Gain the Upper Hand in

Any Market with the Power

of Algo-Driven Trading

Discover the system Callum Newman uses to identify stocks going UP, even as markets FALL, and try it out on YOUR trades with no obligation today…

Dear Reader,

I want you to have a shot at returns like THESE:

Core Lithium — up 56% in two months

Nearmap — up 80% in two months

Coronado Global Resources — up 24% in a month

TerraCom — up 98% in two months

Nanosonics — up 40% in three months

Neometals — up 48% in two months

Altium — up 49% in three months

Even while the rest of the stock market is FALLING…

Is that even possible?

Absolutely.

All the stocks above moved higher in 2022, as the Aussie index fell.

And they were all flagged in backtesting by the new stock trading system I’ve co-developed…

BEFORE they went up.

Callum Newman,

Editor, Small-Cap Systems

Now, backtesting is not necessarily an indicator of future results. And not every stock the system flagged went up, of course.

But enough DID to get me very excited.

My name is Callum Newman.

I edit two stock trading advisories at Fat Tail Investment Research:

- Australian Small-Cap Investigator

- Small-Cap Systems

All told, more than 14,000 people follow my work, most of which involves finding and trading ASX-listed small-caps.

I don’t get everything right — no one does. But I’m proud of the opportunities I’ve shared with my readers over the past few years.

- I’ve given some of my subscribers the chance to make 150% in 34 days…98% in 149 days…and 52% in 25 days (in 2020 and 2021). One reader told me he made ‘[A] profit of $30,000 this financial year from Callum’s advice’.

- I forecasted the iron ore bull market in 2021. When many analysts said prices would collapse, I showed my readers how to nearly double their money in three months.

- One of my picks even helped one reader, John Morgan, make 24 times his money on Chalice Mining.

But in 2022, with markets sliding and investors facing big losses, I took on a new challenge.

To find the handful of stocks on the ASX that were bucking the trend and going up…while the rest of the market was going down.

Easier said than done.

There are more than 2,000 listed stocks in Australia.

And they all spit out new reports, forecasts, plans, and results on a regular basis.

Finding ONE outlier takes a lot of work.

Finding 10 or 20 of them is near impossible.

Without an extra edge to stack the odds in your favour, even the best trader will MISS more of these kinds of stocks than they’ll find.

I’d been grappling with this question for almost a year…and I wasn’t alone.

Fortunately, at Fat Tail Investment Research, we’re part of a vast global network of traders, investors, and money managers.

So, in 2022, I turned to one of the best traders I know, Peter Bakker. Peter is something of an enigma...

- He’s been an officer in the Dutch army…built (and sold) a million-dollar software business…been headhunted by Google…

- He’s known in trading circles simply as ‘Chewie’, a mysterious system builder who once tried to replicate his F-16 Fighter Pilot father’s brain as an algorithm…

- And he specialises in building sophisticated trading systems, using AI and machine learning to identify trades a human alone would simply never find.

Together, we’ve developed a new system for finding the bright spots in any kind of market.

It’s based around a genius new algorithm that can spot patterns in the stock market that even the sharpest technical trader would often miss.

There are just too many stocks for any one person to study and measure the volatility by hand.

You NEED the processing

power of a machine…

Like I said, this system is powered by AI and machine learning.

The algo looks back over the last 90 days in the markets and measures momentum in three ways…

Firstly, it looks for pure price momentum — the stocks that are rising fastest.

Secondly, it strips out highly volatile stuff. We want the stocks that are rising strongly and smoothly, not whipsawing all over the place.

Lastly, it smooths that momentum out by calculating the number of good days a stock is having.

We don’t want a stock going up a lot one day, then down for the next 10. We want to see nice smooth momentum, lots of good days.

Finally, it compares that stock to its sector. We don’t want stocks that are just getting dragged higher in a trend.

We want to see a stock outperforming its sector, having even more momentum.

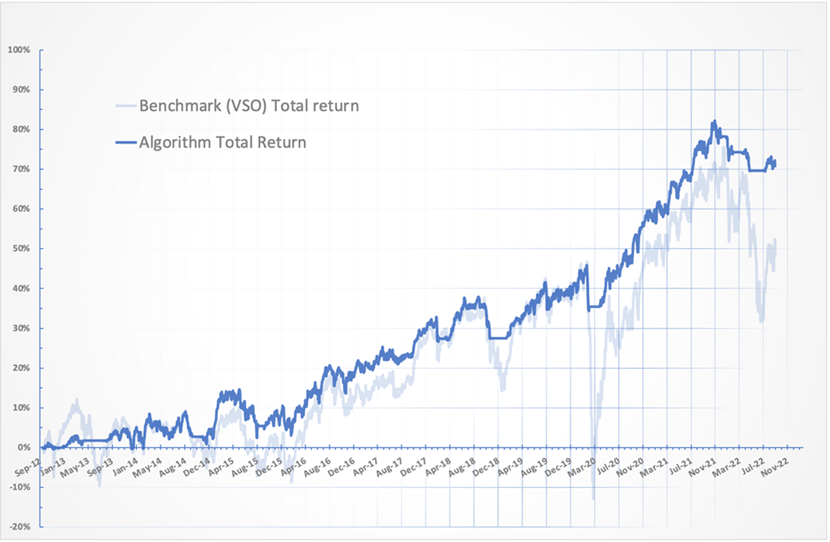

This system was already giving us some pretty compelling results in backtesting…outperforming VSO, the Aussie Small-Cap Index ETF:

For every $1 in profit the benchmark returned, the algo would have returned $1.39.

Now again, backtesting is not necessarily an indicator of future results.

But that kind of outperformance is enough to make any investor sit up and take notice.

The only thing that can make a system like this stronger…

Is to have a real person — that being me — INTERPRET the signals.

Systems are great. But they don’t read the newspaper. They can’t read the mood.

They don’t know what’s coming up (an election, rate hike, a big announcement).

They REACT.

Whereas people PREDICT.

Neither approach is perfect, but together they can be extremely powerful.

Today, I want to give you the chance to tap into this ‘man and machine’ approach to stock trading, with our new advisory service:

Small-Cap Systems

It’s worth pointing out, our strategy doesn’t just work in a bear market.

When markets are trending down, you want to find the pockets of strength.

But when markets are rising, you want to own the shares that are outperforming, rising FASTER than the market.

Like our gold trade in Ramelius Resources from 2022 into 2023. Readers had the chance to make a tidy 30% profit in just 79 days on that one…

Or our retail trade in Accent Group in November 2022. Readers had the chance to make 23% gains in 37 days despite the retail sector tanking in September.

That’s the beauty of this approach. It’s market agnostic.

Even though the outlook for the retail sector was grim in 2022, there was still money to be made, if you could find the right stocks.

Just think what this system could do for you and your trading success.

Imagine the feeling of making a winning trade like Accent Group in a beaten-down sector that most other investors are shying away from…

Or knowing when to take quick profits on a resource stock like Ramelius Resources because you can see the momentum is waning.

That’s exactly what happened…and Ramelius gave up a lot of those gains in the following weeks. Such is the case with small-cap stocks that can go down just as fast as they go up.

But we were able to chalk up a 30% win because our algo was analysing it around the clock and pinged us when it was time to sell.

Now, this might all sound like the kind of sophisticated approach a professional trader would use.

And in many ways, it is.

But it’s actually really easy for you to follow along at home.

This system works 24/7 doing all the grunt work of identifying the strongest stocks on the market.

I then interpret that data and if I’m convinced there’s a high probability of a winning trade, I’ll send you an email.

All the trading information you need will be in that email.

Stock ticker, buy-up-to price, stop-loss, it’s all there.

Reading one of my alerts, logging into your brokerage account, and placing the trade will take no more than 10–15 minutes.

There’s no rush, though.

You’re completely in control. You can trade some, all, or even none of the trades I send you.

I’ll monitor each trade while it’s live and update you by email as the situation develops — and then tell you when to sell.

Simple as that.

So…you’re probably wondering…

How much does it cost to join?

Well, let’s just be clear about what you’re getting here...

You’re getting the benefit of TWO different types of trading expertise with this service.

There’s the trading SYSTEMS side of things.

An endeavour that Peter ‘Chewie’ Bakker has been undertaking for YEARS...building, coding, and constantly testing and refining trading systems.

This is not just incredibly skilled work. It’s really labour-intensive too.

One report from the US suggested building a system takes more than a 1,000 man-hours…and costs up to US$55,000.

And that’s assuming you KNOW someone with the skill to build one.

Then there’s the human EXPERIENCE side of things. I’m talking about my decade-plus experience of trading the markets.

And I can tell you, there are no shortcuts with trading.

You have to be out there, every day, in all conditions, learning, taking losses, and hard knocks — as well as the winners.

That takes time…and can be a costly education.

But I’m happy with my track record of doing that for readers.

Remember, I gave my readers the chance to make 150% in just 34 days on Family Zone…98% on Atomos…and 79% from Althea…

…one reader even made 24 times their money on Chalice Mining after I recommended it.

I’m ready to use every bit of my experience to bring you the highest opportunity trades on the market right now.

Not only that…

There are no performance fees here, like you’d get with a mainstream wealth manager…

…those guys would likely charge you a fat upfront fee AND take 20% of your profits.

You don’t need to worry about any of that.

With all that said…

The annual membership fee to access Small-Cap Systems is $3,499.

It’s expensive, sure.

I make no apologies.

That’s what it costs to get cutting-edge small-cap analysis that spits out potential winners like these, even in a falling market:

Core Lithium — up 56% in two months

Nearmap — up 80% in two months

Coronado Global Resources — up 24% in a month

TerraCom — up 98% in two months

Nanosonics — up 40% in three months

Neometals — up 48% in two months

Altium — up 49% in three months

Again, these are backtested results, and don’t guarantee future performance.

But imagine that you’d been able to jump on those trades in 2022. How would your portfolio look today after that brutal period.

The fact is, NO ONE else in the world has access to the algo trading system we’ve created — that can find stocks like this in ANY market.

The only way you can get access is by joining Small-Cap Systems.

And remember, I will be working solely for you, hunting down the highest opportunity trades our algo finds, week in week out…

Experience like this does not come cheap.

In fact, $3,499 is quite outstanding value when you consider the amount of work that’s gone into building this system.

But I have good news for you today…

You’ve got 30 days to decide if

Small-Cap Systems is right for you

Give Small-Cap Systems a try today, and you can put our analysis to the test with no ongoing obligation for 30 days.

- Look over the full buy list of recommendations…

- Read my latest market and stock updates...

- Read the latest trade alert when it comes out.

If your membership doesn’t meet your highest expectations for ANY reason within the first 30 days, I’ll give you a full and immediate refund of the joining fee you’ll pay today.

No questions asked, every cent will be refunded.

That’s a generous offer.

But I don’t mind making it because I’m confident you’re going to enjoy everything you receive.

Now it’s in your hands...

I’ve shown you what’s possible when you have a sophisticated algo system like this working day in, day out to find you the best trades.

Think about the excitement the next 12 months could hold for you…

Imagine the confidence of having a sophisticated system backing up your trading moves instead of feeling like you’re just winging it…

Or the rush when you see one of your trades shoot up and make the news…but you’ve made a tidy profit because you got in early…

This is an extraordinary chance for you to transform the way you approach trading…and increase your chances of success in the stock market.

If you’re ready to do that, fill in your details below, and hit ‘Confirm Payment’.

I hope to see you on the other side.

Regards,

Callum Newman,

Editor, Small-Cap Systems