World Record

Gold Discovery?

In 1896, prospectors flocked to Canada’s Klondike River after gold nuggets were found in its tributaries.

Now, 128 years on, one explorer may have finally uncovered the source that fed one of the greatest speculative frenzies the gold market has ever seen.

Dear Fat Tail Daily Reader,

It could be the most significant gold find in decades...

The tiny explorer at the centre of it recently pitched up a stone’s throw from the site of one of the world’s biggest gold rushes in history…the great Klondike Gold Rush of the 1890s.

More than 100,000 prospectors descended on the Klondike region of Yukon, in North-West Canada, between 1896 and 1899.

They sought fame and fortune.

Few found it.

In fact, in the almost 130 years that followed, the source of the gold found around the Yukon tributaries was never discovered.

Until now.

I just learned that one gold explorer has hit upon what they believe is the upper tip of the ore body.

So far, rock samples have returned phenomenal grades…52g per tonne, 95g per tonne, 58g per tonne, and 44g per tonne.

As a working geologist for the past 15 years, I can tell you it’s extremely rare to find gold samples and scrapings containing this much gold sitting ABOVE ground.

And to think all it took was a geologist and a hammer!

Rigs now spin over multiple targets…and geos are focused on understanding how big this deposit could be.

Here’s why you need to

pay attention now…

This project is STILL in the exploration phase, meaning much of the geology remains untested.

There’s gold there for sure.

The question is, how much…and how effectively can it be extracted.

If the geology is only half as good as the initial tests show, an early investment in this explorer could make significant gains.

Of course, if this turns out to be a red herring, you could lose money, too.

It’s rare to see a situation where the stakes are so high.

You see, existing drill holes are widely spaced. Approximately 200 meters of unknown geology exists between each exploration hole.

Geologists have ASSUMED, or more aptly ‘hope’, the ore body remains continuous between each hole.

In my mind, that’s a reasonable assumption, but only if you understand a little geology…

You see, drilling has already shown that mineralisation crosses different rock types.

That means the gold is dispersed and not constrained to certain rock formations.

There’s also no sign of a major geological structure displacing (removing) mineralisation between drill holes.

Now, to say it in plain English…for a geologist, these are clear signs that there will be MORE gold between the existing drill holes.

But until infill drilling has been completed, the market will remain cautious.

That is what makes this such a timely and compelling investment opportunity.

If you’re willing to spare some of your risk capital, you can use this information to your advantage before the TRUE size of this deposit is proven by follow-up drilling.

So far...each time they drill, they find more gold.

As a result, the share price of this company has been edging up.

But, if all goes to plan, it could SHOOT up…and stay there.

Right now, we’re still early.

That’s why I’m writing. Because if there ever was a time to consider a small bet on a single gold explorer…it’s now.

So, read on…

What follows is the story behind a remarkable gold exploration outfit…and a potentially huge cache of new gold supply.

In no uncertain terms…

We could be looking at the

heralded ‘motherlode’

As I’ve said, this discovery has deep historical origins.

To explain, I must take you back 230 years to the 1800s…when a long battle was culminating in the US.

I don’t mean the North versus South Civil War.

I’m referring to the little-known East versus West, precious metal showdown.

Rich bankers from the eastern United States wanted an exclusive gold-backed standard and were prepared to fight hard to keep it in place.

Meanwhile, west coast pioneers…entrepreneurs, farmers, miners…pushed hard for silver’s adoption into the country’s monetary system.

But why the division?

Well, gold is rare.

That limits the amount of cash flowing through the financial system.

A gold-backed currency also holds its value and is typically deflationary.

That benefited bankers in the east looking to PRESERVE the value of their loans…the wealthy creditors.

On the other side of the coin were the debtors…

The pioneers pushing west, funding their exploits by borrowing to farm, mine, or build.

But with a gold-backed standard and tight monetary conditions, loans were hard to repay.

It stifled growth in the west.

But there was a solution…

Increasing the money supply would bring inflation, effectively reducing the value of their loans.

Silver was the key to make this happen.

It’s estimated silver is around 19 times more common than gold.

Given its relative abundance, silver would bring more ‘money’ into the monetary system.

Ramping up production at a silver mine in the 1890s was like turning on today’s money printers!

And in 1890, farmers, miners and loggers got their wish…

It was known as the Sherman Silver Purchase Act…where governments bought around 4.5 million ounces of silver each month.

The law would dent bankers’ fortunes in the east, but spark mass speculation in the west.

The era of ‘free silver’ was born.

Colorado’s silver operations ramped up…with that, monetary expansion was on!

Rising inflation drove up commodity prices…wheat, base metals and timber surged thanks to the governments silver purchases.

A commodity super-cycle was underway.

Relying heavily on logging, mining, and farming, frontier townships on US’s west coast expanded rapidly.

Commodity-rich nations like Australia and South Africa also benefited.

But with speculation rampant and powerful bankers looking to end silver’s speculative role, the US government backed down.

In the summer of 1893, Congress repealed the Silver Purchase Act.

An era of ‘easy money’ was over.

The switch

Inflation switched to DEFLATION.

Silver prices fell heavily, from 83 cents to 63 cents an ounce.

It set off the infamous 1893 Silver Crisis which drove prices far lower, still.

According to some sources, more than 15,000 companies went bankrupt across the west while unemployment reached a sky-high 20%.

Boom-time settlements collapsed.

But Denver, Colorado was hit especially hard.

As a major hub for silver mining, it was the epicentre for booming activity in the west.

But with silver’s downfall, the city was doomed.

Workers walked away from newly constructed housing. Real estate prices collapsed.

Indeed, they fell heavily throughout commodity-rich nations like Australia and South Africa too.

Many of Denver’s short-lived millionaires ended up destitute after the Silver Crisis of 1893.

Yet, depressed conditions would eventually stage a recovery.

And this is where the story from the 1890s gets interesting…

In 1896, three lads by the name George Carmack, James Mason, and his nephew, Charlie headed north into Canada’s remote Yukon province.

With unemployment high, the three pioneers sought to make a living from the wild, untamed wilderness.

Fishing and logging their way through the depression years.

But what followed not only changed the

fortunes for these three men, but much of

the economy across North America

Making their way down the Klondike River in the remote Yukon Province of Canada, the trio were following a lead from an Indigenous legend…

It was rumoured that abundant gold sat along the bank of one of Klondike’s many tributaries.

But the exact location was uncertain.

Without any need for gold, the indigenous population never gathered the bounty.

This was Canada’s El Dorado, a kind of vague myth that offered fortunes for its finder…if it was true.

At the time, the Yukon was known to contain gold, a selection of isolated mining camps scattered across the remate territory.

Plagued by its summer mosquitoes and biting flies, the three pioneers spent days hunting the many tributaries branching off the Klondike.

Eventually, these budding prospectors came upon Rabbit Creek.

From there, it didn’t take long…

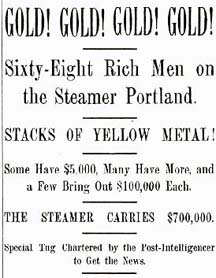

GOLD! GOLD! GOLD! GOLD!

On 17 August 1986, at a sharp bend on the river, the trio stumbled upon a swarm of nuggets.

Golden nuggets!

As Johnny Horton in his ‘North to Alaska’ classic would sing:

‘Where the river is windin’ big nuggets, they’re findin!’

This discovery would kick off the famed ‘Klondike Gold Rush’.

The trio quickly pegged out their claim and registered it with the local police post.

Word quickly spread to nearby mining camps.

Within days, all the land surrounding Rabbit Creek had been staked.

But wherever there’s gold, there’s sure to be more!

With the prized land taken, prospectors continued their hunt…downstream, upstream.

It didn’t take long…another swarm of nuggets even RICHER than the first.

Gold fever was about to grip the entire North American continent.

But with no means of long-distance communication, it took time for the news to flow down south.

In fact, according to some sources, the story didn’t register with the public until a steamer pulled into port and unloaded its rich bounty in front of a jaw-dropped crowd.

From there, news broke like wildfire.

Tram drivers, steamship operators, farmers, loggers…gold fever spread fast!

Here’s a copy of an original news headline after the Steamer Portland arrived in Seattle:

Source: University of Washington Archives

And this excerpt from the local paper, The Seattleite, dated 17 July 1897:

‘Seattle is all “agog” with this gold fever and the streets are crowded with knots of men so worked up over the news that they can scarcely avoid being run over by the cars and carriages.’

By 1897, ‘Klondike Fever’ hadn’t just struck Seattle, but most of the North American continent.

With that…the great northern rush was on!

With at least one years’ supplies in hand, prospectors jumped on dogsleds and made their way through the perilous snow and ice all the way up Canada’s northern frontier.

The journey was made famous by Jack London, a young author who documented his travels up the Yukon all the way from San Francisco.

Around 100,000 desperate hopefuls made the journey.

Some would perish, most would turn back.

Only about a third of those who left in 1897 would make it up to the Yukon goldfields.

Among those, few became rich.

But the discovery marked an important turning point for US’s stunted economy.

The Klondike Gold Printer

According to the World Gold Council, US gold reserves fell dramatically from 442 tonnes in 1890 to just 169 tonnes in 1895.

But some estimates suggest the Klondike discovery added 75 tonnes of gold.

Or around 44% of the entire US gold reserve at the time!

No small measure, given the US currency was entirely pegged to gold.

This single discovery had a major ‘stimulatory’ impact on US’s economy.

More gold effectively increased the supply of money across North America.

The rush also boosted economic activity in US’s west…

Seattle, San Francisco, and Vancouver boomed as shipyards resurrected, transporting goods and passengers up the west coast.

Steel mills kicked back to life as Canada built its White Pass & Yukon Route…a train line shifting prospectors and cargo to the rich goldfields up north.

The 1890s was a fascinating era for precious metals.

With silver’s entry, conditions boomed, and inflation surged.

But after the US government revoked its silver purchase act, money supply dried up — leading to deflation and a depressed economy.

Then finally, an accidental ‘monetary stimulus’ arrived, thanks to a major gold discovery up north.

But how does all this relate to the

gold explorer I want to tell you about today?

Well, gold doesn’t hold the same reserve status as it once did.

However, gold remains on the minds of investors.

In fact, I believe it could SOON turn feverish.

On 4 December, the shiny metal (briefly) zoomed past its all-time high of US$2,093/ounce.

An important milestone.

Yet, prices quickly settled.

But this could be the lull before we see a much bigger uptick in 2024.

As you can see below, the technical setup looks strong.

Source: ProRealTime

Gold futures have remained ‘rangebound’ between $2,080/ounce and $1,600/ounce over the last three years.

But since the major low in mid-2022, gold has continued to trend higher and is now within a whisker of pushing well above its all-time highs.

This is very bullish.

That’s why I’m beefing up our exposure to the gold sector in my resource investing advisory letter Diggers & Drillers.

My name, by the way, is James Cooper.

As I said, I’ve been a working geologist for the past 15 years.

I’ve been involved in massive ore discoveries, multibillion-dollar takeovers…soul-crushing failures and delistings….and everything in between.

When I wasn’t managing rigs, soil sampling, analysing data, and organising field crews in far-flung places...I was teaching geology at international schools...

One minute I’d be having beers with the exploration manager of Equinox Minerals in a Perth bar…next minute I’d signed a contract...boarded a set of five flights to Solwezi in Zambia to look for copper...

I was right at the heart of it when in 2011 Barrick Gold came in and bought out Equinox for a staggering $7.5 billion.

I saw the takeover firsthand, and played a role in what was the biggest resource drill-out that ever took place in Africa.

I’ve seen it all.

At least, I thought I had!

I can tell you the gold discovery this explorer has hit upon is practically unheard of these days.

Don’t me wrong. It’s not by any means a done deal.

They know gold is there.

Like I said before, the question is…how much is there, how deep it goes…and how easy it is to extract!

And that’s no mean feat.

It’s expensive too.

And as with any non-revenue producing stock, liquidity is key.

For explorers, cash in the bank means paying bills and other overheads.

But as investors, we need our explorers to be active.

There’s no use holding stock in a company sitting idle waiting for its bank balance to grow.

Without cash, exploration grinds to a halt.

That means there’s no potential to add value.

It’s why I always target explorers with a healthy cash balance…activity on the ground spurs action in an explorer’s stock price and that’s what we want!

The good thing is this company has plenty of cash in the bank…more than $36 million.

In other words, strong liquidity to pursue extensive drilling.

Point is…

When gold fever strikes, you want

to be part of the action!

I expect the biggest fireworks will take off in the junior space.

A resurgence in small-cap gold explorers could mirror the feverish gold rushes from the past.

That’s why I’m sharing the context and story behind this company with you today.

It’s not often we jump into the exploration end of the mining life cycle at Diggers & Drillers…

It’s an arena usually reserved for our my more speculative trading service, Mining: Phase One.

But in this case, it’s warranted.

We are zeroing in on a company holding precious ground.

And now, after spelling out the history, you’ll be familiar with the area…

This company’s flagship project is just a stone’s throw away from the epicentre of the great Klondike Gold Rush!

It sits on the same geological system.

Canada’s remote Yukon province remains a frontier location for today’s gold explorers.

Except, this explorer isn’t hunting nuggets along the banks of Klondikes tributaries.

Rather, geologists are looking to uncover the source.

The motherlode that’s fed thousands of tonnes of gold into the Yukon River systems.

This company is a true ore hunter. In the most exciting, speculative, and risky phase of the mining life cycle.

That’s why I’m excited about this recommendation for readers of Diggers Drillers right now.

With gold fever about to strike…now could be the ideal time to add this explorer to your portfolio.

To get the full details, click here

To your wealth,

James Cooper,

Editor, Diggers and Drillers