Dear reader...

You and your money are about to go on the mother of all nostalgia trips...

I'm sure you've seen the warning signs: surging energy prices, a massive housing boom...bloated public sector, a rising gold market and banks lending hand over fist.

I'm talking about a trip back to the nightmare economy of the 1970s.

A decade when rampant inflation and high interest rates tore apart the world of disco, bell-bottomed pants, shag-pile carpets...

A decade when unemployment shot up over 5%...stocks crashed by 43% in two years...and millions of Australians saw their savings and investments decimated.

You might have even been one of them.

Well, grab hold of your wallet

because

we

predict it's going

to happen all over again...

Here are five 'flashback factors' that make it clear that Australia is on the brink of another 70s style economic meltdown...

1.ENERGY-DRIVEN INFLATION IS SOARING: In 1975, oil prices pushed inflation up to 17.6%, eating away investors’ wealth and forcing up interest rates.

Today, oil is climbing again, energy bills are more expensive than ever, and Australia's inflation is the highest among advanced economies. In a moment, you’ll discover three investments that could help you profit from this 70's flashback.

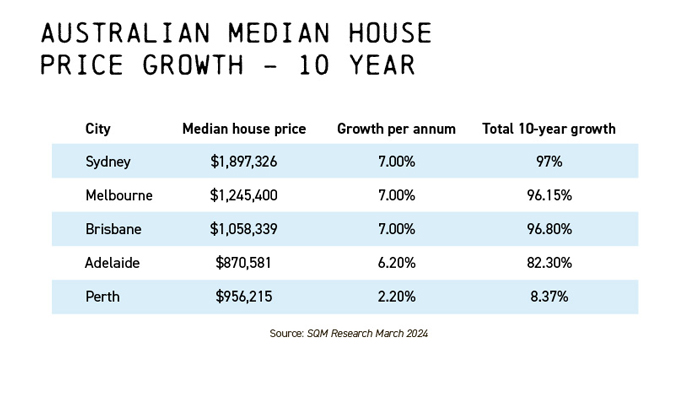

2.THE HOUSING MARKET IS OUT OF CONTROL: In the early 1970s, median house prices doubled, then plummeted.

The same cycle seems to be repeating now. But a correction we see coming in 2026 could be way worse. Keep reading to find out why.

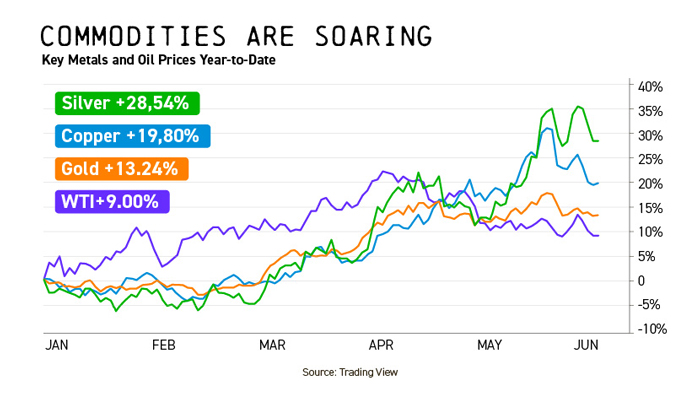

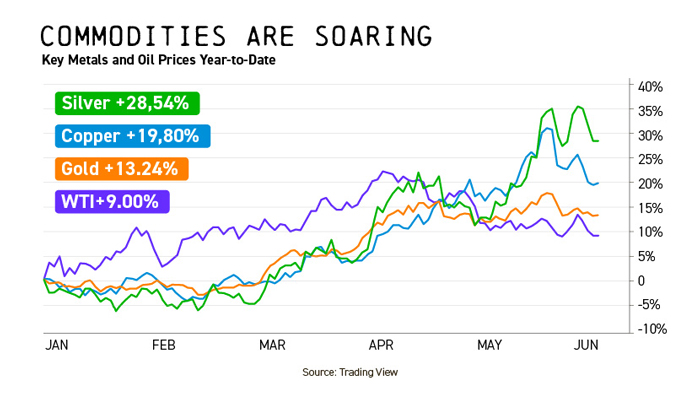

3.COMMODITY PRICES ARE RISING FAST: In the 1970s, oil, sugar, copper, wheat, and coal all went up triple digits.

Today's commodity boom has just begun. Shortly, you’ll discover four must-have mining stocks we believe can help you lock in early gains...

4.THE GOVERNMENT IS GROWING BIGGER AND FASTER THAN ANYTHING ELSE: The 1970s saw huge government expansion as tax revenues doubled, leading to even higher inflation, a debt explosion and economic stagnation.

Today, the public sector is Australia's biggest employer, and we have the fourth highest income tax rate in the developed world. Later, you’ll hear about six investments to avoid in this environment.

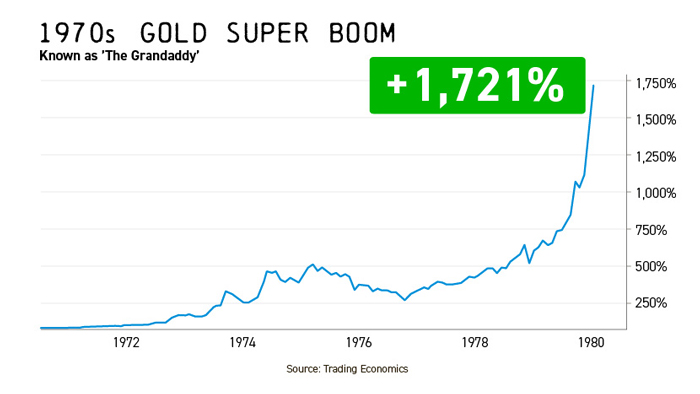

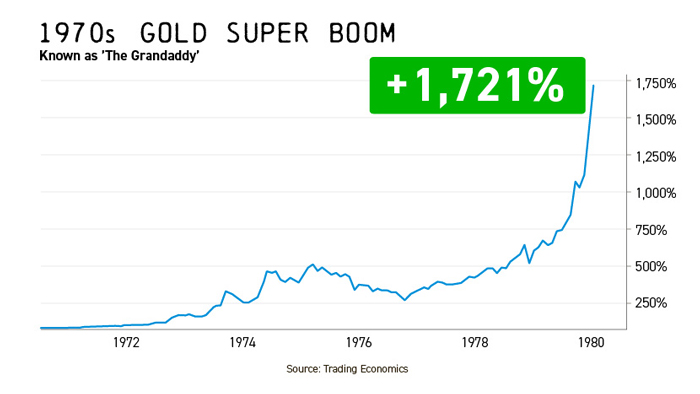

5.GOLD IS FLYING: Gold soared 1,754% between 1970 and 1980. Today, gold has powered up to all-time highs.

Read on and you’ll learn why we believe it will continue rising...plus you’ll get our top three gold investments for 2024...

1. ENERGY-DRIVEN INFLATION IS SOARING: In 1975, oil prices pushed inflation up to 17.6%, eating away investors' wealth and forcing up interest rates.

Today, oil is climbing again, energy bills are more expensive than ever, and Australia's inflation is the highest among advanced economies. In a moment, you’ll discover three investments that could help you profit from this 70's flashback.

2. THE HOUSING MARKET IS OUT OF CONTROL: In the early 1970s, median house prices doubled, then plummeted.

The same cycle seems to be repeating now. But a correction we see coming in 2026 could be way worse. Keep watching to find out why.

3. COMMODITY PRICES ARE RISING FAST: In the 1970s, oil, sugar, copper, wheat, and coal all went up triple digits.

Today's commodity boom has just begun. Shortly, you’ll discover four must-have mining stocks we believe can help you lock in early gains...

4. THE GOVERNMENT IS GROWING BIGGER AND FASTER THAN ANYTHING ELSE: The 1970s saw huge government expansion as tax revenues doubled, leading to even higher inflation, a debt explosion and economic stagnation.

Today, the public sector is Australia's biggest employer, and we have the fourth highest income tax rate in the developed world. Later, you’ll hear about six investments to avoid in this environment.

5. GOLD IS FLYING: Gold soared 1,754% between 1970 and 1980. Today, gold has powered up to all-time highs.

Read on and you’ll learn why we believe it will continue rising... plus you’ll get our top three gold investments for 2024...

We're not the only ones

to spot these similarities

In a recent report, co-authored with the IMF, Former US Treasury Secretary Larry Summers commented: ‘The current inflation regime is closer to that of the 1970s than it may at first appear...’

JP Morgan CEO Jamie Dimon agrees. He told the Economic Club of New York in April: ‘I worry that it looks more like the '70s than we've seen before...’

But this similarity to the most disastrous decade in living memory doesn't have to spell trouble for you...

In the 1970s, some people who saw this coming got rich by investing against the grain. In fact, one type of investment gained more than 3,000% over the decade!

It was a brilliant result. And while we can’t guarantee a similar outcome, that investment looks to be gearing up for another major run today.

In a few moments, you'll learn what we feel are the three best ways to play it.

You'll also discover seven more shares we believe could do remarkably well if we slide further into a seventies style slowdown.

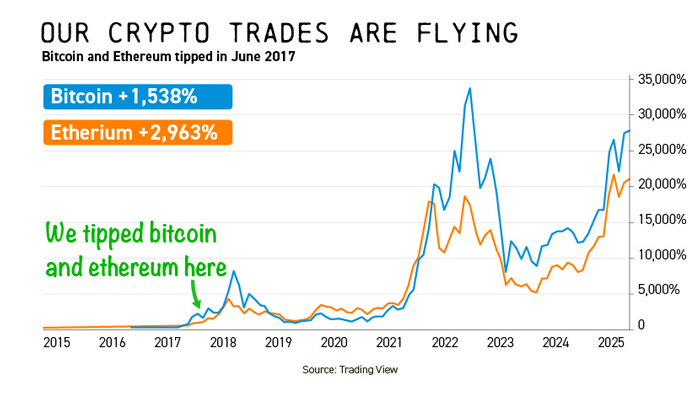

And you'll get the details of two growth assets that weren't available to investors 50 years ago.

These could prove to be your ‘get out of 70s jail free card’ as we move through these difficult next few months.

The first has averaged annual growth of 124% a year over the last decade.

While the second has been THE standout investment of the last 12 months — with some stocks in this sector powering up 180%, 239% and 240% in 2023 alone.

Both could rocket higher still

as the economy falters

How can we forecast all of this with such confidence?

Well, it's easy to predict what might happen when you're watching a rerun of the same conditions that made the 1970s such a dangerous decade for Australia.

These are factors that led to:

- Major unemployment...

- A stock market crash...

- The decimation of our manufacturing sector...

- And Australia being labelled the 'poor white trash' of Asia.

As the next few years unfold, the impact could be equally devastating.

The economy that we've all enjoyed — with its booming stock and house prices...and high standard of living...could reverse in dramatic style.

The signs are that it’s already beginning.

The low-rate environment of the past 10 years is over.

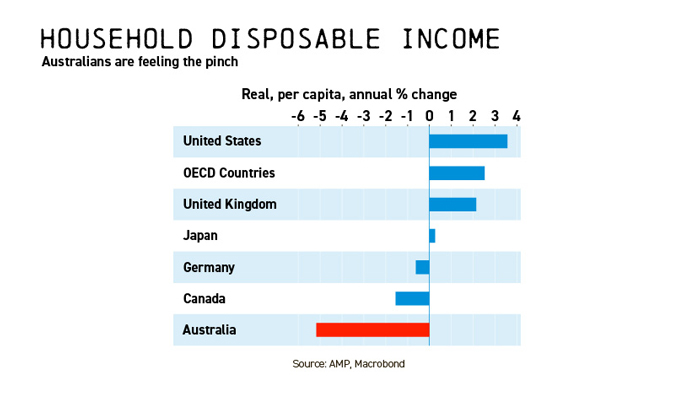

Living standards for many Australians have declined dramatically.

How long will it take for stock and property prices to respond?

To help answer that question, let's have a closer look at the first flashback factor — the soaring cost of energy...

FLASHBACK FACTOR 1

ENERGY-DRIVEN INFLATION

IS SOARING

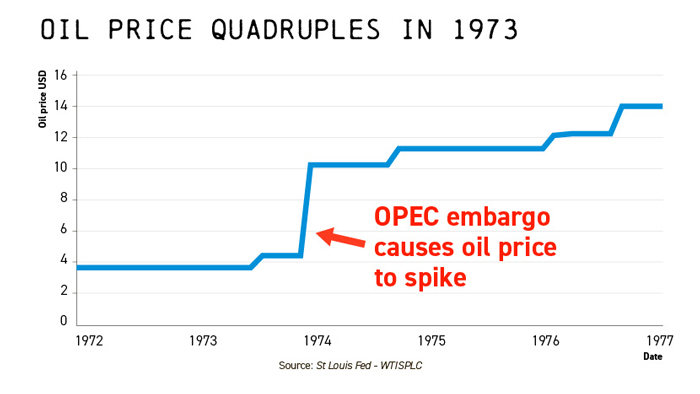

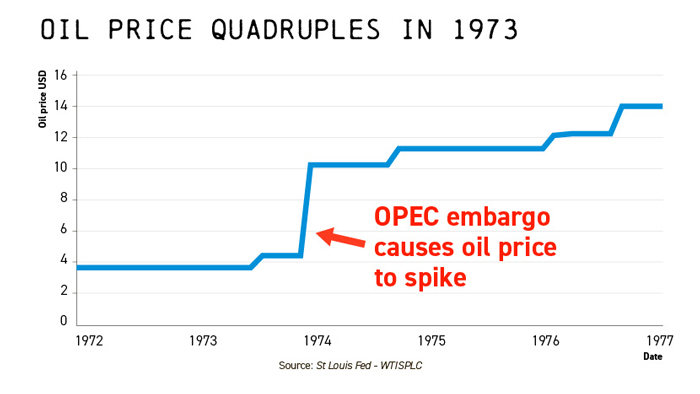

In 1973, the oil price almost quadrupled after OPEC placed an embargo on any country that supported Israel in the Yom Kippur war.

This crippled Australian investors.

The stock market went into a tailspin as inflation soared to 17.6% by 1975 — eating the guts out of people's cash savings.

In fact, a basket of goods costing $100 in 1970 would have cost $270 in 1980 — almost three times as much.

Such was the ravaging effects of energy-driven inflation over the decade.

That might sound crazy to us today, but when you look a little closer, you realise that we're on the same dangerous track.

Oil and gas prices are on the rise again.

Australians have seen their power bills go up by as much as 40% since 2022, with more increases expected over the next five years, thanks to high interest rates and huge spending on ‘Net Zero’.

Meanwhile, petrol prices are approaching record levels, with some Aussies paying as much as $2.35 a litre...for the CHEAPEST unleaded petrol.

And inflation?

Well, you may share the Prime Minister's view that inflation is a 'global phenomenon' driven by factors beyond our control, like ongoing supply chain disruption.

But that doesn't help Aussies in the thick of the worst cost-of-living crisis in a generation, with wage growth in the toilet.

The truth is that the recent inflationary surge has crushed our standard of living.

In November, The Australian Institute predicted it would take 15 years to recoup the damage done to wages since 2020.

And it looks like this menace isn't going anywhere for now.

The RBA says it's currently worried about 'sticky' inflation — with the prices of goods and services remaining stubbornly high and rising.

So what are they

doing about it?

Nothing.

Actually, they’re doing worse than nothing.

State and Federal governments are continuing to spend more, which is only adding to inflationary pressures.

At the same time, Sky News reports that Australians are now at 'breaking point' financially. Especially those with mortgages who have been hit hardest by rate rises.

A recent study by Polis Partners reveals that the average Australian has $21,300 LESS to spend on 'non-essentials' per year than they had in 2020.

Crazy, isn't it?

And it could get even worse.

The way things are looking, inflationary pressures might not be curbed for a long time.

Meaning the money you have stashed away in the bank...in super...in term deposits or bonds will lose more of its value.

And when the time comes that you need that money, it might only buy you a fraction of what you expect.

But things don't have

to get this bad for you

There are smart ways to protect your wealth in an inflationary crisis. There are even investments that benefit from high inflation in certain assets.

Take energy, one of the main drivers of this inflation.

Energy stocks were among the biggest winners in the 1970s. They massively outperformed the wider market over the decade.

We believe the same thing could be on the cards again.

Oil and gas indices are once again in an uptrend, thanks to weak economic growth in China and an irrational belief that wind farms and solar panels will displace traditional energy sources.

This means you have a short window to pick up top class energy stocks at bargain prices.

Later on in the presentation I'll tell you about three strategic energy investments that we believe give you a hedge against inflation...and could also help you make excellent returns over the coming years.

I'm urging our members to get into these out-of-favour assets while prices remain subdued.

I'll also give you the details of six investments that are horribly exposed to 1970's style wealth erosion. If you have any of these stocks in your portfolio, I recommend you give serious thought to offloading them.

Details are coming up. But right now, let's take a look at another uncanny similarity from the 1970s...

FLASHBACK FACTOR 2

THE HOUSING MARKET IS

OUT OF CONTROL

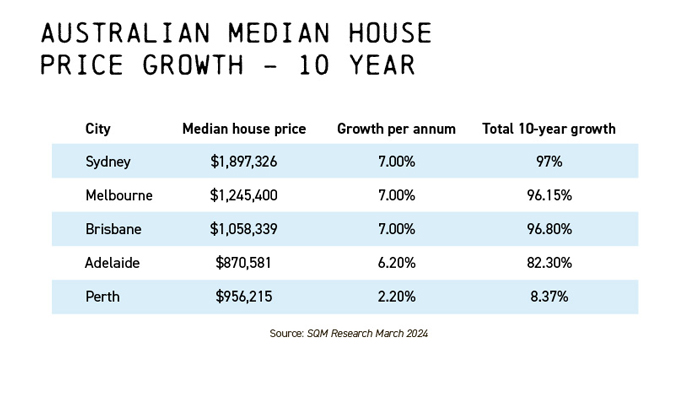

Between 1970 and 1974 the price of the average house in Sydney doubled.

In Melbourne prices went up 125%.

There were two reasons why.

Number one, we had a mining boom in the 1960s. This increased income and living standards. Everyone felt much richer. Property and land were the natural recipients of this wealth.

Number two, Australia added 22% to its population by ramping up immigration in the decade prior to that point.

One of the biggest causes of this surge in house prices was a major lending boom, boosted by non-bank lenders who were just getting into the market.

This lending frenzy prompted the government to intervene to try and stop the economy from overheating.

They jacked up interest rates over 10%. By 1974 the housing market had slammed on the brakes and was in freefall.

Prices in many capital cities dropped by more than 20%. They didn't regain their pre-crash levels for 14 years.

Can you see the

similarities to today?

As I write in mid-2024 house prices across Australia are surging.

They've gone up every month for 15 months straight.

The median price Australia-wide is up 9% just in the 12 months to May this year.

Buying a house in most capital cities is now a pipe dream for most families. You now need a combined income of nearly $300,000 a year to buy an average home in Sydney.

It’s absurd.

So what's going on?

A few things.

First, our most affluent demographic, the baby boomers, are wealthier than ever — and splurging left, right and centre — according to the Financial Review.

It’s the ‘wealth effect’ again. Most likely the result of watching the value of their houses go up, having already paid off their mortgages...

Second, immigration is at an all-time high.

700,000 migrants came to Australia in 2023. That's almost two Canberras, in just one year. Now consider that we built just 148,000 new homes over the same period.

This year, 105,000 people arrived in February alone. That’s a record. The same month we built just 12,000 new homes.

There's literally nowhere

to put these people

This huge supply/demand imbalance is feeding rampant competition between buyers. And it’s driving Australian house prices — even in average suburbs — through the roof.

One house in a western Sydney suburb went $2.6 million OVER its two-million-dollar reserve at a recent auction. Crazy.

And just like the 1970s, there's a lending boom on hand to grease the wheels.

In April, the Commonwealth Bank cancelled broker bonus limits set up in the Hayne Royal Commission to curb over-zealous lending.

CBA is basically saying ‘screw that!’. It wants a bigger share of the booming mortgage market, and so the shackles are now off.

And we're seeing the re-emergence of non-bank lenders.

Private credit firms now account for $600 billion of the mortgage market with investors seeking 'juicy returns' according to Reuters.

It's an almost identical situation to the 1970s. And we fear that the end result will be the same. A collapse in the housing market with years of slow or even no growth to follow.

Don’t agree? Consider the facts...

All around Australia finances are being stretched to the limit.

A lethal cocktail of low wage growth and rising interest rates has left many Australians struggling to service their mortgage.

Around 70% of Aussies are on variable rate deals — they've been really under the pump these past two years.

In fact the IMF says Australia is under more mortgage stress than any other nation in the developed world.

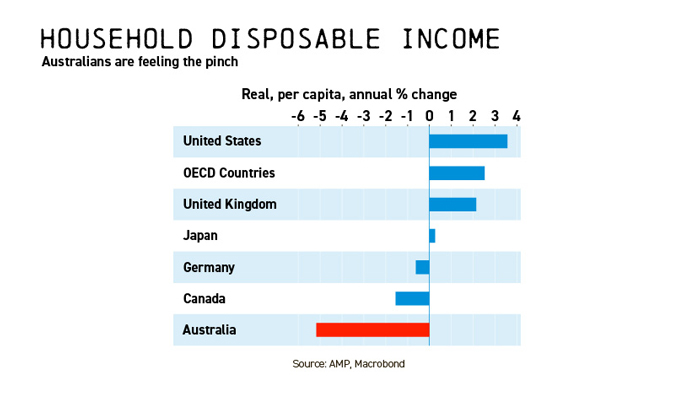

We also have — by some measure — the lowest per capita disposable income in the OECD.

It's not a good combination.

So is a property crash coming?

We believe it's inevitable at this point.

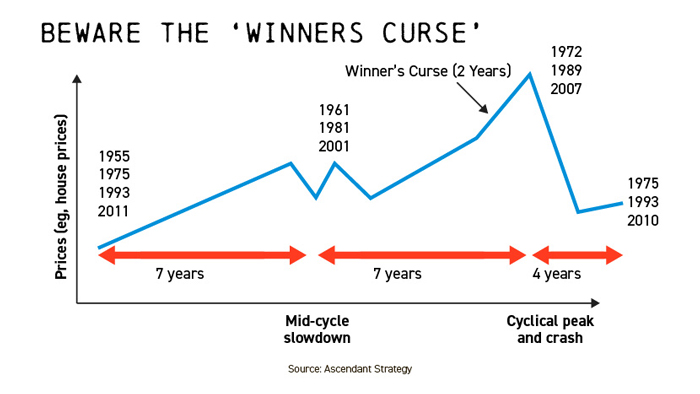

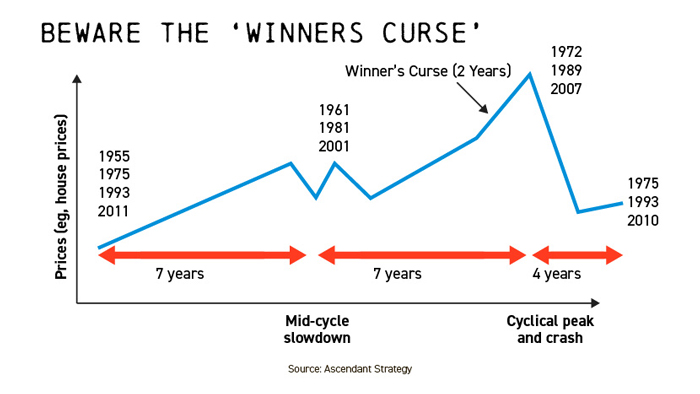

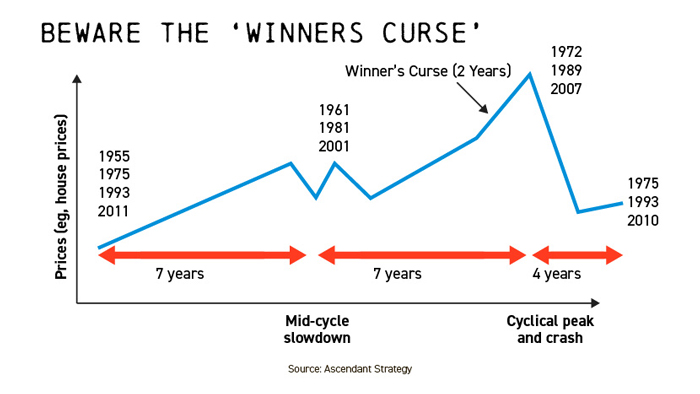

In fact, a little known land value cycle our company has researched for years says to expect a property market peak around 2026.

This cycle has accurately predicted the last three real estate crashes.

We are approaching what’s known as the ‘winners curse’ phase of the current cycle right now.

This is not the time for you or your loved ones to speculate on property or take on large mortgage debt.

Look, the way we see it, you have a choice.

You can ignore the lessons from history. You can keep your head in the sand. And watch your assets suffer as the market comes crashing down.

Or you can prepare today for the chance to prosper tomorrow.

It's up to you.

Keep reading. I'll share the details of our 2024 real estate investment strategy in a moment.

But first — you might be wondering — 'who are you to tell me we're headed for a return to the dog days of the seventies?'

Well, my name is James Woodburn.

I'm the publisher at Fat Tail Investment Research.

Who are we?

James Woodburn

Well, we're not a bank or financial institution.

We're not a political association, or lobby group.

And we're not a money management firm.

We're a research organisation, and a publisher.

We share investment ideas and recommendations with our members to act on however they see fit.

We've been part of the financial landscape in Australia since 2005.

And yet, few people have heard of our research business, because we don't appear or publicise ourselves in the mainstream media.

Unlike many in the financial industry, we're not owned by a big bank or media organisation. We're fully independent.

And we never feature third-party advertising.

This ensures there's no outside influence on our research or recommendations. In other words, no one tells us what we can or can’t write about. The only ideas we share are our own.

Sometimes our conclusions can be controversial.

But having no hidden agendas means we can focus 100% on helping our readers achieve success.

Take our flagship service, Fat Tail Investment Advisory.

We're killing it for subscribers

right now in a difficult market

Our current share portfolio of open positions is up an average of 49% at the time of recording. That includes all winning and losing positions.

Of course this could change by the time you're seeing this, as markets go up and down all the time. But that's a fantastic record by anyone's standards — obviously bearing in mind that it's not a guarantee of future results.

How do we measure success?

Look at what many other Australians are doing with their money...

The most popular mainstream index fund in Australia right now is the Vanguard Australian Shares Index ETF.

This fund invests in large stocks listed on the ASX 200.

Year to date this fund is showing a 1.6% return.

In the last two years the performance is 4.2%

And over three years they're up 2.4%.

Now okay, our 49% figure doesn’t include closed positions.

But which account statement would you rather be looking at right now? The Vanguard ETF? or Fat Tail Investment Advisory.

And this is just ONE of the services we publish to help Australians like you make sense of the financial world and figure out how to profit from it.

We don't get everything right, no one does. But on many occasions over the past 19 years we've helped readers get into booming markets long before other investors picked up the scent.

- In resources and mining we spotted the opportunity coming out of China following the market fall of 2008. Our analysts led some members to gains of 220% from MEO Australia, 243% from LNG Ltd and 458% from Bow Energy.

- In technology we’ve been on the front foot over the last decade, leading some members to gains of 886% from Zip Co, 833% from Advanced Micro Devices and a massive 1,448% from AfterPay back in 2020.

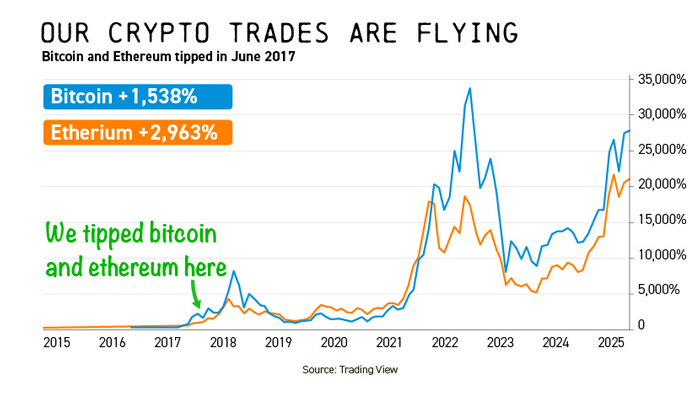

- While in crypto, an asset we were talking about back in 2014 — long before the mainstream — some of our members have had the opportunity to make gains of 2,936% in bitcoin and 1,538% in ethereum.

Now it’s important to point out that we’ve cut losses on many of our recommendations too. They didn’t all go up.

Investing is risky, remember, and it isn’t just about making money.

We've also protected our subscribers from market falls, saving them a lot of cash in the process.

- For example, back in 2005 one of our analysts predicted the global financial crisis two years ahead of time. He told readers it would start in the US property market and spread worldwide.

- In September 2007, the same analyst issued urgent sell alerts on all US stocks — which was a timely call. In 2008, Lehman Brothers went under, bringing Wall Street and the world's financial markets to a grinding halt — and sending US stocks tumbling.

- In 2011, we predicted the European debt crisis, which started in Greece but quickly spread across the entire continent. By the end of that year, Cypriot pension funds were frozen and the European Central Bank ordered emergency 'bail-ins'.

- More recently, our chief trading analyst told his subscribers to take profit on five of their positions at the end of January 2020, just before the COVID crash that sent the market down 30%.

He said:

‘I have been considering ringing the cash register in a few of our positions for a while and I think now is a good time with the threat of the coronavirus rearing its head.’

These positions sold for gains as high as 188%, six weeks before the market tanked, and some people lost almost a third of their invested wealth.

Of course, our past calls are no guarantees of future success. But I hope you can see from these examples just how valuable our opinions and advice could be to you over the coming months.

We believe we could make and save you a lot of money as we career into this 1970s time warp.

And one sector where we may be able to help you make an impact is commodities...

FLASHBACK FACTOR 3

COMMODITY PRICES

ARE RISING FAST

Oil wasn't the only commodity to soar in the early 1970s.

The period between 1972 and 1974 saw everything from sugar...to copper...to nickel...to wheat...to uranium boom at a rate never seen before in peace time.

Gold was skyrocketing, too. It shot up seven-fold after US President Nixon took the dollar off the gold standard in 1971. I'll come back to gold shortly.

But the point is, in the 1970s investors who saw the boom coming and diversified into 'real assets' achieved much better returns than being in stocks alone.

Surging demand sent commodity prices higher in the early to mid-seventies.

And today, demand is ramping up once more.

Year to date this demand is having a big effect on the spot prices of copper, crude oil, gold and silver as you can see here...

Uranium, platinum and cocoa have all been racing up too.

But we predict this new boom has barely even started.

Why?

In a word: electrification

There was no push to reduce carbon dioxide in the 1970s. Most nations were burning fossil fuels by the tonne to drive trade, grow their economies and improve their standards of living.

That's all flipped now.

Today, the drive for 'Net Zero' emissions across industrialised nations has bought with it a huge wave of demand for metals like copper, lithium, nickel, cobalt and graphite, needed for electric vehicles, batteries, solar panels, wind turbines...and all the cables required to link them to the power grid.

Trouble is, the mining industry hasn't prepared for it.

Investing in the exploration and mining of these raw materials went into serious decline in the 2010s due to low prices. It wasn't economically viable to expand production.

At the moment we're relying on major discoveries made 15–20 years ago to service our needs.

But pretty soon we're going to run into a supply shortage...right when demand is set to go through the roof, thanks to the Net Zero initiative.

Take copper. The road to Net Zero begins and ends with the red metal. By the looks of things, it's going to be a short journey.

According to Mining.com, ‘the global copper market is entering an age of deficits so large that it could derail our climate goals.’

Global consulting firm McKinsey says that if the world is going all out to meet its zero emissions targets, it will be short 50 million tonnes of copper by 2030.

What many people don't get is that you can't just turn a dial to increase the supply of these commodities. It takes a minimum of six years to bring a new copper mine into production.

Forbes says we need to open three new copper mines every year for the next 26 years if we're to meet our emissions targets.

Not going to happen.

But what probably will happen is the kind of huge price rises you see when rampant demand collides with a huge supply deficit.

You've seen some commodity markets surge already this year.

But this is just the beginning

According to Peter Milne in The Sydney Morning Herald, 'the years ahead will be like the mining boom on steroids'.

I agree. I think we're on the cusp of a trend that could see huge price rises in the commodities needed to electrify the world.

This trend is potentially so big — and there's so much money behind it — I don't think it matters much what the wider market does.

Remember, in the 1970s, commodities stocks were by far the biggest winners while regular equities went backwards.

I predict the same thing will happen this time.

And that gives you a great opportunity to buy into some of the companies best placed to benefit from the coming supply squeeze.

Luckily for us, many of them are right here in resource-rich Australia!

We've picked out four mining stocks you should look at urgently.

Between them they cover copper, silver, graphite, zinc and rare metals — so you're going to get a lot of exposure to this trend, and multiple opportunities to profit.

I'll tell you more about these crucial stocks in a moment.

But first let's take a look at another 1970s parallel — and another big concern...

FLASHBACK FACTOR 4

THE GOVERNMENT IS GROWING BIGGER AND FASTER THAN ANYTHING ELSE

The 1970s saw one sector in particular boom like never before: the public sector.

A newly installed Labor government embarked on a huge expansion programme.

Along with mega spending commitments made to healthcare and education, federal tentacles extended towards the mining industry where the government sought new powers to supervise, regulate and control resource development.

To pay for this public sector explosion, the government essentially doubled the tax take, adding to cost-of-living pressures caused by a rocketing oil price.

The combination of surging energy prices and an explosion in government spending saw the inflation rate hit 17.6% by the middle of the decade.

Problem was, GDP was contracting at the same time...and unemployment was headed up to 5.3%.

This caused something never seen before in Australia...

Stagflation

Stagflation is a condition politicians fear above all others.

For good reason. We all know how it ended back in the seventies. An economy mired in zero growth and the biggest bear market in stocks since the 1930s.

Fast forward to today, and the parallels are worryingly similar.

A newly installed Labor government presides over a public sector that is now the biggest employer in Australia.

Our spending commitments are different — but, if anything, even grander. The government has signed Australia up to Net Zero carbon emissions by 2050 — effectively mandating a new energy system for the country.

The bill to transition Australia to renewable energy will run into the trillions of dollars — and YOU will be picking up the tab.

You're being shaken down pretty roughly as it is.

Australia has the fourth highest average income tax rate of anywhere in the developed world.

We also have the lowest disposable household income of any country in the OECD, mainly thanks to high interest rates squeezing Australia's 3.3 million mortgage holders.

And inflation remains stubbornly high after the government spent $507 billion of public money on fiscal stimulus during the COVID pandemic.

So we have a Labor government taxing and spending big...

...Exerting greater control over the lives of ordinary Australians during a time of high inflation, soaring energy costs and an increasing cost of living.

Are we headed down the

same nightmare path again?

We're not waiting around to find out and we suggest you don't either.

Whatever happens, the oil and commodities stocks in the report I'd like to send you should help you ride out the trend and give you a little portfolio insurance.

But if things get any worse, there are some investments you WON'T want to be holding...

I'll tell you about them in a moment. First, let’s consider the final 'flashback factor'...

FLASHBACK FACTOR 5

GOLD IS FLYING

In times of uncertainty and turmoil, the smart money heads for gold.

That's precisely what happened in the 1970s.

The oil spike, soaring interest rates, Vietnam war, a decoupling of gold from the US dollar, high inflation and a flailing stock market all contributed to a booming gold price that went up 1,721% just in the 10 years to 1980.

Today I believe we're seeing the early stages of another major run up.

One that could equal, maybe even surpass, what's known as the 'grandaddy' gold bull market of the 1970s.

Gold is already on the move.

Between May 2018 and May 2024 it has climbed 81% in US dollar terms — from $1,300 to $2,300.

In April 2024 gold hit an all-time high in US dollar terms — climbing twice as fast as stocks over the year to that point.

We predict it will

go much higher yet

The signs — once again — are very similar to the 1970s.

We have rising energy prices...inflation that won't go away...high interest rates adding to a cost-of-living crisis...and wars blazing in Europe and the Middle East.

If this escalates to any degree, you can expect the oil price to rocket up fast...and for investors to scurry back to the safe haven of gold.

The idea of gold being a risk hedge is not new to our readers.

I just mentioned the date May 2018.

This is one time where we felt it was right to recommend our subscribers buy and hold physical gold.

We told them at the time: ‘Buying gold is your first step to feeling more secure, richer, freer and more financially robust...’

If they'd followed our advice at the time, that gold would be worth 81% more today.

Of course, we don't always get the call right.

But we know our history — and we’ve studied gold's role in it for millennia. You can clearly see there are right and wrong times to buy.

Right now, with inflation eating away the value of your cash savings and governments across the west spending like there's no tomorrow — it feels like a 'right' time.

If you don't already have exposure to physical gold

we believe it would be a solid buy at the moment

We're clearly not the only ones to think that.

You can now swing by Costco in Melbourne and pick up gold bars and coins off the shelf!

This is just part of the reason why the spot price has risen to all-time highs this year. But as I've said, we believe there's still a long way to go in this new bull market.

And, again, we're not the only ones saying it.

- JP Morgan says it expects the gold price to rise through 2024.

- Goldman Sachs is more bullish on gold for the remainder of 2024 than it is on stocks.

- And Commerzbank is forecasting a new all-time high by the end of the year.

But gold investing is not simply about buying the physical metal.

There are other — at times much more lucrative — ways to inject gold into your portfolio.

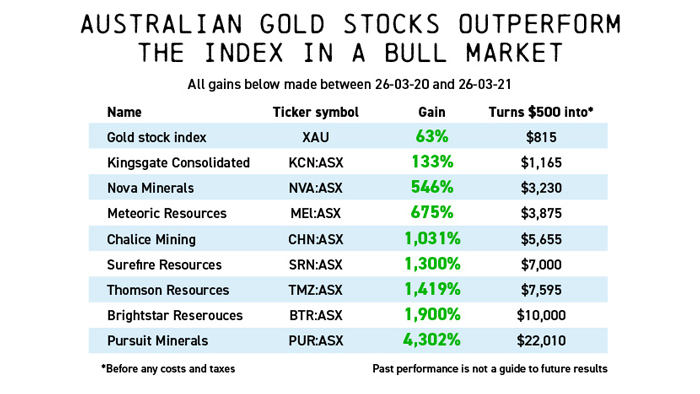

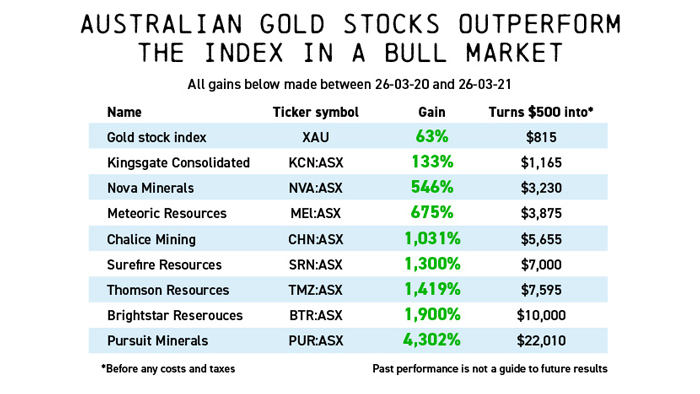

For example, in the last big move up in gold — following the COVID crash in March of 2020 — several Australian gold mining stocks massively outperformed the benchmark index.

The gains some of these miners made over the space of one year were outrageous, as you can see here.

Now obviously it goes without saying that this kind of thing doesn't happen to every gold stock. But this is what CAN happen when gold moves into bull market territory.

Pick the right mining stocks and you can outperform the underlying asset by several orders of magnitude.

This happens because the companies that mine and produce gold can suddenly charge a lot more for their product in a rising market, reduce their costs and increase their margins — which shareholders love.

We call this power

'built-in leverage'

As our good friend Jim Rickards says: ‘Gold mining stocks are like gold on steroids...When gold goes up, mining stocks go up even more.'

There are three ASX-listed gold mining stocks that have caught our attention at the moment.

We predict these stocks are likely to power up as the gold price rises...and are certainly in with a chance of outperforming the index over the coming months. Maybe even by a lot.

Though of course that's not a guarantee — gold miners are highly risky investments. It's fair to call them 'speculations'.

So you need to use your discretion and not invest more than you could comfortably afford to lose in the worst case scenario.

To hedge against this risk I'd also like to send you a guide to buying gold bullion in the form of bars and coins.

We'll walk you through how to buy physical gold at a good price, what type of gold offers the best value and where to store it securely.

It's something you should give serious thought to if you're concerned — as we are — about the economy backsliding into a 1970s-style nightmare of low growth, falling stock prices, a soaring cost of living and high inflation.

Be under no illusion. All of this will impact you one way or another.

From your super, to the value of your home, your shares and your cash savings, there will be very few 'safe harbours' for your wealth in the event of a seventies-style slowdown.

I fear the majority of investors will only find this out when it's too late.

It may end up costing them a lot of money.

But that's why you need to take decisive action now — before you’re sucked deeper into this time warp.

I'd like to give you some ideas about what to do with your money now, to give you the best possible chance of protecting what you have — and even growing it — in investments that are positioned to thrive in this environment.

Let’s get to it...

DECADE OF DECIMATION

SURVIVAL STRATEGY: ENERGY

3 BIG POWER PLAYS: how to find

hidden value in the energy sector

Between 1973 and 1980, energy stocks outperformed the rest of the stock market.

We believe the same thing could happen over the rest of this decade.

The first part of our 'seventies survival strategy' is obvious: buy selected energy stocks.

The sector is already following the script.

Just this year, the BetaShares Crude Oil Index ETF is up 16.8% — while the broader ASX 100 is down -0.6%.

The S&P Global Index, which tracks the largest oil and gas companies in the world, is also up 9.38%.

The first stock I want to tell you about is an oil and gas driller with production coming from multiple sources.

This company is currently in the middle of a major development phase. We see its revenue and profits exploding in the years ahead, if we’re right and its products rise in price.

There's another compelling

reason to move on this stock

By our calculations, its stock price is seriously undervalued right now, given its prospects. For this reason, I'm not sure how long this energy play will stay at its current price. That's why we're marking the stock as an urgent buy.

It's not a small cap by market definition. But it’s small for an energy company with the sort of projects it has under development. And that means it's not on most private investors' radars.

The second recommendation is one of Australia's principal oil and gas producers.

Or rather, it just became one, thanks to a recent merger with a major player that propelled its market value to over $50 billion.

With production set to soar by 21% in 2024, this stock is on track to deliver strong growth.

This company's high-quality operations and progress on massive growth projects make it a compelling investment opportunity.

Even more so when you consider that its share price is, by our analysis, currently undervalued compared to the oil price.

It gets better. Over the next four years, this stock expects to generate a jaw-dropping US$30 billion in operational cashflow, with half of that being free cashflow.

This is money that could flow straight to investors through dividends, growth, and buybacks.

And that's assuming conservative oil prices!

If prices rise, as many experts predict, this company's cashflow — and growth — could skyrocket even further.

If prices rise, as many experts predict, this company's cashflow — and growth — could skyrocket even further.

This is an exciting opportunity — mostly because other investors don’t seem to have cottoned onto it yet.

You’ll find all the details on how to invest in a report I’d like to send you, called ‘3 BIG POWER PLAYS’.

Our third recommendation is a New South Wales coal miner with extremely bright prospects.

Our third recommendation is a New South Wales coal miner with extremely bright prospects.

No, it’s not politically correct to buy coal stocks at the moment. But that’s maybe why you should consider it.

We believe there’s tons

of hidden value here

China and India have no choice but to rely on coal for the next 20–30 years. This stock — currently on track to be a leading producer of metallurgical coal — provides exposure to their growth.

The firm is currently acquiring high-quality coal mines to supply what they expect to be insatiable demand over the coming years.

With high barriers to entry limiting new supply, this company's low-cost position is a competitive advantage that could send its shares soaring.

Insider buying activity, impressive profit growth and a rock-solid balance sheet suggest management knows something big is coming.

And with mainstream analysts such as UBS starting to take notice, now seems like the right time to make your move.

Now to be clear, energy stocks can be volatile and risky. In your report, ‘3 BIG POWER PLAYS’, we’ll explain those risks in detail, and give you a full rundown of how to invest in our three top picks.

Details on how to get your copy are coming up.

DECADE OF DECIMATION

SURVIVAL STRATEGY: COMMODITIES

AUSTRALIA'S NEW DIG: 4 tiny

companies mining the future

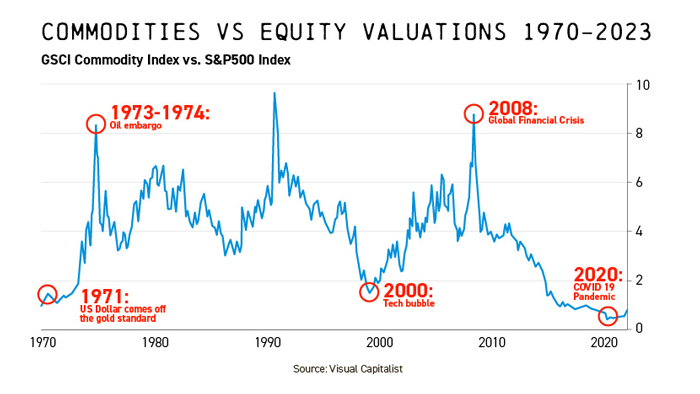

As I said earlier, real assets were one of the biggest’ winners during the ‘decade of decimation’.

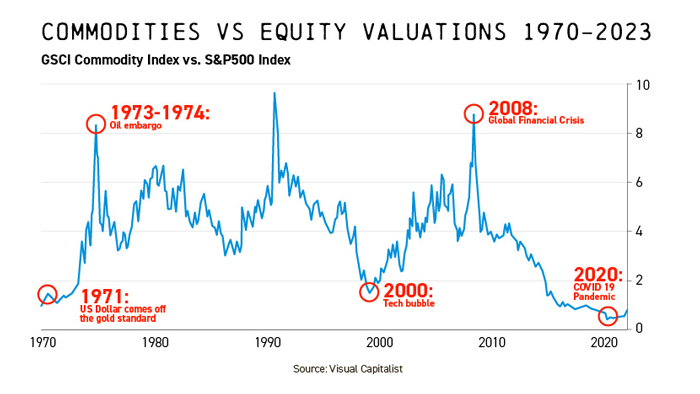

This chart shows how commodities massively outperformed regular stocks in the 1970s.

Now look to the right of the chart to see where the opportunity is in today's market. Commodity valuations are currently low relative to stock prices.

If this continues, where do you think commodity prices are headed next?

You don't need to be a

genius to work it out

And that's why natural resource stocks are a vital part of your ‘decade of decimation’ survival portfolio.

To help you gain exposure, I'd like to send you a copy of another investment briefing, called: 'AUSTRALIA'S NEW DIG'.

To help you gain exposure, I'd like to send you a copy of another investment briefing, called: 'AUSTRALIA'S NEW DIG'.

The first stock you'll learn about is looking to develop a huge deposit of copper in what's considered the best place on Earth for copper discovery.

The first stock you'll learn about is looking to develop a huge deposit of copper in what's considered the best place on Earth for copper discovery.

The company is tapping into rare geological formations known as 'porphyries.' These rich motherlodes contain huge amounts of copper, but also silver and gold.

That makes them a multi-commodity powerhouse leveraged to the critical metal theme and surging interest in precious metals.

The second stock on our commodities list is a sub-40-cent stock with plans to open up the world's second-largest graphite reserve. And it's a PROVEN reserve.

So why is this stock so cheap? You'll need to download our report to find out!

But the reason we're so excited about its prospects is that this company is set to become one of the few non-Chinese processing options for graphite in the years ahead. And given current geopolitical tensions, that could be huge...

The third commodities stock you'll discover is a late-stage explorer operating out of the Pilbara region.

Once thought of as a giant slab of iron ore, the Pilbara is now seen as a richly endowed mineral province which will only increase investment in the region, create more competition for land holdings, and attract a wider spectrum of investors.

This company has copper, zinc, and silver projects on the go and the former CEO of a HUGE player has just come on to run them all.

That's why this is our prime

pick

to dominate the space

And the fourth and final commodities stock to tell you about is a real trailblazer.

It's fairly unique in Australia. You see, it doesn't just dig rocks out of the ground and then ship them off somewhere else for processing.

This company refines aluminium oxide at its Queensland plant and turns it into an ultra-rare, purified material which has applications in AI, renewable energy, smart phone screens and lithium-ion batteries.

So this truly is a metal for the future. Which is great if you don’t want to get dragged back to the past.

The good thing for you is that very few people have ever heard of this material, let alone understand its investment case.

But we do. And at around 90 cents a share at the time of recording, we're calling this commodities stock a 'must-own'.

Now, mining stocks – particularly small ones – can be volatile and riskier than buying big name blue chip stocks.

But don’t worry – you’ll learn all about those risks, plus how to invest in our four recommended commodity stocks in ‘AUSTRALIA'S NEW DIG.’

I’ll show you how to get your copy in a second.

DECADE OF DECIMATION

SURVIVAL STRATEGY: GOLD

THE ULTIMATE GOLD GAMEPLAN:

What, how and where to buy...

Throughout history, gold stocks have proven to be an exciting way to outperform the spot price during a boom.

The 1970s were a classic example of this.

Some gold mining shares shot up thousands of percent over the course of the decade, while regular stocks went in the opposite direction.

Of course, we can't guarantee the same outcome this time, and we should remember that gold stocks are volatile, so please invest with care when you receive the recommendations in your next report, ‘THE ULTIMATE GOLD GAMEPLAN’.

The first gold stock in your gold briefing is on the cusp of becoming a major producer.

The first gold stock in your gold briefing is on the cusp of becoming a major producer.

To achieve this, they've acquired several large projects — and those have been doing so well, the company is now expanding internationally.

It recently paid AU$500 million to purchase a well-known mine site over in Canada. The plan is to use modern technology to revive that site to its former glory.

Unusually for the gold mining sector, the company is cash rich. Since 2013, they've paid out dividends worth over AU$1 billion.

This tells you that management is confident about the firm's ongoing profitability.

And with major producer status just over the horizon, we believe this presents an enormous opportunity right now.

This one's a strong buy

The second gold stock you'll learn about is a mid-tier producer.

These guys are currently sitting on medium-term projections of 350,000 ounces of gold. That's incredibly promising.

Even more so when you consider the company outproduced its two main competitors Ramelius Resources and Silver Lake Resources from 2017 to 2020.

Now, despite all this, the company, in our view, has been chronically undervalued. This is due to being plagued, historically, by basic operational problems.

But those are all sorted now. Plus, the company just announced a series of positive drill results, including one new deposit holding an estimated half a million ounces.

These are all bullish signs.

And that's why we're marking this stock an urgent buy.

When it comes to the third gold stock in your report, it looks like you may have timed your entry to perfection.

This company is on track to more than double its annual gold production by 2025.

Its neighbours include Russia's Nordgold and Canada's Endeavour Mining — companies with multibillion-dollar market caps.

The company in your report has a market cap of around one billion dollars. The growth potential here is monstrous.

And the future looks great

Construction is already underway at a new mine, funding is in place, and the firm expects to pour its first new gold by early 2025.

You have a great opportunity here to invest in a future superstar of Australian gold mining before it really takes off.

And that's why we recommend adding this stock to your 'seventies survival portfolio'.

Now, if you want to benefit from a rising gold price over the coming years — but you don't have the stomach for risky mining stocks, we've got you covered there, too.

Download your copy of ‘THE ULTIMATE GOLD GAMEPLAN’ and you'll also discover how to set up a portfolio of physical gold bullion and coins.

You'll learn where to buy gold in Australia.

And you’ll get details of our optimised physical gold portfolio for people with $1,000, $2,000, or $10,000 to invest.

You'll discover the lowest-cost ways to get exposure to gold in a bull market. And whether bars or coins make the better investment for beginners.

Finally, you'll learn a handful of simple ways to store your physical gold safely.

Talking of keeping your wealth safe, there's something else you need to be aware of...

DECADE OF DECIMATION

SURVIVAL STRATEGY: REAL ESTATE

AVOIDING THE WINNER'S CURSE: A logical

strategy for an irrational property market

The next part of our ‘seventies survival strategy’ is real estate.

Why is real estate important?

Well, 57% of personal wealth in Australia is directly linked to, and derived from, the property market.

Put another way, for many Australians, their home is their single biggest store of wealth — by some margin.

But before I get to our recommendation I want to be clear.

I'm not going to give you a 'flipping' strategy...

Or tell you how to acquire a portfolio of prime real estate with no money down.

We believe buying property is the wrong strategy

right now and could end up costing you big time

Why?

Well, as you'll learn, the property market waxes and wanes according to its own rules. And these rules have been in place for hundreds of years.

You can track land value data back to the 1800s and find clear and obvious patterns.

These patterns repeat in a cycle that lasts around 18 years peak to peak.

Once you know this cycle you can predict when it's likely to be a good time to buy and when it isn't.

Now there are plenty of people who will tell you: 'you can't go wrong with property'...

Those people are wrong

It's a matter of timing, and we have the evidence to prove it.

Timing creates winners and losers in the housing market — it's as simple as that. Right now we're in a period of the real estate cycle called the 'Winners Curse'.

Now you might hear that and think: 'Winners Curse sounds bad...but property prices are still going up in my state...if I wait any longer I'll miss out...'

Your eyes are not deceiving you. The market IS raging.

But don't get sucked in.

At least read the real estate briefing I want to send you before you invest ANY money in property right now. And tell your kids to do the same.

I'm serious. This one timing decision has the potential to affect yours and your children's wealth more than any other you, or they, will ever make.

Think back to the 1970s. Houses went up and up...until they didn't.

When the property market crashed in 1974 house prices didn't recover to their pre-crash levels until 1988...14 years later.

How many people mortgaged up to the hilt in mid-1973 when the market was raging?

And how many of those people ended up regretting it?

What if your son or daughter had spent the last 10 years scraping a deposit together...only to buy at the top of the cycle. And then watch their house drop 20% in value a short while later.

They'll be deep underwater

— maybe for years

And worse. They'll know that if they'd only held on a while longer, they could have secured a better house in a nicer suburb at a cheaper price with a bigger deposit behind them.

That's why they call this period a 'winners curse'.

We want to help you — and your family — avoid it.

So I'd like to send you a copy of our report ‘AVOIDING THE WINNER'S CURSE’.

It will put your mind at rest...show you how the real estate cycle works...and reveal what history shows us could be the best time to buy.

It will put your mind at rest...show you how the real estate cycle works...and reveal what history shows us could be the best time to buy.

And why now isn't.

If you're agonising over whether you should mortgage yourself to the hilt to secure an overinflated property in a second rate area, please read this report before you make any decision.

DECADE OF DECIMATION

SURVIVAL STRATEGY: STOCKS TO DITCH

THE RED LIST: Six endangered investments

to avoid in a

1970s-style backslide

Today we've spoken about the types of investments that could boom if we fall into a period of low growth and even stagnation.

It's an educated prediction based on what we know paid off for investors during the 1970s.

But history also tells us what investments perform terribly in these conditions.

And similar danger investments are

lurking on the ASX right now

We've picked out six stinkers that we recommend you avoid — and if you own them already, you might want to consider selling at your earliest opportunity.

Our report, THE RED LIST, reveals these investments and shows you why we believe they’re bad.

Read it, then decide whether to heed our warning or not.

Read it, then decide whether to heed our warning or not.

But generally, we're looking at things like property trusts with highly leveraged balance sheets...

Airlines that require a lot of capital expenditure...

Telcos that need to invest significantly to maintain their competitive advantage...

Companies that are borrowing heavily to construct major infrastructure projects...

Over-hyped tech stocks...

And even some banks.

Yes, banks!

You might consider them rock solid investments. In THE RED LIST you’ll find out why some of them are likely to struggle in a 1970s-style economic environment.

It’s probably not what your financial advisor will tell you.

But this is where our research can really help.

Download a copy of our report today and you'll get to see if you own any of the endangered companies on our 'Red List'.

And if you don't — be thankful, but steer clear!

Listen, I can't stress enough the importance of getting and reading these briefings as we move through this concerning time.

Make no mistake, having the right investment strategy now could be the difference between enjoying a long and comfortable retirement and years of scrimping, saving and 'making do'.

If you’re sceptical about that claim, consider this...

Inflation is ALREADY

creeping into your life

Over the last two years, the rate of inflation has been as high as 7.8% — which is bad enough.

But in that time, Australian power bills have gone up between 9% and 20%...groceries have gone up as much as 27.3%...and petrol has gone up 7.9%...all rising above the ‘official’ rate of inflation.

With oil in an upward trend...

Mortgage stress squeezing ever tighter...

Qantas putting up airfares three times in the last six months...

And energy bills set to rise even higher in the coming years...

...Are you really going to wait for things to get worse?

Why not prepare today by downloading the investment briefings I’d like to send you?

You’ll learn all about the stocks we’re recommending right now.

Plus you’ll find out about six investments you should avoid — or offload — if you want a better chance of escaping this seventies backslide.

Plus you’ll find out about six investments you should avoid — or offload — if you want a better chance of escaping this seventies backslide.

I'd also like to send you the Fat Tail Investment Advisory for the next three months, to read and review under no obligation to remain a subscriber.

The Advisory is our flagship research service, helmed by Investment Director Greg Canavan.

To remind you, Greg's current share portfolio of open positions is up a highly creditable 49% on average at the time of writing.

Now to be clear, not every stock Greg picks is a winner.

“One of the best investment advisors I’ve had”

Praise for Greg Canavan

‘I find Greg’s advice fantastic...’

M McMahon, West Pymble, NSW

“Following Greg and the other members of the Fat Tail Crew, how could you not be in front with your finances?’

DA

“Fantastic ideas and investment advice – and you do it before all the others,”

Martin, Perth, WA

“I find Greg's interpretation of the financial horizon about the best of the bunch. I subscribe to a few, and this is my anchor, my mainstay.”

Ian T

‘I have found Greg’s advice very accurate, and I have made good returns on Whitehaven Coal, Woodside Petroleum and Beach Energy.’

KW

‘Greg is one of the best investment advisers I’ve had.’

DRG

But he has a unique way of assessing companies...

And an ability to find value in beaten down stocks and sectors — something that has paid off many times for his subscribers.

At the time of writing, many of them are sitting pretty in several of his recommendations, including...

- A 127% gain in Northern Star Resources

- 104% from Origin Energy

- 384% from West African Resources

- And a huge 500% from Whitehaven Coal

Of course, these figures may have changed by the time you're seeing this.

And remember, these are current open gains, not profits.

But this gives you some idea of Greg's ability — and consistency.

And it's why I'd like to offer his services to you for the next three months, under no obligation to remain a subscriber.

I'm confident that once you start receiving Fat Tail Investment Advisory — and hopefully benefiting from Greg's insight — you'll want to get his research on a more regular basis like so many other Australians do.

Fat Tail Investment Advisory is one of our most popular services for good reason.

But the only way you're going to know that it's right for you is by sampling Greg's work first.

As I say...

You can do that

under no obligation

And if you decide the Advisory isn't for you within the first 30 days, no problem. Let us know you'd like to cancel and we'll refund your money.

And if you decide the Advisory isn't for you within the first 30 days, no problem. Let us know you'd like to cancel and we'll refund your money.

If you do accept my invitation I'll also send you one of the most important briefings of the year — at no additional charge.

It's called 'BEYOND THE HORIZON: 2 ways to protect your portfolio from the past'.

As a 21st century investor you have not one but TWO aces up your sleeve.

As a 21st century investor you have not one but TWO aces up your sleeve.

The two investments in this report could give you all the portfolio insurance you need to avoid the worst of an economy that seems hellbent on revisiting the financial nightmare of the 1970s.

The first investment is cryptocurrency. Specifically, bitcoin.

To be honest, if you're still not on board with crypto, please read this report as soon as possible.

Even if you’ve no interest in buying it, you should at least try to understand it.

We may be approaching a time when bitcoin

is much harder and more expensive to buy

Not least because several mainstream funds are now locking up supply — something that has been pushing the price up all year.

We’ll walk you through how to buy it, how to store it, and how to use it, if you decide to in the future.

Buying bitcoin is a lot easier than it used to be, and once you've been through the process once, you shouldn't have any problems creating an entire portfolio of crypto if that's what you want.

We'll even show you the benefits of saving for a house deposit in bitcoin.

With inflation eroding cash savings — even in high-interest bank accounts — you might find that 'dollar cost averaging' into bitcoin is a 'seventies-proof' way of saving for a house...a car...or any other big ticket item you want to get in the future.

We'll show you how to do it, step-by-step.

Of course, there are no guarantees — crypto is a notoriously volatile asset.

But as I write, bitcoin is up 51% year to date...and has averaged returns of 124% a year over the last 10 years.

Will it keep going?

We don't know.

But with finances being squeezed all over Australia right now, and the younger generation struggling to get on the property ladder, this is the kind of idea you'll definitely want to pass on to your kids or grandkids.

The second investment in your report is all about the developing technological revolution driven by AI.

You'd have to be living deep in the bush not to know that everyone's talking about Artificial Intelligence right now.

Since Microsoft-backed Open AI released its first virtual helper, 'Chat GPT' in November 2022, the race has been on to create the world's first sentient computer.

We used to dream about this kind of stuff as kids. Now it looks almost certain to happen. Keep your eye on the fifth iteration of Chat GPT, expected in 2024. If you ever wanted a digital butler, it's coming.

Now obviously this technology has huge social implications, which we won't get into here.

But it also has major financial implications — for those with an investment brain...

In 2023 alone, leading AI stock NVIDIA jumped 239%.

And they weren't the only one. Meta Platforms went up 180% and Super Micro Computer rocketed up 240%.

Those early to the party did exceptionally well. But we believe this party is just getting started. And we're not the only ones...

According to Investor place:

‘The AI Boom is presenting a chance you can't afford to miss. For retail investors, this is your golden ticket to potentially life-changing wealth.’

Now, of course, they could be wrong. And it’s fair to say that AI as a sector is still speculative and therefore risky.

But we feel AI stocks are worth allocating some portion of your capital to at the very least.

If you have a budget for speculative investing this is about the most exciting thing you could be looking at right now.

Download your copy of ‘BEYOND THE HORIZON’ today and you'll get one of our 'must-own' AI stock recommendations to add to your portfolio — if you choose.

And remember, all six of these briefings are yours if you accept my invitation to join Fat Tail Investment Advisory for the next three months, under no obligation to remain a subscriber.

To help you make your decision today, I'd like to offer you a big discount to join our service.

The official price for a one-year subscription to Fat Tail Investment Advisory is $499.

That's great value when you consider that Greg's 24 open investment picks are, at the time of writing, up an average of 49%.

Of course, I can't guarantee you the same results in the future.

But I can assure you that no one will work harder than Greg to help you achieve financial success for as long as you wish to retain his services.

In any case...

Today you won't pay

anywhere near that

The priority for us is to get these reports in front of as many private investors as we can.

Of course, I want you to become a long-term member of Fat Tail as well. But I also know that you need to see what we do first-hand, with as little upfront commitment as possible.

So, here’s what I propose.

I’d like to give you access to Fat Tail Investment Advisory for the next three months — along with an instant download of all six of our ‘Decade of Decimation’ strategy reports.

It will cost you just $99.

ONE FIFTH of the official annual subscription fee.

Now, please don’t mistake this great deal for ‘cheap’.

We charge some of the highest subscription prices for investment research in the country. As you’d expect from a premium service.

But I also respect the fact that you don’t know us. And I want to incentivise you to take that first step.

$99 is a tiny price to pay for access to the first-class investment research and recommendations you’ll get from Greg — one of the best analysts in the business, in my view.

Join us for three months today, and alongside your trial membership you'll get our ‘Decade of Decimation Survival Strategy’, including...

3 BIG POWER PLAYS:

Greg's controversial report on the energy sector including his three best 'hidden value' picks — all three are important additions to your portfolio if, like us, you believe energy inflation is likely to keep going up, and the 'Net Zero' narrative is running out of steam...

AUSTRALIA'S NEW DIG:

A deep dive into what we believe are the four best commodity plays on the market right now. These stocks could be about to go gangbusters as demand for real assets rockets while the supply of the commodities they mine falls off a cliff.

THE ULTIMATE GOLD GAMEPLAN:

As gold soars to new all-time highs we feel it's critically important to have some exposure to it in your portfolio. This report reveals three of the best small gold stocks in Australia...and walks you through how to buy and store physical gold safely...

AVOIDING THE WINNER'S CURSE:

This is our take on the state of the Australian property market, including vital timing data and intel that few other people know about. This information could stop you or a loved one making a disastrous decision you might regret for decades to come...

THE RED LIST:

History tells us there are certain investments you'll want to steer clear of if the Australian economy continues its 1970s nostalgia trip. In this report we'll reveal six stinkers to avoid. And if you're already holding any of them, my guess is you'll want to ditch them at your earliest opportunity.

BEYOND THE HORIZON:

In this report you'll see how to capitalise on two assets that are booming now: cryptocurrency and AI stocks. Neither of these investments existed in the 1970s, but we believe they could provide valuable portfolio insurance, if this dangerous financial backslide continues. You'll get two of our 'must-own' picks to add to your speculation portfolio, if you wish.

These six reports are yours to keep, whether you decide to stick with Fat Tail Investment Advisory after your three-month introduction, or not.

They will present an investment strategy that we feel will not only help you protect your wealth but also position it to grow significantly over the difficult years ahead.

But you don't have to rush your decision. You have that entire three-month period to make up your mind.

Should you choose to stick with us, we'll charge your card a further $99 every quarter for as long as you want to receive Greg's research and recommendations.

If you decide you'd be better off without Greg's insight, simply contact us at any time in the next three months and we'll cancel your subscription.

And if you cancel within 30 days we’ll refund the $99 you pay today.

Listen, there's no

getting away from it

Australia is sliding back towards a decade that most would rather forget. It brought misery and financial stagnation to many thousands of people — and even ruin for some.

However, those who had the right information found that they could quickly shift their capital into assets that flourished despite the turmoil. Many of those investors did exceptionally well.

I don't know for sure what's going to happen over these next few years. I may turn out to be wrong about this. All I know is that I’m getting a strong sense of déjà vu right now.

Please don't be like 90% of investors who won't see the danger until it's too late.

There's no telling what event could sound the starting pistol for a 70's style meltdown. A huge oil squeeze...another interest rate rise...a housing crash...or an escalation of the war in the Middle East.

But we do know that the economy is so fragile it's likely to collapse like a house of cards. This will come as a sudden shock to everyone, but it doesn't have to be that way for you.

Isn't it worth $99 to find out how to prepare your money in the event that we're right?

To get three months' access to Fat Tail Investment Advisory and receive the six urgent briefings that make up our ‘decade of decimation’ survival strategy, simply click the button below now and follow the steps on the next page.

Sincerely,

James Woodburn,

Publisher

Fat Tail Investment Research

GET STARTED HERE

If prices rise, as many experts predict, this company's cashflow — and growth — could skyrocket even further.

If prices rise, as many experts predict, this company's cashflow — and growth — could skyrocket even further.

To help you gain exposure, I'd like to send you a copy of another investment briefing, called: 'AUSTRALIA'S NEW DIG'.

To help you gain exposure, I'd like to send you a copy of another investment briefing, called: 'AUSTRALIA'S NEW DIG'. The first gold stock in your gold briefing is on the cusp of becoming a major producer.

The first gold stock in your gold briefing is on the cusp of becoming a major producer. It will put your mind at rest...show you how the real estate cycle works...and reveal what history shows us could be the best time to buy.

It will put your mind at rest...show you how the real estate cycle works...and reveal what history shows us could be the best time to buy.  Read it, then decide whether to heed our warning or not.

Read it, then decide whether to heed our warning or not. Plus you’ll find out about six investments you should avoid — or offload — if you want a better chance of escaping this seventies backslide.

Plus you’ll find out about six investments you should avoid — or offload — if you want a better chance of escaping this seventies backslide. And if you decide the Advisory isn't for you within the first 30 days, no problem. Let us know you'd like to cancel and we'll refund your money.

And if you decide the Advisory isn't for you within the first 30 days, no problem. Let us know you'd like to cancel and we'll refund your money. As a 21st century investor you have not one but TWO aces up your sleeve.

As a 21st century investor you have not one but TWO aces up your sleeve.