JAMES ‘WOODY’ WOODBURN

A ground floor opportunity has just opened up on the ASX...

One that gives YOU the chance to speculate on a handful of the best and cheapest mining companies in Australia...

And position yourself to benefit from one of the most powerful tailwinds in financial markets...

James ‘Woody’ Woodburn,

Host, GOLD STRIKE 2024

Maybe even before the end of 2024.

Today you’re going to find out you how you can get involved...right down to the individual investments primed and ready to take advantage of this opportunity.

Now of course we’re talking about gold.

No doubt you’ve seen it trending up these past few months.

Spot gold — in US dollar terms — just had its best year since 2020...

And in AUSSIE dollars, gold is up 13% over the year to January 2024...

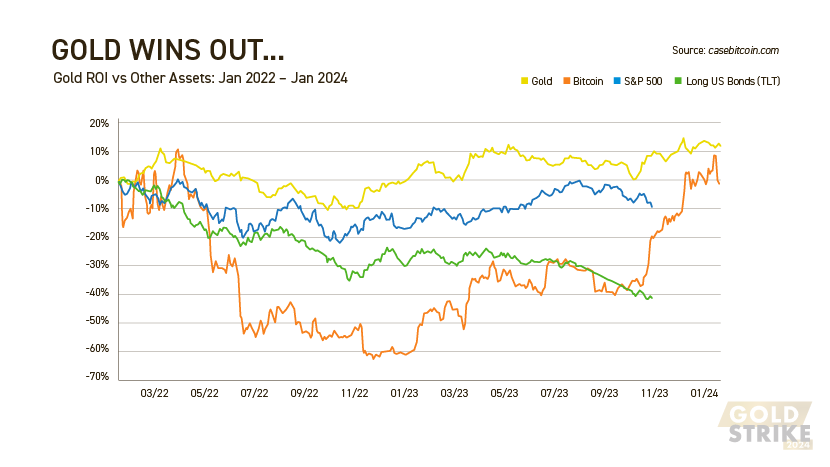

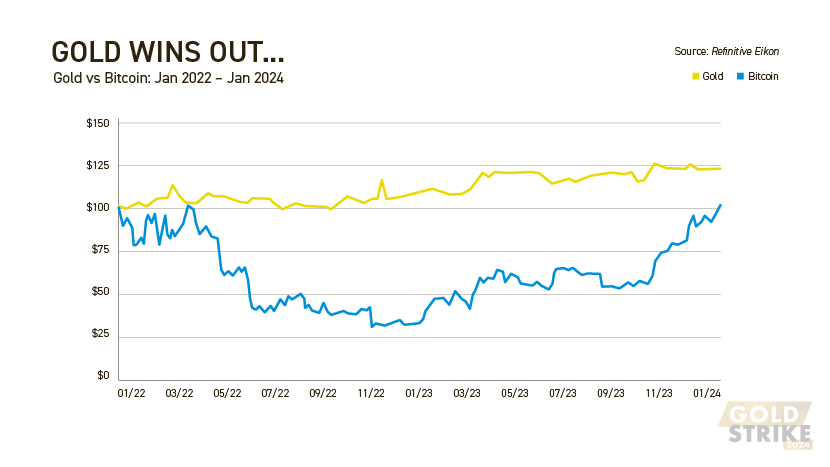

On top of that, gold outperformed a bunch of major asset classes over the two years just gone...stocks, bonds...

Even bitcoin, as you can see here...

And now, even the mainstream media is talking up a gold bull market in 2024

My guest today — and you’ll meet him shortly — says the technical set up amounts to the strongest buy signal he’s seen in the gold market for FOUR years.

This is GREAT news for some of the investments you’ll hear about today.

NOT bullion or coins... but related investments that look set to reward anyone who’s prepared to act quickly.

According to my guest, if history is any guide, the biggest gains in these investments will be made during a frenetic period that could last anywhere between six and fifteen months.

He says that period could begin any day now.

If we just look at the last gold bull market in 2020...when the gold price started to move, investments like the ones we’ll talk about today shot up more than 700% in a matter of a few WEEKS...

Plus we’ll show you how the macro picture fits into all this... remember, this is an election year in the US — that’s significant.

We’re hearing that the Fed is likely to cut interest rates during 2024...

In fact, some are saying there could be as many as SIX rate cuts as the Fed does a complete ‘one-eighty’ on its inflation containment strategy.

Now if that turns out to be the case, it could put a rocket under the gold price over the coming months.

The action that comes out of this — we feel — could be the most significant seen in the gold market this decade...

Now there are, of course, many ways to play a gold bull market.

But we’re only going to talk about one of them in today’s show.

If you’re thinking: great! I’ll buy a bunch of gold coins, then sit back and watch the spot price go up…this one isn’t for you.

But... if you’re here to learn about a more exciting opportunity that’s emerging out of this rising gold trend — stick with us.

What you’re about to learn has the potential to make you a lot more money than holding physical gold in 2024.

In short, this is a window — maybe a brief one — for speculators to exploit...

And as you’ll see today, the timing couldn’t be more perfect...or more pressing...

So, if you have some cash sitting on the sidelines...and you want to put it to work in a more exciting — and yes, riskier — market…one that’s moving now...stick with us.

Now, I’m sure you have a ton of questions, but let’s deal with the obvious one first...

The investments we’re talking about are gold mining stocks. Specifically, gold explorers and early-stage developers.

And what I find so amazing about this is that no one wanted to know any of these companies six months ago.

But, if we’re right about what’s coming...

Our guess is that a handful of these cheap, tiny gold stocks will soon be the ‘must-have’ investments of 2024.

And — in a relatively short amount of time — may even become the ‘leading lights’ of your portfolio this year.

But...if you want to get in on the ground floor, you’ll need to act right away.

As my guest is about to explain, the best chance to make big gains from these stocks could be gone...in a matter of months!

In the last three gold bull markets, movement in the spot price kick-started a rally in these stocks lasting anywhere between six and fifteen months.

The gains can be wild in the moment...

But they can be gone quickly after these stocks hit their peak.

To do well out of this, you’ve got to get in early and leave before the party’s over.

And even then there are no guarantees you’ll get out with a big score.

Gold mining stocks are notoriously volatile. Highly sensitive to a number of underlying factors. And there can be liquidity issues.

You need a mindset for making money...with the possibility that you could lose it too.

Now I know that might sound blunt.

But I want to be upfront about the risks you face when you buy stocks like these tiny gold miners.

Just know that, if we’re right about the bull market formation...

...AND about the stocks with the best prospects...

...AND if you follow the advice you’re about to get to the letter...

And all from a small number of carefully placed gold stock investments today.

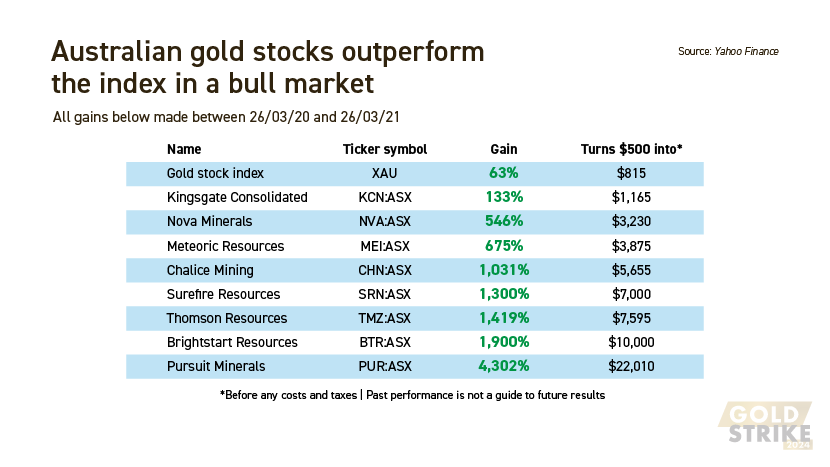

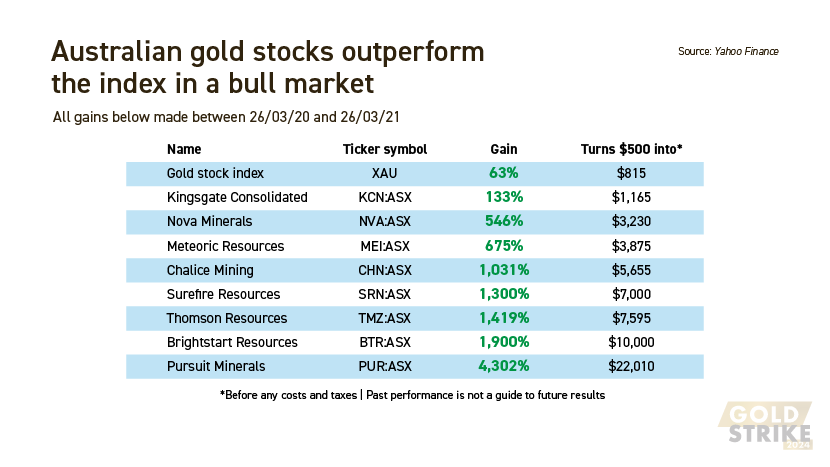

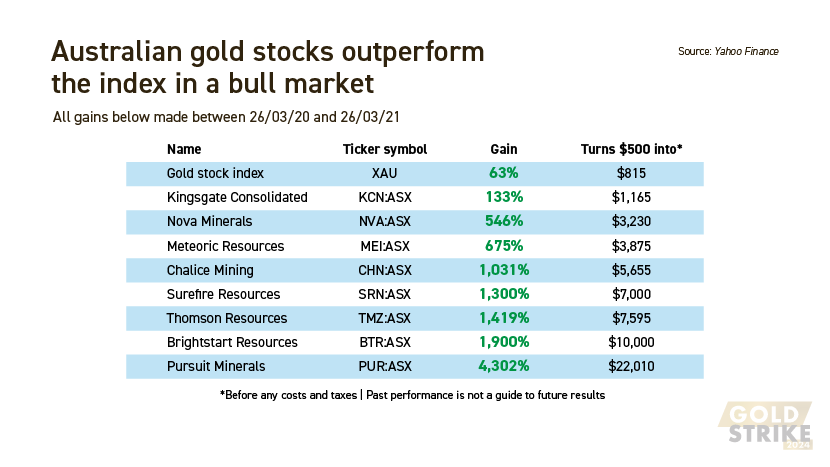

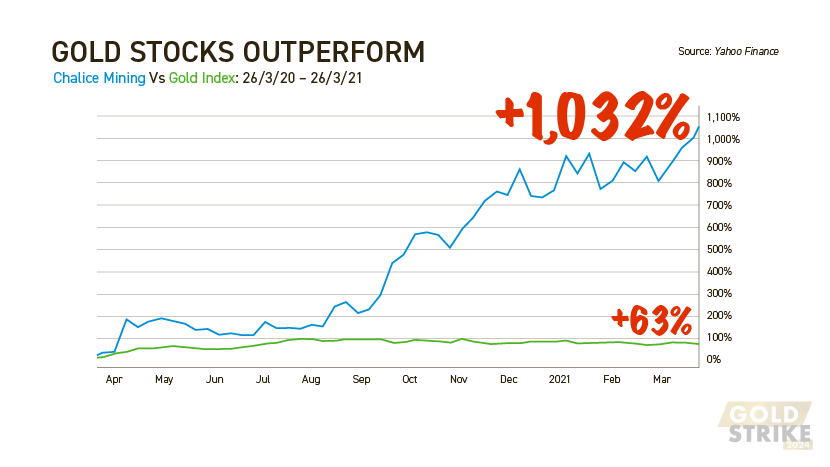

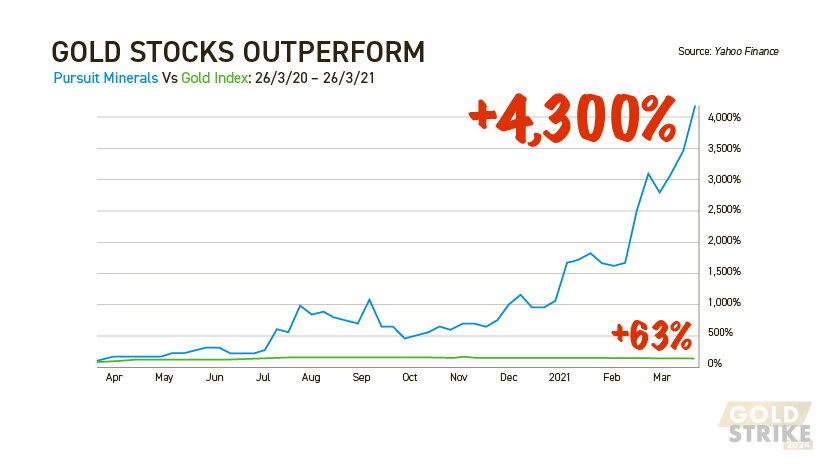

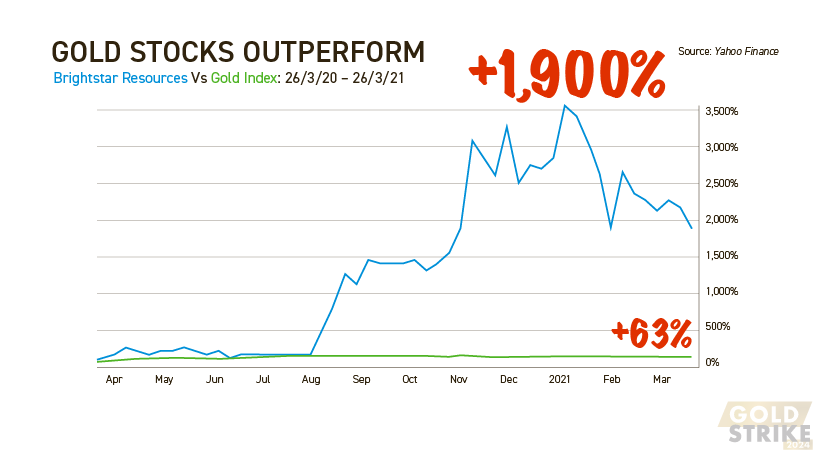

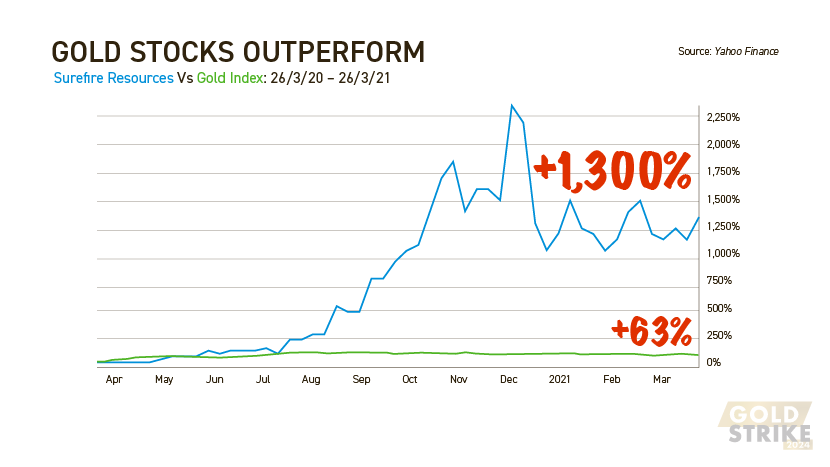

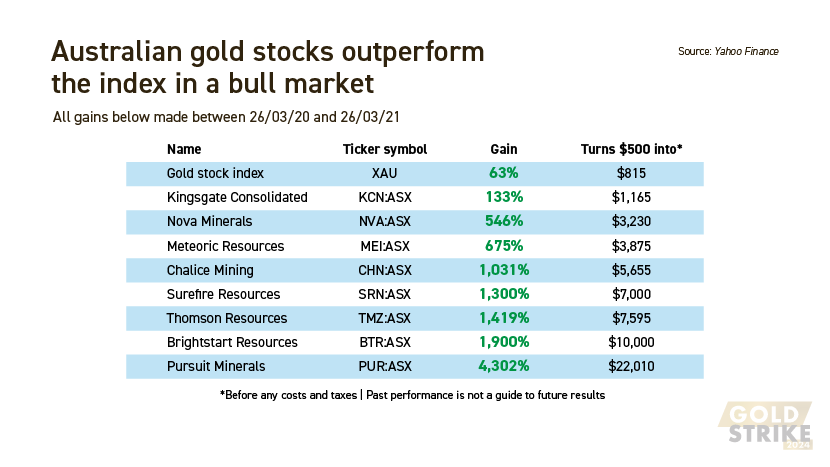

This is the kind of impact I’m talking about...from the last gold bull market in 2020...

Now of course this kind of thing doesn’t happen to every gold mining stock — which is why you need to keep reading...

But all of these gold miners went on an incredible run — in the space of a year — after gold had moved into bull market territory at the end of 2019.

Just look at how they smashed the XAU index — the top line in the table — over the same 12 month period...

And look at the kind of returns you could have made — within a year — had you bought and sold these stocks at the right time!

They all benefited from a kind of natural leverage gold mining stocks have to the spot price.

Now that’s got nothing to do with options, CFDs or any other risky market instrument...

It simply means that gold only has to rise a small amount in dollar terms over the next few months for some of these tiny stocks to rocket up five and ten times higher.

Our friend Jim Rickards famously calls gold mining stocks a ‘leveraged bet’ on the physical metal.

As Jim says in his book, The New Case for Gold...

‘Gold mining stocks are like gold on steroids... When gold goes up, mining stocks go up even more.’

Well, take gold producers. A rising spot price means they can make more money — and bigger profits — from their sales.

That’s because, in a bull market, the gold price tends to go up faster than their costs.

Meaning an increase in the price of gold can go straight to the bottom line.

This often results in higher valuations for gold producers and bigger returns for shareholders.

In the case of gold explorers, this ‘built-in leverage’ effect can be even more pronounced...

...Because their market cap is usually a fraction of the value of their in-ground resources.

If and when those resources are confirmed, the subsequent rally can be fast and furious...especially in a bull market — as the stock price races to close the value gap.

Now obviously, timing is important...stock selection is even more important...

But let’s be clear: we’re holding this event because we feel the timing is in your favour, right now — for two key reasons:

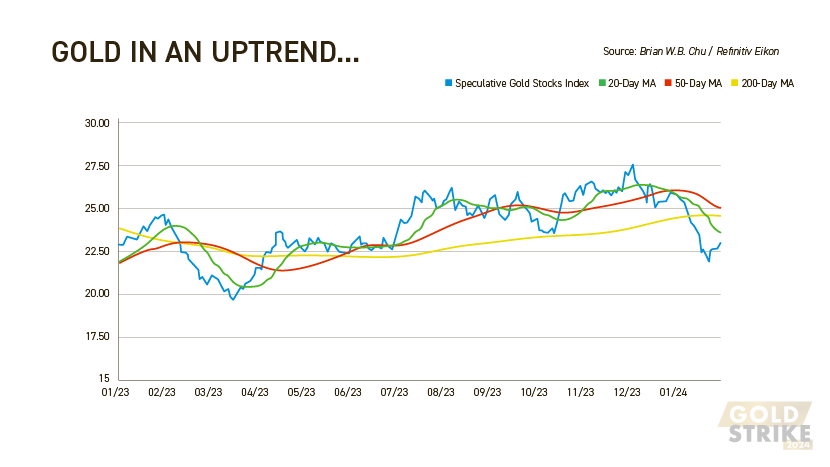

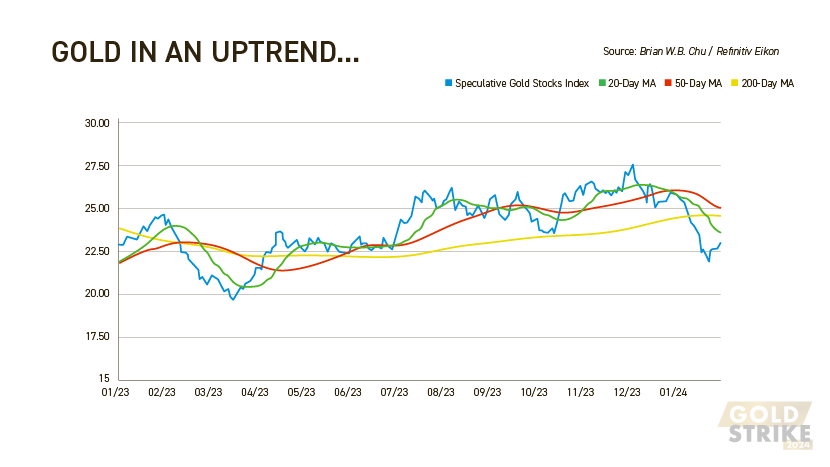

First reason — spot gold in Aussie dollar terms IS trending up — and the trend is holding...

And second — as you’ll see shortly, many small gold explorer and developer stocks are starting to respond...

Technically-speaking, the 200-day moving average — the yellow line on the chart here — has been positive for five months straight now. That’s bull market territory.

Even taking into account a brief sell-off at the beginning of the year, several gold miners have bounced up...

Some are even up 40% or more from their lows that came as late as January this year.

Any speculator will tell you how important it is to see action in a market before you move your risk capital into it.

Well...

And you’ll hear in a moment why we believe it’s going to ramp up further — and faster — from here.

Of course, we’re not making any guarantees here.

Like I say, we saw gold stocks sell-off at the beginning of the year. These are super-sensitive, super volatile stocks — and rarely go up in a straight line.

Then there’s the gold price itself.

That could stall or head south again...

My point is, if you can handle short-term volatility — and if you zoom out to look at the bigger picture...

The Australian gold market is — once again — starting to look like a case of ‘right place, right time’.

BUT...that doesn’t mean the money’s just going to fall into your lap.

You still have to find the right stocks.

And that’s no easy job. For every gold explorer that goes to the moon, there are another 10 that go to the wall.

It’s that risky.

If you want to invest successfully in this market, you need an expert guide.

Luckily, we have one of the best, and he joins me in the studio today.

Brian Chu — welcome back to Fat Tail HQ here in Melbourne!

BRIAN W.B.CHU

Hi Woody, thank you! I’m excited to be here.

And to our readers, you’ve come in at the right time.

WOODY

Now there’s lots to get through today — and I want to come to the specific opportunity quickly.

But, to bring everyone up to speed, tell us about the current set up in the gold market...what’s been happening... and what do you think happens next?

BRIAN

Sure Woody.

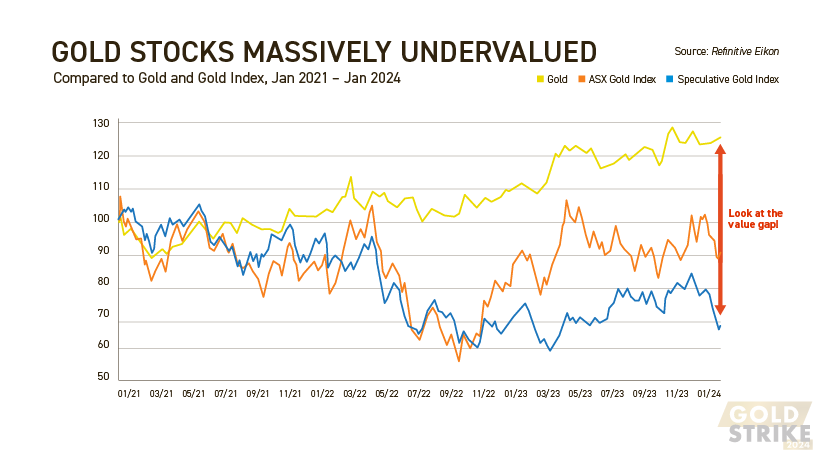

As most investors are aware, gold has done quite well in the last three years, gaining 22% in Aussie Dollar terms during this period.

Even in a difficult market last year, gold was up 13% in Australian dollars. All this while most commodities fell.

You’d think that gold stocks would follow the same trend. Instead, they’ve experienced three brutal years.

Gold producers began recovering in October 2022.

Stocks such as Northern Star Resources, Gold Road Resources and Westgold Resources delivered solid returns last year.

Explorers, on the other hand, have had a torrid time. Some stocks fell more than 70% since mid-2021. Thankfully, they finally bottomed last year.

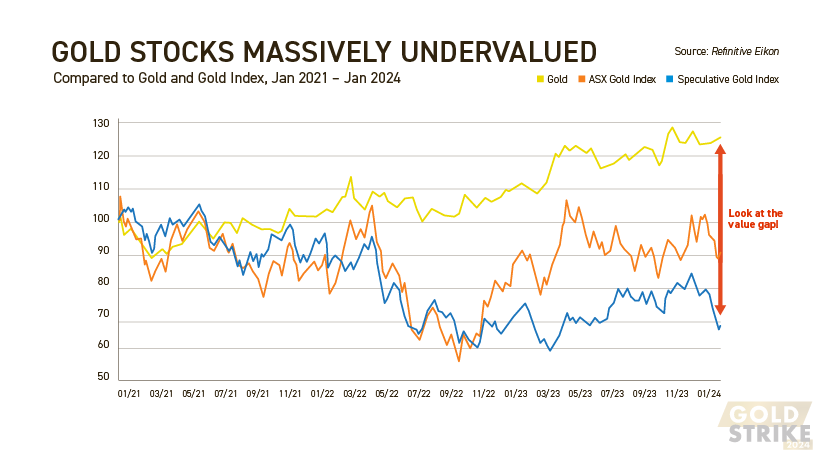

Take another look at this chart.

The blue line shows my own Speculative Gold Stocks Index.

Now Woody, this shows good news...

The index turned bullish in June 2023, when the 200-day moving average started trending upwards.

The last time that happened in 2020, as you showed us a moment ago, some gold explorers ripped higher.

These companies returned on average 722% from their lows, with the best performers delivering quadruple-digit percentage gains.

Could this happen again?

Absolutely.

So the yellow line on this chart represents the gold price. As you can see gold rallied steadily over the last three years.

In 2022 you can see the index of gold producer stocks — the orange line — sold off but recovered some of its lost ground over the last 15 months.

But what’s most interesting to me, Woody, is that blue line.

That represents the tiny stocks — the gold explorers and early-stage developers.

They haven’t staged much of a recovery yet. Which means they remain significantly undervalued against both gold and gold producers.

If history repeats, you could see gold explorers not only close that gap...but I think they’ll even outperform gold and gold producers.

I’ll come to the reasons why I think history will repeat in a moment.

But to summarise:

When the speculators jump on board, history shows us that those big gains are typically made in a frenetic period lasting anywhere between six and fifteen months.

WOODY

So the gold market looks nicely poised from a technical point of view...

What about the macro picture?

I mean we can’t have an explosion in gold stocks...unless there’s a bull market in the metal itself. So what are the main macro indicators telling you right now?

BRIAN

Well, let’s go back to the price of gold...and more specifically, what really drives it.

Many believe that central bank gold purchases, gold production from mining companies, the industry’s demand for gold and gold buying by citizens in China, India and other countries move the price of gold.

Others analyse the Commitment of Traders reports to look at the funding flows to predict where gold is going.

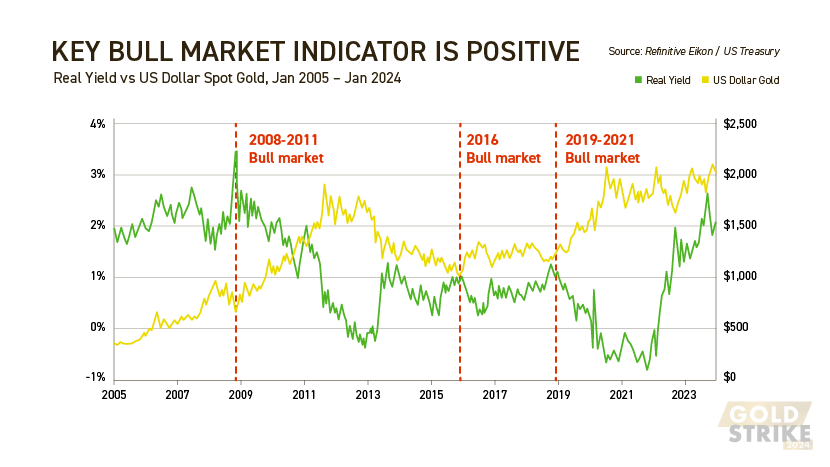

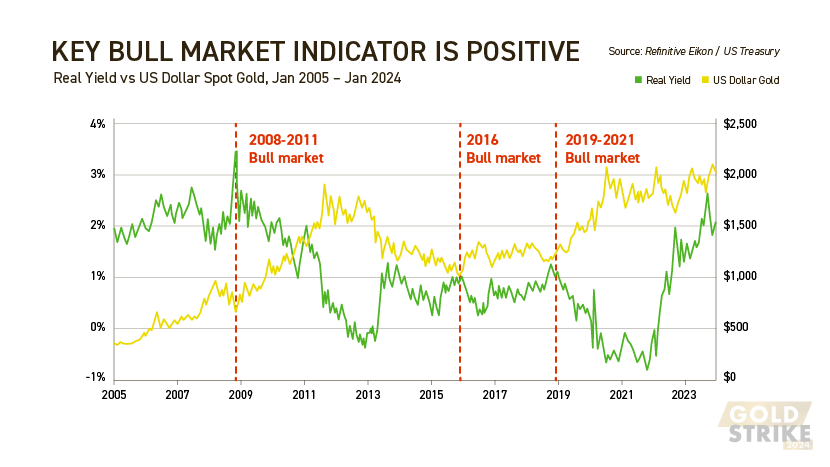

Now, they’re all useful indicators. But there’s one that trumps them all...and it’s the US long-term real yield.

In other words, the return paid by US long-term Treasury bonds after adjusting for inflation.

Let me show you what I mean...

Going back 20 years, you can see there’s an almost perfectly inverse relationship between the price of gold and the US long-term real yield.

Well Woody, the world considers the US dollar and gold as money.

The key difference is that the US dollar pays interest. Gold doesn’t.

The value of the dollar is in the interest it pays. However, inflation acts against that as it reduces your purchasing power.

Now as we know, the Federal Reserve has printed an almost unlimited number of US dollars over the past 100 years.

And as a result, the dollar’s purchasing power has declined massively over time. In 2024, it buys about 3% of what it did in 1913.

Gold on the other hand has limited supply. Compared to the US dollar, it retains its value.

In fact, gold in US dollar terms has risen significantly, some 625% in less than 25 years!

While gold rose 13% in 2023, much of the gains were made in the final quarter of the year.

This came as the Fed indicated that the aggressive rate rise cycle in 2022 is over.

The market started moving last October to price in rate cuts for this year.

Therefore, the US long-term real yield began falling. In other words, the purchasing power of the US dollar is weakening.

As a result, gold began rallying.

Now, I believe the real yield will continue to fall — especially if we see multiple rate cuts this year as some are suggesting.

As long as this relationship holds firm, gold should continue to rally.

In fact, Woody...

If I’m right, this is just the beginning of a much bigger gold stock bull market.

And the gold explorers I cover for my subscribers could really go to town!

WOODY

Now we know the gold market is made up of several different types of companies — each offering investors something different.

We’re here to talk about explorers and early-stage developers — which you say could take off in 2024...

But gold bull markets tend to follow a pattern don’t they Brian...it doesn’t all go up at once, does it?

BRIAN

That’s right, Woody.

The price of gold goes through cycles like all commodities. Many investors don’t understand this.

Gold and the best producers usually kick off the bull market. Then the mid-tiers, smaller producers and late-stage developers follow. Finally, you’ve got the explorers and early-stage developers.

A typical bull market in gold lasts 2–3 years.

The last phase of this bull market — I call it the ‘manic phase’ — can last anywhere between six and fifteen months.

Again, history shows us that some of these stocks can rally

But as you said earlier Woody, catching all of this upside is a tricky business. Many of these companies hand back their gains when the ‘manic phase’ ends.

My challenge — and I’m inviting our readers to come with me — is not only to find the explorers and early-stage developers with the best chance of delivering those three and four-digit gains...

But to make sure we time our raids as well as we can in the manic phase...with the goal of keeping the lion’s share of any winnings!

It won’t be easy.

These stocks fly up and down without warning. So you could end up sitting on paper losses while you wait for the big rally — or even during it.

Not many people have the stomach to withstand the rollercoaster ride. But that’s the price you pay for the potential to make exceptional returns.

WOODY

Now we’re going to talk about some of the individual gold explorer stocks Brian has picked out for you in just a moment...

He has FIVE ‘priority’ trades to tell you about...and I’ll explain shortly how you can take a position in these trades now, to set yourself up for these important next few months.

But I quickly wanted to say that when Brian comes forward with a big prediction about gold and gold stocks, you really do need to listen up.

This guy is one of the smartest, shrewdest gold analysts in the country...

And, also, one of the most successful — when it comes to this niche sector.

Get this:

So this guy knows how and WHERE to strike in a gold bull market.

And by the way you can check all of these results for yourself — they’re all published on the fund’s website.

But, Brian, what makes this performance all the more impressive is that you created the Australian Gold Fund with 85% of your family’s savings...and essentially piled the lot into gold mining stocks!

I mean, talk about conviction Brian!

I don’t think I could have done it — and we’re certainly not suggesting that anyone reading should do the same!

BUT...this same conviction and investing strategy looks like it’s paying off for subscribers of your boutique trading service Gold Stock Pro.

Check this out:

This table shows that virtually all of Brian’s current gold stock recommendations are starting to gain upward momentum...

You can see how far some of them have moved up from their recent lows...

...And this is in spite of the recent sell-off in the sector.

Now just remember what Brian said folks. We haven’t yet reached that ‘manic’ phase where — in previous gold bull markets — many small stocks like these have gone gangbusters over a period lasting anywhere between six and fifteen months.

If you remember...

Now whether any of these stocks go on to do the same is anybody’s guess...but you can see below that they’re moving in the right direction.

But what this table also demonstrates clearly is Brian’s absolute conviction in these stocks and in his ability to find the gold miners with the best prospects.

The truth is, many traders would have ditched these stocks when they hit the skids last year.

Well, not Brian.

He understands the business cycle in the gold mining industry better than anyone I’ve ever met.

And that gives him nerves of steel — which you need in a market like this one.

Well, it means you can see stocks in this sector are actually moving before you commit your risk capital...

And that’s very important — it means, according to the current picture — that you’re buying into strength.

Some of these stocks have rebounded pretty strongly in the last few weeks, Brian...can we really expect further upside from them over the coming months?

BRIAN

Well Woody, I think this is just the beginning...

But I want to be completely clear.

This table simply shows how my recommendations have bounced up off their recent lows.

They aren’t gains from our entry prices, sadly.

It’s very difficult to catch the bottom in stocks like these — and almost impossible to time the top.

My strategy aims to capture the bulk of these moves...and given the position we’re in right now, I’m confident we can do that.

And in terms of further upside from here — well, the last three gold bull markets give me cause for great optimism...

In the manic phases of 2011, 2016 and 2020, explorers rallied an average of 941%, 355% and 722%, respectively.

Specifically in 2020, some explorers really shot the lights out....

Chalice Mining rallied over 1,000%...

Pursuit Minerals rallied 4,300%...

Brightstar Resources was up 1,900%...

And Surefire Resources rocketed up 1,300%.

Now, to repeat: not every explorer is going to deliver these kinds of returns.

Well, to bring it back to the present, I believe that now is the time to take a position in a handful of these explorers.

And, while I can’t make any guarantees, I do believe these kinds of returns could be possible — maybe even before the end of 2024.

WOODY

So now is the time to strike then, Brian?

BRIAN

Yes, absolutely, there’s not a moment to lose.

You’ve seen gold producers rally in the past year.

The recent sell-off has, in my opinion, given us the potential for higher gains going forward.

The way the gold cycle works, explorers should be next.

With this in mind, I’ve picked out my 5 ‘highest priority’ explorer trades to send to our readers right away.

These are the companies that I believe are best positioned to take advantage of the coming ‘manic phase’ of the bull market.

Again, I can’t offer any guarantees...

But I will tell you the price to buy these stocks at, and if you stick with me, I’ll tell you when to sell them too.

And if previous bull markets are anything to go by...

Remember, the companies I’ve currently recommended to my subscribers are trading, on average, 40% higher than their recent lows.

These stocks are moving, but I believe they’ll start moving much more quickly soon.

Like I say, Woody, timing is everything...and it’s in our favour, right now.

WOODY

Okay, so to quickly recap on all of that...

So...we seem to be following a similar pattern to bull markets we’ve seen before.

Most recently in 2016 and 2020 — where, as we’ve shown you, some explorer stocks went gangbusters.

Now, as we keep saying, there are no guarantees this time around — but it certainly all points to fireworks in the gold explorer sector over the next few months.

And the best bit is, as yet...

It’s an exciting situation!

Brian, tell us how you think we should play it...

BRIAN

So I’ve selected five ‘priority trades’.

These companies are among my best prospects.

They each have a strong setup for the upcoming bull market.

As we just mentioned, they’ve started moving already...but there’s still plenty of potential for them to grow.

Those are the first trades to get into.

Then, I have another 25 companies on my Gold Stock Pro buy list, which we can talk about in a moment.

But I just want to make an important point about my trading strategy...

Many speculators trade in and out of gold explorers.

This is not how I play this space.

We’re looking to score big gains in the manic phase of the bull market.

In previous gold manias, that phase has lasted anywhere between six and fifteen months. And it has come on suddenly.

By getting in early, we aim to capture as much of the rally as we can.

What I won’t do is advise you to sell out of a position if it starts to fall.

This will require you to be patient — and to perhaps go against conventional thinking.

But in my experience, if you’re going after the really big gains, holding on is the right thing to do — even if it means wearing an ‘on-paper’ loss in the short term…

In fact, I might use the opportunity presented by a falling price to recommend that you add to your holdings.

This is how I’ve played gold bull markets in the past — especially with explorer stocks — and it’s rewarded me well.

WOODY

Okay. So Brian has picked five stocks for you ranging from pre-discovery explorers to a small producer.

And they’re all listed right here on the Australian market.

Each stock has bounced up off its recent low...but none have gone on a big run yet.

However, as you just heard, Brian says that’s about to change.

To get these five priority trades today, all you need to do is take a subscription to Gold Stock Pro — Brian’s specialist trading service.

In a matter of moments, you’ll know their names, stock tickers and what Brian feels is a fair price to pay for their shares.

Just log into your online broking account, follow Brian’s simple instructions, place your orders — and you’re in.

So that’s five priority gold stock trades to get you started right away.

If you want more action, as Brian just said, there are a further 25 buy recommendations in the Gold Stock Pro trading portfolio — all aimed at the ‘manic phase’ he believes is on the way.

These are all currently open trades — you can take a position in any of them you want to.

Although do be mindful to check the ‘buy up to’ limit for each stock. Brian sets these to guard you against overpaying when you place your trades.

Now remember what Brian said...

He expects these stocks to move significantly over the coming months — if previous bull market cycles are anything to go by.

But...there are no guarantees with this kind of speculation. Remember, this is about as risky as it gets on the Australian market.

There isn’t always a straight path to trading success, no matter how good the underlying picture is. You may have to wear some paper losses along the way.

The aim, as Brian says, is to stick with your positions.

If you can do that — if you can resist the urge to sell when a stock you own dips below your entry price — Brian says the end result should be well worth it.

That’s right, isn’t it Brian?

BRIAN

Yes, Woody.

The key to success in speculating in gold explorers is determination and discipline.

When I started my journey into gold stocks in 2013 with my family investment fund, we were in the middle of one of the worst bear markets in 30 years.

I bought in and watched my holdings plummet within weeks.

But I wasn’t fazed by the price moves as I was confident in my research.

So I continued buying over the next 18 months…all the while the bear market beat these stocks down.

By November 2014, my portfolio was down 75% and some of my holdings were more than 90% lower than what I’d paid for them.

Look, I could’ve given up. It would’ve been a logical decision to throw in the towel when these stocks fell 50%.

But I held on because I knew that these companies weren’t wild punts.

I estimated their value and held firm to my conviction.

And I was right.

The market turned in 2015 and I enjoyed significant gains that year.

By the time the bull market went manic in 2016, I reaped the rewards of not giving up in 2014.

I went on to make further gains in the 2019–20 bull market.

And you know what Woody — I think we’re looking at a similar set up again now.

Provided investors understand that we might see paper losses along the way, the end result, like you say, could be spectacular.

WOODY

Now if that idea excites you, there’s a button at the foot of this page that says: ‘Get Started Here’.

Scroll down and click on it right now if you’ve made your mind up and you want to trade gold explorer stocks with Brian’s help.

You’ll be taken to another page, where you can set up your subscription to Gold Stock Pro.

Once you’ve done that, you’ll get all the information you need to jump onto those five priority explorer stock trades... hopefully before any movement in the gold price sends them higher.

This is a great opportunity at a pivotal moment in the gold market — they don’t come around too often.

So if it’s fast trading action you want, you’ll find plenty of it on the next page.

But...I recommend you keep reading a little while longer.

Because I want to tell you about a special deal that gives you access to Gold Stock Pro at a reduced rate — for a limited time.

Please listen carefully because we’d love you to become part of our flagship gold trading service — but I want to make sure you understand what you’re getting.

Obviously, first you’ll get a lot of quick trading action — with clear instructions on five gold stocks you can act on right away.

But...you don’t just get names, ticker symbols, entry points and buy-limits with Brian.

You get his full research into each recommendation, too.

So you’ll learn all about the company, their operation, their history, their management, ore grades...

...Any upcoming announcements...his valuation of the company...

...Their cash balance, debt, forecast earnings...any risks to their operation...anything you want to know is here.

So if you’re someone who likes to read the rationale behind the trading recommendation, we’ve got you covered.

Next...from today, you’ll get every NEW gold stock trade alert from Brian by private email.

In each alert, Brian will tell you the name of the stock to buy, what to pay, what the risks are and what his target is for the trade.

Again, his deeper analysis will be there if you want to read it.

Now, while these gold trades are open, Brian will be in touch with you regularly, via email with a status report.

If there’s ANY new action to take in the trade, you’ll know about it straight away.

He also uses these email updates to look ahead to other opportunities and potential entry points.

You’re getting access to what we think is the best and quickest way to take advantage of this emerging opportunity...

...With the help of a professional gold stock analyst and fund manager who’s doing all the hard work for you.

Now along with this, you’ll also get access to Brian’s quarterly portfolio review called ‘The Bullion and Bordeaux Hour’.

It’s a live webcast, that I host, along with Brian, once a quarter.

These are typically on a Wednesday. And, as you can tell by the title, there’s wine involved!

We encourage you to enjoy a glass of your favourite tipple while you watch — and hopefully take part.

As I say, it’s a live show and we encourage participation in our chat room.

We try to keep these to an hour — but they often turn into broader discussions about the bigger picture in the gold market, the mining industry, companies on Brian’s radar, upcoming projects getting attention from mining insiders...

...Essentially, all the stuff Brian doesn’t have the time or space to get into in his regular trade alerts or updates.

And because the show is live, you can be part of it. You’re free to ask any questions as we go.

Just one thing — Brian is unable to give you personal investment advice.

But he’ll happily discuss any of the live trades in Gold Stock Pro...or anything else about the gold market.

Access to The Bullion and Bordeaux Hour is included with your Gold Stock Pro subscription today.

If you’d like to join us, we’d love to have you. Remember, pressure is building behind gold as we speak...

And if we’re right, it may only take one or two of these explorer stocks to turn a small trading account into something much bigger — quickly.

So, with all that said, what does it cost to get immediate access to Gold Stock Pro?

Well, normally, we charge $2,999 a year to get everything we’ve talked about today.

Now if you think that sounds expensive, just take a second to imagine how you’d feel if one of Brian’s trades makes you two, three or even ten times that amount over the next few months.

Because — make no mistake — that’s what we’re swinging for here.

And while of course there are no guarantees, I’m upbeat about Brian’s analysis...and confident he’ll deliver in that ‘manic phase’.

Remember, he took 85% of his family’s money, started an investment fund dedicated to gold stocks...and then more than tripled the return from the benchmark Australian index.

This is a guy who knows what he’s doing.

And frankly, for professional guidance like this, you should be paying double what we’re charging, plus commission on top.

But — we’re not going to charge you $2,999...

Join Gold Stock Pro today and you’ll pay just $1,799 for a one-year subscription.

That’s 40% off.

If you want an even bigger discount, go for a two-year subscription on the next page...and you’ll pay just $2,499.

That saves you 58% in total...

And it’s $500 less than the official price for a ONE-year subscription!

So there’s plenty of savings to be made — but only for the next five days.

At midnight AEDT on Tuesday, both of these stunning offers end and the subscription fee jumps back up again.

Scroll down, click the button at the foot of the page and complete the short form on the next page.

Remember, by acting today, you get:

That’s EVERYTHING you need to take advantage of the opportunity emerging in the gold market right now.

Still not sure?

Well, whichever subscription deal you go for, you can take the next 30 days to review everything you get, under absolutely no pressure.

Look, we know it’s tough at the moment..

It’s not as easy to make financial decisions as it was even a couple of years ago.

As publisher of Brian’s service I want you to feel 100% confident that you’re making the right decision to join.

So, at ANY stage in the next 30 days, if you decide trading gold stocks isn’t for you, call our customer services team and ask for a full refund of your joining fee.

We’ll put whatever you pay us today straight back on your card...

AND you can keep everything you’ve received from us up to that point — yes, even all the trade details!

Now it’s a business risk...I understand that. But this is just one of those times where everything appears to be lining up perfectly for some of those smaller gold explorers to really start popping.

You’ve seen today what can happen to some of these mining stocks when the spot price starts to move.

And frankly, with these discounted subscription deals, I couldn’t really make it any easier for you.

So if you want to join Brian on the hunt for tiny gold stocks that could really make a difference to your portfolio this year...

Scroll down, click the button at the foot of the page and select your preferred subscription deal on the next page.

Remember — these discounted deals end on Tuesday at midnight AEDT.

So don’t put this off, go ahead and click on that button and we’ll get those five priority trades over to you right away.

Brian, any final words on the matter?

BRIAN

Yes I do, Woody.

Ladies and gentlemen, I hope that we’ve laid out a powerful case on why you might be at the cusp of a major gold stock bull market.

Gold has done well the last three years, standing firm against the most aggressive rate rise cycle in decades.

Now the US Federal Reserve is looking to cut rates.

That could send gold to new highs.

There’s a massive gap between the value of gold and gold stocks. Especially when it comes to gold explorers.

As you’ve heard from me, I’m seeing gold explorers start to move from their lows...

In similar conditions in previous bull markets, stocks like these have risen an average of 355–940% from their lows.

Right now, most of the ones I cover are trading at 40–50% above their bottom.

It’s early days. That’s why you should seize this opportunity to jump on board with me.

All you have to do is click the button at the foot of this page and I’ll send you all the details and trading instructions.

Remember, these companies are high risk and they’re unlikely to go up in a straight line.

We’re not here to trade in and out of these companies. We’re going to sit and wait for the manic phase when I expect several of these companies to go ballistic.

History shows us that, once that phase begins, you’ve got anywhere between six and fifteen months to see the biggest upside.

By my analysis, that phase could be only a couple of months away.

Now is the right time to join us before everything heats up.

WOODY

Remember, until this coming Tuesday at midnight AEDT, you can get 40% off an annual subscription to Gold Stock Pro...

Or — if you want to save even more money, you can take a two-year subscription at a 58% discount.

That gets you two years’ access to all of Brian’s trades for less than the regular price of one year.

It’s an awesome deal if you ask me.

In fact, they both are.

To select the one that’s right for you, click on the button at the bottom of the page now.

Everything is set out for you on the next page, so you can review it all before making a commitment.

You know, if we’re right about being on the verge of a major gold bull market, you’re going to be so pleased that you did this.

We all say it: the weeks and months seem to fly by, and opportunities come and go.

This is a big one.

Don’t pass it up.

Click on that button now and we’ll look after you from there.

Sincerely,

James Woodburn,

Host, GOLD STRIKE 2024

(You can review your order on the next page)