Dear Reader,

Just after 5:30am on Monday, 15 November 2022, a train bound for Melbourne derailed 30km west of Geelong, VIC.

Thankfully, no one was hurt.

This wasn’t a passenger train. It was a freight train. A big one, measuring 1km from nose to tail.

First responders arriving on the scene found a pile of broken wagons and around 20 mangled — but empty — shipping containers.

No victims. No damaged load.

So why even talk about it?

Let me explain...

The freight train was headed to the Port of Melbourne to drop off its empty containers and then pick up several full ones for the return journey to Adelaide.

But thanks to the derailment, these containers never made it off the dock.

To make matters worse, the train wreckage blocked and damaged the track at Inverleigh, VIC.

That, it turns out, was a major problem.

There are only TWO train lines that run east to west across Australia. The other line, from Sydney to Adelaide, was already cut off due to flooding at Broken Hill.

These two freight lines — the busiest routes in the country, according to government statistics — were shut for a whole week, cutting vital supply lines from international ports in the east to capital cities in the south and west.

Economist Jason Murphy, reporting for News.com.au said:

‘It couldn’t have happened at a worse time...No trains are able to go east to west in the whole country. We were hanging by a single thread, which has now been severed. Get ready. Empty shelves and high prices could be about to get even worse.’

Scary, isn’t it?

Two blocked train lines is all it took to limit the movement of goods across an entire country and harm our economy.

Look a little closer, and you realise...

Australia is a triumph of human ingenuity and bloody-minded determination over the extremes of nature.

We’re an island the size of the continental USA, sitting at the bottom end of the planet, far from anyone and anywhere.

We’ve built and connected major cities on different kinds of terrain, dotted around the edge of this huge land mass, with almost no one in the centre of it.

There are only 25 million of us. And yet we’ve made it work. In fact, Australia doesn’t just work. Our country is a massive, modern-day success story.

How?

Simply: we’ve learned how to transport goods, at scale, in a timely fashion, into and across the country.

Australia is a first-world, dynamic economy — thanks to the global supply chain.

Without it, we’d be screwed.

I’m not even exaggerating. We make hardly anything here. Few people know just how tiny Australia’s manufacturing base is. It accounts for just 10% of our GDP!

We import the vast majority of what we need to survive. Finished goods, parts, food, fuel, raw materials and more — by the container ship load.

Our country is reliant on large, intricate logistics operations: warehousing, fork-lifts, trains, trucks, and drivers...

...Who in turn depend on hundreds of thousands of kilometres of road and rail track...more than 600 airports...a huge river body system...and vast cable and pipeline networks.

It’s hard to comprehend all this when you’re mooching down the aisles at Kmart.

And that’s only scratching the surface.

I haven’t even begun to describe the intricacies of the process. A store like Kmart will stock many thousands of products, each with its own individual supply chain.

It’s an incredibly complex ‘system of systems’ that’s invisible to most of us.

And, until 2018, it all worked seamlessly. There was bread on the supermarket shelves, clothes in the stores and fuel at the pumps — whenever we wanted it. And it was mostly cheap, too.

Now, before you shout ‘COVID’...the pandemic didn’t break the supply chain. It certainly exacerbated the problem. But the fuse had already been lit.

Most people who DO think this is a knock-on effect of COVID will tell you we just need to give it time and things will get ‘back to normal’...

Well, that’s not likely to happen.

The supply chain that facilitated global trade for 30 years is broken.

And it won’t be put back together — not in the same way.

The ideas that brought the global supply chain into being have been upended...tossed away by a self-styled ‘elite class’ of technocrats — billionaires, ideologues, and politicians hell-bent on engineering a new kind of future.

I’ll show you what I mean by that in a moment. But unless you take some of the action I’ll set out in this letter, I don’t think this is a future you’re going to like very much.

Chances are you’ve already seen some of the initial signs of this future firsthand...

It might seem like these things are unrelated.

But one of the world’s top financial authors and geopolitical analysts says this can all be explained by the global supply chain crisis.

Worse, he says no one in the mainstream media has joined the dots...no one is talking about how this could end the Australian economy as we know it within the next 12 months — and take your way of life down with it.

Get ready...

I’ll tell you more about this gentleman in just a moment.

But first, let me quickly introduce myself.

My name is Nick Hubble. I’m a financial writer and investment analyst.

For a long time now, I’ve been troubled by the thought that something is wrong with Australia.

Nick Hubble

The sense of optimism that always helps our country punch above its weight in the world appears to be dimming.

After the awful experience of COVID, many Aussies are fearful of whatever ‘the next big crisis’ is. And how it will be ‘handled’.

That’s what I want to talk to you about today.

The world IS changing. Australia too. And maybe not for the better. If my friend is right, we could be in for a DECADE of pain.

Remember the toilet paper shortages during lockdown?

What if next time there’s no bread in Coles for three days running? Or milk?

What if bananas jump from $3 to $30 a kilo?

What if there’s rationing on meat, eggs, and vegetables?

What if your local pharmacy runs out of antibiotics...painkillers...or diabetes medication?

What if you can only fill your car up once a month?

Could it happen?

You bet it could. And it might...

For example, did you know that, right now, there’s only about FIVE DAYS’ worth of perishable food in the Australian supply chain?

La Trobe Institute of Agriculture and Food Director Antony Bacic told the Sydney Morning Herald: ‘We’re in trouble’...

The Guardian even says that we’re ‘in the midst of a food security crisis’ as nearly 4 million households can’t buy enough to eat.

Then there’s our fuel. Were you aware that more than 90% of the petrol in Australia is imported?

‘It should be of great concern to policymakers that Australia has the highest dependency on manufactured imports — and the lowest level of manufacturing self-sufficiency — of any OECD country’

Australian Sovereign Capability and Supply Chain Resilience: Perspectives and Options

Flinders University report,

September 2021

According to the International Energy Agency, we’re required to hold 90 days’ worth of fuel in reserve...

The Australia Institute says our current stocks would last just 32 DAYS if our imports got cut.

Retired Air Vice-Marshal John Blackburn told The Australian if there are disruptions to our oil supplies:

‘We would have major problems within two weeks... and there’s no plan B.’

It’s the same story with medicines. Australia imports more than 90% of the medications that so many of us, and our loved ones, rely on.

The Australian Financial Review reports (emphasis added):

‘Australia is at the end of a very long global supply chain making the nation vulnerable to supply chain disruptions. Australia’s Therapeutic Goods Administration has noted that at times there may not be enough of a specific medicine in the Australian marketplace.’

Did you know any of this?

Remember, just two years ago there were fistfights in the aisles at Coles over a couple of rolls of toilet paper.

What if next time it’s Ventolin for your son?

Or penicillin for your wife?

What would you do?

Well you might want to give it some thought.

Because, right now, Australia is looking vulnerable. Maybe more so than at any time in the last 50 years.

We’re dangerously dependent on imports of critical supplies.

And even more dependent on the vehicles that deliver them to us...

‘Australia’s truck industry facing imminent collapse’

News.com.au

Road freight is the main way goods are moved across Australia. And by that, I mean trucks. They are involved in most Australian supply chains.

Now very few people realise this because it doesn’t make the evening news. But many Aussie trucking firms are fighting for their lives right now.

Here’s what they’re up against...

Does all this affect you?

You better believe it does.

Because if the trucks fall silent in Australia, our society breaks down fast.

Air Vice-Marshal, John Blackburn, told ABC News Breakfast:

‘In Sydney alone there are 25,000 truck trips a week that do our food supply. If you turn that supply off, it's not a matter of having to import some product, your way of life stops.’

It’s not just food though...or fuel...or even medical shipments that are at risk here. It’s things like water deliveries to remote and rural communities...

Garbage collection (picture the bags piling up on your street — even after a few days...)

Without trucks, farm production stops...construction stops...commodity exports stop...

Life would become grim within just a few weeks.

Like I keep saying, Australia is vulnerable right now.

And hardly anyone can see it.

His name is James Rickards. Most people call him Jim.

Jim has advised several US administrations, the CIA, the Pentagon...and various Wall Street institutions in a 50-year geopolitical and economic analyst career.

I’ve worked with him for about 10 years now — to help bring his research to an Australian audience.

And our mission has never been more vital.

Australia is exposed — more so than most developed countries in the world — to the effects of this supply chain crisis...because we’re remote, and almost totally reliant on imports of critical supplies...not to mention the trucks that deliver them to us.

Jim saw this coming long before most in the mainstream media picked up on it. So he wrote a book to warn people...and to show them a path through it.

In the book, he explains why you need to prepare urgently for much higher food and energy prices (including, yes, stocking up on basic food supplies).

He names financial assets that are likely to drop sharply in value over the next year as the crisis intensifies...

And he shares details of the investment portfolio he’s constructed to look after and even grow his family’s wealth while this crisis plays out.

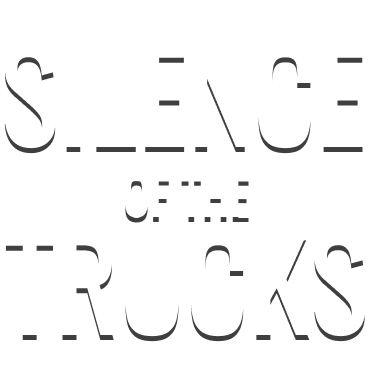

The book is called SOLD OUT: How Broken Supply Chains, Surging Inflation, and Political Instability Will Sink the Global Economy.

In a moment, I’ll explain how you can get your hands on it.

In a moment, I’ll explain how you can get your hands on it.

SOLD OUT is a must-read if you share our concerns about the way things are going in the world — and in Australia — and where we could end up, soon.

If what you’ve read so far has made you nod along...

...or helped articulate some of the things you’ve been thinking privately...

...you need to download your copy of this book.

It will give you a plan to protect your wealth and assets against the worst of the effects of a broken supply chain...maintain your standard of living...and maybe even improve it, as strange as that may sound.

It also gives the best explanation you’re likely to read anywhere of how we’ve arrived at this point.

Revealing how a ‘perfect storm’ of factors —

...including Donald Trump’s China tariffs, COVID lockdowns, war in Ukraine and Russian sanctions, crazy monetary policy decisions, Australia’s ‘quiet’ trade war with China, and secretive globalist agendas...

— have combined to break the global supply chain beyond repair and put our way of life at risk.

Plus, you’ll discover why things cannot and will not go back to the way they were.

This is the bit most people can’t wrap their heads around.

Governments and global elites plan to create a NEW and radically different supply chain.

In SOLD OUT, you’ll learn what it will look like...and the effect it’s likely to have on your standard of living...personal freedom...and civil liberties.

More pressingly, you’ll understand what the economic fallout of this crisis is likely to look like over the next few months — and how you can avoid the worst of it.

You’ll hear what the US Federal Reserve is likely to do to try and ‘fix’ the economy and when...

Why Jim thinks most stock market forecasters have got it dangerously wrong...

Which assets are likely to suffer as a consequence, and which could thrive.

For example — in an exclusive Australian chapter of SOLD OUT, which I’ll also send you, I reveal:

Financial preparation is something both Jim and I feel you need to attend to right away.

We feel that most people are sitting ducks, oblivious to the dangers that are coming down the pike.

For example, people just don’t realise...

According to Forbes, ‘Australia’s inflation rate will stay higher for longer than expected’.

People tend to let statements like that wash over them. But remember, it’s only three years since the oil price went negative, and supertankers were being paid by the day to store it offshore!

To go from negative oil prices to record inflation in three years is a huge shock to the system.

But there’s a bigger one coming...

The inflation we’ve seen so far has been what’s called supply-side inflation. Basically, the supply chain breakdown has resulted in fewer goods in the stores, which drives the price of those goods up. That’s what we’ve been seeing.

There is nothing central banks can do to control supply-side inflation. They can only influence demand. And that’s exactly what they’ve been trying to do — led by the US Federal Reserve.

The Fed believes that the way to ‘solve’ higher prices is to destroy demand in the economy. They do that through raising interest rates and tightening the money supply...in the hopes that borrowing will reduce, as it becomes more expensive, and thus, the economy will ‘cool off’.

We know they’ve been doing this.

But in SOLD OUT, Jim reveals why he believes the Fed has miscalculated...and screwed up big time. And how we’re all about to pay the price...

According to Jim, the rate of inflation will start coming down over the next few months. In fact, the signs are that this may have already begun.

But what investors don’t realise, says Jim, is that inflation is likely to fall rapidly — because the Fed will keep raising rates long after it should have stopped.

The Federal Reserve thinks it has ‘levers’ it can simply pull at various times to either heat up or cool down the economy.

In raising rates too aggressively, they will very likely destroy too much demand in the economy and plunge the US — and, by extension, the world — into a deep recession.

Jim says this will happen in the next 3–6 months. And this time, he’s not the only one saying it...

If Jim’s right, inflation will be swiftly replaced by ‘disinflation’ – a rapid slowing of the rate of inflation.

In turn, that will be replaced by deflation.

And that — says Jim — will be game over.

In SOLD OUT, Jim explains why this scenario is not just likely, but almost certain to happen.

Now you may be wondering what the problem is. Why shouldn’t we enjoy a period of lower prices after everything’s been going up for so long?

Well, the problem is, deflation cannot be controlled by central banks, governments, global elites, or anyone else.

It can run unchecked for decades.

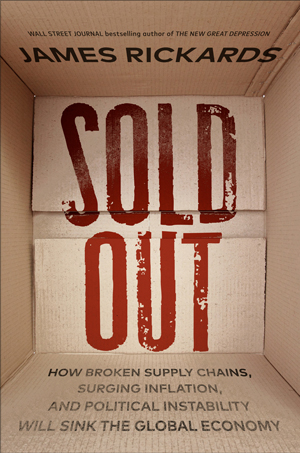

Think Japan post-1991...

Japan was an economic powerhouse in the 1980s. Then in the early ‘90s its stock and real estate markets both crashed, sending the country into recession, which destroyed its GDP and growth.

The deflation that followed ensured the Japanese economy went nowhere for 30 years.

Everything remained depressed…house prices, bond prices...the stock market is, to this day, still 10,000 points — almost 22% — off its 1989 peak!

Make no mistake. Deflation is the Fed’s worst nightmare, and it’s ours. If Jim’s right about the timing of all this, by 2024, we could see...

This is Jim’s big fear for the global economy in 2024.

And it’s my biggest fear for Australia.

Bottom line: unless your finances are prepared for this scenario — your standard of living could be about to go way, way, down...and stay down for a long time.

You don’t even have to take my word for it. Just look around you, and you’ll see the effects of this crisis starting to show up everywhere…

In the property market:

‘Australia is in a housing crisis’

— ABC News

In the small business community:

‘Business failure rate reaches 15-year high’

— ABC News

In the hospitality sector:

‘Australian restaurants on a knife edge’

— The Guardian

And on the high street:

‘Warning signs of retail slowdown amid cost-of-living crisis’

— News.com.au

You see it as clearly as I do.

So what can you do?

Well, when you claim your digital copy of SOLD OUT, I will also send you a ‘preparation package’ that I’ve put together.

Its aim is to keep your wealth and purchasing power intact over the next 12 months and beyond...

...and put you on a firmer financial footing (most people don’t realise just how shaky the ground is right now).

You don’t have to sell everything or resort to risky investments like options or CFDs.

I’m talking about simple steps you can take quickly now to reduce your financial exposure to the kind of scenario Jim is expecting.

For example, one of the things we suggest is to take a look at a small group of stocks in a specific ‘hated’ sector. We predict they will make excellent returns as the next few years unfold, regardless of what the wider market does.

That’s right, you may even be able to profit from a handful of assets that are strategically placed to do well in this environment — believe it or not.

You won’t learn how to get rich by betting on the new ‘hot thing’.

But you WILL learn how to organise your investments now to take advantage of what is likely to be the biggest geo-economic shift of our lifetime.

Entrusting even a small amount to this approach could make all the difference to your financial security and peace of mind over the coming years.

Details on how to claim your ‘SOLD OUT Preparation Package’ are coming up...

Believe me, I realise it’s a big deal, asking you to trust anyone or anything at the moment.

But I hope you’ll give us a chance to prove that...

It’s a smart move to have Jim in your corner right now. He’s got more knowledge and experience of how the global economy works than pretty much anyone you could name.

He’s incredibly well connected — with ties to the finance, intelligence, and political community all over the world.

And by ‘well-connected’, I mean he’s on first-name terms with US presidents, treasury and defense secretaries, and Fed chairmen.

Jim Rickards knows — better than most — how the world really works and who it truly benefits.

He’s observed the machine from the inside — from the West Wing of the White House, the boardroom of the Federal Reserve, the US Treasury, the Pentagon, and CIA headquarters in Langley, Virginia.

And his unique perspective has helped him stay one step ahead of virtually everyone else when it comes to figuring out what happens next.

At times it feels like he has a crystal ball...

Jim warned the US Treasury about a potential subprime collapse several times throughout 2005 and 2006 (he was ignored — and we all remember what happened in 2008).

In 2016, Jim went on US TV to predict that Donald Trump would defeat Hillary Clinton in the US presidential race...and that Britain would vote to leave the European Union.

This was when 99% of polls were saying the opposite.

Jim was laughed out of it. But he was right on both counts.

In his 2019 book, Aftermath, Jim warned of the economic devastation that could ensue from a pandemic. This was a year before COVID spread around the world.

And in late 2021, several months before the first shots were fired in Ukraine…Jim told readers that this war was an ‘almost certainty’.

My point is...

This supply chain mess is unravelling fast.

But practically no one — other than Jim — is talking about it. Everyone thinks the supply chain crisis is just a case of backlogs caused by COVID...and everything will go back to normal soon.

But most people don’t realise that the supply chain is not going to be put back together the way it was.

Because the US wants China out of the picture.

Jim says the US’s goal is to build a NEW supply chain — ‘version 2.0’ — that doesn’t include the world’s second-biggest economy…

They see China as a growing threat to their national security. We do too. In fact, Australia is more vulnerable than most to a hostile China.

Western leaders have realised that we simply can’t allow China to have this economic hold over us. So they are being elbowed out.

‘Supply chain 2.0’ will be made up of ‘friendly’ trading blocs...what Jim calls a ‘College of Nations’.

The US, Europe, the UK, Australia, Canada, New Zealand, and possibly Brazil and India will all be involved — but China will not.

To this end, there is a big move towards ‘onshoring’ that is already underway in the US.

Onshoring is where you build domestic manufacturing infrastructure to make supply chains shorter, more secure and less vulnerable to breakdowns.

To give you one example of this, the world’s biggest producer of computer chips, The Taiwan Semiconductor Manufacturing Company, just signed an eye-watering $US40 BILLION deal to build a chip plant in the US — in Phoenix, Arizona.

The US needs a constant supply of semiconductors for its cars, smartphones, home appliances, military vehicles, weapons systems, and more.

Taiwan is too close to China...and China keeps threatening to invade. That’s too big of a security risk. So they’re cutting China out of the picture.

Apple is making similar moves. The tech giant announced in December 2022 that it plans to move iPhone manufacturing away from China to India and Vietnam. This is the ‘College of Nations’ being formed.

All of this sounds great in theory...

But the construction of ‘supply chain 2.0’ amounts to a major restructuring of the global economy. Something that Jim says will take 5–10 years.

Hardly anyone understands the upheaval this is going to cause...or the extent to which our lives are going to change because of it.

Remember, if you take China out of the equation, cheap Chinese labour is going too.

Please let that sink in. That fact alone means that everyday goods in stores are going to get a lot more expensive. Too expensive for some.

The cost of living will keep going up. The gap between rich and poor will widen.

And the lifestyle you’ve enjoyed for many years will likely suffer...unless you can comfortably absorb these higher prices.

This is something you’re probably going to have to make peace with.

If you only take one thing away from this letter, please make it this:

As the pandemic raged in 2020, Klaus Schwab, technocrat and head of The World Economic Forum, said:

‘Many of us are pondering when things will return to normal. The short response is: never.’

Director-General of The World Health Organisation, Tedros Adhanom Ghebreyesus, said something similar around the same time...

‘It’s completely understandable that people want to get on with their lives, but we will not be going back to the old normal.’

And President Macron of France said more recently, in August 2022:

‘I believe that we are in the process of living through a tipping point or great upheaval. We are living through... what could seem like the end of abundance.’

These are strong, deliberate, pointed words.

And you need to pay attention to them.

Because they’re typical of a growing movement by world leaders and elites to nudge us towards a new way of thinking...and behaving...

...where we no longer aspire to greater personal freedom, abundance, and wealth...instead we feel guilty for wanting these things.

...where we don’t embrace our many differences and challenges…but fear them...

...where we feel increasingly more unsettled, anxious, isolated, and fragmented — at odds with one another.

Listen, SOLD OUT doesn’t make for particularly easy reading.

But knowledge is power. You don’t have to accept Jim’s assessment of the state of our world...or agree with his views.

But at least you’ll be armed with information, practical guidance and a plan you can follow to protect your wealth, assets and lifestyle in the crucial months ahead.

I can’t put it any more plainly:

These moves to ‘reset’ and restructure the global economy place your standard of living under direct threat.

Many Australians will discover this, to their horror, over the coming months.

Some will no doubt struggle badly.

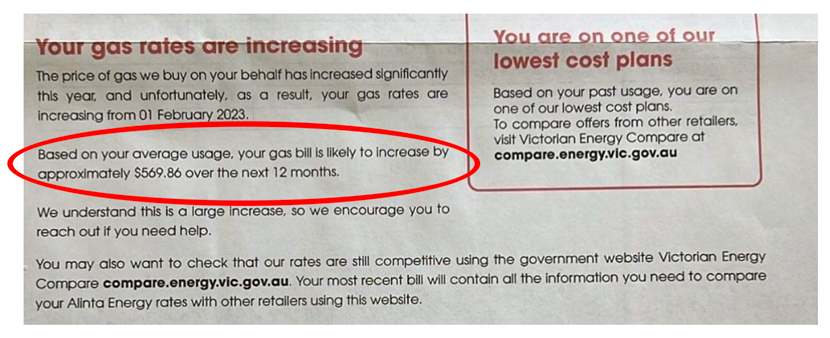

I mean, just look at this note sent to a homeowner in Victoria recently, announcing that their gas bill is set to go up by almost $600 from 1 Feb.

It’s an out-of-the-blue financial shock. The kind we all dread.

But I’m saying it doesn’t have to be this way for you.

There can be upsides too...if you prepare.

Jim says, once you know what’s coming, you can plan and organise your finances accordingly...

...Maybe even grow your wealth using the ideas in the book as your guide.

Now, SOLD OUT is currently on sale online and in stores across Australia.

You can get a digital copy of Jim’s book as part of the ‘SOLD OUT Preparation Package’ I’d like to send you.

You can get a digital copy of Jim’s book as part of the ‘SOLD OUT Preparation Package’ I’d like to send you.

With this package, you’ll be able to download a copy of SOLD OUT to your iPad, Kindle, or eReader.

AND you’ll get an exclusive Australian chapter of SOLD OUT that I’ve written — with Jim’s guidance.

It puts the supply chain breakdown into context for Aussies...and sets out a specific plan of action for you, including several investment recommendations you can follow right away.

You won’t find the Australian Chapter in any copy of SOLD OUT you buy on Amazon or in Dymocks. It’s only available as part of the preparation package I want to send you today.

And that’s only possible because of the close relationship I have with Jim.

Together, he and I write the monthly newsletter, Strategic Intelligence Australia.

Our letter — and regular email correspondence with subscribers — offers insight and advice to Australians who appreciate Jim’s worldview.

Our letter — and regular email correspondence with subscribers — offers insight and advice to Australians who appreciate Jim’s worldview.

Some of our subscribers read Strategic Intelligence Australia because they want to invest their money according to the way Jim sees the world.

We help them do that by giving regular recommendations inspired by Jim’s research. We even have a model portfolio you can copy if you wish.

Our main goal is to help you preserve the wealth you’ve built up all your life.

But when the world goes ‘mad’, there are always investment opportunities to be found on the ‘other side’ of the trade. We’ll show you where they are.

Other subscribers just want to read a credible, non-mainstream, and dare I say, like-minded view of what’s really happening in the world...

...which, as more Australians are realising, bears little resemblance to what you’ll see on the evening news.

Your ‘Preparation Package’ includes a subscription to Strategic Intelligence Australia, as well as a digital copy of Jim’s book, SOLD OUT, and my exclusive Australian chapter.

All with a 30-day money-back guarantee.

And then, over the coming months...

…we’ll help you to prepare for more attacks on your liberty.

What do I mean by that?

What readers are saying about

STRATEGIC INTELLIGENCE AUSTRALIA

‘Wow, I have been subscribing for a number of years now and I have learned so much about the world we live in. Very grateful to have the opportunities to continue reading different experiences, perspectives and recommendations.’

JR

Sydney, NSW

‘One of the best. Wouldn't miss it. Clear, articulate and digs beneath the usual BS.’

Ken

Mylor, SA

‘I feel better informed of world events, the reasons behind them, how they relate to Australia, and what to do about preserving my family's financial security.’

AJB

Aspendale, VIC

‘I have confidence that I am being advised about what is really going on from a team with highly impressive credentials.’

Victoria Ferguson

Tenterfield, NSW

‘It's advantageous and necessary information, as well as interesting to many people sceptical of mainstream media reports. Well worth the membership fees.’

Mike B,

Railton, TAS

‘Always interesting, an alternative approach to the mainstream media and very non woke. I like it.’

GW

Yeppoon, QLD

Well, you may have noticed that we seem to be careering from one crisis to the next at the moment.

The World Economic Forum even has a name for it: ‘the polycrisis’.

The idea of the ‘polycrisis’ is to keep you in a perpetual state of fear...to make you more compliant...and easier to control.

This is why the papers are full of Ukraine...new COVID variants...identity politics...monkeypox...illegal immigration, and more.

The ‘climate emergency’ is the current thing to keep your heart rate soaring and your behaviour in check.

We’re told every day by the media that climate change is our fault.

Whether you agree with this or not doesn’t really matter. Because this daily guilt trip isn’t really about saving the world from climate change.

It’s about softening you up to the idea that the climate ‘catastrophe’ provides justification for more controls...permission-based rules...and curbs on your rights and freedoms.

Remember, it’s only a year or so since you were locked in your house to save Granny.

Pretty soon you could be locked in your house to save the planet.

You don’t think they’d ever do that again?

Well, check this out from the International Energy Agency (emphasis mine):

‘A key question for the energy sector is whether changes to transport behaviours during the [COVID] crisis may result in a permanent change in behaviour or if transport patterns will revert to ‘business as usual’ when the crisis ends.

‘Research has shown that disruptions can be a catalyst for shifts towards more sustainable transport behaviours but avoiding a return to pre-crisis behaviours requires governments to take decisive actions.’

See how they talk of using the climate crisis to assume greater powers...powers to limit your movement?

New South Wales Premier Dominic Perrottet isn’t waiting around. He just gave himself the power to seize the State’s $46 billion coal industry if he declares a climate ‘emergency’.

Hardly sounds like democracy in action, does it?

What if Perrottet’s emergency powers include limiting how long you can have your electricity on at home for...how many car journeys you can take...or how far outside of your suburb you can travel?

And what is Daniel Andrews up to in Victoria?

He recently made dividing Melbourne into ‘20-minute neighbourhoods’ a cornerstone policy of his third term in office.

It sounds to me like the movie The Hunger Games — everyone divided into districts they can’t leave without permission from the authorities.

I’m not making it up — it’s all there on the Victorian Government website.

Just pour yourself a stiff drink and Google: ‘Plan Melbourne’.

All of it makes you wonder...

And if not — what IS it about?

These are exactly the kinds of questions Jim and I explore each week and month in Strategic Intelligence Australia.

And by the way, Jim isn’t against clean energy...

He built what he says is the biggest non-commercial solar farm in the state of New England, where he lives. This (right) is just one portion of it.

When it comes to striving for a cleaner world, Jim’s all in.

But he’ll be the first to tell you: solar is messy, labour-intensive to build, expensive, uses more fossil fuel energy than you think and produces less power than you need.

It simply doesn’t work at scale. Not yet. And it’s hard to see how it will work at all without significant base load power provided by — you guessed it — coal and gas.

Listen...I could write a whole separate report on the economics and practicality of renewables...the speed of this clean energy transition...and what’s really driving it...

But Jim has done a far better job of it in SOLD OUT.

If you’re interested in reading about these ideas from a credible, non-mainstream source...

If you’re interested in reading about these ideas from a credible, non-mainstream source...

...download a copy of Jim’s book — including my Australian chapter — and have a look at Strategic Intelligence Australia.

You’ll find yourself nodding along if you feel — as a growing number of people do — that the maths...the finances...the speed...and the ‘science’ of the clean energy transition is starting to smell a bit...fishy.

I mean, they tell us that it’s going to cost US$150 TRILLION to decarbonise the world by 2050.

Who’s going to pay?

Will our taxes go up?

Will there be a ‘carbon tax’?

And will giving the government more money really stop climate change?

How can Australians influence global temperatures...

...when China — the country responsible for almost a third of global CO2 output — is building three times as many new coal-fired power stations as anywhere else in the world?

Or is all this just a scheme to transfer yet more of your wealth to someone else?

You’ll find out Jim’s take on all this in the pages of SOLD OUT and Strategic Intelligence Australia.

Then there’s the ongoing legacy of the pandemic.

And look, I get that people don’t want to talk about COVID anymore. Frankly, I’m sick of it too.

But whatever your thoughts about the virus itself, the pandemic handed governments an opportunity to restrict our rights and freedoms in ways we’ve never seen before.

It taught them how much control you can exert over a population when you scare the living hell out of them.

It showed them how easy it is to enact special powers under a ‘state of emergency’...to strip people of their liberty, freedom of movement, and bodily autonomy.

Above all, the pandemic showed them that economics can be used as a means of control.

Have you heard that a Central Bank Digital Currency (CBDC) is likely to be launched in Australia soon?

Again, this is not a conspiracy theory. The rails are already in place. If you go to the RBA website, you will read that they are ‘actively researching’ an Aussie CBDC.

Under cover of the pandemic, the RBA quietly launched two CBDC feasibility studies with weird military-sounding names: Project Atom and Project Dunbar.

A pilot project ‘to explore innovative use cases’ — whatever that means — was launched in August 2022...it’s expected to conclude in mid-2023.

And then what?

We don’t know.

More praise for

STRATEGIC INTELLIGENCE AUSTRALIA

‘Awesome. Financial, Lifestyle, Security... an Amazing resource for me to have.’

Mark

North Melbourne, VIC

‘Have greatly appreciated the insights Jim offers. Making me look beyond my perceptions and our usual mainstream lousy media reports! Has changed how I look at stocks!’

TKG

Pakenham, VIC

‘Experience, wisdom and knowledge that cuts through the agendas of the “Lame Stream Media”’

GP

Sydney, NSW

‘My first port of call when I open my computer to find out what is really going on in the financial and real world. I regard you as an invaluable service as an aid to my investing decisions. MSM is a complete waste of my time and eyesight.’

Bob Noble

Toowoomba, QLD

‘Probably my favourite source of investment advice.’

G M Fennen

Wangi Wangi, NSW

‘I've committed to a lifetime membership as I enjoyed the down to earth and intelligent analysis of financial matters, global information that’s critical to my investments and of course my wellbeing.’

Chee

Mayfield, NSW

But this is something you need to know.

Because if the Reserve Bank launches a CBDC, it’s goodbye cash. Goodbye, privacy. And potentially, goodbye free movement and the freedom to transact as you wish.

Physical money — notes and coins — will be phased out. No more slipping a $20 note into your grandchild’s birthday card...or chucking your neighbour a hundred bucks for helping you fix your fence.

Your money will be replaced by a digital version of the dollar that exists only in a ‘virtual wallet’ on your phone.

The currency will be issued directly to you by the government. And politicians will sell it to you as ‘secure’ and ‘convenient’. Just tap your phone to pay for things, exactly like you do now.

Don’t be taken in.

If a CBDC becomes our official currency:

Your privacy will vanish. The government will have the ability to know what you’re doing, how much you’re spending, where, and on what.

They will know how much you earn and will be able to take the tax you owe directly out of your account.

They may even be able to force you to spend your money within a certain timeframe.

There’s also the possibility the government could limit or freeze your account if you indulge in behaviour they don’t approve of...

...like attending a protest...voting for an independent candidate...even posting something ‘contentious’ on Facebook.

I know it sounds like something out of Orwell’s 1984.

But in January 2022, this is exactly what happened in Canada to truck drivers who protested Justin Trudeau’s vaccine mandate...and to others who wanted to contribute money to their cause.

And this is BEFORE a CBDC comes in.

Imagine how quickly they could shut you down if they controlled the currency in your wallet and had oversight of all your transactions!

Jim and I are so concerned by this development — and what it could mean for us all — we filmed an instructional video for Strategic Intelligence Australia subscribers called: ‘Surviving CBDCs with Jim Rickards’.

You will get access to this exclusive video as part of your ‘SOLD OUT Preparation Package’.

It’s one-hour long, and it will walk you through what your options are if you’re worried about the prospect of an Australian CBDC.

Jim and I cover lots of practical topics including...

If you find this issue bewildering, our video will help.

It will give you a much clearer idea of what you can do to protect your savings, investments and privacy if they do away with physical cash, as Jim and I suspect they will.

You’ll find a link to download and watch our CBDC video in the ‘SOLD OUT Preparation Package’ I’d like to send you.

To order a copy now — and join the Strategic Intelligence Australia community — scroll down to the bottom of this page and click on the button.

Right now there is an almighty battle going on — waged by governments and big tech companies — for possession of your private data. It’s worth billions of dollars to these companies.

Your data gives them the ability to track and analyse your movements...and then incentivise and nudge you into behaviours that suit their policy aims or revenue targets.

‘Your mobile phone is spying on you. Your cities are spying on you...the infrastructure for future lockdowns is being put into place right now. Don’t be fooled. You’re being set up to be tracked through your movements, through the future of your digital wallets. By handing over your data, you’re handing over the ability to monitor your behaviour which will soon be turned into a social credit score.’

Liberal Senator Alex Antic

in a speech to The Parliament of South Australia, December 2022

But if you don’t give them your data, they can’t use it against you!

Jim and I both feel strongly, as we move into an era of even greater surveillance, that you should be as ‘off-grid’ as you possibly can be.

Now I know that’s easier said than done. Most of us are 24/7, walking, eating, sleeping data points.

But it might be as simple as deleting your Facebook account if you don’t go on there very often.

It might be making sure you click ‘reject all’ on those cookie requests that are suddenly popping up everywhere on the internet.

It might be using cash in shops instead of reaching for your credit card or, worse, tapping your phone.

It might be a case of leaving your phone at home when you walk the dog...and not wearing your smartwatch to bed.

You get the picture.

Being ‘off-grid’ financially is even more important — especially with a CBDC on the horizon.

Remember, a digital dollar brings with it the possibility of financial lockdowns, taxation mandates, asset track and trace programs, and heavy-handed enforcement.

Before that happens, we recommend you go off the grid with some of your assets.

I’ve put together a 21-page report that shows you how you can do this.

It’s called: ‘Off the Grid: How to Keep Your Money Under Your Control’ — and it’s also included in your ‘SOLD OUT Preparation Package’.

Again, there’s nothing too complicated in my report.

You don’t have to withdraw all your cash from the bank and bury it in the backyard.

You don’t have to withdraw all your cash from the bank and bury it in the backyard.

And you don’t have to do everything I recommend. Only the things that make sense to you.

I’ll show you things like:

These are just ideas, remember.

And, yes, I know that thinking about this kind of thing can put you on a downer.

But history tells us that those who prepare for a crisis can prosper during one. And that’s essentially our mission at Strategic Intelligence Australia.

There’s one ‘off-grid’ asset, though, that is head and shoulders above all the others when it comes to storing wealth and protecting purchasing power.

It’s not digital. Nor is it traceable.

It’s easily transportable. And it’s widely accepted as both a store of value and a medium of exchange.

I’m talking — of course — about gold.

Gold has been considered money for 6,000 years...long before the printing press was invented.

And it will be again, long after paper money dies...and long after people reject CBDCs (remember, communism always fails).

Our advice — start building your gold portfolio right away.

How? Well, you can start by downloading our special report: ‘The Ultimate Bullion Buyers Guide’ — also included in your ‘SOLD OUT Preparation Package’ today.

How? Well, you can start by downloading our special report: ‘The Ultimate Bullion Buyers Guide’ — also included in your ‘SOLD OUT Preparation Package’ today.

In this super-valuable report, contributing editor Brian Chu reveals how to construct a portfolio of gold bullion and coins — whether you have $1,000 to invest or $1,000,000.

Brian, founder and manager of The Australian Gold Fund, will talk you through the different types of physical gold...and reveal which kind of gold investment offers you the best value for money.

This is a MUST-READ report if you’re looking for the quickest and most time-tested way to store a portion of your wealth outside of the financial system.

Remember, the government cannot influence the value of gold.

But — whether by incompetence or design — it CAN destroy the purchasing power of the dollars in your bank account.

You can download a copy of ‘The Ultimate Bullion Buyers Guide’ with your ‘SOLD OUT Preparation Package’ today.

Click the button at the bottom of this page, fill out the short form on the next page, and I will rush you:

Jim and I spent a lot of time putting this package together. It’s the exact advice we’re giving to our own families. And I want you to be able to give it to yours.

Now normally, a 12-month subscription to Strategic Intelligence Australia...just the newsletter without any bonuses...costs $199.

But youʼre not going to pay that.

To get everything in our ʻSOLD OUT Protection Packageʼ, including Jimʼs book, the subscription and all the reports and gifts, youʼll pay just $99.

Thatʼs half the regular price. No gimmicks. No hidden charges. We both feel that whatʼs happening is too important to let the cost of subscribing prevent you from accessing our research.

And because I want you to feel 100% confident about your decision today, Iʼll give you the next 30 days to claim a refund if you change your mind and decide you donʼt want to continue with your Strategic Intelligence Australia subscription.

Just call our customer service team to cancel your subscription and you will get your joining fee back.

You can keep your digital copy of Jimʼs book, the bonus chapter, and all the other reports and gifts with my compliments, no matter what you decide.

I hope that sounds fair to you.

The last three years have been awful.

But with our help the next three could be a good deal better for you.

I’m not saying it’s going to be easy. Remember, Jim says the global supply chain breakdown could take between five and ten years to resolve...

And that the effects of this crisis — higher prices...supply shocks...and potential social unrest...will be felt for a long while to come.

Meanwhile, global elites, billionaires, and politicians are relentlessly pushing their ‘polycrisis’ agenda through their collaborators in the mainstream media...

Just like COVID...they want to scare, scald, coerce, and nudge you into complying with the next restrictions on your freedom...most likely brought about by digital ID, CBDCs, or the climate ‘crisis’.

Let Jim and I help you through it.

To claim your ‘SOLD OUT Preparation Package’ now, just click on the button below.

Sincerely,

|

Nickolai Hubble,

Editor, Strategic Intelligence Australia

Send my SOLD OUT

Preparation Package

‘Evaluation, analysis and candid commentary on much in the universe that has the potential to impact our lives, not just our investments. And that's something we're never going to get from MSM.’

Bernie Clark,

Banora Point, NSW

‘Jim is right on the money. I have followed his advice into gold shares and am cashed up when the correction comes.’

Barry Podger

Beaumaris, VIC

‘I am very impressed with both Jim & Nick and read everything they produce. It's so good to read truthful reports that aren't available elsewhere.’

John C

Pakenham, VIC

‘I find it very enlightening. I feel like I get info that not many people have.’

GHT

Coomealla, NSW

‘An informative and reasoned explanation to what is happening in the world, an appreciated change from what goes as commentary from MSM.’

Mike B

Cowes, VIC

‘I've been reading Jim since 2014, about major issues and he's been pretty bloody accurate. I have really enjoyed Nick's take on things and find myself being swayed by his arguments.’

Reg

Albany DC, WA

‘Noteworthy insights into geopolitics and the correlated impacts on world economies and investment strategies. Allows you to try and think several steps ahead when setting up your portfolio. Very worthwhile service.’

Vasilios Papageorgiou,

Northcote, VIC

‘Jim advised to buy gold at the end of 2017 when it was about A$1700 per ounce. This has proved good advice. I love reading your commentary. It all makes sense.’

Bill

Inverell, NSW

‘Really enjoy the research and insightful deep thinking.’

M Petterson,

Bright, VIC

‘It is refreshing getting a different perspective on world issues compared to the hyped, politically motivated and biased spin generally proffered by mainstream media.’

John Hopman

Randwick, NSW

‘Just love it, always interesting and very informative.’

Peter H,

Brisbane, QLD

‘The newsletter is always right on the mark and [Jim's] predictions and knowledge are second to none.’

Rowan F

Wagga Wagga, NSW

‘Love the way they tell it how they see it, and not following some mainstream narrative.’

Tony Oelkers

Marcoola, QLD

‘It gives me the information I require to make good, informed decisions when investing.’

Colin B

Kings Point, NSW

‘Vital information keeping me up to date with economic, political and geopolitical events that affect me and my grandchildren's future.’

Keith L

Gold Coast, QLD

‘Very much appreciate the global insights to help with informed decisions for my move into retirement.’

Maurice,

Perth, WA

‘I love Strategic Intelligence — Nick, you tell it how it is in plain language, and I hang on your every word; Jim, always read what you predict for gold and the economy.’

Helen,

St Agnes, SA

‘I find it comforting that someone can see through so much of the rubbish churned out by the mainstream media.’

Tony Hill

Geographe, WA

‘It's a very refreshing newsletter that discusses topics and information generally not discussed in other mainstream media. Jim and Nick do a wonderful job of looking ahead, at the big picture and inspire to think strategically over a longer horizon.’

NK,

Brisbane, QLD