Dear Investor,

It’s no secret the ʻold economyʼ is coming back.

Tech stocks are out. Real asset stocks are back in.

You saw the first hints of this trend-change in late 2022/early 2023 market action.

Mining majors like Fortescue and BHP hit gains around 50% and 40% from their lows recorded in late October 2022.

But thereʼs a deeper story here.

One thatʼs bigger — and potentially much more profitable — than the obvious one the mainstream is cottoning onto…

Youʼre about to see data and conclusions

garnered from INSIDE the very industry thatʼs

starting to ramp up once more.Itʼs these data points that have led me to put

URGENT BUY labels on what I believe to be five

KEY players in what happens next.

Even if you donʼt add these stocks to your portfolio, what follows should put you way ahead of the mainstream crowd in the months ahead.

Youʼll have a rare perspective on whatʼs happening right now…where Australia sits in a new and unique commodity cycle…the kind of stocks I see pulling away from the general indices for at least the next few years…

…and, most importantly, WHY this new sub-boom is taking place in such an uncertain market for investors.

My name is James Cooper. And my specialty is in mining exploration.

Over a career spanning 15 years as a working geologist, I’ve had deep involvement with ASX-listed explorers.

I believe that, for the speculative investor, theyʼre going to be the best game to play for the foreseeable future.

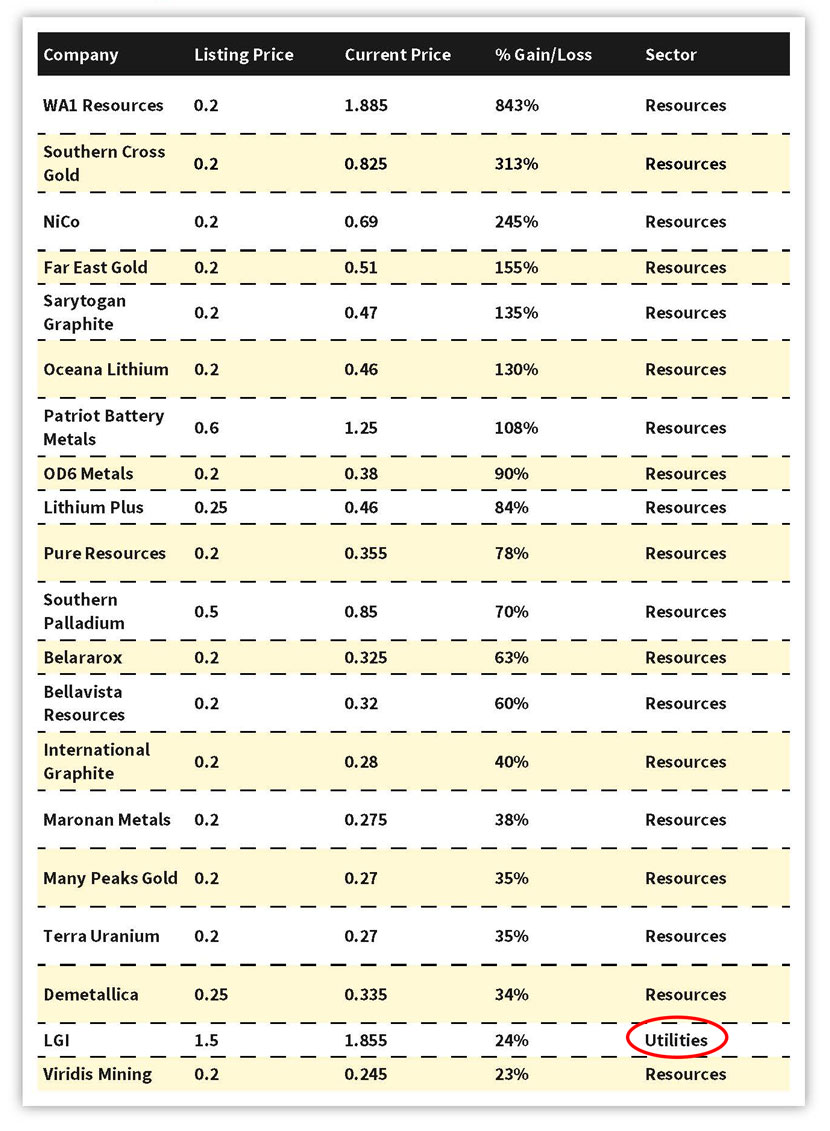

For example, take this for a clue. Have a look at the top 20 IPO performers from 2022.

The ones that listed strong…and then just kept on rising…despite the bad market.

All but one was related to mining:

Source: Stockhead

Among the top-performing IPO shares of 2022, mining stocks took out the top 18 positions.

Not a utility, carmaker, or new tech listing among them.

Of the top-performing 70 IPOs last year, 58 of them were resources.

Even in the earliest days of the mining boom…I donʼt recall a level of IPO dominance quite like this.Something BIG is brewing…

Iʼve been involved in or close to several mining IPOs.

And I know when capital flows into the exploration sector…itʼs a sign of a long-term secular shift in the market.

You see investment flow into producers first…

This is what weʼve seen over the last couple of years as Australiaʼs largest producers break past their early 2000s boom-time peaks.

As momentum continues…capital find its way into exploration, the most speculative part of mining.

These are the ore-hunters Iʼve worked with and specialise in.

Itʼs this next leg-up in the cycle that results in a flurry of IPO listings for new exploration companies.

This is what you saw in 2022. And Iʼm betting it will ramp up further in 2023 and 2024.

For example:

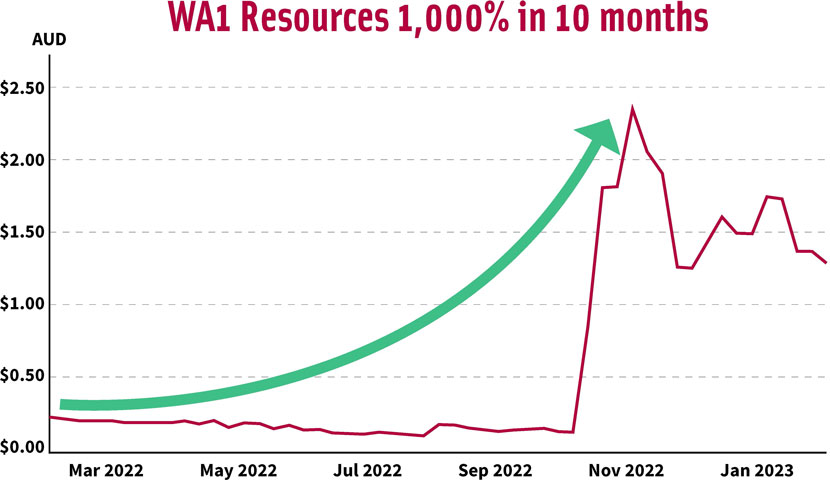

Source: Google Finance

Past performance is not a reliable guide to future results.

WA1 Resources [ASX:WA1] listed for 20 cents in February 2022.

By November, it hit $2.28.

A massive 1,000% gain on the listing price within in 10 months.

Itʼs since dropped back to $1.22.

WA1 is an example of a torrent of small explorers coming to market to fill the supply gap in critical minerals like niobium…

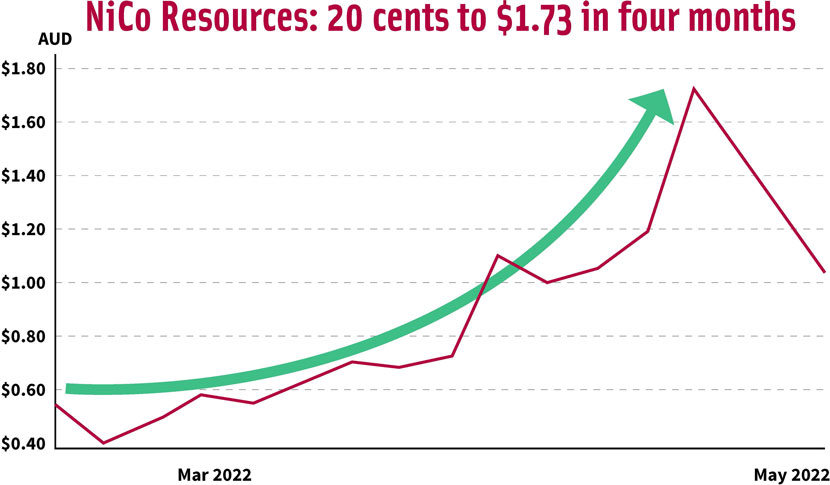

Source: Google Finance

Past performance is not a reliable guide to future results.

NiCo Resources [ASX:NC1].

A nickel, cobalt, and manganese explorer that hit the index in Jan ’22.

By years’ end, its shares were up 360%.

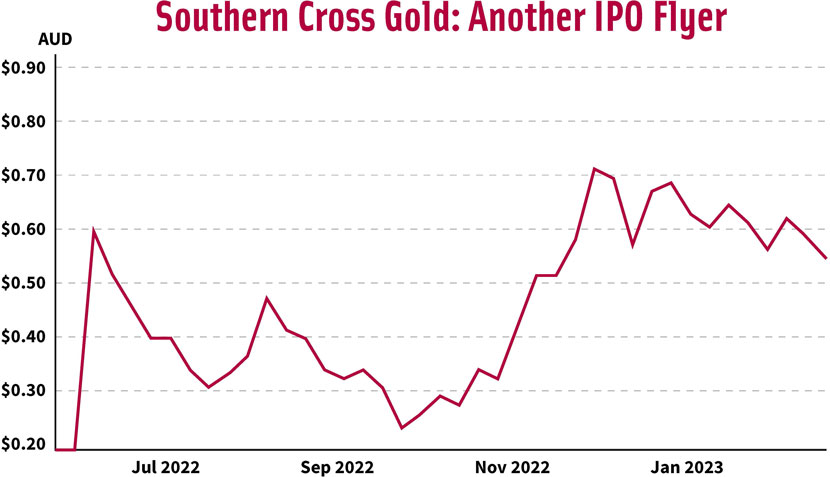

Source: Google Finance

Past performance is not a reliable guide to future results.

Southern Cross Gold [ASX:SXG].

IPOʼd in May at 20 cents.

Shares now trading at 64 cents.

Of course, it was not a free pass to all mining IPOs.

Some, like Southern Cross Gold, came out firing but have given half their gains back.

Others, like Octava Minerals, listed and have gone down ever since.

And, as Iʼve mentioned, recent wider market selling has pulled a lot of these IPOs down more than is justified.

After a huge outperformance in 2022, we were bound to see a correction.

But my contention is, this is a big buying opportunity.

Just like the mid-2000s…the pendulum is swinging back to REAL ASSETS.

And none of this has filtered through to the mainstream consciousness yet.

And thatʼs your ʻinʼ as a speculative investor.

Your window of opportunity

Look. I’m a former mineral hunter who’s worked over the last 15 years with tiny explorers and big-name producers. And it’s my contention that we’re now entering a new kind of mining boom.

Some investors are cottoning onto this fact already.

And realising that if you’re going to speculate on stocks…this is probably the ‘only game in town’ for the foreseeable future.

I’d go one step further…

I predict that the market-topping gains we’re witnessing now are just a precursor of much bigger potential gains to come.

Most investors starting to pay attention to this new boom still remain focused on the large producers.

Most investors starting to pay attention to this new boom still remain focused on the large producers.

That’s why you’re seeing more and more mainstream reporting like this 11 January headline:

But what Iʼm hearing from colleagues and seeing first-hand on the ground…is that weʼre about to see a major focus on exploration.

And, as an investor, itʼs definitely worth allocating a small percentage of your portfolio right now to capture large gains…before more investors pour into the speculative end of the market in 2023 and 2024.

Below I’m going to showcase five ideas to get you started.

There are three primary ones.

These are small- and mid-tier miners I believe are going to become much, much bigger companies over the next 2–3 years.

Each has an X-Factor thatʼs not yet apparent to the wider market.

Several are about to bring MASSIVE resources online. One has an insider onboard who turned a 1- cent shell into a $15 billion producer in the last mining boom.

The idea is simple.

Get in on these stocks at the right price now…and you could see really big capital appreciation. In quick time. Regardless of which direction ʻstandard universeʼ stocks go in.

Then…if youʼre willing to REALLY push the boat out risk-wise…

Iʼm going to introduce you to two ultra-wildcatters.

Tiny explorers I believe have the potential to ride this boom to large-cap status if they play their cards right and get a bit of luck going their way.

Fortescue Metals was the poster child of this kind of play in the last mining boom.

Iʼm certainly not saying these ultra-junior plays will gift you 130,000%, as Fortescue did to investors who got in early.

But we are aiming very high with these two highest risk plays. Invest in them with caution.

In fact, that really applies to each stock weʼre going to get to shortly…

These are make-or-break times for the speculative investor.

The WIDER market is under significant strain as it looks to unwind 2023ʼs early gains.

But with volatility brings enormous opportunity in this unfurling Aussie resources boom.

I firmly believe the coming weeks could offer investors one of the last great opportunities to add quality resource stocks still trading at attractive valuations.

Like I said, what follows are my five PRIMARY recommendations.

Given the volatility…they may not necessarily be in my buy zone at the time youʼre reading this.

But the time to buy will come and all I ask is that you hear what I have to say on them.

Make your own judgement.

TRACK THEM.

From then on, we are setting up for a long secular move in commodity markets.

Of that I am confident.

There are zero guarantees of success even when the cycle appears to be turning.

Plenty of mining explorers blew up and delisted, even during the last mining boom.

Last year…despite the fact that mining clearly broke out from most other sectors…we still saw 14 explorers drop out of the $500 million market cap club.

And, despite resource stocks completely dominating the ASX IPO performance table last year… youʼll find some down the bottom of that table too.

So it goes without saying…

If youʼre going to consider buying any of my selections, you need to do it with your eyes wide open.

You could lose money.

With that caveat out of the way…

I started my new explorer portfolio project last November. Already one of these moves has flown above my buy-up-to price.

Even with the recent selling, itʼs still up around 50%.

However, itʼs a long-term play. And at some point, it may pull back and give you a chance to enter at the right price.

These prices move fast. Up and down.

So, all the following recommendations come with strong advice that you only buy at my suggested prices, when the time is right.

In my view, these are exploration stocks cornering tangible assets thatʼll dominate the investor landscape over the coming years.

At least three are candidates for buy-outs from much bigger producers.

If that happens, you could see really big upward share price moves in a matter of weeks.

As we see a great shift in global capital that brings on more investment into the exploration side in 2023 and 2024…Iʼve pinpointed these small stocks to be prime beneficiaries.

No more so than this first stock move:

PLAY #1

ONE STOCK ABOUT TO UNLEASH

WORLD’S SECOND LARGEST

GRAPHITE RESERVE

2022 was a breakout year for lithium stock investors.

Companies like Argosy Minerals [ASX:AGY], Core Lithium [ASX:CXO], and Mineral Resources [ASX:MIN] piled on stock gains while the rest of the market suffered.

Soaring demand…restricted supply…and a relentlessly growing EV battery market were the drivers.

As we entered 2023, though, the heat cooled in the lithium market.

That happens. And is to be expected going forward.

Even in a long-term uptrend, when things get too hot too quickly, certain pockets will temporarily correct.

The big question you should be asking now is:

What’s the lithium of

2023/24?

My bet is graphite.

Iʼm not alone here.

Stockhead recently released an article saying graphite is poised to ʻdo a lithiumʼ in 2023.

I think theyʼre right.

But that’s only part of the picture. For the real story, you need the geology perspective.

As an exploration geologist, I can tell you now that lithium, nickel, and cobalt are the three headline resources driving the EV transition around the globe.

But graphite is the forgotten fourth.

So far, itʼs the ignored mineral in the battery trend.

Graphite is used in anodes of lithium-ion batteries...and needs a massive 600% increase in its current production to meet future demand. EVs need 40–60kg of graphite…roughly 40 times more than the required amount of lithium.

Now…

Thereʼs one specific type of graphite that commands a premium in the market right now — Purified Spherical Graphite (PSG).

Trust me.

Mining capacity for PSG is nowhere near meeting the demand thatʼs coming.

In a year where lots of these kinds of plays took off, graphite stocks had subpar trading on the ASX.

Theyʼre still in the doldrums.

But I see a flip in the market coming…soon. And getting ahead of it…with the right couple of stocks…could see you making a lot of money over the next 24 months.

From what Iʼm seeing on the ground…and projecting ahead…I predict a huge supply gap opening soon. On par with lithium last year.

So, whatʼs the best stock to play it?

You COULD go with Syrah Resources [ASX:SYR].

The obvious choice.

Itʼs still down two-thirds from its record-high in 2016. But itʼs up 10-fold since its pandemic lows.

I would say Syrah could benefit significantly from the coming graphite supply crunch…and end 2023 with a higher price than where it currently sits.

So, if you want to play as safe as you can in this field, buy Syrah.

Itʼll get renewed investor attention from the scarcity/underinvestment/sharp pickup in demand from the battery maker equation.

But Syrahʼs a billion-dollar company.

Itʼs not a true graphite explorer…which is where I see the REALLY big gains coming from soon.

My selection here is much further down on the graphite food chain.

Much riskier. (And even buying Syrah is still risky.)

But itʼs sitting on a proven reserve. One, when unleashed, could potentially become the worldʼs second largest.

Iʼve gone deep on these guys.

And the more Iʼve dug up, the more excited I am.

This ore body ticks ALL the right boxes from a mining and geological perspective.

Itʼs a high-grade deposit that sits just five metres below the surface, making extraction extremely low cost. Itʼs also a geometrically advantageous flat-lying ore body. Making it easy to mine, which also lowers mining costs.

Most importantly, though, the reserve is high-grade and MASSIVE.

This company is on track to become a unique non-Chinese processing option for graphite in the scarcity years ahead.

Who are they?

And why the heck are they currently trading below 30 cents…if theyʼre such a clear leader in the graphite recovery theme?

Iʼm naming this stock…and have outlined why I think it has the potential to bust out of multiyear sideways lows to be among the top ASX performers come Christmas ʼ23.

Before we get to that, you need to hear about my second play, which is closely linked to what I see about to unfold in the graphite space…

PLAY #2

THE BEST ZINC PLAY ON THE ASX

(WITH AN ACE UP ITS SLEEVE…)

Zinc is a second critical metal that’s about to get renewed attention over the next 12 months.

Certain green energy companies are racing to develop a water-based zinc-ion battery…one that has the same power, performance, and carbon footprint as lithium-ion batteries…but with less safety risk.

My second driller selection is a zinc player emerging from the Pilbara.

Once thought of as a giant slab of iron ore...the region is now seen as a richly endowed critical mineral province.

A new generation of explorers are rising there.

Stock is one of the most promising…

It’s a late-stage explorer knocking on the door of production.

As more investment floods in…creating more competition for land holdings…you want to own companies with a first-mover advantage.

This zinc play has already started drilling and testing open mineralisation.

665 metres have been drilled so far.

When the first results (called assays) are released…and if they’re positive…that’s when you could see the first round of share price fireworks from these guys.

Now, more than ever, it pays to follow the insiders who made their fortunes in the LAST mining boom.

They have an uncanny ability to buy the right projects at precisely the right time in the market.

I’ve been tracking one such insider…and he’s turned his attention and experience to THIS soon-to-be-zinc producer.

This guy turned a particular 1-cent shell into a major $15 billion producer in the last cycle.

In 2023, he’s turning to critical metals. And THIS little-known player…

But there’s one more reason I’ve put an urgent buy on them.

They also have a little ace up their sleeve.

A ‘side gig’ that’s going to provide cash flow while they keep drilling this year.

Trust me from experience…

It’s SUPER RARE for an explorer to have access to immediate revenue WHILE they’re drilling…cash that can be deployed toward project development, without the need for capital raisings or debt.

These are the kind of X-Factors you need to target when picking drilling stocks going forward.

It’s like a winning lottery ticket if you find an explorer…sitting on a key resource…with access to income at the early stage in its development cycle.

Before we get to specific names, ticker symbols, and buy-up-to prices, itʼs important I introduce myself properly…and explain why you should take these five stock recommendations seriously.

Decades of experience

‘kicking rocks’

James Cooper

As I say, my names is James Cooper.

I’ve clocked years of geologist ‘walkabout’ in the Outback and in Africa, contracted by the small explorers and the major players.

And as we move into a scarcity-driven resources bull market…there’s ONE THING you need to keep front-and-center in your mind…

It takes years of dedicated mineral exploration to find the NEW bodies of minerals that are going to be needed in the next few years.

I’ve poured over everything from diatomaceous clays (used in kitty litter)...to copper in Zambia...to helping develop an iron ore project that fed directly into making Toyota Prados and Outlanders.

As I keep saying, I think actual rock hunters are who you should be listening to when it comes to up-and-coming mining stocks.

Not posters on mining stock forums. Or investment journalists.

You need a guy who knows how to dig into actual dirt just as well as balance sheets.

I’m not a hobby pundit; I’ve been right in the thick of it since the rise and fall of the LAST boom…and what came afterwards.

Through the pandemic, for instance, I was with gold mining behemoth Northern Star. In 2021, I was headhunted to be Dacian’s Senior Exploration Geologist...in charge of the company’s growth in rare earth projects.

Put simply: I know through experience how hard it is to make these finds.

Right now, I’m seeing direct evidence of resource companies starting to frantically sift through old drill cores in the hope of finding a strike in critical metals.

It’s an inexpensive strategy that could gift a company an instant windfall.

But it’s a long shot.

And these small wins won’t be enough to supply the breathtaking level of demand that’s coming...

Many exploration geologists have spent careers spanning 40-plus years...unable to make a single find that led to the development of a mine.

This is not due to a lack of skill or knowledge either.

It’s based squarely on the issue that viable bodies of ore, as well as oil and gas fields, are becoming increasingly harder to find.

This is happening at a time when exploration has suffered from critical underinvestment for more than a decade.

‘Perfect storm for commodity prices’ is a cliché.

But there is no truer description of what’s coming.

Each of my stock buys are based on EXACTLY what I’m seeing and hearing in the space at this very moment.

Take gold, for instance...

PLAY #3

IF YOU THINK GOLDʼS RUN WILL

CONTINUE, OWN THIS DRILLER NOW

Noticed the gold rally?

Itʼs quietly powered into 2023.

Gold is its own thing…different dynamics at play here from the critical metals weʼve been talking about so far.

I took an exploration contract with gold major Northern Star a few years after theyʼd bought up Barrick Goldʼs Australian assets for a fire sale price.

Generally, the big players are not my cup of tea. But I learnt some valuable insights on the ground exploring in the goldfields area surrounding Kalgoorlie.

In early 2021, I moved back to my comfort zone and took a job with Dacian as the Senior Exploration Geologist in charge of the companyʼs regional projects.

Dacian was a gold producer, but gold wasnʼt the only commodity we focused on.

Nickel, copper, and Rare Earth Elements (REEs) were also targets in the mineral rich grounds surrounding the small Western Australian township of Leonora, around four hoursʼ drive north of Kalgoorlie.

When it comes to gold, though, and which stocks to buy to leverage goldʼs resurgence…you need to be really picky right now.

I have selected just one.

Itʼs a prime example of the quiet ʻdecouplingʼ from the rest of the market that some of these stocks are undergoing.

Itʼs steadily moved up in the last year as swathes of other stocks have sold off.

But in my opinion...itʼs still MASSIVELY underpriced.

Itʼs WA-based, with projects that span from the Pilbara to just north of Perth. It has a former CEO of a HUGE player thatʼs just come on to run the show.

I would say if youʼre going to buy just ONE stock on the ASX this year that leverages further up- moves in gold, you should make it THIS one.

Iʼve compiled a comprehensive due diligence report on this opportunity…as well as the two other plays.

Itʼs called:

Three Prime ‘Age of Scarcity’

Stocks to Own

You can get this report as part of a new investment advisory I recently launched.

You can get this report as part of a new investment advisory I recently launched.

Itʼs called Diggers and Drillers.

I believe, itʼs perhaps, the most important newsletter you could subscribe to between 2023 and 2030...

Diggers and Drillers has a bit of a backstory.

It was the publishing company I now work for’s first-ever newsletter. Fat Tail Investment Research (then called Port Phillip Publishing) established it for the last mining boom. And the call-to-arms then was just as emphatic as this one. As they said at the time...

‘The sheer magnitude of what’s about to take place is incredible.

‘I can honestly say I’ve seen nothing like it. Australia is about to become the commodities centre of the world.’

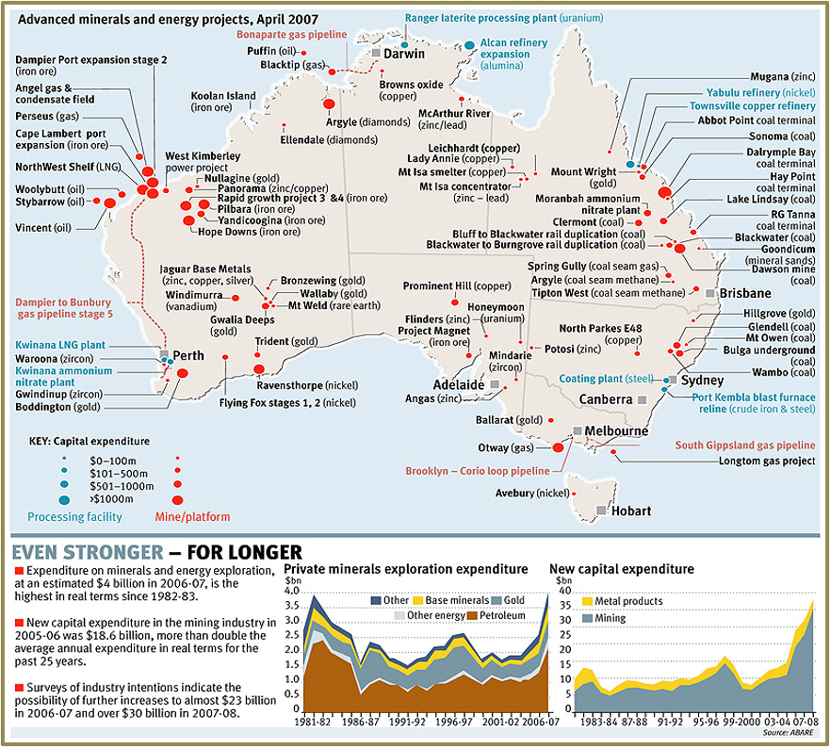

This was the magnitude of those projects by April 2007:

Source: ABARE

Past performance is not a reliable guide to future results.

I’m sure you’re aware of the wealth our country...and SOME early stock investors...made over those boom years.

China had an insatiable appetite for our iron ore.

But that boom, like all booms, wound down.

Mining stocks started to correct...the opportunities began to dry up...and Diggers and Drillers was put on indefinite hiatus.

One of the benefits of being an independent financial research company is we only have one remit: Is this research in our readers’ interest?

I agreed to join Fat Tail Investment Research last year because they don’t publish newsletters for the sake of it.

And don’t put out a mining stock newsletter just because ‘there’s a bunch of mining stocks on the ASX’.

The timing of the cycle has to be exactly right.

Well, the cycle has turned again. And, as such, I’ve accepted the task of taking Diggers and Drillers out of retirement.

The aim of this next-gen 2.0 version is simple:

To get you into the right

companies...at discounted prices...before everyone else

We only began this project last November. But already, I’ve been humbled by the dozens of responses I’ve already received from those who have joined me. No more so than this one, from Martin Breen of Coorparoo, QLD:

‘As a former senior exec of one of the largest energy companies listed on the NYSE, I can’t overemphasize how impressed I’ve been with James Coopers Diggers & Drillers subscription.

‘I was cautious and wary at first, wondering what I was getting into.

‘But now that I’ve been a customer for several months I feel very confident that James is exceptionally well qualified to find top quality resources investments in the ASX. For the modest subscription fee, if I placed a value on my time, I would make that money back in half a day. I have invested in three of his recommendations and even though it’s early days, I am already well ahead and feel safe with the profit margin buffer that has been built since the day I purchased.

‘If that’s not convincing enough for you, then I would strongly recommend you subscribe for James knowledge of both resources companies and markets.

‘Having been a senior exec myself, surrounded by global technical experts at the highest level, it is obvious to me that James knows how resources companies work, how to value their assets and assess their risks, and most importantly how to value the share price relative to the resources in the ground and risks from exploration phases through to development and production.

‘That is exactly what I’m looking for in a resources company adviser.’

And this, from Lawrence Li of Campbelltown, NSW:

‘James, I just want to say that I am grateful to be one of your subscribers and very much appreciate you sharing your knowledge and experience in the mining industry with us.

‘Also trying to buy into the shares that you recommended was an unbelievable experience, like ARU and RNU both not only went up like a rocket but also announced a share placement in a couple of days.’

Gavin W of Port Macquarie, NSW emailed to say:

‘Absolutely love it and this has become my favourite thing. I am thinking my greatest gains will come from this. Very promising so far!’

What these readers and I are doing is targeting a new kind of resources boom.

Australia’s last mining boom revolved around a steel-intensive economic transformation taking place in China...and, to a lesser extent, other emerging Asian countries.

I think this next one is going to be bigger.

As another commodity trading insider predicted on 12 September 2022, we’re now on the verge of ‘the biggest commodity supply squeeze ever in history’.

Not just iron ore and coking coal.

Rare earths, energy, and other critical resources are now going to be in the mix, too.

It’ll involve almost every country and every supply chain in the world.

Each explorer I detail in ‘Three Prime Age of Scarcity Stocks to Own’, has what I see as a distinct first-mover advantage.

If you’re going to consider buying them now, there’s one critical point I need to hammer home…

The ‘everything bubble’

forgot to include

commodities

‘Absolutely love it and this has become my favourite thing. I am thinking my greatest gains will come from this. Very promising so far!’

Gavin W, Port Macquarie, NSW

‘I find this service one of the most potentially valuable advisories from the Group. First hand professional and technical knowledge of the resources sector enables James to provide investors with tailored recommendations well in advance of broader market awareness. Good work James, value you input.’

John Symons, Toorak, VIC

‘Absolutely love his clear and well-argued reasoning, have followed ALL recommendations and am well ahead already. So glad I am a subscriber.’

Peter S, Mosman, NSW

‘To have such an expert as James share his knowledge so “freely” is amazing. I have profited already and am extremely grateful.’

Malcolm, Bellerive, TAS

‘I have found D&D to be a wonderful service, reports are easy to read and understand. With James having worked as an insider to the mining sector, I think his knowledge flows through to his service. (He makes me want to buy every stock and lots of them!!)’

Jenny D, Labrador, QLD

‘I have been thoroughly impressed with the new Diggers and Drillers' service and the value for money it offers. James has produced some very well researched long-term ASX listed recommendations so far while clearly outlining the upside and downside risks for each recommendation. Keep up the good work, James!’

James Dianella, WA

‘Excellent start. Thorough, detailed analysis. Enthusiastic and positive, with sound logic to support ideas. Looking forward to seeing how things unfold.’

AJH, Alexandra Headlands, QLD

‘I think that this service has been introduced at exactly the right time in the cycle. I am looking forward to good results!’

RGL, Sydney, NSW

‘Amazing work getting James Cooper on board. You’ve found a unicorn having a seasoned geologist that understands the field and inner workings of mining companies well, and where they’re going (analysing what they’ve acquired, future exploration potential implications and also takes care to look at who’s running the show within each company). James also puts the pieces of the puzzle together that most can’t see (yet). There’s a wealth of opportunity in the years to come and likely something not too far ahead on the horizon in the mining diggers and drillers space for Australia. Knowing who to back and who some of the rare earths and precious metalsplayers are likely to be (now) is invaluable.’

Josh G, Adelaide, SA

‘I'm loving the technical knowledge that James shares about the mining industry and the expertise he brings in sizing up projects. So far I'm happy with the service and the recommendations James has provided.’

Cam N, Melbourne, VIC

‘Excellent service that gives you the confidence to invest in this sector.’

Miranda, NSW

‘I like the clear explanation about the industry and its history and how that relates to the choice of stocks. I enjoy reading the articles and can understand the logic. Combination of fundamentals and technical analysis from an industry insider is fantastic. It is early days but the stock portfolio seems to be moving in the right direction.’

Elaine, Preston, VIC

‘I’ve long been keen to invest in mining skill in investigating them to be confident in doing so. I’ve found James’s recommendations to be thorough and very believable and written in a way that is easy to understand. Please keep up the good work.’

MW, Redcliffe, QLD

‘Love it. James seems to know what he is talking about. Certainly, he provides excellent information and knowledge that reek of good sense. My preferred style.’

Bruce S, Maroochydore, QLD

You might be wary about making stock speculations right now.

Even in light of the strength that’s come back to markets recently.

Last year’s correction was brutal.

But that big bubble that blew up and popped didn’t include mining shares.

As someone who lives and breathes resources, it’s becoming blindingly obvious the insurmountable task the global economy faces in delivering not just critical metals for the future energy transition but food, water, and energy.

The period from 2013–21 has mistakenly been termed the ‘everything bubble’.

It actually wasn’t.

Resources were NOT part of that boom period…far from it.

The term itself diminishes the significance of resources as an asset class, assuming that ‘everything’ means the NEW economy.

Investors have ignored the onset of extreme scarcity of basic human needs for far too long.

The tech bust we needed to have has finally occurred…and still has some way to go yet.

Another ‘great asset transition’ has commenced.

It’s these tangible assets that will dominate the investor landscape over the coming years.

Each of the recommendations in ‘Three Prime Age of Scarcity Stocks to Own’ sit at the speculative spearhead of this trend-change.

You can download the full report now simply by becoming a member of my new Diggers and Drillers advisory.

You can see from the reader feedback that’s already coming in that we’re coming out of the gates firing on all cylinders.

I’m new to the financial newsletter space.

But I’m told by my publisher that feedback like you see to the right is atypical right after a launch.

So, we’re on the right track!

What you’ll also notice is that Diggers and Drillers is extremely good value.

Just $199-per-year is the official annual subscription.

BUT...

To mark the reopening of this advisory, we’re slashing that by half.

CLICK THIS LINK AND YOU CAN LOCK IN A SUBSCRIPTION FOR JUST $99.

And that crazy-low price is covered by a 30-day subscription refund guarantee.

Meaning, you can read my full due diligence in ‘Three Prime Age of Scarcity Stocks to Own’…

companies but not had either the knowledge or

...and STILL choose to get a full refund of your membership fee within 30 days if you so desire.

Look around. There aren’t many players in this game that swallow a subscription risk like that.

Recommendations like these tend to get locked right behind a paywall without any remote possibility of a refund.

It’s a great deal.

Hopefully it shows you how much conviction I have in what we’ve kickstarted here.

I think once you dig into these stocks and our gameplan going forward...you’d have to be crazy not to stick around after the trial period!

You can find out more on all these plays

now by clicking here to join

Diggers and Drillers for just $99.

Itʼs pretty clear weʼre entering some form of a new commodity boom. But this is going to be driven by scarcity rather than demand.

There are certain investments you can make right now that stand to benefit greatly from this.

Especially because youʼre an investor situated in one of the most resource-rich nations on Earth.

ʻThree Prime Age of Scarcity Stocks to Ownʼ are my best bets here for significant potential capital growth this year and next.

But, as I mentioned, Iʼd like to include two more slightly higher-risk bets.

Mining and exploration are inherently risky business.

All three stocks mentioned so far carry unique risk factors, which I will outline for you in your report.

But these two…even more so…

These are what I call ʻPhase Onersʼ. I typically ignore the very early-stage miners (at phase one in the development cycle). Thereʼs often simply not enough evidence or data available that allows me to determine whether the company has the potential for growth.

These are the ʻpenny dreadfulsʼ you see trading for cents.

Drill targets are developed on very subjective geological ʻideasʼ and rarely lead to success. In normal times, itʼs best to leave these penny stocks alone and wait for them to prove themselves worthy of your hard-earned cash.

Otherwise, itʼs all risk with very little chance of reward.

But, as you’ve seen, these are NOT normal times in Aussie mining…

So, I’m taking a calculated punt on TWO.

So, I’m taking a calculated punt on TWO.

Simply because the potential upside if we get it right is enormous.

I’m talking about potentially repeating the path of stocks like Northern Star Resources…going from a 5-cent ‘Phase One’ to a $15 major producer within the course of a single mining cycle.

Goes without saying don’t go near these plays without purely speculative capital you’re prepared to lose.

But you’ll find everything you need to know in a second report, called ‘Two Mining Moonshots (for Super-Speculators Only)’.

Heads-up on these two plays — there’s a chance they’ll be hovering out of my suggested buy zone when you read this report.

Especially given the wider market action recently.

That’s the volatile nature of going after juniors like this.

What price you take a position at is up to you.

But my advice is to time your entry until these two plays are under my buy-up-to price…

Moonshot #1

MY TOP OUTSIDE-AUSTRALIA PLAY

(BUT STILL ASX-LISTED…)

It doesn’t matter how good you are at the art of geoscience…

…unless you’re looking in the right place, you’re set to fail.

And sometimes those right places are not within Australian borders.

Despite our clear advantages, Australia’s still a relatively small part of the puzzle when it comes to the global supply of critical minerals.

As such, this riskier play is heading across the Indian Ocean and back to my old stomping ground, Africa.

A bit of backstory…

While I was working for the Australian-based copper producer Equinox Minerals in 2011, I took a three-week break in Malawi.

My experiences in the country helped forge my opinion that this small African nation offers immense undiscovered potential.

So, what did I uncover while I was there?

After spending almost 56 days straight working at our small exploration camp in northwest Zambia, I was ready to take an extended break.

I booked a ticket to see this little-visited country.

But I’m not the type to sit idly along the shores of the stunning Lake Malawi drinking Pina Coladas all day…I was in my late twenties and eager to explore.

Catching local buses, visiting rural towns, and even arranging to catch up with a former geologist mate I worked with in Zambia, those three weeks taught me a lot about what Malawi offers.

It was a chance to understand the people and the economy…not to mention the geological riches espoused by my contact working there.

With a country eager to support mining and a population ready to move out of poverty and seek a better future, Malawi has a LOT to offer.

So, too, does my final pick for you today. I think it could potentially top the share price gains tables this year because it has positioned itself well by uncovering an underexplored frontier that offers both geological potential and geopolitical stability.

You’ll hear everything I’ve uncovered on them in ‘Two Mining Moonshots (for Super-Speculators Only)’.

It’s Australian-owned…but holds a world-class deposit just 75 kilometres from the bustling Malawian city, Lilongwe.

This play gives you exposure to TWO critical metals in what I believe to be a premier location.

You can find out more on this play

now by clicking here to join

Diggers and Drillers for just $99.

For my final moonshot play, we circle back to copper.

As we talked about, the set-up for copper is as good as it gets right now.

In mid-2010, I was recruited by copper explorer Equinox Minerals and sent to the frontier in Zambia to look for the stuff.

It was the dream project for an up-and-coming geo.

Equinox owned an enormous tenement package…which gave me free reign and heaps of resources at my disposal to scour virgin areas around the northwest province of Zambia.

We also met with other copper explorers in the area…mostly Canadian companies, and some from just across the border in the DRC.

A few months into the job and I met my future wife, Andrea.

I don’t mention this to be sentimental.

Meeting Andrea was a key moment on my journey to becoming a better explorer.

She was an American Peace Corps volunteer working near our camp.

She was able to show me another side of living in Zambia beyond the exploration work I was doing — visiting and staying in small villages in the area and even helping at the local orphanage.

This is a VITAL aspect of successful exploration that you only see if you work for the BEST players…AND trust your own instincts.

You can’t find ore unless you have ‘good will’ from the people on the ground you’re drilling.

It’s something that Equinox encouraged as an Australian company working in Africa. We developed water bores for the villages and helped build schools, something the bigger miners could learn from.

It helped us gain a lot of support from the locals and made access approvals for exploration a lot easier.

So with all that in mind…what’s the deal with copper exploration going forward? And which ASX explorer do I think has the biggest head start?

Moonshot #2

A COPPER EXPLORER THAT’S FOUND

A ‘CHEAT SHEET’ TO DISCOVERY

At the moment…these guys are still well-up on where I recommended them.

Despite the big market corrections.

That could change, and if it does, I would say: GET IN!

Copper is charging from its lows of less than US$7,000/t towards all-time highs in excess of US$10,000/t.

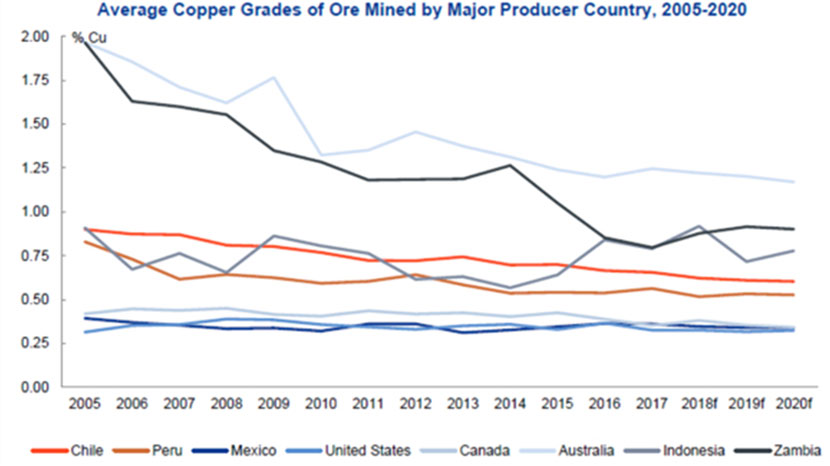

In Chile, copper production dropped last year because of poor ore grades.

Chile is the world’s largest copper producer. But it’s still relying on decades-old low-grade ‘porphyry’ deposits.

I can tell you from a geo perspective…

Lower grades mean higher production costs. This pushes operations to the edge of viability. In ageing operations, like those in Chile, miners are forced to extract low-grade ‘fringes’ of the pit and run ‘low-grade’ waste through processing facilities.

It’s not isolated to Chile, either. The trend of lower copper grades is occurring across all major producing countries. You can see for yourself here:

Source: AME Company Reports

In Peru, there have also been protests that have disrupted copper production and shipments. Chile and Peru together hold around 40% of the world’s copper production.

Metal stockpiles in exchanges have also dropped recently.

So, the million-dollar question is:

What’s the best stock to buy now to play the 2023 copper breakout?

Well, like I say, this play is right up on the risk-spectrum.

You need to go for the super-juniors here.

The fact is, there are very few late-stage copper explorers or early producers listed in Australia.

Copper is not a major Aussie export. Our copper reserves pale in comparison to the world’s largest copper-producing nations — as I said, Chile and Peru.

But…

Aussie copper deposits here offer a risk-free premium.

That’s going to be a distinct advantage going forward.

Ever wondered why BHP was so keen to get hold of one of Australia’s best copper assets via the Oz Minerals [ASX:OZL] takeover?

Well, its Escondida project in Chile is facing major pressures, from striking workers to a less than supportive government, so BHP needs to derisk its copper portfolio fast.

That’s why, while Australia is a relatively small player in terms of global copper production, our deposits offer additional upside thanks to political stability, supportive governments, and a skilled labour force.

The small explorer I’ve landed on has various exploration projects on the go…and not just copper. It’s holding tenement packages with the potential for lithium, platinum group metals (PGEs), and gold as well.

Don’t get me wrong, I’m picking it for copper.

In fact, as I’ll explain, I’ve assessed that these guys hold a sort of ‘cheat sheet’ for coming new copper discoveries.

But the mix of other resources it has on-the-go is important.

When you get into the game of analysing explorers, you need to understand that these companies often diversify their landholdings and commodity exposure.

They’re testing a number of targets in the hope of finding something special.

And I believe — after doubling down in one particular area this year — this niche copper play is about to find something very special indeed…

You’ll get a full rundown in ‘Two Mining Moonshots (for Super-Speculators Only)’.

The only question now is:

Are you ready to join me as

we tackle this new boom head-on?

So now you have my take on what I think is happening in the Aussie resources space currently.

You’ve seen it break away from other stock sectors in 2022.

Evidence has piled up that this ‘decoupling’ is actually accelerating so far in 2023.

You’ve seen some pretty golden words of endorsement from my first Diggers and Drillers subscribers.

I don’t think this trend is a fleeting thing.

As Umair Haque puts it in Medium:

‘It is a Big Deal — as big as the Industrial Revolution before it.’

The Industrial Revolution made generational wealth for those who played it correctly.

I think this new Drill, Baby, Drill boom playing out in Australia will too.

If you agree, you should join me.

And learn about the stocks I’m recommending you buy now.

Remember: there’s a 30-day refund period.

You can learn all about these stocks…and STILL get a refund of that modest $99 outlay inside 30 days if you want.

Up to you.

Up to you.

But I’m convinced this boom is only just beginning.

Join us now and we’ll give you a roadmap for playing it.

$199 normally.

$99 today.

And with a full 30-day refund guarantee.

Click the SUBSCRIBE NOW link below and let’s get cracking.

Regards,

|

James Cooper,

Editor, Diggers and Drillers