Why I’m gearing up for 2024’s

‘Small-Cap

Supernova’

Dear Reader,

Stuff interest rates.

Stuff inflation.

Stuff the cost of living.

Listen…

Right now, some of Australia’s most exciting, innovative small companies are trading for prices I haven’t seen since the lows of 2020.

Among them are Australia’s next millionaire-makers.

Last time round, many of their stock prices doubled, tripled, even quadrupled in the following 6–24 months…yet most are selling today for just cents on the dollar.

When the rebound gets going…it’ll likely happen fast and suddenly…like the explosive burst of a supernova.

I’d like to introduce you to five tiny ASX-listed Australian companies.

A small investment in each — if I’m right — has the potential to make money.

In some cases, big money.

I know that’s a tall claim.

But I make it because the last time I saw these exact beaten-down conditions…where the small-cap sector was literally hated by nearly everyone…it went on to smash its larger brethren out the park.

For example, take a look at the green line in the chart below:

It shows you how the small-cap sector burst back to life after the previous drawdown after the 2020 COVID collapse.

The green line tracks the ‘emerging companies’ index on the ASX — the small caps.

Stocks in this index range from as little as $33 million to $1.1 billion, with an average market cap of $232 million.

The blue line — the Top 100 Total Return index — represent the 100 biggest companies on the ASX share market.

The current top 100 have an average market cap of $9 billion.

You can see that the much smaller ‘emerging companies’ massively outperformed and outplaced the Top 100 ASX stocks in the years after.

Now, here’s the point…

After the market bottoms out, like it did in 2020, it’s the smaller stocks that lead the following rally.

The moves after the 2008 GFC weren’t too shabby either.

The clamour for growth after a lean period pushes smaller stocks up much higher than their larger counterparts.

This shows that if you buy the right stocks — and get your timing right — it’s possible to make eye-watering profits in a short space of time.

I saw these conditions forming again early last year, that’s when I really began writing to my core group of like-minded private investors urging them it was the best time to buy.

And while the NEXT watershed moment where people flood back into growth stocks hasn’t happened yet…the rumblings have started.

I’ll prove it to you...

Take a look at this handsome rooster…

That’s me up on stage in front of 150 people, at a private investor event at the Windsor Hotel, Melbourne, back in November 2023.

My speech was on the massive opportunity in small caps.

At that point the ASX had been falling for three months!

But I urged everyone in the room to stay positive.

I didn’t shirk from putting my neck on the line either.

I named six stocks for everyone in that room to consider.

Here’s a table of the returns of those six stocks from 9 November, the day of the event…to 7 February 2024…

(I won’t name them here out of respect for my subscribers, but keep reading!)

Stock |

Price |

Price |

Return |

Open Recommendation Still? |

#1 |

$1.85 |

$2.34 |

26% |

Yes |

#2 |

$1.30 |

$2.08 |

60% |

Yes |

#3 |

$2.10 |

$3.11 |

48% |

Yes |

#4 |

$3.52 |

$4.02 |

14% |

Yes |

#5 |

$4.75 |

$5.81 |

22% |

Yes |

#6 |

$0.50 |

$0.60 |

20% |

Yes |

A bloody valuable speech, I’m sure you’ll agree!

Lo and behold, afterwards, the ASX stormed up in December!

Shares ripped up.

Don’t get me wrong, I don’t want you to think this is easy.

There’s no doubt 2023 was a tough year. 2024 will have its challenges too — every year always does.

Small caps can be some of the riskiest and most volatile stocks on the market.

As such, you should only allocate speculative capital towards them, that you are willing to lose.

But don’t let that put you off. You can position size with all this in mind. I’ll show you how.

My name is Callum Newman.

I’m a professional stock analyst and advisor.

For 12 years now, I’ve been working with Fat Tail Investment Research.

I was a total greenhorn when I started. But I was also hungry to learn.

In fact, I’ve done nothing else since!

It’s a fulltime job just keeping up with all the changes in the financial world. They come daily, weekly and yearly.

Then there’s studying commodity trends…consumer changes…financial conditions…investor psychology…and market history.

Today, I run two investment services and even have a book published on Amazon.

Today, I run two investment services and even have a book published on Amazon.

I’ve been lucky to learn from a wide network of investors, analysts, and advisors.

Now I also know some big names in finance personally.

Like Warren Ebert, one of Australia’s best property fund managers.

Occasionally I grab a burger with Hedley Widdup, chief investment officer of the $80 million resource fund, Lion Selection Group.

My mate Catherine Cashmore is one of Australia’s best real estate advisors for retail investors.

We even wrote a small book together in April 2020 to say why real estate would boom…despite Covid. We were bang on.

We even wrote a small book together in April 2020 to say why real estate would boom…despite Covid. We were bang on.

Today I run Fat Tail’s ‘small-cap division’, via two premier advisories: Australian Small-Cap Investigator and Small-cap Systems.

Australian Small-Cap Investigator is focused on finding long-term stocks with great products and innovations that could grow market share.

Small-cap Systems is a short-term trading system that combines a proprietary-commissioned momentum algorithm with my fundamental analysis.

Let me be clear…

It’s not as if there’ve been no opportunities since 2021…

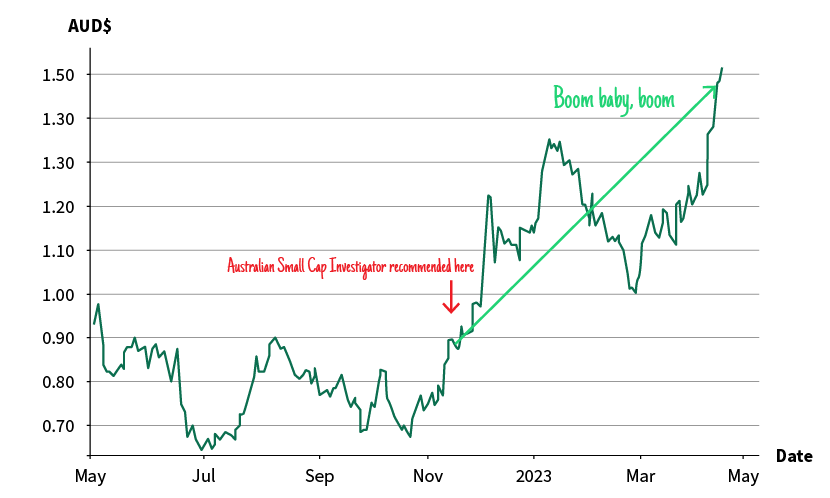

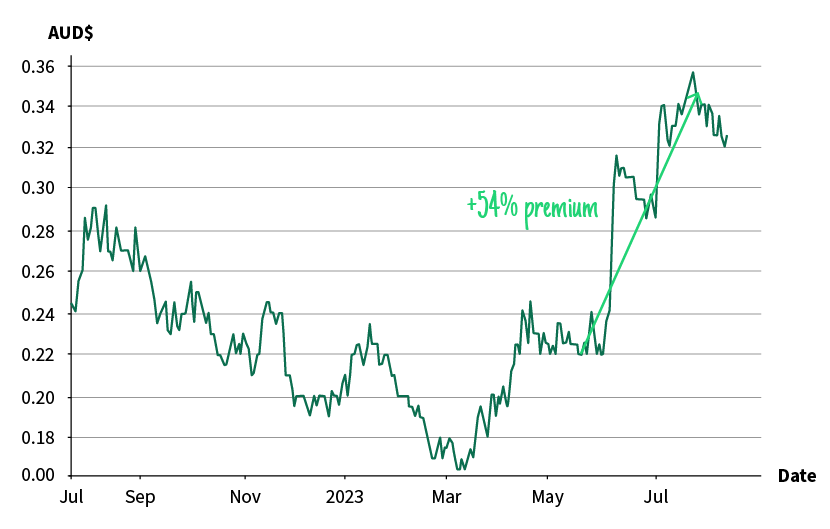

One example is Bellevue Gold [ASX:BGL]…

This gold stock was my key recommendation in Australian Small-Cap Investigator back in November 2022.

Market timing is hard, but this one proved prescient.

Originally, the plan was to hold for 12-18 months.

But BGL flew up 60% between mid-November 2022 and March 2023.

In fact, it went up so hard…and so fast…I told my readers to bank the quick win.

When you look at the chart, you can see why I made this decision….

This move in BGL was an absolute cracker for my readers.

Now…you know as well as I do that not all stocks do this…I can pick a dud too occasionally…and past performance is no guarantee of future performance.

But I show you this for another reason...

It gives you a perfect representation of what I see brewing in the wider small-cap sector in 2024.

You see…

Gold shares were just so darn cheap in late 2022.

Too cheap, in fact, relative to their potential.

They’d been in a downtrend since 2021…and investors got fed up and impatient.

Many threw in the towel.

As a result, gold shares sold off to such historically low levels…the odds told me they had to improve.

All it needed was a spark.

That spark came in November 2022…as the UK financial system wobbled from interest rate volatility…and the world feared a big US recession brewing.

See the big consequential rally in gold shares from late last year to mid-2023?

It shows the ASX gold index — a bunch of gold miners, in other words, aggregated together — rallying 50% from September 2022 to July 2023.

This opportunity presented DESPITE all the negativity you read in the mainstream press about the stock market at the time.

Again, my point is…

…the big rally in gold shares is a taste of what I believe is brewing across the sector…across ALL small-cap shares.

That’s why I’m shouting from the rooftops for all to hear….

As I say, I’m proud to be editor of Fat Tail Investment Research’s longest running flagship small-cap advisory letter, Australian Small-Cap Investigator.

It’s a letter with a history for unearthing and backing some of Australia’s great innovators…before they became big stocks.

Of course, not all recommendations work out. This is the small-cap sector after all. But we’re never afraid of sticking our neck out.

Because when you get on a good one…boy it’s a ride.

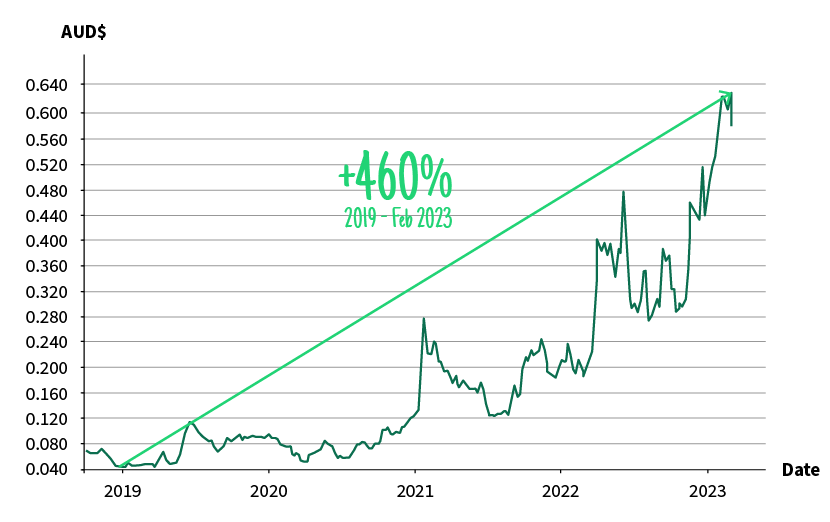

For example, had you been a reader back in June 2019, you’d have learnt about a tiny, unknown resource stock called Arafura Rare Earths.

The stock code was ARU. It was 12.5 cents per share at the time.

We said back then that rare earth resources OUTSIDE of China would catch the eye of the market because of the China/US trade conflict.

It doesn’t get more bang on than this.

By February 2023, ARU hit an all-time high of 70 cents per share.

Take a look at this flier…

That’s a 460% rise.

Australian Small-Cap Investigator readers got most of this move too…banking a 380% gain back in March 2023.

Now consider the wider context here…

Our readers couldn’t be sure that Arafura Rare Earths would be the star stock in 2023 if they backed it way back in 2019.

Australia didn’t look too flash back then, either.

And then Covid came…and rising rates…and a potential recession.

Arafura soared anyway.

All you had to do was put a small stake down…and hang on.

Now, we can’t use hindsight bias here, either.

It’s possible you could have held on…and under different circumstances…ARU could’ve tanked like a free diver wearing concrete boots!

Over the years, I’ve had few recommendations do exactly that.

Small caps are risky, volatile, and unpredictable. They are for your high-risk capital only.

They may also not be for you if you’re down to your last $500 in savings, have a monster mortgage or big pills to pay.

But you can also invest as little as $500 too. You can decide if this sounds right for you.

And as for ARU, that’s yesterday’s news now.

Now it’s time to be thinking about which shares might be the investor darlings in 2024 and 2025.

We’re already getting a taste of the potential for the next wave of ASX stars to storm higher….

Look at some of our current gains from 2023 (as of 7 Feb), which, I’m sure you’ll agree, was pretty tough going…for most of the year anyway.

Of course, it’s not all in the green and looking rosy.

There were a few false starts for us and a couple of total duds too in 2023…but overall, 2023 was fun for my guys!

With the exception of one of those stocks, they’re all still open positions, and I think there’s plenty more coming up for all of them.

These are just a taste of the potential in the market currently.

There are so many potential opportunities out there.

Let me tell you about one specifically…

Here’s the background…

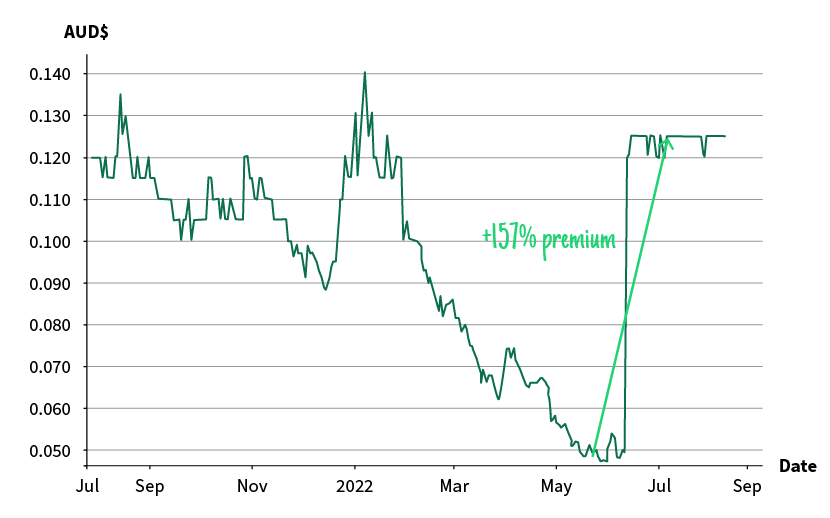

In December 2021 one share of Tuas [ASX:TUA] was over $2.

By June 2022 one share was barely holding above $1...

Investors dumped the stock in a panic over the prospect of a global recession.

But here’s the thing…

The share price performance had nothing to do with how the business was doing.

Tuas sells mobile subscriptions in the Singapore market.

Australia doesn’t even matter to it!

In the second quarter of Financial Year 2022 it had 487,000 subscribers.

Now it has over 640,000.

And you know what?

The man behind Tuas is one of Australia’s most successful — and richest — entrepreneurs.

You could only know that with meticulous research.

David Teoh is famously publicity shy. He doesn’t give interviews.

He doesn’t crow about what’s he’s up too. He barely even speaks on the analyst calls.

But he’s also a cold, hard money maker…

I put it like this to my readers back in March 2023…

‘Come to the fore, David Teoh!

‘Do you know the name? Probably not.

‘David Teoh was the mastermind behind the rise of communication firm TPG.

‘TPG made Teoh a billionaire. It’s an amazing story, considering he emigrated to Australia from Malaysia and began selling computer parts.

‘Teoh merged TPG with Vodafone back in 2020 and later stepped down as Chairman of the business.

‘But he kept an iron in the market fire with a smaller company called Tuas [ASX:TUA].

‘This is something like the original version of ‘TPG’ reborn, except Tuas’s market is now Singapore instead of Australia.

‘Tuas trades on the ASX for around $1.30 per share and has a $600 million market cap.

‘David Teoh isn’t afraid to back himself. He entered the Singapore market from scratch and built a 4G network to take on the incumbent providers.

‘He used a familiar move too: undercut them on price to win market share!’

Since then, Tuas has ran back toward $3 per share.

The chart has investor psychology all over it…

As of February 2024, Tuas is up over 153% for my subscribers.

It’s still an open position on my buy list as I write…

(NOTE: that does NOT mean you should buy it. Things change fast on the stock market. And my specific buying instructions are only available to Australian Small-Cap Investigator subscribers.)

The point I’m driving home is that in the same timeframe that Tuas rose 153%, the ASX 200 went up about 4%…

Let me tell you, of course, that Tuas could keep soaring from here…

Or it could crash and burn.

That’s the wild, speculative ride of backing small-cap stocks.

It’s the risk you take. They certainly don’t all go up like Tuas…and they aren’t all backed by David Teoh.

But personally, I’d rather back one of Australia’s best businessmen growing sales and subscribers than some doddering old stock that passed its best years ago.

Let me illustrate why…

Small-cap stocks are companies with market capitalisations usually between $50 million and about $2 billion.

They tend to be innovators...start-ups...or explorers.

And they’re typically listed on the ASX for anywhere between one cent and three bucks a share.

Because of their tiny size, it doesn’t take much trading volume to move the value of a small-cap company by a lot — up OR down.

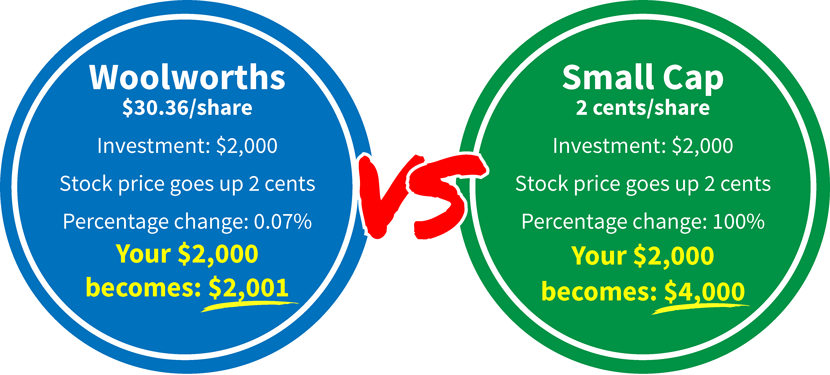

Here’s the logic…

If Woolworths’ shares go up by 2 cents, big whoop.

But if a small-cap stock goes up by 2 cents…it can double your investment fast.

Here’s a hypothetical example:

Woolworths — on the left — is a large-cap share, sometimes known as a ‘blue-chip’ share. It’s one of the largest companies in Australia.

At around $35 a share, Woolworths is probably not going to double in a week.

In fact, there’s little chance of any blue-chip share going up by any more than a handful of percent in the short term.

Sure, they may pay a small dividend a couple of times a year…but if you’re looking for stunning profits, forget it.

A quick note of caution too on this point...

What gives small caps this ‘hyper-gearing’ quality is also what makes them the riskiest stocks on the market.

Put another way: Woolworths is also unlikely to HALVE in a week.

But some small caps can.

However, as above, so many stocks in the sector have been hammered that I believe you’re almost crazy NOT to dip your toe in now.

Let me reiterate…

There are potential opportunities like Tuas and ARU all over the market.

(And I have five of them ready to tell you about right now, if you’d like to step inside and see if Australian Small-Cap Investigator is right for you — keep reading).

I’m not saying there’s no more risk. I can’t promise you that.

But let me emphasise this point…

You need to know a little about how markets work to see the opportunity here.

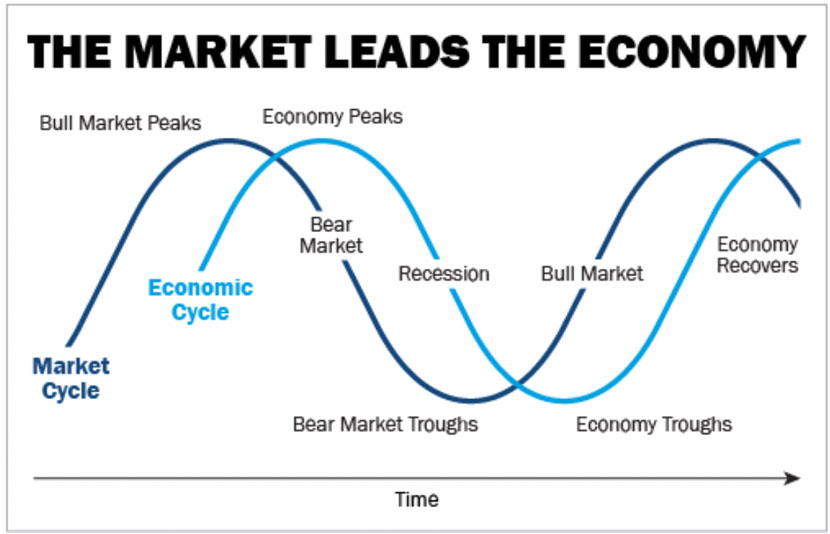

Here’s a stylised chart to see that — historically anyway — the stock market will bottom ahead of the recession/slowdown in the economy…

As my US colleague Matt Weinsheck puts it,

“The market leads the economy. Stocks are priced on expectations. So a bottom in the market will come before a bottom in the economy.”

However, a stylised chart is all well and good, in theory.

We’re both human.

It can feel risky to put your money into the market at times like these.

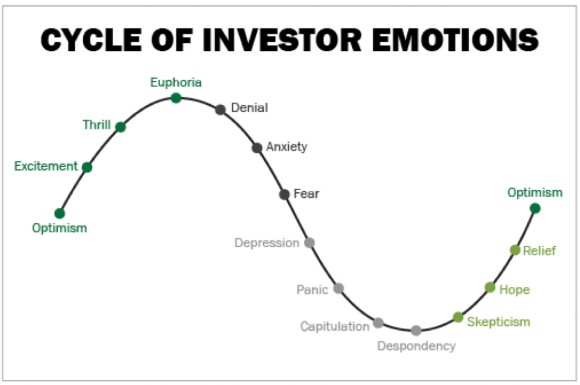

That’s why investors usually ascend this emotional curve as well…

I’d say most people are somewhere between despondency and scepticism right now.

By the end of listening to me you should be at hope…and prepared to invest on it!

Do you see the implication?

In my view…

Like I said, everything I see says that we’re now in the first phase of a new bull market.

Here’s what I told my subscribers back in March 2023, in the heat of the US banking crisis that gripped the markets earlier in the year…

‘There’s another reason I lean to think the next few years could look like the boom years of the late 90s.

‘Back then, the internet was the hot new thing that sent US productivity soaring.

‘It seems to me we could be up for the same thing as artificial intelligence finds more and more commercial application…

‘Forecasting markets is a tough game. So much can change…as we’ve just seen in the last week or two.

‘However, as far as I’m concerned, dips are still opportunities to buy if you’re in for the long term.’

The Nasdaq rose 43% in 2023!

We caught this AI tailwind on one of our former Australian Small-Cap Investigator recommendations too.

See how semiconductor firm Weebit Nano [ASX:WBT] took off from October 2022 to March 2023…

Readers of Australian Small-Cap Investigator had the chance to bank an 80% profit on that one too.

More opportunities should be coming.

There’s another nice way of putting it…

Fund manager Nick Griffin said recently…

“‘The reality is you can spend the last 20 years in Australia looking at macroeconomics.

‘“You could have tried to work out what interest rates were going to do, what the government was going to do, or what was going to happen to the budget deficit,” he said.

‘Or you could have worked out blood plasma was going to be pretty useful to cure diseases, and you could have just bought CSL.’

Now’s the time to be actively hunting for the next CSL.

We should have the market tailwind at our back soon enough too.

A new bull run brewing now is perfectly in accord with the history of markets.

There’s a classic Aussie investment book I keep in my office library.

It’s called Building Wealth in the Stock Market. A private investor Colin Nicholson wrote it.

It’s an outstanding guide to navigating the stock market with your hard-earned money at risk.

Colin gives us the following list to identify that we’re in stage one of a new bull market — and not, say, a so-called “bear market rally”.

Colin called this part…

Colin also listed some indicators to identify it. They were:

Colin also listed some indicators to identify it. They were:

Today, this looks spot on to me.

Now it’s time to hunt for the stocks oversold, misunderstood, and ready to grow.

This is exactly what the professional investors are doing: accumulating cheap stocks!

Here’s one example:

‘Aussie equity investment manager Datt Capital also believes the market timing is opportune to uncover alpha in the ASX small caps space in 2023…

‘“Many of these small caps, which offer investors access to earlier-stage, higher-growth businesses, are currently trading on single-digit earnings multiples, and, as such, present a compelling investment story,” he said.’

I couldn’t agree more.

You have a chance right now to swoop in and pick up incredibly cheap small-cap shares, some selling at 50-90% off their former highs.

We can see the massive opportunity to acquire cheap shares in other ways too: mergers, buyouts and acquisitions.

Look at this activity on the ASX lately…and the gains for shareholders:

Wesfarmers bidding for small-cap stock Silk Laser Australia [ASX:SLA]:

Gold miner Ramelius Resources going after smaller player Musgrave Minerals [ASX:MGV]:

International player Thales swallowing Tesserent:

There could be a whole lot more coming too.

The Australian reported…

‘At least one Australian private equity firm is understood to have started turning its attention to listed buyout opportunities among the non-bank financials as valuations come under heavy pressure in the high interest rate environment.’

Get it?

OK, I hope you’re with me by now.

I’ve prepared a fresh report detailing my five of my favourite ‘Big Buys’ ahead of the coming ‘small-cap supernova’ rebound in 2024.

Here’s a brief rundown of each play it uncovers…

In my report, you’ll get the rundown of why I think these opportunities are so good, and the risks they come with.

But really, this report is just the start of what I have for you.

You can access this report today by commencing a 12-month subscription to Australian Small-Cap Investigator, covered by a fully guaranteed membership-fee refund period for the first 30 days.

You can access this report today by commencing a 12-month subscription to Australian Small-Cap Investigator, covered by a fully guaranteed membership-fee refund period for the first 30 days.

Each month, you’ll receive a new recommendation along with bespoke market updates, occasional exclusive interviews with market insiders, and more.

The usual price for a 12-month subscription to my flagship small-cap advisory is $199.

In my opinion, that’s already a steal.

But if you respond to this invitation by filling out the secure Order Form, you can receive a full year of my work for half that price — just $99.

In other words, the first six months are essentially FREE.

That means for about $8.25 a month, you can take advantage of everything I’ve highlighted today.

You’ll get instant access to my top five small-cap plays in Australia today.

These are the first stocks I recommend you look at now — before the bull market really kicks off.

Of course, they come as part of subscribing to my monthly research letter, so you’ll have no shortage of ideas.

I’ve been getting great feedback this year too.

Take a look at what some of my subscribers are saying…

SA from NSW wrote…

‘Excellent service. Priceless info at a very reasonable price! The team really know their stuff.’

BM said…

‘My favourite investing subscription, simple.’

TB has a different sort of complaint!

‘Frustrating...only because I don’t have enough money available to invest in recommended stocks. Apart from that I like it.’

And CG is happy…

‘Callum has recommended stocks which have jumped off the chart.’

KH from NSW is enjoying it too…

‘I think you are one of the best services out there.’

Now, I’m not going to assess myself in that way by agreeing with these readers. And I’m not going to expect you take their words for it either.

Instead, I’d like you to step inside and see if my work suits you, firsthand.

What are you waiting for?

Let’s get going…