28 February 2023.

That’s my best estimate…

That’s when Joe Biden’s administration starts to fill the US’s Strategic Petroleum Reserve…reserves they’ve been running down over the past eight months.

And that’s when the finger-pointing will begin…

It’ll start with the virtue-signalling politicians that ignored this obvious fact for fear of losing votes.

Next, we’ll blame the mainstream media that shunned piles of evidence available to them all along, but simply didn’t fit their ideological narratives.

We’ll blame Russian President Vladimir Putin for starting a war with Ukraine…and China’s President Xi for not signing up to the various net-zero initiatives.

And we’ll blame ‘Big Oil’, who made no new investment in future supply despite knowing what was coming.

Why would they?

If world leaders were determined to hit net zero by 2050…what need is there for investment into more oil production?

Well…lots of need, as you’re about to see.

Because even when the finger-pointing is done, I believe we’ll still have the Earth-rattling crisis I’m about to reveal.

What crisis?

Petrol pump prices quadrupling…huge fuel lines…airports empty because it’s too expensive to fly…supermarkets empty because it’s too expensive to ship goods.

You’ve already witnessed pump prices rise 15% this year up to August 2022.

Maybe you’re waiting for them to come down again. Like they always do, right?

This wait will be a long one.

Australia and the rest of the world have kissed goodbye to cheap petrol…forever.

And it’s going to have a significant impact on your wealth, health, and way of life.

I don’t usually come out with such alarming claims.

In fact, it’s my number one criticism of the green lobby and its extremist wing.

They say unless we stop using all fossil fuels by 2025, the world will literally end.

Ironically, this ludicrous climate alarmism has helped sow the seeds of a REAL catastrophe that will affect every man, woman, and child from every walk of life.

In fact, it’s already begun.

Canny investors are already waking up to what could become the most vicious and unpredictable time in the post-war era.

A new proxy war between the East and West around the shores of the Black Sea…

Many ‘winters of discontent’ in an ever-unstable European Union…

Brewing military conflict over strategic islands in the South China Sea...

Let’s not kid ourselves…

Deep down, we all know you can’t just switch off a resource critical to the functioning of every aspect of modern life, enterprise, and society…and not expect serious ramifications.

We’re witnessing the start of those ramifications now.

Europe is at the epicentre.

Having put all its eggs into the renewable basket and relying on an enemy (Russia) for their fossil fuel needs…the continent is now crumbling from high energy costs.

The UK isn’t much better.

A recent article published in The Australian stated:

‘As the country heads towards autumn and winter, families and the elderly are fearful and everyone is testing how far they can cut back to save on soaring electricity and gas prices.

‘The country is bracing for a huge shock as the summer holidays end and schools go back. At the end of next week, we will discover just how accurate the forecast energy prices rise will be. And then the real panic will set in.

‘As parts of Australia grapple with energy rises of 8 per cent, Britain is reeling with increases of double, quadruple and more.’

What millions of people never realised was that it would start to unravel this soon.

In fact, it was never meant to unravel at all!

According to the so-called ‘experts’, we were supposed to neatly switch over to green-based fuel sources.

Net zero by 2050.

And a massive reduction in the use of all fossil fuels.

Look, I have nothing against clean forms of energy. In fact, I fully expect this is the future. It has to be.

But it’s only possible with the natural progression and development of market players, innovators, and entrepreneurs figuring out the solution…competing with each other to bring these forms of energy to market reliably and at an acceptable cost.

In other words, the market is the solution. Not political direction.

This is exactly how oil changed the world 150 years ago. And it’s how the world will evolve.

Few understand this.

But those that do could gain a big investment advantage in the years to come.

This advantage starts with four key stocks.

One of which, I believe, is THE MOST compelling energy sector investment on the ASX today. Bar none.

It’s just completed a merger, which helped grow its global operations significantly.

It now dominates five of the most oil- and gas-rich regions in the Southern Hemisphere and North America.

If I’m right, these regions are going to be extremely handy for this company in the years ahead…and potentially transformational for your portfolio if you get in at these prices.

Because you cannot cheat the law of supply and demand for long.

This company knows that. And so should you.

So let’s start at the beginning…

A millennia ago, oil was merely a laxative.

Then, in 480 BC, the Persians used oil to dip and light fire-tipped arrows, which they launched over the walls of Athens. Back then, oil didn’t mean much at all.

The world had the Renaissance, the Enlightenment, and the English Civil War…

All without the benefit of oil.

Then something changed. Something people didn’t expect to make such a difference at the time.

Cities got bigger. Big cities needed better lamps. The market met that need. Along came kerosene! In 1861, Nikolaus Otto invented the first oil-burning engine. Along came petrol!

Then Henry Ford showed us how to mass-market cars. And build mass-market factories.

Oil made it possible to mass produce food, build cities, and wage war on a global scale…

For the whole of the 20th century, oil reshaped the world. It changed us.

More than the internet. More than the 1990s stock market bubble. More than the property boom of 2010–22. More than the GFC. More than the pandemic we’ve just experienced.

And that’s what makes us so vulnerable to the shock we’re about to witness…

Without oil, the world shuts down.

It’s as simple as that.

Farms close. People starve. Hospitals don’t open. Planes don’t fly.

This isn’t some fantastical doomsday scenario. It’s a fact.

We can’t just stop using oil.

We burn through nearly 100 million barrels per day. It’s the source of more than 70% of total global energy consumption.

It drives most of our cars. And even the crucial material parts of electric vehicles (EVs) require huge amounts of oil to mine in order to make them.

As EVs replace petrol engines…we’ll still need oil to aid in the mining and manufacturing process.

Our phones, internet, televisions, washers, dryers, refrigerators, and sound systems in our homes…the trucks, trains, planes, and ships that deliver food to our supermarkets…our factories, tractors, turbines, and compressors…

Ambulances, fire engines, and police cars. Hospital equipment. Modern dentistry.

You get the picture.

NONE can exist without a steady, cheap supply of oil.

How else do you get grapefruits in Melbourne and maple syrup in Perth? Bananas in Britain and cola in Africa?

Or let me ask you another question…

Considering all this, how likely is it that cleaner, renewable forms of energy will be able to replace this vast demand?

Logically, as the global supply of fossil fuels falls, the world must bring on the supply of renewables at the same pace.

But that’s not happening nearly fast enough.

You can consider this scaling issue another way.

We’ve been told we must drastically curb fossil fuel usage by more than half by such ambitious dates as 2050.

That renders a massive hole in the system.

What will it take to fill it?

In his book Power Hungry, energy journalist Robert Bryce made the point this way:

‘…if the world’s policymakers really want to quit using carbon-based fuels, then we will need to find the energy equivalent of 23.5 Saudi Arabias every day, and all of that energy must be carbon-free.’

I’m convinced that’s not going to happen anytime soon…

Again, I’m not against clean energy.

But I’m a realist.

You cannot conjure up results simply because idealistic politicians, activists, and bureaucrats wish it so.

We’ll learn this the hard way.

That, coupled with years of critical underinvestment in new forms of fossil fuel supply…and we’re approaching a tipping point.

And you need to be ready for it.

That’s what this letter is really all about.

I’m as certain as I’ve ever been that in the wake of this crisis…even as markets and economies spiral into energy-based chaos…a few smart plays in this sector should help you and your family get through it…

…and…hopefully…come out the other side better off as a result.

Greg Canavan

My name is Greg Canavan.

I’m the Editorial Director at Fat Tail Investment Research. I’d confidently say we’re Australia’s biggest unknown financial publisher.

Since we first set up in Australia back in ‘06, we’ve had a simple mission:

To help private investors understand how big changes in the world will impact them…and make smarter investment decisions in response.

Well, I believe understanding the great ‘Crude Awakening’ is the smartest thing you can do right now.

My longer-term readers will know we were onto this theme early.

I recommended several oil, gas, and coal plays in 2021.

It started with oil and gas in January 2021.

I recommended one Australian oil stock, and two strategically related ETFs — one invested across global equities and one currency hedged.

We’ve already banked 50%-plus profits on the two ETF investments. We’re still holding the initial oil stock, and I expect big things in the next few years. It’s currently a BUY recommendation (you can get hold of the details in just a moment).

Then came the coal play in February 2021…

Its share price started running as coal prices lifted from ridiculously low levels.

We sold half in March this year for a roughly 80% gain and let the remainder run. At the time of writing, we’re up more than 620% from the initial recommendation.

Then there were another two oil plays — one in April 2021 and another in October 2021.

We’ve taken profits on half of these positions for gains of approximately 40% each.

All these stocks are still showing amazing long-term value right now.

And you can access details of all of them today — plus a brand-new, just-released recommendation — if you so wish.

I believe all these moves are just the beginning of significant upside in the years ahead.

I don’t mean ‘significant upside’ to sound like a cliched, throwaway comment. I’m convinced, more than ever, that ‘old energy’ stocks should massively outperform in the coming months and years.

That’s because we’re hurtling into an energy supply crisis.

If I’m right, you’ll want your portfolio full of high-quality companies that will help solve it…and take advantage of it.

Because if you think we’ve just had a crisis, you haven’t seen anything yet.

To explain why, we have to go back to the 1970s…

In October 1973, Syria and Egypt launched a surprise attack on Israel.

In response, US President Richard Nixon green-lit the supply of weapons to Israel.

The Organisation of Arab Petroleum Exporting Countries (OAPEC) retaliated by hiking oil prices by 70%...and cutting production by 5%.

This didn’t sway Nixon. He asked Congress to authorise US$2.2 billion to aid Israel.

It triggered an extreme response from OAPEC — a total oil embargo on the US.

Supply — already tight given strong demand and the rise of a culture built around the ‘automobile’ — was crunched.

And prices soared.

The US economy plunged into recession.

Petrol shortages were widespread. Signs like this one littered petrol stations all over the country:

OAPEC lifted the embargo by March 1974.

But it profoundly affected US energy security.

To prevent such a supply crisis happening again, President Gerald Ford established the Strategic Petroleum Reserve (SPR) in 1975.

Two years later, the Department of Energy acquired several existing salt caverns along the Gulf of Mexico to serve as storage sites.

Today, these caverns can store up to 713.5 million barrels.

Now, you may have heard about the SPR before.

What you may not know is that President Biden has been tapping this crucial supply since March this year…

He’s doing this to try and bring down petrol prices and inflation ahead of the midterm elections in November.

As at the end of September 2022, the SPR’s holdings are down to just 416 million barrels…its lowest since 1984.

And it’s going lower…

On 1 March…in response to the Russian invasion of Ukraine…the US committed to releasing 30 million barrels of oil from the SPR.

Other International Energy Agency (IEA) members also agreed to release 30 million barrels from their strategic reserves.

But that was just the start.

On 31 March, Biden issued a statement in response to ‘Putin’s price hike at the pump’:

‘After consultation with allies and partners, the President will announce the largest release of oil reserves in history, putting one million additional barrels on the market per day on average — every day — for the next six months.

‘The scale of this release is unprecedented: the world has never had a release of oil reserves at this 1 million per day rate for this length of time. This record release will provide a historic amount of supply to serve as bridge until the end of the year when domestic production ramps up.’

A week later, the IEA issued this statement:

‘Over the next six months, around 240 million barrels of emergency oil stocks, the equivalent of well over 1 million barrels a day, will be made available to the global market.’

And then, on 18 October, in a White House press fact sheet, Biden confirmed he’s ready to release more SPRs…through to the end of the Northern Hemisphere winter.

But these reserves are already approaching critically low levels.

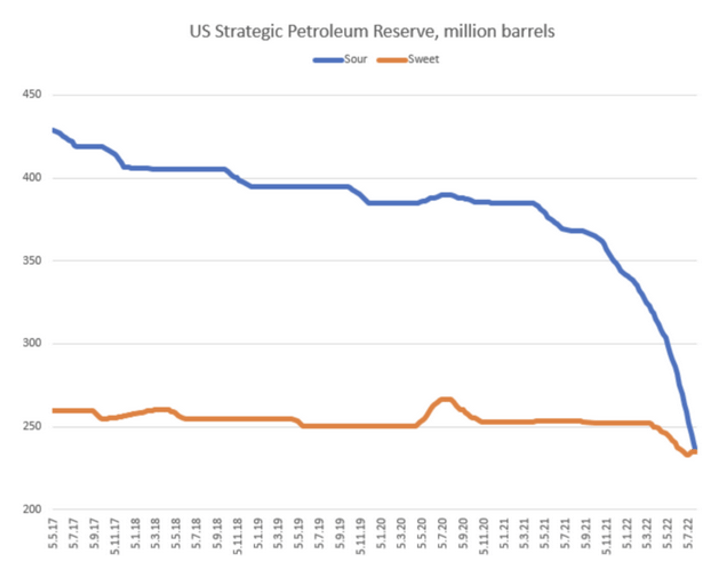

Take a look at the graph below:

It shows the two types of oil held by the SPR — medium sour (the blue line) and light sweet (the orange line).

Forget the technicalities of it.

All you need to know is that medium sour (the blue line) is the preferred oil for the US refining industry. Oil refined into ‘gas’ (or petrol, as we know it) is the price that often determines the fate of US presidents.

That’s why, over the past year, around 85% of oil sold by the SPR has been medium sour.

The stockpiles of this crucial oil have plummeted.

Now, there’s little firepower left, short of draining the reserve completely.

This is exasperating an already critical problem…

By far, the biggest reason why I believe a major energy price spike lies ahead is down to a simple, fundamental issue…

A critical lack of investment in new supply over the past decade.

There’s an old maxim that the cure for high prices is high prices.

When prices are high, capital comes into a sector to capture high returns.

Over time, this investment leads to increased supply…and so prices fall.

This, in turn, sees capital move elsewhere until undersupply again becomes a problem…and prices rise again.

Between 2010 and 2014, oil prices averaged US$100 a barrel.

Investment poured into the sector.

Most notably, this produced the US shale boom.

According to natural resource investors Goehring & Rozencwajg (G&R), shale oil production went from nothing in 2010…to more than nine million barrels per day by 2019.

US shale production made up the world’s third-largest production, only behind Saudi Arabia and Russia.

It turned the US into a net exporter of oil for the first time in nearly half a century.

No wonder the oil price collapsed in 2014!

That price collapse marked the beginning of a sharp decline in capital investment.

According to G&R:

‘Oil and gas spending fell by over 60% between 2010 and 2020. Investment in the US shales fell by over 70%. Over that entire period, the cumulative reduction in capital spending compared to trend was more than $1 trillion.’

Since 2020, energy prices have bounced back.

Yet investment hasn’t responded.

As G&R writes:

‘Oil prices are at 15-year highs and natural gas in Europe and Asia are setting new records yet E&P [exploration and production] capital spending is still down 50% from the peak with shale spending down 60%.

‘Despite record free cash flow, companies prefer to return capital through dividends and share buybacks rather than drill new wells.’

It’s not just a US thing.

Globally, oil and gas investment are down 50% from the 2014 peak.

Why is this important?

Because oil and gas reservoirs naturally deplete.

In a recent interview with hedge fund manager Kyle Bass, Wil VanLoh, the Founder and CEO of Quantum Energy Partners, said that global oil decline rates are on average around 8% annually.

In other words, each year, the world will lose about eight million barrels a day if drilling stops completely.

Or put another way, the world must find eight million more barrels a day just to keep supply stable.

With investment at half the levels of the 2014 peak, that is a risk…let alone increasing supply to satisfy higher demand.

Because you can’t just flick a switch and turn up global supply overnight.

As VanLoh points out, while the US shale oil fields can be turned on relatively quickly, they only represent 12% of global supply:

‘The rest of the world’s supply comes from these large, large projects, offshore deep water or in very inhospitable places around the world. And these projects take six to eight years to bring on.’

Bottom line: it takes the best part of a decade to shore up new oil supplies.

And that’s in normal times.

What you must understand is that lack of investment is enough for a supply-side bull market on its own.

But now throw in the war in Ukraine, through which much of the world’s oil and gas flow from Russia…and you see the problem.

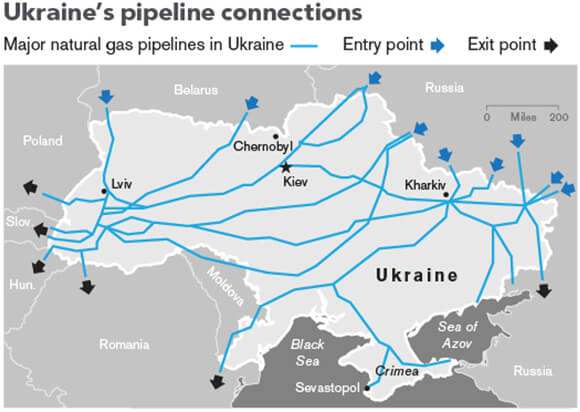

This graphic below shows the major natural gas pipelines running from Russia in the east and Belarus in the north toward Poland, Slovakia, Hungary, and Romania.

From there, those pipelines connect to hubs that distribute the natural gas further to Italy, Germany, Austria, and other major economies in Western Europe:

Western Europe’s dependence on Russian natural gas is critical.

The 27 member nations of the EU currently receive 40% of their imported natural gas from Russia.

Most of this natural gas passes through Ukraine. Some natural gas enters Germany through the Nord Stream 1 pipeline and other conduits under the Baltic Sea.

But war invites sabotage…and that’s exactly what happened to this critical pipeline in September. An unknown State actor blew a hole in it.

Of course, these nations have other energy sources — including oil, coal, wind, and solar.

But OPEC recently cut oil production quotas by two million barrels a day.

Here at home, coal power plants are being decommissioned 10 years early, as part of the politically motivated move to ‘net zero by 2050’.

But if you think renewables can even come close to providing the energy needed to run modern industrial economies…think again.

Look. We all want to live in a world powered by renewable energy.

I’m no different.

But the fact is, renewable energy is nowhere near reliable enough to power the planet. And it won’t be for decades.

Yet virtue-signalling politicians and wealthy elites pretend otherwise…to your detriment.

For starters, renewable energy is, paradoxically, energy intensive.

Consider…

Research by G&R shows that a 1.5 megawatt General Electric wind turbine contains 40 tonnes of steel…and 600 tonnes of concrete in the foundation.

The tower consists of another 150 tonnes of steel…and the generator requires nine tonnes of copper.

It requires a huge amount of energy to produce these materials.

G&R points out that between 2010 and 2020, the cost of every form of fossil fuel energy fell by 90% from peak to trough.

That made the cost of building renewable infrastructure fall dramatically.

In addition, renewables are capital intensive.

Over the past decade, a cheap cost of capital (meaning low interest rates and easy money) has boosted the economics of renewable generation.

But now we are entering an era of higher energy AND capital costs.

That means the cost of renewables will go UP.

And the returns on the trillions of dollars of investment flowing into the sector (at the expense of traditional forms of energy) will go DOWN.

The other issue is that renewable energy needs land.

And lots of it.

Check this out…

In his book, Energy Economics, Peter M Schwarz compares how much land is required for nuclear, solar, and wind to supply 1,800 megawatts of power.

His findings are eye-opening:

‘Consider the amount of land needed for a two-reactor 1,800 MW nuclear plant. Such a plant would serve approximately 1.8 million homes. It would encompass about 1,100 acres (a football field is about 1 acre) or 1.7 square miles.

‘If solar energy produces the same amount of power, it would require 7.4 acres of photovoltaic solar panels, and 13,320 acres in all (21 square miles).

‘For wind, it would take 720 2.5 MW turbines, requiring 108,000 acres, or 169 square miles.’

Yes, that’s right…ONE HUNDRED AND EIGHT THOUSAND football fields of wind turbines for a million homes.

That’s insane!

But even so…

While we’re all feeling good about heading to ‘net zero’ by 2050…the IEA projects that under current and stated public policies…

…fossil fuels will still account for 74% of US energy consumption in 2040.

The same fossil fuels that we are no longer investing in…and many politicians are openly hostile to.

The ignorance is astounding.

And we’ll all pay the price.

The reality is that the great clean energy transition will take decades.

There just isn’t a politician brave enough to tell you that.

And it won’t see the end of fossil fuels. They’ll still be around as a part of the energy mix.

As Wil VanLoh observed in his interview with Kyle Bass:

‘…about 10 years ago, we started in earnest really building out global wind and solar capacity, which is the fifth energy transition.

‘What’s ironic, Kyle, is if you look at every form of energy that we’ve ever used as humanity, that we use more of every form today than we’ve ever used in absolute terms.

‘Coal’s market share peaked 30 years ago, but we use three and a half times more coal today globally than we used 30 years ago.’

I could go on.

However, the stark reality of the situation this is:

This is why I’m urging you to set your portfolio to protect yourself from the coming price rises…and to benefit from the energy disaster our politicians have created.

The time to do this is now.

Oil prices are correcting as central banks raise interest rates to try to crush demand.

This gives you an amazing short-term buying opportunity.

Energy stocks are incredibly cheap, as investors think this is the ‘top of the cycle’.

As I hope to have convinced you by now, IT’S NOT.

The world is running out of cheap, reliable energy.

Governments worldwide have masked this fact by draining their energy reserves under the pretext of Russian energy sanctions.

They’ll need to refill those reserves in the years ahead.

A perfect storm is coming to global energy markets.

It’s time to prepare.

Let me quickly show you how…

The first thing I believe you can do to protect you and your family from the pain that’s coming is to ensure you have an overweight portfolio exposure to energy.

What does ‘overweight’ mean?

Well, the ASX 200 Energy Index is about 7% of the broader ASX 200.

So an overweight position would be greater than that.

A 10% allocation would be reasonable. Or, if you’re bullish and willing to take on more risk and volatility, you could go to a 15% weighting.

What you want to do, though, is gain exposure in a way that represents the least possible risk.

I’ve done that over the past few years by recommending large-cap energy investments.

I continue to think that is the way to go.

You don’t want to get the overall call of an energy bull market right but bet on speculative plays that might blow up.

For this reason, I recommend avoiding pure exploration plays.

You want companies with large existing resources that underpin current production from multiple sources and provide growth options.

This allows companies to generate strong cash flows now and into the future.

Despite the rally the energy sector has enjoyed over the past year or so, I believe we’re in a secular bull market. It has years to run.

The current correction you’re seeing in energy prices (benchmark oil prices are down more than 30% from the high in March to the September low) makes this an opportune time to build or increase exposure.

Also, as I’ve as pointed out so far, it’s taken the largest globally coordinated drawdown of strategic reserves in history to get oil prices down.

On top of that, you have the central banks trying to kill demand globally to rein in inflation.

Yet oil prices remain in the US$80 a barrel region. They could fall more as central banks continue to raise rates.

But again, I’m convinced this is a long-term buying opportunity.

So the next question is: what do you buy?

As I said, there are a core group of four, high-quality, energy-focused companies I think you should consider adding to your portfolio immediately.

This core group begins with my latest recommendation…a key ASX-listed producer that’s cemented operations across the globe thanks to a strategic merger in 2021.

If you consider just one stock out of the four, it should be this one.

Details of all these stocks make the second part of the ‘Crude Awakening’ thesis.

This part is called ‘How to Protect Yourself from the Coming Energy Crunch’.

And you can get full access in the next five minutes by becoming a subscriber of my flagship monthly research letter, the Fat Tail Investment Advisory.

You can take the next 30 days as a ‘guaranteed, no-obligation trial period’ to check out the full two-part report.

This includes the full breakdown and analysis of the investment recommendations.

Of course, I’m hoping you’ll love what you see, and this is just the beginning of a long-lasting relationship with serious investing success…

Besides the opportunities in energy-related shares in the months ahead…I’d also like to introduce you to many other ideas I share with a core group of Fat Tail Investment Advisory subscribers.

The Advisory is the flagship investment letter of our company, Fat Tail Investment Research.

And while it’s useful for all types of investors, it’s specifically aimed at investors focused on long-term investment opportunities.

If you manage your superannuation, for example, and are looking for ideas for quality blue-chip stocks at attractive, beaten-down prices…the Advisory is ideal.

It’s easy to forget that quality stocks can deliver great returns.

You just have to buy them at the right price!

That means you don’t have to speculate on tiny stocks that may go bust.

You can get capital growth AND a healthy dividend return from well-known, everyday stocks.

Why punt when you can invest soundly?

As I’ll show you, there are cheap, quality stocks on the market right now with dividend yields of 6–8%.

Yet everyone is scared of buying them!

Think about it…

You can buy large companies with high-quality earnings that are forecast to deliver you a 6%-plus dividend yield at current prices (potential income far better than anything the bank will pay you).

During the bear phase, the stock price might not do much…or it might even go down a bit.

But you’re in line to get any dividend.

The funny thing is, 12 months ago, there were little-to-no such opportunities.

Stocks were much more expensive…and everyone wanted to buy!

That’s investor psychology for you.

With this in mind, here’s a valuable tip. It’s one of the rules of the market I always keep in mind:

When perceived risk is low…actual risk is high.

And when perceived risk is high…actual risk is low.

The end of 2021 was a perfect example of this.

The market was flying high.

The ASX 200 was back to its August all-time highs…and the US market was at an all-time high too.

Perceived risk was low.

But in December 2021, I warned Advisory subscribers otherwise:

‘Right now, the reality is that ultra-cheap money is still flowing into growth and momentum stocks, while leaving the “boring” value-oriented stocks behind.

‘As an investor, the most important thing is for you to remember that ultimately, returns are about the price you pay, and the cash flows a company produces.

‘In times of heightened speculation, the market will absolutely forget this lesson. And it can ignore it even in the face of obvious headwinds, like rising interest rates.

‘So, it’s important to remain disciplined and remember there is a difference between investing and speculation.

‘Much of what is going on right now is pure speculation, it’s as simple as that.’

Since then, the tech-heavy NASDAQ has fallen more than 30%.

Speculation is great in bull markets. But it can be devastating in bear markets.

Well, this advisory is not about speculating, it’s about investing and doing so in a smart way.

For example, right now, there are themes and opportunities I’m following that inform the sectors we are invested in.

As of now, they are:

And then, of course…

The most pressing issue — and the most urgent opportunity coming out of it — is the great ‘Crude Awakening’ playing out in the global energy market.

This is a vital moment in market history. You need to be ready for it.

And if you’re prepared to think critically, and act against the crowd…there are many opportunities lining up.

I would hate for you to miss them.

Of course, I can’t promise you profits. Like any investment, there are risks. And past performance is no guide of future profits. Losses do occur, and I’m disciplined about taking them to preserve capital when it’s necessary to do so.

Sign up for a subscription to our company’s flagship monthly research letter, the Fat Tail Investment Advisory.

You’ll see that you don’t have to take crazy risks to achieve success. Calculated risks are what’s needed in this market.

You’ll be covered by our water-tight money-back guarantee period in the first 30 days.

If you don’t find it’s for you at any point in that time, we will give you your small subscription fee back — no questions asked.

I hope that sounds fair.

Because you are looking at some challenging times ahead.

Most Australians don’t realise the true extent of it. But you will not get the real picture by watching the major news channels…

A coming 50% global shortfall in energy supplies unless something drastic happens.

The gap between rising energy demand and plummeting energy supplies will only get wider.

At today’s rates, if we don’t replace natural declines and demand grows by 2% a year, this gap will grow by 10% per year.

That’s an extreme and unrealistic scenario. But a gap of half that amount isn’t as wild.

That means within a decade, we could face a shortfall in available reliable energy by as much as 50%.

That will come with serious consequences. It also means a mad scramble for the kinds of energy-focused stocks I’ll introduce you to.

OPEC will continue trying to SEIZE all the purse strings.

In 2014, the US shale boom really got going. It spawned a great re-emergence of the US as an energy powerhouse.

But do you remember what OPEC did at the time?

They turned on the taps…flooding the world with oil.

It created a huge supply glut and crashed the oil price. Sure, it hurt Saudi profits. But it also sent hundreds of North American ‘shalers’ bankrupt and ensured the end of the nascent US shale oil industry.

Fast forward to today…

This time it’s a supply crisis so bad that the US is tapping its special petroleum reserves.

And what’s OPEC doing now?

It’s CUTTING supply right when the West needs it.

What’s more, there’s increasing speculation that OPEC no longer has the spare capacity to push prices lower, even if they wanted to.

Meanwhile, the new cold war between the West and Russia has only just begun…and the risk of a ‘hot war’ with China is only increasing.

You know what’s happening on Europe’s doorstep. You read about it each day in the papers and watch it on the nightly news. I’m not going to add to the noise here.

But I will say this…

Germany foolishly shut down almost all its coal- and nuclear-generating capacity over the past 10 years at the urging of climate alarmists, leaving it almost completely dependent on Russia.

In that sense, Russia timed its invasion of Ukraine perfectly if one aim was to have the maximum effect on energy prices.

Those prices were already rising steeply due to basic supply and demand factors well before the invasion.

Meanwhile, Russia is finding new markets for its oil and gas through India and — crucially for Australia — China.

We’re looking at oil as high as $200 per barrel. Others say double that again to $400.

Imagine paying $8–10 for a litre of petrol…

In a hyperinflationary energy supply crunch, prices for everything oil-related spirals up, while the purchasing power of your dollars goes the other way: DOWN.

One way to offset this challenge is to have your portfolio full of high-quality companies helping to solve this crisis…and take advantage of it.

Remember again how it was in the 1970s…

Oil was used as a political weapon during the Yom Kippur War, causing OPEC to dramatically increase crude prices…and enforce production curbs and export sanctions.

The entire world was seized in a fever of car-free days and petrol-rationing.

Well, today’s crisis is far more serious than that of the ‘70s. And you don’t want to be caught unprepared.

As soon as you give me permission, you’ll get immediate access to the full two-part edition of ‘Crude Awakening: The Total Global Energy Crisis of 2023–24’.

You’ve read part one in this letter.

As I’ve said, part two — ‘How to Protect Yourself from the Coming Energy Crunch’— reveals the investment recommendations.

Then, ongoing every month, you’ll get my latest comprehensive overview of the market in an exclusive report.

In this briefing, you’ll also get my analysis on individual securities.

You’ll know which Australian stocks I think are currently undervalued — which are overpriced — and why.

You’ll learn that you don’t have to take crazy risks to achieve success.

Calculated risk-taking is what’s needed at this time. If you want to be a successful investor, you need to be smart…no matter what’s happening in the market.

Being a student of the financial markets for more than 20 years, I consider myself skilled at deciphering price signals in a world of mainstream noise…and leading you to exciting investment opportunities many would rule out.

The investment categories above fit this bill.

Importantly for many Fat Tail Investment Advisory members — I provide a truly Australian-focused analysis.

The aim of this analysis is to help you invest as soundly as possible, using rational and contrarian thought processes.

I know, I know…everyone is a ‘contrarian’ these days.

But I’d wager most are not. Not when it comes down to it.

It takes a certain kind of person to recognise when something is truly showing value…and buy when the rest of the market hates it.

That’s why I started buying and recommending coal and oil and gas stocks in 2021, when everyone else thought the world was going green.

Or bank stocks in September 2020 while the economy was reeling from the COVID shock.

In our group of like-minded investors, that’s what we do.

We think for yourselves. We take responsibility for our own choices and actions. And put the wellbeing of our families first and foremost.

Connecting our group is our monthly newsletter.

Your monthly communiques also have my portfolio of current buy, sell, and hold recommendations — for you to incorporate into your financial plan as you see fit.

Also, I’ll send you a private email (usually weekly) to keep you posted on the progress of the stocks in the Investment Advisory portfolio.

I’ll tell you whether I think you should buy more, sell, adjust the portfolio weighting, or hold the position.

In this email, I’ll also pass on any time-sensitive tips, plus reveal details of other investments that are on my value radar.

But it all starts with the most pressing opportunity of today: the ‘Crude Awakening’.

Remember, you have the next 30 days to see if our community and my ongoing research and advice are right for you.

So with that mind…

First things first, let me tell you that the regular price for an annual membership is $499.

Is it worth that outlay?

Well, consider this…

There are a lot of people who simply don’t understand the big picture forces at play in the global financial system right now.

Most have no clue about delicate supply and demand dynamics in the global energy market either.

The most important thing you can get out of this letter is to understand where we are in the bigger picture.

This is difficult to do when you’re down on the ground on a daily basis, bombarded with headlines and information.

But what if I could help you?

And what if I could show you a strategy that could save and make you tens of thousands of dollars over the next five, 10, or 20 years?

A serious, long-term strategy…especially handy if you’re managing your own super or retirement fund…that aims to buy assets of great value when few others want them…and sell them when others will pay any price?

Would it be worth $499 then?

I think so.

But I realise that we’re in the middle of an ugly bear market…and you may not know me, especially if you’re new to Fat Tail Investment Research.

So I’m going to make you a special introductory deal…

Join today, and we’ll cut the official subscription price by half.

Meaning you’ll pay a special introductory rate of just $249 for your first year of your Fat Tail Investment Advisory membership.

That discounted fee will be fully refundable for the first 30 days of your membership.

Take that time to look around our members-only website and go through all my research, including the two-part report ‘Crude Awakening’, plus my archive of monthly issues, old and new…and full access to all current open investment recommendations.

Consider what $249 buys you in the investment world today…

You might be able to get a couple of sessions with a Certified Financial Planner...or a meeting or two with an accountant.

But for the same amount, a whole year of access to an independent investment community of like-mind individuals all trying to achieve the same thing as you…plus access to everything I’ve discussed today.

Again, you have the next 30 days to make sure it’s right for you.

Like I said, if you decide it’s not for you in that time. No problem. Just let us know, and we’ll give you a full refund of the subscription fee paid.

I want as many people as possible to understand the opportunities available to them in this market today.

And this 30-day satisfaction guarantee period of our most comprehensive and long-term-focused advisory letter is the best way we can think to do that.

To take advantage immediately, click here.

Thank you for your time, and whatever you decide, I wish you all the best for the future.

Sincerely,

Greg Canavan,

Editor, Fat Tail Investment Advisory