He bought bitcoin at $600…

He first recommended Ethereum for $345…

In the past, he’s given his followers the opportunity to see 2,751% on Chainlink…2,320% on Cardano…1,063% on VERUS…and 752% on LEND…

And last year, he predicted that the SEC would approve the first ever spot bitcoin exchange traded fund (ETF).

In fact, by December he predicted the EXACT DAY the SEC would give the green light.

It has since become the fastest US ETF in history to hit $10 billion…

…helping drive the price of bitcoin to a new all-time high in March.

But today, veteran crypto investor Ryan Dinse is stepping forward with a new prediction — one he says you need to act upon immediately.

Put simply, there’s a major event about to play out in the crypto market.

It’ll happen just days from now, on 20 April.

It’s an event that’s written into bitcoin’s mining algorithm to take place every four years…

…and it guarantees that bitcoin will soon become twice as scarce.

The last three times this event — known as the Halving — took place, it led directly to new all-time highs for bitcoin within 100 days afterwards…

It also sent other top performing cryptocurrencies as high as 4,000% inside the following year.

Now Ryan says the same set up is forming again…

Except this time…he says the opportunity is even bigger.

Because this is no ‘ordinary’ Halving.

This time around, much bigger forces are at work — and the opportunity could be even more compelling.

That’s because of the man onscreen right now.

Larry Fink.

Head of the $10 trillion giant BlackRock.

And without doubt the most powerful man in the traditional world of asset management.

It may not be as well known as Apple or Google.

But BlackRock is a major shareholder in almost every major listed company.

It’s part of what’s been called ‘the most powerful cartel in human history’.

In fact, its algorithms direct the actions of the Federal Reserve and every major US bank…controls 17% of the bond market…and half of all ETFs.

In short, BlackRock — and Larry Fink — dominate the entire financial system.

Fink is also the man who, in many peoples’ eyes, brought bitcoin to the mainstream masses when he filed for a bitcoin ETF last year.

But his plans don’t stop at bitcoin.

They involve the disruption of the entire $460 trillion global asset markets.

Put simply, Fink believes the entire financial system — every stock, bond, commodity and piece of real estate…

…could soon ‘go crypto’.

If he gets his way, that could mean incredible rewards for smart crypto investors.

You’ll see what that means in the next few minutes.

And you’ll see why it presents a major opportunity — if you buy the right cryptos today.

Now, in the next few minutes, Ryan will talk about the best way of taking advantage of it.

You’ll hear about the specific cryptos Ryan is backing.

And you’ll see why learning about them before 20 April could prove critical — and potentially transformative — to your long term wealth and legacy.

Just remember:

bitcoin has ALREADY made a new all-time high in 2024.

But if Ryan’s correct about what’s coming, we haven’t seen the really big move yet...

Today, you still have the chance to take a position.

But you don’t have much longer.

To explain what you need to do, here’s the man himself…Ryan Dinse.

RYAN DINSE:

Ryan Dinse

In July 2022, I did something most people considered crazy.

The crypto market was in turmoil after the collapse of so-called ‘Stablecoin’ Terra Luna — which wiped out $60 billion in crypto capital…

The price of bitcoin dipped below US$20,000 as fear gripped the market. Most mainstream pundits said it was the end.

One well-known geopolitical analyst even said the price was heading BELOW zero!

Me?

I urged people to BUY.

Here’s how I put it back then:

‘I’m a raging bull when it comes to the long-term crypto project.

I think it’s going to be the biggest disruptor to the global economy since the internet.

The future I see will shock a lot of the naysayers.

We WILL see a recovery.

Of that I’m certain.’

To the vast majority of people out there, there’s no question I looked mad.

But that didn’t bother me.

10 years in the crypto space will give you a thick skin.

And I knew — even back in the dark days of the last bear market — that the long-term story for cryptocurrencies was bullish.

Fast forward a year, to August of 2023.

A cloud of doom and gloom still hung heavily over the crypto market.

Sam Bankman-Fried was preparing to go to trial, over an $8 billion fraud that had cost some investors dearly.

People were still falling over each other to call crypto a ponzi scheme.

This time, I was even more emphatic in my calls for investors to buy.

With bitcoin sitting at US$29,00, these were my exact words:

‘If I’m right, this is your last chance to buy bitcoin — and a handful of other cryptocurrencies — before you get priced out of the market forever.

I want to help you take it.’

Why was I so emphatic?

Because I knew that billions of dollars of institutional capital would enter the bitcoin market, following the approval of America’s first spot bitcoin ETF.

I even gave out the details of one my crypto recommendations, free of charge, to help anyone who was interested in taking advantage of my thesis…

Here’s what happened to that recommendation in the six months afterwards...

…as you can see, it tripled in value.

Then, in December last year, I went EVEN FURTHER.

I released another call ahead of what I called bitcoin’s ‘Ascension Day’.

This was in reference to the coming bitcoin ETF approval on 10 January 2024.

The specific moment in time when bitcoin could join stocks, bonds, commodities and gold as a part of every serious investor’s portfolio.

Sure enough, the SEC approved multiple bitcoin ETFs on 10 January — starting with BlackRock’s — triggering a flood of capital into the market.

By March, bitcoin made a new all-time high.

It’s up more than 300% since its bear market lows.

I wasn’t right immediately.

And not everything I’ve recommended has doubled or tripled — every crypto investor sees losses sometimes, it’s part and parcel of such a high risk market.

(Though that said, my current CORE portfolio is showing gains on open recommendations of 371%, 196%, 244%, 40%, 41% and 94%, at the time of recording.)

But when I look at the market right now, a lot of what I said was going to happen HAS HAPPENED.

The approval of bitcoin ETFs in January sparked a monster rally of institutional capital into the market. Just as I said it would.

By March, bitcoin had a US$1.3 trillion market cap, double the size of Tesla. It also overtook silver as the second most valuable monetary commodity.

In fact, this year the entire crypto space hit a US$2.5 trillion market cap…

…which is bigger than Nvidia, and every single listed company in the world, except Microsoft and Apple.

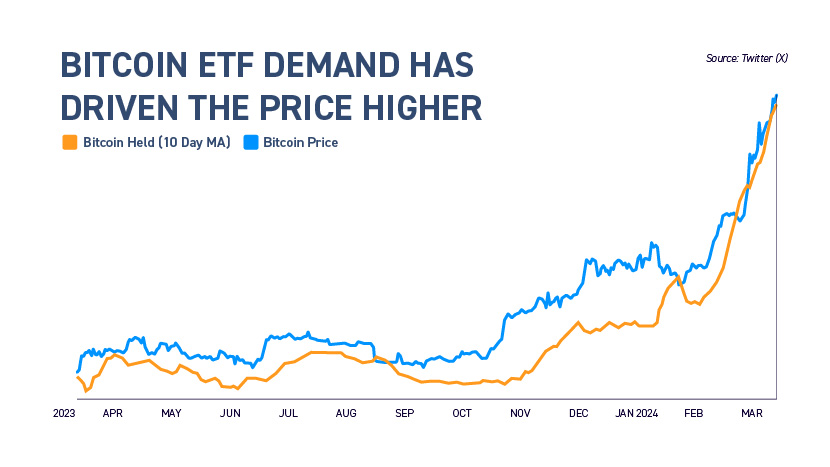

As I predicted, demand for bitcoin through these new ETFs is off the charts.

In a single day at the end of February, institutional ETFs bought 11,211 bitcoins…

While bitcoin miners produced roughly 900.

In other words, demand outstripped supply by more than 11-fold.

Glassnode even reported that major bitcoin platforms had almost run out of bitcoin…with only 40 bitcoin remaining for sale.

I’d take that news — some people get carried away when the price is surging — with a pinch of salt.

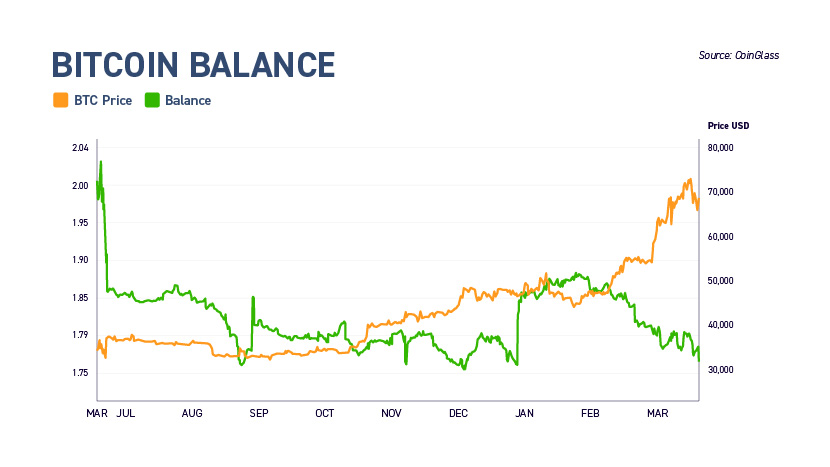

But it’s very clear from this chart that ‘ready for sale’ bitcoin is moving swiftly out of exchange addresses and into longer term cold storage:

You can see from that gaping chasm between the price (orange line) and the green line (bitcoin held by exchanges) that, as the price rises, more and more bitcoin is getting tucked away.

Given that, it’s no wonder that bitcoin is barrelling to new all-time highs.

Or that it’s now more valuable than the Swiss franc — once considered the soundest currency in the world.

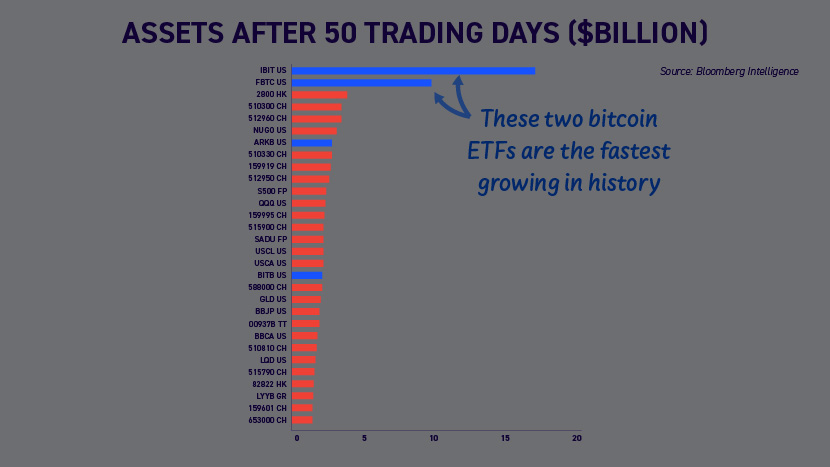

Or that BlackRock’s bitcoin ETF became the fastest ETF in history to hit $10 billion in assets (it took just 37 days).

In fact, the Fidelity and BlackRock bitcoin ETFs are the fastest growing ETFs of all time:

This is what billions of dollars, all rushing into the crypto market looks like.

And it’s exactly what I predicted.

What we’re seeing here is a paradigm shift in how bitcoin and the wider crypto markets are perceived by the financial elite.

Consider this…

Amidst all the excitement this year, one of the most bullish developments I’ve seen came from Fidelity’s Canadian branch.

It revealed a 1–3% allocation to crypto assets…even in its CONSERVATIVE portfolio.

I can’t begin to explain how significant this is.

It shows that bitcoin is becoming a crucial part not just of speculative portfolios, but ALL serious portfolios, no matter what the risk profile is.

Again, this is something I’ve been saying for a while.

Three years ago, I wrote:

‘As a new monetary asset, bitcoin is, in a way, a hedge (insurance) against the collapse or devaluation of existing money.

The fixed-income (bond) market represents that and, as you can see, it’s a large part of a conservative investor’s allocation (60–65%).’

The idea in that report was that you should use bitcoin to hedge (insure) the collapsing value of your cash/bonds.

At the time people said this idea was madness.

But we’re starting to see that call proven correct, with even conservative portfolios now including a bitcoin allocation.

Multiply this trend across portfolios worldwide and you’re going to see a monumental amount of capital move into crypto.

One analyst I follow has said that if only Fidelity and BlackRock — never mind every other investing firm in the world — allocated 3% of client assets to crypto, bitcoin would easily hit US$125,000 in short order.

Keep in mind that bitcoin has already more than doubled in the past six months.

It’s certainly not impossible for it to do so again…and fast.

And frankly, calling for bitcoin at US$100,000 is now starting to feel like a prediction your barber might make.

Analysts at Fidelity are already on the record predicting we’ll see bitcoin hit one million dollars before the end of the decade.

Look closer and you see there are plenty of other new sources of demand on the horizon.

In March, Brazil, Russia, China, South Africa and other nations announced they’re creating an independent payment system based on crypto technology.

It’s yet another sign bitcoin is fast becoming ‘the new gold’ — not amongst fringe analysts, but amongst the custodians of the financial system itself.

In November last year, Fidelity’s director of macro said that bitcoin is ‘exponential gold’, noting that bitcoin ranks alongside gold as a store of value for many investors'.

And it’s worth noting, money has actually been flowing OUT of gold ETFs and INTO bitcoin ETFs in 2024.

As of March, $6.1 billion had left gold ETFs…

And $6.7 billion had moved INTO bitcoin ETFs.

It’s precisely this dynamic that led Standard Chartered to predict bitcoin will hit $200k by 2025.

Analyst Geoff Kendrick pointed out that after the introduction of the first gold ETF in 2004, the price of gold rose 4.3-fold in the next 7–8 years.

Using the same logic, he believes bitcoin could make a similar move, but in a much faster time period.

He called the bitcoin ETF:

‘A watershed moment for normalizing bitcoin participation by institutional money, and we expect approval to drive significant inflows and price upside for BTC.’

That could ultimately end up being conservative.

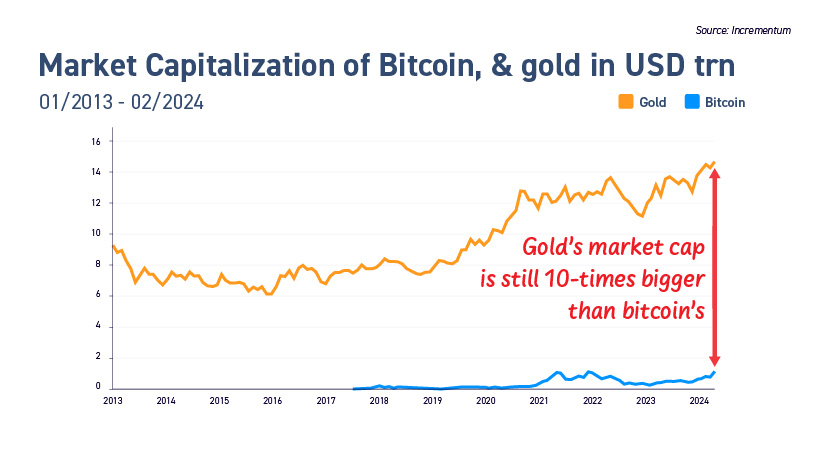

bitcoin’s market cap is roughly $1.3 trillion.

Gold’s is more than $14 trillion.

So for bitcoin to truly catch gold up, we’d need to see it increase more than ten-fold from here.

I’m not saying that’s going to happen in this cycle — though in crypto, you can’t rule anything out.

And as I said before, silver has already fallen to bitcoin.

What I am saying — as emphatically as I can — is that bitcoin has now become a must-own asset worldwide.

Demand for bitcoin has increased to levels we’ve never seen before.

This is the reason bitcoin and other cryptos are soaring in 2024.

And make no mistake — it’s all extremely bullish.

In normal circumstances, I’d be urging all Fat Tail Investment Research readers to consider the crypto recommendations I’m sharing today very seriously indeed.

Remember: I’m going to be telling you all about the three specific cryptos that are my top-ranked buys right now — cryptos that could surpass even bitcoin in the months ahead. More on that in a second.

But the truth is, these aren’t ‘normal circumstances’.

Because this isn’t just a case of demand taking off, as important as that is.

No — there’s more here.

And it makes the opportunity I want to share with you even more compelling…and even more urgent.

Because as demand is exploding to levels never before seen in the crypto market…

…the available supply of bitcoin is about to fall off a cliff.

So do yourself a favour:

That’s the day I’m expecting to see another major event play out in the crypto market.

But this time, it’s the supply side of the equation that’s going to change dramatically.

To understand why, let’s go back to a graphic I shared earlier…

As I said, it shows the number of bitcoin purchased by ETFs in late February, against the number supplied by bitcoin miners.

It shows just how mismatched supply and demand is.

Now just imagine what’s going to happen when the supply of new bitcoin gets cut in half.

That’s what’s going to happen in 20 April.

This happens every four years.

It’s hard-coded into the structure of the bitcoin market.

And it’s one of the things that makes bitcoin so compelling as a store of value — and to sound money enthusiasts.

The supply of bitcoin will never surpass 21 million.

As part of that limitation, the ‘reward’ for bitcoin miners gets cut in half every 210,000 blocks of bitcoin are mined, which usually takes four years.

For instance, right now a bitcoin miner receives 6.25 bitcoin for every block it mines.

After 20 April, that reward will get cut in half — to 3.125 bitcoin.

In one move, that’ll cut the new supply of bitcoin in half.

In other words…it’s going to get even harder to get hold of bitcoin.

In fact, one model says that bitcoin will soon overtake gold in terms of its ‘scarcity value’.

Remember: this is about to happen in a market where demand is ALREADY outstripping supply by a factor of 11–1.

Just how high could the price go once bitcoin becomes even scarcer?

Impossible to say for sure.

And none of this will reduce the volatility and high risk involved with all crypto investing, by the way.

In fact, it could make bitcoin even more volatile — as the market tightens and people scramble to buy up new supply wherever they can find it.

But history does offer some clues as to what could happen next.

You see, after the past three Halvings, bitcoin passed its old all-time high within 100 days, as this chart shows.

If the pattern repeats, we’d be looking at a new high above US$75,000 inside the next 12 months.

But this time around is different.

Things are playing out much faster.

With institutions flooding into the market, we saw a new all-time high in March — BEFORE the Halving had even taken place.

This is unprecedented.

Frankly, no one knows just what’s going to happen once the supply of bitcoin dries up after 20 April.

Will we see US$80k?

US$100k?

US$200k?

I can’t rule any of it out.

Of course, there are no guarantees here. All I can say for sure is that — after more than a decade in the crypto market — this is as bullish a setup as I’ve ever seen.

It feels like a real ‘before and after’ moment.

After this, nothing will ever be the same again.

And as if that wasn’t enough…

Each of them could ramp up the momentum behind the crypto markets…

And I’m expecting each one to hit within the next few months or so.

First, in April and May it’s regulatory filing season in the USA.

That means any US institutions that have been buying bitcoin through these new ETFs have to disclose it publicly.

No one knows who — if anyone — is buying right now.

And no one knows how much.

But there are plenty of rumours floating around — everyone from Jeff Bezos to a big Middle Eastern country are apparently buying in.

We’ll see soon enough perhaps.

And that creates the opportunity for a major surprise as these facts become known.

In fact, we’ve seen such things happen before.

Think back to 2020, when Elon Musk announced he’d put bitcoin on the Tesla balance sheet.

This is what happened after he just put the word ‘bitcoin’ in his Twitter bio!:

Now, imagine that playing out again, but with someone like Goldman Sachs, Apple or Microsoft buying in.

That’s total speculation, for now.

But it’s possible…and we’ll find out who’s been dipping in to the market through April and May.

Then we have to turn our attention to what’s happening in China…

Follow the mainstream news and you’ll have heard about all sorts of crypto crackdowns playing out over there.

And there’s at least a little truth to some of those stories…to a point.

But look closer and a very different picture emerges.

Right now, there’s an application with the Hong Kong authorities for a bitcoin ETF.

As Forbes reports:

‘Hong Kong is making strides towards the introduction of a spot bitcoin exchange traded fund’

Recent reports suggest this could be ruled on in the near future.

If we get a positive result, there’s every chance we’ll see a mirror image of what’s just happened in the USA, as institutions finally have a credible ‘on ramp’ to own crypto.

The same is happening in the UK.

The London Stock Exchange has just cleared two new Exchange Traded Notes in both bitcoin and Ethereum to trade starting on the 28 May.

That’s not all…

You also have a third catalyst, one that could be extremely bullish for the market beyond bitcoin.

Both BlackRock and Fidelity have filed to launch their own Ethereum spot ETF in the USA.

These filings are with the SEC as we speak.

And it has until May to approve or deny the application.

Which provides yet another very compelling catalyst that could trigger even more capital to flow into the crypto space.

If I’m not being blunt enough here, let me make this really simple.

Crypto demand is going vertical.

Institutions are pouring cash into the market.

The supply of new bitcoin is about to get cut in half.

And there’s a whole series of additional bullish catalysts in the near future.

Everything is lining up perfectly.

So if you’ve been on the sidelines, waiting for the right moment to get into the crypto market…

THIS IS IT.

The time to strike.

And that’s what I’m going to help you do in the second half of this presentation.

I first bought bitcoin myself in 2014 at $600.

It’s up more than 100-fold since then.

I first recommended my readers buy in 2017 Ethereum at $345…it’s up more than 1,000% so far.

But as you might have guessed, I’m not selling.

Because I think this story has a lot longer to run.

That’s why I’ve dedicated a lot of time and effort since 2017 to covering the crypto markets for Fat Tail Investment Research.

My mission has been pretty simple:

To help people like you make cryptocurrency a serious part of your portfolio…

…and to show you how to speculate on up-and-coming cryptos without buying into the latest ‘scamcoin’ (as we call them in the market).

Of course, not everything I’ve picked has gone up — this is cryptocurrency we’re talking about here. It’s high risk and volatile.

You need to go in with your eyes open and a firm focus on the big picture trends — not the many sideshows that can lead you astray,

But I’ve had many great results along the way.

I’ve run various advisories dedicated to trading and investing in cryptocurrencies

In one of these services, which ran in 2017, I gave my readers the chance to make 1,498% on bitcoin…726% on Ethereum…2,751% on Chainlink…2,320% on Cardano…1,063% on VERUS…and 752% on LEND…

I took my fair share of losses too, of course.

You can’t avoid that.

But I’ve also shown plenty of readers how to make 10 or 20 times their money in a crypto bull market with my recommendations.

And I think there’s similar upside on the table once again this year.

That’s not a forecast, by the way.

It’s merely what I think is possible, given the bullish setup I’m seeing.

A look at past bull markets suggests the same thing.

But here’s the really important thing…

They’ll come from the cryptos playing a key role in the next phase of the crypto disruption.

Now, there are two ways of thinking about this.

A smart way…and a dumb way.

The dumb way is to speculate wildly on any altcoin that appears to have momentum.

On the surface of things, that might look like a good idea…

In 2020 — the year of the last bitcoin Halving — bitcoin rose 300%.

But that only made it the 15th best performing crypto that year.

The best performing coin — according to Coincodex — was KSM, which rose 4,813%.

In other words…the best crypto rose 16-times more than bitcoin.

Then there was Yearn which rose six times more.

Just look:

In 2021 — as the full impact of the Halving played out — it was the same story.

bitcoin rose 59%.

But Ethereum rose 399%...Solana rose 11,177%...Cardano rose 621%... Dogecoin rose 3,546%...Avalanche rose 3,334%.

The problem is…a lot of these projects subsequently crashed back down to Earth.

Many were disastrous investments. Many were just pump and dumps that just enriched insider investors.

Some even went to zero.

So how do you avoid that happening?

That’s simple.

You buy the handful of cryptos with serious real world potential — the cryptos that have real applications and genuine value.

These smaller cryptos have all the short-term potential upside you’d expect.

But that upside extends into the long term, too.

It’s real, it’s not purely speculative.

There are three cryptos like this I have my eye on right now.

If you’re prepared to take a risk — allocating a small part of your risk capital — I think these smaller cryptos could be very smart buys for right now.

Why?

It’s all down to something I call:

And the guy on your screen right now is at the heart of it all.

Fink is one of the most powerful men in the financial world.

As head of BlackRock — a multi-trillion dollar asset manager — the decisions he makes can move the entire market.

And right now, he’s super bullish on crypto.

In fact, you can trace bitcoin’s ascent to mainstream acceptance by looking at what Larry Fink has to say.

In 2021, he sided with JP Morgan CEO Jamie Dimon, after Dimon dubbed bitcoin ‘worthless’.

Yet by 2023, he was instrumental in bringing bitcoin to the heart of the financial system, with BlackRock’s bitcoin ETF.

It was a complete 180.

But Fink isn’t finished.

In fact, he’s on the record in stating that crypto ETFs are just the first step.

Ultimately, he wants to tokenise ‘every financial asset’.

Stocks.

Bonds.

Real estate.

Gold. Silver. Commodities.

Fink sees a future where all of them trade in the same way as cryptocurrencies, running on decentralised networks like the blockchain.

This is big business.

The Boston Consulting Group predicted in 2022 that asset tokenisation will be worth $16 trillion in the next decade…almost 10 times more than bitcoin’s entire market cap in March.

If I’m not being clear, we’re not just talking about institutions buying cryptos here…

We’re talking about the entire financial system ‘GOING CRYPTO’ — using the same technologies that make cryptocurrencies work as the basis of the entire financial system.

This is huge.

Actually, huge doesn’t even begin to describe it.

It’s an all-out disruption, reset and rewiring of the entire financial system.

Not just currencies…not just banks…but everything.

The whole financial ecosystem.

Now you might well ask:

After all, Fink and BlackRock already dominate the existing system.

And it’s a BIG system.

BlackRock directly controls $10 trillion.

And it’s a key part of a system with $460 trillion in assets.

That’s a monstrous amount of money…more than 10 times bigger than the entire US economy.

Crypto, by comparison, is tiny.

The entire system is only worth $2.5 trillion.

Ask yourself — why would Larry Fink even bother about bitcoin and crypto…?

It’s still miniscule compared to the existing system.

If he wanted to, he could just ignore it.

And yet he’s now building an entire business strategy around EMBRACING it.

Why?

I think that was Fink’s epiphany last year.

He understood that we were going to transition to a new financial system built around crypto tech — like it or not.

The way I see it, in that new system bitcoin starts to replace US Treasuries as the pristine asset that underpins global markets.

But it goes further than that…

Soon, I see decentralised crypto tech disrupting and replacing the entire architecture of global capital markets.

Stocks…bonds…commodities…the whole lot.

It’s ALL going to ‘go crypto’, one way or another.

That’s my view.

This is why bitcoin at US$1 million and beyond isn’t a pipe dream. I see it as a very possible outcome.

So right now the opportunity before you — the individual — is to own a part of that system.

If I’m not being blunt enough, I’m saying I think you should be seriously considering buying bitcoin right now.

But that much is obvious.

The bigger question is…

Where do other cryptos fall in this new financial order?

Forget the memecoins and the pump and dumps.

What you want to own right now as this transition unfolds are the 'new plumbing' projects.

The cryptos that will replace the old banking system which still relies on 1970s tech.

Fink also knows that is coming and is why he just launched a Digital Assets Fund (with the fund living on the Ethereum Blockchain as a token!).

In the short-term, the Halving is likely to have a big impact on the price of bitcoin.

But longer term, the overall opportunity is MUCH, MUCH BIGGER.

And if it plays out as I expect, it’s going to provide a powerful tailwind for the cryptos that’ll be essential to this process of tokenisation.

These are the cryptos I think will benefit from the ‘Fink Effect’, as people realise this story isn’t just about bitcoin.

It’s also about the cryptos that could ultimately provide the ‘plumbing’ for a new, tokenised financial system.

The networks running smart contracts.

The blockchain validators.

The decentralised exchanges.

New forms of data exchange.

After bitcoin, these are the type of projects in crypto I’m most excited about right now.

Now these aren’t the kind of ‘shitcoin’ you see shilled on social media.

They each have real world potential…and real business uses.

But let me be clear: they’re all VERY HIGH RISK.

As high risk as it’s possible to get in investment markets.

You could lose all your money if things don’t play out as I expect.

You should know that from the outset.

Never invest more than you can safely afford to lose.

That said…

If I’m right here, there’s more upside on offer than in any other market I know.

Find the right crypto…with the right tailwind…and get your timing right…

And it’s possible to see 10…20…even 50 times your money from top performing cryptos.

Again: that’s not a promise…or a forecast.

But it’s how I see the best-case-scenario upside here.

Take the first crypto I want to tell you about…

It’s disrupting one of the most important parts of the global financial system…the payments network.

This is big business.

Right now, the Swift payments network transfers US$5 trillion PER DAY.

Over a year, that’s more than a quadrillion dollars flowing through the system.

So to say this is a ‘big’ industry is an understatement.

But the first crypto I want to tell you about is primed to disrupt it all.

Right now, it’s small.

It’s worth roughly $11 billion right now.

But it’s growing fast — it just saw its revenues increase 180% in just two months.

And here’s what I really like…

This crypto isn’t disrupting the payments system from the outside, as a competitor.

It’s PARTNERED UP with Swift already.

So it’s already primed to help launch a new, crypto-led payments system from the INSIDE.

That Swift partnership isn’t the only deal its done, either.

And it’s already showing signs of being adopted by the mainstream.

It’s part of a huge experiment involving a dozen different financial institutions.

One of those banks is ANZ — so this is a story that’s playing out right here in Australia too.

But then you have Lloyds, Citi, Euroclear and the Depository Trust and Clearing Corporation all working with this project.

By the way, the Depository Trust and Clearing Corp custodies $87 TRILLION worth of financial assets — so there’s big money at stake here.

That’s on top of other crucial partnerships already signed, including T Mobile, AWS, Google, SwissCom and more.

Then you have another of my key cryptos.

This one is poised to be a key beneficiary of Fink’s ‘tokenising the world’ strategy.

That’s because it allows every asset to be traded with any other asset.

This is potentially an US$89.5 trillion market ready to be disrupted.

Yet today this market leading project is only valued around US$7 billion!

That might sound crazy.

But if I’m right — and if Fink succeeds in his goal — you’re literally talking the end of these famous names:

All these exchanges could be replaced by a decentralised blockchain protocol that exists solely in cyber space.

Then you have my final play…a ‘DAPP’ developer — decentralised apps running on the blockchain.

That’s an addressable market expected to be worth $368 billion by 2027.

This project has some major big name partnerships already in place.

It’s working with the likes of Adidas, Starbucks, Adobe, Meta (Facebook) and payment provider Stripe. So it’s clearly onto something.

It’s goal is to bring mass adoption to the blockchain arena.

If you want to find out more about all three of these cryptos — plus three more I think are strong buys — I have good news.

I’ve compiled a new report called The 4th Halving Gameplan: 2024’s Must Own Crypto Portfolio.

This report contains a breakdown of my CORE crypto portfolio.

This report contains a breakdown of my CORE crypto portfolio.

It will show the seven cryptos I think are ‘must owns’ right now as well as how much you should allocate to each project, given the risks and potential on offer.

I’d like to send you a copy right away.

Inside, you’ll find everything you need to make your move.

All my research.

My entire buying rationale…risk analysis…plus detailed instructions on how to buy each of these cryptos — that’s something few other people will tell you.

To get your copy, all you need to do is join me as a member of my advisory service, Crypto Capital.

So far as I know, it’s the only service of its kind in Australia…

And it’s designed to help solve the HUGE challenges investors like you face when you approach the crypto markets.

If you’ve invested in cryptocurrencies before…or you’ve TRIED to but been put off…you’ll know exactly what I’m talking about.

Let’s say you want to make cryptocurrencies a real part of your long-term financial plans — even if that’s just with 1% of portfolio…

Where do you turn?

Beyond the new ETFs, there are SHOCKINGLY FEW options out there for you, especially when you consider we’re talking about a TRILLION DOLLAR asset class.

Money managers…IFAs…Hedge Funds…the vast majority of them won’t touch crypto. At least not yet. And by the time they do, the early opportunity will likely be long gone.

If you want to invest in shares, commodities, bonds, property, gold…the financial industry will GLADLY take your money, and charge you a fat fee for doing so.

But if you want to make CRYPTO a part of your long-term plans…

You’re on your own.

And that presents big challenges.

Where do you turn to get honest, accurate and INDEPENDENT information on the crypto markets?

Most of the financial media treats the crypto market with barely concealed scorn.

And there are plenty of ‘bad actors’ out there, trying to shill the next worthless shitcoin on Twitter.

Figuring out what’s happening requires piecing it together from white papers…blog posts…company filings…tweets…press releases…interviews…

It’s time consuming.

And it’s HARD.

No wonder people struggle.

Just look at the number of so-called ‘elite’ institutions that got it wrong on Sam Bankman-Fried’s FTX exchange.

Billion dollar VC funds Sequoia Capital and Softbank. The Singapore government. Even the Ontario Teachers Pension Plan!

They all got it completely wrong — and paid the price.

In other words…

The financial industry makes it HARD for serious investors to take a position in the crypto market.

Crypto Capital exists to help regular people solve that problem.

My mission is to arm you with the information you need to make cryptocurrencies a real part of your financial plans.

How much capital you allocate to crypto is your call, of course.

It could be 1%...5%...10%. It’ll be different for everyone.

But whatever portion of your portfolio you decide to invest, my goal is to show you how to do it the smart way.

Here’s how it works:

Join Crypto Capital today and you’ll get instant access to the report I told you about, The 4th Halving Gameplan: 2024’s Must Own Crypto Portfolio.

That gets you up to speed with the seven cryptos at the top of my buy list.

But that’s just the first in a series of resources you’ll get access to.

For instance, the second report you’ll get is called The Crypto Capital Blueprint.

It talks you through how to buy and store cryptos like bitcoin and other cryptos step by step, so you know exactly what you’re doing.

I know how daunting it can be to enter this space.

Now…with so much disinformation around…that’s doubly true.

The Crypto Capital Blueprint is a full compendium of all the practical knowledge you’ll need to hit the ground running.

You’ll learn:

And heaps more.

Then you’ll get a copy of another report I’ve put together, called The Crypto Lloyds of London.

It’s a crypto most people have almost certainly never heard about.

It’s a crypto most people have almost certainly never heard about.

But it’s aiming to disrupt the 6 trillion USD INSURANCE market.

This is a market that’s been around for hundreds of years, since Edward Lloyd opened his coffee house in London in 1686.

That coffee house eventually became the ‘go to’ place for merchants and entrepreneurs to insure their ships against disaster.

It eventually morphed into the world’s first insurance business. And it’s still going strong today.

But this cryptocurrency is developing smart contract technology that could ultimately disrupt this ENTIRE market — which is worth $6 trillion globally.

I’ve written up everything you need to know about it in a new report called The Crypto Lloyds of London, which is ready and waiting for you when you subscribe.

Plus you’ll get access to TWO separate portfolios of crypto recommendations.

The first is the Crypto Capital CORE PORTFOLIO.

These cryptos — as you can imagine — are my core holdings.

These cryptos — as you can imagine — are my core holdings.

They’re long term.

The equivalent — if things go right — of the Apples and Amazons of the crypto world.

Long-term plays you’ll want to hold for 10 or 20 years.

Then you’ll get access to a separate Crypto Capital SPECULATIVE PORTFOLIO.

Again — pretty self explanatory.

Again — pretty self explanatory.

These are my most speculative, highest risk picks.

The ‘small caps’ of the crypto world.

But much, much riskier.

I won’t hide that from you. These are picks that could do 10x…or go to zero. Both outcomes are very possible.

Obviously I do everything I can on the research side to avoid getting zeroed out.

But it DOES happen.

That said, when things go right…these cryptos can really move.

That’s why I’ll share my full rationale with you. I’ll explain why I’m recommending them…what I expects in the future…and crucially I’ll give you a FULL risk analysis.

You’ll get access to the whole portfolio, as soon as you sign up.

Next, you’ll get access to a subscriber only smartphone app I’ve developed with a Californian blockchain company.

They created a unique Crypto Capital version of the app exclusively for subscribers.

They created a unique Crypto Capital version of the app exclusively for subscribers.

And it removes all the stress and hassle of buying into your CORE crypto portfolio.

Back in the day, if you wanted to trade different crypto assets, you had to sign up to multiple exchanges…store lots of different private keys…pay expensive trading or ‘gas’ costs…and keep detailed records of every transaction for tax purposes.

It took nearly 20 minutes to make one trade!

The trading app Crypto Capital uses is simple and ‘one touch’.

It’s a ‘mirror’ of the CORE portfolio I maintain. This is the place for your serious crypto investments.

So when I add a crypto to my portfolio…it’ll automatically be added to yours, too.

The same thing is true in reverse when I sell.

I do everything. All the research. All the buys and sells. All the asset allocations.

PLUS, it’s ‘non-custodial’…a HUGE plus…in an environment where crypto exchanges have come under pressure.

That means only YOU can access your cryptocurrency holdings.

Not exchanges, not us, not the software company who developed the app.

This removes a huge risk for you as a cryptocurrency investor — it means you no longer need to trust anyone to keep your funds secure.

Though as I’ll explain, that comes with some new responsibilities too.

And it’s EXCLUSIVE to Crypto Capital members.

Of course, this is completely optional. The fund itself is owned by a third party, not me. You’re completely in control of whether you use it or not — there’s no obligation.

You’ll get a special link when you join along with detailed instructions.

To help you get started, I’ve recorded a short video tutorial to explain everything, which you’ll get when you sign up.

So what does it cost to sign up?

Well, quality crypto research is hard to find.

And it’s hard to do an exact ‘apples to apples’ comparison, because every provider has a different business model.

But what IS out there is expensive.

For instance, one resource I use is called Glassnode…which costs US$799 a month.

Over the course of a year, you’re looking at north of US$10,000 for their Professional level data.

Another specialist research firm — called Nansen — charges US$3,000 per month.

That’s $36k a year…or more than 50 thousand Aussie dollars.

Given that…and after much thought…my publisher set the price of Crypto Capital at $3,499 per year.

But given I’m expecting big things to play out in the bitcoin market between now and 20 April…

We’re cutting the price down, for a limited time only — to give as many people as possible the chance to get in.

So if we hear from you right now…today…you can lock in your place for a 57% discount on that price.

Meaning: you can cut that subscription fee IN HALF.

$1,499…instead of $3,499.

That’s a 58% discount.

Still…not chickenfeed.

But if you’re the right kind of person, you’ll snap this up.

Just one thing though — this offer is only on the table until Friday night at midnight.

After that, you could pay a lot more money for exactly the same subscription.

That deadline again: THIS FRIDAY at midnight.

And for added peace of mind, you also have the backstop of that 30-day refund guarantee.

Meaning…you can request a FULL refund of every cent of that subscription fee at any time in the next month.

Meaning…you can request a FULL refund of every cent of that subscription fee at any time in the next month.

If anything about this service does not meet your expectations…

Just request a full refund. We’ll be happy to give it to you.

To recap…

You’ll get access to:

Plus, you’ll get regular updates…the latest analysis…plus new recommendations from me.

All you need to do to access all that is hit the button at the bottom of this page before the deadline.

There’s a reason the big players like BlackRock are moving not just on bitcoin…but the entire crypto space.

Cryptocurrencies are here to stay.

And institutional capital is making its move.

That much is undeniable.

It’s no longer up for debate.

The big money has made its move on bitcoin.

And with the Halving in just a few days’ time, there’s plenty more excitement to come.

That’s why right now is the time to be seriously considering making your move.

Because as you’ve seen, the forces at work right now go beyond the Halving itself.

If Larry Fink gets his way, the entire $460 trillion financial system is going to ‘go crypto’.

Today is your chance to own your slice of that new world.

That’s what’s on the table.

But to grasp this opportunity with both hands, you need to take action.

You don’t have to become a rabid speculator and chase 10,000% gains.

This is bigger and more important than that.

Hit the link below now to join me at Crypto Capital.

Thank you — and I look forward to welcoming you as a subscriber.

Sincerely,

Ryan Dinse,

Editor, Crypto Capital

(You can review your order on the next page)