went mainstream…and then supersonic. And in those pioneer days we didn’t mince words…

‘A giant exploration and production rush is about to hit Australia, the likes of which have not been seen in 25 years.’

Our prediction seems obvious in retrospect.

Trust me, most scoffed at the time we made it.

The Australian mining boom that peaked in 2011 came on SO fast…and SO hard…it blindsided even the veterans.

‘The word “boom” is a misnomer’, a shocked Rio Tinto CEO said at the time.

‘I don’t know what the right word is — maybe it’s a paradigm shift.’

Whatever it was…while the rest of the world got smacked by a credit crisis…the first ‘Big Dig’ created a recession force field around Australia.

National wealth grew exponentially.

Sadly, for the average Aussie, the boom years did little more than change the morning newspaper headlines.

HOWEVER…

Some non-professional investors…with the smarts to own the right stocks early…made colossal wealth.

For a brief time, it was a speculator’s paradise.

China’s huge appetite for minerals was a tide that lifted all boats.

High grade, low grade, long mine life, short mine life…it didn’t really matter.

Any company with a decent possibility of going into some form of production benefited.

As did those who owned the stocks before everyone else.

But just ONE company can lay claim to TOTALLY OWNING this First Age in modern Aussie mining:

Fortescue Metals Group.

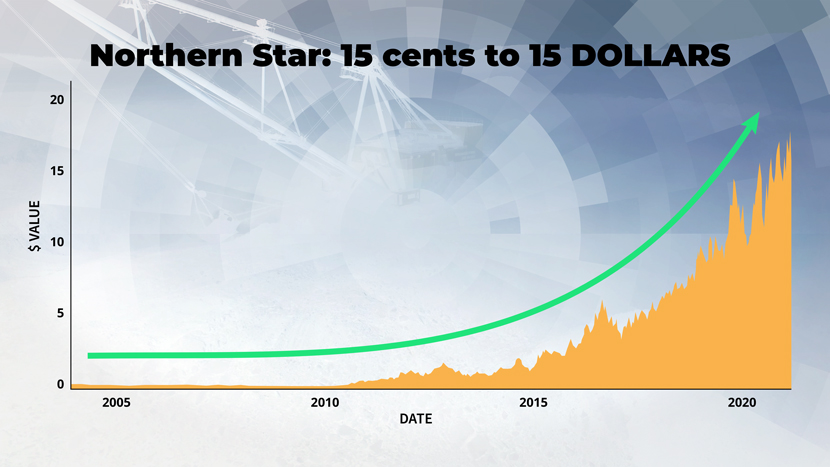

Source: Yahoo Finance

Past performance is not a reliable guide to future results.

Their rise from ‘penny dreadful’ to one of the biggest miners on the planet…in less than five years…was SOME story…

…a tale of towering ambition...brilliant forecasting...consummate salesmanship…burnt bridges, missteps, and misfires…

…then, ultimately, UTTERLY IMMENSE share price gains.

It’s unrealistic to expect any stock to repeat that performance.

But 20 years later — on the cusp of a SECOND big Australian dig…

…there are a set of up-and-comers…and one stock in particular…who are looking to corner the critical metals scene…

…using similar tactics to the ones Andrew Forrest employed to challenge Rio Tinto and BHP dominance 20 years ago.

Before we name these stocks, let’s rewind to an infamous date:

September 11, 2001...

An Aussie bloke sits in a hotel room in Manila.

Beside him is a convicted drug dealer.

Like the rest of the world, they’re glued to the TV. Watching two steel skyscrapers implode on repeat.

Back home...the Aussie bloke’s world is imploding too.

He’s in Manila for money. Lots of it.

He’s just been booted from the mining company he founded 10 years earlier. His investors are coming with pitchforks. He’s about to lose the family home.

This church-going country boy isn’t used to feeling like a villain. But he’s now in self-exile. With a good riddance from the Aussie mining establishment.

Fast-forward 10 years later...

Source: Erenow

This same bloke...named Andrew Forrest, ‘Twiggy’ to his mates, is standing at Westminster Abbey.

Before him are the late Queen, the then Prince Charles, and heads of government. He’s the only Aussie invited to speak at the Commonwealth Day ceremony.

The bankrupt man from 2001 is now Australia’s richest man.

His Fortescue Metals Group has made early stock investors rich too.

Most of those gains accrued at the beginning, between 2003 and 2007.

Source: Motley Fool

In fact, depending on how much you invested, if you’d bought Fortescue early...you could be funding your lifestyle today on the gigantic dividends alone.

At one point, Forrest himself was earning an average of $2.3 million A DAY in dividends.

Love him or loathe him...Andrew Forrest blazed a trail.

He didn’t just create billions in wealth.

He gave us a pathway...

If you study what Fortescue did in the last mining boom...

...you get a clearer idea who might pick up the mantle in the NEXT one.

That is the central focus of what we’re about to reveal to you.

James Woodburn

My name is James Woodburn, and I head up a company called Fat Tail Investment Research.

We came into the Australian financial advice scene in the 2000s.

And set about disrupting it in much the same way as Andrew Forrest upended mining around the same time.

Our motto was and is BUGGER THE ESTABLISHMENT.

Independence is true strength when it comes to financial guidance.

We’re not tied to any bank, brokerage, financial institution, listed company, shareholders, industry, old boys club or major media organisation.

Meaning we could arrive and tell you EXACTLY how to play the last mining boom as we saw it...in a completely unbiased, no-strings-attached way.

We did it fairly effectively the first time.

Although we NEVER got our readers into Fortescue — the best time to buy was several years before we arrived.

In that sense, it was our white whale.

In 2024, we seek to make up for that ‘big one we missed’...

We’re about to introduce you

to a set of FIVE stocks

We think there’s a strong case for buying all of them, right now, at their current prices.

One, in particular though, is extra-special.

We have dubbed this little-known company ‘The Next Potential Aussie Mining Disruptor’.

For reasons that will become apparent soon.

There was a headline that The Age put out in July 2003:

‘Andrew Forrest has a grand $1.2bn plan for tiny Perth mining company.’

If you don’t remember, this was a super-volatile time in markets — and the world generally.

September 11 was still fresh. The US was ramping up multiple wars.

We had crazy geopolitical risks.

The Internet (like AI today) was this weird new thing we’d known about for a while…but was now finally disrupting everything.

Gold was making new highs.

Sound familiar?

Back then, Fortescue Metals was little more than a light bulb above Andrew Forrest’s head.

What Forrest saw in the early 2000s was a ‘super-squeeze’ in iron ore and base metal prices.

A ‘super-squeeze’ is when the prices of certain resources go up…not just because of demand…but also because of supply constraints.

This was the back-drop of Twiggy’s big bet.

He figured everyone was underestimating how China's hunger for iron ore would soar as its steel production ramped up.

But he saw that the supply just wasn’t there.

He wagered $15 billion of mostly borrowed money to start buying up remote iron ore assets in the Pilbara desert.

Right under the noses of the giants…

At the time, these deposits were stranded.

Sure, iron ore mining in Australia is relatively cheap and relatively easy to extract. Simply load rock on a boat and ship it to China’s massive steel refineries.

But few consider the vast infrastructure required to get to that point.

Iron ore is a bulky commodity.

Mine feasibility studies include costs well beyond the mining operation: railways, ports, loading facilities. It’s this barrier to entry that enabled the majors to retain their grip over iron ore supply in Australia.

Yet these challenges didn’t deter Forrest.

When iron ore prices were still sitting below $20 per tonne…Twiggy went to work.

He ‘read the squeeze’…and the rest is history.

In mid-2024, another

‘super-squeeze’ is forming…

Only this time, it’s not iron ore.

It’s in what our exploration geologist expert calls ‘critically endangered minerals’.

Aluminium, Copper, Cobalt, Nickel, Lithium, Palladium Platinum, Silver and Rare Earths and more.

FX Empire puts it down to ‘the perfect storm of geopolitics, climate change and energy transition.’

This is happening after a period of massive underinvestment in the resources sector.

Where miners prioritised paying off debts over financing new projects.

Back in the 2000s, this was Twiggy’s problem, too.

Getting hold of cash to build a capital-intensive iron ore operation was almost impossible.

That’s why his blue-sky plan for iron ore was mocked by many journalists and insiders at the time. DESPITE the fact commodity prices were coming back to life…just as they are in 2024…

Today, demand is surging once more.

Copper, gold, silver, and crude oil are all firing back with strong gains this year.

But the industry is not prepared for it.

We’ve just had years of underinvestment in new mines and oilfields due to low prices in the 2010s. This has now created scarcity in supply as demand recovers.

A mirror to the supply-demand imbalance that gave birth to Fortescue Metals Group…

Today, instead of China, we have the clean energy transition.

The push towards electrification, renewable energy and decarbonisation is squeezing things even further. Intensifying demand for metals like copper, lithium and nickel needed for batteries and clean technologies.

But growth in emerging nations hasn’t disappeared. It’s just shifting.

As Australia’s former Prime Minister, Kevin Rudd says:

‘India, Mexico, and Southeast Asia will benefit from ‘the great diversification.’

In February 2024, the BullionVault announced ‘China is no longer the number one supplier of goods to USA.’

Incredibly, that title now belongs to Mexico.

To get a sense of how this ‘great diversification’ is playing out, just take a look at the performance between Mexico’s largest stock index versus China, since November 2022:

Reshoring of manufacturing away from China will need massive infrastructure building.

In effect, that means rebuilding all the commodity intensive infrastructure that led to the early 2000’s commodity boom.

My point is, commodity demand won’t sit still in the years ahead, it will surge!

One final parallel…

Just like in the early 2000s, mining stocks are DEEPLY undervalued.

THIS is your ‘in’.

It’s these stocks you should be honing in on while they’re still criminally cheap. Basically, 2024 is like:

A resource super-cycle

Groundhog Day

And if you cotton on to this before most mainstream investors…

…there’s the scope to make a LOT more money than just sinking your cash along with the crowd into already-hyped-up AI stocks.

If you remember, it was the MINERS…NOT tech companies…that really lifted the Aussie stock market out of oblivion in the early 2000s...helping the ASX 200 post a 150% gain from the dot com lows.

At the height of the last super-cycle, our market was the toast of all the indices.

But smart, private investors who speculated on the right stocks early on were the ones who REALLY benefited.

You saw what Fortescue did.

But even the blue-chip miners Twiggy set about disrupting grew exponentially.

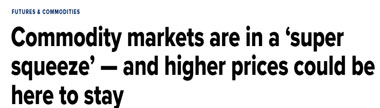

If you owned BHP Group at the right time, you made more than 500%:

Source: ProRealTime

Past performance is not a reliable guide to future results.

That wasn’t punting on a tiny small cap. That was from a massive blue chip!

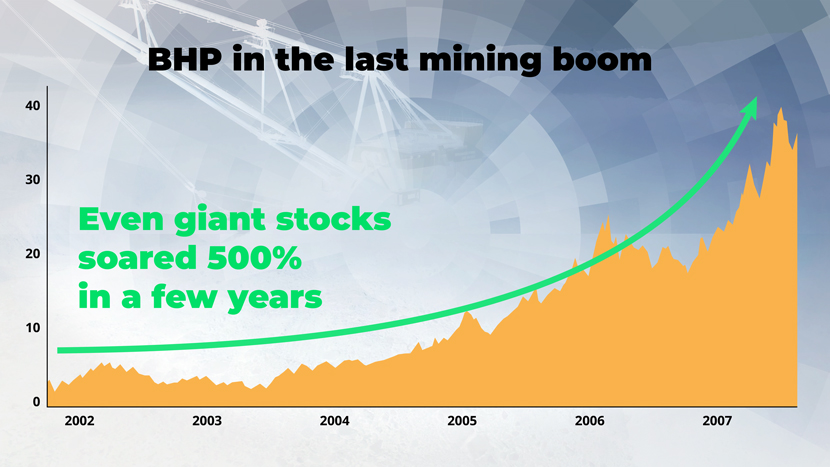

Another large-cap play was Lynas Rare Earths, which socked away a whopping 1,200% within a short burst later in the boom cycle.

Source: Google Finance

Past performance is not a reliable guide to future results.

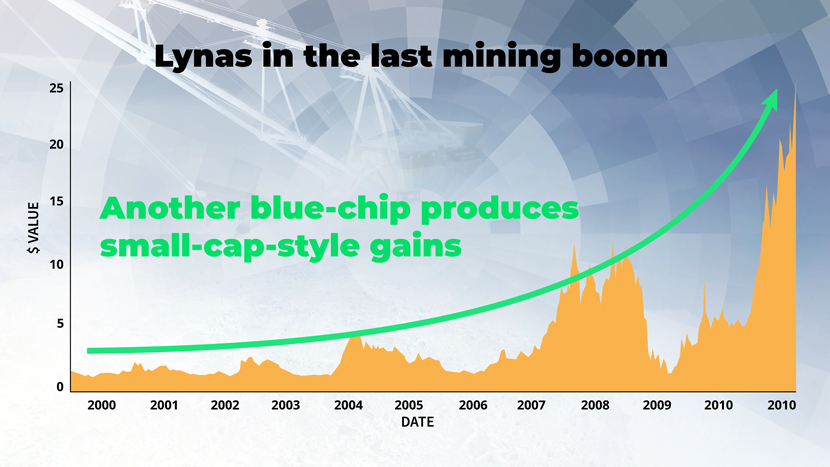

Of course, not every producer saw massive price rises in the last mining boom. It’s also worth noting that many saw huge falls back to Earth when the boom wound down. Coal baron Nathan Tinkler famously lost his fortune when coal prices collapsed.

Point is...

Source: Google Finance

Past performance is not a reliable guide to future results.

...it tends to be ONLY ultra-boom times where you see blue-chip stocks clocking gains akin to a small-cap growth company.

That hardly ever happens, in any industry. But it DID happen for many of the large mining producers in the last cycle.

And you could have directly benefited if you took action and bought these stocks in the doldrums of a totally crap market.

Source: Google Finance

Past performance is not a reliable guide to future results.

If you took a punt on the right SLIGHTLY SMALLER companies...many of them BECAME blue chips WHILE you owned the shares...before your very eyes...

Fortescue Metals Group is a prime example.

My point is all this arose out of the exact market conditions we have RIGHT NOW...

History is rhyming.

And you should be buying.

But not just any old mining stock...

This time round...our competitive advantage will look much different.

China will still be a huge player. But perhaps not in the way you would think...

We are entering a new kind of commodities boom. A ‘Second Age’.

The last one was driven by demand.

This one...as we’re going to clearly show you...is going to be all about SUPPLY.

Specifically, lack of it. The SQUEEZE.

For the moment, governments have convinced the public that the supply shortages of key commodities are a temporary dilemma.

And it’ll sort itself out.

It won’t.

And just like the early 2000s, few people grasp that we’re entering a new age...

The Age of Scarcity is dawning

I’ll repeat:

If you can JUST GET this idea now.

Like Twiggy did 20 years ago...

And make the right moves — moves we’re going to suggest to you shortly — you could do just as well as some early resource stock investors who came in...in 2001 and 2002.

See...

What governments know — but are not willing to admit — is that the supply of commodities can’t be turned on at the flick of a switch.

While leaders scramble in the background to find new avenues for providing vital commodities...

...there’s a hard truth waiting for them...and just about every other person on the planet.

That truth is that substantial investment has failed to reach the exploration of key metals...oil...and gas for more than a decade.

This means NO major discoveries to replace depleting reserves.

The war in Ukraine...the disruptions to supply chains...the eye-watering shipping costs and the labour shortages...THEY’RE thrown at you as the reasons that prices are soaring.

But, really, they’re just smokescreens.

Since the last mining boom, exploration investment has fallen off a cliff.

We still rely on major discoveries made 15–20 years ago to maintain our current needs.

This is the REAL reason you’re seeing certain parts of the Australian mining industry roar back to life.

While Australia...alone...won’t be able to ‘solve’ the enormous supply crunch that’s coming...a handful of local explorers are about to shift into production...

...just as the issue reaches a tipping point within the next two years.

Owning these companies now could be your get-out-of-jail card as a private investor for the rest of this decade.

Buying the stocks we’re going to recommend...and one very special one in particular...will take some guts.

Tech is still the darling.

Mining stocks at this point are still cheap and volatile.

And you can still get a decent return from cash in the bank (despite the fact rates are coming down…)

But the bet here is simple:

Just as happened in 2002 and 2003…you’re going to see investors jump FROM TECH and back into certain REAL ASSET stocks.

Resource scarcity, we believe, is about to become the only game in town when it comes to making exponential gains over the next 10 years.

If want a good shot at speculative gains in the next few years...then you should be buying cheap stocks now that could become much, MUCH more expensive stocks...as this Age of Scarcity plays out.

What you need to do is select the right investments and BE IN THEM before the exodus from cash into ‘real equities’ properly begins.

Because when it DOES really kick off...it will be rapid and unexpected by the mainstream...just as it was in 2002 and 2003.

Years of underinvestment means the industry hasn’t been able to deliver additional reserves to meet future demand.

Companies with superior grades and long mine lives are rarely discounted like they are RIGHT NOW.

Few investors have the audacity to press the buy trigger at the moment.

That’s exactly what we’re suggesting you do.

But which stocks?

You’re about to find out...

As I say, I head up Fat Tail Investment Research. We’re one of Australia’s leading publishers of financial and investment research for the self-directed investor.

As our 50,000-plus like-minded followers will attest, we tend to be more than a little contrarian.

For nearly 20 years, we’ve used this approach to help Aussie investors chart a course through various emerging megatrends.

That included the LAST secular resources bull market, which we labelled ‘The Big Dig’.

In late 2022, it became crystal clear to us that a NEW kind of mineral hunt was kicking off.

And so, we went on a

little hunt of our own…

We’ve recruited a seasoned exploration geologist to help us pick the stocks that could massively outperform over the next few years.

It took us over a year to find and attract the right person.

But we carefully spent this time because this will not be a game for amateurs or fly-by-nighters.

It takes years of dedicated mineral exploration to find the NEW bodies of minerals that are going to be needed in the next few years.

The guy we recruited has clocked years of geologist ‘walkabout’ in the Outback and in Africa, contracted by both the small explorers and the major players.

He’s poured over everything copper in Zambia...to helping develop an iron ore project that fed directly into making Toyota Prados and Outlanders.

As a financial publisher, you encounter a lot of guys who talk a good talk.

They’ll write thousands of words about tech breakthroughs and AI stocks...but have never met a software engineer or been in the boardrooms of Silicon Valley.

I knew from experience that this wouldn’t cut it for this new resource stock project.

Which is precisely why we

connected with James Cooper...

James Cooper

Our Head of Research, Greg Canavan, and I realised pretty quickly that with a new ‘scarcity-driven’ boom forming...we needed a SEASONED EXPLORER.

The career of a geologist is a wild ride of adventures, booms, and busts.

James Cooper’s has followed that exact path.

He’s been involved in massive ore discoveries and multibillion-dollar takeovers...soul-crushing failures and delistings...and everything in between.

When he wasn’t managing rigs, soil sampling, analysing data, and organising field crews in far-flung places...James was TEACHING geology at international schools...

There’s a bit of Indiana Jones about him.

For instance, one minute he was having beers with the exploration manager of Equinox Minerals in a Perth bar…several beers in, and he’d signed a contract...boarding a set of five flights to Solwezi in Zambia to look for copper...

James with his field crew undertaking

remote exploration in the Zambian bush

James was actually right at the heart of it when Barrick Gold came in in 2011 and bought out Equinox for a staggering $7.5 billion.

He tells me:

‘While the big major mine companies were not really my cup of tea. It was interesting to see the takeover, then play a role in what was the biggest resource drill-out that ever took place in Africa.’

The crux of it is:

If you’re going to search out the miners with the best chance of hitting it big in the NEXT cycle...you need an actual ore hunter with these credentials as your guide.

Not a hack or a keyboard ‘expert’.

You need a guy who knows how to dig into actual dirt just as well as balance sheets.

James at a mobile exploration camp in Zambia.

Office tent in the background.

James knows through experience how hard it is to make these finds.

Right now, he’s seeing direct evidence of resource companies starting to frantically sift through old drill cores...in the hope of finding a strike in critical metals.

It’s an inexpensive strategy that could gift a company an instant windfall.

But it’s a long shot.

And these small wins won’t be enough to supply the breathtaking level of demand that’s coming...

James on a geological field trip

in New Zealand

Many exploration geologists have spent careers spanning 40-plus years...unable to make a single find that led to the development of a mine.

This is not due to a lack of skill or knowledge either.

It is based squarely on the issue that viable bodies of ore, as well as oil and gas fields, are becoming increasingly harder to find.

This is happening at a time when exploration has suffered from critical underinvestment for more than a decade.

‘Perfect storm for commodity prices’ is another cliché. Just like ‘the next Fortescue’.

But, according to James, there is no truer description of what’s coming.

Remember, he’s not a hobby pundit.

He’s been right in the thick of it.

Through the pandemic he was with gold mining behemoth Northern Star.

In 2021, he was headhunted to be Dacian’s Senior Exploration Geologist...in charge of the company’s growth in rare earth projects.

Each stock selection we’re going to show you now is based on EXACTLY what James is seeing and hearing at this very moment

Which brings us to those stock selections.

James has identified FIVE core players.

Each are first movers in key areas.

Each are trying to define critical resources for the new Age of Scarcity.

Each...James believes with high conviction...has the potential to outperform the wider market significantly in 2024 and 2025.

But...

One in particular has brought our entire office to a standstill...

If you consider buying just one single share to harness the impact of critical supply shortages, it should be a company that we’ve dubbed:

‘The Next Potential

Aussie Mining Disruptor’

Let’s dig into this company now by circling back to Mr Forrest.

‘We took the view in 2003 that China had awakened’,he explained.

In retrospect, this audacious $10 billion bet on a China-driven iron ore boom seems like a no-brainer.

But no one at the time imagined exports of the bulk commodity were about to expand four-fold.

‘On a visit to China I saw how deeply the Chinese respected the iron ore, nickel and cobalt resources, which we in Australia took for granted’, he said.

‘It taught me how serious a resource deficit could be for their country. So, we started with a vision to be a major iron ore player.’

While the two big multinational miners were ignoring the federal government’s pleas to expand production...

A new company called Fortescue was building railways, ports, and mines...and soon hurling millions of tonnes of iron ore at a hungry China...

...while iron ore was TRIPLING in price.

So, here’s our first big reveal...

James is seeing a similar set-up right now. But this time...it’s happening in a poorly-understood segment of the critical metal market.

A niche but hugely important metal.

One where war and geopolitical uncertainty is completely reshuffling the supply chain.

And yet, the coming ‘super-squeeze’ in this metal is getting very little airtime by the mainstream press.

Now, you MAY already know that critical metals are ground zero in the coming scarcity era.

I’m not going to go deep into making that case here.

Suffice to say...

James calls them

critically endangered metals

for good reasons...

Now, chances are you already know how important certain critical metals are to the green energy transition.

With the stroke of a pen, governments across the globe have started to build out a carbon-free, pollution-free, automated utopia.

Whether it’s going to work out for the best is beside the point.

The POINT is this...

There is one KEY factor that environmentalists, leaders, CEOs, and celebrities have left out...

How do we get the critical materials to build this multitrillion-dollar-green dreamland?

Exploration geologists like James were not invited to the Paris or Glasgow Climate Summits.

Because of that...

Policymakers have made BIG and IGNORANT assumptions that resources will just BE AVAILABLE.

Those responsible for actually making them available know better.

Supply of critical metals is not a straightforward process of increasing production...like it is for iron ore mining.

Twiggy had that in his favour. He knew if he could get all the ducks in a row to get to production before everyone else...the ore was there. Heaps of it.

Like I said, we’re not going to go any deeper into the supply crunch case for critical minerals.

But it’s actually much bigger than just the ‘Great Green Energy Transition’.

It’s a scarcity problem for ALL segments of the economy.

A tidal wave of changing technologies means an enormous shift in the types of raw materials needed.

From healthcare to defence to manufacturing, the commercial need for these metals is rising each month.

Right now, China dominates extraction and processing of almost everything needed here.

The latest US Geological Survey report found China as the dominant supplier for no less than 25 critical minerals.

For this reason...

Unease is brewing throughout the developed world.

Non-Chinese manufacturing of EVs, solar panels, iPhones, smart TVs, laptops, and defence technology will come to a standstill should China decide to ramp up its pressure against Western powers.

The very threat of cutting off supplies will send shivers down the spine of major manufacturers.

So what’s the contingency plan for the US or Europe?

Nothing.

China has played a VERY smart long-term game.

And the West may have an enormous price to pay for its stupidity in ignoring early warning signs.

As resource companies collapsed during the depths of the last commodity downturn, China stepped in and purchased major deposits for pennies on the dollar.

The downturn gifted China an enormous opportunity to dominate global supplies of critical metals.

In 2025…we’re going to see what happens when the West is forced to make a charge on to this battleground.

And, if our analysis is correct, one little-known Australian miner could be about to lead it...

Let me explain a bit more how we know this...

James Cooper came directly to Fat Tail Investment Research from his last job as Senior Exploration Geologist for a miner called Dacian...

Look them up. They just had a $75 million takeover bid launched on them from a bigger miner called Genesis.

Dacian was primarily a gold producer. But when James arrived, it was starting to pay attention to the CRITICAL METALS it was finding too.

Dacian was primarily a gold producer. But when James arrived, it was starting to pay attention to the CRITICAL METALS it was finding too.

He and his team spent much of 2021 scouring the mineral-rich grounds surrounding the small Western Australian township of Leonora, around four hours’ drive north of Kalgoorlie.

This, you may know, is right next to the largest, rare earth elements deposit outside of China, Mt Weld. This is operated by Lynas Corp...the big Kahuna player in rare earths.

The Genesis takeover of Dacian is — according to James — just the tip of the iceberg.

A massive transition is about to take place in this part of the Aussie resources sector.

And one single, for-now

unknown player could be about

to take a starring role...

Now here’s the thing.

Very few in the year 2000 guessed iron ore would be the star resource of the coming decade.

And VERY few are focused on the rise of another very important metal in 2024.

Ask most so-called insiders what they think the go-to metals will be in the next few years…and you’ll get the standard answers: cobalt, lithium, nickel, graphite and various rare earth elements.

But one resource…which is NONE of the above…is about to experience the ultimate super-squeeze…

…and virtually no one is paying attention.

Despite that, miners specialising in this metal have started exhibiting some VERY curious price rises.

It started last year, when a company called Empire Metals, who’s announced a ‘globally significant’ strike of this metal, soared 720% in six months.

ASX-listed IperionX has developed a new, low-cost way to process this metal for the defense industry. Its shares have jumped 200% in a year.

CVW CleanTech Inc. has developed a new proprietary tech to recover this resource. Over just eight days in March 2024 its shares jumped 48%.

Those are just some initial rumblings.

Our pick here, we believe, is actually way ahead of all these guys.

Just like Fortescue…these guys are looking to unlock a truly massive resource to generate DECADES of supply.

Just like Fortescue…they’re targeting a specific supply-squeeze that the market is currently underestimating. In fact, this resource has almost been left out of the critical metal rush completely so far.

Just like Fortescue…they’re targeting shallow, flat-lying deposits that are simple to mine…there for the taking…but have previously been ignored because prices have been so low…

Just like Fortescue…it’s an unprofitable company burning cash it doesn’t have into ONE SINGLE BIG BET.

It goes without saying, there are big risks buying this stock.

In 2003…Fortescue’s revenue was…wait for it…

$980,000.

Not even a million dollars.

By June 2010 that was $3 BILLION dollars.

But Fortescue was…by no means…a dead-set buy in 2003.

It looked like a dog of a stock.

Right now, the ‘Next Disruptor’ stock we’re targeting has annual revenue of just $800,000.

It’s not (barring a miracle) going to become a $25 billion revenue generator like Fortescue.

But OUR big bet is they start seeing similar exponential growth…and really quickly.

Why?

It’s sitting in potentially the biggest resource of its kind in the world right now…and just 3 metres below the surface.

But getting it out. Getting the right structures in place. And getting the attention of investors.

None of that is a done deal.

So…you must approach this very small stock with all that in mind.

But the coming global supply crunch for its highly prized critical metal cannot be overstated.

Tension is brewing and shots are already being fired.

What has our ‘Next Potential Aussie Mining Disruptor’ seen forming on the horizon?

Well, Twiggy set his sights on becoming ‘the new force in iron ore.’

These guys are gunning to be:

The New Force in TITANIUM

Now wait on, you might be thinking.

Titanium the new iron ore???

What am I smoking?

Bear with me.

Because if I’m right…we could be looking at multiple opportunities mirroring certain iron ore players from the early 2000s.

Hardly anyone realises how quickly this poorly-understood metal has become irreplaceable — in lightweight electric vehicles, aircraft structures, medical implants and a whole bunch of military applications.

Demand is soaring.

And supplies are drying up.

Titanium shortages are snowballing…and causing major manufacturing disruptions in a bunch of industries.

Aerospace companies, for instance, are having to push back deadlines and cancel deliveries.

Why?

It’s the general critical metal super-squeeze I’ve already mentioned.

Plus, something else…

Right now, Russia dominates supply.

And Ukraine is ALSO one of the largest producers of titanium in the world. Specifically deposits located in the Zaporizhia region.

That’s a big problem! For obvious reasons.

And it’s not going away.

The Russia-Ukraine war has already led to the closure of ports, congestion in shipping routes, container shortages, and increased freight costs.

Then there’s the spectre of Russia using titanium as a geopolitical weapon.

There’s a reason titanium is one of the few Russian exports yet to be sanctioned.

WE NEED IT VERY BADLY.

As the Airbus CEO puts it:

‘We think sanctioning titanium from Russia would be sanctioning ourselves.’

So…for now…

Russian titanium is still flowing into Western hands.

According to a March 2024 report by The Washington Post, Western firms just…

‘…bought hundreds of millions of dollars of titanium metal from a Russian company with deep ties to the country’s defense industry…’

‘The purchases illustrate how the West remains dependent on Russia for certain products despite pledges to break economic ties with Moscow. In the case of titanium, that dependence raises security concerns, industry and defense analysts say, as the metal is vital in the manufacturing of both commercial and military airplanes.’

But…

‘Russia could shut off the flow of these materials and leave companies critical to national defense and civil aviation scrambling.’

According to James Cooper, this outcome is not a 100% certainty.

But it’s growing more likely by the day.

SOME smart investors are starting to sniff the coming titanium super-squeeze. As I just showed you with those recent stock moves.

But for the most part…mainstream finance remains oblivious.

The same was true for the China boom in the very early 2000s.

When Forrest was making his war plans on a kitchen table…lining up Chinese customers who didn’t want to be captive to the three iron ore giants — Brazil's Vale, Rio Tinto and BHP.

So, what’s the play here?

Well, new titanium supplies need to be found outside of Russia.

Very quickly.

This is a process that requires far more infrastructure and technology compared with the relatively straightforward method of processing iron ore.

In summary: Just like with iron ore in the early 2000s, you need a DISRUPTOR...

You need a NEW Twiggy...

and a NEW company...

with a NEW disruptive vision...

There’s a specific no-name company here that has our attention.

It has a bit of a renegade at its helm.

A relatively young guy to lead a mining company…like Forrest was at the time…but with 20 years’ experience down in the dirt of the mining world.

Orchestrating financing, permitting, development and operation of mining projects in some of the harshest regions on the planet.

This guy knows his stuff.

And he’s making a big play…

- The small explorer we’ve dubbed ‘The Next Potential Aussie Mining Disruptor’ is looking to ‘own’ the titanium scene...just like Fortescue ram-raided the Pilbara in the 2000s...

- They’re aiming to directly attack the two biggest players: Russia and Ukraine. Again, like Twiggy gazumped BHP and Rio Tinto.

- Like Fortescue, it’s not satisfied with just the small crumbs of a big pie. A modest market share of a gargantuan revenue pot that 99 out of 100 small-cap miners would be more than happy with. THESE GUYS WANT MORE. Much more. ‘The Next Potential Aussie Mining Disruptor’ is gunning for hyper-dominance: supplying almost the entire supply for Western economies. With advanced exploration in place...once it moves to mining...it will be in a very exclusive club as a dedicated titanium supplier...

- What’s the X-Factor here? What puts these guys way ahead of the other titanium players I mentioned? An absolutely MAMMOTH rutile deposit. Rutile is the highest-grade titanium mineral. And these guys have hit the largest of its kind anywhere in the world. It’s also shallow, making it easy to extract.

And get this…

This disruptor’s ‘largest deposit in the world’ could be about to get EVEN LARGER

The latest drill results have shown potential that this deposit could get much larger, still.

Again, we won’t get into the geology weeds here, but titanium is used in everything from defense missiles, aircraft wings, turbine blades, and corrosion prevention. Ever wondered how those multi-billion offshore wind farms survive out in the elements? Titanium plays a major role.

This is not solely about new skyscrapers in China, which pretty much single-handedly fuelled the last boom.

This is global in scope.

Now, it’s important to point out we’re in no way predicting a similar bottom-to-top share price rise to Fortescue Metals Group.

That was...by all accounts...a massive outlier.

$5,000 invested in Fortescue in 2003 would be worth around $4.2 MILLION today! That is an absurd gain that almost certainly won’t be replicated.

There is also significant risk investing in this stock right now. Just like there was in Fortescue back in the day. Our comparisons could be off the mark. And you could lose money on it.

There were zero guarantees of Fortescue’s success in 2003...and there are zero with this play.

THE POINT IS...

In the mire of a very challenging mining market...THESE GUYS...in our opinion...are the one ultra-speculation to rule them all.

OK...

Because we THINK we’ve spotted incredible potential in this play that the wider market has not wised up to...

And because of the small market cap of this company...weighed up against where it could potentially be in three years’ time...you’ll need to take another step to get the full details.

James Cooper has compiled a comprehensive due diligence report on this opportunity.

It’s called ‘The Next Potential Aussie Mining Disruptor’.

You can get this report, as part of James’ investment advisory.

And that’s called Diggers and Drillers.

Diggers has a storied history.

Let me quickly explain why I think our James Cooper-helmed Diggers and Drillers is perhaps the most important newsletter you could subscribe to between 2024 and 2030...

Our last mining boom may have been big.

BUT TIMES THAT BY 10...

Diggers and Drillers was actually our company’s first ever newsletter. We established it for the last mining boom. And our call to arms was just as emphatic as this one. As we said at the time...

‘The sheer magnitude of what’s about to take place is incredible.

‘I can honestly say I’ve seen nothing like it. Australia is about to become the commodities centre of the world.’

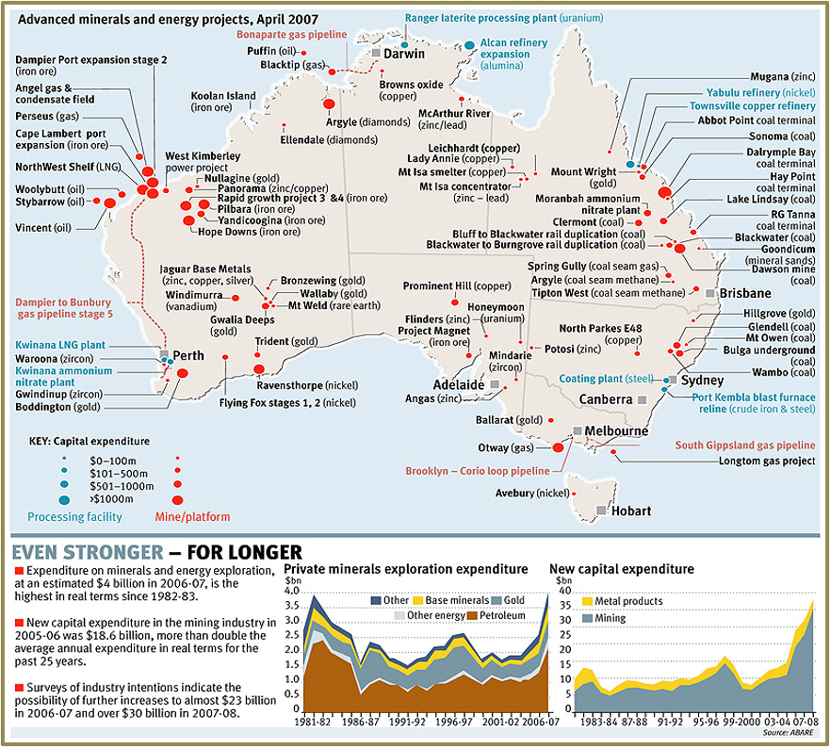

This was the magnitude of those projects by April 2007:

Source: ABARE

Past performance is not a reliable guide to future results.

I’m sure you’re aware of the wealth our country and SOME early stock investors made over those boom years.

China had an insatiable appetite for our iron ore.

But that boom, like all booms, wound down.

Mining stocks started to correct...the opportunities began to dry up...and we put Diggers and Drillers on indefinite hiatus.

One of the benefits of being an independent financial research company is we have one remit only: is this research in our readers’ interest?

We don’t publish newsletters for the sake of it.

We don’t put out a mining stock newsletter just because ‘there’s a bunch of mining stocks on the ASX’.

The timing of the cycle has to be exactly right.

Well, the cycle has turned again. And, as such, in 2022 we took Diggers and Drillers out of retirement.

The aim of this next-gen 2.0 version is simple:

To get you into the right companies...at

discounted prices...before everyone else

Australia’s last mining boom revolved around a steel-intensive economic transformation taking place in China...and, to a lesser extent, other emerging Asian countries.

We think this next one is going to be bigger.

In a case of history rhyming, critical metal developers sit at the edge of enormous opportunity.

Critical metals stocks are the iron ore developers from 2003.

Sitting at the precipice of a major upward leg in the commodity cycle — yet hobbled by enormous cost of capital required to get projects underway.

Just like it did with iron ore in the early 2000s, expect downbeat sentiment to shift rapidly in line with rising prices.

This is how commodity cycles work. This is how inconceivable capex finds its way into new projects.

The world’s biggest insiders are moving.

But we’re in a pocket where the stock prices of many great projects AREN’T MOVING.

I don’t think that will last long.

The time to buy is now.

This next boom is not just a China story.

It’ll involve almost every country and every supply chain in the world.

The company we’re dubbing ‘The Next Potential Aussie Mining Disruptor’ is our prime, swing-for-the-rafters speculation on all this.

As I say, James has spent many years in the field, be it on the side of a dusty drill rig or mapping rock outcrops through remote Australian bush and the African jungles.

He’s seen what’s happening firsthand, and says:

James Cooper

‘This very obscure company appears to have read the tea leaves just as Twiggy did 20 years ago.

‘It’s spotted what’s likely coming with titanium.

‘It’s advanced its exploration well before the majors.

‘And it could be about to shock the world by joining a very exclusive club, almost overnight...’

This kind of disruption only ever takes place inside a small window of time.

When Forrest mapped out his plan on a kitchen table in 2003...he didn’t mess around.

The goal was to tear down the entire status quo.

Not just join the game.

RUN it.

Forrest grew up in the remote Pilbara region in Western Australia. A region dominated by the complacent duopoly of BHP Billiton and Rio Tinto.

He ended up achieving the seemingly impossible: gatecrashing that party and creating ‘Australia’s third force’ in iron ore.

In just a couple of years, Forrest had expanded 100 times over, massively overtaking the tenements of both Rio and BHP combined.

Now again, it’s unlikely you’ll ever see a rise with that kind of velocity in our lifetimes. We’re in no way saying the stock James is zeroing in on is a direct comparison in 2024.

From zero to $25 a share is a one-in-a-million.

But here’s what’s clear…

The resource cycle stars are aligning once more here in Australia.

We have the exact type of fertile conditions that fuelled Fortescue’s rise.

A new mega-theme (the energy transition).

A new super-squeeze (titanium and several other critical metals).

A new set of geopolitical headaches and supply chain problems.

Rapidly rising growth in places like India, Mexico and Southeast Asia.

A preoccupation with tech stocks that has left miners deeply undervalued.

And…underlying it all…just like in 2003…a mining industry that’s unprepared for the new cycle.

15 years of underinvestment in mines. Mothballed projects. Not enough geologists. And massive capital costs in getting new projects cranking.

These are PRIME conditions

And James has singled out one in particular.

You can download the full report now simply by becoming a member of our Diggers and Drillers advisory.

It’s very reasonably priced.

$199 per year is the official subscription for full access to James’ intel and recommendations.

BUT...

To mark the urgency of stock opportunity, we’re slashing that by half.

IF YOU CLICK THIS LINK NOW…YOU CAN LOCK

IN A 12-MONTH SUBSCRIPTION FOR JUST $99.

And that crazy-low price is covered by a 30-day subscription refund guarantee.

Meaning, you can read ‘The Next Potential Aussie Mining Disruptor’…

...and get James’ four other core ‘Age of Scarcity’ picks...right out of the gate...

...and STILL choose to get a full refund of your membership fee within 30 days if you so desire.

Look around. There are not many players in this game that swallow a subscription risk like that.

Recommendations like these tend to get locked right behind a paywall without any remote possibility of a refund.

It’s a testament to how much we rate James...and what a coup it was to land him to helm this project.

You’ll see what we mean within a half hour of joining.

Once you read his stuff, study his insights, and start tracking his recommendations, you’d have to be crazy not to stick around!

But that’ll be your choice.

If you DO stick around...here’s the

Diggers and Drillers game plan...

So, simple premise here.

We’re entering a Second Age in Australian mining.

It’ll be based around a new, expanded set of resources.

The wheels are already moving.

And it’s going to be based on a transition shift from ‘abundance’ to ‘scarcity’.

Chronic underinvestment in mines worldwide is presenting you with a very contrarian opportunity; one that only crops up to the smart investor every 20 years or so — if you’re lucky.

There are massive discounts in the resource sector on offer right now.

The aim of Diggers and Drillers is to help you find them.

But those discounts are just gravy.

Even if the resource stocks James is going to introduce you to WEREN’T trading at sell-off discounts...we’d STILL be putting them as urgent buys.

This is not merely a case for buying against bear market sentiment.

It’s way bigger than that.

We’re on the cusp of a trend that could send certain resource stocks much higher in 2024 and 2025.

Even if the wider equities markets go nowhere.

It’ll make certain stocks ‘break away’ from the wider indices in a spectacular fashion.

You just need to own the right ones.

As I’ve said, we’ve been in this position before, we called it right then, and we think we’re right now.

We believe it’s the only game in town if you’re going to be involved in the markets over the next few years.

This is still going to be highly risky. Just as speculating on the early mining boom was in 2003/04. There were no guarantees you’d make money then...and there are none here. But if you’re one of the lucky ones who have capital to play around with...and that you can afford to lose...then we firmly believe this is the best place for it over the next year or two.

There are certain investments you can make right now that stand to benefit greatly from this next great ‘super-squeeze’.

Especially because you’re an investor situated in one of the most resource-rich nations on Earth.

Which brings me to another resource you’ll get instant access to if you click the link below and join us right now...

Four Prime

Age of Scarcity

Stocks to Own Now

‘The Next Potential Aussie Mining Disruptor’ is our primary play at the moment.

‘The Next Potential Aussie Mining Disruptor’ is our primary play at the moment.

If you were to buy and track just one single recommendation from James over the next few years, it should be that one.

But, as I’ve said, it’s by no means a sure thing.

And this is a boom that’s going to be bigger in scale than just one company.

Fortescue, remember, was a prime beneficiary of the last mining boom.

But it was hardly the only one.

In ‘Four Prime Age of Scarcity Stocks to Own Now’, James gives you blanket coverage on four key scarcity areas and four mining companies he reckons are best positioned to nail them in the coming years.

Without trying to make this sound like a Year 10 Science class...there are some bizarre-sounding metals now shaping future investment in mining.

There’s promethium...a healer and a weapon.

This element is a critical component for making pacemakers, but it’s also used for building self-guided missiles in defense.

Or niobium...scientists have capitalised on its unique ‘superconducting’ properties allowing them to develop new kinds of superfast, highly energy-efficient large-scale computing...without the need for semiconductors.

Or there’s zirconium...a key metal used for cladding nuclear reactor fuel cells.

The potential for critical metals is endless...the only limitation is SUPPLY.

But this is not just a critical metals story.

The Age of Scarcity is going to involve the old-guard resources as well: nickel, aluminium, and copper...and you’ve seen what’s going on in the energy world recently.

That’s why a mineral known as natural graphite is being increasingly sought. It’s used in cathodes of lithium-ion batteries...and needs a massive 600% increase to its current production to meet future demand!

‘Four Prime Age of Scarcity Stocks to Own’ puts you into what James sees as the four best resource stock speculations on the planet right now.

- PLAY #1 IS ‘ONE OF THE BEST SCARCITY STORIES ON ANY LISTED MARKET’, says James. In fact, it was a contender for The Next Potential Aussie Mining Disruptor...but was ruled out because it’s not listed on the ASX. Instead, you’ll find this company on the world’s largest exchange for junior mining stocks, the Toronto Stock Exchange in Canada. This company is looking to develop one of the biggest deposits of copper. Recent drilling has hit upon over 1,000 metres of mineralisation. Truly staggering

- PLAY #2 IS A $400M PILBARA DOMINATOR. The Pilbara is about to undergo an Age of Scarcity upgrade. The region is increasingly coming up with new base metal and lithium discoveries. Once thought of as a giant slab of iron ore...it’s now seen as a richly endowed mineral province which will only increase investment in the region, create more competition for land holdings, and attract a wider spectrum of investors. This company is James’ prime pick to dominate the space. It covers copper, zinc, and silver.

- PLAY #3 IS A SUB-40-CENT STOCK WITH PLANS TO OPEN UP THE WORLD’S SECOND-LARGEST GRAPHITE RESERVE. And it’s a PROVEN reserve. Why the hell’s this stock still only trading so cheap then? You’ll need to download the report to find out. But, again, it’s going to become a unique non-Chinese processing option for graphite in the scarcity years ahead.

- PLAY #4 IS BUILDING THE WORLD'S LARGEST PROCESSING FACILITY FOR ANOTHER SUPER-SQUEEZE METAL. I doubt you've even heard of this metal (let alone this stock). It's that rare. But it's going to be like gold dust for the big tech firms and the EV market in the coming decade. Not only is this little ASX stock building a mega-factory in Queensland to handle production...it's breaking ground by uncovering a new way to purify this critical metal. An absolute MUST-BUY.

In James’ words, the ground held by this company has become the hottest place on Earth for copper discovery. The company is tapping into a geological freak of nature known as ‘porphyries.’ These rich motherlodes contain huge amounts of copper, but also silver and gold. That makes them a multi-commodity powerhouse leveraged to the critical metal theme and surging interest in precious metals.

A lot of graphite stocks could be about to break out of their multiyear sideways lows. Get James’ intel on this stock and you’ll see why...

Look, if you take just one thing away from this presentation...please make it this...

The Age of Abundance is over.

The Age of Scarcity has dawned.

I don’t need to bombard you with more evidence.

It’s all around you.

A report from ABB Motion, entitled ‘Circularity: No Time to Waste,’ reveals that a staggering 91% of industrial businesses are feeling the effects of resource scarcity.

This is not a fleeting thing.

As Umair Haque puts it in Medium:

‘Everything is now changing.

‘Suddenly, catastrophically...’

That’s a bit doomy.

But Diggers and Drillers is a defiantly positive advisory.

As Medium goes on to say:

‘It is a Big Deal — as big as the Industrial Revolution before it.’

The Industrial Revolution made generational wealth for those who played it correctly.

The Age of Scarcity will too.

Especially for those lucky enough to be sitting on the things that are about to become scarce...

This is what you’ll get if you join us right now.

But all that will be just for starters.

This boom is only just beginning.

Join us now and we’ll give you a roadmap for playing it.

$199 normally.

$99 today.

And with a full 30-day refund guarantee.

Click the link below, and let’s get cracking.